1. The Trade Desk (TTD) -- SMB Program

The Trade Desk debuted its “certified service partner program” for Small and Medium businesses (SMBs). The product streamlines and deepens the self-serve functionality within The Trade Desk’s platform. This should lower minimum costs for SMBs using the new product to cater to these entities and their generally smaller marketing budgets with more flexible, customizable models of campaign spend. In a world where every advertiser needs to get the most out of every marketing dollar, that reality is even more true for smaller, less durable enterprises. This release should help that need become a more consistent reality by bolstering access to The Trade Desk’s “industry leading” demand side programmatic advertising platform. All advertisers can benefit from more visibility and objectivity within programmatic advertising in the open internet vs. within esoteric walled gardens.

Goodway Group has been named the first certified partner within this new endeavor. More partners which “represent distinct capabilities in support of client marketing needs” will be named in the near future.

Click here for my deep dive into The Trade Desk's business.

2. Upstart (UPST) -- Subaru & a New Credit Union

a. Subaru

Another week, and yet another sign of a broadening auto purchase partnership with a major OEM. Subaru became Upstart's first partner in the lending disruptor's new “Build and Price” digital tools program. The feature will allow Subaru's consumers to shop online for nearly finished goods and to connect it with approved buyers. Considering how pressing current supply chain issues are for the auto industry, enhancing a dealer’s ability to tap into inventory from across the production cycle should provide immense value to match more cars with demand. Specifically, this will free Subaru shoppers to pre-build the year, make and vehicle model with accurate pricing every step of the way.

“Many manufacturers are forecasting shortages through 2023… the Build & Price product is an innovative way to help customers get started online and for Subaru retailers to provide extra value early in the purchase process.” — GM of Upstart Auto Retail Michia Rohrssen

The bolt-on feature will be available to all Subaru dealers participating in Upstart Auto Retail with no additional charge or for $175 per month as an independent offering. Upstart already aids the auto industry in underwriting and input cost reduction via automation -- now it will help its partners weather supply chain issues as well.

“There’s nothing more powerful than having everything you need, right up front, to structure a deal that a customer is ready to say yes to.” — Sales Manager at Byers Subaru Shane Fouch

b. Credit Union

Upstart also announced a deepening partnership with Bellwether Community Credit Union to offer Upstart-powered personal loans to people in New Hampshire and two Massachusetts counties. The companies had been working together within Upstart’s referral network since December.

To be frank, this is a small win for Upstart as the credit union (CU) only has 30,000 members in total vs. 400,000 for Patelco -- another Upstart CU partner. Still, a win is a win and this simply serves as another sign of Upstart’s building traction and clout in the credit industry.

c. ABS Markets

More investor concern is circulating around a tightening asset-backed securitization (ABS) market and rising delinquencies. As I've said many times before, Upstart's strong 2022 guide assumes a normalization of delinquencies and liquidity as well as less reliance on ABS markets as we exit this strange stimulus-era. Furthermore, its investors' aggressive usage of the ABS market in 2021 was a factor of that market being so favorable and is not by necessity. For reference, Upstart's investors were selling its sourced loans for 108% of par value in ABS markets just weeks after buying the loans at par. That's not normal. Leadership expects bank and credit unions to retain a larger portion of its sourced loans this year while whole loan sales also account for a growing portion of its overall transaction volume.

The company is and always will be intimately connected to capital markets, and its success will rely largely on how well its loan pools perform when things are most hectic. It thrived on a relative basis during the pandemic, which fostered explosive growth and adoption as soon as credit markets recovered. Credit cycles will always cycle and during the cycling the cream will rise to the top. That's what Upstart needs to continue to do. So far so very good -- but still a long, long way to go.

3. Cresco Labs (CRLBF) -- The Blockbuster Columbia Care Acquisition & an Earnings Review

a. Columbia Care Acquisition

Cresco Labs agreed to acquire Columbia Care in an all stock deal valued at $2 billion. Existing Columbia Care shareholders will own 35% of the combined company upon deal closing.

The transaction will make Cresco Labs the largest multi-state operator in the nation by revenue with a current run rate over $1.4 billion (after “planned divestitures”) -- this sales split will be 65% retail post-closing vs. 47% retail today to juice Cresco’s long term margin potential via more vertical integration. This shift will also help make forecasting revenue more predictable. Compared to Cresco Labs’ current 50 store footprint, the transaction will bring it to 133 retail stores overall giving it the 2nd largest retail footprint in the nation and largest when excluding Trulieve’s Florida stores. Cresco Labs still sees wholesale branded distribution as its long term bread and butter, but it also sees retail as a bridge to get to that future.

With the combination, Cresco’s population footprint will cover 70% of the addressable cannabis market while now putting it in 18 states including all 10 of BDSA’s largest and most promising markets over the next 4 years. Cresco had been in 10 states meaning this translates into an 80% boost overnight. Along with a larger market, Cresco will also get new cultivation and retail assets in Maryland, California and Arizona where it is currently “under-scaled.” With all of the assets being acquired, Cresco will be able to bolster its vertical integration opportunity to raise its profit ceiling in all 18 of its states (including Washington D.C.) besides Michigan (for now).

The two companies feature leading market share positions in four states -- Cresco labs in Illinois and Pennsylvania (+ number 2 in Massachusetts) and Columbia Care in Colorado and Virginia. Together, the companies believe they have a clear path to top 3 market share in New York, New Jersey and Florida as well. Finally, Cresco will now be ideally positioned in all of the states with the most to gain from an expected near-term flipping from medical to recreational cannabis. Cresco Labs currently has 2 states contributing over $100 million in annual sales and expects that to be 5 states this year and 8 next year with the purchase.

