Table of Contents

In case you missed it:

- Sea Limited Earnings Review.

- On Holdings Earnings Review.

- The Trade Desk Earnings Review.

- Lemonade & Duolingo Earnings Reviews.

- Palantir & Hims Earnings Reviews.

- Cava Earnings Review.

- DraftKings Earnings Review.

- Uber Earnings Review.

- Shopify & Coupang Earnings Reviews.

- Meta Earnings Review.

- Alphabet Earnings Review.

- Apple, ServiceNow & Starbucks Earnings Reviews.

- Amazon & Mercado Libre Earnings Reviews.

- PayPal Earnings Review.

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- Portfolio & performance updates.

Read my Nu Deep Dive here to learn about the company in detail.

a. Key Points

- Mexico looks like another Brazil for Nu.

- It's shifting more to secured lending and higher-quality borrowers.

- The response to slashing its high-yield savings rate in Mexico was as expected.

- They will attempt to secure a charter and launch in the USA.

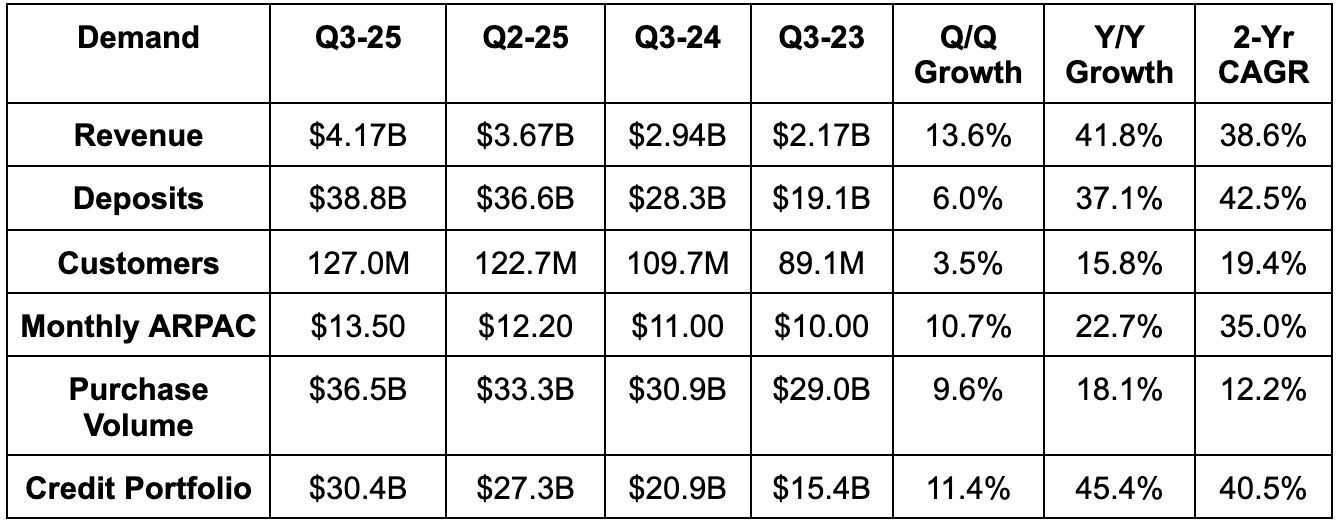

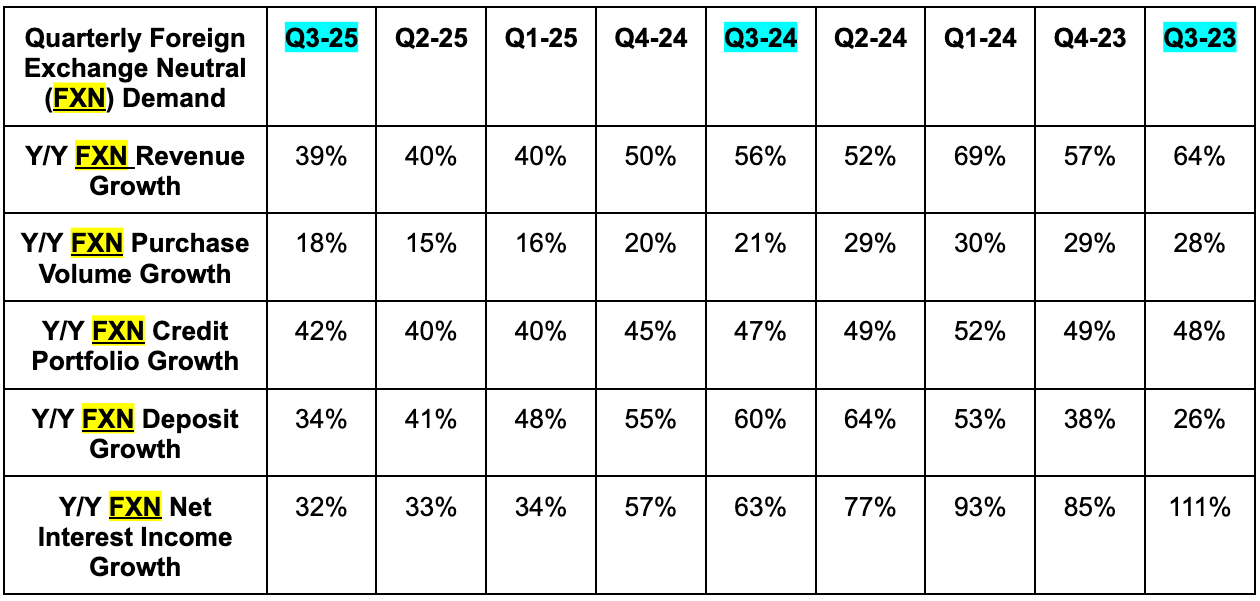

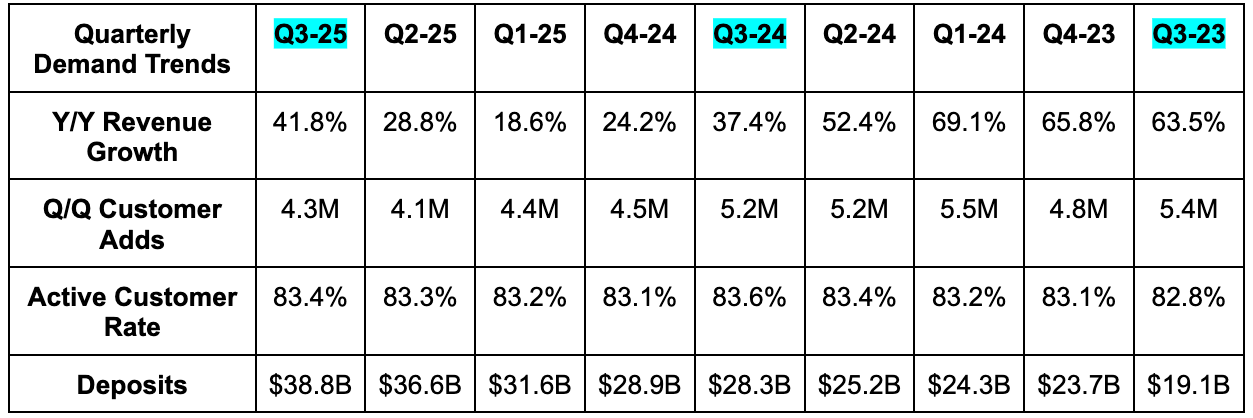

b. Demand

- Beat revenue estimates by 6.4%.

- Beat purchase volume estimates by 2.5%.

- Slightly beat deposit estimates.

- Slightly beat customer estimates & beat net new customer estimates by 0.3M or 7.5%.

- Beat $12.80 monthly average revenue per active customer (ARPAC) estimates by $0.20 or 1.5%.

- The credit portfolio is 3.1% larger than it’s supposed to be.

