Cresco Labs and Green Thumb Q2 Earnings Reviews

Dissecting the results of these 2 Multi-State Operators.

1. Cresco Labs

“We believe the outlook for the U.S. cannabis sector has never been brighter than it is today.” — Charles Bachtell

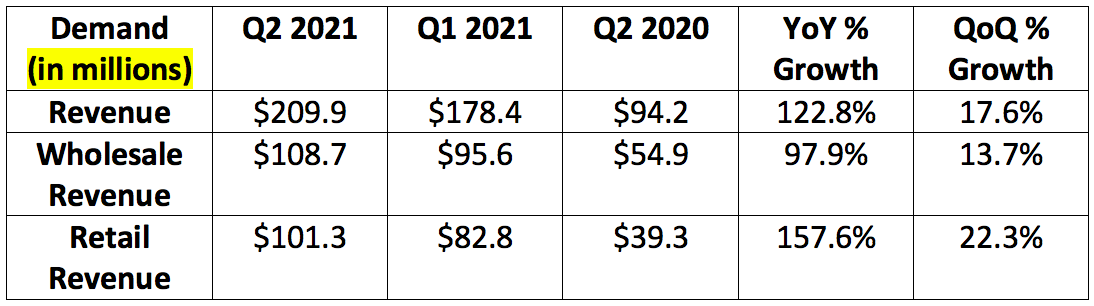

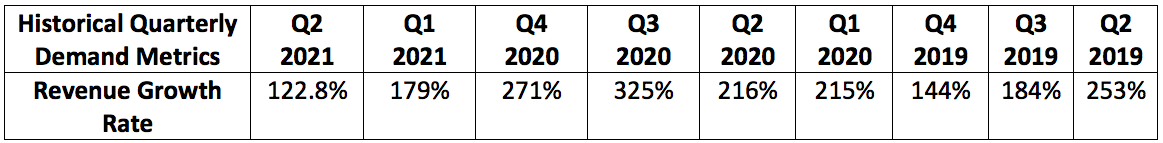

a. demand

Analysts were expecting Cresco Labs to generate $194.6 million in quarterly sales. It posted $210 million outpacing estimates by 7.9%.

Revenue growth was 86% organic & 14% inorganic from purchases like Bluma — a vertically integrated operator in Florida — which closed April 14th. Bluma is off to a strong start for Cresco Labs seeing 33% sequential growth. Cresco has already realized incremental operational efficiencies and yield increases from this purchase. The company plans to double its current store count in Florida in the future as well as debuting edibles and more brands. Next quarter will be the first full quarter of Bluma results integrated into Cresco’s.

“In Illinois, the social equity license lotteries are underway. We are proud to report that multiple license winners were part of our 2020 seed program incubator.” — Bachtell

Cresco’s wholesale revenue business is the largest in the industry & sold to 1000 retail shops during the quarter.

“We are excited about what lies ahead as we begin recognizing contributions from growth initiatives from the last 18 months.” — Bachtell

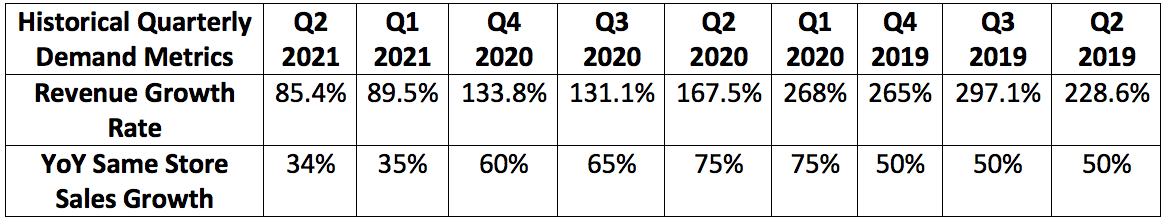

The company has 33 stores open vs. 24 sequentially and 13 stores year over year. Same store sales grew 14% sequentially and 58% year over year.

