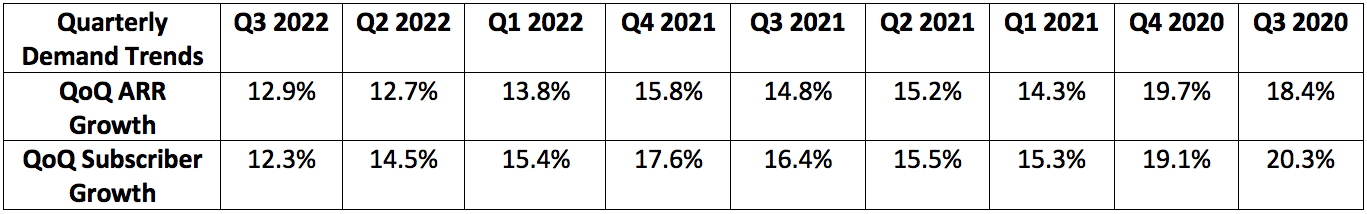

A. Demand

On results:

CrowdStrike guided to a revenue range of $358-$365.3 million for this quarter. Analysts were expecting $364.2 million in sales for the period. The company posted $380.1 million beating its own midpoint by 5.1% and analyst estimates by 4.4%.

QoQ growth acceleration (last quarter vs. this quarter):

Sequential revenue growth accelerated from 11.5% to 12.6%..

Sequential demand backlog growth accelerated from 14.1% to 27.7%.

Sequential remaining performance obligation (RPO) growth accelerated from 13.6% to 16.2%.

Lofty RPO and demand backlog growth both hint at more rapid expansion to come. These are both purely forward-looking demand metrics.

Note that year over year comparisons are measuring current times vs. a period in which work-from-home greatly accelerated endpoint security needs (CrowdStrike’s main niche). CrowdStrike’s strong results are despite this comparison headwind.

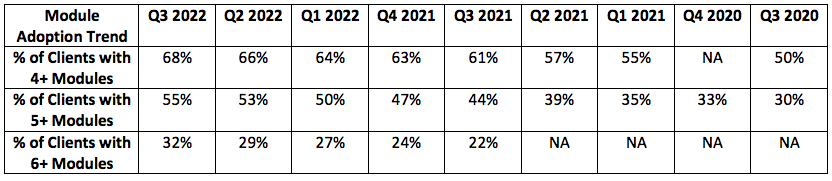

On key sequential trends:

Module adoption costs CrowdStrike virtually nothing in added operating costs after the first module has been on-boarded. This means the trend of strong module adoption depicted below is a clear sign of more margin expansion to come. CFO Burt Podbere has told us numerous times in the past that CrowdStrike will continue to debut 1-2 new modules every year.

For some reason CrowdStrike did not disclose its % of clients with 4+ modules in Q4 2020 then began doing so again the following quarter.

Last quarter, Burt Podbere told us that CrowdStrike would soon begin disclosing users with 7+ modules which offers more evidence of strong continued adoption. The company didn’t even disclose users with 6+ modules until fiscal Q3 2021 because the number wasn’t material enough to report.

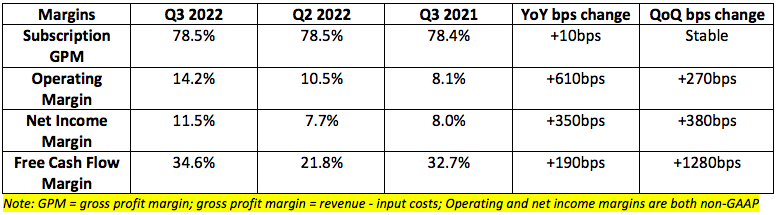

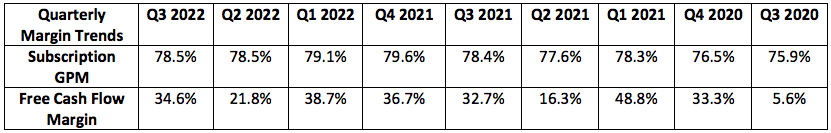

B. Margins

CrowdStrike was expected to earn $0.11 per share for the quarter. It earned $0.17 per share beating expectations by $0.06.

