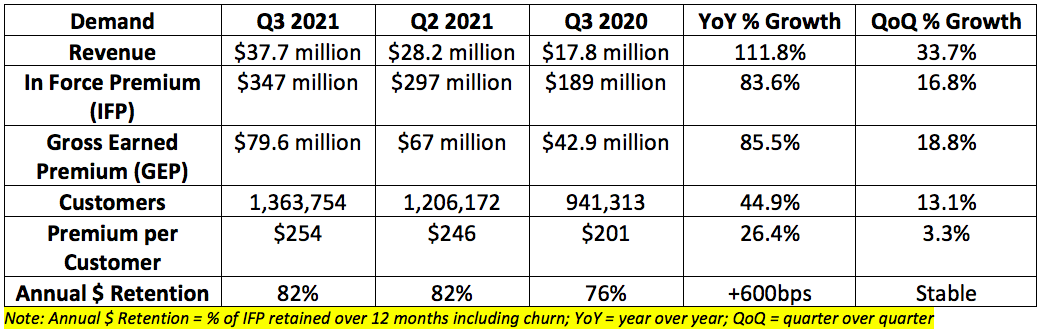

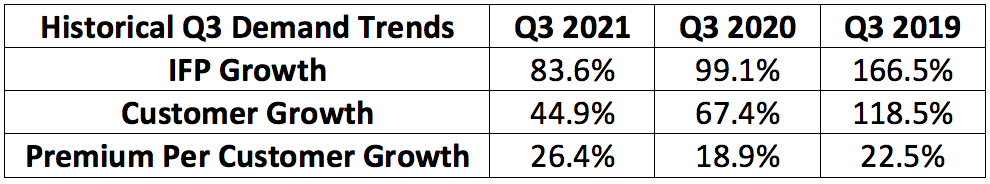

a. Demand

Lemonade guided to the following:

$32.5-$33.5 million in revenue. It posted $37.7 million beating the midpoint by 14.2%.

$336-$339 million in IFP. It posted $347 million beating the midpoint by 2.8%

$76.5-$77.5 million in GEP. It posted $79.6 million beating the midpoint by 3.4%

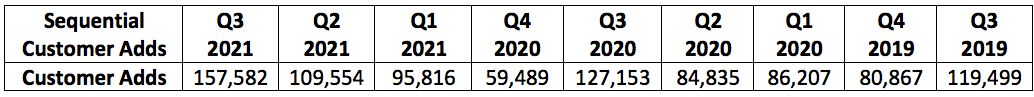

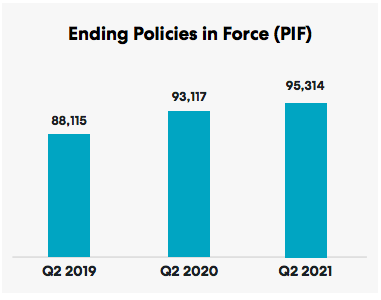

13.1% sequential customer growth accelerated briskly vs. 10% sequential customer growth last quarter. Lemonade continues to enjoy healthy net customer additions each quarter:

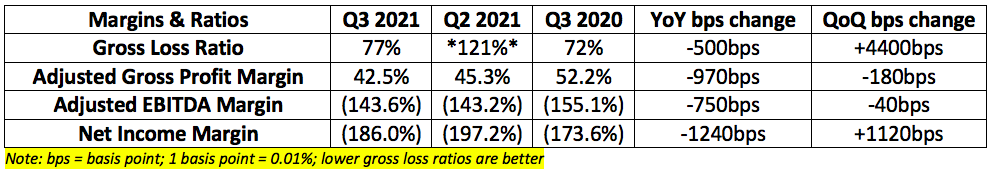

b. Profitability

Lemonade was expected to lose $1.16 per share. It lost $1.08 per share beating expectations by $0.08. It was also expected to lose $53.4 million in adjusted EBITDA. It lost $51.3 million beating expectations by 3.9%.

*Note that last quarter’s gross loss ratio was severely impacted by the Texas Freeze. This made the sequential comparison uniquely easy and should be taken with a grain of salt.

The adjusted gross profit margin decline during the quarter is due to the higher YoY loss ratio as its newer products proliferate — newer products initially come with higher loss ratios. The loss ratios and unit economics on its original renter product both continue to improve but that segment is also (encouragingly) becoming a smaller piece of the business.

The adjusted gross margin still compares extremely favorably to the 21.1% it posted in the same period for 2019 — this is partially due to the same accounting change that hurt revenue growth for the last 4 quarters but also due to improving unit economics.

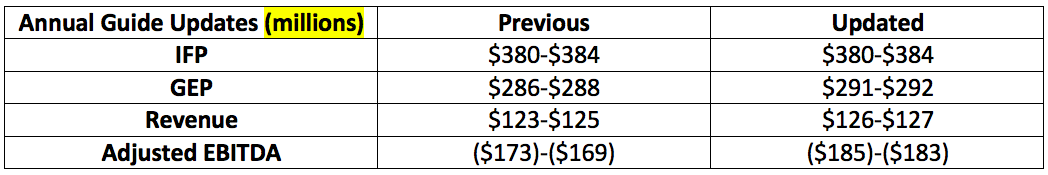

c. Guide Updates

Lemonade guided to the following for the 4th quarter:

$380-$384 million in IFP

$88-$89 million in GEP

$39-$40 million in revenue (1.2% ahead of analyst expectations)

Lemonade directly addressed the worsening EBITDA outlook in the shareholder letter and explained the change with the following reasons:

Conservative assumptions on how quickly marketing efficiency recovers.

Pulling forward 2022 operating costs to support its accelerated car launch timeline (now with 49 state licenses and Metromile’s data in hand). All customer facing teams have been staffed ahead of launch for car to train and prepare them for all the expected growth.

d. Lemonade is Buying Metromile

Lemonade is buying Metromile — a car insurance-technology company — in an all stock deal for an equity valuation of $500 million fully diluted or just over $200 million when netting out Metromile’s cash.

Lemonade was especially interested in Metromile’s expertise with telematics and precision sensors and all of the data coming from the 400 million road trips these sensors have taken. Metromile is a trailblazer in leveraging its customer’s training data to predict losses per mile driven. The tangible result is Metromile customers saving 47% by switching to it with loss ratios within 10% of GEICO and Progressive. It even lowered its user’s premiums by 16.2% in real-time during 2020 to adjust to lower driving rates and to avoid overcharging — talk about refreshing.

This savings and fairer pricing is powered by embracing pricing based on precision (tracking and recording data on driving behavior) rather than proxies (credit scores and marital states). With an estimated 2/3 car insurance customers paying 30% too much in premiums, this downward cost pressure is important. Despite telematics driving so much savings — or perhaps because of it — 96% of incumbent car policies do not use any sensors at all with the remaining 4% generally underweighting the signals.

Lemonade’s own brand-new car product does leverage telematics to help quantify risk — but it’s a newbie in this endeavor and competing in a dauntingly competitive space. Metromile’s more established product here — in the words of Co-CEO Daniel Schreiber — “will vault Lemonade over the most time and cost intensive parts of the journey.”

It would’ve taken Lemonade years to scale its auto business to get it to a point of maturity where loss ratios were competitive — this purchase allows Lemonade to avoid that growing pain process. With these acquired assets, Lemonade jumps from merely embarking on aggregating and analyzing data to better quantify loss per mile to being a seasoned veteran in doing so overnight.

“The riskiest 5% of drivers are 10X more likely to crash [vs. the average]. Most insurers can’t tell who is who but Metromile is able to identify these drivers with unrivaled precision. This deal allows us to skip over the riskiest part of our car ambitions: growing Lemonade Car before our data models season.” — Daniel Schreiber

Lemonade is not buying Metromile because it’s a great business on its own. Lemonade is buying Metromile because the company has the assets to accelerate Lemonade’s dive into car insurance. Schreiber even directly acknowledged this when he stated that Metromile is not “celebrated” for its growth but is “celebrated” for its innovation in telematics and data science. I see the move as similar to SoFi Technologies or Ozon buying small banks for licensing and I am a fan of the decision.

“Metromile’s algorithms hold the promise of propelling Lemonade Car from a newcomer in the car insurance space to its vanguard.” — CEO Daniel Schreiber

“Our companies enjoy a near-perfect overlap of vision and culture — yet have almost zero overlap in products and licenses. Those are the building blocks of a rewarding union.” — CEO Daniel Schreiber

Developing a brand new car insurance product (in 12 months) is unprecedented — this makes me far more comfortable in Lemonade’s ability to succeed here and gives it immediate licensing in 49 states vs. the 1 state its licensed in currently. An associate of mine working at another car insurance disruptor told me it has taken his company 2 years to get licensed in 38 states; this is a time consuming process and Lemonade just skipped the line.

Metromile also comes with $100 million in, in-force premium (IFP) and $250 million in cash for Lemonade to add to its already strong balance sheet. Schreiber believes it will take 18 months to fully integrate these two companies — all of Metromile’s assets will be re-branded as Lemonade.

“Injecting all the Metromile mojo into Lemonade Car could make the most seamless and customer-centric car insurance product also the most affordable, differentiated, precise and fair. That’s the plan.”

e. Shareholder Letter

On business momentum:

“Across our book of business, we are seeing trends that enhance customer lifetime value -- most notably the increasing prevalence of bundling and improving loss ratios for newer products -- giving us the confidence to accelerate our pace of investment.” — Schreiber

More highlights:

The $50 million in sequential IFP marks the 3rd consecutive quarter of record sequential IFP adds.

The renter business enjoyed a 25% sequential increase in new business but growth rates in its other (newer) lines of business continued to outpace renter growth.

Lemonade added a record number of new sequential renters during the quarter.

The 3rd quarter is seasonally strong for Lemonade although healthy demand was the primary reason here and not seasonality.

On philosophy:

Lemonade will continue to prioritize market share and growth far above profitability. With $1.1 billion in cash and equivalents on hand, a lifetime value to customer acquisition cost (LTV/CAC) ratio comfortable above 2x and the traction it’s clearly gaining, I think this is the right decision. If you are looking for profitability in the near term from this company you will not find it here.

On the evolving premiums mix and cross-selling:

Sequential updates to the company’s premiums mix:

Renter is now 53% of premiums vs. 56% sequentially.

Pet is now 15% of premiums vs. 13% sequentially.

20-30% of new customer sales are coming from pet insurance.

1/3 pet policy sales are to existing customers.

Homeowner remained at 30% of premiums.

Life is now 2% of premiums vs. 1% sequentially.

Bundles now contribute 8% of total IFP vs. 0% just 12 months ago when pet insurance launched; the company enjoyed a “record volume” of cross-selling activity this quarter. Its multiple policy customers have quadrupled year over year and contribute a premium per customer of roughly $762 vs. $254 for the company’s book as a whole.

On investing in Europe:

Lemonade will re-allocate some of its marketing spend away from life insurance and to growth in Europe in the near term as a result of encouraging loss ratio trends within that continent. The company continues to see Life being a successful piece of its business going forward.

The company expects Europe growth to outpace growth in North America in the future.

I actually found this to be bearish as it depicts less short-term confidence in its life insurance product. At the same time, I’m excited to see what impact Europe can have on its IFP and customer growth.

On Apple privacy changes:

Lemonade’s marketing efficiency worsened by 26% due to Apple targeting changes. Lemonade stated that this hurt them less than most and that it’s seeing marketing conversions recover (and was still able to beat on its top-line guide handsomely).

On loss ratios:

Gross loss ratio rising from 72% to 77% (lower is better) is solely due to the increasing contribution of newer products like pet and homeowner insurance. All individual product loss ratios are improving.

Newer products inherently come with worse loss ratios as Lemonade becomes more capable of quantifying risk. This ends up placing downward pressure on these loss ratios over time.

Loss ratio highlights:

Pet loss ratio improved 4% quarter over quarter.

Homeowner loss ratio has improved 52% year over year.

The company continues to see a “clear path” to overall loss ratios sustainably below 75% in the long term.

f. Co-CEO Daniel Schreiber Notes

As a reminder, Lemonade reduced its portion of ceded premiums last quarter from 75% to 70%. It sees this re-insurance rate continuing to fall in the coming years.

“We see re-insurance as an option, not as a necessity.”

Schreiber was asked about Lemonade partnering with auto OEMs for its car product. While he wouldn’t offer specifics he did hint at this being very much so on the table — especially considering Metromile’s existing relationships.

Schreiber reminded investors that Lemonade could be profitable today if that was its main focus — but that’s not the main focus and will not be for some time to come. Again, the plan is to lean into market share and growth. That will continue.

Metromile is licensed in 49 states and currently operating in 8 states. There were plans to double that footprint next year and Lemonade is planning to greatly accelerate that state rollout process.

g. CFO Tim Bixby Notes

80% of the premium per customer growth was driven by cross-selling with other 20% due to plan graduation and pricing power. There was a time when that split was 50-50 but bundling continues to gain more steam.

Global headcount grew 111% YoY to 969 with marketing spend also growing at a lofty 90% YoY rate.

h. My Take

Lemonade remains in hyper-growth mode and far from profitability. Strong demand and a solid balance sheet paired with a favorable LTV/CAC ratio gives me the confidence that the company should be spending as aggressively as it is on market share. Still, this investment will take a very long time to play out. The company is 5 years old — extreme patience is required. Good quarter.

Very high conviction on this controversial stock! Thank you! 👍

I am long on LMND. Simply because it is a great consumer product, actually a much needed product. Not too happy with the generous stock based compensation, but otherwise it is indeed a promising long term bet. @Bradd thanks for this neatly compiled analyses. You have strengthened my conviction here.