CrowdStrike Fiscal Year Q3 2023 Earnings Review

Digging into the results of this security disruptor.

Today’s piece is powered by my favorite research platform: Stratosphere.io.

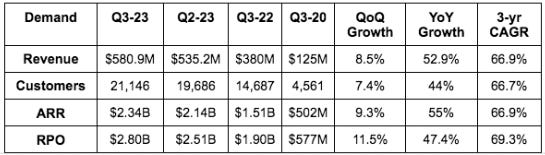

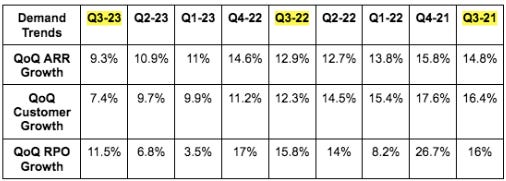

1. Demand

Beat its revenue guide by 1.5% and estimates by 1%

Missed customer estimates by 0.8%.

Met Annual Recurring Revenue (ARR) estimates.

ARR missed CrowdStrike’s internal expectations (which weren’t publicly shared) -- more on this later.

More Demand Context:

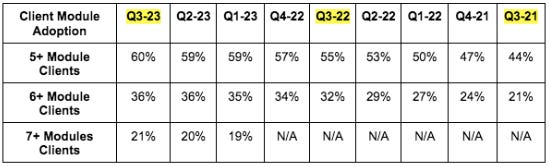

CrowdStrike stopped disclosing customers with 4+, 5+ & 6+ modules after Q4 2022 and began disclosing 5+, 6+ & 7+ module customers instead. Module adoption remains brisk.

More module adoption is not only a revenue driver, but a margin expander as well. Why? Because there are virtually no added operating expenses for CrowdStrike selling every module after the first.

Partner-sourced ARR grew 55% YoY.

Clients contributing over $1 million in net new ARR rose 67% YoY.

Gross retention remains at record highs over 98%.

Net retention was at its highest level in 7 quarters. This implies a reading over 125%.

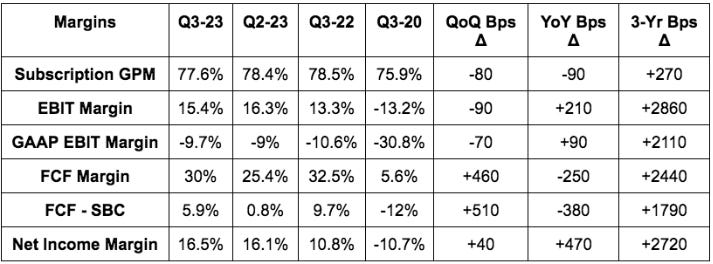

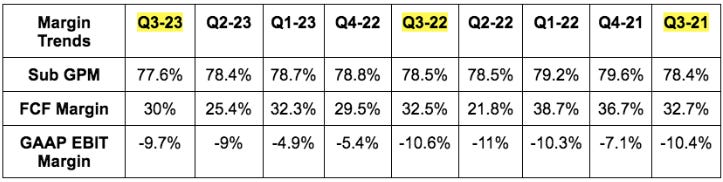

2. Profitability

Beat its EBIT guide by 19.2% & beat estimates by 16.6%.

Beat its net income guide & beat estimates by 29%.

Beat free cash flow (FCF) estimates by 7%.

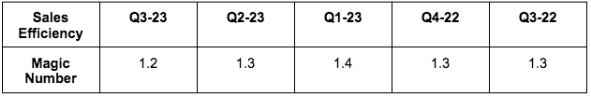

More Margin Context:

Magic number refers to net new subscription revenue multiplied by 4 and then divided by the company’s sales and marketing expense. Anything above 1.0 is a sign to Podbere to lean even more heavily into growth spend. Still, this is CrowdStrike’s lowest magic number since going public.

Fundamental stock research just got way easier. Thanks to Stratosphere.io, no longer must we dig through endless SEC filings for relevant information.

Stratosphere has all of the financial statement data, estimates and insider insight I could ever want. And it pulls from high quality, RELIABLE sources to ensure everything I’m absorbing is entirely accurate. It’s the only non-primary source that I actually trust.

But it gets better. Not only does this platform feature all needed traditional data, but it even has key performance indicators depicted with beautiful visuals. With this powerful tool, I pulled up Airbnb’s take rate and nights booked stats from the last several years vs. spending time seeking out the needed metrics myself. This is truly a force efficiency multiplier for research, and I know you’ll all agree.

All of this leaves me asking myself: “Stratosphere, where have you been all my life?” Luckily, it has officially arrived and you can check it out here.

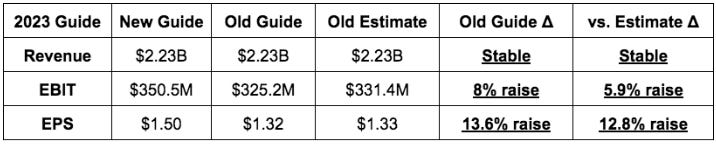

3. Guide

While the Q4 2022 demand guide was light, the full year guide was in line on revenue and exceedingly strong on profitability.

