“We continue to see strong engagement and have the most exciting roadmap I’ve seen in a while with llama 2, Threads, Reels, AI products in the pipeline and Quest 3 this fall.” – CEO Mark Zuckerberg

1. Demand

- Beat revenue estimates by 3% & beat guidance by 4.1%.

- Slightly beat user growth estimates for Facebook & its Family of Apps (FOA)

- FOA revenue beat estimates by 3.8%.

- Beat ad impression growth estimates of 17.8% Y/Y with growth of 34% Y/Y.

- Missed price per impression growth estimates of -11.2% Y/Y with growth of -16% Y/Y.

Share

Demand Context:

- 19.6% 3-yr revenue compounded annual growth rate (CAGR) vs. 17.3% Q/Q & 15.1% 2 quarters ago.

- Meta has 3.88 billion MAUs of at least one of its apps and 3.07 billion DAUs. Still, company critics still will readily tell you “nobody uses the apps.” It’s hard to say if they’re immensely biased against Meta, don’t care about the objective data… or both.

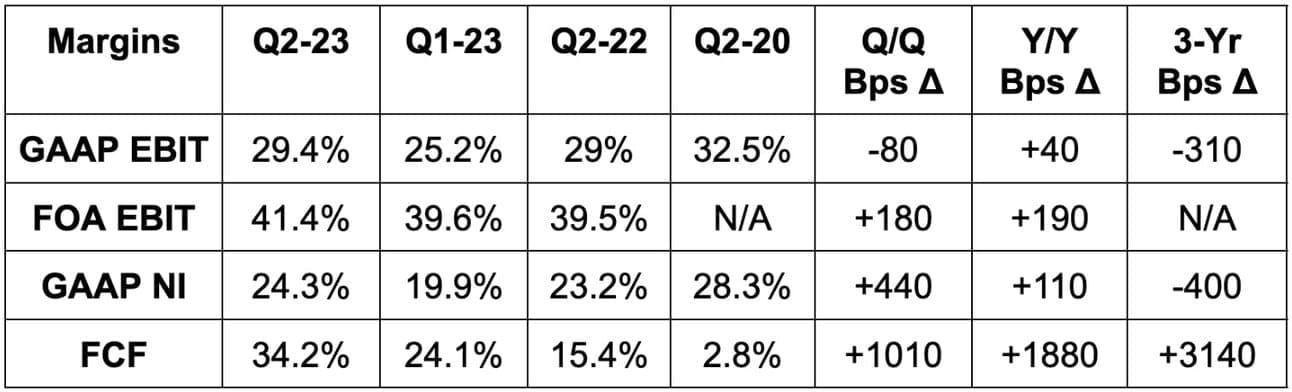

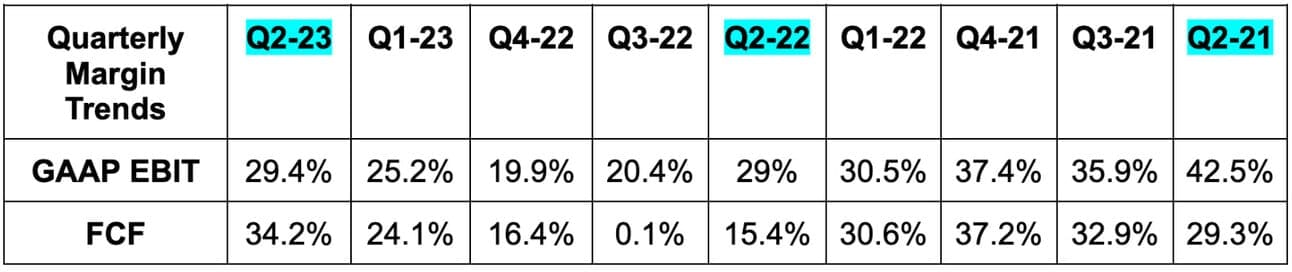

2. Margins

- Beat EBIT estimates by 1%.

- Beat $2.91 GAAP EPS estimates by $.07.

- EPS growth of 21% Y/Y beat 18.5% growth estimates.

- Beat FCF estimates by 78%. More later.

Margin context:

- Restructuring charges lowered EBIT margin by 2% this quarter and EPS by $0.25 for the quarter.

- Overall costs rose 10% Y/Y to $22.61 billion. Without restructuring and legal charges, operating costs Y/Y would have fallen by 2.4%.

- By segment, 82% of Meta’s operating expense (OpEx) was directed to the Family of Apps (FOA). FOA OpEx rose 8% Y/Y with the one time charges and Reality Labs OpEx rose 23% Y/Y with the one time charges.

- Net income was helped by Meta’s share price rising so quickly. This meant higher income tax deductions and a lower effective tax rate which will last through 2023.

- Meta differed some cash tax payments to Q4 of this year just like Alphabet did. This helped FCF growth.

3. Guidance

For Q3 2023, Meta’s revenue estimate was a robust 6.8% ahead of consensus. Revenue includes a 300 bps FX TAILWIND (which analysts had modeled into their estimates that Meta easily eclipsed).

For the full year, Meta raised its OpEx guide by 1.7% due to legal charges and lowered its capital expenditure (CapEx) guide by 9.5%. The reduction in CapEx was partially due to spend rationalization but mainly due to delays on data center projects and pushing some CapEx out to 2024. For this reason, CapEx will grow Y/Y in 2024 at a rate faster than in 2023 (as expected by the sell side) due to AI investments.

It offered a bit more color on 2024 cost guidance as well. Higher infrastructure spend and more depreciation (due to all of the CapEx since 2020) will mean more depreciation expense. This will drive Y/Y OpEx growth in 2024 while Meta resumes hiring at a very slow pace. Finally, Reality Labs losses will continue to rise in 2024. It will pull the learnings from 2023’s year of efficiency into 2024, but will also continue to invest in high priority areas as its growth accelerates. Expect cost growth going forward, but nothing like we saw heading into 2022.