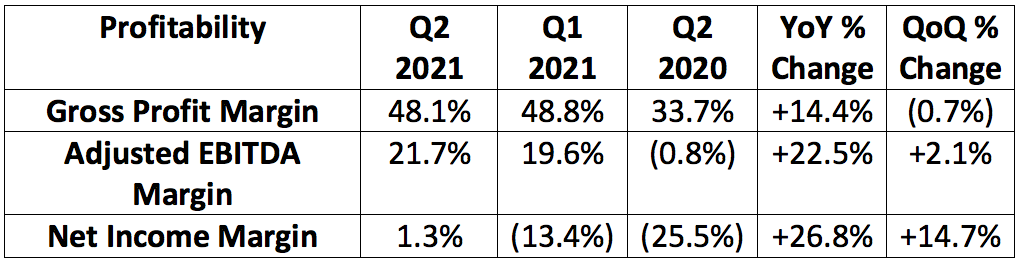

b. Profitability

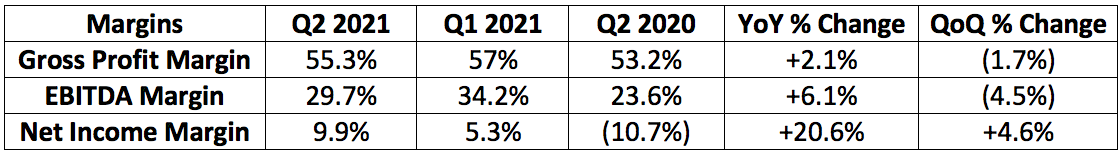

Gross profit margin was impacted by a fair value markup on acquired inventory via the Bluma acquisition. Without this temporary hit, gross profit margin would have been 51.0%.

SG&A as a percent of sales fell from 32.4% to 31.6% sequentially. The company expects this to decline further going forward as investments in growth are completed.

c. Cresco Labs reaffirmed the following 2021 guidance:

Annualized revenue run rate over $1 billion by the end of the year

GPM over 50% for the remaining 3 quarters of 2021

Adjusted EBITDA margin run-rate of 30%+ by the end of the year with “more upside here in the years to come”

d. Operational Highlights

Closed on an overnight offering of subordinate voting shares in January for $125 million.

Bought 4 Ohio dispensaries from Verdant Creations in February. These stores had been open for more than 2 years before Cresco purchased them yet saw 12% sequential growth following Cresco’s purchase. This outpaced the market by 30%.

Bought Cultivate Licensing LLC and BL Real Estate LLC — a vertically integrated Massachusetts cannabis operator.

The company has $131 million in cash on hand with $189.4 million in debt. This week, Cresco Labs also raised $400 million in debt to pay off existing debt and to add $200 million in cash to the balance sheet. This came with a cost of capital of 9.5% maturing in 2026 — this is among the lowest rates (not the lowest) in the industry.

e. Conference Call Commentary

1. CEO Charles Bachtell:

“We’ve demonstrated the ability to reach and sustain top market share positions in two of the industry’s top five states including Illinois. We are gearing up to repeat that success in more markets this year and are determined to achieve top 3 market share in every state in which we operate.” — Bachtell

The Cresco brand remained the top brand in Illinois. The company has the top 2 best-selling flower brands in the state, the top selling edibles portfolio and the top selling concentrates brand as well.

Cresco Labs’ first harvest in Michigan is on schedule for later in the year. This is a $1.8 billion annualized market.

At Hash Bash (a large cannabis convention in Michigan) this year, Cresco’s team won:

Top 2 vapes

Top 2 concentrates

Second place in edibles

Cresco Labs continues to grow its market share in California. Demand for Cresco’s brands in the state is rising precipitously with shelf penetration and repeat ordering activity both very positive. Cresco already has a top ten brand in California.

“Sunnyside (Cresco’s retail brand) remains the most productive per-store retail platform among scaled national retailers.” — Bachtell

(Average revenue per retail shop rose to $3.9 million — the highest per-store revenue among multi-state operators)

Momentum in non-vertically integrated retailers entering the market continues to grow. This is a positive trend for Cresco’s wholesale-focused business.

e. My Take

Cresco delivered another excellent quarter. Its efficiency within the retail space is the perfect complement to its thriving wholesale business. Securing leading market share in states such as Illinois is nothing short of admirable. Margins continue to improve and growth remains lofty.

I have no interest in doing anything but adding to my already large position over time. Great job Cresco Labs!