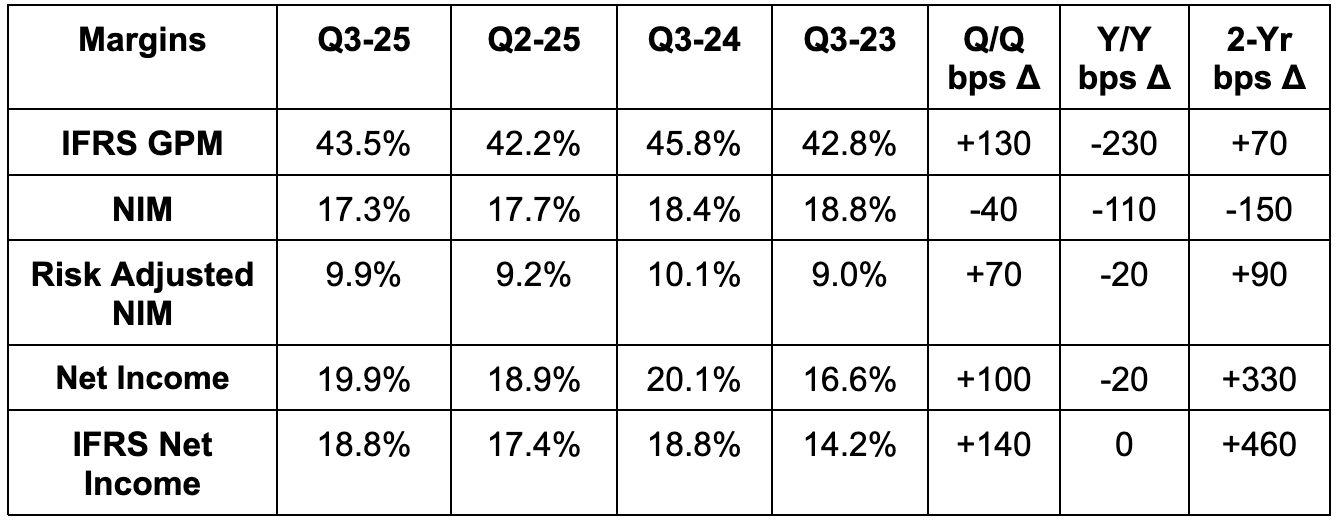

c. Profits

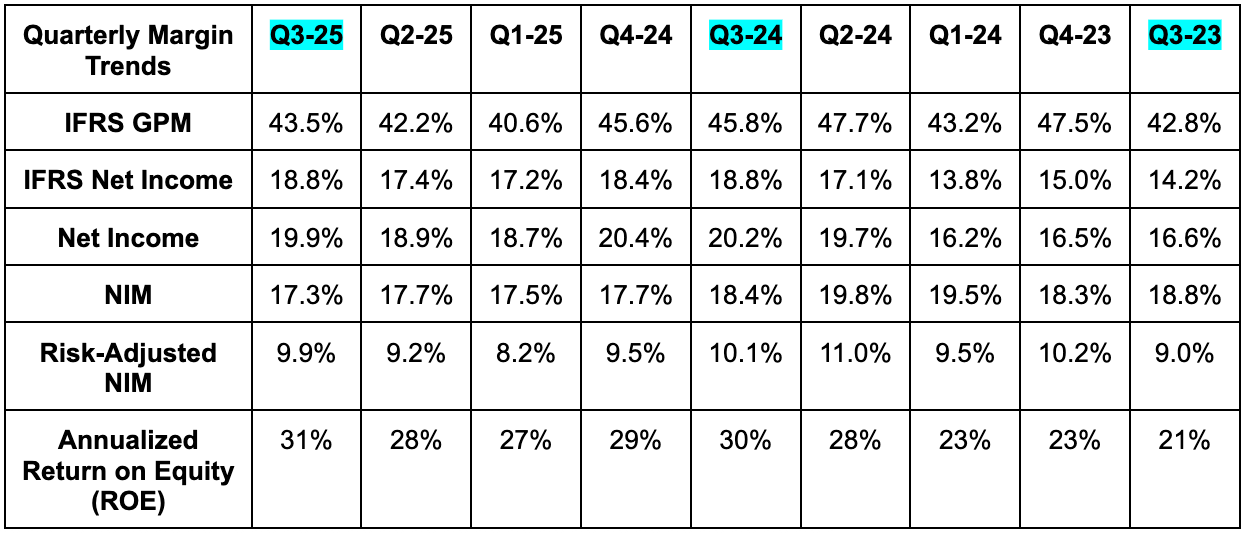

- Beat 43.2% GPM estimates by 30 basis points (bps; 1 basis point = 0.01%). Ongoing rapid growth in Mexico and Colombia, where margins are lower than in Brazil, continues to weigh on GPM. While GPM and NIM are tied together, this is a big reason why GPM contraction was larger than NIM contraction on a Y/Y basis.

- Beat net income & adjusted net income estimates by 6.7% each.

- Beat 29.5% return on equity (ROE) estimates with a 31% ROE.

- Note that they’re still investing aggressively in Mexico and, to a lesser extent, Colombia. They could be profitable in Mexico but they care more about growth today. The team is confident in strong margins over the long haul. These margins below are despite this approach.

d. Balance Sheet

- $1.8B capital excess on top of $3.4B requirement.

- $2.9B in additional cash & equivalents with the holding company.

- $3.1B in borrowings & financing.

- 11.9% common equity tier 1 ratio (CET1) 12.9% Q/Q & 13% Y/Y. The regulatory minimum is 4.5% across its 3 markets.

- They were asked about joining the mortgage space, but they’re not interested in the near term. Nu loves having a balance sheet full of short-duration, relatively asset-light lending products that give them the “opportunity to quickly react to changing macro.” Mortgages certainly don't fit that bill. It may look to partner to add this as a product on its app without using its balance sheet.