Today's Newsletter is Brought to You By The Wolf Report:

For a Savvy Trader-powered view of my current portfolio, click here.

1. CrowdStrike (CRWD) -- Channel Checks

Morgan Stanley issued a research note this week on continued cybersecurity demand trends. Unsurprisingly, they, like everyone else, see continued robust security spend while other pieces of enterprise investment falter. Security is mission critical, Slack (for example) is not.

Interestingly, Morgan Stanley also sees agent consolidation as a clear theme in the space. This is advantage CrowdStrike considering its seamless ability to routinely consolidate 5-10 security agents across use cases like endpoint, cloud workload, log management, zero trust identity & more. Other beneficiaries will be Palo Alto and, to a lesser extent, Microsoft within the small-medium business segment predominately.

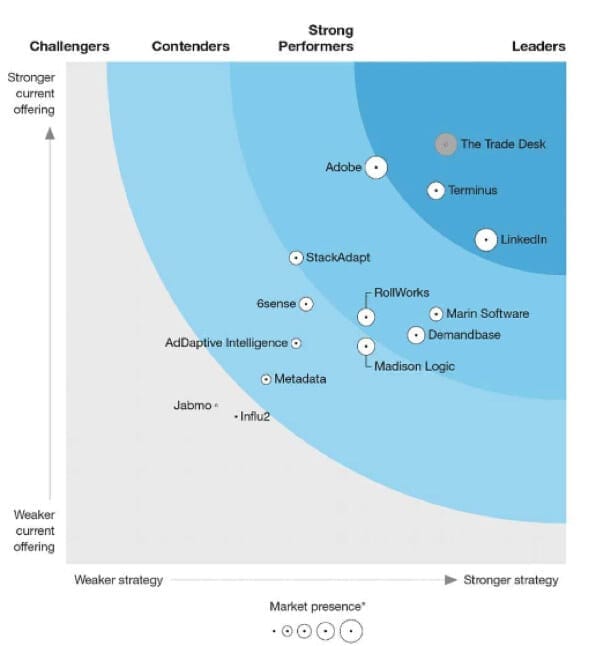

2. The Trade Desk (TTD) -- Forrester

Another week, another convincing accolade for The Trade Desk from an independent, 3rd party research organization. For the 3rd quarter of 2022, The Trade Desk ranked 1st out of 14 in both offering and go to market strategy for business to business (B2B) advertising. It’s far and away the leader in business to consumer (B2C) open internet advertising as well and it’s important to note that B2C is the core company focus here. It intentionally leaves low hanging B2B products to other partners in order to maintain close relationships and no conflicts of interest. This superior score is despite that. Encouragingly, some of the other top scorers like Terminus are fueled by an integration with The Trade Desk.

The report read like a sales pitch for The Trade Desk with language like “the company makes B2B advertising more scalable and targetable” and “it’s leading visionary initiatives to benefit B2B advertising.” Forrester also praised the company for its ability to integrate with agencies that serve demand of all sizes so that the smallest of businesses can access these lucrative tools. When you read through the rest of the company reports, Forrester was not NEARLY as complimentary.

“The Trade Desk is best for B2B advertisers and agencies with large audiences and sophisticated advertising needs.” -- Per the Forrester Report

Click here for my TTD Deep Dive.

If you're interested in entrepreneurship, franchises are a slept on path to own your own business. Everyone thinks of McDonald's when they hear the word franchise, but there's over 4,000+ franchises in the United States, and The Wolf is always breaking down the best ones. His work is perfectly complementary to mine -- and high quality.

He does the research to find brands that show a great return-on-investment, and also how you can become a big time franchise owner (seriously - he gives the playbook for how to be like this guy who owns 140 OrangeTheory franchises). If you want to learn about franchises from the expert - check out The Wolf Report!

3. Meta Platforms (META) -- Hiring & Product Announcements

a) Hiring

Meta is freezing all hiring and restructuring teams in its latest attempt to cut costs. In a Q&A with Meta team members, Zuck said this was to “make sure we’re not adding people to teams that we don’t expect to exist next year” and in light of a persistently poor macro backdrop to “plan conservatively.”

Meta remains in survival mode. The plethora of macro headwinds hitting the industry coincided perfectly with its bumpy monetization transition to Reels -- and its longevity has been questioned as a result. It still has half the planet using its products (Facebook users in North America are still growing), WhatsApp is still in the 1st inning of monetization, commerce is still exploding within the family of apps, and I still fully believe in a future where Metaverse use cases are a daily phenomenon.

Is owning Meta today more speculative than it has been since the IPO? Absolutely. Do I believe in Zuck to right the ship while taking advantage as temporary headwinds abate. Absolutely.

I’ll likely be adding to my position as any semblance of a base begins to form. While I could always be wrong, I wholeheartedly see this as easily a 10%+ revenue compounder going forward with eye-popping margins, a fortress balance sheet, significant optionality and a more than fair multiple.

b) Product Announcements

- WhatsApp is debuting sharable links to enter a voice call with the tap of a button. It’s easy to see how this feature could be a relevant enterprise use case going forward.

- Meta Platforms is actively testing toggling between Facebook and Instagram in a push to bolster interoperability between the two and to create stickier users.

- Meta debuted a new AI algorithm to transform text prompts into video content. To the people who say AI will not turn this world on its head, I think you’re wrong.

4. Lululemon Athletica (LULU) -- Lululemon Studio & Nike

a) Lululemon Studio

The Athleisure behemoth announced Lululemon Studio this week which will debut October 5th. The membership will cost $39 per month and can only be purchased with the Mirror. The Studio will “connect members to the most dynamic fitness content, community and products.” It will offer the same at-home workout capabilities that made Peloton so popular over the years, but will also offer in-person studio workouts as well. This is sort of like a business model merger between Peloton and Soul Cycle -- without Lulu directly maintaining all of the real estate.

This launch stems from the principle that the more you can keep loyal shoppers in your ecosystem, the more (in general) they will spend and the less (in general) they will churn. This gives those shopper more opportunity to engage and spend.

The product will use and add to Mirror Studio’s 10,000 classes leveraging Lulu’s deep fitness and wellness partner relationships. Content partners to start will include Pure Barre, Rumble, YogaSix, AARMY and many more. At discounted prices, users will be able to access the content and buy Lulu gear if taking the classes in person.

Considering Lulu’s massive, passionate following in the Athleisure space, success here seems like a probable outcome. I still don’t like the Mirror purchase, but traction here could change my mind on that in a hurry. And conversely, I love the way Lulu is going about this omni-channel studio make-over: In an asset-light way that leans on already established infrastructure of what would have been entrenched competition.

“No longer will you have to choose between going to your favorite studio or streaming a class a home -- you can have both.” -- Lululemon Chief Brand Officer Nikki Neuburger

As part of this announcement, Lululemon is launching the Lululemon Essential Membership program. All existing North American guests will receive free access. This is essentially a loyalty program refresh with rewards and early product access to create more recurring, loyal revenue streams. This launch will be intimately intertwined with the Lululemon Studio membership as Studio includes all of the same perks as the Essential Membership with a few unique features (like another 10% off lulu purchases).

b) Nike’s Quarter

Nike is struggling with inventory gluts amid a weakening economy and will have to mark down apparel more aggressively to work through it. Margins and growth will be tough to find for this consumer discretionary icon in the near term. While Lulu shares fell on this news with all other retailers, I don’t see this as a relevant read-through to Lulu’s future results, and here is why:

Lulu’s management has a wonderful track record of effectively guiding through tumultuous times. It has already guided to a strong end to the year with zero plans to enhance discounting. It sees ZERO evidence of macro pressure hurting its customer while that’s largely what Nike is blaming. How could this be? It’s a combination of serving the slice of our world that is less sensitive to Macro pressure and the brand also firing on all cylinders. I think a rock star management team helps too -- but I’m clearly biased. Yes, Lulu’s inventory spiked last quarter, but it’s having no trouble moving the gear as it was a reaction to (NOT A FORECAST OF) demand and being under-inventoried last year.

Click here for my Lululemon Introduction.

5. Shopify (SHOP) -- Brick and Mortar

It’s no secret: Shopify and countless other e-commerce companies got too excited with pandemic trends and assumed them to be far more permanent than they turned out to be. Brick and mortar retail is instead back with a vengeance, growing 60% YoY over the first 6 months of 2022. So? Shopify is sinking more resources into carving out its brick and mortar niche. This week, the company announced its new point-of-sale (POS) hardware called Shopify POS Go to “power a new kind of retail.”

Rather than tell you how large of a hardware upgrade this is vs. the previous model, I think it’s better to just show you. Here’s a comparison with the old model on the left and the new on the right: