Introduction:

Duolingo (Ticker: DUOL) is an online language learning platform offering content to nearly 40 million monthly active users (MAUs) globally. The main product is its gamified mobile language learning app built for smartphones, but the company also offers a desktop version of its software for consumers and teachers. It was founded a decade ago in Pittsburgh by Luis von Ahn and Severin Hacker and has already eclipsed 500 million total downloads while employing 400 Duolingo team members. Today, the company offers lessons in 40 different languages.

Here I will present the investment case for Duolingo (Note: I intend to purchase shares of the IPO) and the available, pertinent information regarding this unique organization including:

The Issue with Education

Duolingo’s Solution

Power in Scale

The Market

More Duolingo Products and Optionality

Demand Growth

The Margin Profile and Upside

Balance Sheet Pre-IPO

Leadership and Ownership

Competition and Risks

The Deal, Valuation and My Plan

Citations

1. The Issue with Education

Education is systematically unequal, far too expensive, and somewhat ineffective -- not the greatest combination. According to the Economic Policy Institute, years of extensive research revealed what we all intuitively know: a person’s social class and wealth are the strongest indicators of their educational success. Because of this, the vast majority of the world is at a distinct disadvantage when it comes to accessing top quality education: some are swimming with the current, and some are swimming against it.

And in a world where educational success powers economic mobility, one could argue that this is the single most pressing obstacle that equal access to economic opportunity faces. James E. Ryan -- The Dean of Harvard’s Graduate School of Education -- describes this frustrating reality perfectly:

“Right now, there exists an almost ironclad link between a child’s ZIP code and her chances of success,” said Ryan. “Our education system, traditionally thought of as the chief mechanism to address the opportunity gap, instead too often reflects and entrenches existing societal inequities.” (Ryan)

Let’s put some numbers behind this. In developed nations students receive on average 12 years of schooling vs. 6.5 years in developing regions, and the effect of this is dramatic. North America and Western Europe boast math and reading proficiency scores of 97% and 100% respectively. These scores are more than double the scores of Southern and Western Asia with regions like the Middle East and Sub-Saharan Africa also lagging far behind. As a whole, developed regions have a 33% lead in math proficiency and a 16% lead in reading proficiency. And this shouldn't surprise us: If there is no equal access to education then of course this frustrating learning gap will persist.

2. Duolingo’s Solution

Duolingo’s app attacks education’s problems from 3 separate angles within language learning specifically. First, is affordability. None of Duolingo’s content is paywall protected; anyone with a smartphone or a computer can access the product. Its business model is obsessed with broad access. The cost of the free product version is defrayed by advertising, but that’s a small price to pay compared to some less effective, legacy alternatives. Specifically, ad-sales made up 17% of the company’s overall revenues for 2020.

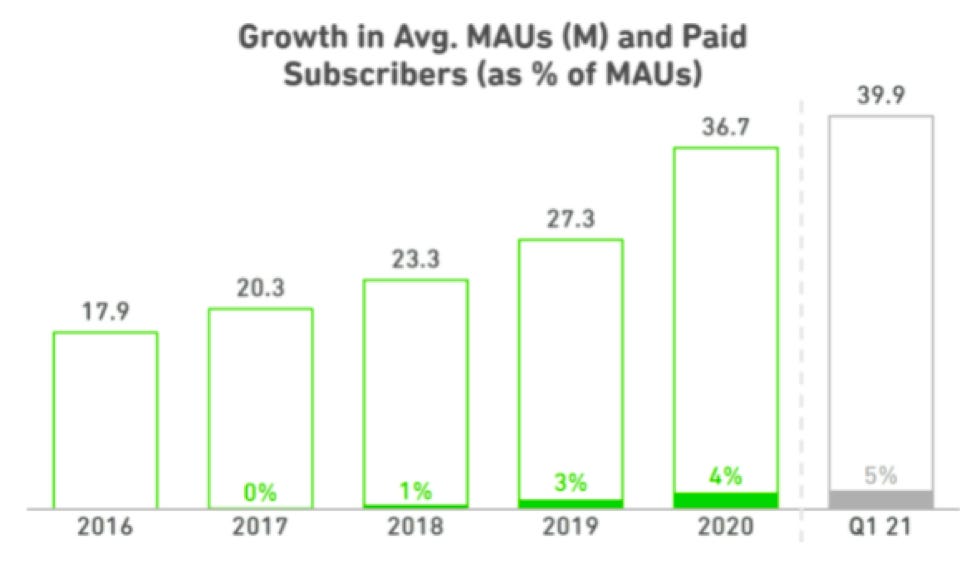

The flagship app also has an affordable paid-version called “Duolingo Plus” with monthly costs of $12.99 (or as little as $6.99 a month with an annual subscription). With these plans, paid users skip advertisements, can move through content at their own discretion and are able to track personal progress more closely. Today, 5% of Duolingo’s MAUs are paid subscribers vs. 4% in 2020 and 0% as of 2017; these subscribers contributed 72% of the company’s total 2020 revenues. Leadership believes that Duolingo is in the early stages of free-user conversion and the trend is positive and quite strong.

The second key differentiator Duolingo offers is an educational product that’s actually enjoyable. The company “believes that the hardest part of learning is motivation and engagement so it built gamification features into the platform” to keep users engaged. Things such as leaderboards, levels, points, crowns and streaks are just a few examples of how this company has designed an educational product that sometimes feels more like a video game or social media platform. Another example: Instead of learning a “chapter” users learn a new “skill” with the Duolingo app. Ask yourself how great it would be if the most addictive video game in the world taught you a new language while you played? This is the essence of Duolingo.

We’ve seen the gamification of other things like options-trading by Robinhood being met with harsh criticism and rightfully so. When people are investing it doesn’t seem like gamification is at all appropriate because of the incredible risk of loss. In education, however, it is more palatable because there is no risk of loss and because the goal is individual development. The concrete effect of gamifying a product like this is simply that users actually learn a language. This is something everyone can understand and embrace.

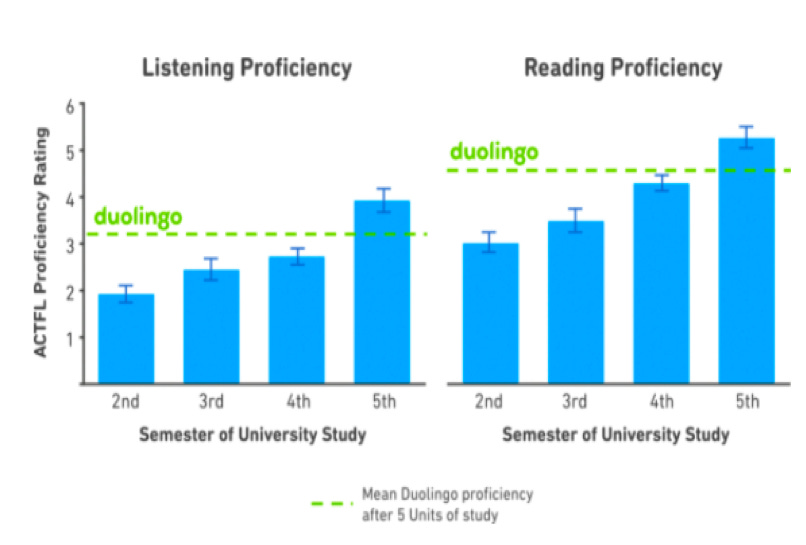

Third and finally, Duolingo built a language learning product that is more effective than legacy alternatives. It calls itself “the fastest way to learn a new language” and proudly proclaims that its users reach Spanish and French listening and reading proficiency equal to University students in their 4th semester and in just half the time. Quite the impact. This data is internally sourced form Duolingo (not an independent 3rd party) but it did carefully eliminate confounding variables to ensure accuracy. In the study, all users sampled were brand new to the subject, had only completed 5 units of a Duolingo course and were not using any other materials.

It is not that Duolingo’s product is teaching a brand-new curriculum. Its content is strictly aligned with the Common European Framework of Reference which is an international language proficiency standard. Instead, Duolingo crafts beautiful products in a way that keeps users more engaged, motivated, excited, and disciplined about learning. It also splits lessons into tiny, “bite-sized” pieces so that even the busiest of people can make progress. To ensure efficacy remains elevated, users are continuously monitored with checkpoint quizzes.

So how are consumers responding to these three supposed differentiators? Today, Duolingo is the top grossing education app on both Google and Apple thanks to a mind-boggling 500 million total downloads, as mentioned previously. It has nearly 40 million MAUs and now sports 1.8 million total subscribers while also featuring a leading brand awareness position within language learning. To offer some real-world context, there are more people in the U.S. learning a language through Duolingo than in all U.S. High Schools combined.

The product has claimed a position on Fortune’s “Change the World” list, Time Magazine’s “Genius Company” list and CNBC’s Disruptor 50 list for 3 straight years as well. It even won Apple’s free app of the year award.

3. Power in Scale

Thanks to its already massive, unparalleled scale and data collection efforts, Duolingo rightfully calls itself the world’s largest learning dataset. This reality comes with some distinct advantages. The more data points Duolingo accumulates and ingests, the better they can make the experience for its users.

On a daily basis, it collects 2.3 billion tracking events to power 500 A/B tests (or split tests) every single quarter. These tests leverage internal artificial intelligence (AI) and machine learning (ML) algorithms to examine 2 different product versions and how the user base reacts to each. This way it can continuously improve the app by knowing what actually works rather than guessing thus boosting engagement and efficacy ratings further. The A/B test could compare something as subtle as a button having 2 different colors or as complex as introducing a brand-new feature.

This relentless trial and error approach has been incredibly effective. Today, 40% of Duolingo users return to the app after day 1 vs. just 12% at the company’s founding and it has a lofty 4.7 star Apple app store rating with 1.2 million reviews. When the company A/B tested a leaderboard feature its total user hours rose by 20% immediately. Not only has this method been effective, it’s also efficient as the company can simply abandon any change to the app that isn’t well-received.

It helps to have real, tangible examples of this AI in action and we have those here. “BirdBrain” is Duolingo’s personalized instruction algorithm that crafts individual course difficulty based on a user’s ability. It stores and analyzes every answer a user has ever given to predict the probability of a correct response to make sure that users aren’t getting frustrated with impossible questions or too bored with easy ones.

“Smart Tips” is another Duolingo-built algorithm actively improving the user experience. This program gauges common user errors and then interrupts an individual lesson in a timely manner to explain concepts that are eluding a student. Smart Tips can identify and target weak spots in understanding so that they can directly be addressed.

Data, AI & ML are all at the core of Duolingo’s ability to continue offering a superior product. Everyone likes to say they have a data/AI/ML/scale advantage. Duolingo actually does.

4. The Market

According to HolonIQ, there are 1.8 billion people in the world actively trying to learn a language in some capacity. The market is already large with a total addressable market (TAM) of $61 billion powered by the tremendous economic opportunity that comes with learning English and the unlocking of new connections/experiences.

The TAM is also growing quickly with language learning as a whole poised for an 11% compounded annual growth rate (CAGR) through the year 2025 to reach $115 billion. That CAGR includes both online and offline learning but Duolingo’s online niche specifically is set for a 26% CAGR during that same period. Somewhat unsurprisingly, online language learning penetration will jump from 19.6% of total spend today to 40.8% of total spend in 2025 to reach roughly $47 billion in market size.

The company also appears to be actively growing the language learning TAM on its own. Internal Duolingo data suggests that roughly 80% of its users are brand new to language learning, offering a powerful sign of how inclusive and expansionary the app truly is.

As we will touch on below, the organization is now expanding its model into new subjects beyond language to deepen its value proposition and engagement. Successfully converting from a language learning company to an online education platform would open Duolingo up to $6 trillion in annual global education spend; this will be extremely interesting to monitor.

This growth in online education as a whole (not just languages) also seems to be in the early innings. As of 2019, just 2.3% of total education spend was digital. This compares to 10% for restaurants and 50% for books according to Cowen research from Olo’s recent S-1. The market is large, quickly growing, and still comparatively untapped. It will be up to Duolingo to create products to capture this opportunity and so far, so good.

5. More Duolingo Products and Optionality

The organization continues to find success outside of its core language learning app which hints at strong optionality going forward. In 2017, it launched the Duolingo English proficiency test for people around the globe seeking everything from university admission to work visas.

Today, the main alternatives like TOEFL are administered in testing centers and typically cost several hundred dollars (even in developing nations). Conversely, Duolingo’s tests are growingly accepted substitutes and cost just $49. To differentiate further, grading is automated and exams can be taken remotely. The proficiency test product reached $15 million in sales in 2020 vs. just $1 million year over year and already contributes 9% to the company’s total revenues.

