Earnings Roundup -- The Trade Desk; Progyny; Duolingo; Upstart

Digging into the results of these holdings.

1. The Trade Desk (TTD) -- Q1 2023 Earnings Review

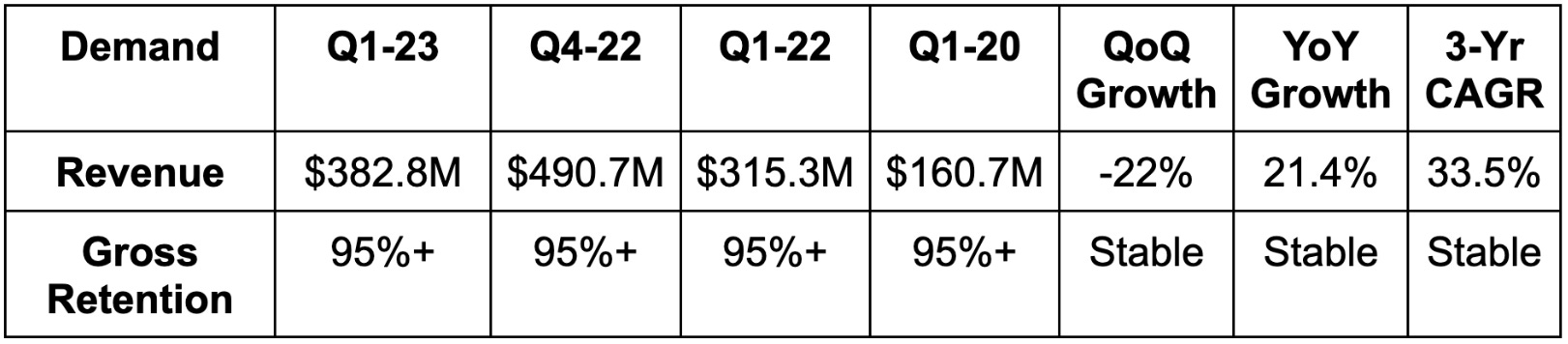

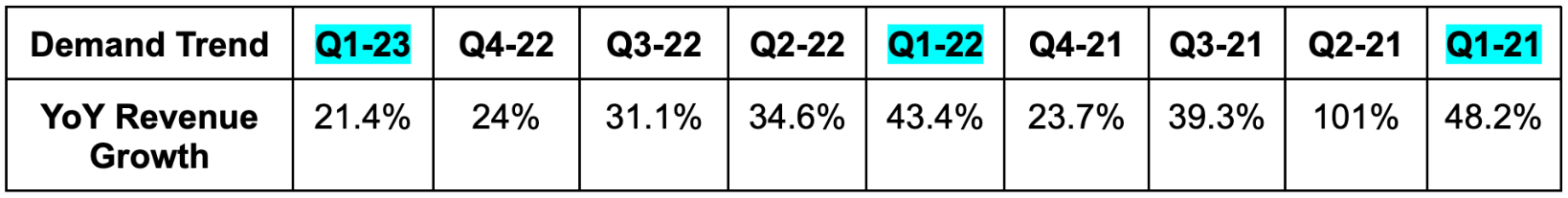

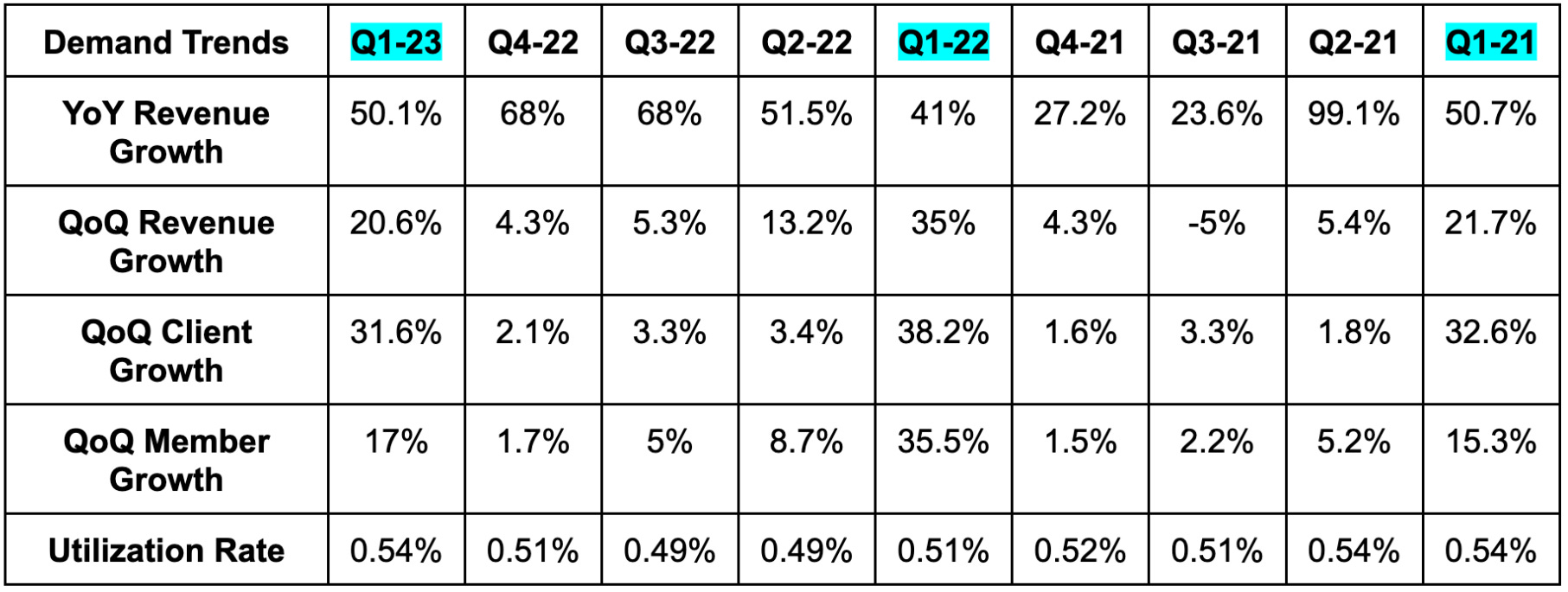

a. Demand

More Demand Context:

Easy comps in Q1 2021 and Q1 2022 turned into tough comps this quarter. Revenue growth would have been closer to 23% ex-2022 political spend.

Video is around 45% of revenue, mobile is around 35% of revenue; display is around 10% of revenue and audio makes up the remaining 5%.

Travel as a vertical was a standout for the company. Spend there nearly tripled YoY.

