Table of Contents:

- Adobe & Rubrik – Brief Earnings Snapshots

- Oracle – Detailed Earnings Review

- SoFi – CEO Interview with Goldman Sachs

- Uber – CEO Interview with Goldman Sachs

- SentinelOne – CEO Interview with Goldman Sachs

- Meta – CFO Interview with Goldman Sachs

- Cava – CEO & CFO Interview with Piper Sandler

- Mercado Libre – CFO Interview with Goldman Sachs

- PayPal – CEO Interview with Goldman Sachs

- CrowdStrike – CEO Interview with Goldman Sachs

- Alphabet – Cloud CEO Interview/Presentation with Goldman Sachs

- DraftKings – Data

- The Trade Desk – Noisy Week

- Duolingo – Noisy Week

- Headlines

- Macro

Earnings Reviews from this Season:

- Zscaler earnings review

- Lululemon, Salesforce & Broadcom earnings reviews (sections 2-4)

- Nu & Airbnb earnings reviews

- Cava & On Running earnings reviews

- Datadog & Sea Limited earnings reviews (sections 1 & 2)

- Palo Alto & Spotify earnings reviews (sections 1 & 2)

- AMD earnings review (section 4)

- Trade Desk, Duolingo & DraftKings earnings reviews

- Uber & Shopify earnings reviews

- Lemonade, Hims & Coupang earnings reviews

- Mercado Libre & Palantir earnings reviews

- Amazon & Microsoft earnings reviews

- Meta & Robinhood earnings reviews

- SoFi & PayPal earnings reviews

- Alphabet & Tesla earnings reviews

- Chipotle earnings review.

- ServiceNow earnings review

- Netflix & Taiwan Semi earnings reviews

- Starbucks & Apple earnings reviews

& my current portfolio/performance.

1. Adobe (ADBE) & Rubrik (RBRK) – Earnings Snapshots

a. Adobe

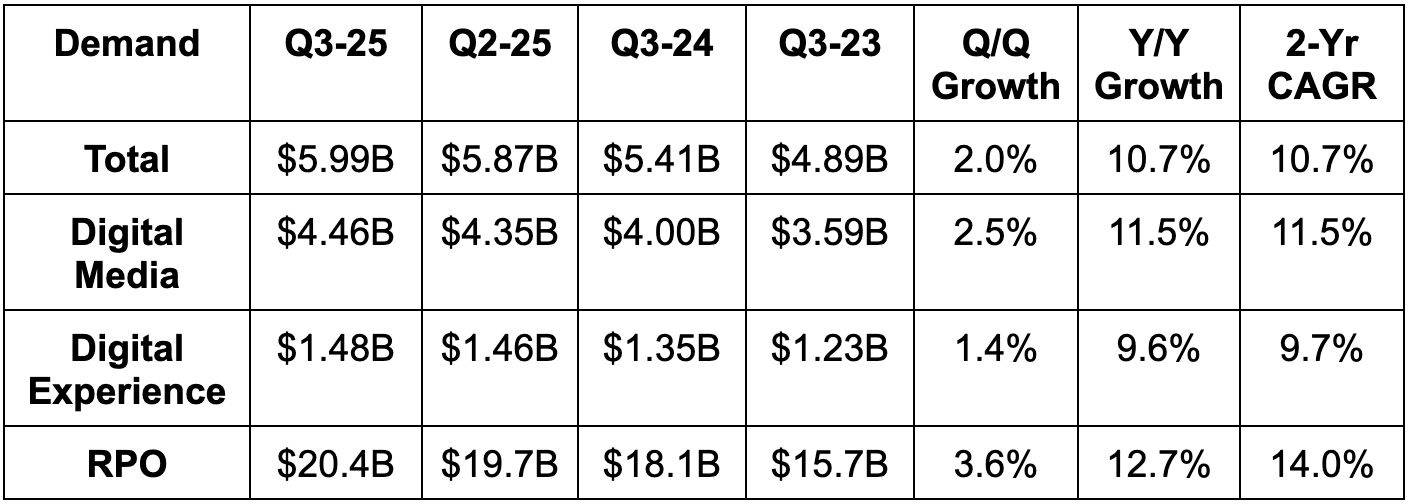

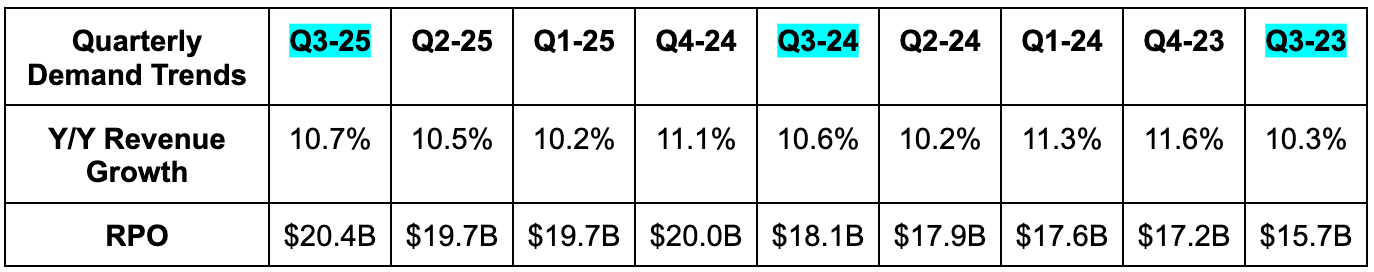

Demand:

- Beat revenue estimates by 1.4% & beat guidance by 1.5%.

- Digital Media & Digital Experience segments both beat guidance by ~1.5%.

Profits:

- Beat EBIT estimates by 3%; beat OCF estimates by 3.8%.

- Beat $5.18 EPS estimates & beat identical guidance by $0.13 each.

Balance Sheet:

- ~$6B in cash & equivalents.

- $6.2B in debt.

- Share count fell by 1.2% Y/Y.

Q4 Guidance & Valuation:

- Raised Q4 revenue guide by 0.8%, which slightly beat estimates.

- Raised Q4 EPS guide from $5.29 to $5.375, which beat by $0.045.

- Modestly lowered Q4 experience revenue expectations (given annual reiteration).

- Roughly reiterated Q4 Digital Media revenue expectations.

- Raised annual media ARR growth guide from 11% Y/Y to 11.3% Y/Y.

