Meta Platforms Q3 2022 Earnings Review

Digging into the results of this struggling social media giant.

“The fundamentals are there for a return to stronger revenue growth in 2023. We’re approaching next year with a focus on prioritization and efficiency that will help us navigate the current environment and emerge stronger… I think those who are patient and invest with us will be rewarded.” — Founder/CEO Mark Zuckerberg

1. Demand

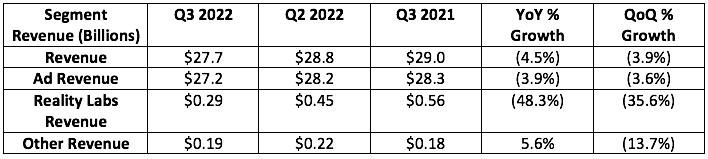

Meta guided to $27.25 billion in revenue while analysts were looking for $27.4 billion. It posted $27.7 billion, beating its expectations by 1.6% and analyst estimates by 1.1%.

More Context on Demand:

YoY revenue growth would have been +1.7% on a constant currency basis.

Advertising revenue YoY grew +3% constant currency which was better than the extremely low expectations.

Total impressions grew 17% YoY which was in line with expectations. Price per impression fell by 18% which was worse than expected.

Meta is still dealing with Reels monetization ramping and a weak ad market as significant revenue headwinds. Conversely, we have now lapped the bulk of the IDFA headwind and it’s now up to Meta to finish addressing measurement and targeting issues. This is no longer an Apple issue.

2. Profitability

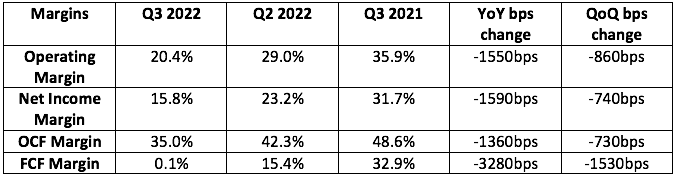

Analysts were looking for $1.86 in earnings per share. Meta earned $1.64, missing expectations by 11.9%. It earned roughly double that last year. Yikes.

Meta sharply missed analyst expectations of $2.82 billion in free cash flow (FCF). It generated close to $0 in FCF. Double Yikes. Capital Expenditure growth year-to-date of 66.4% was even faster than expected. Yikes Yikes Yikes.

More Margin Context:

FCF margin is where Meta’s heavy, heavy CapEx impacts margins the most noticeably.

Headcount grew 28% YoY. Meta expects 0% head count growth through the end of next year.

Family of Apps operating margin was 33.7% vs. 39% sequentially.

A $3.7 billion Facebook Reality Laps operating loss was actually a bit better than feared.

Liquidity & buybacks:

Meta bought back $6.55 billion in stock this quarter with $17.78 remaining left on the plan.

It has $41.8 billion in cash, equivalents and marketable securities with $10 billion in very affordable long term debt.

3. Guidance

Meta’s Q4 revenue guide of $31.25 billion missed expectations by 3.3%. Whispers on the street actually thought this would be a larger miss. It expects the 600 basis point FX growth headwind to intensify to 700 basis points next quarter.

More Context on Guidance:

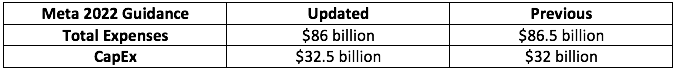

The $500 million reduction in the expense estimate includes an incremental $900 million charge from retail impairment charges this year. So this would have been $85.1 billion if not for the longer term savings decision.

For 2023, total expenses are expected to be $98.5 billion -- up 14.5% YoY. THIS WAS THE LARGEST NEGATIVE SURPRISE OF THE CALL.

Starting in 2024, CFO Dave Wehner told us that Meta expects to “pace Reality Labs investments to achieve its goal of growing overall company operating income in the long run.” Quite vague.

Meta also expects to “return to stronger levels of revenue growth next year.” I would hope so, considering YoY growth is currently negative.

