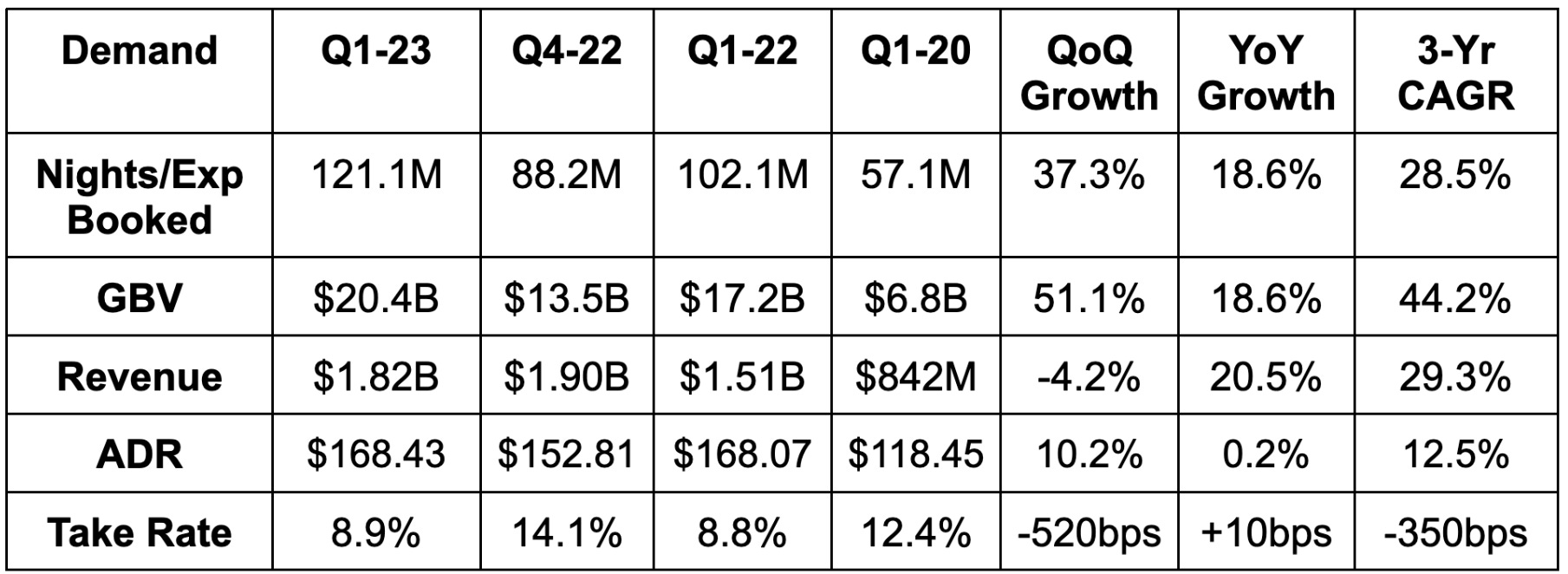

1. Demand

Beat revenue estimates by 1.7% & beat its guidance by 1.7%.

Beat gross booking value (GBV) estimates by 1.5%.

Roughly met abstract nights booked guidance and slightly missed estimates.

Demand Context:

90% of Airbnb’s traffic continues to be direct and unpaid. It’s great to be a verb.

