1. CrowdStrike (CRWD) -- New Module, M&A & Needham

a) New Module

CrowdStrike introduced the Falcon OverWatch Cloud Threat Hunting Module this week -- calling it the “first standalone threat hunting service for cloud environments.” This module comes with proactive alerts on adversary activity, zero-day threats (new threats) and vulnerable spots. With this new tool, vendors gain a 24-7 expert in cloud security without incurring the typically hefty overhead costs.

“Elite threat hunting skills are hard to find and retain. This has truly been a seamless extension of our security team to see and stop sophisticated cloud threats.” — Las Vegas CIO Michael Sherwood

b) M&A?

CrowdStrike seems to be standing up an R&D team in Israel. This is prompting many to infer that it’s planning to make a $2 billion M&A splash to buy Radware. Radware engages in data center security, application security and, more interestingly, network security. Zscaler and Cloudflare are two close partners of CrowdStrike’s in the network niche, so I’m interested to see how this could impact those relationships.

CrowdStrike was able to buy Preempt to expand into Zero Trust and Identity in a way that complemented its identity partner Okta -- rather than competing. It did this by building its identity offering from the endpoint perspective, rather than focusing on Okta’s authorization prowess. I’d assume it would love to expand into network security in a way that keeps both CloudFlare and Zscaler -- two wonderful companies -- as allies vs. enemies. There seems to be slightly more overlap between Radware and Cloudflare. Cloudflare offers all of the same content delivery, web application firewall and bot security that Radware is known for. And again, Cloudflare is extremely capable.

c) Needham

Needham released some channel checks this week. The conclusions were encouraging and unsurprising: spend continues to gravitate to security and the cloud where investment levels remain robust.

2. The Trade Desk -- Industry Softness & an Executive Change

a) Industry Softness

Roku’s 20%+ Q3 2022 revenue guide down this past week paired with Snapchat’s unwillingness to offer guidance has ad-tech land spooked. This spook is warranted. Terrible macro first weighs on advertising budgets for corporations which is how these companies generate revenue.

While I don’t think The Trade Desk is immune from the issues, I do think it’s the best-equipped company in the space to most gracefully weather these tough times. Why? First -- as I’ve mentioned in the past -- the company has already recently re-affirmed its second quarter results. On May 26th, long after macroeconomic pain had begun, it re-assured investors that its rosy guidance was still in place. Considering how visible its revenues are, this makes me extremely comfortable assuming a strong Q2. Beyond that, CEO Jeff Green and his team have built a years-long reputation of candor -- regardless of how good or bad things get. If the company was seeing a drastically worse Q3 than everyone expected, I’d like to think it would tell us as it has in the past.

Finally, The Trade Desk’s value is born in delivering relative return on ad spend (ROAS) strength to its demand side. It does this through industry-leading (by a mile) data and market scale within the open internet. These advantages don’t vanish with a poor macro backdrop. Instead, they arguably become even more valuable as marketing departments are forced to extract as much value from shrinking advertising budgets as humanly possible. This should always be the goal, but it becomes a larger focus when things get tough. That’s why The Trade Desk has performed so well across cycles and why I think it will this time around as well.

Finally, programmatic advertising within open internet streaming remains vastly supply constrained which leaves room for some demand disruption. We’re also gearing up for the largest mid-term spend cycle ever and The Trade Desk will surely benefit. I’m more optimistic about the firm's 2022 than most seem to be today.

b) Chief Data Officer Departure

The company’s Chief Data Officer -- Michelle Hulst -- is stepping down effective at the end of the month. Never ideal, but not devastating. There’s always C-suite turnover, and The Trade Desk’s average tenure is much lengthier than most.

Click here for my TTD Deep Dive.

3. Shopify (SHOP) -- Earnings Review

a) Pre-Earnings Press Release

About 24 hours before Shopify’s earnings report, its charismatic CEO Tobi Lutke published a blog post. In it were two key pieces of news:

- Shopify would be laying off 10% of its workforce (with more possible layoffs to come later this year).

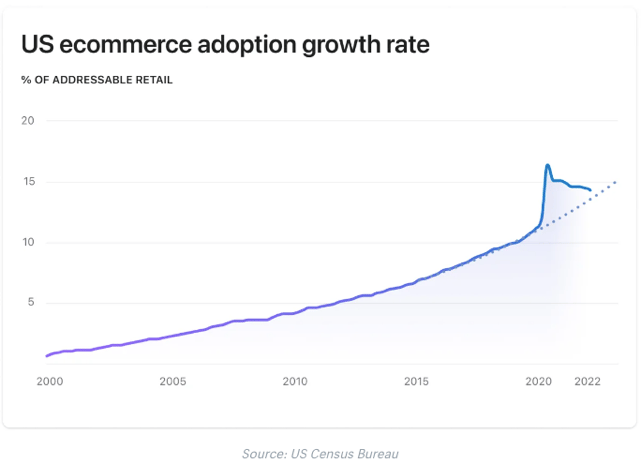

- Lutke acknowledged that Shopify’s forecasts were overly ambitious as the team extrapolated pandemic trends to be longer lasting than they turned out to be. Better late than never. E-commerce penetration pulled back to trend while Shopify thought that wouldn’t occur:

b) Demand

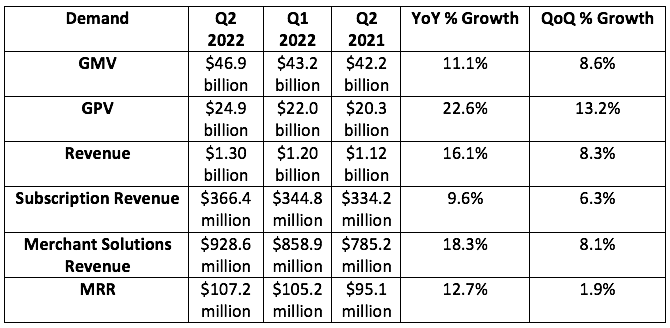

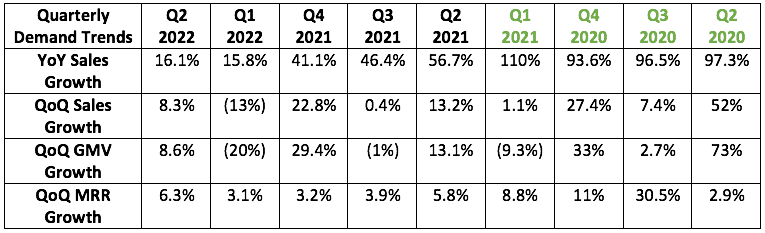

Analyst were estimating $1.33 billion in sales. Shopify did not offer revenue guidance, but posted $1.30 billion, missing expectations by 2.3%. This included a foreign currency headwind of 150 basis points. Constant currency, this represents a 0.8% miss.

More context on demand:

- Quarters when Shopify got its largest pandemic boost are highlighted in green.

- 11% GMV growth compared to 7% growth for the industry.

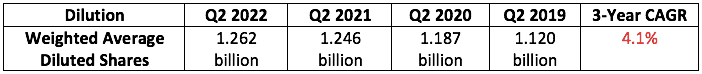

- Its 3-year revenue & volume CAGRs still sit at an elite 53% and 50%, respectively. This slowing growth is solely a matter of the pandemic hangover.

- In Q1 2022, Shopify changed its developer revenue take rate from a flat fee of 20% to 0% on the first $1 million and 15% thereafter. This quarter, that move erased 400 basis points of subscription revenue growth. That will continue through Q4 2022 when comps normalize. Also in Q1 2022, Shopify began recognizing theme (design) sales on a net (not gross) basis which will weigh on growth through Q4 2022.

- Q1 is seasonally Shopify’s slowest period. This makes this quarter’s sequential growth comps easier.

- Shopify Plus Merchants now = 31% of MRR vs. 26% YoY as customers trade up.

- Shopify issued $416 million in merchant credit -- up 15% YoY.

- Offline GMV grew 47% YoY after 266% growth in Q2 2021.

- GMV through key partners like Meta and Google 5X’d YoY.

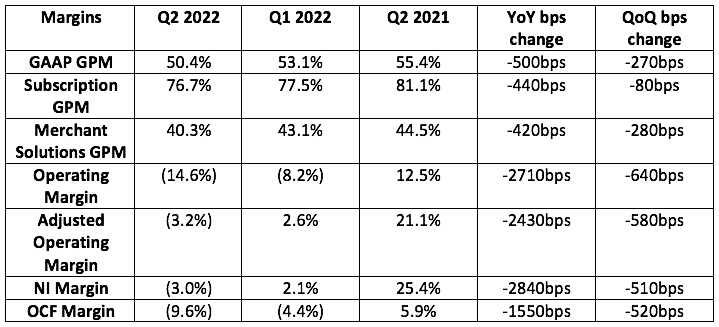

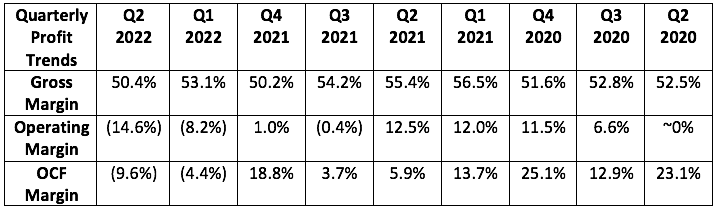

c) Profit

Analysts expected $27.8 million in EBITDA (AKA adjusted operating income) & $0.03 in earnings per share (EPS). Shopify again offered no formal guidance besides “investing all gross profit dollars back into growth.” It posted an adjusted operating loss of $42 million and lost $0.03 per share. Both results sharply disappointed analyst estimates.

