CrowdStrike FY Q2 2024 Earnings Review

Digesting the strong results of this cybersecurity disruptor.

As always, please feel free to share this far & wide if you find the piece valuable. That is how we grow.

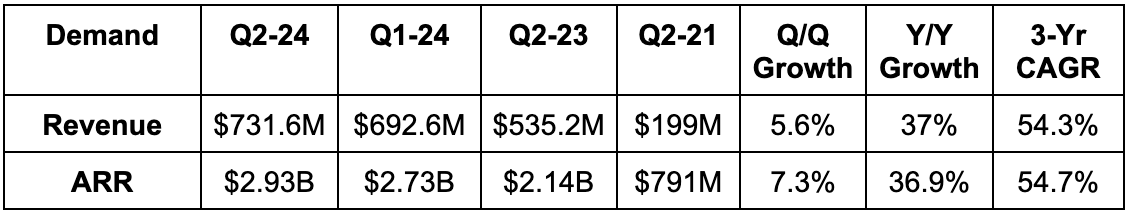

1. Demand

Beat revenue estimates by 1% & beat guidance by 1.3%.

Beat annual recurring revenue (ARR) estimates by 2.8%. Some data sources had higher estimates which CrowdStrike slightly beat. This ARR performance was also ahead of CrowdStrike’s implied guidance.

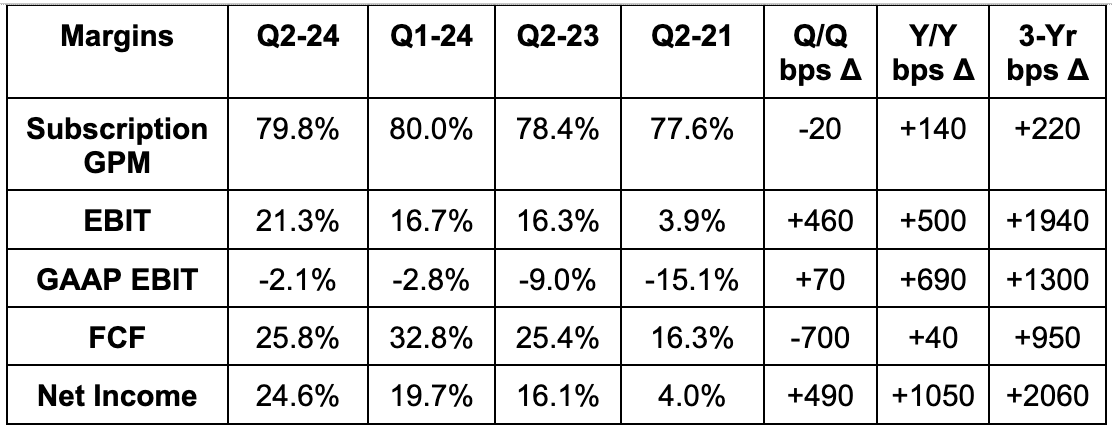

2. Profitability

Beat EBIT estimates by 30% & beat guidance by 30%.

Beat $0.56 EPS estimates & guidance by $0.18.

Beat FCF estimates by 4.8%.

3. Annual Guidance

Raised revenue guidance by 0.5% & beat estimates by 0.4%. This represents about 35.5% Y/Y growth.

Raised EBIT guidance by 18.2% & beat estimates by 18%.

Raised $2.38 EPS guidance by $0.42 & beat estimate by $0.40.

Reiterated 30% FCF margin guidance for the year.

Reiterated 2% dilution for this year and under 3% next year as it re-ramps hiring. Important.

Next quarter guidance was slightly ahead on revenue and well ahead on profit metrics.

4. Balance Sheet

$3.17B in cash & equivalents.

$740M in debt.

Diluted shares up 4.3% Y/Y; basic shares up 2.2% Y/Y.