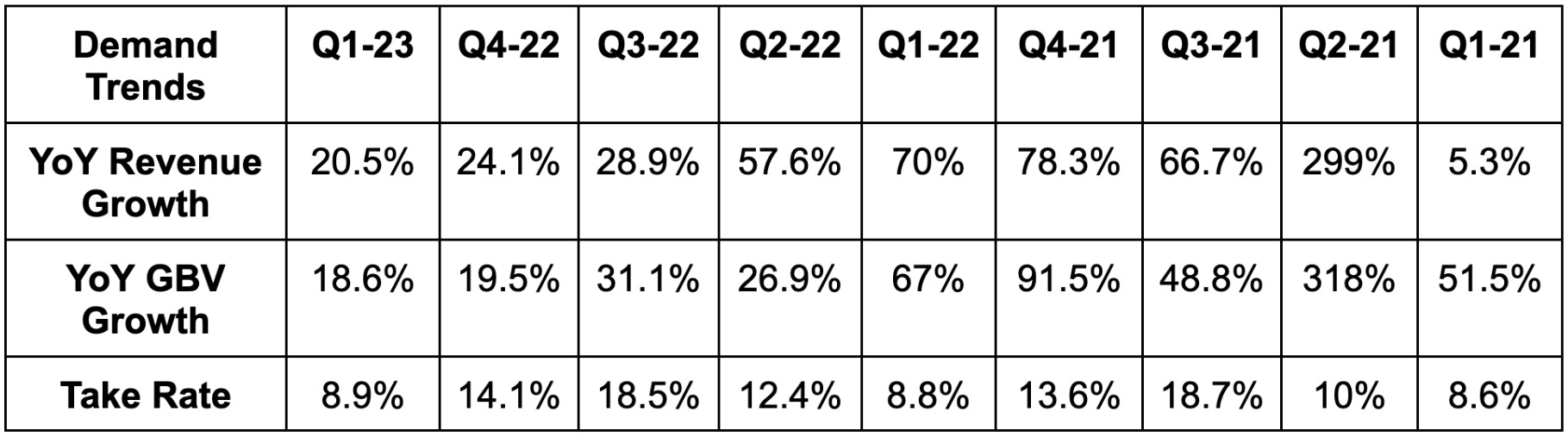

Very easy 3-year pandemic comps this quarter. That’s also why Q1 2021 - Q2 2022 saw growth far outpacing the company’s long term trend.

Q1 is seasonally weak for take rate and revenue with that seasonality absent the last few years due to strange pandemic comps. It has now normalized.

Supply growth has now accelerated in every quarter since Airbnb went public. Supply rose 18% YoY vs. 16% YoY last quarter. This is a major key to any sustainably healthy marketplace. It helps mightily with controlling nightly rates thanks to less listing scarcity which, in turn, juices demand. Active bookers set a new record high to balance this accelerating supply growth with robust demand.

Both urban and non-urban supply was up 18% YoY.

High density urban nights booked rose 20% YoY. Urban nights represented 48% of total vs. 46% YoY.

North American cross border nights booked growth accelerated from 31% YoY last quarter to 34% YoY this quarter. Overall cross-border nights booked rose 36% YoY as global travel makes a comeback.

Cross border = 45% of total nights booked vs. 39% YoY and 51% pre-pandemic.

Revenue FX neutral (FXN) growth was 24% YoY.

ADR FXN growth was 3% YoY.

Latin America is its fastest growing region with nights booked up 2x since pre pandemic.

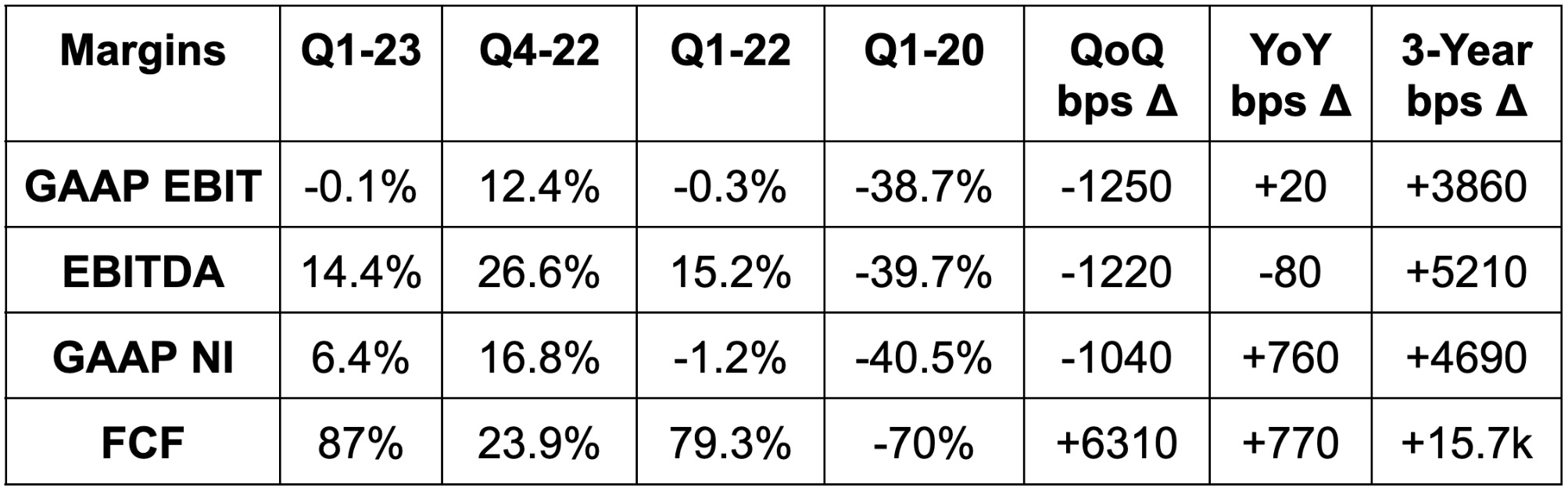

2. Profitability

Beat EBITDA estimates by 1% & beat its guidance by roughly 0.8%.

