1) Shopify (SHOP) -- Introduction

Shopify is at the top of my watch list and I will be covering the name going forward. I wanted to give some general background on the company and the investment case, along with my plans on potentially investing.

a) Qualitative

Shopify powers commerce for businesses ranging from single-person entrepreneurs to Fortune 500 companies like Netflix. It enables seamless creation of beautiful websites -- like many others do -- without needing any expertise on coding to make that happen. I for one -- with zero coding experience -- was able to design & open my own store in about 90 minutes and with no confusion using its application programming interface (API).

Shopify’s service transcends the label of website-builder by creating a deeply functional store to power an end-to-end, delightful shopping experience. It frees merchants to effectively participate in the rapidly growing digital economy and to do so across more than a dozen different omni-channel verticals including marketplaces, social media and pop-up shops. Whether it’s cross-border, e-commerce automation, reporting and data analytics tools, working capital access or fulfillment, Shopify is there to help.

And if you want to use other vendors for a piece of your technology stack -- that’s entirely fine. The company shines with its vast partner integration network which enables broad interoperability all within the Shopify ecosystem. You can link a drop shipping company like Printful with just a few clicks to power on-demand fulfillment, search engine optimizers to enhance marketing returns and so much more. It takes a purely “better-together” mentality by plugging in to nearly every other relevant player in the e-commerce landscape -- including Amazon, Facebook, Google, PayPal etc.

Shopify’s merchant-obsessed, partner-first philosophy works wonders to eliminate potential conflicts of interest. This -- along with frequent design knock-offs -- is why vendors such as Allbirds have left Amazon in the past to focus on their Shopify relationship and to gain control of their lucrative customer data. With Shopify, the merchant brand is ALWAYS front and center.

To put it as simply as possible, Shopify’s mission is to enable all businesses to offer end-to-end omni-channel commerce solutions that were previously only attainable for the largest of firms.

“Shopify’s power comes from infrastructure, merchant solutions and the partner ecosystem.” — Shopify President Harley Finkelstein

b) Two revenue buckets

Number 1 -- Subscription solutions:

This revenue bucket is the company's highest margin business and encompasses Shopify’s platform access fees. It includes purchases of broad plans, apps, design themes and things like domain management. Shopify aims to make these plans as accessible as possible and so its cheapest option starts at just $29 per month. Typically, smaller merchants start out with smaller plans and add more services over time. Furthermore, the variable piece of this revenue bucket ensures that the interests of Shopify and its merchants are aligned: It does better when its sellers sell more and so Shopify will do whatever it can to make that happen. It’s a team effort.

The three main pricing tiers (mainly for small and medium businesses) include:

- Basic Shopify ($29 per month)

- This comes with all of the standard website building tools and omni-channel selling management Shopify provides. Additionally, it includes 2 staff accounts which gives someone (like an employee or a Shopify partner) the ability to log in to a store to handle orders and work on certain tasks. This is really all an entrepreneur needs to get going.

- Shopify ($79 per month)

- This includes the Basic package and with 5 staff accounts, professionally curated operational reports, discounted card processing fees etc.

- Advanced Shopify ($299 per month)

- This plan is the Shopify plan plus 15 staff accounts, automated shipping rate calculation and further card processing discounts.

The premium pricing tier is called Shopify Plus. This is generally for larger enterprises and represents a small percent of its merchants but a much larger percent of its total sales. Vendors here include: Heinz, Unilever, Crayola, The NBA, Tupperware, Adele and 14,000+ others with 4,000 of those joining just in the last 12 months.

Pricing change:

As of August 2021, Shopify’s subscription revenue share model changed for developer apps and themes. It now takes a 0% cut of the first million a developer makes annually and 15% of sales thereafter. It used to be a flat 20% fee. Shopify’s value is greatly enhanced by developers building new tools specifically for its app store which fosters more functionality, use cases and cross-selling potential. In my view, lowering the fee was the right move to thrive in the wildly competitive niche. This switch to tiered pricing ($0 for the first million) is the primary reason why subscription service revenue growth underwhelmed so much last quarter.

40,000 merchants joined Shopify in 2021 directly due to a developer referral. Keeping this community happy is imperative and Shopify was willing to sacrifice short term revenue for long term relationships.

