Hey readers! Please share this article with your network if you feel inspired to do so. That is how we grow and keep the content 100% free.

1. Microsoft (MSFT) — Earnings Review

a. Demand

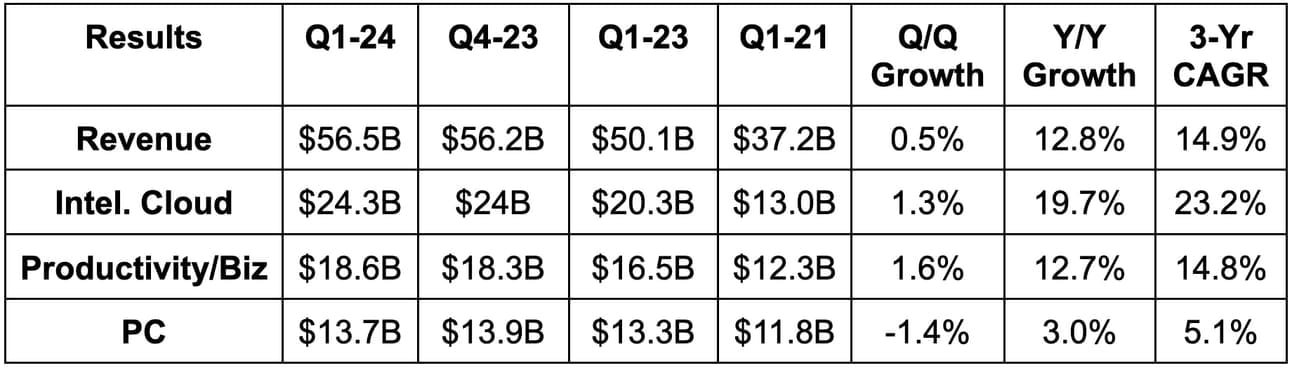

- Microsoft beat revenue estimates by 3.5% & beat its guidance by 4.1%.

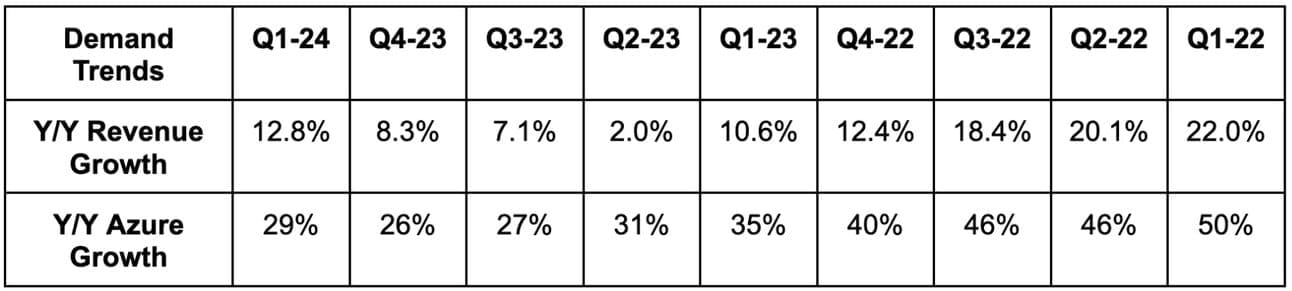

- Azure beat 27.2% constant currency growth estimates by nearly 200 basis points (bps) and beat Microsoft’s guidance by nearly 350 bps. AI services added 300 bps to Azure growth which was better than expected.

- Its 14.9% 3-year revenue growth compounded annual growth rate (CAGR) compares to 13.9% Q/Q & 14.8% 2 quarters ago.

