“Our robust growth and leverage enable us to step-up investments in new technologies and geographies. Our platform and innovation offer strong momentum heading into fiscal year 2023 and we firmly believe CrowdStrike’s best days are ahead.” — CFO Burt Podbere

1. Demand

CrowdStrike guided to $409.5 million in revenue for the quarter and analysts were expecting $412.4 million. CrowdStrike posted $431.0 million in revenue, beating its expectations by 5.2% and analyst expectations by 4.5%. This represents CrowdStrike’s largest revenue beat over the last 3 quarters.

For 2021 as whole:

Revenue grew 66% YoY.

Subscription revenue grew 69% YoY.

Dollar-based net retention was 123.9% vs. 125.0% YoY and 124.0% 2 years ago.

Gross retention was at a “best in class” 98.1% vs. 98.0% YoY

CrowdStrike’s revenue split continues to be 72% U.S. based and 28%. international.

Note that subscription customer growth would have been 64.7% YoY without a small, inorganic contribution from SecureCircle. The revenue contribution was immaterial.

2. Profitability

CrowdStrike guided to $57.4 million in non-GAAP operating income and posted $80.4 million, beatings expectations by 40.1%

CrowdStrike guided to $47.3 million in net income. CrowdStrike posted $70.4 million, beating expectations by 48.8%. CrowdStrike and analysts both expected $0.20 in earnings per share (EPS). CrowdStrike posted $0.30, beating expectations by $0.10 or 50%.

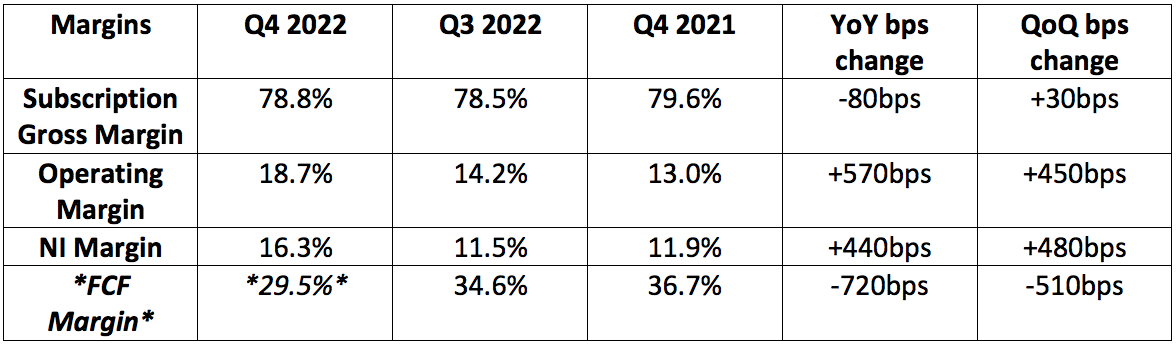

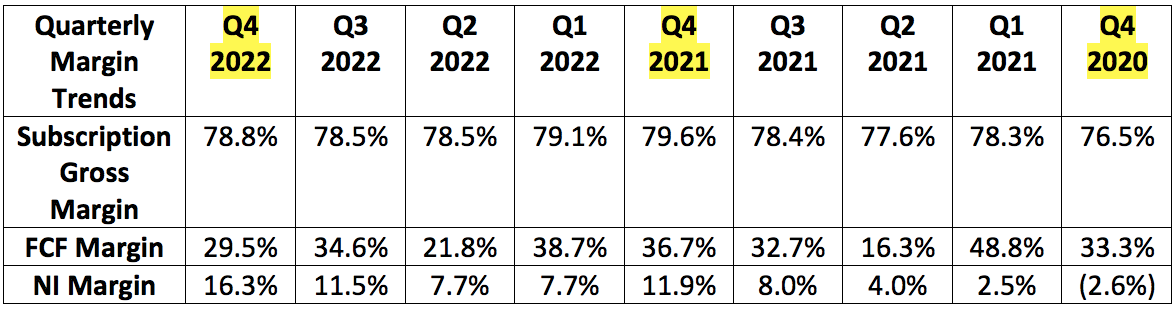

NOTE: FCF margin for the quarter was impacted by an IP transfer tax charge related to CrowdStrike’s purchase of Humio. Without this headwind, FCF margin would have greatly expanded to 45.7%. $92.6 million in stock-based compensation (SBC) for the quarter aided this result. Without any SBC help, FCF margin would’ve still been 24.2% when subbing out the IP transfer tax.

For 2021 as a whole:

Operating income grew 215% YoY.

CrowdStrike posted its 2nd straight year of FCF margin over 30%.

CrowdStrike has $2 billion in cash and equivalents on its balance sheet vs. $1.91 billion sequentially. It has about $740 million in total long term debt.

CrowdStrike’s weighted diluted average shares outstanding was 238 million for Q4 2022 (calendar 2021). That will rise to 243 million next year for modest 2.1% shareholder dilution.

3. Fiscal 2023 (Calendar 2022) Guidance:

For Fiscal 2023 (Calendar 2022):

Analysts were expecting $2.01 billion in sales. CrowdStrike guided to roughly $2.15 billion, representing a 7.0% raise and 48% YoY growth at the midpoint.