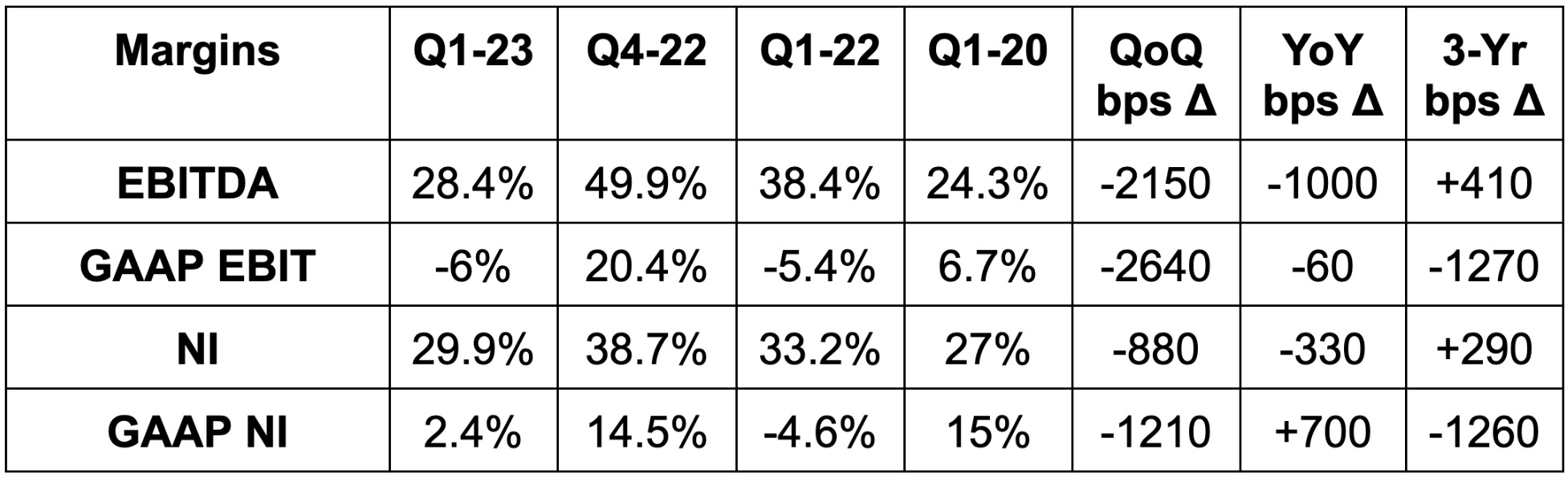

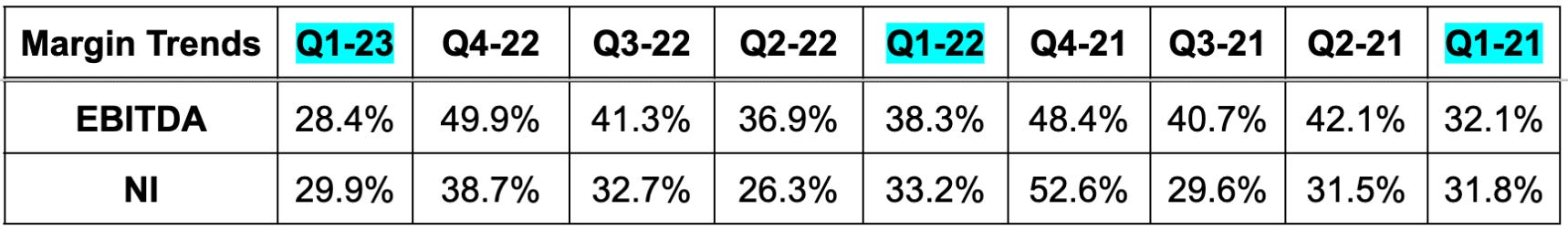

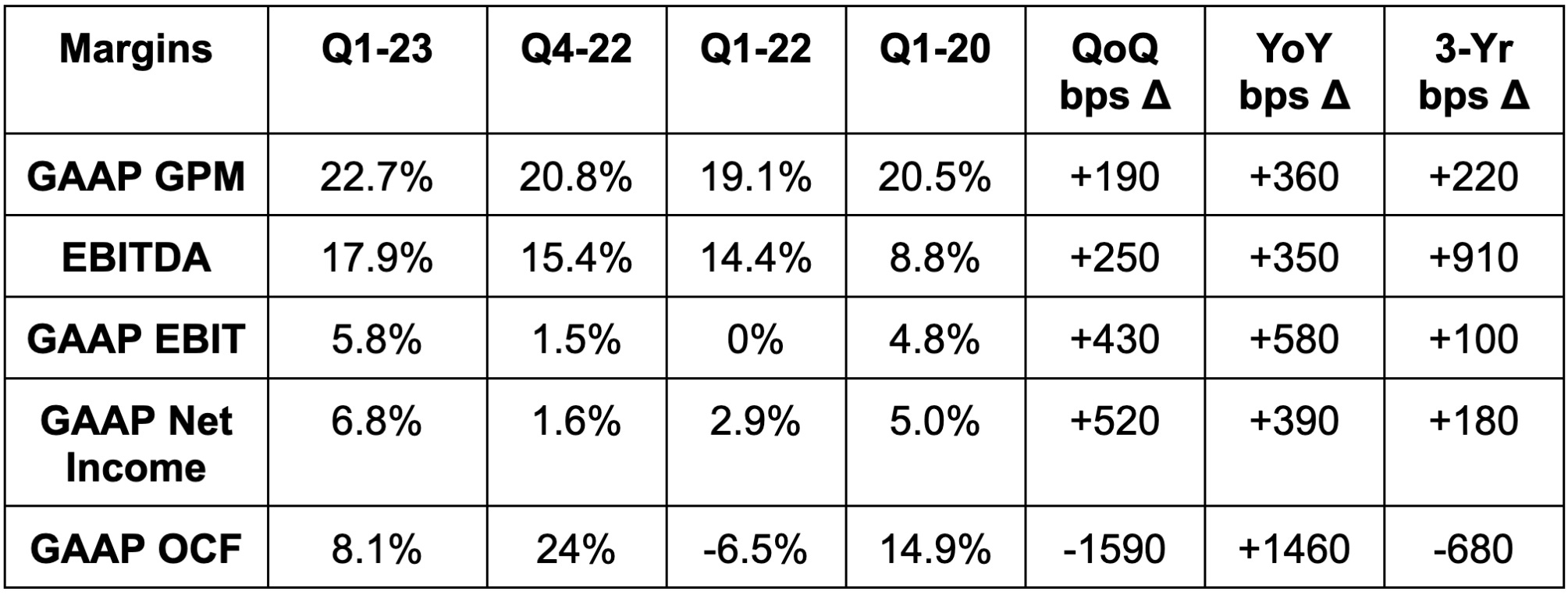

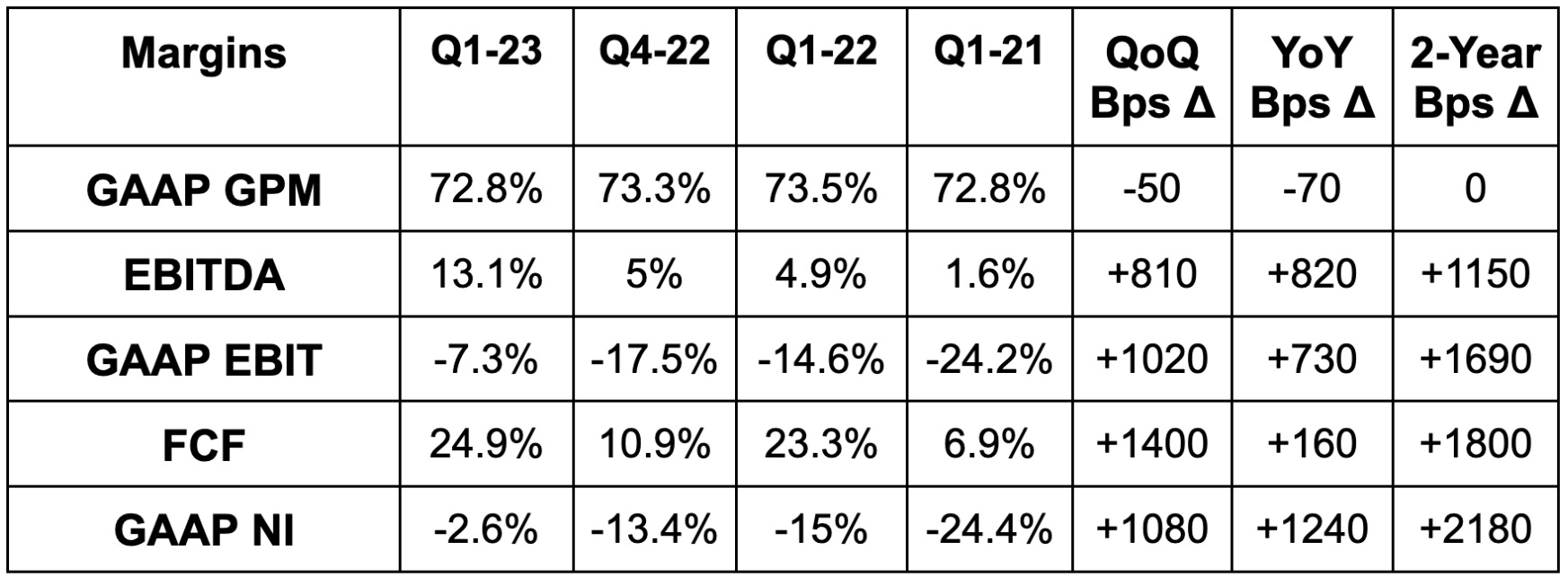

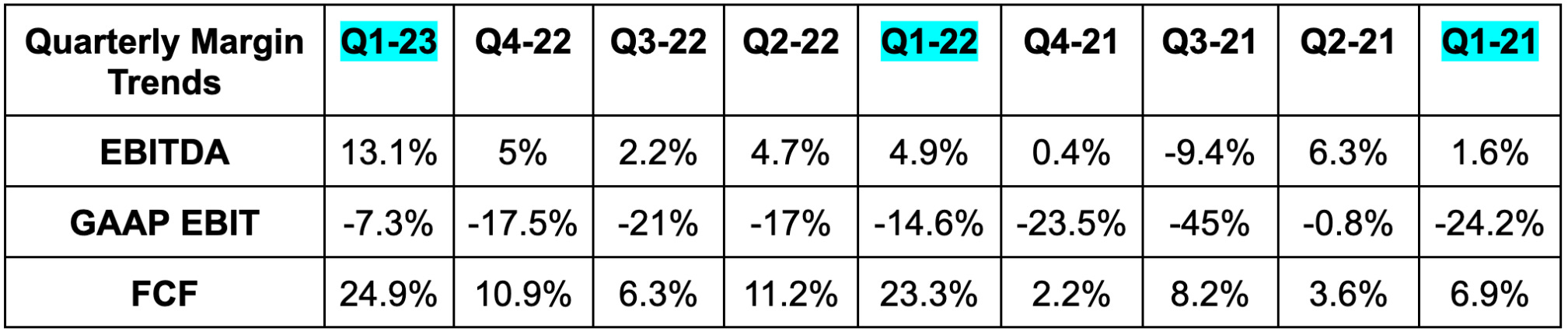

b. Profitability

More Margin Context:

Free Cash flow generation is compounding at a rate over 100%.

Operating expense growth of 41% YoY was due to continued platform investments and also the return of in-person events/travel.

c. Balance Sheet

$1.3 billion in cash & equivalents.

$0 debt.

Paid out $113 million in stock compensation which is still being inflated by temporary founder awards (for hitting performance targets). It bought back $259 million in stock to more offset this dilution.

d. Guidance

Beat revenue estimates by “at least” 1.5%.

Beat EBITDA estimates by 1.2%.

The Trade Desk will continue to hire in 2023 at half the pace it did in 2022. It sees the talent market as far more favorable today than it has been since pre-pandemic. This, more cash taxes and the return of in-person events is expected to lead to operating expenses growing YoY in 2023.

The team hinted at operating leverage in the second half of the year and into 2024 but did not offer concrete guidance there.

e. Call & Release Highlights

Success:

The company again vastly outgrew digital advertising and took more market share. Companies amid uncertain macro are embracing better precision, more efficient reach and more relevant targeting. That is exactly what this scale leader within programmatic advertising delivers. And its commitment to only serving the buy-side merges this added accuracy with a lack of conflict of interest.

While some advertisers are somewhat timid amid poor macro, dollars continue to shift faster and faster to the firm’s channels and platform. This is why it continues to readily sign joint business plans with massive agencies worth well over $1 billion in spend. And that’s why it keeps taking share every single quarter.

Channel standouts this quarter were the same as they have been in recent periods: Connected TV (CTV) and retail media. It signed a new retail media partnership with Macy’s to join Home Depot, Walmart, Kroger, Meijer, Target, Gojek and many others. It spoke about Fair Price (largest grocer in Singapore) cutting customer acquisition cost by 33% with this platform at twice the scale. Good combination.

For CTV, streamers are increasingly embracing ad supported formats to fund their competitive content spend. To maximize value per impression within this newer approach, they must embrace open bidding and efficient price discovery. The Trade Desk offers that need with more scale (so more bids) than anyone else can.

Finally, the firm talked about this year’s up-front process so far. As a reminder, up-fronts mean purchasing large blocks of impressions well in advance -- with little visibility and data. The firm is thriving in an environment where uncertainty is extreme because it frees purchases to be done on an impression basis rather than millions at a time and far in advance. While that’s true, it still wants a piece of the upfront market while the shift to programmatic continues. So? The Trade Desk created a product to make this process more biddable and granular to help advertisers evolve.

Advertisers at up-front events are now routinely requesting that publishers allow them to use The Trade Desk for purchasing. That’s powerful.

Unified ID (UID) 2.0 — The Trade Desk’s open internet identifier to replace 3rd party cookies and upgrade it to a fully omni-channel, always on customer view:

NBC Universal added a UID2 integration along with Paramount and Rave (70 million users).

The Trade Desk launched its TV Quality Index (TVQI) this quarter. This allows advertisers to understand consumer ad response, relevance and optimal return areas. It directly plugs into UID2 to accomplish this. Two large clients including Sinyi (largest real estate firm in Taiwan) used this newer tool to lift awareness and brand favorability by over 15% each. Sinya also enjoyed 2x the ad performance vs. its previous marketing strategy.

75% of its inventory is now UID2 tagged -- 3 months ahead of schedule.

UID2’s better ID tagging is routinely fetching impression premiums vs. non-tagged inventory. Advertisers are happy to pay up for better targeting. Publishers get better rates. Win/win.

Generative AI:

Jeff Green sees The Trade Desk as being in a “leading position” for generative AI. This is because investing in the compute power and tech is expensive. It requires balance sheet health and stable profits. The Trade Desk has that. This opinion also comes from The Trade Desk being born as an AI-supported company. It’s not a new thing for this firm.

Its Koa platform has been using AI models for impression recommendations and campaign management for 5 years.

Like others, The Trade Desk expects AI to improve its developer efficiency and to create new use cases like virtual assistants to “shorten the programmatic learning curve.” That last piece is expected to make the company a better vendor for smaller firms with more finite budgets and teams.

It will launch its new AI-powered platform in June.

OpenPath:

OpenPath is TTD’s product allowing the demand side to plug directly into the supply side. The was born from players like Google opaquely siloing pieces of the supply chain and other vendors taking advantage of the confusion with excess fees and dishonest reporting. This is The Trade Desk’s response. OpenPath is NOT to replace the supply side. It is to let publishers on the supply side who want to perform their own supply side tasks like yield management to do so. Green was asked about Magnite’s new product called Clearline (which carries a similar philosophy). He thinks analysts are looking for drama for the sake of clicks while the two continue to co-exist. He’s not concerned.

Leadership:

CFO Laura Schenkein will replace Blake Grayson as TTD’s CFO next month. Schenkein has been with the team for 10 years and was most recently a finance team VP. That should make for a smooth transition. She previously worked as a VP at Barclays.

f. Take

This was an excellent quarter. More share gains, robust margins and a lengthy programmatic ad runway with leading open internet scale. The bar for execution is set extremely high based on the company’s valuation multiples… and deservedly so. We expect more drama-less execution despite numerous macro headwinds holding its competition back. The company just keeps executing.

2. Progyny (PGNY) -- Q1 2023 Earnings Review

“The year has begun with clear and positive momentum across all the key areas we look to including sales momentum early in the 2023 selling season.” -- CEO Peter Anevski

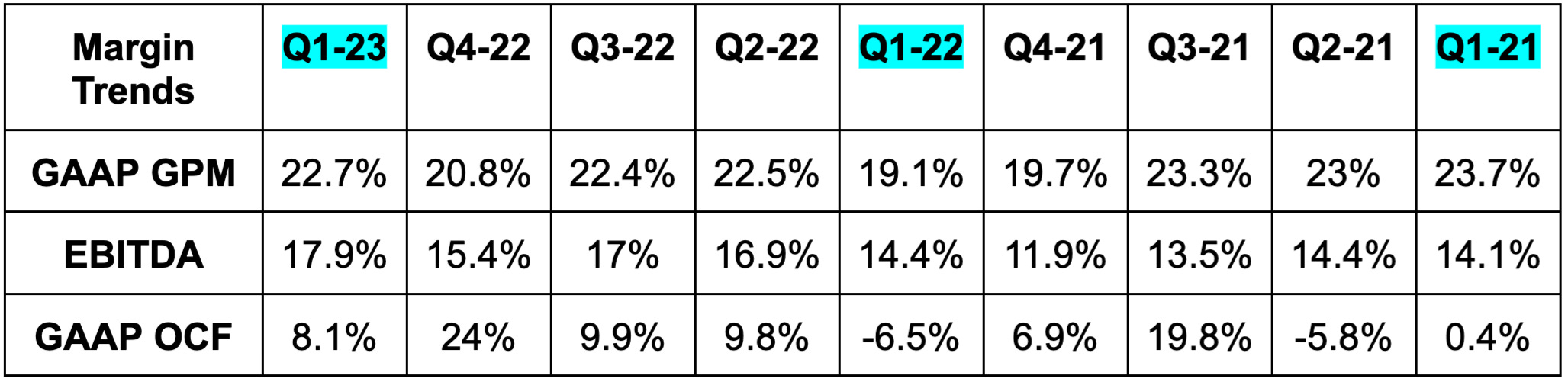

a. Demand

Progyny beat revenue estimates by 4.8% & beat its revenue guidance by 4.4%.

More Demand Context:

Un-billed accounts receivable grew at a rate well below revenue. If you read our short report response in December… we told ya so.

The pandemic made for easy 3-yr demand comps. New fertility treatments were temporarily halted in Q1 2020.

Female Utilization rate improved from 0.45% to 0.48% YoY. This is despite rapid new client growth and these new clients always starting at utilization troughs.

Progyny is now over 380 clients and 5.4 million members as of today.

ProgynyRx attach rate reached 90% vs. 83% YoY. New clients boasted a 97% ProgynyRx attach rate.

Assisted Reproductive Treatment (ART) cycles rose 47.6% YoY.

b. Profitability

Beat EBITDA estimates by 9.3% & beat its EBITDA guidance by 8.3%.

Beat $0.07 GAAP EPS estimates by $0.11 & beat its guide by $0.10. The $0.18 in EPS this quarter compares to $0.05 per share YoY. Importantly, this was NOT aided by income tax benefits which were $1.3 million this quarter vs. $5.1 million in the YoY period. This growth was powered by operating profitability.

Progyny also beat cash flow and GAAP EBIT estimates, but these estimates were aggregated from just 2 analysts -- so not super valuable.

Margin context:

Margin expansion was powered by cost base efficiency and economies of scale. General and administrative (G&A) as a % of revenue fell from 13.4% to 11.4% YoY as a result.

Gross margin expansion was helped by a normalization in client onboarding timing. Last year, several clients launched in Q1 which led to it needing to invest ahead of the volume ramp. That hit margins. That impact was less pronounced this year.

c. Balance Sheet

The balance sheet is pristine. It has $208 million in cash and equivalents with no debt.

Stock based compensation was 11.9% of sales vs. 14.2% of sales YoY. This should continue to fall as Progyny distances itself from equity awards to executives for meeting performance targets.

Bad debt expense was 2% of revenue vs. 1.3% YoY. Industry benchmarks of “good” for Progyny’s space is anything under 5%.

d. Guidance

Q2:

Beat revenue estimates by 3.5%.

Beat EBITDA estimates by 4.2%.

Beat GAAP $0.08 EPS estimates by $0.015.

2023:

Raised its revenue guide by 3.7% and beat estimates by 3.3%.

Raised its EBITDA guide by 5.9% and beat estimates by 4.9%.

Raised its previous $0.29 GAAP EPS guide by $0.16 and beat estimates by $0.17. This does not include any tax benefits that could come this year. This should keep being raised.

Progyny now expects incremental EBITDA margin (EBITDA margin on new revenue) of 20%+ for 2023. This compares to its previous guidance of 19.4% and paves the way for more margin expansion.

e. Call Highlights

Macro:

Perhaps in light of the short reports that came out of the company recently, some started to argue that falling birth rates were a bear case for Progyny. I’d encourage those folks to do just a little bit of work on where those declines are coming from. The predominant reason is women enjoying more career opportunities and deferring family building to later in life. This RAISES the need for its services. It’s biology. Specifically, despite falling aggregate birth rate in the USA, birth rate for women over the age of 35 continues to steadily rise and feed Progyny demand. And the need is only growing with the World Health Organization recently reporting that 1 out of 6 couples need fertility treatment vs. 1 out of 8 as of 2019.

The other macro concern from the short reports was on layoffs for some of Progyny’s clients. As it has told us to expect, hiring from other industries represented in its client base is more than offsetting these layoffs. And importantly, its strong 2023 guide still pessimistically assumes flat existing client headcount growth.

Progyny also reiterated that it is delivering 25%-30% cost savings for clients via better outcomes. It will hold its service costs flat this year while healthcare service inflation runs rampant to further enhance its value proposition. It continues to deliver more and more volume to its network of clinics and pharmacies which is allowing it to negotiate better contracts and profitably pass savings on to its members.

Selling Season & Demand:

The 2023 selling season is going well so far. The pipeline activity is “favorable vs. record 2022 activity.” It has enjoyed a “healthy number of early commitments” and again expects its number of client and member adds in 2023 to be larger on an absolute basis vs. the prior year. This implies worst case YoY growth of 33.5% and sets the company up for continued 2024 success.

The newer channel partnership with the Children’s Hospital Association (CHA) has already generated 7 new clients for Progyny in just a few months. Encouragingly, it was just added by FamilyPath (owned by Evernorth) as a preferred partner just like with CHA last quarter. Evernorth (its full network did over $140 billion in 2022 revenue) had been trying to internally upgrade its fertility solutions. It gave up and decided to go with Progyny via the inherent outcome and cost advantages.

Progress within labor populations is very early but positive.

New Growth Vectors:

Progyny signed a partnership with Parsley Health to debut Progyny Plus. Progyny Plus is “physician led primary care service” encompassing women’s health. It considers this a pilot program.

There was no update offered on its Canadian expansion progress.

f. Take

This was a flawless quarter and a wildly satisfying one. Progyny is the outcome leader in the space… it’s the cost leader in the space… and so? It’s the clear share leader in the space. With ART penetration in the U.S. less than half that of comparable nations due to poor access, the runway remains long. Progyny’s ability to vastly bolster access means it should continue finding rapid growth and margin expansion. For 6 years it has delivered healthier pregnancies and superior performance indicators vs. its competition. That lead continues to consistently grow to power a truly unique value proposition.

We defended the company following not one…. not two… but three noisy short reports. We were right to do so. Fantastic report in every sense of the imagination.

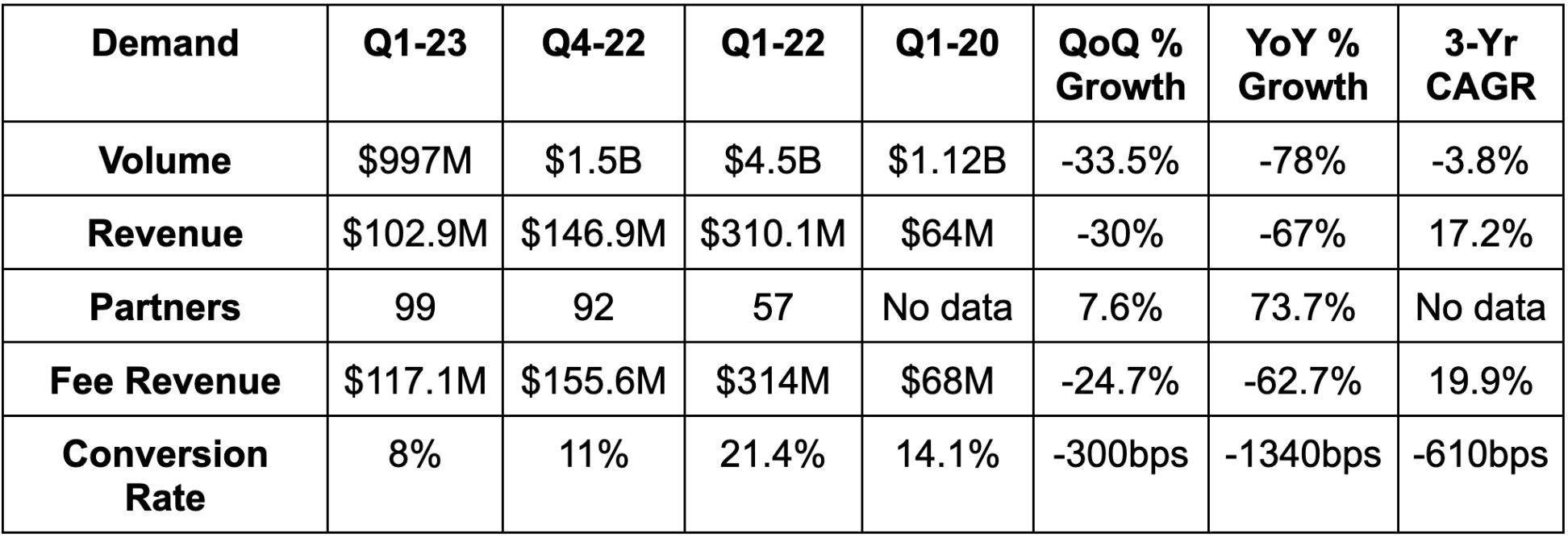

3. Upstart (UPST) -- Q1 2023 Earnings Review

“I’m hopeful that as we move through the year, you will come to see Q1 as a transitional quarter for Upstart.” -- Co-Founder/CEO Dave Girouard

a. Demand

Upstart beat revenue estimates by 3% and beat its guidance by 2.9%. Its fee revenue generation beat guidance by 6.5%.

Demand Context:

Upstart generated $45.3 million in interest income vs. $15.1 million YoY via more loans on the balance sheet. It reduced the fair value of its loans by $52.4 million vs. an $18 million reduction YoY. The net impact was therefore negative in terms of net interest income.

Personal unsecured loans fell 46% QoQ and 82% YoY; auto secured loans fell 15% QoQ and 82% YoY.

It sounded like newly secured committed funding (discussed below) began to benefit its funding supply dynamics which slightly helped revenue. Its 11.7% take rate vs. 7.0% YoY helped a lot too.

The collapsing conversion rate is due to Upstart’s loan offers becoming much more expensive with rising risk and benchmark rates. A lot of borrowers are now being underwritten at annual percent rates (APRs) over its 36% maximum… and so rejected. Its lack of funding supply is still hurting here as well. It’s turning down some borrowers due to that and also its unwillingness to grow its balance sheet (which we support).

b. Profitability

Beat its contribution margin guide by 270 bps.

Beat GAAP net loss estimates by 10.3% & beat its guide by 11%.

Beat net loss estimates by 40.4% & beat its guide by 44.7%.

Beat EBITDA estimates by 31.6% & beat its guide by 30.9%.

Margin Context:

The contribution margin trend is far better than the rest via rising take rate and, to a lesser extent, marketing spend cuts. Sales and marketing spend was $31.4 million this quarter vs. $133.4 million YoY to give an idea of how severe these cuts were.

All other cost buckets rose YoY besides customer operations which came in at $40.6 million vs. $48.4 million YoY. Engineering and product development (similar to R&D) more than doubled YoY to reach $110 million.

Headcount is also down 30% from last quarter to allow it to “soon return to profitable growth.” It now has a cost base that will deliver profitability with far less volume than it previously needed.

It continues to very selectively hire.

Operating expenses fell 15% YoY. They rose 14% QoQ due to restructuring charges and a cancellation of an executive equity award which (due to weird GAAP accounting gimmicks) counts as a GAAP operating expense.

c. Balance Sheet

$452 million in cash & equivalents vs. $1.01 billion YoY due to storing more loans on the balance sheet. The cash cushion is dwindling, but leadership also told us that a balance sheet transaction closed after the first quarter. This will shrink its loan balance considerably and should be a very nice source of cash as the company re-inflects to positive EBITDA.

$986 million in borrowings.

Loans held rose 63.3% YoY but FELL 2.9% QoQ.

It has $493 million in loans for R&D and $489 million for core personal for a bit less than a billion in total. Core personal was the source of the welcomed sequential shrinkage.

d. Guidance

Revenue was 7% above expectations. Fee revenue is expected to be below total revenue (for the first time in a while) due to less of a fair value hit. It sees most of the mark-to-market valuation reductions as behind it via rate hikes now wrapping up and less loan pool sales from its balance sheet into capital markets.

EBITDA guidance of $0 was $12 million ahead of expectations.

GAAP net loss guidance of $40 million was $5.5 million ahead of expectations while net loss guidance of $7 million was $2.1 million better than expectations.

Upstart continues to expect pricing power and funding supply scarcity to facilitate contribution margin expansion. It guided to a 60% contribution margin. It sees its take rate falling over time as the economy improves and funding returns… but sees it settling above where it was in 2021.

e. Call & Release Highlights

Long Term Funding Commitments:

As we were told to expect last quarter, Upstart secured multiple long term funding agreements to provide over $2 billion in capital to the platform through Q1 2024. The capital is strictly for unsecured personal loans. This was the highlight of the call. It expects to announce more of these agreements over time with the goal of having enough committed capital to ensure positive cash flow throughout future cycles.

“After the last year, I’m keenly aware that we need to build more resilience into Upstart’s business.” – Co-Founder/CEO Dave Girouard

Unsurprisingly, to solidify this new funding source, Upstart had to concede some of its take rate and margin. The exact contract terms weren’t disclosed. Considering how lofty its margins were with more favorable macro, this is the correct decision. It can afford to lower its margin ceiling to create a more durable funding partner roster.

Customer Access & Service:

In an internal study, Upstart delivered 53% less defaults at the same approval rate vs. a large U.S. bank and 173% more approvals at the same default rate. As always, take internal studies with a grain of salt.

Upstart’s net promoter score (NPS) sits at a lofty 83. That’s not normal for a loan facilitator.

Auto:

39 dealers are now using Upstart credit underwriting to originate auto loans vs. 27 last quarter.

Upstart Auto added Acura and Mercedes to its OEM partner roster to reach 9.

Launched a new underwriting model for auto that it “now considers calibrated and performing on target.”

It signed its first external funding agreement for auto during the quarter.

HELOC & Small Dollar:

Upstart plans to enter the home equity line of credit (HELOC) market this year. This will serve a more prime borrower than its other products and is expected to boast annual loss rates under 1%. HELOCs are also countercyclical to most of Upstart’s refi-based book of business.

It hopes to fund these HELOC loans within 5 days vs. 36 days for the industry average.

It debuted a new AI underwriting model for its small dollar loan product that it calls its “largest accuracy improvement to date.”

It released 23 new model updates during the quarter. Updates will remain constant.

Upstart sees its small dollar loan product as replacing 70% of payday loans in the next 5 years. This is also helping banks to avoid overdraft fees by giving them a viable solution for hyper short term and tiny loans.

Debuted a shorter term small dollar loan product which boosted approval rates by 37%.

Credit Performance & Macro:

The Upstart Macro Index (UMI) improved slightly QoQ thanks to rising savings rates (over 5% vs. under 3% nine months ago) and lower inflation.

Upstart’s credit vintage expected cash flows have re-surpassed its target cash flows following a year of underperformance and the beginnings of a recovery discussed last quarter. Its gross realized returns were 11% this Q vs. 3.5% YoY. That lofty return is needed to justify riskier credit origination willingness from partners.

Since inception, Upstart has delivered 9.9% gross annualized returns across all vintages vs. a target of 8.4%. It has seemingly endured the worst of the credit cycle while continuing to deliver outperforming returns. Some vintages has underperformed… but in aggregate they’re beating expectations handsomely. That should build real partner trust to motivate funding resilience across future cycles. The committed capital helps a lot too as well as news that it added capital market partners to its ecosystem this quarter.

“Loans on our platform are priced conservatively vs. UMI so partners can feel confident that recent vintages are performing at or above expectations.” -- Co-Founder/CEO Dave Girouard

“We’ve seen stability in consumer re-payment trends.” -- CFO Sanjay Datta

Furthermore, Upstart’s credit bands continue to be far more accurate at default prediction vs. a FICO score:

Despite all of this, funding supply remains understandably timid. There’s no appetite for subprime capital market origination today. That became even more true via the regional banking turmoil which worsened asset backed securitization (ABS) credit spreads incrementally during the quarter. While credit health has begun to stabilize thanks to Upstart’s strong yields and short duration credit (and new committed capital), the success this quarter was driven by pricing power and cost controls. Macro tailwinds are almost entirely in front of this firm as headwinds remain firmly intact.

Capital Market Conduits:

Upstart has 3 banking conduits that serve as an origination bridge between it and capital markets (and retain a small portion of the loans themselves). One is Cross River Bank which recently received a cease and desist order based on fair lending practices. Girouard reminded us that these conduits represent dozens upon dozens of institutions, take very little balance sheet risk, and are easily replaceable.

“And it's quite possible to move volumes between them. It's quite purposeful that we can do that.” -- Co-Founder/CEO Dave Girouard

f. Take

This was Upstart’s best quarter in a long time. Can we call it good? Not when margins are plummeting and demand is tanking. As an inherently cyclical company however, it’s hard to get angry at them with those trends. They’re inevitable and should violently improve as the economy stabilizes.

The committed funding was wonderful news, the expected cash flow improvement was wonderful news, the continued pricing power was wonderful news and its underwriting prowess was also wonderful news. There was more to be excited about in this report than investors have enjoyed in a long time. One more quarter of convincing progress and this will be removed from my do not add list. There is a long way to go as management will readily tell you… but this was a fantastic step in the right direction.