The two plan to share best practices in terms of cultivation and operations as well as retail which could be fruitful considering Cresco’s superior dispensary operations vs. the field.

While $2 billion does represent a hefty premium and dilution with Columbia Care assuming a 35% stake, we have to remember the premium is mainly a result of tumultuous times for cannabis stocks. Columbia Care’s enterprise value (EV) has already surpassed $2 billion on numerous occasions, and if you think cannabis remains a promising, early-innings growth story like I do, then that premium becomes far more palatable. Also keep in mind that there will be some cash coming back to the combined organization post-closing. The two have significant licensing overlap in some limited licensing states and will sell off all of the redundant assets it will have in “high-value markets” which should fetch a few hundred million for the organization to utilize. These sales will occur in New York, Illinois, Ohio, Massachusetts, and Florida.

“We believe the combined footprint and operational capabilities will lead to so much more than either company could achieve individually… We’re cognizant of the risks inherent in a deal of this size, but feel confident in our team after integrating 5 companies and 600+ employees in 2021… This acquisition addresses all of our material gaps.” — Founder/CEO Charles Bachtell

The combined entity will also be able to “reduce some of the capital spend” plans in markets where divestitures are coming. In New York specifically, Cresco Labs somewhat recently broke ground on a cultivation facility that will likely be sold as Columbia Care’s is more built. Synergies from typical things like sharing accounting and public cost teams should help create a better company as well.

“Our mission has always been to deliver for our stakeholders… in an evolving industry, the opportunities to better achieve our mission through consolidation led us to this historic moment. We will together create the most investable company in cannabis.” — Columbia Care CEO Nicholas Vita

“The ability to leverage our cultivation , production and brand performance across a much wider footprint is expected to lead to long-term sustainable growth and market share gains. This will turn our tiered brand portfolio into the Miller High Life, Coca-Cola and Johnnie Walker Blue Label of the cannabis industry.” — Founder/CEO Charles Bachtell

Despite the heavy dilution coming, I’m a big fan of the move. Consolidation is inevitable and in my mind, the sooner it happens, the better.

b. Demand:

Analysts were looking for $234.5 million in revenue and it guided to a midpoint of $240 million in revenue . Cresco Labs posted $217.8 million, missing expectations by 7.2% due to various factors discussed below. Revenue for 2021 as a whole grew by roughly 73% YoY.

Cresco’s Sunnyside dispensaries remain the most productive in the industry despite the decline (related to new store openings & M&A). This $2.8 million is 33% higher than fellow tier 1 grower averages and 50% higher in key states like Illinois. This seems to be standard operating procedure (SOP) driven more than anything as M&A in other states like Ohio allowed it to immediately deliver a 57% improvement in retail efficiency. Same store sales grew by 1% quarter over quarter and 28% year over year. Impressive to me that the top selling wholesaler of cannabis flower, concentrates and vapes in the nation is also the most efficient at selling through its own stores.

c. Profitability:

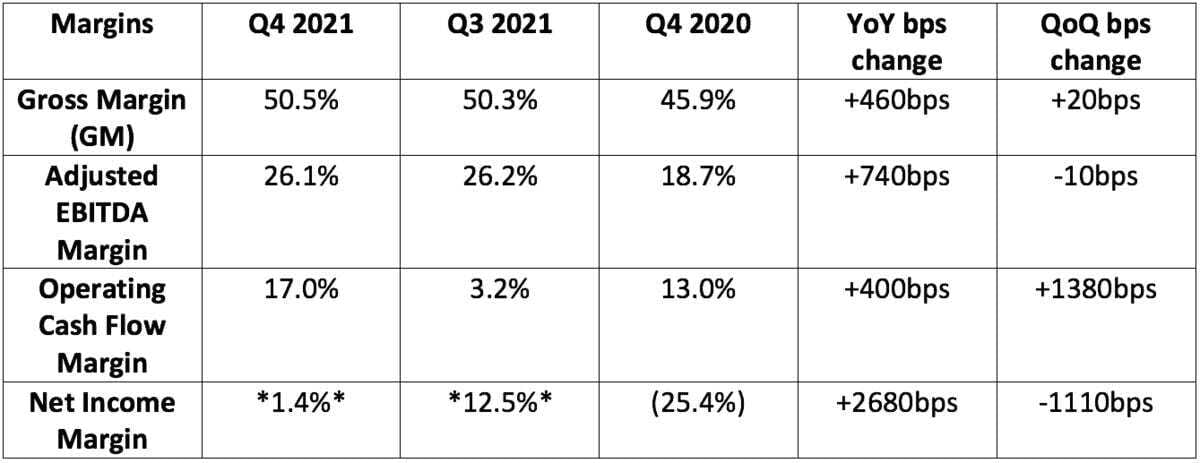

Cresco guided to a gross margin over 50% and was able to deliver on its promises with a 50.5% margin. It had also guided to a 30% adjusted EBITDA margin but fell short there at 26.1% due to the factors cited below. For 2021 as a whole, adjusted EBITDA margin expanded to 23.6% of sales vs. 12.7% YoY as Cresco’s economies of scale took hold.

*Adjusted for a $15 million non-cash impairment charge in Q4 2021 and a $290 million non-cash impairment charge in Q3 2021 related to its Origin House acquisition. Without giving Cresco labs this exemption, net income margin for the quarter would have been (5.4%).