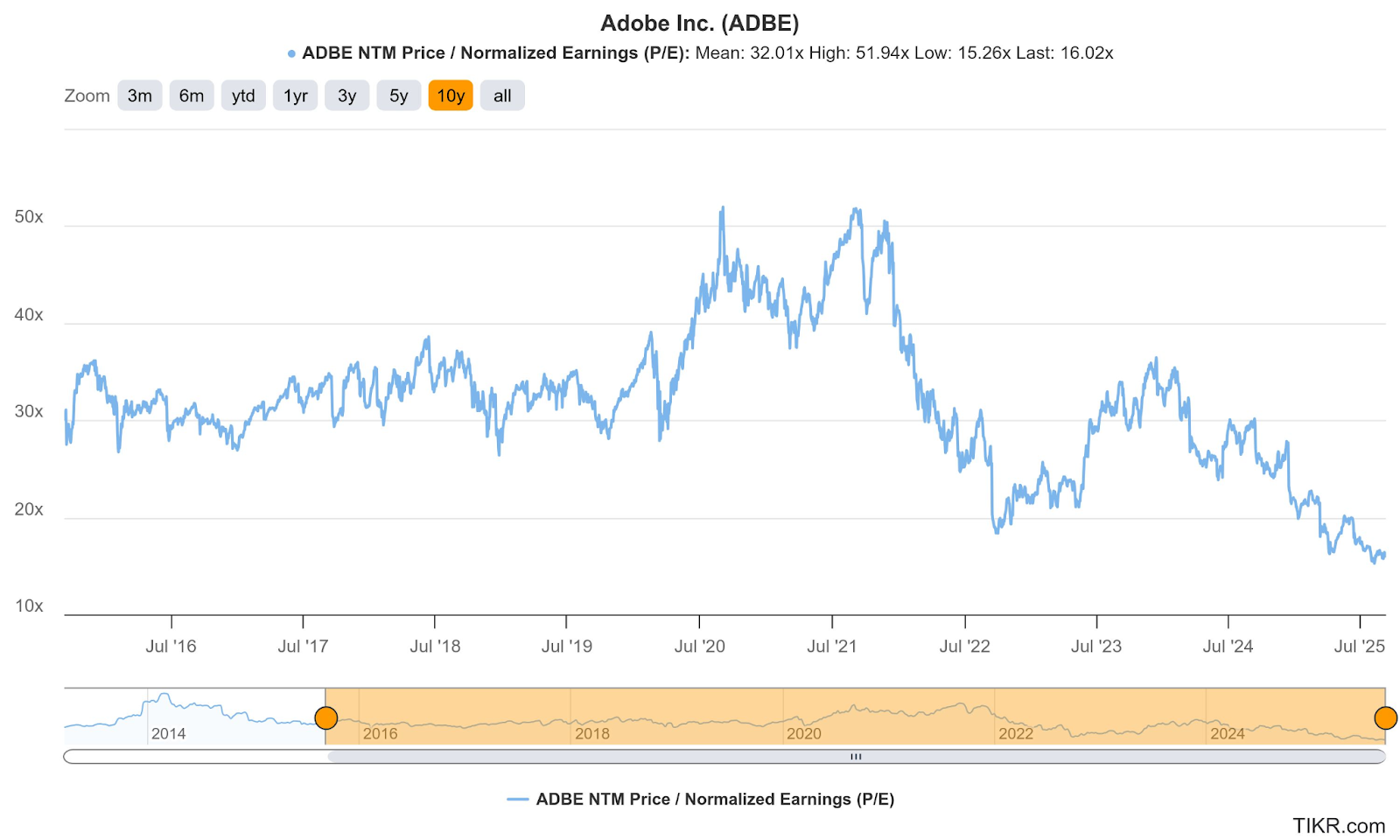

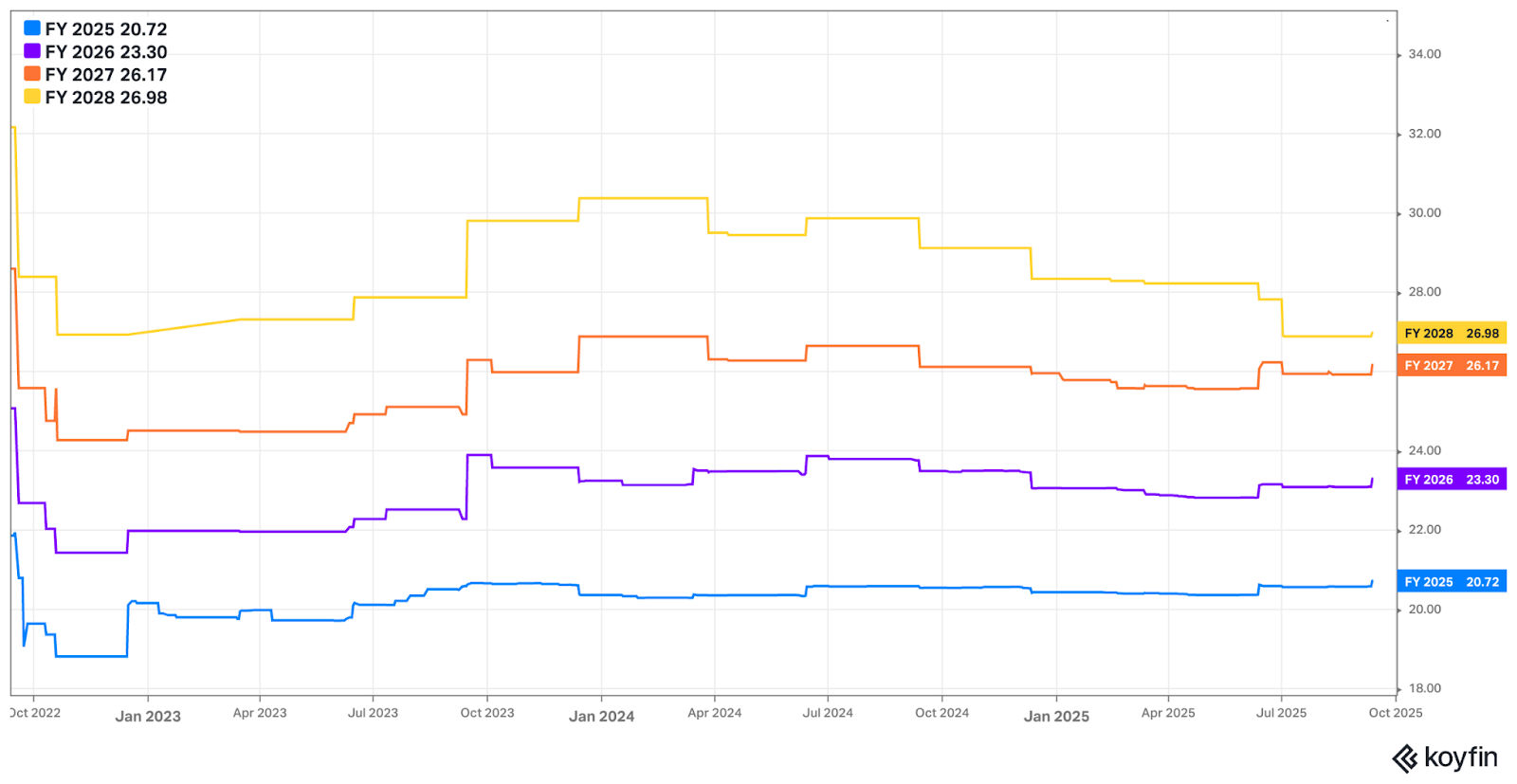

Adobe trades for 16x forward EPS. EPS is expected to grow by 12.5% in each of the next two years.

b. Rubrik

Demand:

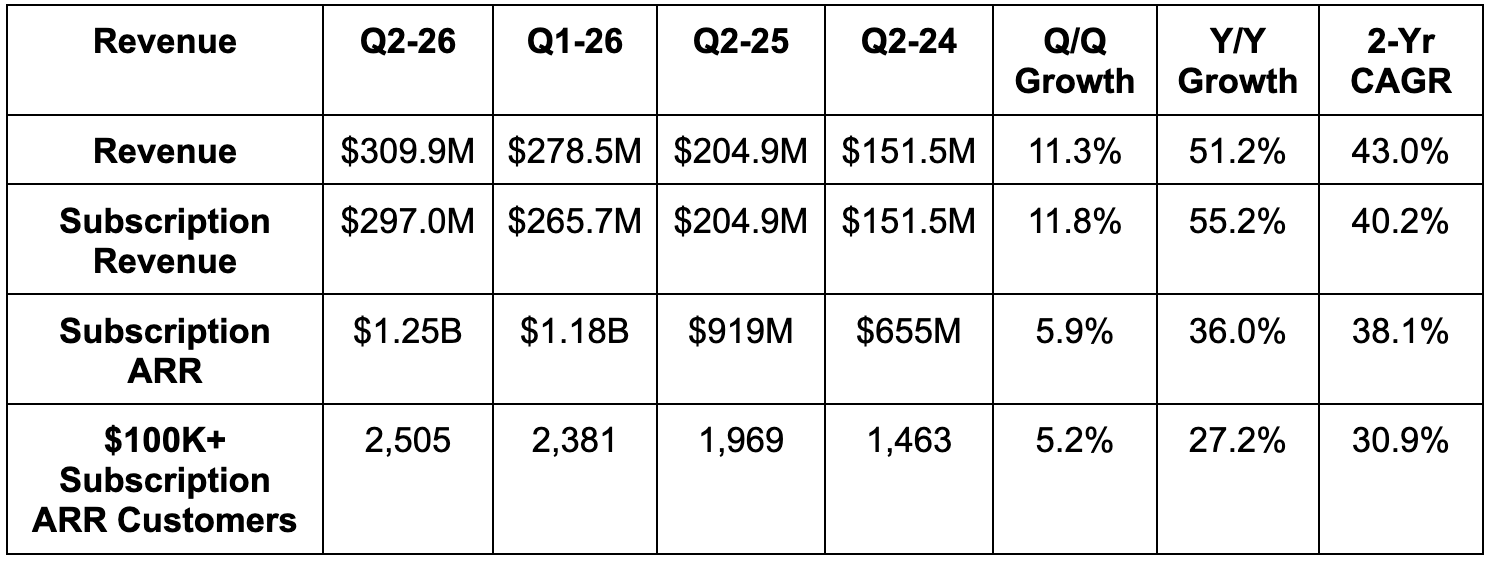

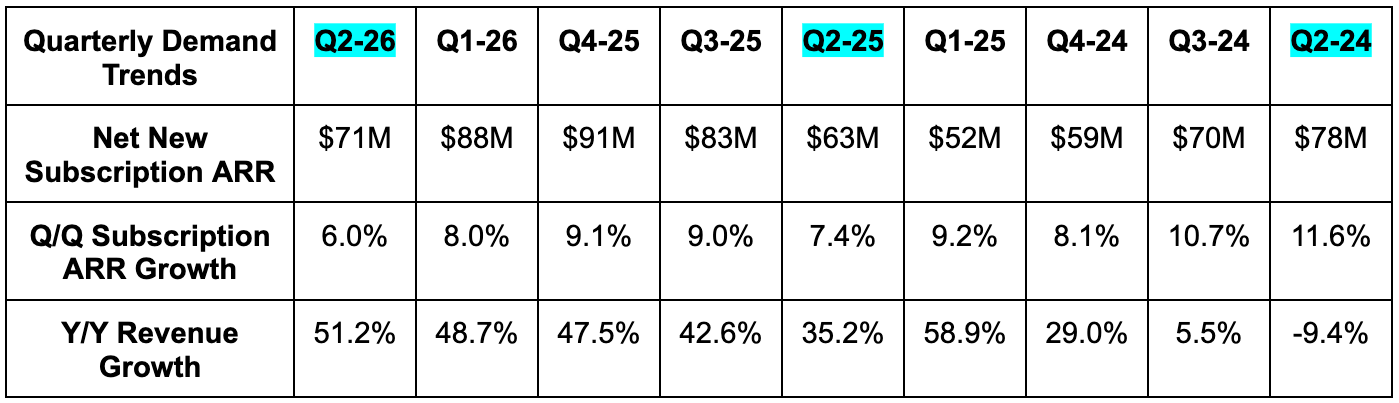

Rubrik beat revenue estimates by 9.8% and beat guidance by 9.9%. Slow growth from Q2-24 to Q4-24 was related to declines in maintenance and other revenue. Subscription revenue maintained at least 39% Y/Y growth for that period. Beat ARR estimates by 2% and beat $45M net new ARR estimates by $25M. It’s good to see subscription revenue carry the bulk of the beat. The nasty earnings reaction is likely related to some buy-side expectations calling for a larger beat than they delivered vs. sell-side analyst consensus.

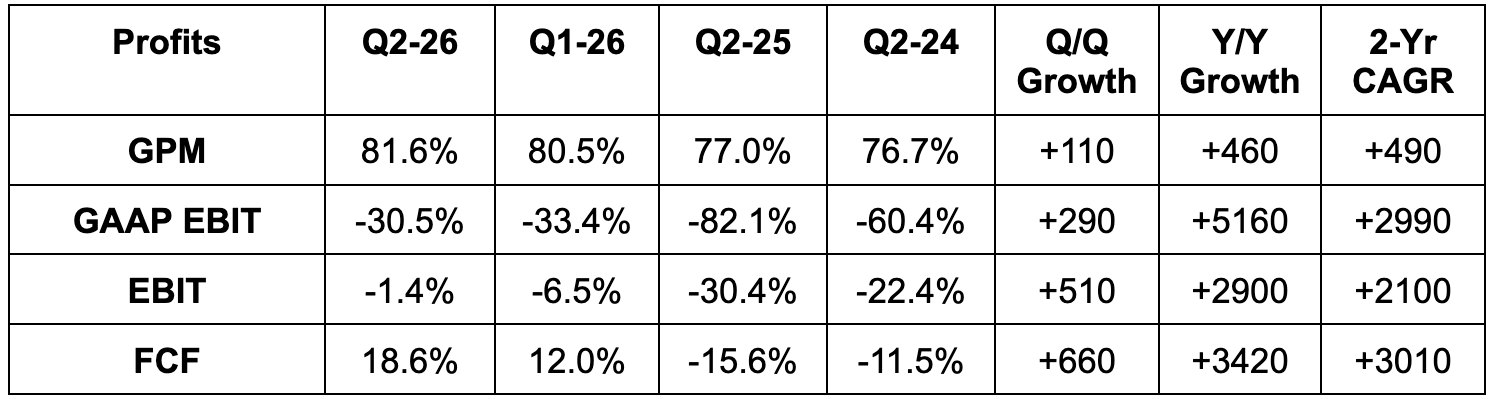

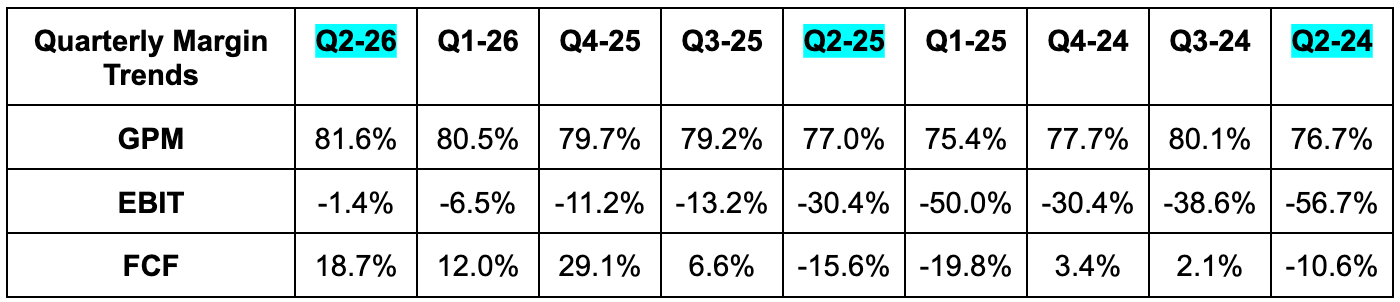

Profits:

- Beat 5.0% subscription ARR contribution margin (that’s a new one) with a 9.4% margin. This calculates subscription profit remaining after deducting all variable costs.