Number 2 -- Merchant Services:

The Merchant Services bucket is growing at twice the rate of subscriptions but is lower margin overall. These features serve as add on capabilities like a payment gateway (Shopify Payments), brick and mortar point of sale, access to the Shopify Fulfillment Network (SFN), and email marketing tools.

- Payment gateway meaning -- It's easiest to think of this like a virtual point of sale system. All companies wishing to digitally transact use gateways to connect to a processor like Stipe, merchant accounts and card issuers.

Revenue here comes predominately from the payment gateway and currency conversion services and this product replaces the need to maintain direct relationships with various other gateways. Shopify Shipping and Fulfillment is expected to be a rapidly growing piece of this business over time. More on fulfillment and its “Deliverr” acquisition later.

Perhaps the most compelling piece of this business is the vast up-selling capabilities it has with its clients to bolt on other merchant services and to boost revenue and functionality. It frequently starts merchants on its $29 per month subscription plan and sees those merchants blossom into higher subscription tiers like Shopify Plus. This fosters reliable net dollar retention that makes the company less reliant on solely new customer wins to find growth.

c) Future Growth Vectors beyond Fulfillment and Recent Highlights

Shopify will continue to find ample opportunity to expand within the growth industry that is e-commerce enablement. Most small businesses today still don't have any material online presence. Still, there are other pieces of the business (mostly within the merchant services segment) that are newer, and beginning to show promise for strong future contributions.

- “Shopify Markets” -- debuted in 2021 -- is the firm’s cross-border engine allowing merchants to localize their website in several languages and countries with one managed store. This makes global expansion FAR easier by doing things like forecasting demand, automating compliance, calculating taxes and translating site language for more comfortable user experiences abroad.

- This complements Global-E’s offering (Shopify is an investor and partner here) which features these services for higher maintenance clients with more specialized needs.

- “Shop” is the company’s consumer-facing shopping assistant. It allows for its merchants to plug their pages into the aggregated feed to target promotions and to juice total payment volume for all involved parties.

- This is Shopify's attempt at building a 2-sided network to hopefully emulate Block and PayPal. Having more consumers involved in that centralized shopping product makes it an intrinsically more valuable destination for merchants to market and sell. PayPal for example, has been able to use its 30 million+ merchants (Shopify has 2 million) and hundreds of millions of consumers to create unique, incremental value via data-driven wish lists built by consumers. These are essentially highly reliable consumer demand curves for merchants to observe and utilize. I think this is a great focus for Shopify, but there’s a LONG way to go to catch up here.

- This feature integrates fully with Shopify’s back-end to make this an easy integration functioning as merely adding another selling channel to the merchant’s centralized dashboard.

- “Shopify Pay” is the company’s checkout accelerator that minimizes clicks to checkout and raises conversion.

- “Point of Sale (POS) Pro” is Shopify’s omni-channel POS hardware that connects issuers to processors like a traditional POS but also infuses detailed and simplistic inventory management capabilities.

- Merchant adoption here is currently doubling YoY.

- Shopify also offers other interesting tools like cart abandonment help. A key differentiator for Shopify and its substitutes is maximizing conversion and approval wherever possible. Shopify’s ability to re-target almost buyers in a fully data-driven manner works wonders in accomplishing this.

- Continued up-selling to the Shopify Plus plan will also be key to its long term success.

You’ll notice that the newer products are launching in very competitive fields. Every single mega cap tech company is competing in the payments space, Amazon is trying harder and harder to emulate Shopify’s value, Clover and Block are two out of the countless worthy POS players and formidable gateways like PayPal aren’t just going to give up share because Shopify wants to take it. These projects are all up-hill battles, but Shopify has been winning up-hill battles since its beginning. We’ll see how it can do going forward.

Recent highlights:

- Added Deloitte and Accenture as new partners to promote Shopify to its largest clients in early 2022.

- Added TikTok shopping for merchants and a Spotify integration to sync product catalogues and display them within the audio streamer’s platform.

- Integrated with Buy on Google in 2021 to allow goods to be displayed directly on the search page.

- Launched with JD’s marketplace to unlock the Chinese economy and allow its merchants to use JD’s warehouses to sell into China and JD’s 550 million customers.

- Shopify will also debut in several more geographies in 2022 to build on its cross-border value and domestic reach.

d) Risks -- Pandemic boost, Stock Compensation and Competition, Competition, Competition

Pandemic boost:

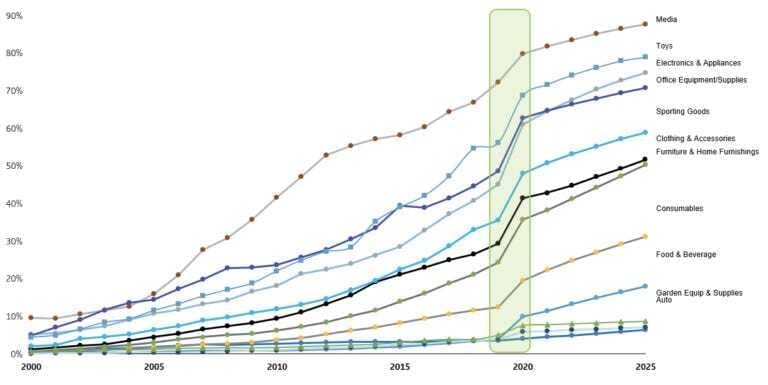

There are few companies that got a stronger boost than Shopify did from social distancing and lockdowns. Businesses were forced to rapidly embrace digital sales channels and that’s Shopify’s bread and butter. As a result, its growth was propelled higher throughout 2021 and the comps for the next few quarters will be quite challenging. This is not so much a long term structural risk as it is a temporary macro-economic hangover from Covid-19 and I think e-commerce growth re-accelerating over time is a safe bet. The e-commerce penetration rate as a percent of total retail sales trend is depicted below:

Stock-based compensation and employee attrition:

Shopify has used its stock as a currency for employee compensation and growth throughout its existence. The stock compensation specifically comes in the form of options with strike prices that are now deeply out of the money. While its depressed share price is something I find compelling, for employees of the company it’s not so much compelling as it is anxiety provoking. This is how a large portion of their net worth is calculated and the value of this currency diminishing could lead to higher employee attrition or more difficulty with competing for talent. I’ve seen anecdotal evidence of this playing out, but nothing all that significant or thematic. To add to the headache, the depressed share price forces Shopify to issue more and more options as its stock price falls to offer the same amount of value. This could accelerate dilution and is a common problem in all of tech. Fortunately, share count growth has recently been more muted.

Competition -- the main risk:

The main risk facing Shopify is talented competition hitting it from every angle. When a company exists in such a rapidly growing space, competition will always follow and Shopify is no different. There are many other website builders vying for share like Wix and WooCommerce and both are finding success. Shopify differentiates vs. those formidable alternatives with deeper partner integrations enabling broader usability. An example that was provided to me was Wix requiring manual input of lines of code to access Facebook Pixels while with Shopify the process is automated. Still, Wix and WooCommerce are strong alternatives and will likely remain that way, but Shopify's $160 billion, briskly growing market leaves room for many winners.

For the sake of brevity and not turning this overview into a 50 page novel, I will focus on Amazon here.

Amazon and Shopify run very different models. Amazon is a 3rd party marketplace that drives unparalleled traffic. Still, this traffic is usually not coming for a specific merchant but instead the aggregated network of sellers that Amazon has built. Shopify -- conversely -- provides white-labeled tools for merchants to build their own, customized website while having their brand ALWAYS at the forefront with full ownership of lucrative consumer relationships. Amazon is the virtual mall while Shopify is the virtual, stand-alone store builder. Considering this, I think there’s room for both players and Shopify is certainly holding its own for now with the platform’s overall merchant traffic passing Amazon late last year -- per Similarweb.

