CrowdStrike Second Quarter Earnings Review

Digging into the results of this cybersecurity disruptor.

“There is no vendor in the market with our vision, our platform or our ability to execute at scale.” — CEO/Founder/President George Kurtz

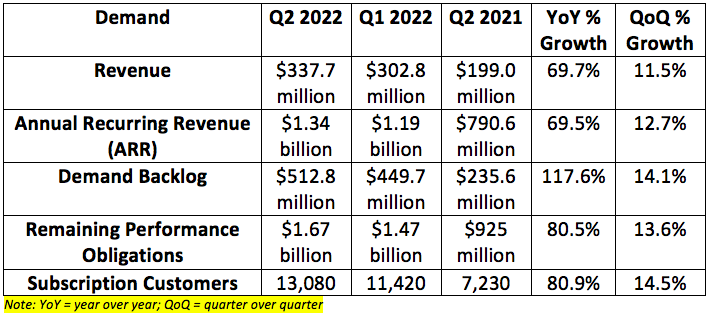

1. Demand

CrowdStrike internally guided to $318.3-$324.4 million in revenue for this quarter. Analysts were expecting $323.2 million in revenue. CrowdStrike posted $337.7 million beating the high point of its internal guide by 4.1% and analyst estimates by 4.5%.

The elevated backlog and remaining performance obligation growth both offer strong forward-looking indicators for continued elevated revenue growth going forward.

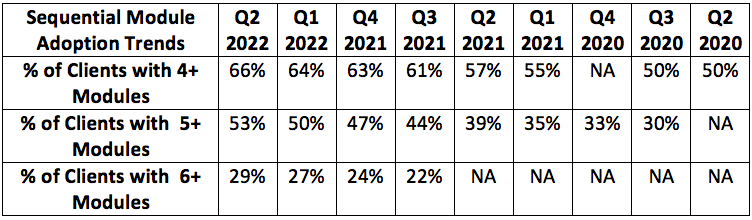

This module adoption trend (pictured above) is a strong sign of more margin expansion to come. It costs the company virtually nothing to onboard additional modules for a client after the first has been integrated — additional module purchases directly feed CrowdStrike’s profitability.

As a reminder, CFO Burt Podbere recently updated investors on CrowdStrike’s long term plans to introduce 1-2 new modules every year. Areas such as Zero Trust and Cloud Workloads will likely be 2 of the major themes of these debuts going forward.

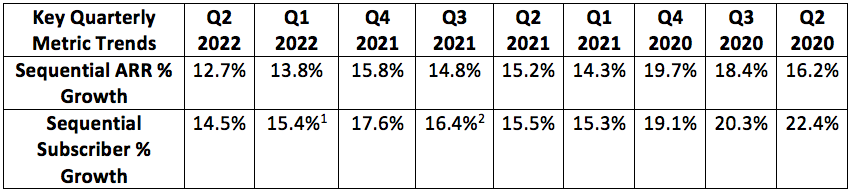

Q1 fiscal 2022 subscriber growth includes an inorganic boost from CrowdStrike’s acquisition of Humio. Without this boost, sequential subscriber growth would have been 14.0%.

Q3 fiscal 2021 subscriber growth includes an inorganic boost from CrowdStrike’s acquisition of Preempt Security. Without this boost, sequential subscriber growth would have been 15.4%.

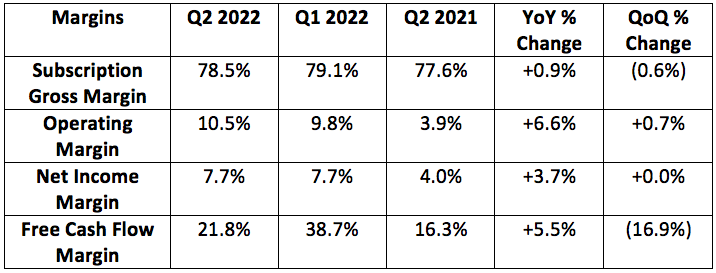

2. Margins

CrowdStrike internally guided to $26.3-$30.7 million in operating income for the quarter. It posted $35.3 million beating the high point of its internal guide by 15%.

CrowdStrike internally guided to $0.07-$0.09 in earnings per share (EPS) for the quarter. Analysts were expecting the company to earn $0.09 per share. CrowdStrike posted $0.11 per share beating the high point of its internal guide and analyst estimates by $0.02.

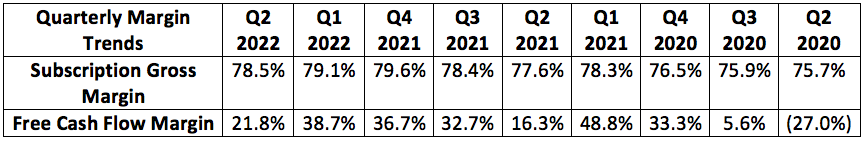

Subscription gross margin will continue to fluctuate but the company expects it to remain at least in the 77%-82% range in the years to come.

Stock based compensation as a % of revenue was 22.5% of company sales vs. 18.9% of company sales year over year. This is a massive company cost.

The second quarter is a seasonally weak period for CrowdStrike’s subscription gross margin and free cash flow margin -- as depicted in the chart below.

3. Guidance Updates

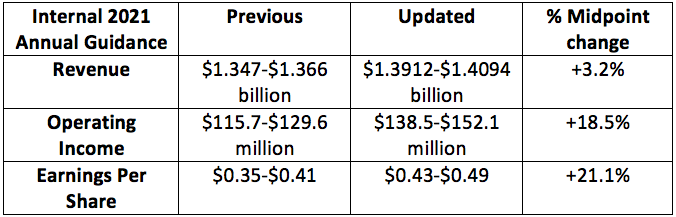

For next quarter, CrowdStrike guided to $358-$365.3 million in sales. Analysts were expecting $350.9 million.

“Given our strong performance and growing market momentum — and reflecting our view of a continued robust demand environment — we are raising our guidance for fiscal year 2022.” — CFO Burt Podbere

4. Operational Highlights

CrowdStrike ranked #1 for “Modern Endpoint Security 2020 revenue market share” in a 2020 report from IDC.

The company added CrowdStrike Store integrations with Google Cloud and many others.

As previously announced, CrowdStrike launched its Falcon Complete for GovCloud — a public sector solution for managed, cloud-native detection.

CrowdStrike achieved 99.8% malware protection on Falcon Pro for Mac within the AV-Comparatives malware exam.

The company has $1.79 billion in cash and equivalents on its balance sheet.

Accolades from happy partners included:

2021 AWS Global Public Sector Partner Award for best cybersecurity solution

Go-to-Market Technology Partner of the Year Award at Zscaler’s ZenithLive Cloud Summit

5. Conference Call Commentary

a. Founder/CEO/President George Kurtz

Kurtz was asked about SentinelOne’s impact of CrowdStrike’s competitive environment. This was his response:

“We’ve seen an increase in our win rates across the board [since SentinelOne went public] including in our SMB business. There is significantly more automation built into our platform than SentinelOne. We routinely win with a higher price point because our product works and because our platform is differentiated. For low cost options like that one, you get what you pay for.” — Kurtz

“Competitors fall further behind as they blindly promote malware prevention rather than a comprehensive solution that stops breaches. More than half of detections analyzed were not malware, based on data from CrowdStrike’s threat graph.” — Kurtz

Kurtz told investors that the company is still “in the very early innings” of taking market share from legacy vendors exiting its space.

“We replace McAfee and Symantec solutions every single quarter.” — Kurtz

On an organic basis, sequential customer growth accelerated. Inorganic growth from last quarter contributed to the decline in sequential customer growth.

Kurtz on customer wins:

One of the largest non-profit Healthcare organizations in USA switched from BlackBerry’s Cylance to CrowdStrike. The platform was seamlessly deployed across 400,000 endpoints in just a few weeks.

A “Fortune 50 global insurance provider”

A Fortune 500 company that was using Microsoft’s legacy products which cost the new client hundreds of millions of dollars via unnecessary breaches. They then deployed “CrowdStrike Complete” across their entire platform.

A large media company that was using a legacy provider and was hit with a severe malware attack. CrowdStrike remediated the breach and purchased 11 CrowdStrike modules including Falcon Complete.

Workday -- a cloud pioneer

A Forbes cloud 100 member that was struggling to scale with a competitor’s cloud security offering.

“We expect the big enterprise client wins to continue to be there.” — Kurtz

New notable partnerships:

CrowdStrike announced a new alliance with Verizon to bring the Falcon platform to Verizon Business’s security portfolio.

Telefónica became a CrowdStrike partner during the quarter.

Customer interest in Humio is very high and that segment is already off to a great start this quarter with a 7 figure customer win and a growing pipeline.

“Humio is a shining star.” — Kurtz

Falcon complete — CrowdStrike’s full-service, turnkey solution — saw its customer base grow 2.5X year over year.

Just like he does in every quarter, Kurtz explicitly called out how Microsoft’s shortcomings (among many other competitors’) in the cyber security field are fueling market share and demand growth for CrowdStrike’s business.

For the first half of fiscal 2022, partner-sourced ARR more than doubled year over year.

b. CFO Burt Podbere

CrowdStrike’s Magic number** of 1.4 is stable sequentially. Anything above 1.0 is a sign to the company to lean even more heavily into growth.

**NOTE: Magic number formula = net new subscription revenue *4) /sales and market expense

CrowdStrike will soon start to disclose users with 7+ modules as adoption momentum continues to build.

6. My Take

This was another remarkably positive quarter for the company. CrowdStrike beat expectations and raised its forward guidance across the board. It continued to demonstrate a seamless ability to win more market share and continues to depict a rare combination of elite margins and rapid demand growth.

This company is my largest position and — regardless of the stock being quite expensive — I have no interest in trimming any shares. Another great performance.

Thank you for reading!