b. Margins

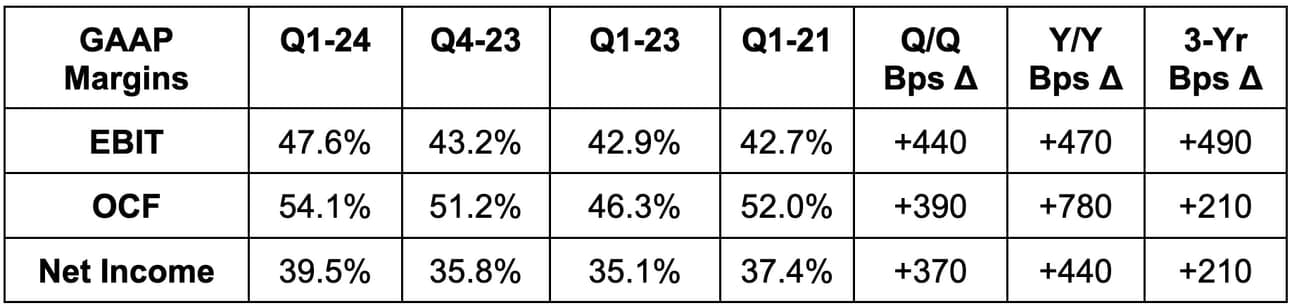

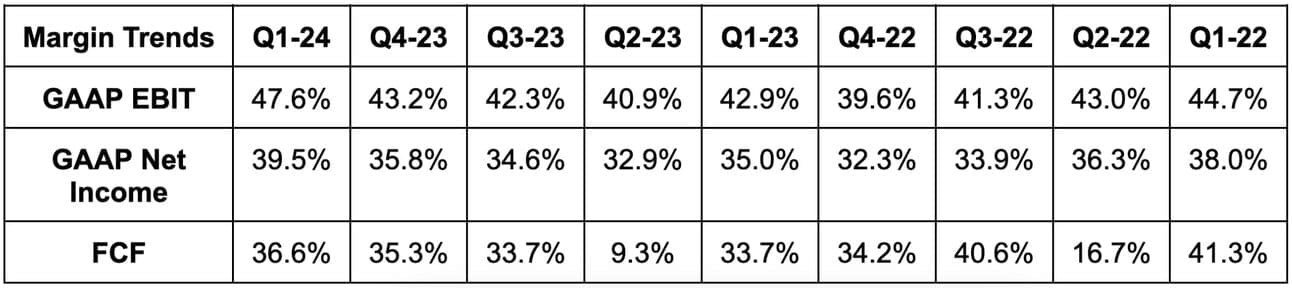

Microsoft beat EBIT estimates by 0.8% and beat its EBIT guidance by 1.0%. The company also beat $2.65 GAAP earnings per share (EPS) estimates by a robust $0.34. EPS rose by 27% Y/Y.

c. Balance Sheet

- $143 billion in cash & equivalents.

- $66 billion in debt ($26 billion is current or due within 12 months).

- Dividends up 9.3% Y/Y; $4.8 billion in buybacks vs. $5.6 billion Y/Y.

d. Guidance

For next quarter, Microsoft beat revenue estimates by 3.9% and beat EBIT estimates by 6.8%. This includes a full quarter contribution from its Activision Blizzard M&A. It also told us that Azure will grow by around 26%-27% constant currency Y/Y for the next three quarters. Strong.

By segment, Productivity and Businesses Processes revenue will be around $18.95 billion, Intelligent Cloud will be around $25.25 billion and Personal Computing will be around $16.7 billion.

Finally, CFO Amy Hood reiterated that EBIT margin will be flat Y/Y in fiscal year 2024 despite Activision integration costs.

e. Call & Release Highlights

Microsoft Copilot:

Microsoft has been the most aggressive mega cap in terms of monetizing generative AI directly and expeditiously. It’s doing so through a product called Microsoft Copilot, which has already been infused into several of its products. A key theme of this call was adding Copilot to more Microsoft use cases.

Today, Copilot bolsters GitHub (source code writing) developer productivity by 55%. This tool just crossed 37,000 customers following 40% Q/Q growth. Copilot was added to its Power Platform (for app creation and data analytics) with 126,000 customers already using it. Microsoft’s Power Apps are ranked first in low/no-code developing market share with 20 million monthly active users (MAUs) — up 40% Y/Y. It’s easy to see how this success will be replicated within product areas like 365 where Copilot will become generally available next week for excel, powerpoint etc.

Generative AI Approach:

I’ve well documented how Microsoft’s monetization journey within GenAI stands in stark contrast to others like Meta. But there’s another interesting difference between the two partners. All Microsoft models pull from a singular foundational model. This is somewhat similar to Amazon and its Bedrock model. Microsoft takes a full stack approach. Within it, one model trains all others and just one more provides all inference help. It thinks this will allow it to scale with greater operating leverage. That is important considering how expensive GenAI models are to build and maintain.

Meta thinks models should be local and specific to more niche use cases. It’s building out dozens of independent models pulling from several foundational models rather than taking this centralized approach. It will be interesting to see how each plan works over time.

Azure:

Microsoft Azure continued to take more market share with that trend fully expected to continue. Cloud optimization trends didn’t improve or worsen sequentially, but demand for AI services powered the outperformance here. Azure is thriving. It’s bigger than competition like Google Cloud, yet growing faster and printing more profits. We’ll see how AWS’s performance compares when Amazon reports later in the week.

Azure’s OpenAI service, which offers access to OpenAI’s roster of models, reached 18,000 enterprise customers. Azure Arc is Microsoft’s cloud platform that offers customers access to its service in on-premise, hybrid and multi-cloud environments. Customers of this service rose 140% Y/Y to reach 21,000.

- Azure remains the partner of choice for giants like SAP and their customer workloads.

- Nearly 3/4 of the Fortune 1000 uses 3+ data cloud services from Azure today.

- Microsoft Fabric (which consolidates all cloud services including governance and security) eclipsed 50% of the Fortune 500 as customers.

Teams & 365:

Microsoft Teams crossed 320 million MAUs this quarter vs. 300 million 6 months ago. It just debuted a new version which halves latency and memory storage needs. Finally, Teams Rooms enjoyed its 9th straight quarter of triple digit Y/Y growth.

Microsoft 365’s most advanced, overarching license is called E5. It includes Teams, security, business intelligence and all 365 tools. Healthy renewals for E5 were cited by leadership as a contributing factor for the strong quarter.

Margins:

Cloud gross margin was about 100 bps (basis point; 1 basis point = 0.01%) better than expected thanks to Azure growth. It came in at 72% vs. 73% Q/Q and 70% Y/Y. Without a change in the estimate of useful life for certain assets, gross margin would have expanded by 200 bps Y/Y. Without this same change, EBIT margin would have been about 130 bps better for the quarter. This is why I want all companies to report GAAP & non-GAAP metrics… not just GAAP.

Segment Notes:

Productivity and Business Processes enjoyed 17.8% Y/Y consumer subscriber growth. The segment also saw 10% Y/Y Office 365 Commercial seat growth. Billings performed about as well as expected here.