Amazon is doing its best to capture and emulate the unique value Shopify provides -- and that must be taken seriously by investors. To do so, it launched Buy with Prime. This allows for the same direct shopper relationships that Shopify trail-blazes to occur within a merchant’s own site (whether that's a Shopify-built site or another) while also tapping into Amazon’s elite, massive fulfillment network. Now, any product listed on the Amazon marketplace can be listed on a 1st party site as well while tapping into all of Amazon’s utility building services like same day shipping and its famous checkout flow. Current Fulfilled by Amazon (FBA) customers solely need to conduct a minutes long integration to gain access. Interestingly, Shopify Co-Founder/Co-CEO Tobi Lutke is trying to sell this as a positive:

“We are actually thrilled with Amazon making a decision to take its amazing infrastructure to share broadly with small merchants. We are happy to integrate this into Shopify just like we did with Meta, Google and TikTok. This is not nearly as zero-sum as some think… the more channels that exist to sell into, the more important Shopify tools become. This is good news.” — Shopify Co-Founder/Co-CEO Tobi Lutke

I think that’s about as optimistic of a spin as you can put on this announcement but it is nice to know he doesn't see any problem with integrating Shopify and this new offering. The news is undeniably intimidating for Shopify as it marks a willingness of Amazon to break down the doors of its walled ecosystem to do a lot of what Shopify does for merchants. Still, Amazon doesn’t offer the same granular e-commerce building options or hands-on customer service of Shopify and doesn’t typically allow for payment gateways outside of its own to be used (although it is now adding Venmo) while Shopify plugs into over 100 of them. Additionally, at their core, merchants know that if they are successful enough, Amazon could compete with them and take their business. Shopify won't.

With all of that said, same day fulfillment is likely a deal-maker for countless organizations wanting to pick or choose between the marketplace approach or Shopify’s offering. Many go with both but many more go with one or another. Because of that, Shopify is heavily investing in fulfillment.

e) Fulfillment and Deliverr

Shopify’s fulfillment ambitions accelerated in 2019 with its purchase of 6 River Systems (6RS). 6RS builds warehouse fulfillment software that Shopify has used as the foundation of its own warehouse software which is now handling all Shopify fulfillment out of its Atlanta facility as of this quarter. The software allows Shopify to deliver packages to over 90% of Americans within 2 days -- but that’s still worse than Amazon.

To try to emulate what Amazon provides, it purchased Deliverr this year for $2.1 billion in an 80% cash, 20% equity transaction.

Deliverr combines disparate pieces of the fulfillment supply chain to unlock direct communication and cohesion for millions of merchants. Like Shopify, it takes a partner-first approach with vendors like Wal-Mart, Amazon and all social media part of its ecosystem.

The key to Deliverr’s value is actually not at all in fulfillment space scale -- and that’s good considering Shopify will never match Amazon’s courier footprint (or FedEx/UPS). Deliverr owns no warehouse space and instead leases square feet as needed while partnering with players like FedEx to scale its distribution capabilities.

Its value is derived from software programs that allow it to intelligently forecast demand to place inventory where it needs to be ahead of purchases. This minimizes inventory (and so working capital) needs for merchants and keeps them far nimbler while also optimizing fulfillment for cost to juice margins by comparing multiple bids. With this new purchase, Shopify is quickly working towards 1 day shipping. In every way, shape and form -- this is a Shopify Fulfillment Network (SFN) upgrade.

The acquisition was both wildly expensive and a much needed shot in the arm for Shopify to compete in fulfillment.

f) Team

To keep this section short (trying my best here), I’m going to focus entirely on Tobias Lutke, Co-founder and CEO of Shopify. Tobi has been building this company for nearly 2 decades from its humble beginnings as a Snowboard shop to the $40+ billion firm Shopify is today. He’s clearly highly capable, talented, and also very polarizing. He takes to Twitter to talk about his stock being undervalued (yuck), he used an NFT as a profile picture for several months (more yuck) and he has made some competitive predictions that now look cringe-worthy when using the luxury of hindsight. His Board of Directors authorizing new founder shares to shore up his ownership amid continued dilution is also something I want to see quickly slow.