Beat -$10.6 million GAAP EBIT estimates by $5.6M.

Beat $0.10 GAAP EPS estimates by $0.08.

Beat FCF estimates by 55%. There were other consensus estimates from different sources that Airbnb beat by a much wider margin.

More Margin Context:

Airbnb has rapidly morphed into a FCF machine. Its trailing 12 month FCF margin is 44%. HOWEVER, Q1 is always its best FCF quarter due to collection on unearned fees from bookings to take place throughout the year. An 87% margin should not be extrapolated for future quarterly estimates.

Net income is better than EBIT due to interest income. This revenue bucket helped Airbnb generate its first positive net income Q1 ever.

3. Balance Sheet

Airbnb tore through its $2 billion buyback program in under a year thanks to rapidly growing FCF generation. So? It added a new $2.5 billion buyback program this quarter. Buybacks this quarter were more than double stock compensation dollars and diluted shares fell slighty YoY.

It has $10.6 billion in cash and liquid assets and nearly $2 billion in long term debt.

4. Guidance

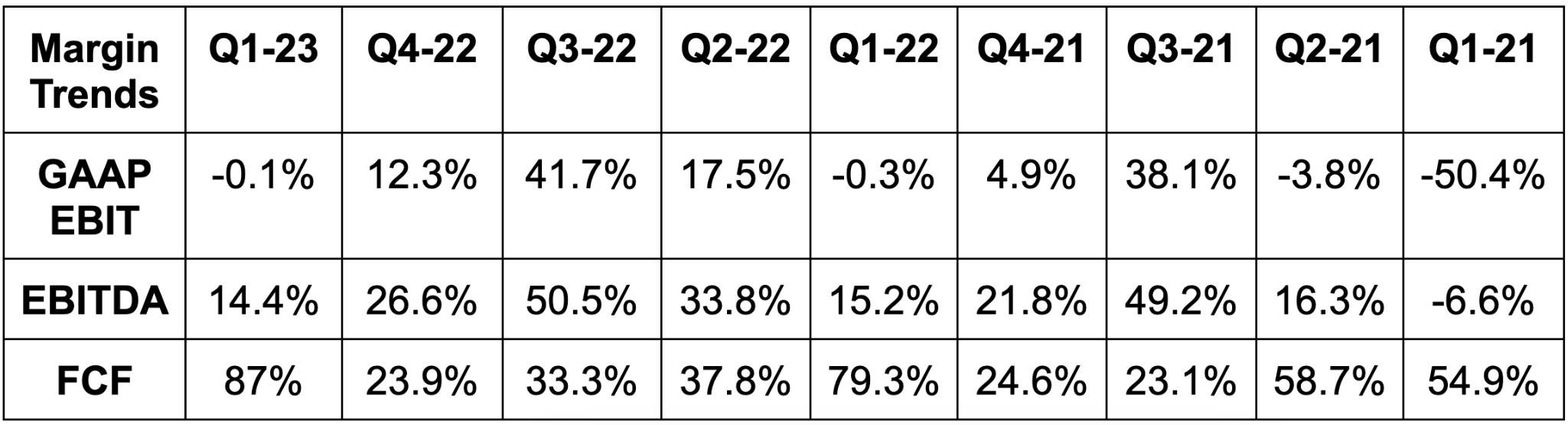

Airbnb’s Q2 guidance missed on revenue by 0.8% and missed on EBITDA by 14.6%. The EBITDA miss was alarming at first glance, but the reasoning eliminated that concern. The miss is related to Airbnb changing the timing of its annual marketing spend. It wanted to get its brand marketing programs started earlier this year to get ahead of peak travel season. It’s also enjoying strong marketing returns that it wants to capitalize on and debuting new international marketing programs. Importantly, marketing as a % of revenue for 2023 will be the same as 2022. And even more importantly, it reiterated its full year 2023 EBITDA margin guide of flat YoY. This miss is not a matter of fundamental deterioration in the least; this truly is timing related.

Q2 revenue is expected to grow by 14% YoY at the midpoint with nights booked growth expected to be slightly lower. This is being impacted by tougher YoY comps related to the Omicron variant. Q2 2022 travel enjoyed some Q1 2022 delays via the variant which propped up growth during the period. It expects growth to re-accelerate in the 2nd half of the year.

Finally, Airbnb sees a sequential fall in ADR via mix shift to lower ADR geographies -- though noted it has held up better than it expected thus far.

5. Call & Letter Highlights

Global Expansion:

Airbnb rolled out a new playbook for marketing and product localization across Brazil and Germany. The results have “exceeded its expectations” with growth in both countries accelerating to become two of its highest growth markets. Brazil nights booked rose 114% YoY and Germany enjoyed 70% YoY growth. It will take this approach to APAC and across more countries in Europe like Spain and Italy this year. Airbnb pulled back on international growth during the pandemic to perfect the core service and control its cost base. Now, the company’s far healthier profitability/balance sheet puts it in a position to re-accelerate efforts across the globe.

APAC specifically is beginning to show real signs of recovery with nights booked up 40% YoY. Border closures lasted longer in that region than elsewhere so it’s good to hear this geography is coming back. Airbnb is “significantly underpenetrated” across all of Asia and will invest to address that opportunity. China specifically was 5% of total volume before it shuttered travel and is now just starting to come back.

“We are encouraged by China’s recent lifting of its travel restrictions even though we anticipate the outbound recovery to be gradual due to challenges with limited flight capacities.” – Shareholder Letter

Backlog:

Airbnb is enjoying longer booking lead times than last year. Specifically, its bookings backlog for the second half of the year is 25% larger than at this time in 2022.

New Product Launches:

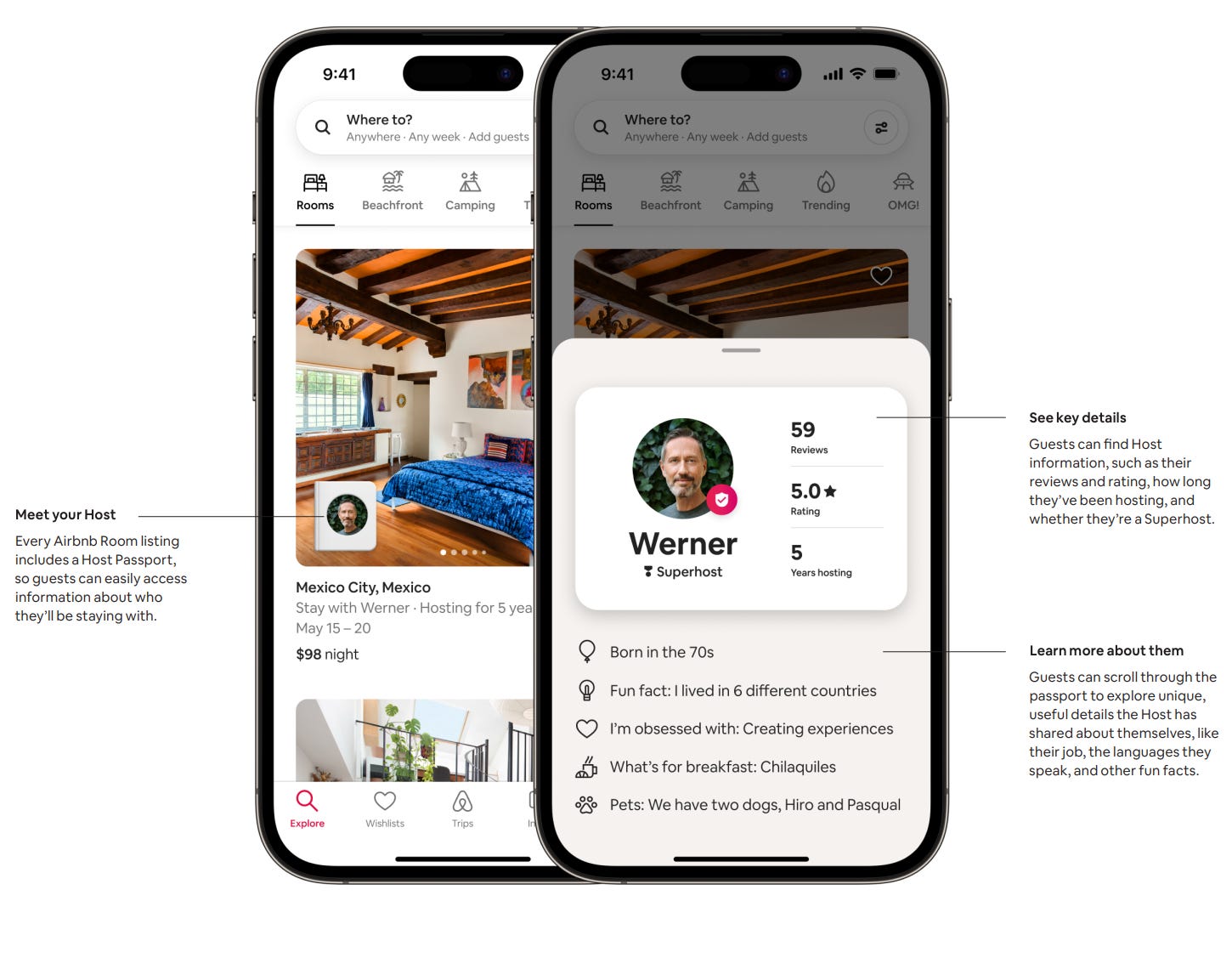

Airbnb’s summer release event came with a core theme of making travel more affordable. All releases were a response to direct customer feedback. It debuted a new Stripe partnership to discount rates for users paying from a bank account, added more pricing transparency (which has been revenue neutral) and released a new pay later feature with Klarna. Most interestingly, it debuted Airbnb Rooms (book an individual room vs. an entire living quarters) to lower the cost barrier for some travelers. According to leadership, this is a “new take on the original Airbnb niche.” It aims to recapture Airbnb’s status as a destination for cheap travel to complement its thriving luxury, long term and big group segments. Specifically, Airbnb Rooms are cheaper than many hotels at $67 per night on average.

The firm already had a private rooms product, but Airbnb Rooms is a new version of this offering with a key upgrade called Host Passports. This is a more detailed hosting profile to ensure compatibility between guest and resident. When you’re living with someone for weeks at a time, this is imperative to establish comfort between both parties. 65% of guests are not comfortable staying with a stranger and this should help.

The response to this release has “exceeded all expectations.” This, along with Airbnb friendly apartments (which now has 250+ buildings in the program vs. 175 last quarter) makes regulatory compliance easier. Why? Places like New York City are trying to mandate that a host must be on-premise to have a short term rental. This makes that much easier by letting them rent out a spare room instead of their entire apartment.

For hosts, Airbnb launched a new pricing comparison tool. This lets them compare their rates to similar listings to hone in on what to actually charge. It’s expected to limit vacancy rates while creating more affordable and efficiently priced listings. The firm also added more granular discounting tools for hosts to utilize during slow seasons.

All of these releases are expected to control the recent trend of rising prices to book on Airbnb. Hotels are expecting pricing power to boost their growth this year; Airbnb is conversely trying to limit price hikes to instead let volume power its growth.

Co-Founder/CEO Brian Chesky spoke a bit on AI (like everyone else). He sees ChatGPT generative AI models pushing Airbnb closer to its vision of being the online travel concierge. This will let the firm be far more effective in playing matchmaker between the supply and demand sides. Eventually, it will take this newfound matching prowess to new verticals beyond travel. In the near term, AI is also expected to help with its customer service and developer productivity.

The team teased expansion into new product categories beyond travel in 2024 thanks to its increasingly healthy balance sheet and profitability. It continues to re-tool its Experiences product and believes in the long term potential of it.

Additional product launches:

Discounted Airbnb fees for stays beyond 90 days.

Transparent checkout to more expediently guide guests through the process.

New customer service team “with the goal of answering 90% of calls in English in under 2 minutes.

6. Take

This was a rock solid quarter. We’re excited by the prospect of Airbnb Friendly apartments and Airbnb Rooms both opening the company up to new demographics and thrilled with the early success of international marketing programs. The firm’s opportunity is still relatively untapped in the USA… it’s extremely untapped across the globe. The EBITDA miss isn’t concerning based on the reasoning and the reiterated annual guide; everything else in the report looks positive. The share price will do what it will do. If the reaction is negative enough, I’ll likely add.

Beautifully written and great takes, loved it. Thank you for sharing Brad!