CrowdStrike also guided to the following:

$29.4 - $34.7 million in non-GAAP operating income. It posted $50.7 million beating the highpoint of its guidance by 46.1%.

$19.7 - $25.0 million in non-GAAP net income. It posted $41.1 million beating the highpoint of its guidance by 64.4%.

Q3 is a seasonally stronger period for cash flow generation vs. Q2. This is due to performance obligations and accounts receivable translating more commonly into free cash in the period vs. Q2.

As a reminder, CrowdStrike’s target subscription GPM range is 77%-82% — a range that it has now been in for nearly 2 years:

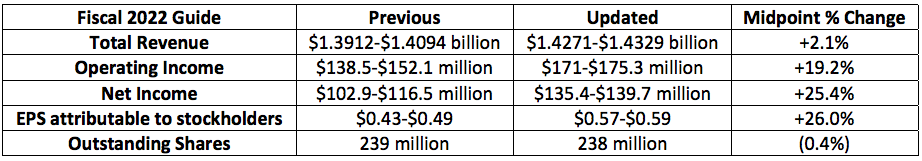

C. 2021 Guidance Updates

Analysts were looking for roughly $400 million for next quarter’s revenue guide. CrowdStrike guided to $406.5-$412.4 million representing a beat at the midpoint of 2.4%.

D. The Cybersecurity and Infrastructure Security Agency (CISA)

The Cybersecurity and Infrastructure Security Agency (CISA) has officially selected CrowdStrike as a major platform partner to augment Biden’s endpoint detection and response (EDR) executive order. CISA worked with several federal agencies to arrive at this decision. The selection opens CrowdStrike’s Falcon platform up to protecting dozens of federal agencies to strengthen our government’s cybersecurity capabilities.

Specifically, CrowdStrike will support CISA’s Continuous Diagnostics and Mitigation (CDM) program to protect all “.gov” domains. CISA has direct access to The White House’s American Rescue Plan funding. This new executive order embraces practices that CrowdStrike trail-blazed more than a decade ago and opens it up to significant new public market opportunities.

CrowdStrike was also named a partner for CISA’s brand new Joint Cyber Defense Collaborative (JDOC) which “unifies cyber capabilities spread out across federal agencies.” This continues a trend of positive public sector momentum with CrowdStrike Falcon Forensics gaining FedRAMP authorization during the quarter.

“This was a signature win for CrowdStrike. This is a big opportunity for us and will allow us to showcase how we can protect governments around the world.” — Founder/CEO George Kurtz

“The CISA deal with make the U.S federal government one of our largest customers. The net new ARR contribution will begin in the coming quarters.” — CFO Burt Podbere

E. Notes from Founder/CEO George Kurtz

“We have proven that we are the Salesforce of security.” — Founder/CEO George Kurtz

On accolades highlighted:

Named a leader in IDC MarketScape Worldwide Modern Endpoint Security.

Named best EDR product by SE Labs.

Humio received a top 3 award for log management and observability by Enterprise Management Associates.

CrowdStrike again earned highest rating for Gartner’s October 2021 endpoint study.

On competition:

“We realized several wins and displacements over newly public SentinelOne during the quarter. One of the largest hospital systems in the U.S. chose SentinelOne on price and based on their unfulfilled promises. Just within a few months of a multi-year contract the hospital system realized that it failed to scale or maintain efficacy and drove considerable friction. The client then turned to CrowdStrike & realized an up to 30% performance enhancement & greater efficacy without false positives.”

“We have no competitor matching our scalability, performance, ease of use and commitment to customers. Our win rates increased across the board and we saw a record number of wins with SMB, mid-market and enterprise customers. The competitive and pricing environment remains very favorable for CrowdStrike. We continue to expand our lead over legacy and next-gen vendors.”

“A leading healthcare system was using Microsoft and Symantec when it was hit with a ransomeware attack leading them to turn to CrowdStrike’s incident response team. They realized that they needed CrowdStrike and standardized on Falcon Complete.”

On newer product adoption:

“We are seeing an inflection in demand for new products in identity, log management and cloud security.”

“The 4th quarter is off to great start with one of the world’s largest financial institutions becoming a CrowdStrike customer.”