5. Call & Release Highlights

But… Macro:

The theme of this software earnings season has been vendor consolidation and lowering total cost of ownership. If you’re selling a point solution, you’re probably struggling. If you’re selling an ability to consolidate numerous vendors onto a single platform to drive cost savings and superior efficacy, you’re probably faring better. We saw this with upbeat earnings reports and forward commentary from ServiceNow and Workday… and we’re seeing it with CrowdStrike.

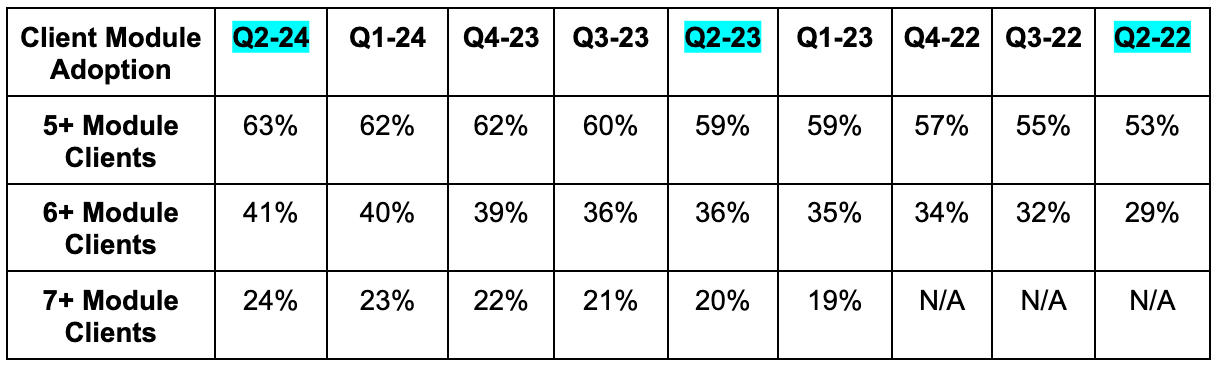

It’s uncanny ability to combine world-class endpoint protection with use cases in log management/observability, cloud security, identity protection, forensics, managed detection and response and more is standing out in today’s budget-constrained world. That is why 8+ module deals rose 80% Y/Y and why it will stop referring to newer product buckets as “emerging modules.” Why? Because they’ve already emerged as perfect complements to its market share-leading endpoint suite. Specifically, the now emerged modules outside of endpoint represent $500 million in ARR.

As a notable positive from this development, as it collects more data from these other product categories, its extended detection and response (XDR) product improves. This is because XDR is simply endpoint detection and response (EDR) with more ability to infuse ancillary data sources for extending threat detection beyond just the endpoint. CrowdStrike’s log management tool allows it to ingest and utilize all of this data with scale while its full product suite creates a truly unique data set in terms of breadth of insight and scale. That’s why it continues to outgrow all of its competition, steal more market share, enjoy more operating leverage & deliver for shareholders amid tough times. Budget scrutiny and sales cycle elongation is still holding back the entire sector. CrowdStrike is simply overcoming these headwinds with record new and existing client pipeline and, generally speaking, these results.

More on Cloud and Log Scale:

Ending ARR in the public cloud rose 70% Y/Y. Kurtz called this “faster than any other vendor in cloud security.”

Net new cloud ARR rose 70% Q/Q.

Won a Fortune 50 retailer for a $5 million ARR deal to displace several point solutions and a firewall vendor.

Fortune 500 vendor went with Falcon’s cloud tools. This was due to the “superiority” of the suite vs. its old vendor Wiz (SentinelOne’s cloud partner).

Kurtz sees CrowdStrike’s cloud suite and its ability to operate in a multi-cloud environment as entirely unmatched by competition. He doesn’t think anyone can deliver Cloud Native Application Protection (CNAP) plus External Attack Surface Management (EASM) plus Cloud workload protection (CWP) plus Posture management and Entitlement Management all in one. This roster of tools gives clients “an inside out complete view of cloud security posture” per Kurtz. This offers clients “immediate time to value” and clears the path for this wonderful growth. All of these tools taken together allow for protection of cloud native assets, shields a firm from data hacks, discovers and ranks vulnerabilities for remediation, flags cloud misconfigurations and ensures employees have access to the sheer minimum of what they need to work… nothing more, nothing less.

Log scale customers rose 3x Y/Y.

Ending log scale ARR rose 200% Y/Y with total ARR approaching $100 million.

Consolidation & Customer Wins:

A manufacturing giant tried and failed to consolidate on Microsoft and its E5 licensing. It moved to CrowdStrike for superior efficacy and 50% per year per using savings by shedding licensing costs and complexity.

Won a 7-figure deal to standardize a new construction client on Falcon. This change allowed the client to cut spend with several vendors by 60% and to eliminate many more vendors.

Its identity suite won a Fortune 500 client and displaced 4 vendors including Microsoft and SentinelOne.

Accolades:

Won the 2024 US Independent Software Vendor partner of the year award from AWS. Amazon and CrowdStrike continue to VERY closely work together.

Named a leader in Frost & Sullivan’s Cloud Workload Protection report (showing its new products are high quality) and a leader in the Forrester’s External Threat Intelligence Service report.

Secured the highest level of certification with Spanish National Cryptologic Center (CCN).

Won the 2023 CRN Tech innovator award for Identity and Access Management products.

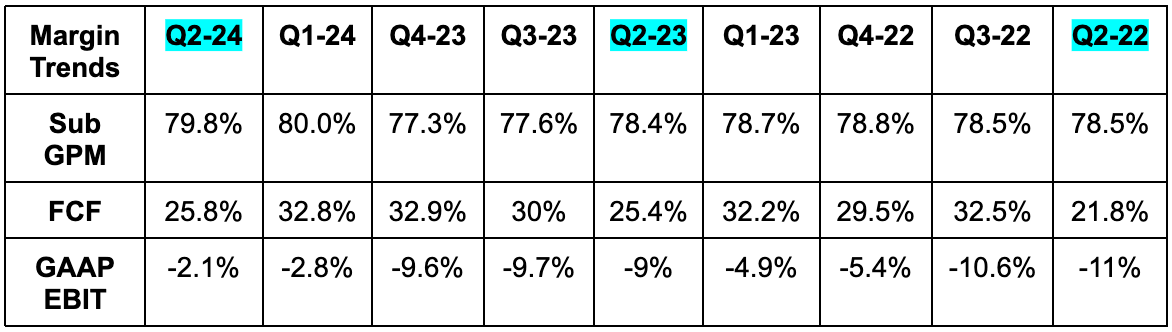

Margins:

CrowdStrike delivered EBIT margin within its long term target well ahead of schedule. What’s more encouraging is that this will be a sustainable trend starting in Q4 of this year.

This is its 2nd straight quarter of positive GAAP net income well ahead of schedule. This continues to be helped by interest income which is the luxury of CrowdStrike’s pristine balance sheet. That’s why GAAP net income is positive while GAAP EBIT is close, but not yet there.

CrowdStrike is gearing up to raise its long term subscription gross margin target (which is 77%-82%+) with that metric already at 80%. It will update the target model in December at its investor briefing. Infrastructure investments are now paying off.

2nd Half of the Year:

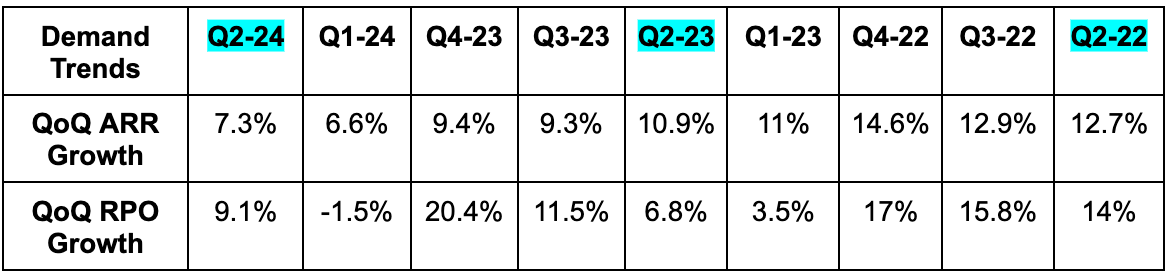

Some analysts were expecting CrowdStrike to walk back on its commentary of flat to modestly up net new ARR for the full year. The Q&A made that utterly clear.

Instead, it guided to double digit net new ARR growth for the back half which represents a modest raise vs. implied expectations of just under 10% growth. This optimism is not coming from a change in guidance methodology. The company continues to lean pessimistically with its assumptions in light of what it calls a cautious demand environment that it will have to continue overcoming. The optimism, instead, is via the record pipeline as well as channel partner deal strength, a voracious vendor consolidation appetite from clients and the quality of its suite. There’s another interesting factor to add. CrowdStrike loaded up on sales talent in the second half of 2022 as its competition stopped hiring and so headcount competition faded away. Those newer hires are now fully trained and eager to go sell Falcon. It was missing needed sales capacity and no longer is.

Competition:

CEO/Founder George Kurtz took a sharper tone about competition than he has in the past. He’s always fiery in his dialogue… but this quarter was a tad more aggressive. He sees the current environment as separating the “weak from the tough” and called out “once competitors” as now being “immediate share donors.” Mic drop. In the Q&A, he was asked if he sees the rumors of a potential SentinelOne sale or “BlackBerry going quiet” as already leading to wins for CrowdStrike. He said yes which tells me he was talking about these two vendors (maybe more) in his prepared remarks. Win rates remain sky high while the competitive landscape shifts even further in CrowdStrike’s favor.

Billings:

I got a few questions on this and wanted to address them. CrowdStrike missed analyst billings estimates by 3.0%. It does not guide to billings and has ALWAYS explicitly told investors not to focus on the quarterly metric (annual is bit better).

ARR is its preferred growth benchmark which is inherently less lumpy and less prone to noisy volatility vs. billings. Why? Because quarterly billings are greatly impacted by the timing of contract renewals/closures in a way that ARR is not. Furthermore, CrowdStrike has a certain amount of flexibility on when it recognizes billings. It can technically pull forward longer term billings by a quarter or two when it wants to. That means it has a bit of discretion with flexing up its billings performance to appease Wall Street. It’s just not the company’s focus.

Net new ARR is the company’s core focus. Again, this metric was above consensus for the quarter while it offered the aforementioned upbeat ARR commentary for the second half of the year. Adding to that optimistic FY 2025 preliminary margin guidance and record deal pipeline and all signs point to strong results continuing. A 20% or 50% billings miss vs. consensus estimates would concern me here… not a 3% miss amid all of the other positivity.

Final Notes:

54.3% 3-yr revenue CAGR vs. 57.3% Q/Q & 61.3% 2 Qs ago.

CrowdStrike will directly monetize its Charlotte AI product. As a reminder, this is its generative AI tool that emulates a virtual security specialist and turns beginners into tier 3 experts. Pricing will be announced in December. It’s taking the Microsoft approach here.

Retention rates remain “best in class.” Net revenue retention was “at its benchmark” implying 120%.

The M&A environment is “improving” in leadership’s words. Maybe more deals coming?

6. Takeaway

This was a very good quarter. The quality of its product suite paired with its ability to foster cost savings is especially popular in today’s macro backdrop. That’s why its growth remains rapid, why its share taking continues, why its margin profile looks so pretty vs. other hyper growers and why I’m so comfortable investing in this specific team within this massive opportunity. Kurtz and company are, in my view, best in class with this quarter marking another data point to support that opinion. This will remain a core holding and I’d look to add into multiple compression if the stock reaction is poor.

I'm wondering what's the difference with Palo Alto ?

Great summary of a great company. Will be adding to my position. Thanks Brad