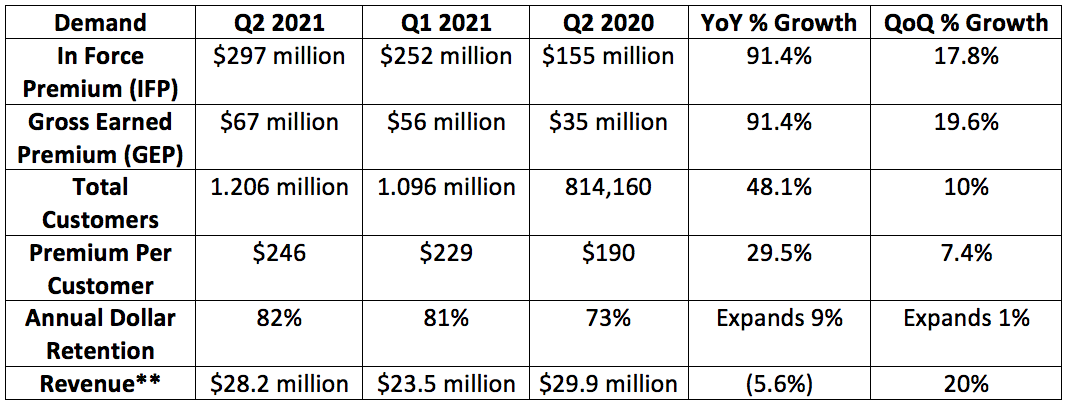

1. Demand

**In the 3rd quarter of 2020, Lemonade conducted an accounting change to cede 75% of its premiums to reinsurers (while retaining a 25% commission). This prevented the company from recognizing these ceded premiums as revenues, thus making year over year revenue comparisons apples and oranges. We will lap the change after next quarter when revenue growth will again become relevant.

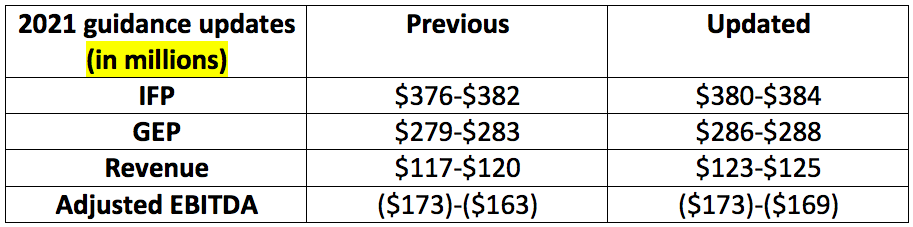

These results beat the high point of the company’s guide across the board, including:

A 3.1% high point in force premium (IFP) beat

A 3% high point gross earned premium (GEP) beat

A 4.4% high point revenue beat

The company plans to gradually reduce the portion of premiums ceded to reinsurers over time as its book grows and matures. It did so this quarter by cutting its ceded premium rate from 75% to 70%. Lemonade has the flexibility to reduce it down to 55% throughout the course of its current 3 year contract.

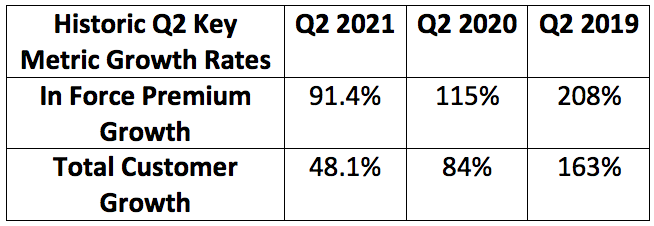

This marks the 3rd straight quarter of accelerating IFP growth. Lemonade also posted its 4th straight quarter of accelerating premium per customer growth pointing to insurance products outside of renters continuing to proliferate for the organization. The 29% increase in premium per customer is its largest quarterly jump in the metric to date.

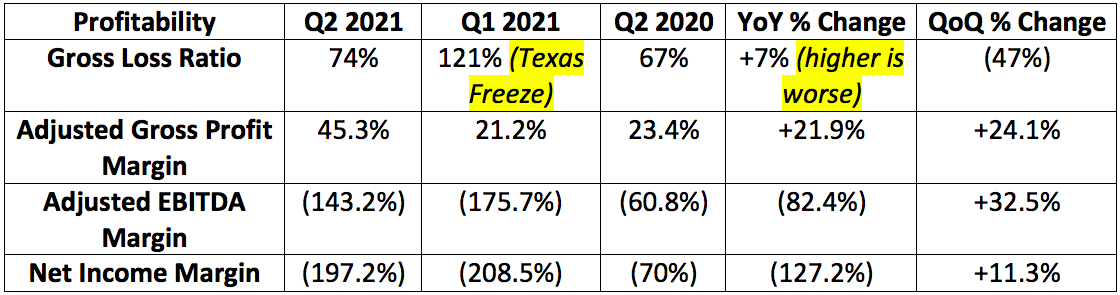

2. Profitability

The company guided to ($43)-($40) million in adjusted EBITDA. It posted in-line results of ($40.4) million.

The gross loss ratio increase was powered by new products making up a larger portion of new business. These products have a higher loss ratio at launch with that ratio falling over time.

Gross profit margin benefited from the ceded premium accounting change highlighted above.

Adjusted EBITDA and Net Income margins suffered from the ceded premium accounting change highlighted above.

3. Guide Updates

4. Shareholder Letter

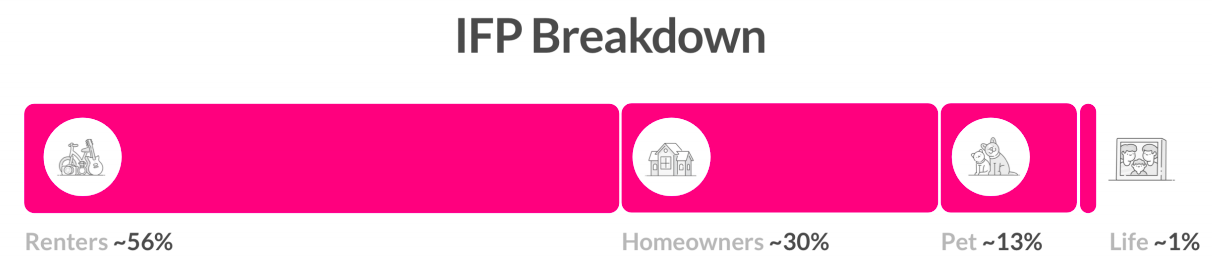

a. The Product Mix

Renters represented 50% of the company’s new premiums during the quarter. This was down from 75% in the year over year period and stable sequentially. This change has been fostered by up-selling renters and the cross-selling of pet and life.

Last year, renters policies made up 75% of Lemonade’s total business. That number fell to 56% this quarter as higher premium channels continued to rapidly grow.

b. Lemonade Car Insurance

Based on the results of a 10,000 Lemonade-customer survey, the company has “developed from scratch an end-to-end , digital-first car policy management system.” It’s core goal as always is to delight its users at every turn.

“We’ll use telematics data to implement a nuanced pricing structure to provide a fair price for safe drivers as well as ensuring a low-risk book of business.” — President Shai Wininger

“We don’t anticipate any regulatory issues on the car product, it’s just difficult to time the process.” — CEO Daniel Schreiber

The company is not ready to announce a launch date — regardless of the product development being “ahead of schedule” — as that date is based on regulatory approvals. It does continue to anticipate the product will be released “within the year” and CEO Daniel Schreiber did say the launch is “imminent.” IFP guidance for 2021 includes a $0 contribution from car insurance. Expect more updates in the coming quarters.

c. Lemonade Pet Insurance

It took pet insurance just a few months to achieve the LTV/CAC (lifetime value/consumer acquisition cost) that its homeowners product achieved in “a few years.” This reality has prompted the company to sink its teeth into pet growth even more aggressively.

Cross-selling represents 30% of the company’s total pet IFP.

d. Lemonade Life Insurance

This quarter marked the move from product development to product advertising for Lemonade’s life insurance product. The dollars it’s spending here are still quite small compared to other channels but “the early signals are strong, with tangible traction and conversion funnel improvement achieved throughout the quarter.”

“We are more bullish on profitable life insurance than we were at launch just a few months ago”. — CEO Daniel Schreiber

Daily new sales are trending well above the 1% of Lemonade premiums that life insurance currently contributes to the company’s overall business.

e. Lemonade Homeowners Insurance

This segment outpaced overall company growth with triple digit year over year expansion.

Direct to Lemonade channels continue to work for the homeowners product, but it’s now finding growth here in other encouragingly efficient places. Insurance agent partners (referrals) and Lemonade graduates (word-of-mouth) have doubled their % contribution to overall Lemonade home insurance sales year over year.

f. Lemonade Renters Insurance

This is the original and most mature segment of the business and still delivered 50% year over year growth in Q2 2021. The company continues to see downward CAC pressure via cross-selling and funnel optimization as well as upward LTV momentum due to loss ratio improvements here.

This quarter Lemonade launched its renters product in Florida — the 4th largest market in the nation. The company plans to be very slow and methodical with rolling out other products in Florida as natural disaster there make that state rather complicated.

It’s important to remember 2 things for the renters product:

Lemonade uses renters as a means of customer acquisition by undercutting competition to gain market share and loyalty. It then charges market rates for the remainder of its products.

The renters premium opportunity is quite limited compared to its newer products.

If Lemonade is to be a successful investment overtime, it will be because its other products succeeded along with renters.

g. Early Signs in Europe

The company began to shift a small portion of investment dollars from North America to Europe in response to rising conversion rates and declining loss ratios across the pond.

The product is starting to gain attention thanks to claiming the following awards:'

5-stars for best product quality on MoneyView Research — a Dutch insurance rating company

Best product from Consumentenbond — a Dutch consumer protection organization

Best score for a digital service by Focus Money — a German financial publication

Lemonade anticipates to more dramatically shift investment dollars internationally starting in 2022.

h. Management Commentary

Lemonade head count grew by 97% year over year.

Schreiber believes Lemonade has the liquidity today to reach cash flow breakeven without raising more funds.

5. My Take

This was a strong quarter for Lemonade. Some are worried about regulatory hurdles for car insurance, but even without it contributing to IFP guidance, the outlook was raised for 2021. I am also heartened to see net sequential customer adds rise well above 100,000 for the quarter.

New products continue to work, growth remains lofty and we remain a few years away from free cash flow. With $1.2 billion on the balance sheet, it does not need to be profitable today and has the luxury of most aggressively pursuing market share. This one will take a very long time to play out, but so far so good.

Thank you for reading!

Hi Brad, great article and thanks for sharing :) May I check with you regarding the fuzz right now on fintwit about insider selling by CEO of LMND? Daniel, CEO sold 300k shares at the high in January 2021. That was 85% of his shares. He now has 50k shares left this seems to me a red flag as he has significantly reduced his skin-in-the-game in LMND ? May I get your view about Daniel, CEO trimmed his shares from 900KU to 50KU in just 2 months (Dec 2020/Jan 2021) ? Should we be worried as it clearly shows management has substantially reduced his skin-in-the-game ? It’s not the number that concerned me, it’s that he sold like 95% of his shares in two month. Looking forward to hear from you. Thanks, BK. https://twitter.com/badpak/status/1423047999744356354?s=21