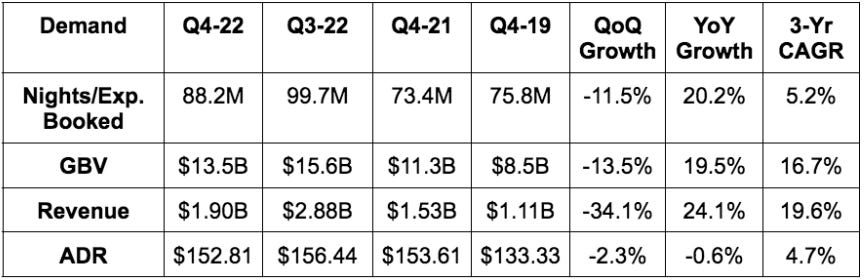

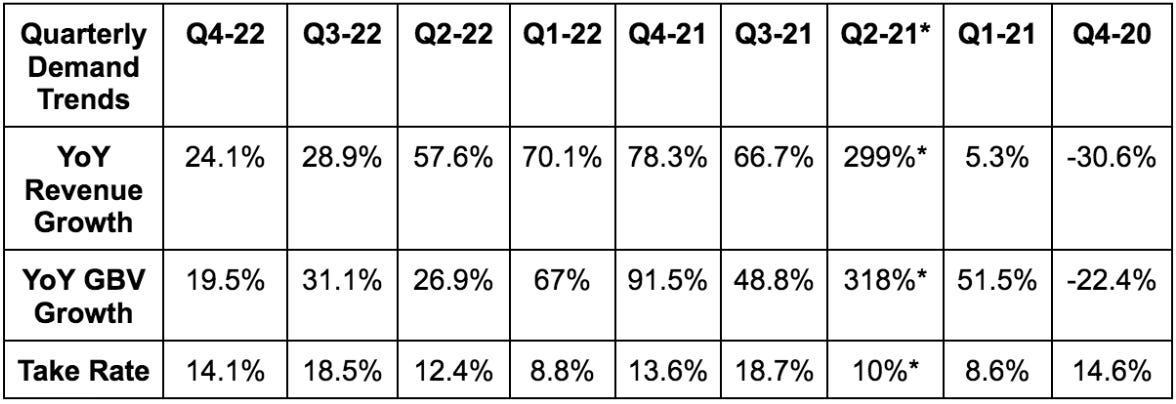

1. Demand

Airbnb beat revenue estimates by 2.2% & beat the midpoint of its guidance by 3.3%. This is despite a 700 basis point (bps) foreign exchange (FX) headwind vs. a 600bps headwind it assumed in its guide. Strong result.

Results were roughly in line with abstract total nights and experiences booked guidance offered last quarter.

More Demand Context:

Airbnb gained share in global nights stayed vs. 2021 & 2019 — across all markets.

Generated $8.4 billion in 2022 revenue growing 40% YoY (46% FXN).

YoY listings growth ex-China accelerated vs. last quarter to 16% YoY. New host initiatives are working.

It removed all listings in China in 2022 to focus entirely on its outbound business there.

Cross border & high density urban growth vectors continue to recover while Airbnb’s long term and off the grid stays remain resilient. Good combination.

Guest cancellations are still above 2019 levels but fell YoY.

Take rate rising YoY is a matter of reservation booking timing. “On a time adjusted basis take rate is very stable” per CFO Dave Stephenson

Q2 2021 and throughout 2021 is when it got pent up demand release. The easy comps = why growth was so rapid at that time.

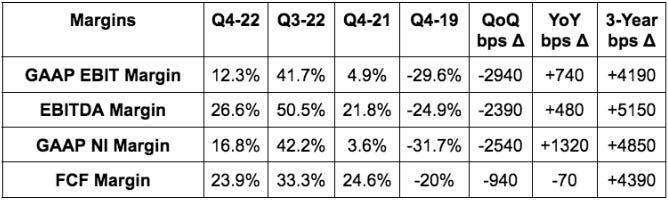

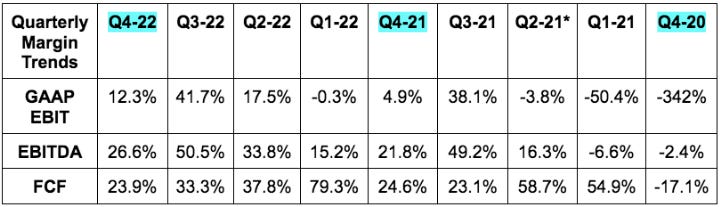

2. Margins

Beat EBITDA estimates by 16.8% and beat its EBITDA guide by 23.4%.