And despite all of that, I still think he’s a fantastic CEO. You don’t build a Shopify through the Great Financial Crisis and other macro-shocks by accident. While he certainty comes off as eccentric at times (which is less palatable amid macroeconomic downturns), his track record speaks for itself. His 91% glassdoor rating with 1700+ reviews helps too. I have mixed, but mainly positive views of him and really like the rest of the team that he has built.

g) Quantitative

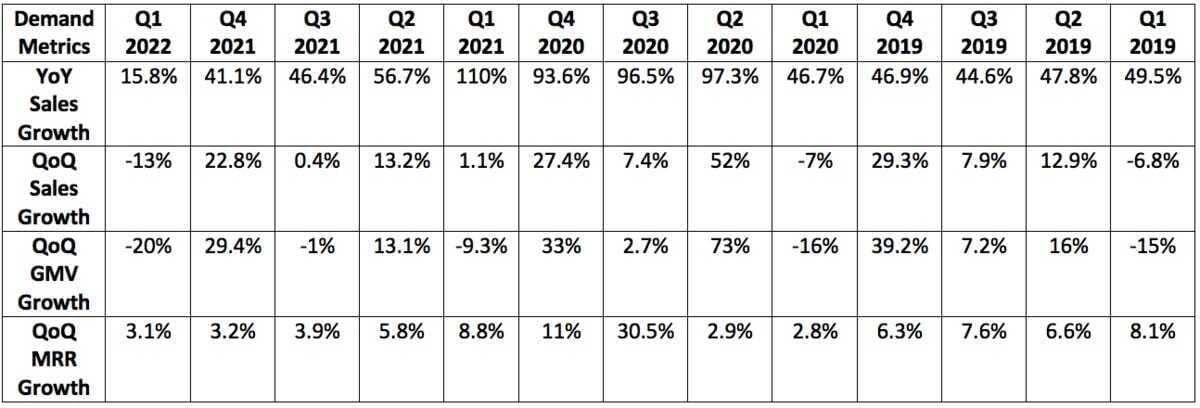

Most recent demand trends (might need to zoom in a bit):

More context on demand:

- I generally only go back 2 years with quarterly metric charts. I went back 3 years here to depict how abruptly strong of an influence Covid-19 had on Shopify.

- Growth from Q2 2020 to Q1 2021 was greatly propped up by the pandemic. The company’s 2-year revenue CAGR for this past quarter was 60% to offer evidence of this pull-forward being aggressive.

- The aforementioned change in developer fees hit revenue growth hard in Q1 2022 as well as shifting from gross revenue recognition for its theme sales to net revenue recognition.

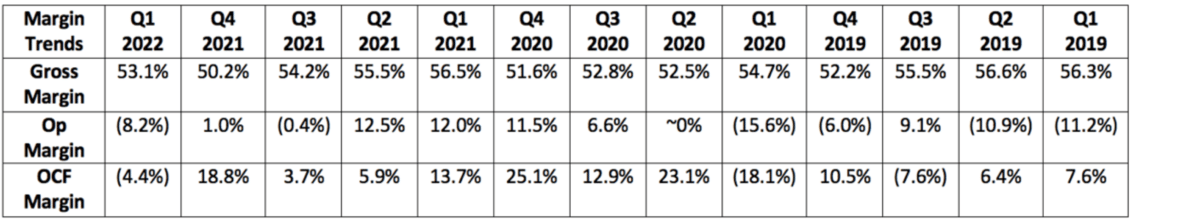

Most recent profit trends (might need to zoom in a bit):

More context on profit:

- Shopify continues to invest all gross profit dollars back into product upgrades and geographic expansion. It is not trying to earn operating income but attempting to operate at break-even for now. This is very similar to what the market rewarded Amazon for in it’s early years (very different market now).

- Proliferation of merchant services and the change in developer fees are both weighing on margins. A shift back from debit-funding to credit funding as we move past stimulus is also hurting margins.

- Shopify’s Q1 2022 GAAP net income margin was (125%) vs. 127.3% YoY and (26.9%) QoQ. This crazy volatility is not unit-economics related in the least -- it is entirely related to unrealized fluctuations in the value of its equity investments. This is not a super important profit metric to track for the company for now -- so I left it out of the table.

Guidance:

Shopify doesn’t provide formal guidance but has offered the following color:

- Merchant revenue growth rate will be roughly 2X subscription revenue growth for 2022.

- All gross profit dollars will continue to be invested into growth.

- $800 million in stock-based comp (partially Deliverr M&A-related)

- A similar number of merchants will be added to the platform vs. 2021 (previously thought it would add more than 2021 so this was a guide down).

- This weakness was blamed on things like slower e-commerce growth for the industry, supply chain headaches and post-pandemic normalization.