CrowdStrike Fiscal Q4 2023 Earnings Review

Exploring the results of this cybersecurity disruptor.

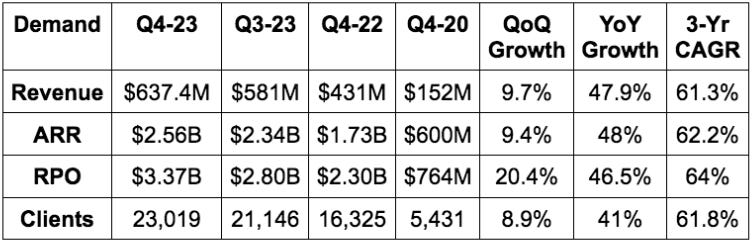

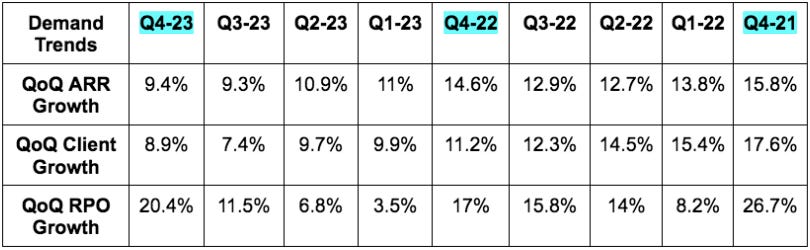

1. Demand

“CrowdStrike’s growing market share showcases customer recognition of Falcon platform’s tech leadership and advanced AI. We drive better outcomes, vendor consolidation and lower total cost of ownership.” -- Co-Founder/CEO George Kurtz

More Demand Context:

The 61.3% 3-yr revenue CAGR compares to 66.8% last Q and 70.4% 2 Qs ago.

CrowdStrike stopped disclosing customers with 4+, 5+ and 6+ modules after Q4 2022 and began disclosing 5+, 6+ and 7+ module customers instead. Why? Because too many of them had 4+ modules. Great problem. More module adoption is not only a revenue driver, but a margin expander as well as there is virtually no added OpEx to sell additional modules after the first.

Customers with $1 million+ in ARR rose 57% YoY to reach 400. These customers use 10 modules on average.

U.S. revenue for the quarter rose 44% YoY with international up 57% YoY.

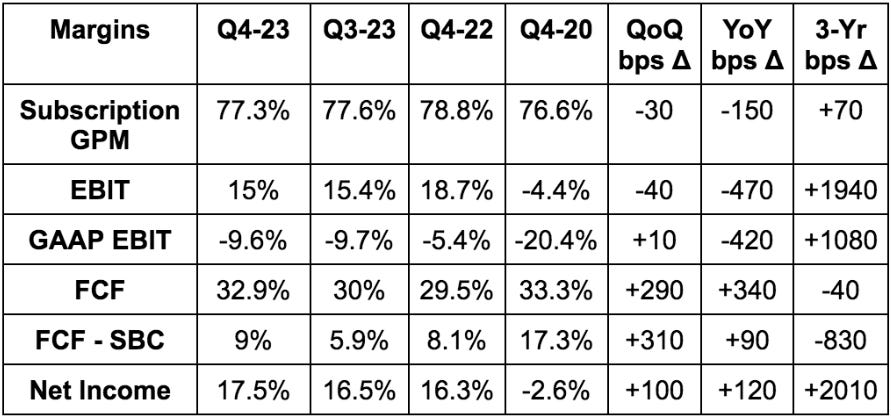

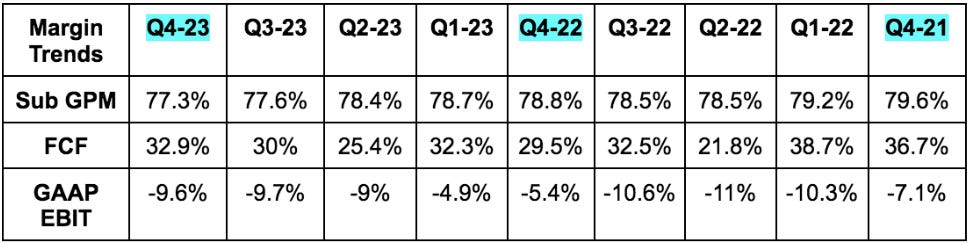

2. Profitability

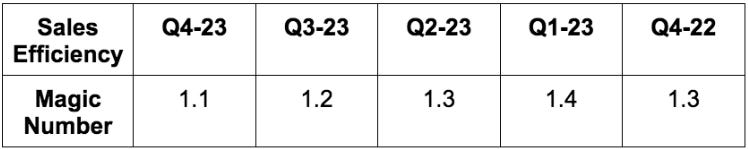

Magic number refers to net new subscription revenue multiplied by 4 and then divided by the company’s sales and marketing expense. Anything above 1.0 is a sign to CFO Burt Podbere to lean even more heavily into growth spend.

More Margin Context:

The downward trend in gross margin is related to continued data center investments and a temporary M&A drag -- NOT discounting or tougher competition. CFO Burt Podbere reiterated CrowdStrike’s goal to reach an 82% subscription GPM by calendar 2024. I repeat: This is not related to tougher competition.

Q4 2020 FCF margin was uniquely aided by abnormally strong collections.

Operating income more than doubled in calendar 2022 as a whole while CrowdStrike reached its long term FCF margin target of 30%+ for the third straight year. Maybe it’s time to raise that target?

FCF generation for calendar 2022 as a whole rose 53.2% YoY to reach $676.8 million. It should generate roughly $1 billion in FCF this year. Yes, this includes the stock comp add back which is a real expense. But FCF starts its calculation from net income. Net income is directly reduced by stock comp. It would not be able to have this kind of cash flow profile without strong income statement unit economics.

Simply put: 5+5 = 10; 4+6 also = 10; 0+6 does not = 10.

3. Full Fiscal Year 2024 Guidance

CrowdStrike told us last quarter to expect low to mid 30% revenue growth for fiscal year 2024. It essentially reiterated that estimate along with its guide of low 30% ARR growth.

Met revenue estimates of $2.99 billion representing 33.4% YoY growth. It always leaves room to raise as the year progresses and as things become more clear.

According to some data sources, this revenue figure was about 1% ahead of estimates. My number comes from the Bloomberg Terminal.

Beat EBIT estimates by 1.2%.

Beat EPS estimates of $2.01 by $0.29.

First quarter guidance was slightly stronger than the full year guide. Notably subscription gross margin guidance of 100 bps of sequential expansion was much stronger than the 10-20 bps of expansion expected. Q1 being better than the full year is likely because CrowdStrike approaches uncertainty with extreme pessimism. It only offers more upbeat (and realistic) guidance as things become more clear. That’s one of the things I love about them. As it’s already March 7th, the clarity for Q1 is much higher than 2024 as a whole.

I expect the company to continue beating and raising throughout the year as it always does.

Importantly, CrowdStrike’s fiscal year 2024 guidance assumes macro headwinds do not improve at all throughout the year. Encouragingly, like other software vendors we’ve heard from, its sales pipeline continued to rapidly grow into the new year. Conversion of that pipeline is just temporarily being held back by poor macro conditions.

If these headwinds fade — which is entirely possible — there will be more upside. Leadership hinted at these conditions beginning to brighten already, but thought it was too soon to raise its assumptions. Like SoFi, PayPal and others, it has set itself up nicely for a year of beating and raising.

More Guidance Notes:

The company will continue to facilitate more margin expansion through things like headcount growth slowing, but will also continue to “thoughtfully invest” to capture the expansive opportunity ahead of it.

CrowdStrike reiterated $5 billion or more in calendar 2025 ARR and reaching its margin targets in calendar 2024. More compounding and margin expansion ahead.

4. Balance Sheet

Stock compensation was 23.8% of revenue vs. 24% QoQ and 21.4% YoY. Stock comp was 72% of total free cash flow generation. We’ve been told to expect slowing stock comp growth this year as hiring slows. I expect and want that to happen.

$2.71 billion in cash and equivalents.

$741 million in debt.

Share count growth will be under 2% for calendar 2023.

Leadership repeated its messaging from last quarter on hiring slowing down this year. It front-loaded years of headcount growth into 2021 and 2022 as competition pulled back and it pounced on the opportunity. Now, it thinks it has most of the needed talent for this year in place. Because of this, I fully expect (and require) stock comp growth to slow while revenue and profit growth remains rapid.

The team was asked if it was considering a buyback. It side-stepped the question.

5. Call Highlights

On Macro and Next Year Guidance:

Sales cycle elongation, a lack of budget flushes and added budget approvals continued to slow down deal cadence and growth in Q4. These impacts were more than overcome considering the outperforming quarter and guide. This success was micro-based and despite macro obstacles.

On Large Enterprise Traction:

Has 556 members of the Global 2,000 as clients.

Has 271 members of the Fortune 500 as clients.

Enjoys 15 of the largest 20 U.S. banks (and their stringent regulatory requirements) as clients. I’ve head the argument that CrowdStrike will never win in highly regulated industries like finance because they don’t offer an on-premise solution. Cloud-only seems to be working just fine.

CrowdStrike’s IDC endpoint security marketshare for 2022 was 17.8%. This compares to 13.9% YoY and just 9.2% as of 2020. Its share increase accelerated this year as it outpaced gains from all other vendors.

On Microsoft and Competition:

CrowdStrike won a large client this quarter from Microsoft Defender after they failed to protect the client in a multi-cloud environment. It turned to CrowdStrike’s incident response service to more than double coverage capacity while cutting costs by 50%. Microsoft breaches continue to be a large lead generator for CrowdStrike new logos and incident response business. And for every $1 in incident response business, CrowdStrike enjoys more than $6 on average in up-selling those customers to other modules.

Leadership was asked multiple times if Microsoft was impacting CrowdStrike’s pricing power. It adamantly shot that sentiment down and reminded us that most of the breaches CrowdStrike cleans up are directly the fault of Microsoft Defender.

“Average spend for us remains consistent. Our share gains tell us that Microsoft’s product is just not good enough.” -- Co-Founder/CEO George Kurtz

Competitive win rate “remained high." It told us that rate “rose” last quarter so this more abstract disclosure was a tad underwhelming to me. But the strong IDC data does entirely eliminate my concern.

Leadership attributed success to superior efficacy and vendor consolidation lowering total cost of ownership. This is exactly what CrowdStrike was built to accomplish.

Gross retention rate remained “best in class” at 98%.

Net retention was 125.3% and rose slightly YoY.

It talked up the high scores it received from 3 prominent competitive landscape research firms. Gartner ranked it 1st & 2nd in their categories, SE Labs gave it top marks and so did Frost & Sullivan.

On Customer Wins:

It won a leading financial institution in the Fortune 50. The client consolidated on Falcon and replaced 4 disparate vendors in doing so including Symantec and Trend Micro. It tested CrowdStrike vs. all other relevant next generation bids and thought it was clearly the best option.

A global financial technology company replaced 8 siloed security vendors with Falcon. Displacements included Microsoft Defender and Carbon Black. It also bought Falcon’s log management module in a sign that Humio is resonating with large clients. And speaking of log management, yet another global financial institution purchased the module for faster data querying and more scalable, cheaper storage.

A leading transportation company purchased Falcon Complete after conducting cost benefit analysis on other next-generation proposals. CrowdStrike’s identity module helped it win the business.

On New Product Traction:

Emerging module ARR rose over 100% YoY to surpass the total ARR CrowdStrike was generating at its 2019 IPO.

The identity protection module crossed $100 million in ARR.

Its log management offering via the Humio acquisition rose 200% YoY.

Public cloud ARR reached $224 million.

XDR traction has been “great” but it’s too early for leadership to quantify that color.

On Dell and Other Partners:

Dell and CrowdStrike entered into a new selling partnership this week. The partnership entails Falcon being available for purchase for all Dell enterprise computers. It also involves Dell using CrowdStrike’s managed service business for its own offering.

Managed Security Service Provider (MSSP) ending ARR rose 100% YoY.

Partner-sourced ARR rose 50% YoY.

On Catering to Smaller Customers:

The bigger customer beat vs. revenue and ARR beats was likely a matter of smaller merchant traction. Specifically with Falcon Go (its smaller merchant bundle of 3 modules) CrowdStrike has enjoyed 1,000 new customers in just 6 months. As a reminder, it re-tooled its organizational structure with a couple of key executive hires from SentinelOne to make this area more of a priority.

Disclosure Change:

CrowdStrike will only report total customers on an annual basis going forward -- not quarterly anymore.

6. My Take

Unlike last quarter, there were no negative surprises in this report -- it was solid all-around. While we’ve seen larger beats and raises from CrowdStrike in the past, this result is arguably even more impressive to me given the exogenous backdrop. Core and new module traction is rapid, market share gains are brisk and operating leverage will continue to consistently be enjoyed this year.

This company is expensive at 55x EBIT -- and for very good reason. I see it as the cream of the crop in endpoint security with ample low hanging fruit to devour. The bar for execution is set very high given its valuation. I expect it to continue clearing that bar with more upward guidance revisions coming in the next few quarters. Solid performance.

What about their market share in their core categories? Do you have numbers? Thanks!

Great work Brad, much appreciated 👌