Beat GAAP EBIT estimates by 34.3%.

Beat GAAP EPS estimates of $0.27 by $0.21.

More than DOUBLED free cash flow estimates.

More Margin Context:

Continued operating leverage in Q4 2022 has been extremely rare among all of the large cap companies that I cover. Most companies are seeing margin contraction. Wonderful deviation from that trend here.

Airbnb generated $1.9 billion in 2022 GAAP net income vs. ($352M) in 2021. It grew FCF YoY by 49% in 2022. Cost controls are not taking the shine off of its demand growth. Airbnb’s headcount is down 5% vs. pre-pandemic with revenue up 75%. It cut marketing spend yet continued to find robust demand growth.

That’s why margins are exploding higher and why it’s so nice to be a verb. Where should we stay? Just Airbnb it.

c. Forward Guide

“We are excited by continued strong demand in Q1 2023 and a strong backlog with longer lead times for bookings. We’re particularly encouraged by European guests booking summer travel earlier this year, market share gains in LatAm and the continued APAC recovery.” – Founder/CEO Brian Chesky

Q1 commentary:

Beat Q1 2023 revenue estimates by 5.5%. This was a far stronger result than its traveling counterparts like Booking and Expedia. Guidance includes a 500 bps FX headwind.

Take rate to be similar YoY in Q1 2023 vs. Q1 2022.

Nights & experiences booked growth to be similar next quarter vs. this quarter. This implies 20% YoY growth or ~122.5 million nights & experiences booked in Q1 2023.

ADR to fall slightly YoY throughout 2023 via mix shift.

The abstract EBITDA commentary implies adjusted EBITDA roughly in-line to slightly better than estimates. This is despite shifting more of its 2023 marketing spend into Q1 than previously planned.

2023 commentary:

2023 EBITDA margin to be similar to the 34.5% margin it posted in 2022. Expectations were around 33.9%.

Headcount to grow in the low single digit % range. It has no layoffs planned and will instead continue hiring to key areas. It was well ahead of the curve on cost controls a few years ago and now finds itself in a position where it can accelerate headcount growth.

d. Balance Sheet

$9.6 billion in cash & equivalents.

Another $4.8 billion held on behalf of guests.

$1.98 billion in long term debt.

Bought back another $500 million in stock during the quarter. It has $500 million left out of its $2 billion buyback. This buyback has offset equity dilution but management hinted at accelerating future buyback pace beyond stock based compensation levels.

e. Letter & Call Highlights

On Supply Growth:

Leadership talked about the obvious factor of Airbnb’s massive demand aggregation driving host supply. This factor becomes even stronger amid macro turmoil as people seek out secondary income sources.

The other key contributor to accelerating supply growth talked about on the call was Airbnb’s product innovation. Whether it's “Airbnb Setup” which gives new hosts free guidance through on-boarding, enhanced guest identity controls or raising damage protection to $3 million, host Net Promoter Score (NPS) continues to skyrocket.

Since 2019, supply and demand growth has been roughly in line. This is key to any successful marketplace.

Product Innovation:

Its new search engine for Airbnb-friendly apartments is up to 175 buildings listed.

Airbnb rolled out its total pricing display product for guests in December. Encouragingly, the impact to revenue has been neutral.

Will debut new discounting tools to help Hosts dynamically toggle pricing based on demand for higher occupancy rates in 2023.

Chesky hinted at new eco services for hosts and leaning into new guest experiences in 2023.

“We have some big ideas for where to take Airbnb next. This year we will build a foundation for future products & services to provide incremental growth for years to come.” – Founder/CEO Brian Chesky

Asia Pacific:

This region has yet to recover to pre-pandemic levels. China’s recent lifting of outbound travel restrictions could provide a material tailwind to 2023 results. China outbound travel was nearly 5% of total booking volume before the pandemic struck. Management expects the recovery there to be very gradual.

On Average Daily Rates (ADR):

Leadership expects ADR to decline throughout 2023 although hinted at that being a somewhat pessimistic assumption. The declines are predominantly powered by mix shift back to cross border travel & lower ADR regions. The planned discounting programs it will debut in 2023 are interestingly not expected to have a material impact.

f. My Take

This was an elite quarter. The combination of growth and operating leverage is strong while it continues to take more share. The China re-opening tailwind is entirely ahead of it. The forward guide was far better than its public travel counterparts fared and I find it difficult to pick on any piece of this performance. Great job, Airbnb. Enough said.

Very strong quarter!