- Beat -$0.34 EPS estimates by $0.31 & beat identical guidance by the same amount.

- Beat -$58.2M EBIT estimates by $54M.

Balance Sheet:

- $1.52B in cash & equivalents.

- $1.13B in convertible senior notes. No traditional debt.

- 8.3% Y/Y share count dilution.

Guidance & Valuation:

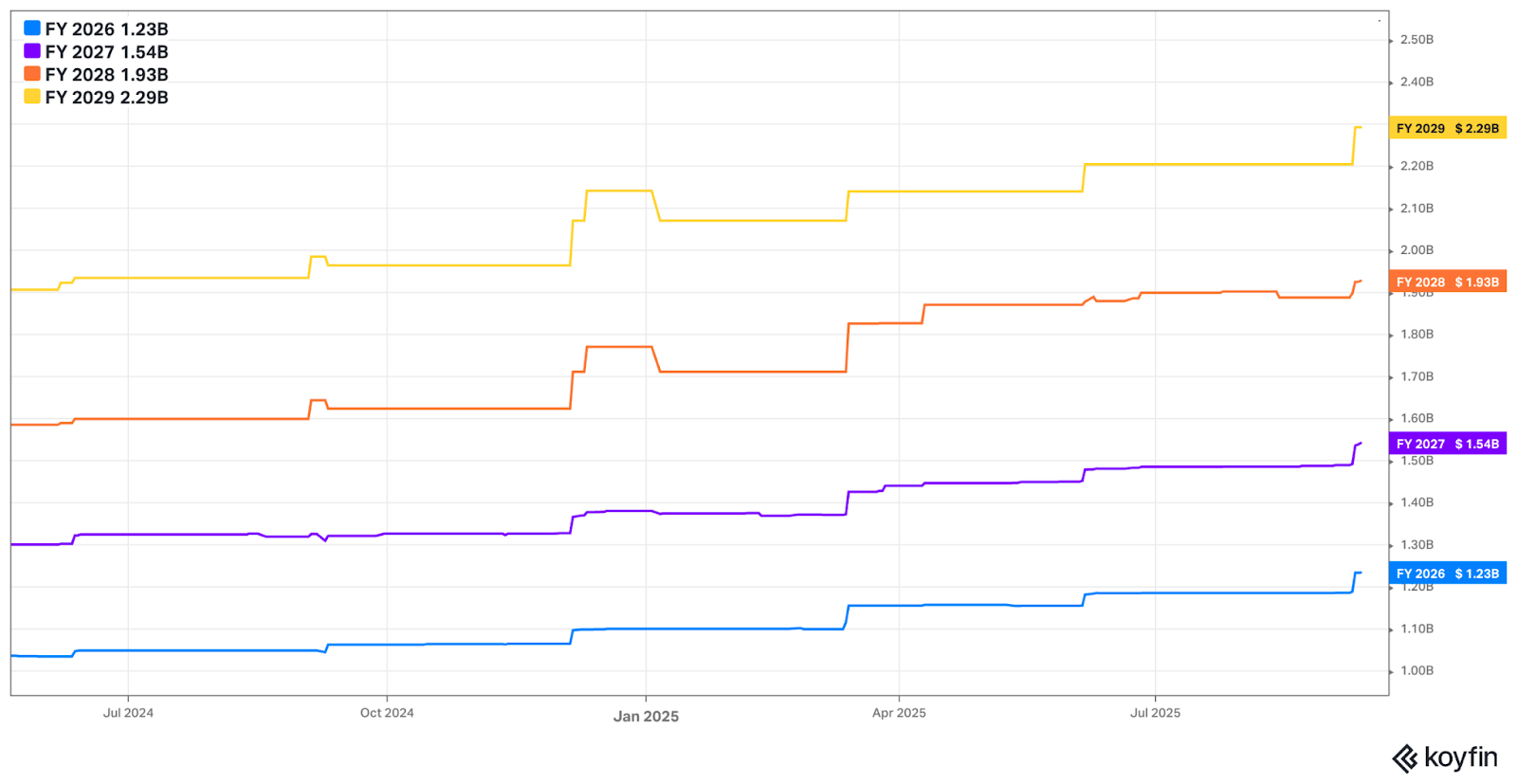

For the full year, RBRK raised subscription ARR guidance by 2% or $28M. This was $3M larger than the Q2 beat. It also raised annual revenue guidance by 4% or $48M. This beat estimates by 3.5% and was $18M larger than the Q2 beat. Next, it raised non-GAAP EPS guidance from -$0.99 to -$0.47, which beat by $0.51. Finally, it more than doubled FCF guidance from $70M to $150M.

