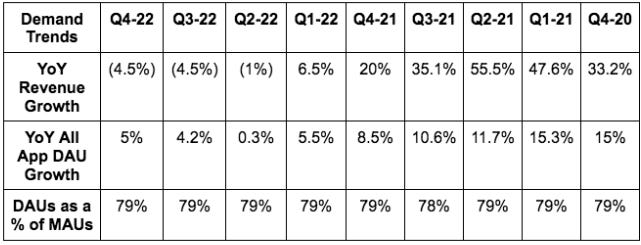

1. Demand

Meta beat revenue estimates by 1.6% & beat its guide by 2.9%.

Demand Context:

DAUs for Facebook in the U.S. -- its most mature market -- rose 1% QoQ & 2.1% YoY. Despite what some say, Facebook is not dead… at all. It was hibernating through the post-pandemic hangover as I said all along.

Facebook Reality Labs revenue fell 18% YoY & more than doubled QoQ (hardware release).

FX was a 700bps headwind to growth.

Its 15.1% 3-year revenue CAGR compares to 16.2% last Q & 19.5% 2 Qs ago.

Ad impressions rose 23% YoY; price per impression fell 22% YoY. Reels, Apple signal loss and weak macro all are contributing to pricing pressure… BUT:

Meta is now through Apple’s IDFA change making cross app data sharing (and so targeting) more difficult . The 8% IDFA revenue growth headwind in 2022 will now turn to a YoY comp TAILWIND starting in Q1. This is happening as its ad investments and Reels monetization both take hold. Compelling setup.

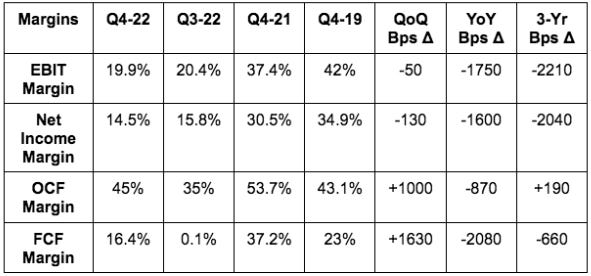

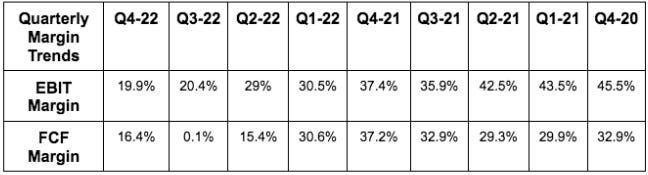

2. Profitability

Meta missed EBIT estimates of $7.54 billion by 15%. This includes restructuring charges explained below. It would have earned $10.6 billion in EBIT without these charges. Similarly, EPS missed $2.23 estimates by $0.47, but Meta’s $1.76 in earnings would have been $3.00 with no restructuring charges.

Meta nearly doubled free cash flow estimates which is the profit metric not impacted by these charges.

Margin context:

Meta’s EBIT margin was 33% ex-restructuring charges.

Heavy CapEx investments to build out data center infrastructure hits FCF directly as FCF = OCF - CapEx.

The Family of Apps EBIT margin improved from 33.7% to 34% QoQ. That was perhaps my favorite piece of the call. Stabilization here is key.

The lion’s share of Meta’s expense growth during the quarter was allocated to Family of Apps and not the Metaverse.

Restructuring charges from Q4 2022 totaled $4.2 billion and include real estate downsizing, layoffs and cancelling data center projects as it pivots to a “next generation data center layout” (more later).

NOTE — Meta incurred $1 billion in restructuring charges previously earmarked for 2023. This hit margins harder than expected this Q but will help them in 2023.

3. Balance Sheet

Bought back $6.9 billion in stock vs. $6.6 billion QoQ. It had $10.9 billion left on its buyback, but announced a fresh $40 billion infusion to that program.

Combined, that equates to more than 10% of its market cap.

$40.7 billion in cash, equivalents and investments.

$10 billion in cheap long term debt.

4. Forward Guidance

Q1 2023:

Meta met forward revenue estimates of $27.3 billion at the midpoint.

This assumes a 2% FX headwind for the quarter

2023

Meta lowered its operating expense (OpEx) guide from $97 billion to $92 billion.

This is due to lower payroll growth and slower cost of revenue growth as it extended the useful life of some data centers (less depreciation). Incurring $1 billion of the $2 billion in expected 2023 restructuring charges in Q4 helped too.

Meta also lowered its capital expenditure (CapEx) guide due to lower data center construction spend planned as it pivots to a next generation data center architecture. This new format is set to deliver capital intensity easing which should boost run rate free cash flow margins. It also gives Meta more flexibly in scaling construction with “lower upfront capital outlays” and spend ramping based on actual need rather than estimates. The overall construction is also “cheaper and faster.”

5. Conference Call Notes:

On Family of Apps Engagement:

Leadership told us the product engagement trends Meta was enjoying last quarter strengthened this past quarter.

Reels consumption doubled YoY and Reels shares doubled over the last 6 months.

The AI discovery engine investments are boosting engagement across all content forms -- as expected. Considering all of the data we’ve gotten from institutions this past month, this isn’t surprising, but is still encouraging.

On Family of Apps Monetization & Ad Targeting

Monetization efficiency on Facebook Reels doubled in the last 6 months.

The profit headwind from Reels ramping (doesn’t monetize as well as other content forms yet) is expected to become neutral by the end of 2023.

Advertisers enjoyed a 20% rise to ad conversions YoY as Meta’s advertising investments to address IDFA’s void take hold.

Customer acquisition cost (CAC) fell 20% YoY meaning advertisers enjoyed a large return on ad spend (ROAS) boost. Ad investments like lengthening attribution windows, campaign automations, enhanced audience segmenting & sharpening reporting are also further boosting ROAS.

Click to message ads reached a $10 billion revenue run rate vs. $9 billion QoQ.

50%+ of click to message advertisers exclusively use this format and it’s deeply incremental to total ad revenue.

Reels & WhatsApp both now have the desired scale (per Zuck) to begin prioritizing monetization more aggressively.

Onsite ad conversions (a tool for combatting IDFA signal loss) offer a 2.7X lower cost per lead vs. offsite as Meta gets better at targeting without help from others.

On Trimming the Fat:

Zuck told us that 2023 will be the “year of efficiency.” He elaborated on on how quickly (partially due to the pandemic pull-forward) Meta evolved from a hyper growth business to one that must balance growth and profitability. He further reiterated his core objective to deliver innovation and growth through investments while compounding earnings growth simultaneously.

Q4 2022 headcount includes the 11,000 laid off employees. They’ll be removed from the count this quarter.

Meta is removing middle management layers to expedite decision making.

Meta will continue to look for other areas to reduce spend. This could lead to incremental restructuring charges.

On Metaverse Progress:

Reality Labs operating loss is still expected to rise YoY in 2023.

200+ apps on Quest have now reached $1 million in revenue.

Meta launched Avatars on WhatsApp with 100 million users opting in and 20 million of them making it their profile picture.

On Regulation:

Leadership sees no issues with effectively targeting amid the Digital Markets Act (DMA) drama in Europe and lawsuits from countries like Ireland. Noise.

6. My Take

I view this quarter as the beginning of Meta’s comeback. It’s showing clear signs of beating its most pressing competitive threat (TikTok) while it juices advertiser ROAS and rationalizes its operations. Macro headwinds will only ease from here and I expect this cream of the crop social media player to be the best positioned to take advantage.

The Family of Apps engagement and margin trends have both turned positive once more, and that makes me far more comfortable with aggressive Metaverse spend. This firm can generate $5 billion in free cash, compound multi-year sales at a 15% clip, invest aggressively and return $7 billion to shareholders all at the same time. Not bad for a dinosaur.