Next Year Preliminary Guide:

Revenue growth in the “low-to-mid 30% range” vs. estimates of roughly 36%. While this is technically a miss, CrowdStrike always offers wildly conservative initial guidance so it can easily beat & raise throughout the year. Furthermore, the guide doesn’t rely on any macro improvement.

ARR growth in the low 30% range with a 1000 basis point headwind in the first half of the year from the longer enterprise deployment times.

“A path to a” 30% free cash flow margin.

Modest operating margin expansion.

Importantly, it also guided to headcount growth sharply slowing next year. During calendar 2022, it leaned into front-loading headcount growth to take advantage of competitors pulling back. Now it thinks it has the talent in place to allow its focus to shift to productivity going forward.

CrowdStrike also reiterated its long term guidance of eclipsing $5 billion in ARR in calendar 2025 while getting to its long term margin targets in calendar 2024.

4. Balance Sheet

Cash & equivalents grew from $2.32B to $2.47B sequentially.

It has $740 million in debt.

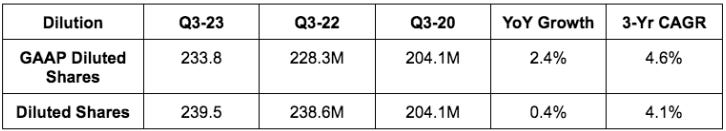

Stock compensation expense was 9% larger than expected and was 24% of sales. I expect this to fall materially next year as it slows hiring and continues to rapidly scale.

5. Call Notes

On Macro:

Macro pressures have finally hit the cybersecurity space. CrowdStrike’s net new ARR for the quarter was slightly below its expectations. This was via two factors:

An elongated sales cycle with small and medium businesses (days to close rose 11% QoQ). This was a $15 million hit.

This was the source of new customer growth slightly below expectations.

Large enterprises electing to pursue multi-phased deployments vs. front loading deployments -- which pushes ARR recognition to future quarters. This was a $10 million hit.

Importantly, all of these multi-phased deployments are signed contracts, not verbal agreements. And furthermore, its demand pipeline size exceeded the company’s internal expectations which offers more evidence of this being a demand delay, not reduction.

On Customer Wins:

2 Global 500 financial institutions replaced multiple legacy providers to standardize on Falcon.

A Global 500 consumer goods manufacturer went with Falcon Complete.

A Fortune 500 luxury brand signed on with Falcon for endpoints and cloud.

40 U.S. State governments are now CrowdStrike customers with 21 having standardized on the platform.

Signed one of the largest federal agencies to standardize on Falcon.

On Falcon Complete:

Falcon complete net new ARR rose 20% sequentially. The more challenging macro environment makes this fully managed service even more appealing by allowing companies to consolidate security teams. Specifically, the product boosts a client’s security efficiency by 13% and allows them to forgo 3.5 security employee hires on average.

On Performance and Competition:

CrowdStrike’s small/medium business competitive win rate rose sequentially while its large enterprise win rate was stable. This just offers more evidence that the underwhelming demand from the quarter is not a matter of losing its competitive edge.

It has not increased discounting efforts at all to win this business. It’s competing on merit and value proposition, not price.

6. My Take

This was the most disappointing quarter CrowdStrike has reported since going public a few years ago. Yes, some other companies would dream of a performance like this. But CrowdStrike’s past results and its valuation heading into the print set the execution bar as high as any, and it fell short of what we’ve come to expect.

Macro headwinds have finally hit its sector and business, and its results suffered accordingly. The calendar 2023 preliminary guidance was fine in terms of profitability and slightly underwhelming from a demand perspective. But again, its first crack at forward annual guidance is always overly pessimistic. Next year should be no different. And furthermore, while the miss is certainly not ideal, the company’s reiteration of its calendar 2025 ARR expectations on the call eased my anxiety significantly. I take these claims seriously as the team has always met expectations and features a business model that offers wonderful long term visibility.

Profitability was also exceedingly strong, its win rates are rising and most of this small revenue shortfall is a matter of demand being pushed out, not disappearing. Furthermore, stock comp growth is set to significantly slow as its hiring cadence is reduced and it tightens its belt to weather the current storm. That needs to happen over time, and it will.

So? I can’t help but to get excited about this 20% price reduction. The long term thesis on CrowdStrike is entirely intact, and it now sports a forward earnings multiple in the low 40s. For context, it once fetched a sales multiple in the low 40s. The valuation is finally reasonable, and I’d like to selfishly say thank you to the macro-backdrop for making that happen. In the coming days as the dust settles, I’ll begin adding to this name more aggressively than I’ve been able to in years.

Nice!

Thank you!