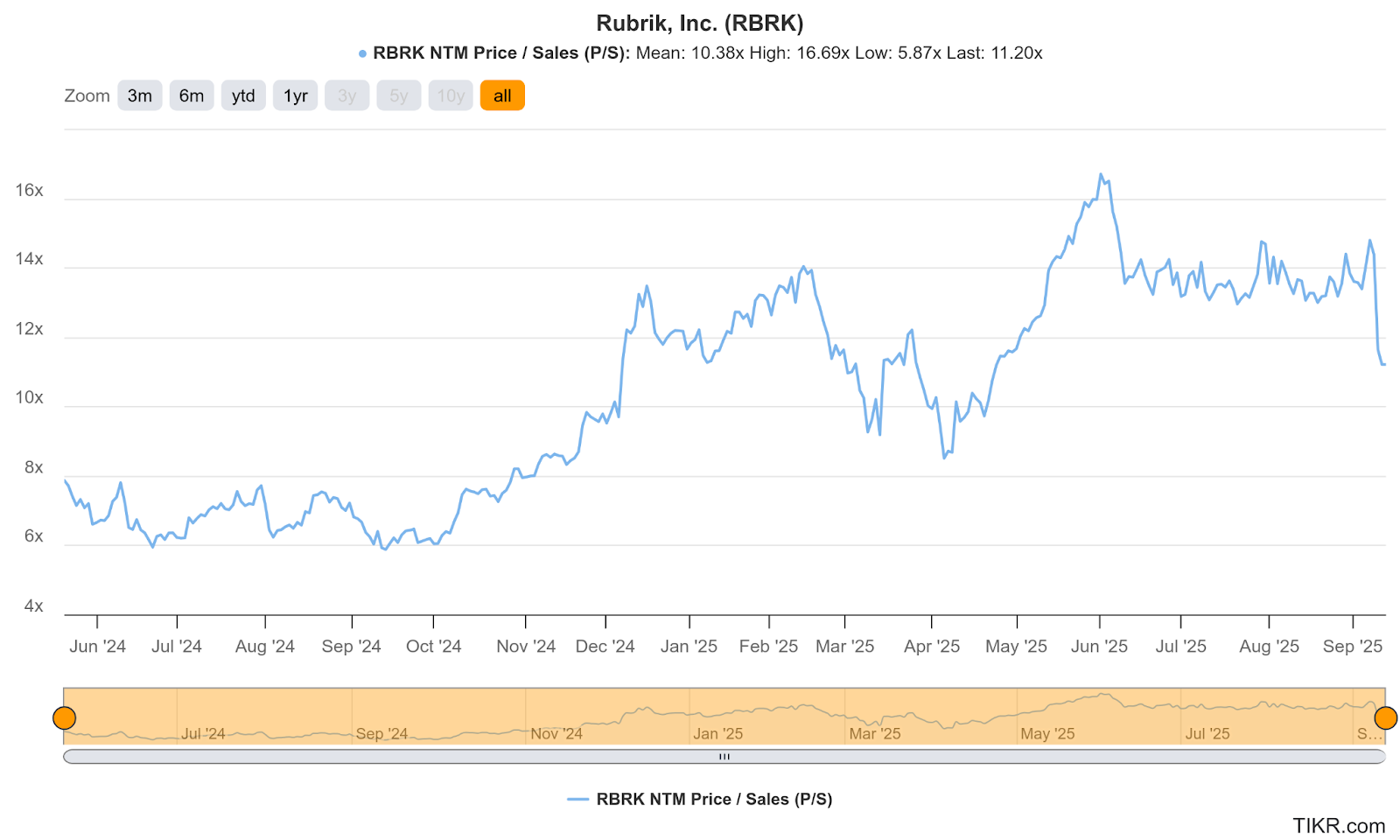

RBRK trades for 11x forward sales (no income statement profitability) and 89x forward FCF. Revenue is expected to grow by 39% this year and by 25% next year. FCF is expected to grow by 580% this year (from a base of nearly 0) and by 60% the following year.

I get excited when I see expensive stocks sell off on strong results like this. I’m looking forward to digging into the company.

2. Oracle (ORCL) – Earnings Review

a. Oracle 101

Oracle provides a slew of software and hardware tools for on-premise and cloud environments. It has 3 main segments that tie very closely together.

Oracle Cloud Infrastructure (OCI) is its fully managed business for infrastructure services (virtual machines, storage, managed high-performance compute data centers etc.). This segment also includes platform services to build apps in its safe, controlled environment (serverless and container-based).

Strategic Software As A Service (SaaS) includes Oracle NetSuite. This is a set of applications for enterprise resource planning (ERP), customer relationship management (CRM), human capital management (HCM), e-commerce and more. It’s hard at work on launching more industry-specific software apps across areas like healthcare. It has a more customizable, feature-rich product that’s similar to NetSuite called Oracle Fusion. This one is geared towards larger customers.

The last segment is its broad range of database products including both relational and document-oriented offerings across structured, semi-structured and unstructured data. Creating valuable apps from GenAI infrastructure requires great models and rich, organized information access to properly season those models. That’s where its database capabilities come into play.

Oracle closely integrates with the 3 big hyperscalers, allowing its databases to run anywhere. This also means that customers can migrate their on-premise databases to the cloud via OCI or through any of these hyperscalers, diminishing user friction. Oracle believes that this data cloud interoperability provides innate data transferring cost advantages. Cost is estimated to be “several times cheaper” for model training than any competitive product, according to leadership. Oracle has re-emerged as a digital infrastructure titan. While the company did take longer to roll out its high-performance compute product suite, it has since achieved fantastic traction.

b. Key Points

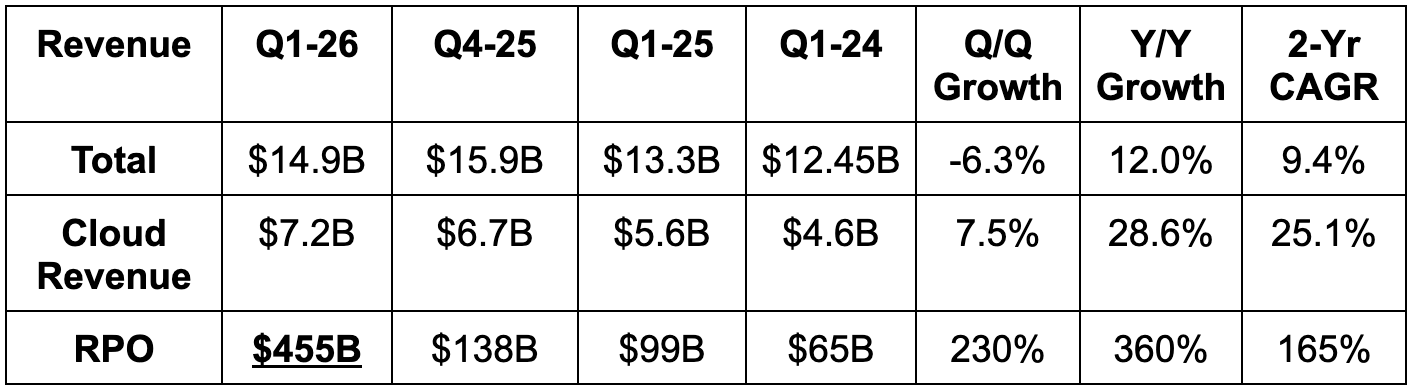

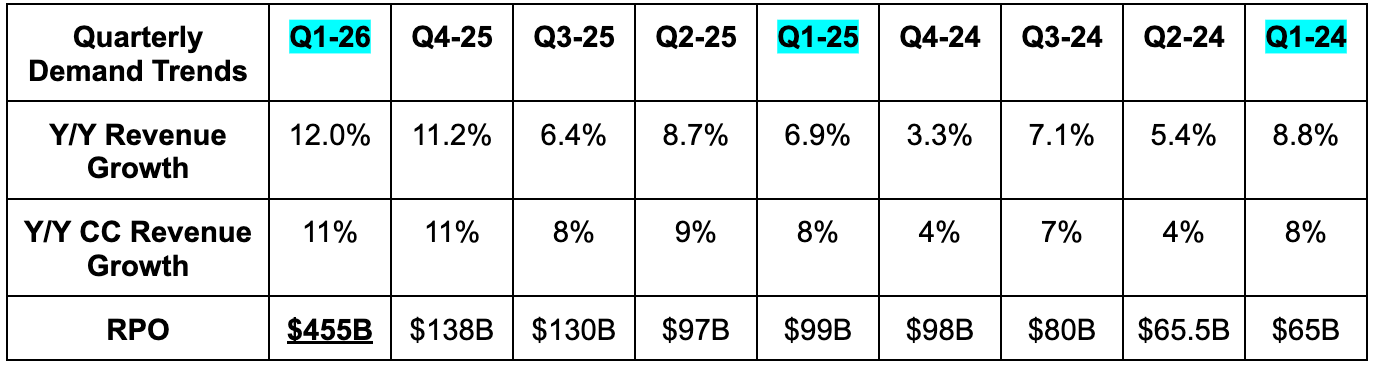

- Historically good remaining performance obligation (RPO) beat with some context needed.

- Exciting profit growth forecasts through 2027.

- The OCI and database value proposition combo is deeply resonating.

- More business means $35B in annual CapEx vs. $25B previously.

c. Demand

- Missed revenue estimate by 2.1% & missed guidance by 0.9%.

- Missed 12% constant currency (CC) growth guidance with 11% Y/Y growth.

- Obliterated remaining performance obligation (RPO) estimates by 205%. Much more on this later.

- Cloud RPO rose by 500% Y/Y.

Oracle re-grouped some income statement disclosures. It now reports cloud revenue, software revenue, hardware revenue and services revenue in separate buckets.

- Cloud (apps + infrastructure) rose by 27% Y/Y CC. Cloud infrastructure revenue rose by 54% Y/Y CC. OCI consumption revenue rose by 57% Y/Y CC.

- Software fell by 0.8% Y/Y.

- Hardware was roughly flat Y/Y.

- Services revenue rose by 6.8% Y/Y.

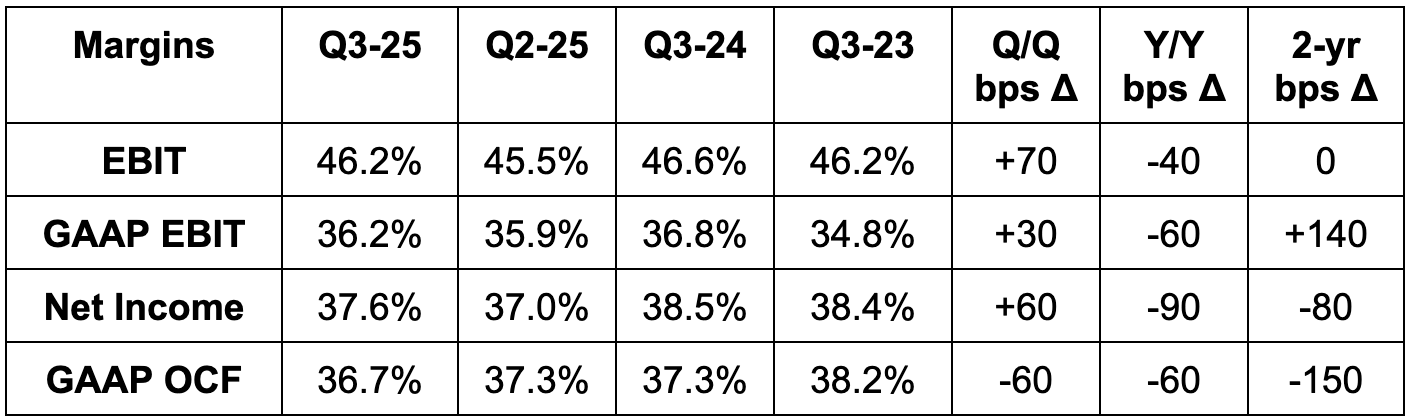

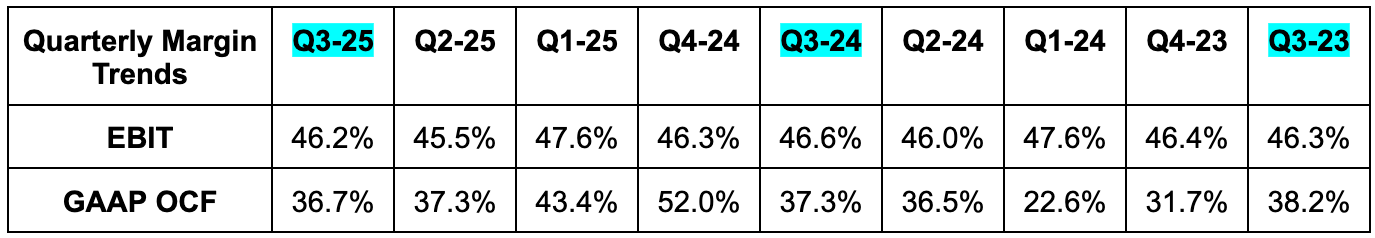

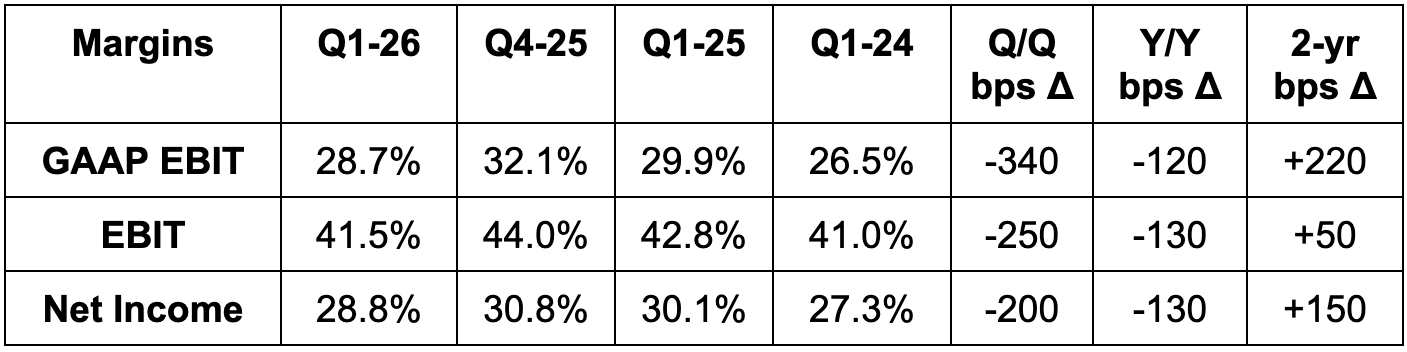

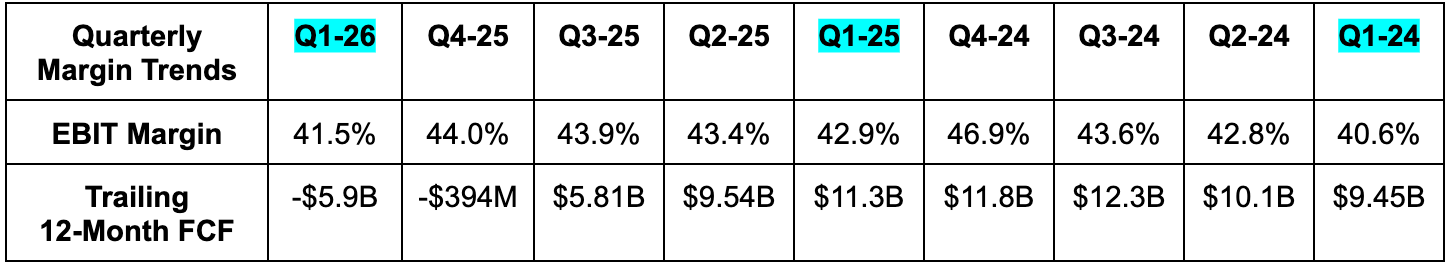

d. Profits & Margins

- Met 68.7% GPM estimates.

- Met EBIT estimate. EBIT rose by 7% Y/Y.

- Slightly missed $1.48 EPS estimate & slightly missed identical guidance.

- An unfavorable tax rate lowered EPS by $0.03 vs. guidance.

- Missed $1.5B FCF estimate by about $1.8B.

- Ramping CapEx to support demand is heavily weighing on FCF

e. Balance Sheet

- $11B in cash & equivalents.

- $91B in total debt.

- 2% share count dilution.

- 28% Y/Y dividend growth.

f. Guidance & Valuation

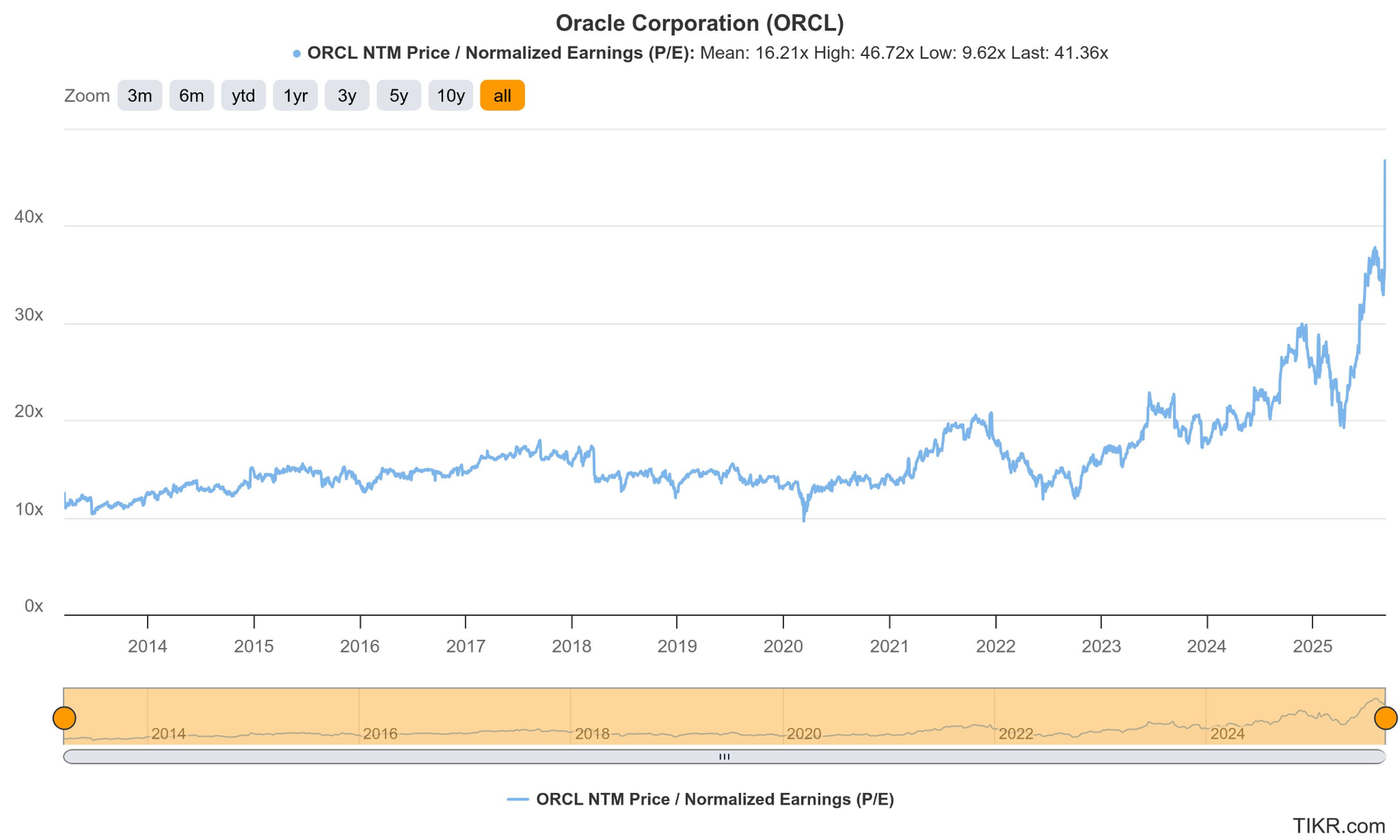

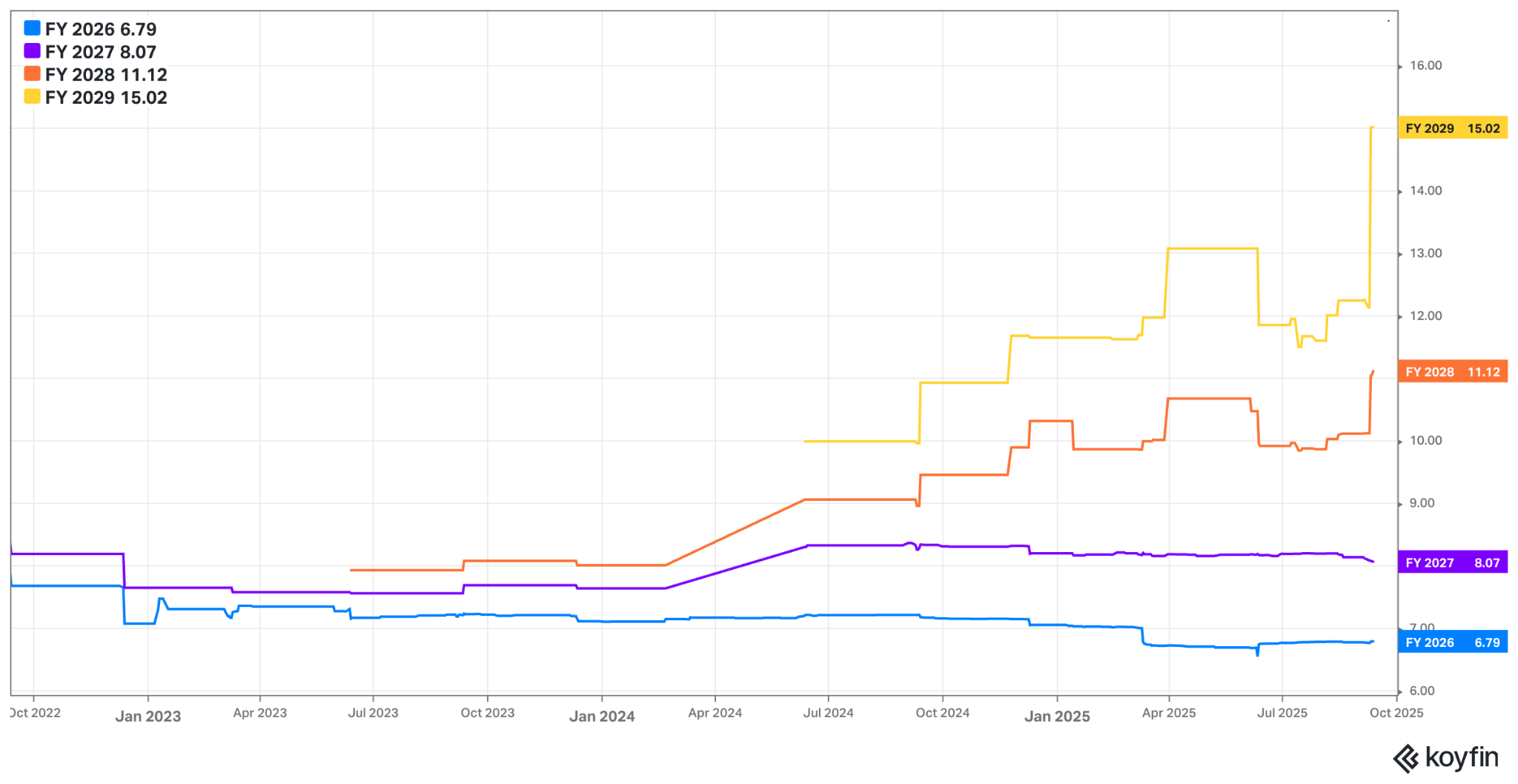

Oracle maintained 16% CC Y/Y revenue growth guidance for the year, as the vast majority of the RPO boost will not translate into revenue this year. In terms of RPO guidance, it raised 100%+ Y/Y growth targets offered last quarter to roughly 4x growth for the year. This is related to expectations of more multi-billion dollar contracts, such as a massive $300B contract signed with OpenAI. The heightened RPO growth will mean more CapEx to fund all of these forward-looking demand signals. As a result, they now expect to spend $35B on CapEx rather than $25B. The RPO and CapEx raises coincided with OCI growth guidance moving from 70% Y/Y previously to now 77% Y/Y. As the leadership told us, it doesn’t build or own the buildings… just the equipment that goes in them. This means real estate availability triggers CapEx investments that lead to revenue a lot quicker than for the competition. For operating income, they expect around 15% Y/Y growth this year and “even higher growth” next year. This led to consensus estimates for that metric modestly rising for both years.

The only slight negative I’d poke at is the reiterated overall revenue growth guidance for this year. If OCI expectations are rising and overall expectations are not, that technically means non-OCI revenue guidance was modestly lowered for the year. And while that’s not ideal, “more confidence” in accelerated revenue and profit growth for FY 2027 makes that less irksome.

- Beyond $18B in expected FY 2026 OCI revenue, the company expects 78% growth next year, 128% growth the following year, 56% growth the year after and 26% growth for FY 2030. While I don’t love giving a lot of attention to 2030 targets, this is related mainly to booked business, which makes it more legitimate.

- Q2 revenue guidance slightly missed estimates. It expects 35% Y/Y cloud growth for Q2 (34% CC growth).

- Q2 $1.63 EPS guidance beat estimates by $0.02.

g. Call & Release

Massive RPO Beat:

The massive RPO beat came from a $300B contract with OpenAI for the OCI segment. Without this, RPO would have beaten expectations by 4%. The result is still incredible, but it does create customer concentration risk with an unprofitable client burning cash at an aggressive clip. If capital markets turn and the appetite to fund all of these losses worsens, that could make executing this contract quite difficult. The team is very confident in the project’s viability, but this is still worth noting.

Furthermore, Microsoft gets right of first refusal for any new compute contract OpenAI signs. That was implemented when the exclusivity piece of their original cloud contract went away. This week, Microsoft and OpenAI signed a Memorandum Of Understanding (MOU) to usher in the next era of their partnership and pave the way for OpenAI restructuring. In my mind, the fact that Microsoft isn’t the cloud vendor for this contract means one of three things:

- They didn’t want the contract.

- They couldn’t fulfill the contract.

- The MOU included a tacit understanding allowing this contract to go to Oracle.

In terms of how ORCL plans to fund this, they reminded investors that they only own the equipment that goes into physical data centers. This allows them to be more asset light and gives them a “very good line of sight” into delivering this contract. We shall see.

OCI Edge:

As we work through this section, note that all hyperscalers would say they offer the best performance and cost of ownership. These can be subjective calculations and all of these CEOs are charismatic. And while that’s true, it’s hard to think OpenAI would be giving them a $300B contract if their products were convincingly inferior.