Analysts were expecting $0.94 in EPS. CrowdStrike guided to roughly $1.08, beating expectations by $0.14 or 14.9%.

For Q1 Fiscal 2023 (Calendar 2022):

Analysts were expecting $440.8 million in sales for the quarter. CrowdStrike guided to roughly $462.1 million, beating expectations by 4.8%.

Analysts were expecting $0.18 in EPS for the quarter. CrowdStrike guided to roughly $0.21 in EPS, beating expectations by $0.03 or 16.7%.

2023 guidance also implies more margin expansion with profit growth set to again outpace revenue growth.

4. Notes from President/Co-Founder/CEO George Kurtz:

On Large Partners:

“In fiscal 2022, ending ARR through the AWS marketplace more than doubled YoY. We ended the year as one of AWS’s top partners by transaction volume with strong growth throughout the year.”

CrowdStrike continues to work with CISA on final approvals to begin selling into the Federal Government. This hints at the tailwind still being predominately ahead of the company. Good news.

On non-endpoint product success:

Non-endpoint modules (includes log management, cloud security, identity and others) more than doubled YoY to $157 million in ARR growing over 100% YoY. Non-endpoint net new ARR was 17% of CrowdStrike’s total new business this past quarter. This is no longer just an endpoint security company — but much more.

On Customer Wins and Competition:

Wins highlighted:

Cloudflare is now a CrowdStrike customer. It was already a partner.

CrowdStrike won a top global financial services organization.

CrowdStrike won a “record number” of new Falcon Complete contracts including multiple Fortune 500s.

CrowdStrike won a “record number” of cloud workload contracts including a “large U.S. insurance provider,” a Fortune 50 energy firm and a Fortune 250 software company.

Its identity modules continued to push CrowdStrike’s overall win rate higher while landing it multiple Fortune 500 clients during the year.

Humio won deals across several verticals including landing a seven figure financial services deal as the client’s old vendor became budget prohibitive with insufficient scalability. Humio can now clear over 1 petabyte of data per day.

For CrowdStrike’s new Extended Detection and Response (XDR) module, this is a game-changer as it greatly bolsters CrowdStrike’s scalability. With Humio, it can ingest 3rd party data from partners like ZScaler and Okta to add that data to the mix to augment threat detection and expand it beyond the endpoint. Again, Humio is key to this entire equation.

CrowdStrike added 77 Fortune 500 members as clients during calendar 2021. Remarkable.

Partner-sourced ARR grew 83% YoY with Managed Service Provider (MSP) revenue more than tripling. The narrative of CrowdStrike not being a good partner is rapidly dying.

“When we look at the competition, this quarter we put a punctuation mark on our competition positioning. We’ve never seen a better competitive environment for us. We’ve had lots of displacements in the legacy and next-generation worlds. Customers understand that we can consolidate agents, lower costs and deliver better outcomes. It’s full steam ahead — we continue to out-innovate…. our TAM continues to expand.

A case study (I think he’s referring to SentinelOne):

“A next generation competitor could not deploy their solution for a Fortune 500 company after 6 months. There were forced reboots and unmet promises. Falcon was fully deployed across several hundred thousand endpoints in weeks with no reboot. Side by side, we demonstrated our differentiation in a real product environment. This is just one of many customer stories demonstrating why we have rising win rates.”

On Mandiant and Google:

Kurtz reminded us that both of these companies are CrowdStrike partners. Furthermore, it appears that Google will use Mandiant mainly to power some internal systems. This could leave independent Mandiant clients being displaced and CrowdStrike could potentially fill this void.

On Preempt (Identity/Zero Trust):

“This has been a standout for us. Our competition has nothing close to this.”

5. Notes from CFO Burt Podbere

On efficiency:

In calendar Q4 2021, $1 in CrowdStrike spend on its incident response business (helping clean up existing breaches and hacks usually for firms that aren’t yet customers) equated to $5.71 in net new ARR vs. $5.51 YoY. This was around $3 pre-pandemic. This is essentially used for lead-generation at CrowdStrike.

CrowdStrike’s magic number is stable sequentially at 1.3. Any reading above 1.0 is a direct sign to the company to spend more on growth.

Magic number equation = (net new subscription revenue * 4)/sales & marketing expense)

On next year:

“We entered the quarter with our strongest Q1 pipeline ever. We remain optimistic about the demand for our offering… We see none of our momentum fading.”

Sequential net new ARR growth next quarter will be impacted by two 8-figure deals that CrowdStrike signed this past quarter. This resulted in exceedingly strong net new ARR growth in Q4.

Press release highlights:

CrowdStrike signed Deloitte as a customer to “power critical components of its Managed XDR suite.”

CrowdStrike was named Asia-Pacific Endpoint Security company of the year by Frost & Sullivan.

CrowdStrike achieved a 100% attack detection rate with SE Labs.

CrowdStrike won its 10th straight Approved Business Security Product award from AV-Comparatives.

CrowdStrike launched the Falcon Fund II as a “cross-stage” PE firm to invest in cybersecurity and other relevant adjacencies.

6. My Take

This was another flawless quarter from CrowdStrike. The team is firing on all cylinders with bountiful opportunities ahead of it to continue taking advantage of. Great report.

Thank you Brad for detailed explanation.

great summary, thanks!