2. Green Thumb

“The great American growth story in cannabis is happening — the momentum is undeniable.” — Founder and CEO Ben Kovler

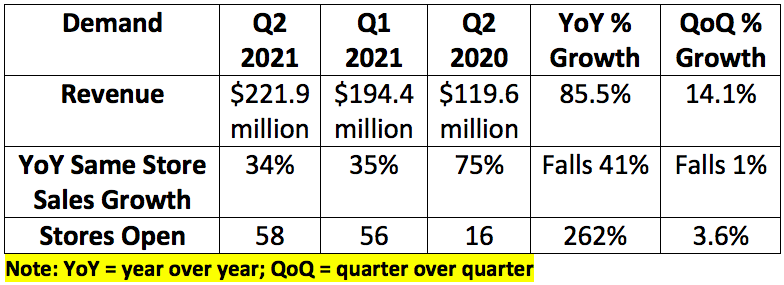

a. Demand

The company opened its 62nd store in Pennsylvania on August 10th.

This Q2 2021 revenue metric exceeded Green Thumb’s revenues from all of 2019.

Consumer packaged goods revenue enjoyed 13% sequential growth. The company expects this CPG growth to accelerate further going forward as distribution channels proliferate.

Retail revenue grew 15% sequentially via foot traffic and new stores.

b. Profitability

This was the company’s 4th straight quarter of positive GAAP net income and 6th straight quarter of positive cash flow from operations.

The sequential decline in gross profit margin was due to the ramping investments in branded wholesale.

c. Operational highlights

In April, Green Thumb raised $216 million in debt at 7%. It paid off $105 million in 12% debt with the funds and will use the remainder to support growth. It has $359 million in cash on hand and $197.6 million in debt.

“Regardless of the current barriers limiting access to capital markets, U.S. institutions are demonstrating an appetite for greater access to cannabis investments.” — Kovler

“With this cash, we intend to double and triple down our investments in a number of key markets (Ohio, New Jersey and Pennsylvania). Our patients and consumers have spoken: They want [our brands]. We will double capacity in New Jersey by next year. We have more large projects being contemplated that have not started yet.” — Kovler

In June, Green Thumb bought Liberty Compassion (a vertically integrated cannabis operator) to expand further into the Massachusetts market

In July, Green Thumb bought Dharma Pharmaceuticals to enter Virginia. Dharma owns 1 of 5 vertically integrated licenses in the state. It has 1 retail facility in Ohio as well with the ability to open up 5 more over time. Green Thumb opened “Rise Salem” in Virginia on August 2nd. This is the first stand-alone dispensary in the state (not attached to a cultivation facility).

Earlier in the month, Green Thumb bought Mobley Pain Management and Wellness as well as Canwell Processing to enter the Rhode Island market. These 2 entities together own 1 of 3 retail licenses in the state.

“We feel very comfortable with our balance sheet. We have significant financial flexibility to invest for the future with strong shareholder returns.” — Kovler

These acquisitions bring Green Thumb’s total state footprint to 14.

d. Conference Call Commentary

Legal U.S. cannabis sales are at an annual run rate of $24 billion. Green Thumb is expecting this to more than triple by 2030; Kovler thinks this estimate is still too conservative as it does not even include New York, New Jersey, Ohio or Virginia.

The company continues to be supply-constrained which hints at more rapid growth to come.

Mature markets are still showing strong sequential growth:

1) California grew 9% sequentially on a base of $1 billion

Green Thumb continues to monitor this market closely and is waiting for continued consolidation to enter it

2) Colorado grew 25% sequentially despite being 7 years into its recreational cannabis program

“In every market we operate in, consumer demand for legal cannabis is going up and to the right.” — CFO Anthony Georgiadis

Cannabis beverages continued to perform very well for the company but still will not contribute meaningfully to sales in the shorter term.

Demand for cannabis has remained strong across the nation into this current quarter.

e. My Take

This was another strong quarter for Green Thumb on virtually every financial metric. It continues to succeed in all areas and is poised to be a dominant player in this lucrative space for the long term.

I have no interest in doing anything but add to my position over time. Great job Green Thumb!

Thank you for reading! For my overview of American cannabis politics click here.