On GAAP Net Loss:

GAAP net income moved from $900 million to ($1.2) billion YoY -- that was predominately related to a $1.8 billion net difference in equity investment impacts. Q2 2021 representing a gain of $800 million; this quarter represented a loss of $1.0 billion. This is simply the result of mark to market GAAP accounting and is not all that important to me. The firm didn’t burn through remotely close to $1.2 billion in the quarter ($120 million in OCF burn still not good). When its equity investments exploded in value with the Fed Asset Bubble, it benefitted unsustainably. Now, this is the flip-side which will be very negative and very temporary.

More context on profit:

- Shopify continues its dedication to investing all gross profit dollars back into more growth and innovation. It’s not trying to earn operating profit -- but instead trying to operate at breakeven. I believe that’s both the correct approach and also a move that will be hated by markets amid our hawkish climate.

- Merchant service growth and the change in developer fees are weighing on margins. You can see that in the larger sequential step down in GPM for the merchant segment.

d) Balance Sheet

Shopify has $6.95 billion in cash, equivalents and marketable securities vs. $7.25 billion sequentially and $7.76 billion YoY. Please note that since the Deliverr acquisition closed after Q2 ended, the $1.7 billion cash expense has not yet been deducted in its audited financial statements. That will happen next quarter -- so cash & equivalents is really around $5.25 billion.

e) Guidance

Shopify doesn’t offer formal guidance, but did offer a rough framework of how to think about the rest of the year. Following this report, the mean analyst 2022 sales estimates fell by nearly 4% while earnings per share guidance flipped from a gain of 9 cents to a loss of 9 cents. Considering the 2nd quarter revenue results missed by about half of this drop, we can imply that the abstract guidance was still a slight disappointment to Wall Street.

Here were the vague details offered:

- Inflation will persist at high levels through year’s end.

- Merchant solutions growth will continue outpacing subscription growth -- which will weigh on overall GPM along with the developer fee change.

- Shopify’s volume growth will continue to outpace the broader market -- meaning it’s taking more share (although weak macro dampens the value of that share for now).

- Stock based compensation of $750 million (previously $800 million).

- A larger operating loss next quarter (so more than $42 million) with operating leverage expected to kick in starting in the 4th quarter this year as OpEx growth slows. 4th quarter loss is still expected to be larger than $42 million, but smaller than the 3rd quarter.

f) Past Quarter’s Headlines

- Added Deloitte and Accenture as new Partners to promote Shopify to their clients.

- Added Spotify, TikTok, YouTube & Twitter integrations to sync product catalogues.

- Launched with JD.com’s marketplace in China.

- Debuted “Tap to Pay” on iPhone & was listed as 1/9 partners for Apple’s BNPL launch.

- Shop Payments debuted in France. Point of Sale (POS) launched in Italy & Singapore.

- Debuted “Business to Business Selling” with wholesale and custom discount features.

Click here and scroll to the Shopify section to learn more about these launches.

g) Conference Call Notes From President Harley Finkelstein

On Logistics:

Harley covered the three main pieces of Shopify’s logistics ambitions -- Freight, Distribution and Fulfillment.

Shopify Fulfillment Network (SFN) is enhancing freight with its Flexport partnership to automate that end-to-end process. This also means that a merchant can ship at the pallet level vs. container level and have “just in time” access to deliver goods to an SFN hub. This eases inventory glut concerns and keeps businesses nimbler. Early results here are revealing that SFN delivers 50% faster service with a massive drop in freight cost per unit.

Distribution is an optimization problem: Uncovering the most profitable way to accumulate and release inventory. Deliverr is its solution here:

“Deliverr accelerates simplification of distribution. Using ML and software, SFN Hubs will unpack, scan and inspect all inventory. Then the hubs compare against metadata in Shopify’s back office to forward inventory to Shopify’s Spoke fulfillment centers based on expected demand.” — President Harley Finkelstein

Click here to learn more about what Shopify saw in Deliverr

Finally on Fulfillment, Shopify’s aim is to guarantee shorter and shorter delivery times. This greatly boosts merchant conversion rates. For example, Shop’s 2 Day Promise (in pilot) raises conversion by 30% -- it matters a lot. The company accomplishes shorter delivery through another past acquisition -- 6 Rivers Software:

"Using Deliverr and 6RS, we can forward merchant inventory to support timely fulfillment with minimal merchant inventory commitment." — President Harley Finkelstein

Shopify addresses all 3 of these segments with the same utility building, yet asset-light approach. It is not trying to be Amazon, although is trying to eventually match its 1 day shipping capability through innovation and partnerships. That will take time.

100% of SFN fulfillments are now processed by its 6RS fulfillment system -- right on time. Shopify’s orders delivered in 2 days or less rose from under 2% pre-software integrations to 70% afterwards.

On Layoffs:

“The normalized rate of spend online, where most merchant orders occur, has reset higher than 2019, but the rate is lower than we planned for. In short, we overshot our prediction. We are recalibrating without sacrificing critical components for Shopify to remain in an enviable position in this growing market.” — President Harley Finkelstein