CrowdStrike Fiscal Q2 2023 Earnings Review

Exploring the results of this cybersecurity disruptor.

Today’s Piece is Powered by Quartr:

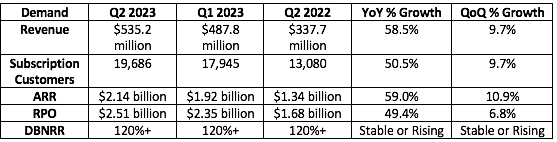

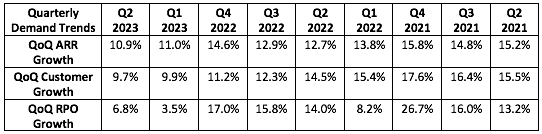

1. Demand

“As organizations respond to macroeconomic conditions, they are looking to standardize with a new security partner with better protection & less cost. Our ability to deliver immediate ROI & consolidate across the security stack sets us apart.” -- Founder/CEO George Kurtz

CrowdStrike guided to $514.8 million in revenue for the quarter while analysts expected $517.2 million. It generated $535.2 million in sales, beating its expectations by 4% and analyst estimates by 3.5%.

Per The Bloomberg Terminal, analysts were also looking for:

Net new Annual Recurring Revenue (ARR) of $191 million. CrowdStrike added $218.1 million, beating expectations by 14.1%.

Beats of this size in previous quarters were due to especially large deals being signed. This strength was broad-based and unrelated to any single contract.

19,631 customers. CrowdStrike reported 19,686, beating expectations slightly.

More Demand Context:

CrowdStrike is the 2nd fastest software company ever to reach $2 billion in ARR.

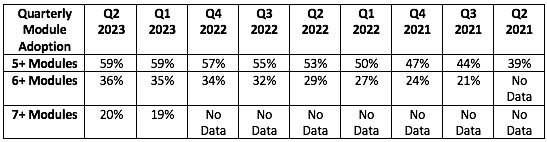

CrowdStrike stopped disclosing customers with 4+, 5+ & 6+ modules after Q4 2022 and began disclosing 5+, 6+ & 7+ module customers instead. Module adoption remains brisk.

More module adoption is not only a revenue driver, but a margin expander as well.

This was the first quarter where we got no sequential up-tick in 5+ module customers. This isn’t a massive deal, but I’d like to see momentum resume next quarter.

Please note that customer wins from its Managed Security Service Provider (MSSP) segment are not included in the total customer count. And that contribution continues to become more and more material. MSSP growth eclipsed 150% YoY this quarter.

“We are still in the early innings of new customer growth.” — CFO Burt Podbere."

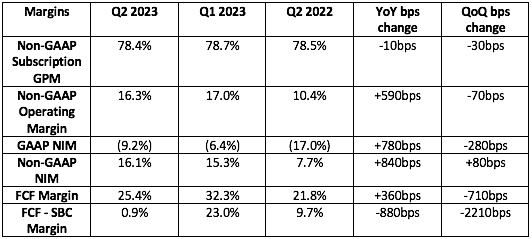

2. Profitability

CrowdStrike guided to:

$66.4 million in Non-GAAP net income while analysts expected $66 million. It generated $85.9 million, shattering its expectations by 29.3% and analyst estimates by 30%. This came out to $0.36 in earnings per share which beat by a similarly wide margin.

$71.9 million in Non-GAAP operating income. It generated $87.3 million, beating expectations by 21.4%

Analysts also expected:

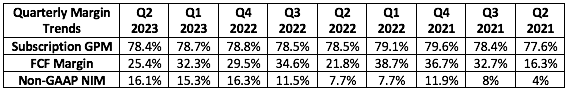

A 78.8% subscription gross margin. It missed expectations by 40bps.

$139.3 million in FCF. It posted $135.8 million, missing expectations by 2%. This was my least favorite part of the call, but it reiterating its 30% minimum FCF margin guide for the year made me feel much better.

$106.2 million in SBC. CrowdStrike paid out $131.6 million as it continues to aggressively hire. This was the other negative from the call… but it’s the price to pay to rapidly hire new talent to support growth. The lowering of its full year diluted share count eased my concern here as well.

More Margin Context:

CrowdStrike’s effective tax rate this quarter was less than 1% vs. just under 1.5% YoY. This aided net income growth a bit which is why the operating income beat was smaller.

The Gap between income statement and cash flow statement margins is largely via stock based compensation. That’s why I include FCF - SBC margin.

CrowdStrike has $2.32 billion in cash and equivalents on the balance sheet and $740 million in long term debt.

Thanks to Quartr’s app, earnings season is simplified, and the busiest periods of my year are far more manageable. It’s as simple as that. Whether it’s speeding through conference calls at various paces, or instant access to searchable transcripts, this service has got every Stock Market Nerd covered. And now, with its cutting-edge transcript search tool, I can even see which bank partner just talked about Upstart, or which bellwether mentioned pricing power amid worsening macro. Talk about useful.

There's a very good reason as to why I'm an active Quartr user.

Must cost a fortune, right? Wrong. It’s a free-to-use force multiplier for research efficiency. Simply go to your app store of choice and try it today. There’s no other free tool like Quartr out there -- and I’m confident that you’ll all agree. Check it out here.

3. Guide

“Our raised guidance for the year reflects our advantage and strong industry tailwinds combined with a pragmatic view of current macro conditions. We remain committed to delivering operating leverage and 30%+ free cash flow margins for the year.” -- CFO Burt Podbere

CrowdStrike fiscal 2023 (Calendar 2022) guidance:

CrowdStrike raised its previous annual revenue guide by 1% from $2.2 billion to $2.23 billion. This represents roughly 53% YoY growth and beat analyst estimates by about 1%.

CrowdStrike raised its non-GAAP operating income guide by 4.1% from $312.2 million to $325.2 million.

CrowdStrike raised its non-GAAP EPS guide by 10% from $1.20 to $1.32. This also beat analyst estimates by about 10%.

CrowdStrike lowered its diluted share guide for the year from 241 million to 240 million shares.

Next quarter guidance beat by a similarly slim margin.

4. Notes from Founder/Co-CEO George Kurtz

On Robust Demand:

Gross Retention Rate set a new company record (implying better than 98.2%) for the third straight quarter.

CrowdStrike DBNRR climbed to its highest level in nearly 2 years.

Growth was well-balanced between small and large customers. However, large customers with over $1 million in ARR continue to outgrow the business. Massive companies continue to standardize on Falcon.

It landed 4 new Fortune 100 companies during the quarter.

New York became the 20th state in the union to Standardize with the Falcon platform.

CrowdStrike sees no pricing pressure for its products. It’s not winning via discounting… but superiority.

“Win rates are consistently strong and the competitive environment is favorable... We see no competitor with a comparable offering… There’s a lot of FUD from our competitors because they don’t have anything resembling what we have… We are focused on the facts, not the fiction.” — Founder/CEO George Kurtz

Unlike some other software players in my portfolio like Olo, worsening macro did not lead to a materially lengthened sales cycles or delayed revenue for the company. The mission critical nature of CrowdStrike’s offering, paired with its ability to consolidate security agents, bolster efficacy and lower cost of ownership was credited as the recipe for this lucrative immunity. Makes sense. CrowdStrike began to see evidence of a lengthening sales cycle, but was able to mitigate the risk thanks to its wildly seamless on-boarding process.

On Module Standouts:

CrowdStrike’s Identity module grew customer count by more than 30% sequentially with new customer attach rates MORE THAN TRIPLING sequentially.

Note: This is NOT an Okta competitor/identity broker. This is an endpoint-focused product to stop free horizontal movement throughout a firm’s infrastructure once a vulnerable piece of it has been breached by a hacker.

CrowdStrike’s ability to combine agent and agent-less solutions in Identity frees it to conduct both pre-runtime and runtime support. Agent-less only competition can’t perform runtime identity security.

Falcon Fusion — its security remediation automation engine — has reached a 35% customer attach rate in under a year!

Falcon Complete has added 1,000 new customers so far in calendar 2022.

Its ability to allow firms to protect more with fewer resources is shining amid worsening macro and tightening corporate budgets.

CrowdStrike’s emerging module category (includes Humio, Spotlight, Identity & more) overall grew ARR by 129% YoY to $219 million.

Falcon for Public Cloud growth accelerated for the 2nd straight quarter.

On Newer Developments:

CrowdStrike launched Falcon Go during the quarter. This is specifically tailored to smaller companies with less than 100 endpoints and is priced for extra cost-conscious customers. This directly compete’s with SentinelOne’s small, medium business (SMB) niche.

CrowdStrike’s Identity Module for the public sector is now live. That makes it available to U.S. organizations requiring Federal Risk and Authorization Management Program (FedRAMP) approval or Impact Level 4 (IL-4) Authorization. This is merely one of many growth vectors that will come from CrowdStrike’s growing governmental clout.

5. Notes from CFO Burt Podbere

On Free Cash Flow:

The eroding FCF margin paired with a near breakeven FCF number when eliminating stock comp is as expected. It’s the result of CrowdStrike leaning more heavily into growth and hiring to support its continued marketshare gains. Its spend is coming with a larger sense of urgency today with other competitors pulling back. It smells blood in the water and has the firepower to capitalize. Evidence of this comes via doubling CapEX YoY and a rapid, record-setting hiring cadence (refreshing). It’s impressive to me that it can spend this aggressively while still reiterating the 30%+ FCF margin guide.

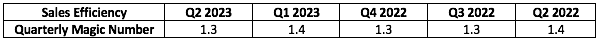

On the Magic Number:

Magic number refers to net new subscription revenue multiplied by 4 and then divided by the company’s sales and marketing expense. Anything above 1.0 is a sign to Podbere to lean even more heavily into growth spend.

Quarterly Accolades:

CrowdStrike received the best AV-Comparables Mac Malware Protection Score.

CrowdStrike won AV-Comparables’s Security Product of the Year award.

Frost & Sullivan granted CrowdStrike its Leadership Award in Endpoint Security for 2022.

Final Notes & highlights from the last quarter:

FX didn’t impact results as CrowdStrike bills in U.S. Dollars.

It launched Falcon OverWatch Cloud: the first independent cloud threat hunting product for cloud-native threats.

It added Cloud support for Amazon’s Elastic Container Service to expand CrowdStrike’s image scanning abilities to 8 new container registries.

6. My Take

Every quarter, expectations for CrowdStrike are sky high. And every quarter, CrowdStrike gracefully surpasses them. This result was no different. While there are a few small negatives to pick at (like stock-comp), my overwhelming take away is quite positive yet again. This remains one of the easiest companies for me to own. Is it expensive? Yes. Does it deserve to be? Double yes. Great job, CrowdStrike.

Great update thx! Not interested in Datadog?

Great update. Thanks for publishing it so quickly!