4. Duolingo (DUOL) -- Q1 2023 Earnings Review

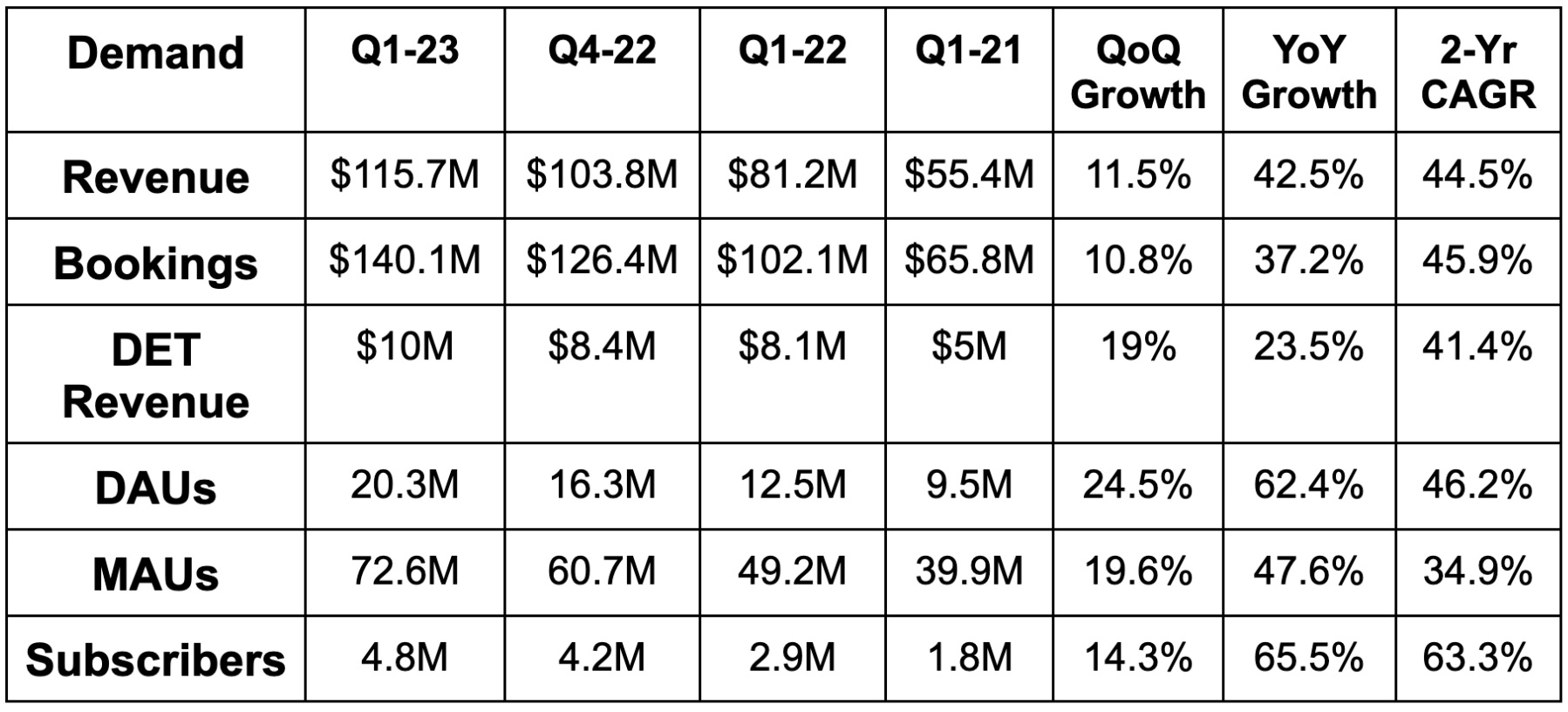

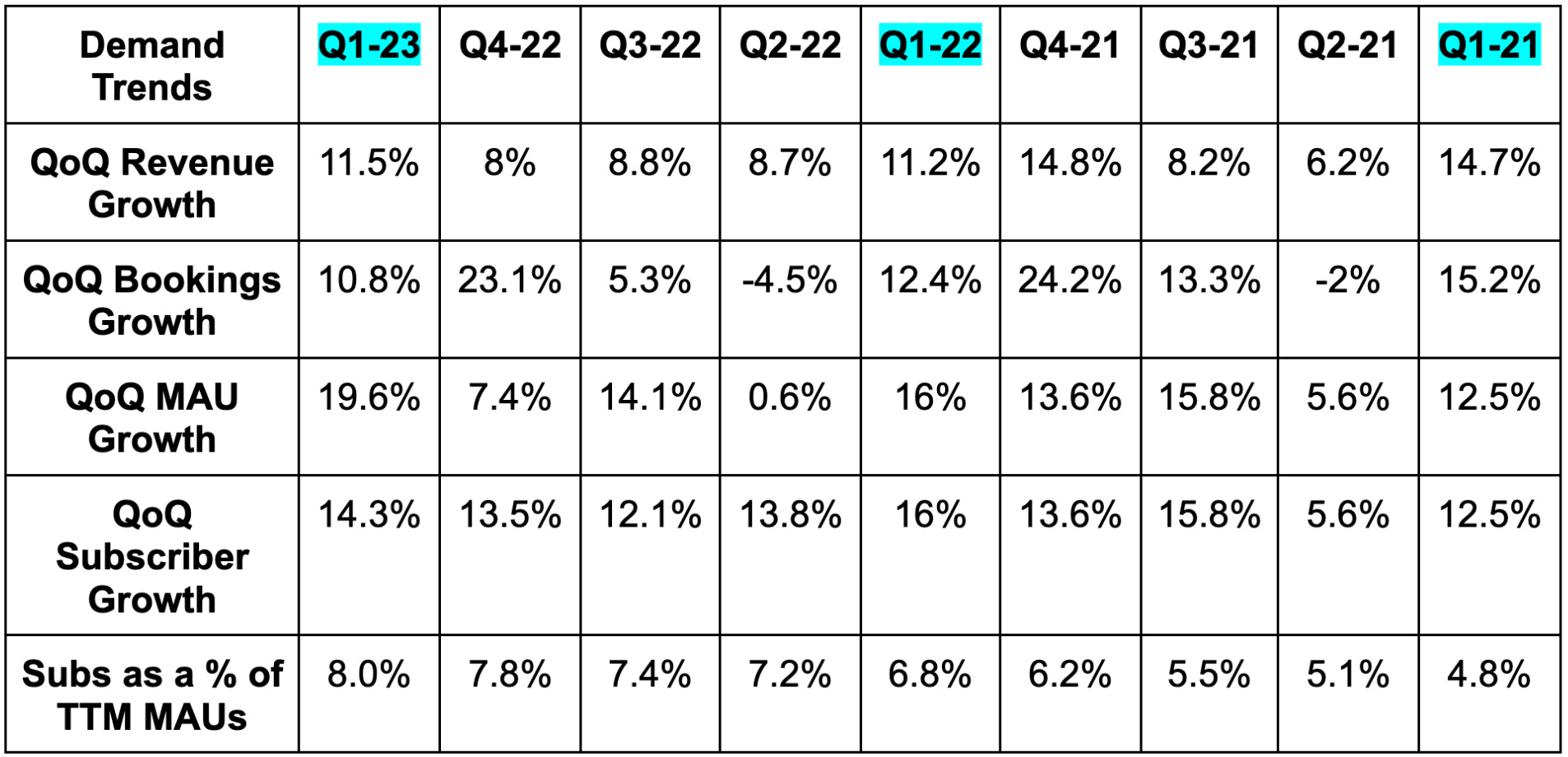

a. Demand

Beat bookings guidance by 8.6%.

Beat revenue guidance by 2.8% and beat estimates by 2.7%.

More Demand Context:

DAU to MAU ratio was 28% vs. 25% YoY.

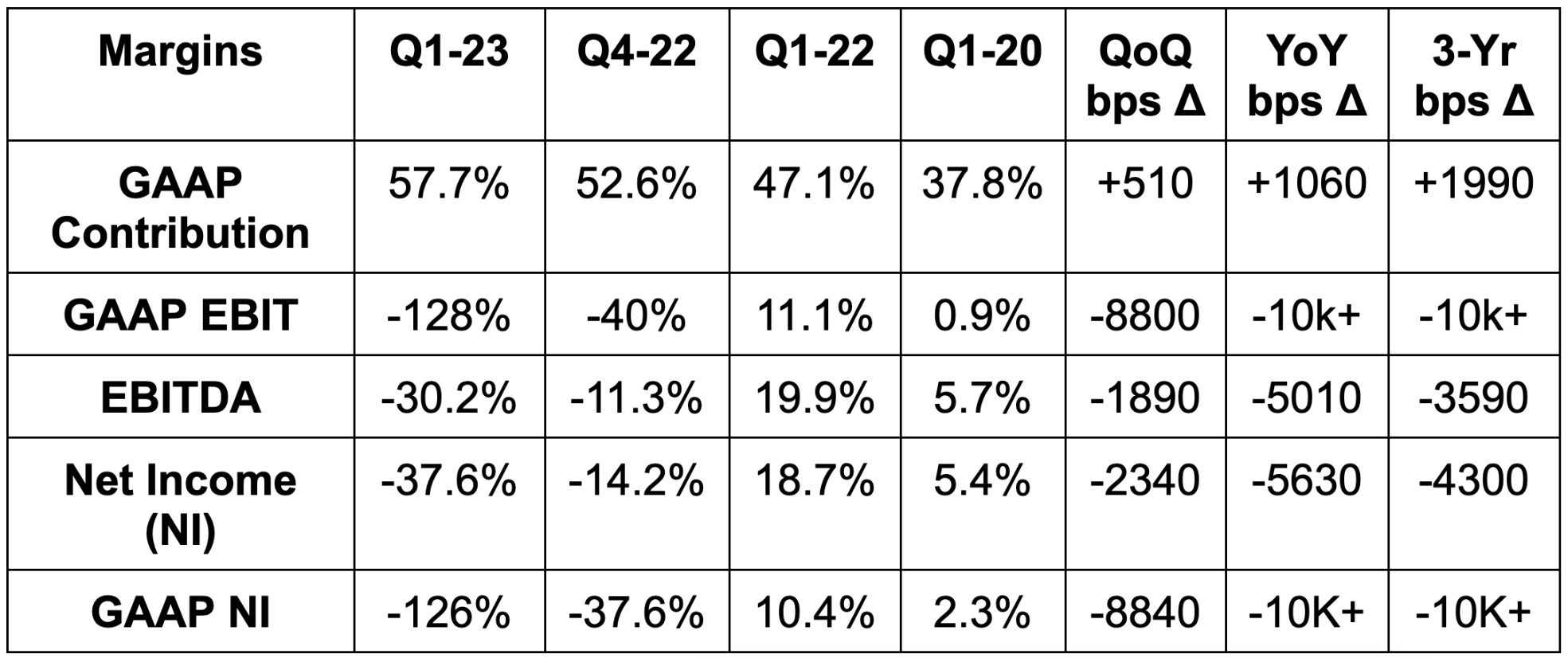

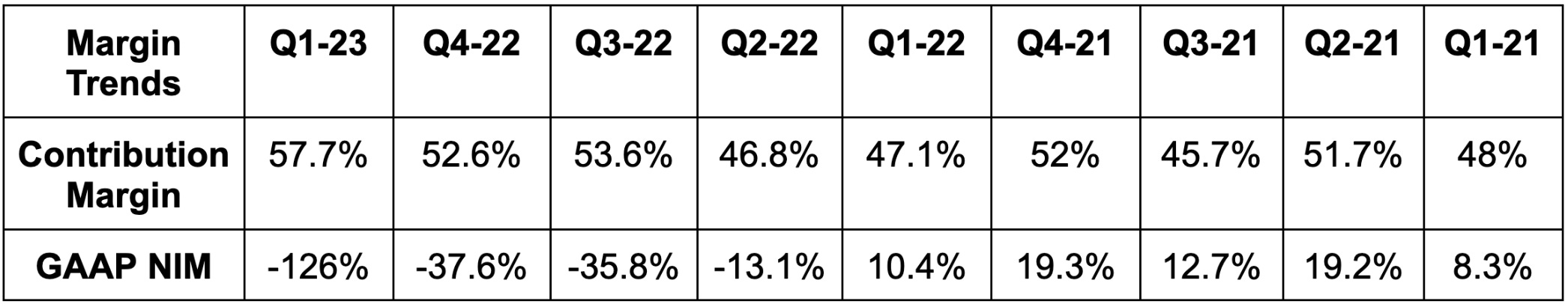

b. Profitability

Beat EBITDA guidance by 41% and estimates by 41%.

Beat GAAP EBIT estimates by 12.4%.

Beat -$0.24 GAAP EPS estimates by $0.18 or 75%.

Missed GAAP GPM estimates by 80 bps.

More Margin Context:

Incremental EBITDA margin was 32% which is already at Duolingo’s long term EBITDA margin target of 30%-35%.

Cost buckets:

GAAP R&D = 40% of sales vs. 37% YoY.

GAAP sales and marketing (S&M) = 14% of sales vs. 18% YoY.

GAAP G&A = 26% of sales vs. 33% YoY.

c. Balance Sheet

$641 million in cash and equivalents with no debt.

Stock compensation was 18.2% of sales vs. 18.0% YoY. This was the only thing to pick at from the report as it remains somewhat elevated. It’s still being impacted by IPO-related equity awards and is fully expected to shrink over time. Share count grew 5.2% YoY. Again, that needs to slow materially which is expected based on 2023 guidance of roughly 2% dilution.

d. Guidance

Q2:

Revenue beat estimates by 3.5%.

EBITDA beat estimates by 24.5%.

100bps of R&D leverage; 300bps of G&A leverage; 150bps of S&M leverage.

2023:

Raised its bookings guide by 3.8%.

Raised its revenue guide by 2.5% which beat estimates by 2.2%.

Raised its EBITDA guide by 7.0% which beat estimates by 7.6%.

Incremental EBITDA margin of 32%.

Importantly, its new subscription tier (Duolingo Max) is NOT included in guidance. Any revenue there would be upside.

2% dilution.

e. Call & Letter Highlights:

AI:

Following Chegg’s report, there were growing fears that ChatGPT would ruin demand across all of online education. What these concerns didn’t consider is that Duolingo is for learning… not for cheating like with Chegg.

AI has been in the company’s DNA since inception with products like Birdbrain customizing lesson difficulty with large learning models for several years. It sees its data scale lead as putting it in an ideal position to enjoy the benefits of Generative AI. Furthermore, it has been working with OpenAI since 2021 and was a pre-launch partner for ChatGPT-4. Duolingo thinks this is the perfect complement for its own proprietary models to make it even more effective and engaging; it is not using “off the shelf” versions of these models which can be easily replicated. Large language models are “great to train on the worldwide web” but have “very generic information.” Duolingo creates more complex, purpose built models that it doesn’t see its competition emulating.

It is already using ChatGPT-4 to create more advanced content in a microscopic fraction of the time that it used to take. Its new Duolingo Max subscription tier is also built using ChatGPT-4 as a core element.

“I feel very fortunate to be among the companies with the best chances of taking advantage of the rapid advances in AI.” — Co-Founder/CEO Luis von Ahn

The team reminded us that von Ahn wrote his grad school thesis on how AI can help humans become more successful. He was born for this opportunity.

Math:

Duolingo Math is “growing entirely organically and at a very nice pace.” The firm remains in product perfection mode and is not yet monetizing it. The product is #32 on Apple’s education app rankings and #7 for math just a few months into launch (with no marketing).

f. Take

There’s nothing to say here except excellent quarter… again. This is my second largest holding and I have no plans to trim any more shares.

TTD and DUOL are execution machines

Excellent work as usual, Brad. Thank you.