Assets from the Preempt acquisition last year generated more net new ARR this quarter than in the combined history of Preempt pre-acquisition. It helped CrowdStrike sign new contracts with AIA Insurance, multiple major airlines and a fortune 100 manufacturer.

“Preempt hit an inflection point this quarter.”

Humio (its log management and observability arm) won a fortune 150 food brand and a leading cloud platform in Europe during the quarter. Humio’s free, community edition reached 100% of CrowdStrike’s 6 months registration goal in just a few weeks.

“We underestimated how huge the opportunity is for Humio.”

Partner-based revenue grew more than 30% sequentially as CrowdStrike embraces a collaborative approach across the cloud.

On Zscaler:

“We continue to pull each other into large deals.”

F. Notes from CFO Burt Podbere

On the success:

CrowdStrike’s Rule of 40 score of 77 becomes 96 when calculated using free cash flow.

“We realized a record amount of net new ARR from $1 million+ deals to reflect our leadership in the enterprise segment.”

“We ended the quarter with our strongest pipeline to date to give an indication of future growth.”

CrowdStrike’s magic number was 1.3 vs. 1.4 last quarter as the company leans more heavily into growth. Anything above 1.0 depicts evidence of being able to lean in even more which CrowdStrike now plans to do in the coming quarters.

Magic number equation = (net new subscription revenue * 4)/sales & marketing expense

On competition:

The pricing environment has not changed for CrowdStrike regardless of competition attempting to undercut them. This offers strong evidence of the superior nature of CrowdStrike’s product..

On the balance sheet:

CrowdStrike now has $1.91 billion in cash & equivalents vs. $1.79 billion sequentially.

G. My Take

What else can I say besides fantastic job, CrowdStrike. This is already one of my largest positions and I have 0 interest in doing anything but accumulating more shares. Its combination of growth, profit and optionality is nothing short of remarkable. At 70X 2022 free cash flow — and the rapid growth it showcases — this company does not seem all that expensive to me like many others seem to think.

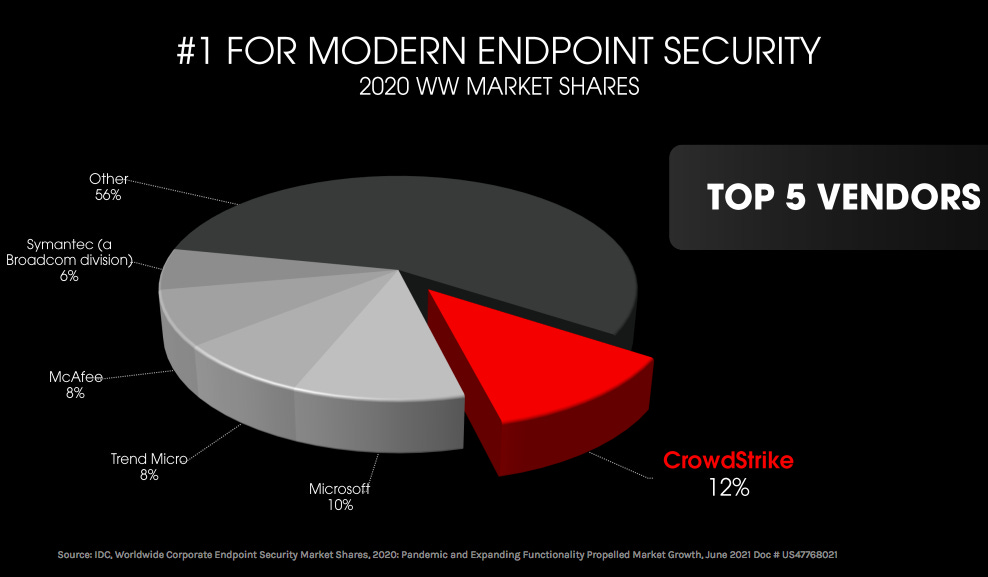

There remains a long runway of marketshare for CrowdStrike to take and it has continuously demonstrated a unique ability to do so:

I started investing this year and I am still building my CRWD position. The first time I read about this company, I felt it was too good to be true. But they just keep executing and the future potential looks so good :0 reporting 7+ modules :clap:

I started investing this year and I am still building my CRWD position. The first time I read about this company, I felt it was too good to be true. But they just keep executing and the future potential looks so good :0 reporting 7+ modules :clap: