We strongly encourage you to share this article far and wide if you find it valuable and feel inspired to do so. That’s how we grow.

1. Microsoft (MSFT) -- FY Q4 2023 Earnings Review

a) Demand

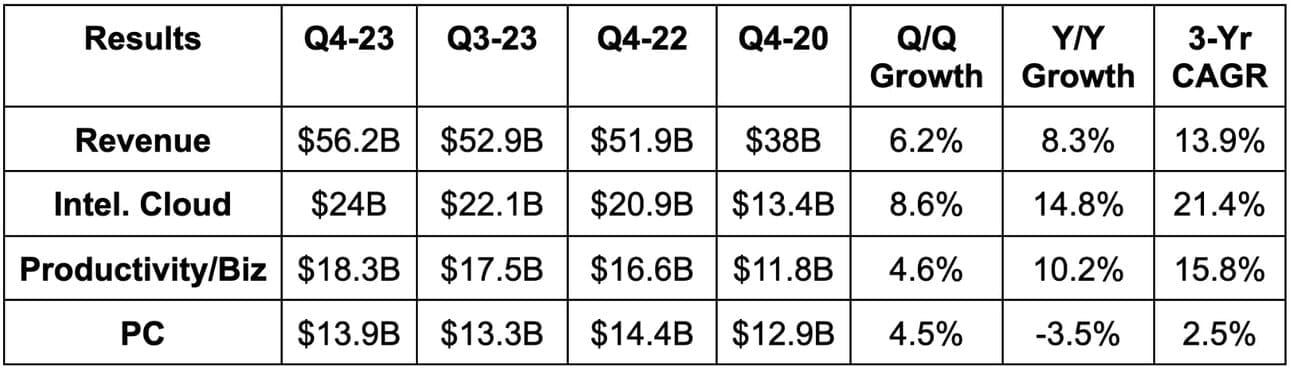

- Beat revenue estimates by 1.3% & beat guidance by 1.5%.

- All three revenue buckets beat consensus estimates.

- Azure revenue +26% Y/Y FX neutral (FXN) missed 26.7% growth estimates & missed 26.5% growth guidance.

- Met commercial bookings guidance of roughly flat Y/Y growth.

Demand Context:

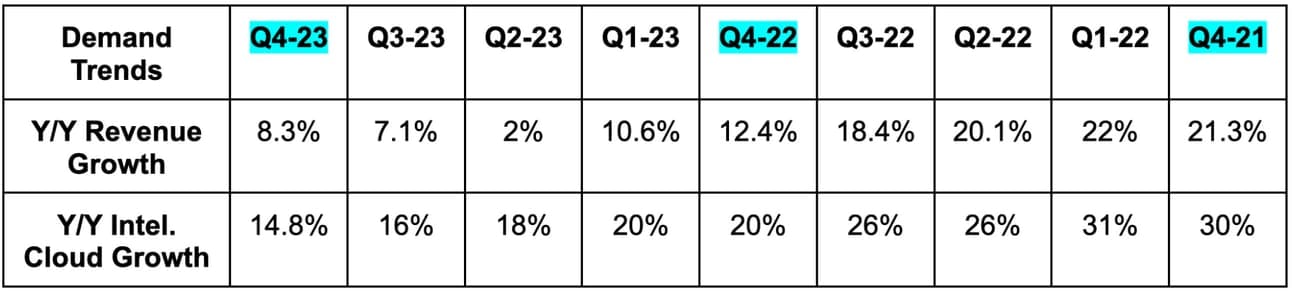

- Revenue was up 10% Y/Y FXN.

- $224 billion in commercial remaining performance obligations rose 18.5% Y/Y.

- Ad spend was weak and below internal expectations.

- Office 365 commercial seats rose 11% Y/Y with consumer subscribers rising 12.2% Y/Y to 67 million.

- 13.9% 3-yr revenue CAGR vs. 14.8% Q/Q & 12.6% 2 quarters ago.

