Today’s Article is Powered by my Favorite Brians Over at Long Term Mindset:

1. Demand

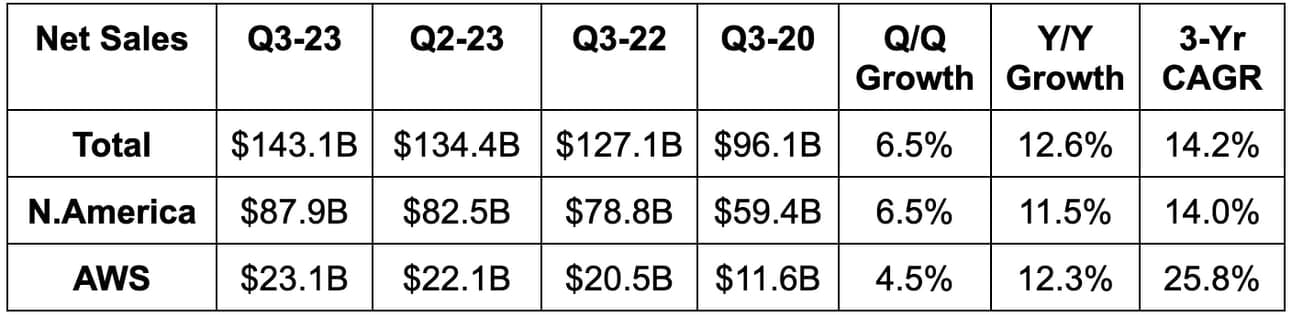

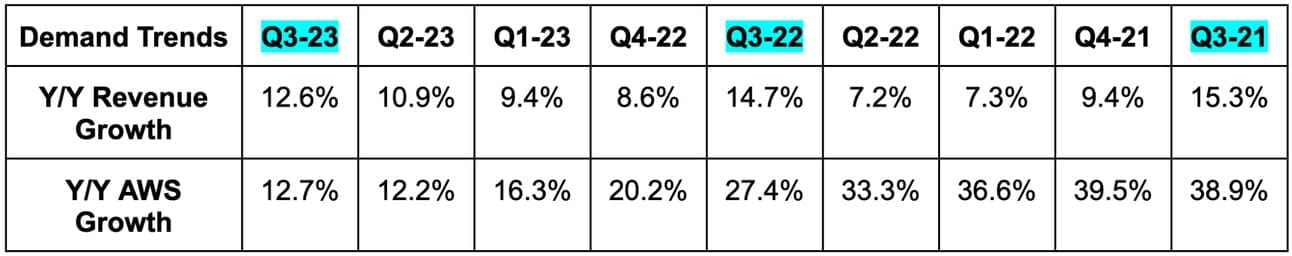

- Beat revenue estimates by 1.1% & beat guidance by 1.9%. Its 14.2% 3-year revenue compounded annual growth rate (CAGR) compares to 14.8% Q/Q & 19.1% 2 quarters ago.

- Roughly met AWS revenue estimates.

2. Margins

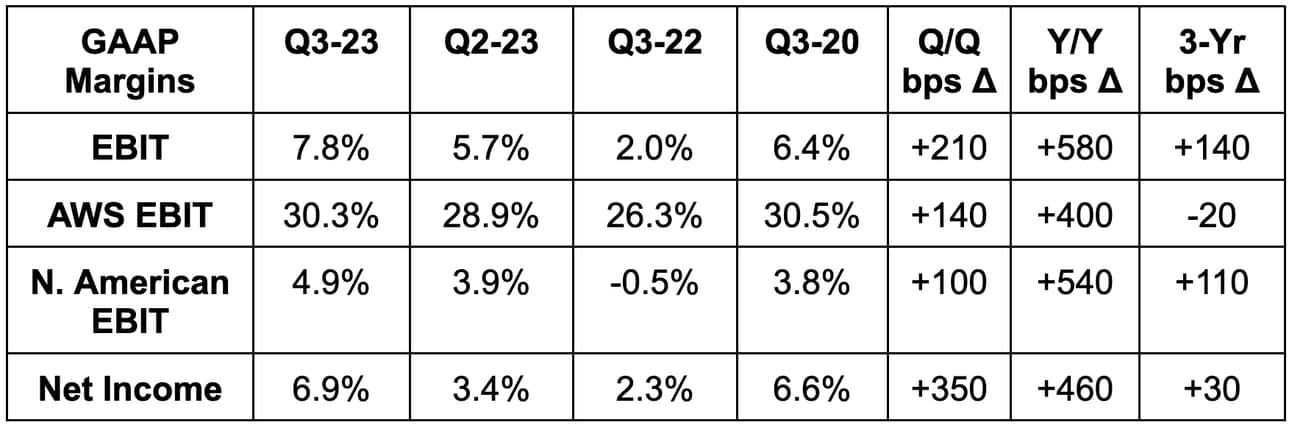

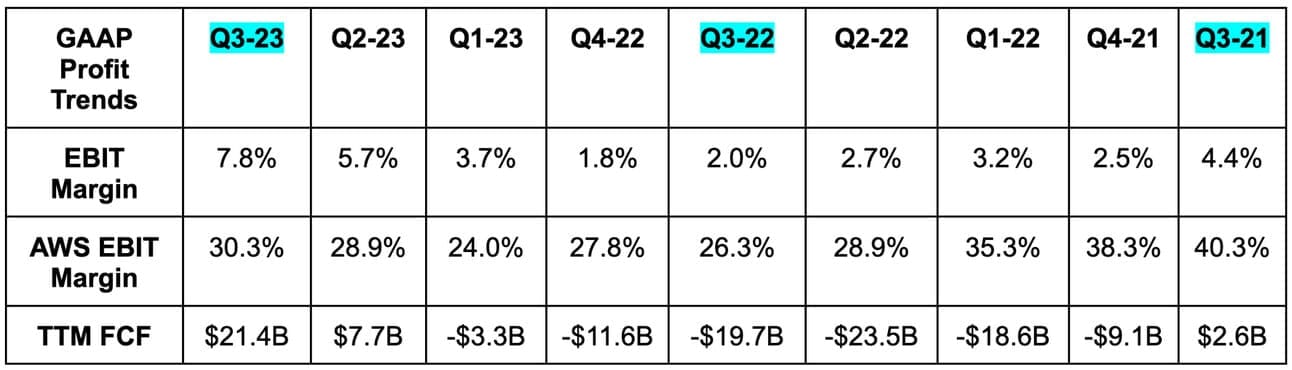

- Beat EBIT estimates by 45% & beat EBIT guidance by 60%. EBIT grew by over 300% Y/Y. That rate of growth will not continue, but is still impressive and shows how much cost optimizing there is to do within Amazon.

- Beat $0.58 GAAP EPS estimate by $0.36. $0.94 in EPS represents 235% Y/Y growth. Same EBIT growth note above applies here.

- Rivian mark to market equity gains make GAAP net income very noisy for Amazon. Its stock price directly impacts Amazon’s net income. Free cash flow and EBIT are my preferred metrics here for this reason.

3. Guidance

Next quarter revenue guidance missed estimates by 2.0%. Conversely, next quarter EBIT guidance beat estimates by 6.5%.

It continues to expect $50 billion in 2023 capital expenditures (CapEx) vs. $59 billion last year.

4. Balance Sheet

- $79B in cash & equivalents.

- Inventory down slightly Y/Y.

- $67B in debt.

- Share count rose 2.2% Y/Y. I want this to slow as it’s expected to.

Long-Term Mindset is a FREE weekly newsletter emailed each Wednesday. Each issue contains five pieces of timeless content to encourage you to think long-term. All issues can be read in less than 1 minute. There’s a reason why we are consistent readers and think you should be too. Subscribe here.

5. Call & Presser Highlights

Fulfillment Localization:

As I’ve discussed in detail, Amazon is conducting a series of operational tweaks to make its fulfillment business more efficient. A key piece of this is converting its national fulfillment network into 8 regional centers to cut miles to fulfill. Per the team, the benefits of this change are “exceeding optimistic expectations.” Specifically, Amazon’s local in-stock inventory rate has surpassed what it initially expected. That means shorter delivery times and lower cost to serve. It’s ideal to see cost cutting coincide with better customer service. That’s what is happening here.

The regional overhaul’s impact has yet to be fully felt. Amazon sees more efficiency to be gained as it perfects inventory algorithms, invests in robotics, more effectively utilizes line hauls and further consolidates shipments. This candidly got me excited. North American (N.A.) EBIT margin is already nearing 5%. Just 2 quarters ago, Jassy had to try to convince analysts that N.A. EBIT margin could eventually reach 4%. Now? 5% seems like a positive step rather than a final destination. I love operating leverage.