1. Apple (AAPL) – Earnings Review

a. Demand

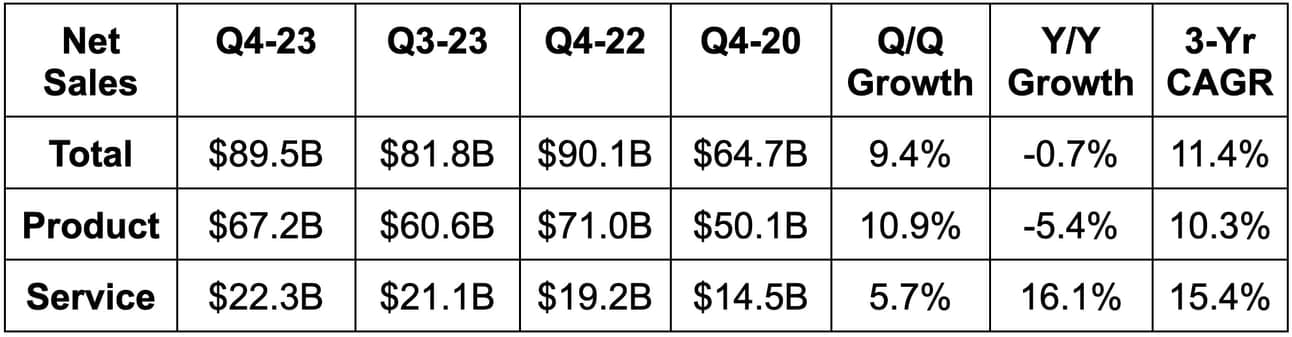

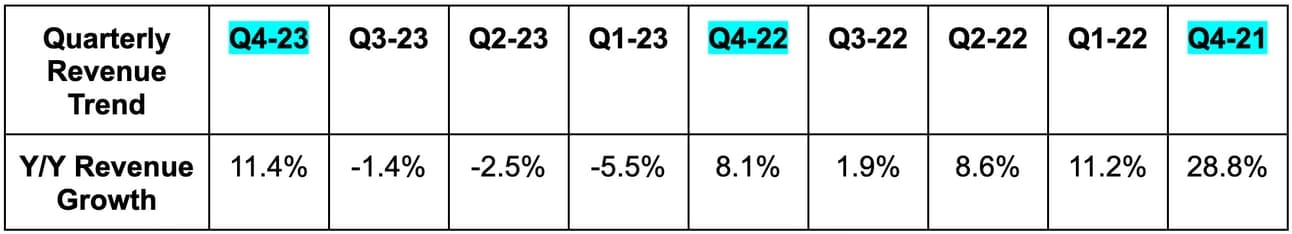

Apple beat revenue estimates by 0.7% & beat guidance by 0.1%. The 11.4% 3-yr revenue compounded annual growth rate (CAGR) compares to 11.0% Q/Q & 17.6% 2 quarters ago. Revenue rose by about 1.3% Y/Y on a foreign exchange neutral (FXN) basis.

Mac & iPad revenue both declined by double digits Y/Y as expected. The 34% decline in Mac was sharper than expected. As a reminder, in the Y/Y period, it enjoyed a recovery in supply chain disruptions. This meant the unleashing of pent up demand and the tough Y/Y comp. iPhone and services growth Y/Y improved vs. last quarter as expected.