b) Profitability

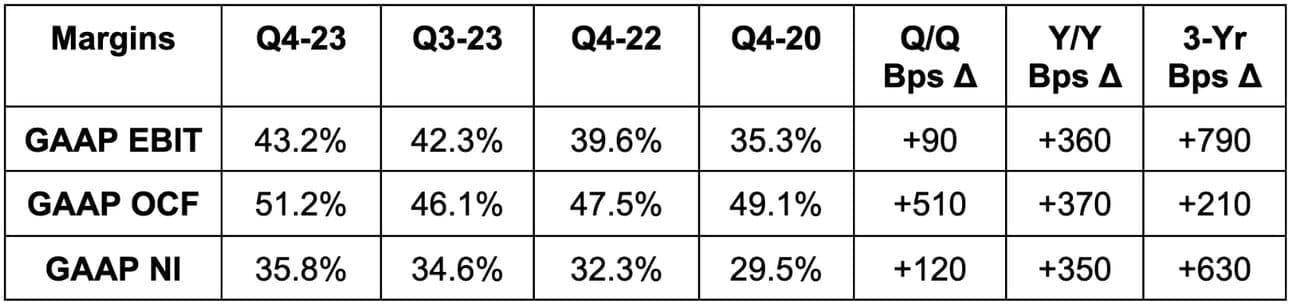

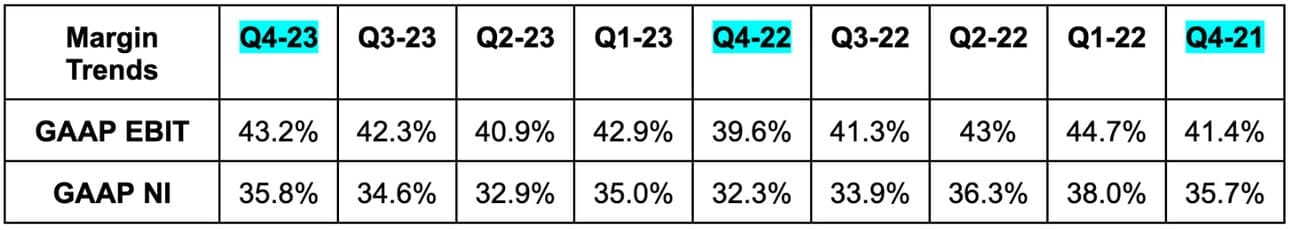

- Beat EBIT estimates by 4.3% & beat guidance by 4.3%.

- Beat $2.55 GAAP EPS estimates by $0.14.

- Beat operating cash flow (OCF) estimates by 5.6%.

- Beat cloud gross margin estimates of +200 basis points (bps) Y/Y by 100 bps.

Margin Context:

- Earnings per Share (EPS) rose 21% Y/Y.

- Gross margin was helped by a change in accounting methodology last quarter. When stripping out this benefit, it still beat expectations and guidance by 100bps.

- Operating expenses (OpEx) rose 2% Y/Y but would have been flat without a payment to the Irish Data Protection Commission.

- Free cash flow rose 12% Y/Y and would have risen 19% Y/Y without a one time tax payment for capitalizing R&D provisions.

c) Outlook

- Missed revenue estimates by 1.1%.

- Met 25.5% Y/Y constant currency Azure growth estimates.

- Beat EBIT estimates by 1.6%.

For the full fiscal year 2024, it guided to margins being flat Y/Y which is slightly worse than the modest expansion expected. Furthermore, it enjoyed $3.7 billion in avoided depreciation by extending the useful like of its servers and equipment in FY 2023. This benefit will fall to $2.1 billion next year and will serve as a profit comp headwind. Finally, CapEx will rise throughout 2024 to support investments in AI infrastructure. Google said the same thing on its call. All of this is to say that input costs will rise, but it will manage OpEx to ensure EBIT and net income margins don’t contract.

d) Balance Sheet

- Returned $9.7 billion to shareholders vs. $9.7 billion Q/Q.

- $111.3 billion in cash & equivalents.

- $42 billion in long term debt.

- Headcount is flat Y/Y.

e) Call & Release Highlights

Cloud & Azure:

Azure continued to take more market share this quarter. The company is still dealing with the same workload optimization issue holding back the cloud industry. Still, that headwind did not worsen sequentially and Satya expects this obstacle to be worked through over the next couple of quarters. Analysts pressed leadership on any long term growth color it would give about Azure. They declined to provide that color.

- Azure Arc customers rose 150% Y/Y & 20% Q/Q to reach 18,000.

- Arc is its multi-cloud management platform to let a customer access Azure services on-premise and on the edge.

- Azure AI added 100 new customers per day during the quarter including Mercedes and Flipkart.

- KPMG announced a multi-billion dollar commitment to transform its operations through Azure AI.

- Average contract value for Azure set a new record this quarter.

“We think Azure can have sustained high growth which is something we’re excited about.” -- CEO Satya Nadella

More on CoPilot (Microsoft’s AI powered virtual assistant to power code writing, email sending and productivity):

27,000 organizations use GitHub Copilot to automate source code processes within the DevSecOps (development-security-operations) world. That represents 100% Q/Q growth. Copilot has now been integrated into Power pages to make building low code sites seamless. Microsoft will continue to work on rolling out Copilot-augmented products like for its security suite this fall.

It spent the call talking about all of the opportunity for Copilot to drive better outcomes and monetization. For Windows 365 alone, a 10% up-take of its new Copilot subscription would drive 5% upside to 2023 revenue and likely higher profit upside. That’s just one monetization example and uses a pessimistic take rate. 365 Copilot is now live for 600 early release customers who call it a “game changer.”