It’s important to note that this product got a uniquely large boost from the Covid-19 pandemic as competing testing centers were forced to close temporarily. This led to acceptance of these proficiency scores soaring to 3000 institutions including iconic schools like Yale, Stanford, MIT and more. The organization does not expect any of these institutions to stop accepting Duolingo tests but growth in university adoption could slow. It’s now tapping into immigration and workforce markets to combat this potential headwind and grow the product further.

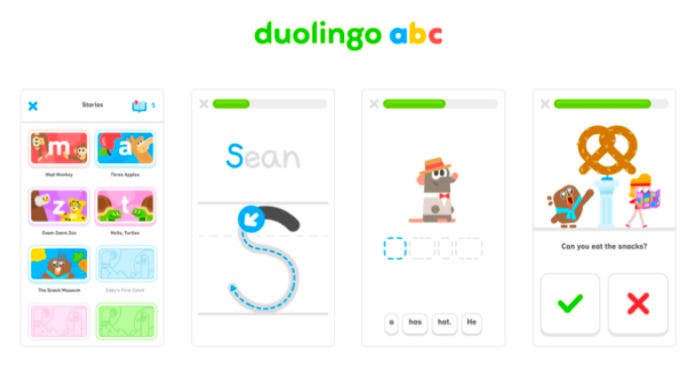

Duolingo abc -- launched in 2020 -- is another product finding meaningful success. This is a program to teach literacy to children aged 3 to 6. The company likes to let products mature for a few years before monetizing so this is not yet contributing any revenues. Still, it is generating positive press with Time Magazine naming it the best new product of 2020.

The company also offers a Spanish language learning podcast for more advanced users which consistently ranks in the top 5 education podcasts in The United States. By bringing together learners of all backgrounds from around the world, it can offer a unique opportunity to practice conversation among people with a similar level of mastery of the language.

Duolingo has even built a version of its flagship app designed for the traditional classroom. “Duolingo for Schools” allows for a more structured experience using the organization’s software. With it, teachers can use a centralized dashboard to assign content as well as monitor a student’s progress. Incredibly, nearly 40% of U.S K-12 foreign language teachers used this product in some capacity during 2020 vs. 25% in 2018.

While all of these round out a compelling language product suite on their own, Duolingo is far from done with introducing new offerings. Investors have been told to expect expansion into other subjects such as mathematics, and English/Language Arts. Furthermore, leadership believes it’s in the early stages of entering international markets including Asia, Europe and Latin America. Daily Active Users (DAUs) in Asia jumped 136% from 2019 to 2020 hinting at strong demand abroad.

Duolingo believes that its value proposition is even more compelling internationally than in the United States. This is borne out by English learning accounting for 54% of its MAU’s.

6. Demand Growth

Duolingo is not simply talking a big game, it’s delivering excellent metrics. In its most recent quarter revenues jumped 96.7% year over year to $55.4 million with total bookings soaring 78.3% to reach $65.8 million. MAUs rose 19.1% year over year to 39.9 million on the heels of some extremely tough pandemic comps. Finally, subscription growth continued to be strong with that number rising 63.6% year over year to reach 1.8 million.

As we have seen with online platforms like Pinterest and Netflix, the pandemic likely pulled forward some user and revenue growth for the company as some competition closed temporarily. Clearly, maintaining 96.7% revenue growth over the long term is not realistic for any stock. Growth will always continue to slow as the revenue base expands.

7. The Margin Profile and Upside

Gross profit margin (GPM) for Duolingo is strong and improving. Last quarter GPM came in at 72.8% vs. 70.4% in the year before. Its adjusted EBITDA margin inflected positive reaching 1.6% vs. -3.1% in the year over year period. Interestingly, its net income margin worsened from -7.8% to -24.3% in the quarter as Duolingo boosted R&D spend by 135% and marketing spend by 259%. It is encouragingly already free cash flow (FCF) positive with a 6.8% FCF margin last quarter.

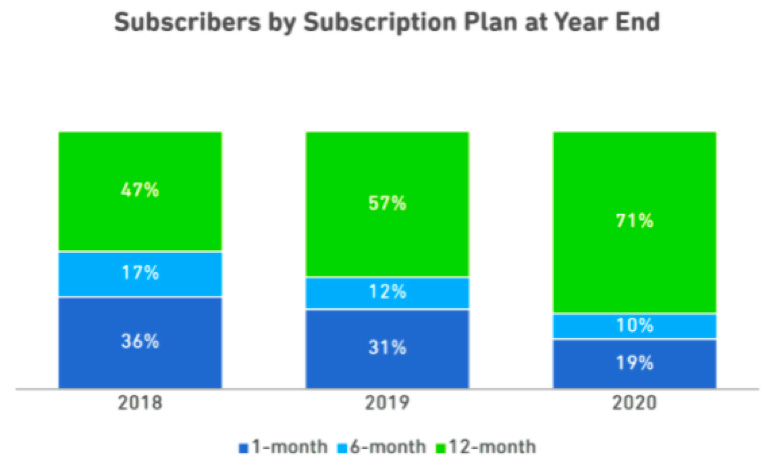

Strong margins are nice, but they are even nicer when they come with upside. The company pays 30% of total sales to Apple and Google for the first year of a user’s subscription and then 15% afterwards. This means lowering user churn would directly translate into better unit economics if attainable, and for Duolingo it is. In 2018 just 47% of Duolingo subscribers picked an annual subscription which spiked to 71% as of 2020. Annual subscribers renew more than 4x more frequently than monthly subscribers and generate 2x the lifetime value (LTV) making this change immensely positive for the organization’s potential profitability.

Unlike the expensive Apple & Google store options, Microsoft is introducing its own app store with a near-0% commission. If successful, this should put pressure on Apple and Google’s walled gardens to lower their own fees over time (we’ll see).

Beyond lower churn, Duolingo to date has been admirably efficient in terms of marketing and growth. It has spent just $41.8 million on external marketing since its founding in 2011 and leans heavily on its 39.9 million MAUs to promote the product organically through word-of-mouth. This is where gigantic scale, leading brand awareness and high app ratings really makes a difference.

The company doesn’t need to spend as aggressively on expansion when its users are selling for them. Incredibly, Duolingo claims that 90% of its 2020 growth came from organic marketing channels like word-of-mouth rather than paid user acquisition. It then uses these incremental savings to pour back into R&D and product improvement rather than having to spend on consumer awareness.

This is likely why free cash flow is already positive and margins are so strong for a company this early in its growth curve. Despite this, the organization is starting to press the gas pedal on external marketing. Its 2021 New Year’s marketing campaign was by far its largest yet (roughly half the size of its combined marketing spend to date) and boosted brand awareness in the USA, UK, and Mexico by 6%, 3% and 3% respectively.

8. Balance Sheet Pre-IPO

Pre-IPO Duolingo has $117.5 million in cash and equivalents predominantly held in money market funds. It does have another $18 million in net receivables and the upcoming IPO will certainly bolster the cash position further. It has raised $183.3 million in financing since inception but has 0 interest expense meaning there is no current debt on the balance sheet.

It’s expected that there will be 35.9 million shares outstanding at the IPO. There are another 10.1 million shares available for future issuance for a total of roughly 46 million shares.

9. Leadership and ownership

The Duolingo team is led by both of its young co-founders: Luis von Ahn (right), PhD and Severin Hacker (left), PhD. The two have together been twice-crowned Forbes’s Best Startup Employers award.

Luis serves as the CEO and is just 42 years old. He is a computer science professor at Carnegie Mellon University, and a winner of the MacArthur Genius Grant as well as the Lemelson-MIT Prize for Inventors. Before founding the company, he led reCAPTCHA -- a fraud detection company purchased by Google. We have just 73 total Glassdoor ratings on Luis’s leadership style but with a 96% approval rating, the data we do have is excellent.

A quote from his shareholder letter sums up his passion and drive for Duolingo perfectly:

“I plan to dedicate my life to building a future in which, through technology, every person can access the best education.” (Ahn)

This does not sound like someone eager to move on to the next project, and that works wonders in ensuring the culture and path stay on the right track.

Severin Hacker serves as the company’s CTO and is just 36 years old. Due to the young age, Severin has very limited experience outside of Duolingo (he was 26 at the founding). The little experience he does have, however, is impressive. He earned his PhD from Carnegie Mellon (where he was advised by von Ahn) and started his career at Microsoft before developing Duolingo’s programming infrastructure.

The Chief business officer, Robert (Bob) Meese was the Global Head of Games Business Development at Google Play and the SVP of Engineering Natalie Glance, PhD was an engineering manager at Google as well. Considering Luis’s reCAPTCHA organization was purchased by them, this does make some sense.

With regard to the board, excluding institutions with large Duolingo stakes, there are 3 interesting BOD highlights: the COO of Twitch, the former COO of Zillow and a former Deputy Secretary of the U.S. Department of Education.

In terms of ownership, Luis and Severin each own 14.6% of the total equity voting power for 29.2% combined. New View Capital, Union Square Ventures, CapitalG (AKA Google Capital), KPCB Holdings and General Atlantic are the 5 largest institutional holders accounting for 54.8% of the voting power. Interestingly, Ashton Kutcher and Tim Ferriss are also invested in the company. Like many other companies going public, Duolingo sports a dual-class share structure with each class B share featuring 20X the voting power of a class A share.

10. Risks and Competition

Whenever free markets are presented with an opportunity like Duolingo’s, there will always be abundant competition. This time is no different. The most direct competition comes from gamified educational substitutes such as Kahoot and Babbel. Furthermore, it competes less directly with online tutor aggregators such as Wyzant, and more traditional tutoring services. Even the 60% of K-12 classrooms not yet using Duolingo in their curriculum serve as a competitive threat.

If we consider anyone taking eyeballs away from Duolingo’s app to be competition, we could call video games, streaming services and social media platforms substitutes for spending time on Duolingo. Services like YouTube do boast a plethora of free language learning content for consumers to enjoy.

The main risk comes from the long list of competition all chasing market share paired with extremely low switching costs. It takes just a few minutes to make an account for free and start learning which is ironically both a strength in terms of convenience and a concern in terms of churn. While Duolingo has been fabulously successful with rolling out new products and features to date, there is no guarantee that will continue.

Covid-19 also complicates things somewhat. The company expects its next quarter to face the toughest pandemic year over year comparisons meaning growth could be uniquely impacted and somewhat underwhelming.

More specifically, Duolingo’s English proficiency test enjoyed a boost from brick and mortar testing centers being shut down, and Duolingo abc likely gained more engagement from the K-12 system temporarily closing or going remote as well.

Google, Zoom and others are also planning to release live translation services in the future. Much like a calculator doesn’t stop our world’s motivation to learn math, I do not think a product like this would eliminate language learning demand. The product could, however, dampen demand to a certain extent and also may place more pressure on Duolingo’s newer products to generate growth. This is something I will be closely watching going forward.

Beyond competition and the unknown degree to which the pandemic distorted the sales growth, the company also referenced a material weakness in their internal accounting controls in 2019. Duolingo had not hired the appropriate personnel and had also not incorporated the appropriate risk assessments to ensure absence of misstatements. Essentially, they were too casual with reporting and auditing.

This would be unacceptable for a public company with a several billion dollar valuation like Duolingo will feature if it were to happen again, but they have since remedied this issue and integrated proper controls. Not to make excuses for the organization, but this seems to be the result of an obsession with product innovation and engineering as 70% of the company’s 400 employees are focused there. That makes the issue a little more palatable to me, but still a concern.

11. The Deal, Valuation and My Plan

Duolingo previously raised funds from General Atlantic at a $2.4 billion valuation which translates into 12.7x trailing 12-month (TTM) sales and 17.5x TTM gross profit. On a fully diluted basis, it would mean that Duolingo trades for 16.3x TTM sales and 22.4x TTM gross profit. While the IPO has not yet been priced, it will invariably be more expensive than that, but regardless of the valuation, I will be purchasing shares on day 1. If the valuation gets out of control, however, the size of my initial purchase will be much smaller and I will look to average in a larger portion of my full position over time. The tough 2nd quarter comparisons Duolingo expects may provide an interesting buying opportunity for patient investors to do just that.

The company does not need to maintain 96.7% revenue growth to deliver strong returns going forward. Still, it does need to grow at a compounded rate of at least 35% over the next several years to earn the frothy multiple it will likely carry when it debuts. I do not pass on companies due to valuation if the product, the path, the competitive position and the leadership are all compelling enough. To me, Duolingo clearly is but that will be a decision you must make for yourself.

Thank you for reading!

12. Citations

Welcome to Substack, this was Epic