b. Profitability

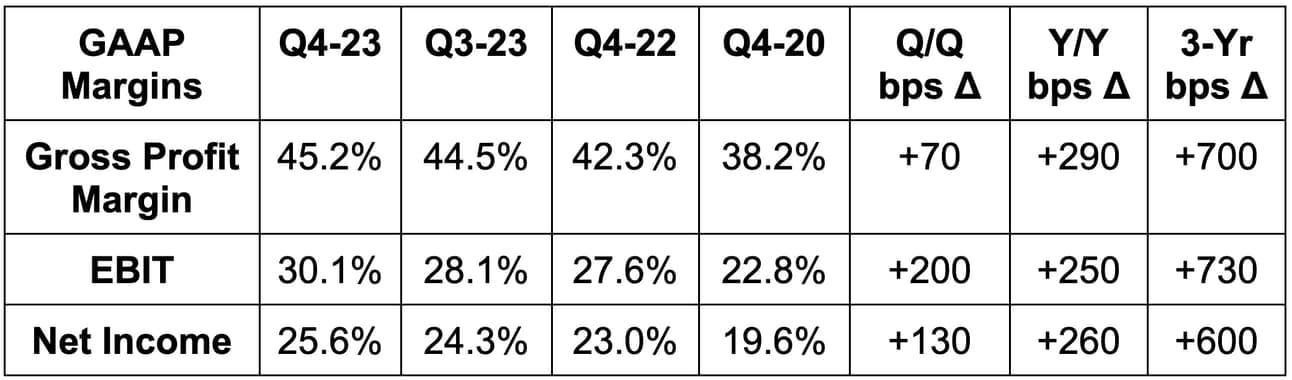

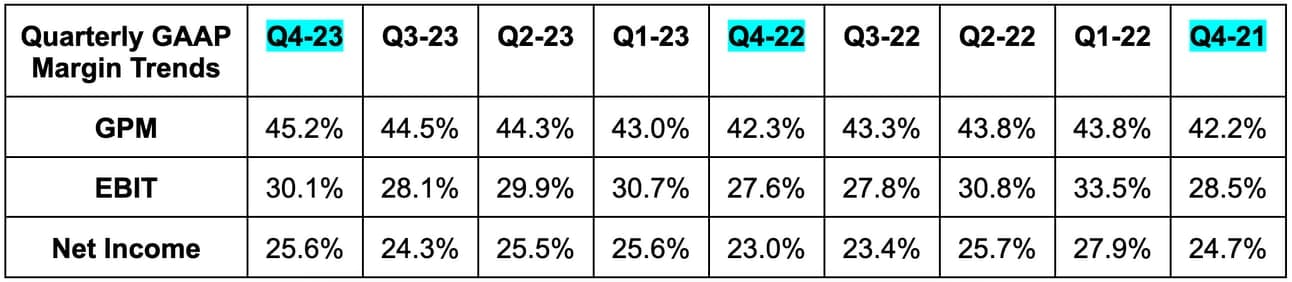

Apple’s 45.2% GAAP gross profit margin (GPM) was 80 basis points (bps) better than its guidance and 70 bps better than estimates. Its EBIT was ahead of both guidance and estimates by 3.3%. Finally, earnings per share (EPS) of $1.46 beat estimates by $0.07. EPS rose 13% Y/Y partially thanks to buybacks.

- Product GPM was 36.6% vs. 35.4% Q/Q and 34.6% Y/Y.

- Services GPM was 70.9% vs. 70.5% Q/Q & 70.4% Y/Y.

c. Guidance

Apple guided to roughly 0% Y/Y revenue growth next quarter. This materially missed expectations of 4.6% Y/Y growth. It’s important to note that fiscal Q1 2024 has one less week than Q1 2023. That boosted Q1-2023 revenue by 7%, but should have already been baked into estimates. What likely wasn’t fully incorporated into estimates were supply chain challenges with the iPhone 15 lineup. These issues are capping its ability to fulfill demand and will last through next quarter.

Conversely, the 45.5% GAAP GPM guidance was 200 bps better than expected thanks to mix shift towards services. Input cost efficiency gains helped too. This paved the way for EBIT guidance that was about 1% ahead of consensus.

d. Balance Sheet

- $162 billion in cash & equivalents. Crazy.

- $111 billion in total debt.

- $77.6 billion in fiscal year 2023 buybacks vs. $89.4 billion Y/Y. Crazy again.

Share count fell by 2.7% Y/Y via continued aggressive buybacks. It initiated an additional “accelerated $5 billion buyback” this past quarter. Must be nice to be able to casually spend $5 billion on repurchases when you feel like it. That’s the luxury of its fortress balance sheet. It has the goal of being at $0 in net cash (cash - debt). It’s over $50 billion today, which gives it significantly more room to lever up the balance sheet for more buybacks.

e. Call & Release Highlights

Macro:

CEO Tim Cook unsurprisingly cited uneven macro in the September quarter. Refreshingly however, he spoke about Apple overcoming these issues rather than citing them as excuses for softness. It will continue to invest heavily in innovation which, again, is the luxury of its best in class balance sheet and massive net cash position. It doesn’t need to pull back when cost of capital rises.

Products:

iPhone revenue rose 3% Y/Y for the quarter vs. negative Y/Y growth last quarter. This represents a new quarterly record for the segment The new phone lineup is receiving nearly perfect 3rd party customer satisfaction scores. Cook spoke about the iPhone 15 Pro in a nothing but a positive light. The heating issues around the titanium frame were not discussed in prepared remarks or asked about in the Q&A. The Americas and emerging markets were the two geographic standouts that powered iPhone’s growth.

Mac’s -34% Y/Y performance was again related to difficult comps already discussed. Weak macro and “challenging market conditions” added to the softness. The demand runway here still looks promising over the longer term. Two-thirds of the young, affluent college student demographic uses Macs. Additionally, half of the buyers this quarter were brand new to the product.

As Apple debuted its new M3 chips this past week, leadership was understandably asked about how this investment is going. Cook would not explicitly say that the vertical integration is boosting margins. It’s unclear if it is. What is clear is that the pace of product innovation (thanks to this vertical integration) is far better than if it were solely utilizing 3rd party chips. He’s happier every single day” that it made this transition.

Wearables were not a big part of the discussion. Revenue shrank a bit Y/Y vs. modest Y/Y growth in the previous quarter. He talked up the previously debuted product upgrades for the new Watch lineup like the touch-less hand controls. Two-thirds of Watch buyers this quarter were brand new to the product as it becomes more ubiquitous.

Services:

Services growth of 16% Y/Y vs. 8% Y/Y last quarter was probably the highlight of this report. That makes commentary about next quarter’s services growth being “similar to this quarter” quite positive. This drove the bulk of the GPM outperformance in the guidance.

- It was a banner quarter for Apple Music subscribers. Maybe I’m not the only GenZ consumer who uses it instead of Spotify after all.

- Its first season with Major League Soccer’s league pass is “exceeding expectations.” This could make Apple more eager to bid on more live sports content in the future.