4. Conference Call Notes

On Engagement and Product Trends:

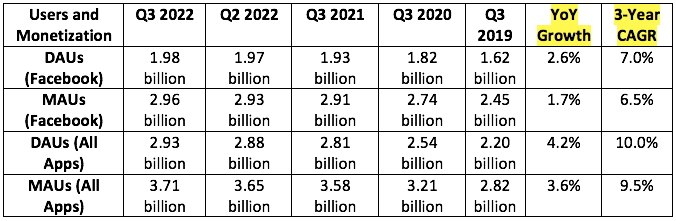

Zuck spoke on the product trends Meta is seeing being more positive than public commentary indicates. Facebook is setting daily engagement records, Instagram is over 2 billion MAUs and WhatsApp is now over 2 billion DAUs. Interestingly, North America has now morphed into WhatsApps strongest growth market. Time spent on Facebook in the United States even continues to rise following the positive pandemic shock.

Click to Message ads for Meta reached a $9 billion revenue run rate ($1.5 billion for WhatsApp alone growing 80% YoY).

On Reels:

Reels consumption is up 50% in the last 6 months and continues to be incremental to time spent trends.

Reels content is now shared 1 billion times per day and has reached a $3 billion revenue run rate vs. $1 billion just 3 months ago.

Still, it remains cannibalistic to overall revenue by $500 million per quarter as monetization continues to be worse than other formats (as expected)… but progress continues to exceed hopes and Meta now expects this to turn to a revenue tailwind in “12 to 18 months.”

Zuck added that Meta is now seeing clear signs of Reels taking share from TikTok.

On 2023 Cost Growth:

Most of the OpEx growth in 2023 is coming from already hired employees from 2022 adding to YoY payroll comps. Meta expects headcount to be the same in 15 months as it is today, so that growth will slow after 2023.

All of the CapEx growth in 2023 is coming from the build out of infrastructure to shift more of its business to being AI-powered. This requires a lot more computing and server capacity/sophistication. CapEx growth will moderate in 2024.

Reality Labs expense growth in 2023 will be driven by the launch of the new consumer headset.

More data center capacity (which is expected to drive longer term savings) is the other large piece of the expense growth.

Meta will incur an added $2 billion in costs from impairment charges related to downsizing its Real Estate footprint.

“I know a lot of you disagree with the Metaverse investments. But I think it would be a mistake not to focus here. The historic work we are doing will be talked about decades from now.” — Founder/CEO Mark Zuckerberg

On Ads:

Apple’s new ad boosting policy announced this week is not expected to have a material impact on Meta’s revenue.

“We continue to improve ad measurement performance… We are pleased with the progress on helping advertisers boost their returns. Our Advantage+ Shopping launched in August with a recent test showing a 32% rise in return on ad spend (ROAS) for advertisers.” — Incoming CFO Susan Li

5. My Take

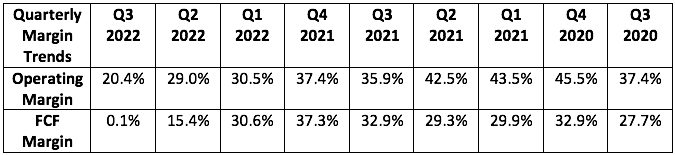

This was a bad quarter. Meta missed forward guidance expectations that had already been sharply lowered… lowered and then lowered some more. It showed little evidence of mid term operating leverage and has made no material progress on recovering price per ad impression. Expenses are growing even faster than I thought they’d be and forward demand expectations are not justifying that added expense growth. Its Family of Apps (FOA) cash cow is showing clear vulnerability with nearly 600 basis points of SEQUENTIAL margin contraction, and that makes the wildly aggressive Metaverse investments less and less appealing to me.

I did not invest in Meta expecting it to become such a speculative bet, and yet here we are. My confidence in team righting this growingly fragile ship is at an all time low, and I am pausing accumulating shares in the firm for the time being. I am not selling any shares. This is a falling knife until its fundamental performance shows stronger signs of improvement. While it looks cheap today, I have zero confidence in earnings estimates having found a trough -- they could absolutely fall more from here. Management is clearly optimistic that its heavy investments are working, but I’d like to see that optimism translate into much better results before I get excited.

They also produce GOBS of cash… and literally half the world almost uses their services. I believe they are much stronger than they are perceived to be. They have the courage to innovate, and literally create their own markets…. That is powerful long term. Also, won’t be the first time he does that.

Good job - thanx.