1. Meta Platforms Demand

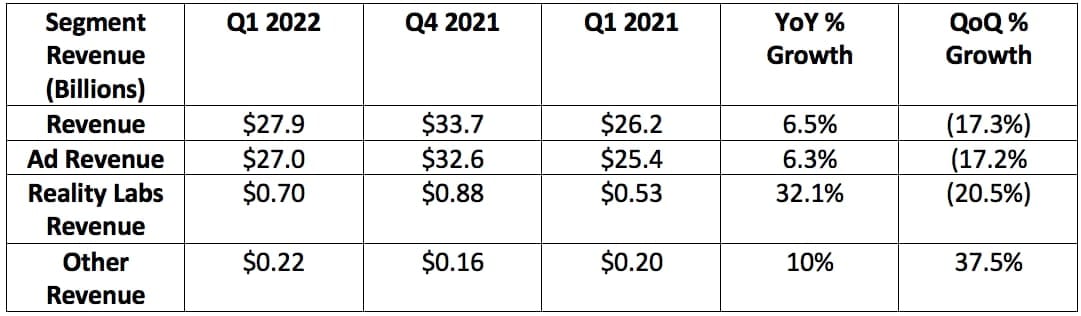

Meta guided to a midpoint of roughly $28.0 billion in revenue and analysts were looking for $28.2 billion. The company posted $27.9 billion, missing its expectation by 0.3% and analyst expectations by 1.1%. The 7% revenue growth would have been 10% growth without an $893 million currency headwind.

Ad impressions across the family of apps rose 15% YOY while price per ad fell 8% YoY.

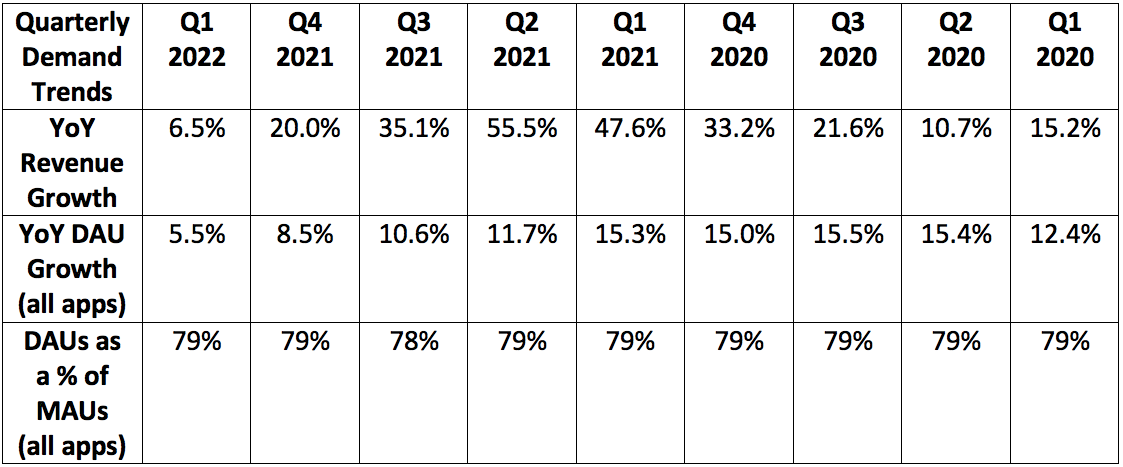

User growth was roughly in-line to slightly ahead of expectations across the board. I found it encouraging to see continued daily active user (DAU) growth for Facebook, specifically.

While it's not a metric most fixate on, I find DAUs remaining at 79% of MAUs to be an encouraging sign of durable, post-pandemic engagement.

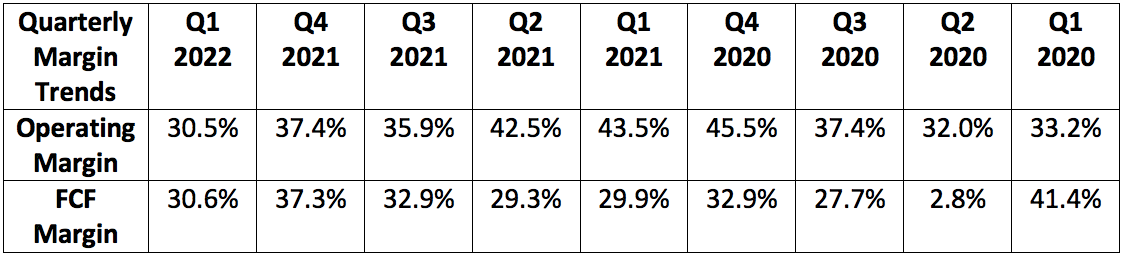

2. Meta Platforms Profitability

Analysts were looking for $2.51 in EPS for the quarter. The company posted $2.72 in EPS, beating expectations by $0.21.

3. Guidance

Q2 2022:

- Analysts wanted $30.7 billion in revenue. Facebook guided to a midpoint of $29.0 billion, missing expectations by 5.5%. This includes an assumed 3% unfavorable currency headwind like in Q1.

2022:

- Guided to a midpoint of $89.5 billion in total expenses vs. $92.5 billion previously. More on this later.

- Guided to $31.5 billion in 2022 CapEx (71% increase) -- unchanged.

Other quick notes:

- Facebook bought back $9.4 billion in stock during the quarter and has another $29.4 billion in buybacks left to deploy.

- Headcount rose 28% YoY to 77,805.

4. Notes from Founder/CEO Mark Zuckerberg

On Reels & AI-Powered Social Discovery:

Zuckerberg reiterated his confidence in Reels monetization continuing to ramp over the next several quarters to monetize at levels more similar to Feeds and Stories.

“Since I started Facebook 18 years ago, we’ve seen multiple media consumption shifts… back in 2012 when we transitioned to mobile, we saw explosive growth but not monetization and we leaned in anyway. We had a couple tough quarters until this became the foundation of our business. Similarly, in 2018 this happened with a shift to Stories from Feeds." — Founder/CEO Mark Zuckerberg