Click here for a SavvyTrader-powered view of my current portfolio.

1. The Trade Desk (TTD) -- Investor Day

a. Notes from Co-Founder/CEO Jeff Green:

On a look back at 2020’s investor day:

Green took the first chunk of his talk to essentially take a victory lap. He was laughed at in 2020 when saying the company’s login ID footprint would be one of the largest in the world. Well? Today, its new Unified ID 2.0 (UID2) creation has 3 billion registered devices on it. Not bad. He also predicted that its nascent CTV category would grow to become the company’s largest. And? You guessed it. That happened.

On Why Buy Side is and Always Will Be in the Driver’s Seat:

Green spoke on poor results posted from supply-oriented firms like Snap and how people incorrectly extrapolate that to mean The Trade Desk will suffer. Beyond the superior targeting, measurement and channel optionality, Green explained The Trade Desk’s outperformance as the overarching dynamic of advertising being permanently demand constrained -- and it’s the market leader in servicing that piece of the ecosystem. If demand were approaching supply, publishers would just seamlessly create more. Conversely, creating more demand is far more problematic.

The supply side needs The Trade Desk’s demand aggregation to fetch cost per mille (CPM) rates that make their models work. The demand side needs The Trade Desk to reach the right people at the right time with the right frequency to deliver better return on ad spend (ROAS) despite the higher CPMs -- otherwise, buyers would just seek out the cheaper options. The Trade Desk does both of these things very well and has established itself as the de-facto open internet advertising platform as a result… with a focus on the demand side but with direct plug-ins to the supply side.

With Netflix, HBOMax and Disney all deciding to embrace ads in the last year, The Trade Desk expects the demand imbalance to become even more favorable for it in 2023. This simply shifts the power dynamic further to its niche.

On Macro and Secular Headwinds:

- The Trade Desk has not slowed down its hiring cadence in 2022… at all.

- It continues to see brisker share gains as macro worsens and advertisers are increasingly forced to seek out ROAS optimization. Some brands still aren’t fully comfortable with embracing a shift to programmatic, but a poor macro backdrop forces their hands and accelerates the evolution.

- The Trade Desk is not immune to macro. Shocks like the pandemic did temporarily slow its growth. But that impact was very short-lived as advertising came back with a vengeance and with The Trade Desk possessing larger market share. That’s generally what happens: When markets slow, it simply takes a larger piece of the pie and positions itself to capitalize on the next phase of the cycle.

On Google:

- Green thinks a Google targeting/advertising federal lawsuit is coming “any minute now.” He’s always right.

- He acknowledged that Google is a competitor… but that it competes with the giant on its “37th priority which doesn’t move the Google P&L needle.” To him, The Trade Desk’s combination of openness, objectivity, superior outcomes and Google having 36 more things to focus on first has forced Google to try and compete by creating a market that unfairly favors them. Green thinks this approach is far from worth it for the company’s financials, and that we’ll eventually get to a point where Google concedes and the playing field levels.

- It’s important to point out that advertising’s demand constrained reality isn’t unique to the open internet. It extends to walled gardens like Google’s YouTube as well. So? That product would greatly benefit from allowing open internet bidding to free all possible demand to place their offers. These offers are routinely better than what walled gardens can fetch alone, meaning they’re leaving significant revenue on the table.

“If we’ve done this well in an unfair market, imagine what we can do in a fair one.” -- Jeff Green

On Connected TV:

- Connected TV (CTV) is very fragmented. This blocks any single participant from assuming the market power that Google enjoys in search. These participants will need competitive bidding processes to fund expensive content creation and sustain their businesses. As an aside, that’s why 3rd party cookies are such an outdated internet identifier: It only works in web and none of the other rapidly proliferating advertising channels.

- CTV has now matured to a point where it’s enjoying the “first dollar of ad budgets” with other players like walled gardens enjoying the leftovers. It used to be the polar opposite.

- CTV is still just 6.4% of the TV advertising market. But when looking at solely data-driven, auction-based programmatic advertising (The Trade Desk’s model) it’s just 1.6%. The segment is rapidly growing and still in the early innings of its maturity. Great combo.

On OpenPass:

Green announced a new company product called OpenPass (different from OpenPath) that is currently in private beta testing. This is a next-generation single sign on (SSO) product like Google’s with a convenience and privacy upgrade. It’s an “open internet wide pass that enables publishers to join their user bases.” Considering that less than 5% of impressions for sectors like journalism are from logged-in users, cookie degradation makes it so that the other 95% are not AT ALL targetable.

So, The Trade Desk is making up for this degradation in its own way. How? Like other SSOs, this feature allows consumers to forgo account creation and login for all participating publishers. But here, consumers can opt in on a per site basis to customize who gets access to what data. Today, other SSOs are opt out, meaning you’re automatically opted-in unless you explicitly say otherwise. Most of us have countless sites that we don’t even use leveraging our data for profit. Not consumer friendly. OpenPass’s opt in process is also done with the click of a button, thus marrying responsibility and convenience.

On The Trade Desk’s Budding Data Marketplace and UID2 (AKA its identity tokens):

The Trade Desk’s data marketplace transforms the manual process of sifting through thousands of data sources to guess at which will increase ad spend returns. Now, The Trade Desk organizes, contextualizes and recommends which data sources are actually utility building in a fully automated fashion. It offers “Multi-Element Bidding” which frees buyers to layer on new pieces of data with a full understanding of value creation -- while paying based on the data’s performance instead of quantity used.

Green talked through several data marketplace issues. Data scrolling, matching and efficacy he sees as solved with this new product. This next year, the focus will be on fostering efficient price discovery vs. a legacy buying process that is almost entirely lacking it.

This data marketplace closely relies on The Trade Desk’s UID2 open internet identifier. Why? Without it, coverage overlap between the publisher, The Trade Desk and 3rd party data providers was routinely below 5%. This means advertisers have no sense of how to apply data to successfully promote to the other 95%. Quite the issue. This leads to things like generalized, less effective targeting. Using UID2 as the common currency of the open internet vs. the already sparingly available 3rd party cookies allows stakeholders to move from 5% coverage to 100%.

The company is using a pricing model here to “align costs with results.” Rather than charging a flat fee, it will charge a percentage with more revenue earned by data efficacy and performance.

On Shopper Marketing:

The Trade Desk’s ability to connect shopper marketing dollars to brick and mortar sales has unlocked yet another channel with a vast runway, little formidable competition and ample low hanging fruit. 2020’s Investor Day was about the incredible opportunity that CTV represented. This year, CTV still received a lot of deserved love, but Shopper Marketing took a larger piece of the conversation as it continues to shatter all internal company expectations. It sees the iconic logos such as Walmart and Home Depot serving as dominos pushing other retailers to follow suit to keep up with the competition -- and that’s already playing out:

b) Notes from Co-Founder/CTO Dave Pickles

On Solimar (its ad-buying platform):

One year into The Trade Desk’s brand new platform (Solimar) going live, here are the results:

- 50% mean increase in client channel usage

- 100% increase in data elements used per impression.

- 100% adoption rate after just 1 year despite the brand new, unfamiliar user interface (UI).

A key part of Solimar is its cross-channel graph which offers a holistic visualization of granular identity. This is how The Trade Desk alone makes sense of ID while UID2 is leveraged for the whole industry. The company created the “Identity Alliance” to incorporate other ID vendors like LiveRamp into Solimar to raise cross-device usage by 150% vs. the old identity graph The Trade Desk had been using (via its 2017 acquisition of AdBrain).

On Koa (its AI engine):

“Several prominent ad agencies have now made Koa a core part of their processes this year.” -- Pickles

On The Planned Next-Gen Forward Market Product:

The Trade Desk -- after about a decade of talking about it -- is now creating a dedicated, data-driven forward market product to transform the archaic up-front buying process. This will function as a bridge for clients as they move from spending marketing dollars on linear to streaming. The Trade Desk wants to be a big piece of that transition to increase its chances of winning streaming dollars in the future.

This product will allow for the reservation of inventory just like with traditional up-front markets. But now, advertisers will be able to do so while unleashing The Trade Desk’s platform to intelligently and actionably forecast where and when your target audience will be. This new precision will motivate buyers to pay a premium for having more relevant impressions reserved. In the past, up-front buying was like throwing darts at a board; The Trade Desk is fixing that.

c) Notes from Chief Strategy Officer Samantha Jacobson

On UID2 Open Identifiers (Tokens) and How They’re Created:

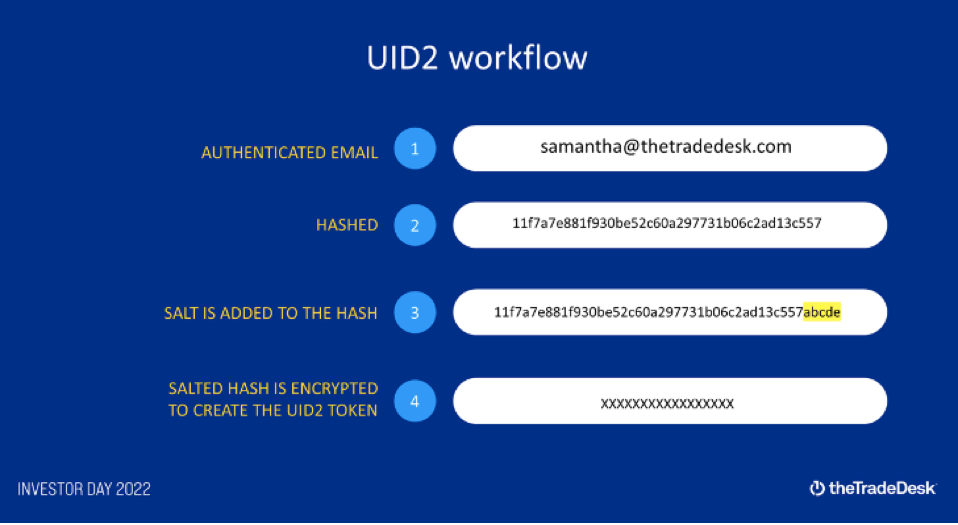

Jacobson talked us through a valuable breakdown of how UID2 goes about anonymizing an identifier like an email address. Here’s the process in her paraphrased words:

- Interact with a brand online like Lululemon.

- It collects an email or phone number for a more personalized customer experience.

- Via key integrations with data firms like Snowflake and Salesforce, the brand can overlay the UID2 algorithm within their own ecosystem or can also send it externally to the UID operator if that’s preferred.

- UID2 then hashes the email address which just means turning it into a randomized group of numbers and letters.

- Next, UID2 “salts” the hashed address. This means adding a uniform code specific to UID2 (which is “ABCDE”) to the end of each address. This makes the code unique to UID2’s environment.

- Finally, it encrypts this hashed, salted address. This turns it into a series of X’s.

- It also allows firms to use double encryption protection. That lets companies take their list of UID2 tokens and add another layer of encryption specific to themselves. The firm can then transfer it to their end clients which always need a decryption key from that publisher for access.

The Trade Desk’s platform can then use this token and layer in all relevant data on it (without risking ID exposure) to ensure unique, responsible targeting.

Keep in mind:

- UID2 (its ID product) is how advertisers know who they’re talking to, data is how they know who they want to talk to & what to say.

- The Trade Desk built BUT DOES NOT OWN UID2. It vested ownership to remove potential conflicts of interest which is why countless competitors have adopted it.

On Case Studies

For Fubo, UID2 delivered:

- A 62% rise in ad spend year over year DESPITE just a 25% rise in ad impressions YoY.

- A 14% rise in ROAS for Fubo ad buyers. So The Trade Desk is getting buyers to spend more and enjoy more success while making Fubo more money.

For Mercedes-Benz, The Trade Desk’s CTV Platform facilitated:

- A 5% rise in brand awareness.

- An 11% rise in key demographic brand awareness.

- A 1.5 million unique household reach.

d) Notes from Chief Revenue Officer Tim Sims

On Why the Future of CTV is Decisioned and Biddable:

Sims worked through a striking example of CPMs for streaming-based advertising that isn’t data driven (decisioned) or biddable -- so very similar to linear up-front buying with a little more timing flexibility. Generally, CPMs under that dated format range from $18-$23 for publishers. Amazingly, when opening these same placements up for bids and connecting them to The Trade Desk’s decisioned impression engine, millions of incremental offers flowed in at CPMs astronomically higher. This is because The Trade Desk’s data infusions uncovered the wants and likes of the audiences and removed the guessing from ad buying while freeing more demand to flood in. So? Without using The Trade Desk’s decisioned, biddable programmatic advertising platform on the demand side, publishers leave a fortune on the table: