Table of Contents:

- Nike – Earnings Review

- Cloudflare – Earnings Review

- The Trade Desk – New Product & a Partner

- Mercado Libre – Noisy Week

- SoFi – Data & Products

- Uber – M&A

- DraftKings & FanDuel – Prediction Markets

- PayPal – Partnerships

- Nu – USA

- Headlines

- Macro

For access to my latest portfolio and performance, 40+ earnings reviews from this past season and so much more, click here.

1. Nike (NKE) – Earnings Review

a. Key Points

- The signs of a recovery are building. More signs needed.

- Wholesale and North America are leading the way.

- Digital and China have a lot more work to do.

- Last quarter looks like it was the bottom in terms of financial performance.

b. Demand

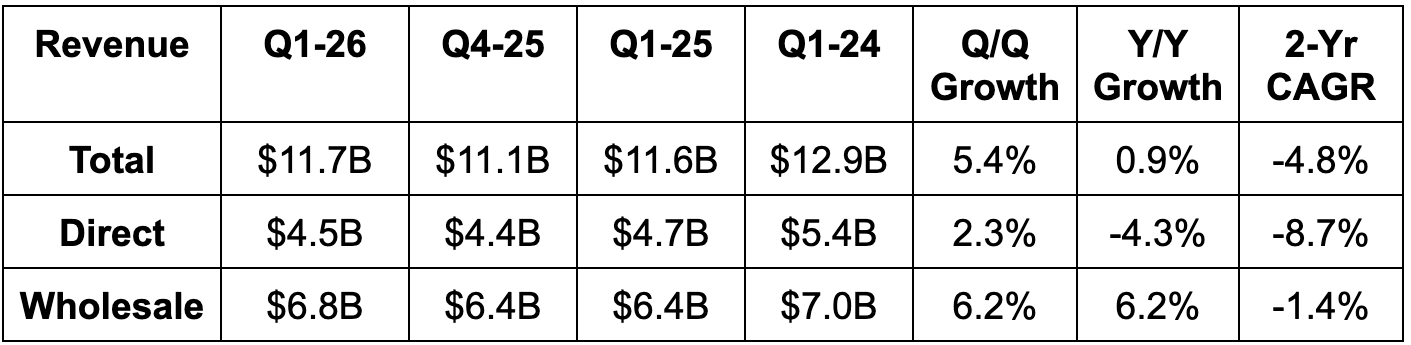

- Beat revenue estimates by 6.4%. It also beat -5% Y/Y revenue growth guidance comfortably.

- North America beat by 9.5%. China beat by 5%. APAC + LATAM beat by 5%. Europe, the Middle East and Africa (EMEA) beat by 7.5%.

- Beat wholesale revenue estimates by 8.3%.

- Beat direct-to-consumer revenue estimates by 4.8%.

c. Profits & Margins

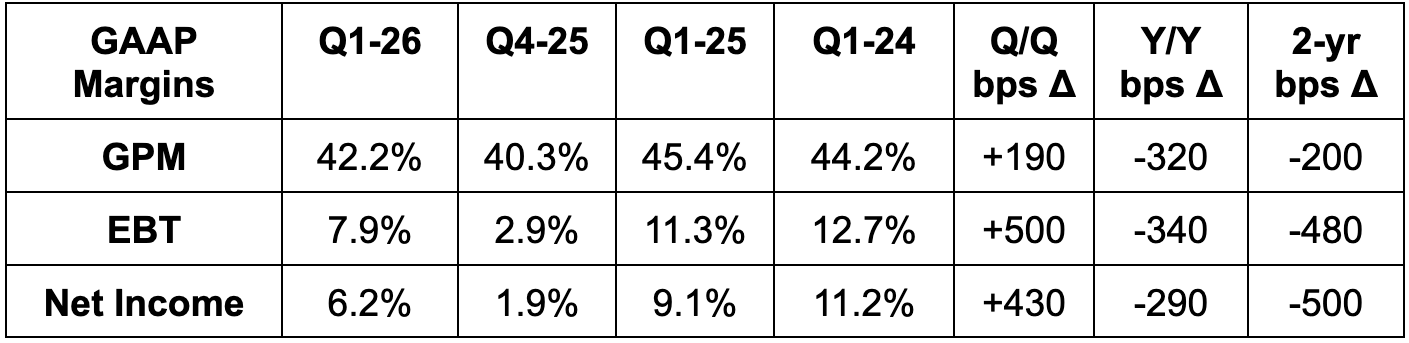

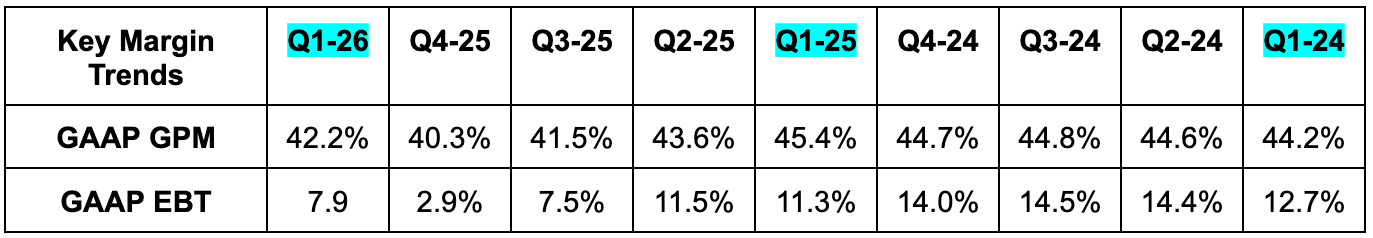

- Beat 41.7% GPM estimates by 50 basis points (bps; 1 basis point = 0.01%).

- Gross margin headwinds continue to include higher wholesale and Factory Store discounting (not on digital) to work through stale inventory, fixed cost deleveraging due to all of the revenue headwinds and tariffs.

- Beat $0.28 GAAP EPS estimates by $0.21.

- SG&A fell by 1% Y/Y due to lower brand marketing expense, which was nearly entirely offset by higher sport-specific performance marketing.

- EPS fell from $0.70 to $0.49 Y/Y as expected due to its aggressive turnaround plan discussed throughout this piece. A small portion of the decline was related to a higher effective tax rate. Most of the decline was related to core operations.

d. Balance Sheet

- $8.5B in cash & equivalents.

- Inventory -2% Y/Y to $8.1B.

- $2.6B in total debt.

- Share count fell by 1.5% Y/Y.

e. Guidance & Valuation

- Guided to low single-digit Q2 revenue declines, which met -2.9% Y/Y growth expectations.

- This weakness is powered by Nike Digital, China, Converse and cutting reliance on legacy franchises

- Guided to about 340 bps of Y/Y GPM contraction, vs. 220 bps expected. This is related to incremental tariff headwinds discussed below. Between this and high single-digit SG&A expense growth guidance, Q2 net income estimates fell by about 28%. At the same time, the large Q1 beat and low single-digit full-year SG&A growth guidance led to full-year 2026 net income estimates modestly rising.

I think the subtle rise in annual net income estimates is an encouraging sign of progress. That’s especially true considering Nike added $500M in incremental cost headwinds for the year related to tariffs. Based on how estimate trends unfolded inter-quarter, it looks like analysts were waiting on commentary surrounding this change before reflecting it in estimate revisions. Furthermore, this cost headwind will shrink over time as it negotiates with vendors, tweaks its supply chain and hikes some pricing.

For the full year, as we’ll dig into in more detail throughout the piece, wholesale-related demand and gross margin headwinds should keep easing through the remainder of 2025. That should mean full-year wholesale revenue grows while the large GPM headwind fades away. This is thanks to North America, as strength here will offset ongoing weakness in China. Much more on that later as well. For the Nike Direct bucket, ongoing double-digit digital declines related to reduced prices will continue to weigh on results and generate negative overall segment growth for the full year. That digital traffic trend could actually get worse in Q2 before things start to improve. Some signs of improvement… many more needed with North America expected to keep leading the way.

f. Call & Release

Win Now – Overall Progress Report:

The theme of the quarterly call was Nike turning a corner. Last quarter, they told us that would be the worst financial period for this turnaround. That expectation was reiterated this week, as growth rates trough and NIKE enjoys some early success with operational changes.

The first focus areas for change were the running segment, wholesale partnerships and North America overall. As we’ll see throughout this piece, improvements are most pronounced in these three areas, clearly showing that the changes are working. They’re “getting some wins under their belt.”

And while that’s true, the team cautioned against getting overly excited about the pace of the overall business recovery. There are many more categories in need of fixing, with those repairs early on in their impact journeys. Furthermore, the macro backdrop is not amazing for clothing vendors right now. They have a ton of things within their control to improve underlying financials, but macro cooperation will not be a supportive tailwind at this stage.

Win Now – Sport at the Center:

As a reminder, the main piece of its Win Now approach is placing Sport at the center of operations (“Sport Offense”) by segmenting teams by individual brand (Nike, Jordan and Converse) and sport. They reorganized 8,000 employees this past quarter and believe this has tightened communication around more local, specific objectives, making Nike better at catering to needs on a by-sport or by-market basis.

Running is perhaps the best example of tighter, by-sport focus leading to fundamental momentum. The company has changed product delivery to fixate on comfort, stability and the ability to wear shoes for everyday use cases. Sounds rational. They’ve overhauled the Vomero (type of running shoe), with strong sell-through rates for the Vomero Plus telling them the approach is well placed. Redesigns for the Pegasus (also a shoe) and some other models are expected to generate similar momentum, while newness in Nike All Conditions Gear (ACG) added outdoor high-performance running apparel to the mix. They added a dedicated team for this segment as part of the overarching mission to group talent and focus into more granular buckets. All in all, Nike Running grew by more than 20% Y/Y, and they’re looking to extend the effective work and learnings from this category to the rest of their sports. Again, all of these sport-based recoveries will be on different timelines, but their strategy working in running bodes very well for it working elsewhere.

It sounds like Global Football/Soccer and basketball will be the next priorities. They’re gearing up for the 2026 World Cup with “several football streetwear collections” and a various array of cleats at all different price points. They’ve debuted a new “Scary Good” marketing campaign to amplify new product traction.

As an aside, that’s another point of differentiation Nike is looking to leverage. It has products at all cost levels that cater to all different kinds of consumers. That should mean product innovation can be even more impactful and help them win all types of consumers. Their addressable market is uniquely massive in shoes and apparel, but they’ve done a poor job catering to all facets of it. That leaves a lot of lucrative low-hanging fruit to take advantage of. This company reminds me of Starbucks in so many ways.

Win Now – Better, More Focused Stores:

The Win Now objective also involves redesigning storefronts to cater to more specific activities and deliver more compelling product displays. For example, they revamped the House of Innovation location in New York City, which has already yielded a 10%+ uplift in store revenue. They upgraded a smaller location in Austin that also led to “significant sales increases,” showing this concept can be applied to many different store models.

Win Now – Reinvigorating Marketplace Health:

Aside from improving stores, taking better care of wholesale partners and fixing the digital shopping environment are top priorities. Repairing wholesale relationships is the furthest along. They’ve worked hard to ship higher-quality inventory to partners like Dick’s Sporting goods and more proactively manage product display areas at retail partners. They updated 1,300 of these display areas across Dick’s, Nordstrom and other partners during the quarter. It was not giving retailers compelling products to sell to customers, as it was prioritizing digital channels too much, rather than simply focusing on generating demand wherever a customer shops. They’ve become far more channel agnostic, and the byproduct here is happier wholesalers generating more revenue for Nike.

An impactful tool within that pivot has been cutting hefty, constant discounting on their digital storefront. Not only did that greatly diminish Nike’s brand quality perception, but it also burned the trust of some retailers, as they saw Nike simply undercutting them. No longer is this the case. In North America specifically, where marketplace fixes are the furthest along, promotions fell by 50% Y/Y while markdown rates also improved. Their reliance on selling the classic franchises they’re trying to phase out (another current revenue headwind) also diminished

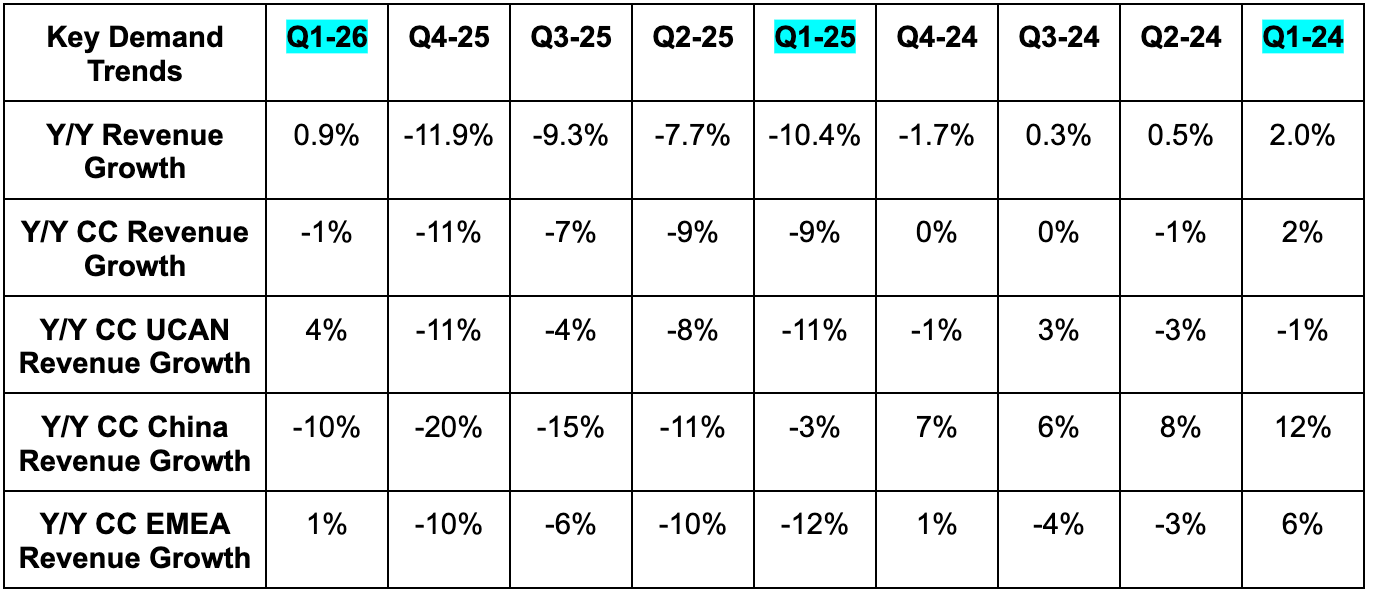

Like in previous quarters, higher digital pricing is leading to significant digital traffic headwinds and is why that channel is expected to generate negative growth this fiscal year.

Conversely, these changes are leading to positive spring wholesaler order book growth and Nike’s confidence in this channel returning to positive growth for the year. Wholesale’s margin drag related to old product liquidation should also diminish during the second half of the year. This specific bucket is nearing much healthier results.

- Its return to Amazon is yielding better-than-expected sales.

Win Now – Lifestyle Segment Recovery:

The lifestyle category recovery is not as far along as the performance category. It continues to struggle, as Nike picked other areas of the business to fix before this one. Nearly all focus has been spent on the performance side of the business to date.

Still, there are very subtle signs of this category starting to find its footing. Its Air Force 1 franchise is "stabilizing" and Air Jordan 1 inventory levels are getting back to a healthier place. The Dunk franchise has a lot of inventory still to address, which is happening through wholesale channels and, as briefly mentioned, weighing on gross margin.

- For Converse, the company just changed the leadership team and is taking “aggressive actions” to set this brand up for future growth. Converve is struggling, and it sounds like incremental inventory liquidation needs will provide more margin pressure for the next few quarters. It’s great that the aforementioned wholesale headwind is fading, but overall results won’t start to look starkly better until these issues stop popping up. It’s like a game of whack-a-mole right now, but it does seem like the moles are getting a tad less frequent.

More on Various Stages of Geography-Specific Turnarounds:

The North American market is the most advanced in its recovery. EBIT still fell by 7% Y/Y, but wholesale returned to positive growth for the first time in a while and Nike Stores was flat. The overall revenue decline there was all Nike Digital-driven, as it greatly reduces discounts to support its overall marketplace.

China is probably the market with the most remaining work to do. Running delivered nearly 10% Y/Y growth in the market, but EBIT fell by 25%Y/Y and everything else struggled. They’re in a tough situation there right now with double-digit declines in shopper traffic and underwhelming conversion rates as well. They are investing in stores and product assortment to better cater to the Chinese consumer. At the same time, it will take a while for changes to be implemented across its large 5,000-store footprint. And after that, it will also take a while for consumer awareness to build and for sales trends to respond. That means a lot of near-term cost without a lot of near-term financial contribution, hence the bad numbers

Despite this, following trips to China, leadership is confident in that market being a key source of future growth. The same sport-centric focus in North America will be brought to China, and they’ve already piloted a few stores and products in recent weeks with strong receptions. Throughout fiscal year (FY) 2026, this market will be an overall financial obstacle. Deep discounting on the digital site will probably continue and consumer momentum stemming from operational changes won’t come overnight. Things should look a lot better during FY 2027.

While North America is ahead on “return to sport” and wholesale recovery, EMEA is closest to overall marketplace health normalization. They’re “close to repositioning Nike Digital as a full-price business,” but traffic and demand patterns “remain soft.” That’s likely because price boosts in that market have been more rapid and aggressive than elsewhere. They’ve had to do that amid a sharply promotional environment throughout Europe.

Asian-Pacific + Latin America (APLA) is mixed. Overall digital discounting fell in the region overall, but there were a few material offsets to that strength. Some markets are experiencing inventory gluts that are forcing more promotional discounts in those specific countries. Inventory continues to grow there despite a desire to shrink it; they’re going to need to be more aggressive on pricing in the near-term. So again… mixed. Like the business overall, performance growth was strong and lifestyle growth was very weak.

Other Notes:

- The introduction of products under the Nike/SKIMS partnership enjoyed a “strong early customer response.”

- There was no material demand pull-forward from an abnormally strong back-to-school period like some thought.

g. Take

Much better quarter with many more reasons for optimism… but? Still with a lot more progress needed. Like for Starbucks, there was such a big mess to fix here. Nothing was going well and there weren’t prospects for improvement. Now there are. Hill is doing his absolute best to right the ship. I think he’s focusing on the right things and implementing the right changes. Things should continue to improve, and as Nike finishes repairing the remaining parts of its business, this can get back to steady growth between 5%-10% per year with a ton of margin catch-up left to enjoy.

If I was going to go with exposure to this sector (which is not my favorite place to invest), I think I’d pick On Running at this stage, but Nike has surpassed Lululemon in terms of investment quality in my mind and is a compelling turnaround play. Elliot Hill > Calvin McDonald.

2. Cloudflare (NET) – Catch Up Earnings Review

a. Cloudflare 101

Basic Niche:

Cloudflare makes the internet fast and secure. They have a massive global Content Delivery Network (CDN) to move traffic closer to the end user, which cuts web latency. They actively assist clients in optimizing traffic, speed and consistency as well. NET doesn’t sell physical firewall hardware, but instead a virtual, cloud-native “Magic Firewall” to supplant these hardware needs. It offers web application firewalls (WAFs) for app-level security and Magic Firewall is for network-level security. Magic WAN is Magic Firewall’s partner in crime; it connects networks while Magic Firewall protects them.

Workers Platform & AI Tools:

Workers Platform is its serverless (so fully managed by Cloudflare) product suite for millions of developers to build, maintain, secure and deploy applications. This enables caching of content and apps across Cloudflare’s global network for faster delivery. Its newer Workers AI product allows developers to access models and GenAI tools (like sentiment analysis) to build and customize apps hosted by Cloudflare’s network. Workers AI pairs seamlessly with its “Vectorize.” Vectorize offers a style of data querying that allows for visualization of patterns.

Another key example of Cloudflare’s GenAI tools is its R2 product. This allows cloud workloads and data to freely move among public clouds with no tax. This is key in a multi-cloud world and is popular for model building and implementation. Models are voracious users of data and data is routinely hosted in many clouds. That's where R2 comes in handy.

- Cloudflare AI is its overarching suite of AI tools, which include the developer AI tools in Workers AI, among others.

- Hyperdrive is a notable product within Workers AI. This allows any legacy database to plug into NET’s global CDN. It makes NET an easier migration partner as it helps customers embrace next-gen databases, on-premise-to-cloud migrations and GenAI.

Zero Trust & More on Network Security:

Cloudflare also offers its Zero Trust Network Access (ZTNA) program. This directly competes with Zscaler and many others. Zero trust means that a user or device must be constantly verified (or never trusted) as it moves through the network. Cloudflare does this in a seamless manner, minimizing user friction. It considers device type, location, usage patterns (or signatures) and other contextual clues to better authorize permission requests. This way, it knows when to block those requests or when to require more information. It then deploys a minimal privilege approach to ensure only the necessary permissions are granted to workers. Nothing more, nothing less. Zero Trust ensures an adversary can’t breach the most vulnerable part of a tech stack and move freely throughout it thereafter.

Secure Access Service Edge (SASE) is a term for how Cloudflare conjoins web performance like SWG, Magic WAN with security use cases like data loss prevention (DLP), Magic Firewall, email security and broad threat intelligence capabilities. This drives vendor consolidation, controls costs and augments performance. Cloudflare One is its overarching product bundle subscription combining this suite.

Cloud Access Security Broker (CASB) is a security tool to provide firms with a bird’s-eye view of application usage. This has both security and performance optimization implications. It hosts and secures client data and uncovers suspicious activity or deviations in typical usage patterns to flag threats. It plugs into NET’s Secure Web Gateway (SWG), which is essentially a digital security guard ensuring protection of a firm’s secure network and assets from the open internet. It ties closely to NET’s DLP and URL filtering tools.

It offers Distributed Denial of Service (DDoS) attack protection to augment its security and network capabilities. This form of hacking aims to inundate and overwhelm networks with traffic. This is delivered through a product called Magic Transit and boasts higher success rates, scalability and cost efficiency. That recipe is a cliché for Cloudflare products. They think they’re one of one in terms of handling massive traffic spikes without ballooning costs or issues. While alternatives route separate networks for DDOS-specific functions, sacrificing interoperability, Cloudflare provides non-siloed service.

More on GenAI:

Browser Isolation is Net’s managed service for providing users with a purely secluded environment to search and scrape the web. This will be an increasingly important tool for its GenAI inference products that are now building steam. Inference is where Cloudflare expects to realize the bulk of GenAI’s financial value. Models are trained once and periodically updated with new data. After that, the value of those models lies in their ability to connect dots and drive insights (or inference). That’s where Cloudflare thrives. It offers a managed cloud platform to do all of that app and model work in a secure and compliant fashion.