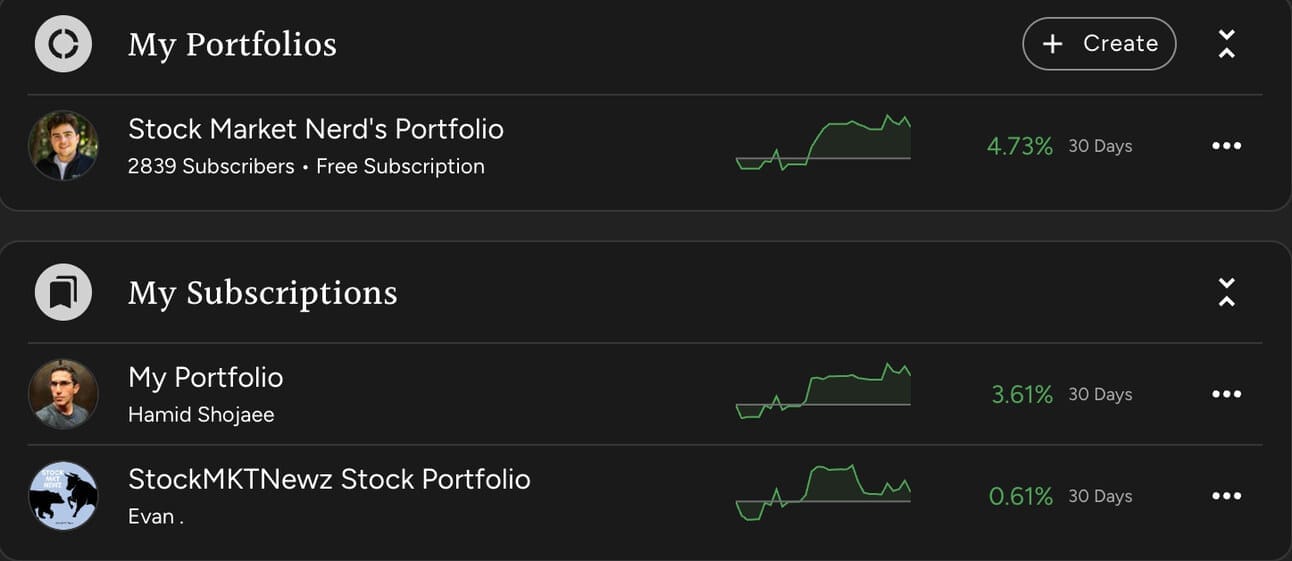

Today’s Piece is Powered by Savvy Trader:

1. PayPal (PYPL) -- Uber, China & a CFO Interview

a) Uber

What’s the News?

PayPal signed a multi-year agreement to deepen its global relationship with Uber (a long time customer). As part of the agreement, Braintree will assume more of Uber’s unbranded processing volume and add debit network servicing to the credit orchestration it was already providing. Orchestration merely means utilizing PayPal’s vast partner network to route payments as quickly and cheaply as possible for Uber and its stakeholders.

Encouragingly, the new deal will also see Uber utilizing several of PayPal’s value-add services. This is the more important piece of the news. These services include Hyperwallet which is its payouts product that unlocks immediate earnings transferal to PayPal or Venmo. Hyperwallet’s ability to drive broad and flexible payout options has been a key marketplace selling point for unbranded PayPal. The fattened-up agreement will also include Chargehound (for chargeback minimization services) and a partnership on testing and releasing authorization optimizations. Interestingly, the two will create “combined incentives” for UberOne customers to use PayPal or Venmo at checkout. That hints at PayPal Gold (formerly Honey) being part of the contract.

Why does this news matter?

First, Braintree’s “additional processing” for Uber should lead to some nice private label growth. Uber uses Braintree, Adyen and Stripe with estimates around the internet showing Braintree being the third global option. That could (could) now be changing. This meshes well with what leadership tells us is the general life cycle of a client: Braintree starts as a secondary processor and slowly assumes more volume as it demonstrates its supposed (per leadership) authorization and loss rate edges vs. the competition. The boost to revenue from these added responsibilities will not be sharp, but instead subtle.

Braintree revenue growth is not the concern for PayPal… the margin associated with that growth is the main concern. Braintree’s rapid market share taking and brisk compounding has materially weighed on PayPal’s overall transaction margin. The team has a few levers to address this issue: expanding downstream to smaller merchants, more global and cross-border volume and more value-add services.

This deal fulfills that third objective of cross-selling more value-add services. These services are more differentiated and have higher margins than core private label processing. That means Uber as a client just got more profitable for PayPal. This won’t drive a transaction margin bottom alone but is a small step in the right direction. Value add services are PayPal’s best chance at driving a near-term transaction margin trough. Braintree’s book of business is made up of massive clients like Uber. Service cross-selling means massive chunks of existing revenue pretty much immediately coincide with heftier profits.

Finally, the incentive program will push more Uber customers to use branded PayPal and Venmo as payment options for their rides and deliveries. Branded checkout is much, much higher margin revenue for PayPal.

b) China

Mizuho published some interesting research on Temu’s (large Chinese marketplace) U.S. launch. The site is gaining rapid adoption and PayPal is a key payment option available on the site. Temu’s traffic contribution to PayPal has nearly tripled year to date and this branded growth driver would be welcomed from both a demand and margin perspective. Between China and things in Europe hopefully not getting much worse from here, PayPal’s key international markets should become healthier in the coming quarters.

c) CFO Interview

Branded Checkout Acceleration:

Acting CFO Gabrielle Rabinovitch didn’t offer August branded checkout volume data following the company’s acceleration to 8% Y/Y July growth. She did, however, say the quarter and macro backdrop continue to progress roughly as expected.

Unbranded:

Last week, Dan Schulman told us that Braintree is winning market share via superior authorization and loss rates with no change to its pricing philosophy. This ran contrary to Adyen’s comments last quarter saying increasing pricing pressures were impacting its growth in North America. This week, CFO Gabrielle Rabinovitch echoed Schulman’s same opinion. She told us that Braintree’s market share gains and success are based on “performance and best in class authorization rates.” I’d love to see more specific checkout data and margin/demand disclosures for Braintree under new leadership and expect that will come considering how detailed Intuit’s reporting is (which is where new CEO Alex Chriss comes from).

Transaction Margin:

I’ve mentioned this before but it is truly important and worth repeating. PayPal’s transaction margin needs to bottom for sentiment to turn, for profit to compound, and for this investment to work. I won’t add until this happens. Braintree’s rapid growth has weighed on this margin line along with a few other headwinds.

Those headwinds need to abate, and I’m confident that they will as PayPal delivers the margin trough. Not in Q3, maybe in Q4 and likely in 2024. Why? Several reasons:

- The same note on its whole business being made up of the lowest possible margin clients (giant & U.S. based).

- It’s having success expanding internationally in Latin America and in Europe through relationships with clients like Booking.com.

- It now finally has a modern full stack product (PayPal Commerce Platform) geared towards smaller, higher margin businesses.

- Industry e-commerce growth and discretionary spend are showing signs of recovering per PayPal. This will feed branded transaction revenue which is margin accretive.

- Braintree customers let PayPal integrate its latest and greatest branded checkout flows into merchant sites. This raises branded checkout market share.

- It’s debuting more value-add services for Braintree clients like FX as a service next year (impact to be in 2025).

- FX translation and currency hedging gains were abnormally strong in 2022. The company will finish lapping that transaction dollar comp headwind in Q4. Similarly, non-recurring merchant cleanup fees added $190 million in one-time transaction margin dollars for 2022. That comp headwind goes away in Q4.

- As it finishes onboarding merchants to the newest Braintree integration and PayPal Commerce Platform, it will be able to sunset antiquated versions of these products to cut redundant costs. It will also finish somewhat hefty custom Braintree integration work for its largest 100 merchants by the end of 2024 to shed those costs (which are considered transaction-related costs) as well.

- There’s a lot of custom onboarding work needed for gigantic clients such as Uber and these will diminish with the rollout completion.

Final Notes:

- Expect more EBIT margin expansion in 2024.

- No discernible impact on peer-to-peer payment volumes from the FedNow Launch. The use cases are different.

- Will keep aggressively buying back shares while it sees the “intrinsic value of the company as much higher than the valuation.”

- While Net New Active Accounts continue to grow in core markets, they have been declining overall as PayPal eliminates cash burning incentive plans to retain users in less important markets where it doesn’t have its full product suite.

2. Walt Disney (DIS) -- Charter, ABC & Subscriber Targets

Sorry for the delay on the Disney piece. It’s currently in its final round of edits and will be published Monday Morning.

a. Charter

Disney and Charter ended their roughly one week contract dispute. It’s no coincidence that this happened just in time for a marquee Monday Night Football game. The structure of this new deal illustrates the power and draw of ESPN (and streaming too).

So what’s in the new 10 year deal? While complete financial terms were not shared, Charter will supposedly pay Disney $2.2 billion in content access fees. Interestingly, it will drop 8 of Disney’s 27 stations including less popular channels like Freeform, while accepting Disney’s price increases on the remaining 19.

The most notable piece of this newer deal is how it combines linear and streaming. Charter customers will gain access to the ad tiers of Disney+ and ESPN+ as part of a wholesale agreement for Disney to grant access in Spectrum’s overall bundle. The price of these services will be baked into Spectrum’s overall fees.

Furthermore, Spectrum customers will have access to ESPN’s planned streaming service whenever that goes live. Live sports is the remaining healthy part of linear TV and advertising. This ensures Spectrum continues to hold rights to that valuable content as the streaming revolution marches on.

This is also perfect for Disney. Why? Because they have long relied on Charter and Comcast as centralized distribution partners for its linear assets. That outlet potentially vanishes in the World of streaming, but as part of this deal, Spectrum will continue to serve as that distributor to its nearly 15 million customers. That will mean immediate traction for the new service and was the main sticking point for Spectrum granting Disney’s other demands.

This really was all about Spectrum wanting to maintain access to great content as it moves off of linear. Content is king… Disney is (still) the king of content.

Furthermore, this allows Disney to keep linear TV as a cash cow (a deteriorating cash cow but still a cash cow) for the next decade. That gives it far more flexibility and control over the eventual full shift to streaming. Laura Martin, one of my favorite media analysts, calls this a “win, win” and I’d have to agree.

b) ABC’s Multiple Bidders

Rumors are circulating that Disney could sell ABC to Nexstar. I love this news. Turn dying linear assets into cash while you can. Give yourself more flexibility to re-invest into your core intellectual property and to bid on highly valuable live sports rights. ABC’s general entertainment and live news niches are not what make this company stand out. They are expendable.

There was also a rumored $10 billion offer for ABC and other channels (including National Geographic and FX) from Byron Allen. I have the same opinion about this deal as the potential Nexstar deal.

c) Subscriber Targets

Bloomberg reported this week that Disney is preparing to cut its 2024 Disney+ subscriber target. While this is not ideal, it’s entirely expected and not alarming to me as a new shareholder. Why? The targets were born during different times when the backdrop demanded growth at all costs ignored profits and margins. So? Disney grew its subscribers at all costs.

Under Iger, amid changing investor demands and soaring interest rates, the philosophy changed. Disney stopped guiding to quarterly subscribers and set a new goal of streaming reaching EBIT breakeven by the end of 2024. It greatly cut back on content volume, exited some low value licensing agreements and sought to lean into its core brands to focus on quality of its creations… not quantity. Considering this, should investors really be surprised that its growth at all costs model is no longer relevant? No they shouldn’t be. This headline was coming, and anyone surprised by it has not been paying attention.

I heard rumblings that this weakness was the result of ineffective price hikes. That isn’t accurate. Its 2022 price hike was met with less churn and greater retention than expected. In fact, that hike went so well that prices were again aggressively hiked less than a year later. Some subscriber churn from these hikes was actually intended to push more traffic to its higher value ad-supported tier.

Finally, a lot of subscriber growth weakness is related to it losing India Premier League Cricket rights. That’s the main source of losses and those subscribers were in no way contributing meaningfully to profitability (ie, not worth investing in the Cricket rights). Disney no longer feels compelled to invest in unprofitable subscriber growth and that is a good thing.

This is not to say subscriber growth is finished. The company has guided to a growth acceleration through the end of the year and into 2024 as comps get easier and its content slate builds traction. Priorities have simply become more healthy and balanced.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for freehere. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible throughthis link.

3. Amazon (AMZN) -- Supply Chain by Amazon

Important Acronyms for this Piece

- Fulfillment by Amazon (FBA) is Amazon’s fulfillment center business where it stores goods for near future fulfillment and handles the pick, pack and ship for merchants.

- Amazon Warehousing and Distribution (AWD) is its longer term storage program utilizing Amazon’s distribution center footprint. Less full service than FBA as merchants more directly handle shipment organization and customer service.

- Closely related to FBA’s storage service.

- Amazon Global Logistics (AGL) ships products from (usually) China to Amazon’s fulfillment centers across UCAN and Europe.

- It allows small merchants to reserve pieces of containers rather than needing an entire unit, thus cutting costs, and handles all global compliance.

- SCA (Supply Chain by Amazon) extends its end-to-end supply chain service earlier on in a good’s lifecycle all the way to the manufacturer.

- AGL, FBA and AWD customer overlap is considerable (and will be with SCA too).

a. The King Strikes Again

Amazon is the master of turning its own costs into revenue and shareholder value generators. Its vast compute infrastructure costs were monetized as AWS. FBA in 2006 effectively monetized their fulfillment needs as well. Amazon is simply second to none in its ability to treat every cost line item as an opportunity. That was one of many Bezos strengths and this strength is clearly carrying on following his retirement.