Demand for the segment continues to “dramatically outstrip supply.” Why? Because of what Oracle views as an ability to run data centers more efficiently than the competition. This edge scales beyond gigawatt data centers. And interestingly, it also includes a unique ability to use its uniform, modular-based layout to offer its full suite of cloud tools on just a few server racks. That singular architecture makes it very easy and affordable to add compute racks as needed, which can scale to massive clusters while maintaining the aforementioned cost and performance edges. Specifically for its “butterfly product,” it can offer a private iteration of OCI with all features for $6M; per leadership, that’s 100x cheaper than the other guys. That’s because its data center designs make tiny deployments rational, while minuscule incremental additions can be profitably offered to augment flexibility. No minimums! That’s not true for the other guys, so they have to overcharge when companies only need a little bit.

Cost advantages from its data center design are amplified by what it views as superior levels of automation and lower compute error rates, superior server density and a perceived ability to move data in and out of GPUs faster. As Ellison puts it, when you’re paying by the hour, faster means cheaper.

OCI Runway:

Oracle thinks the runway for OCI is incredibly long. And while that has a lot to do with successful market share gains in the AI training market, its optimism pertaining to the size of the inference market is even larger. Much of the $300B OpenAI deal is for more inference capacity. AI inference is the only way to use all of the publicly trained models to create enterprise-level applications and real value. Inference is where trained and highly capable models plug into 1st-party datasets to create new insights, connect new dots and unlock answers to enterprise-specific questions. For me specifically, it’s nice that I can ask Gemini questions about conference schedules on a public website. It would be far more valuable to upgrade this capability by infusing my own coverage network to get a curated list of events ranked by prioritization to cover. If I were a large clothing vendor, I could use this capability to get a perfect sense of tariff impacts for my specific supply chain with damage mitigation recommendations, rather than a generic regurgitation of current policy.

That’s how a company unlocks the productivity gains and value creation potential packed into its own data. And that will come mainly from inference for most firms. As Ellison says, usage of publicly trained apps and models will need to eventually lead to revenue and profit. The meshing of world-class frontier models and the inference value stemming from private data is how to do this. Jensen Huang of Nvidia says agentic reasoning models (heavily reliant on inference) will consume exponentially more compute than older model versions. That bodes very well for the Oracle runway.

Data:

If you noticed, data was a big piece of the OCI discussion. That’s because Oracle’s dynamic, malleable database offerings are the perfect complement for OCI. It’s one thing to have cheaper infrastructure costs. It’s another to enjoy those lower expenses alongside cheaper data transference. That’s how companies can tap into omnipresent model choice within OCI to ingest data and deliver the aforementioned inference magic. Making sure all of this happens within Oracle creates more lucrative and loyal customers for the firm – all while contributing to the cost advantages we’ve already discussed. Vendor consolidation always has a way of doing that.

It’s this uniquely broad mix of utility that Oracle thinks is unmatched, which is why they think they will win in inference.

- Cloud database services rose 32% Y/Y to $2.8B annualized.

- Multi-cloud database revenue (data product deployed in other clouds in addition to OCI) rose by 1500%+ Y/Y.

- Oracle now has 34 multi-cloud data centers live, with 37 more planned.

Application Business:

Oracle thinks it’s ahead of the pack in the utilization of AI app generators to create most of its new applications. As Ellison puts it, applications are really just a mixture of seasoned agents, guardrails and workflows. Those workflows can be built more quickly and more effectively with algorithms, and so ORCL is doing just that. As an aside, this is contributing to its accelerated profit growth expectations for this year and next year. They’re doing more with less.