This is meant to be a broad overview of the Amazon investment case. This is not a deep dive and does not attempt to be nearly as thorough as one.

a) Introduction

Obvious secular tailwinds often make for great investments. These tailwinds, however, are never linear. They blow in fits and starts in a manner much less predictable than the compounded annual growth rate (CAGR) estimates would indicate. While these performance fluctuations can be anxiety-provoking, they’re also what foster opportunity. When tailwinds temporarily fade is often when that opportunity becomes the most promising to secure compelling risk/reward and alpha.

Amazon has two structural tailwinds moving in its favor: Cloud computing and e-commerce. Interestingly, both are currently facing short-term, macro-related headwinds. The cloud computing industry is enduring added budget scrutiny, workload optimization, sales cycle elongation and so revenue growth slowing. E-commerce is dealing with a post-pandemic demand realignment, making Y/Y comps wildly difficult. To make things even more challenging, broad-based discretionary consumer spending continues to weaken amid a softening economy.

As the largest player in both spaces, Amazon is not at all immune. These obstacles will not go away overnight, but for this to work as an investment, they need to eventually fade. Fortunately, it’s likely that both will and that is the bet I am making by starting a position this week.

b) E-Commerce Titan

Amazon owns U.S. e-commerce. Depending on where you look, its market share sits between 30% and 40% while its growth rate consistently remains in excess of competitors’. As the clear leader in the area, it also prospers from a fragmented industry with smaller marketplaces everywhere from which to take share. Those potential share gains come for the players who can create the best dynamics for buyers and sellers. That’s what Amazon’s scale provides. Its leading SKU selection paired with consistent, lightning-fast fulfillment is a key recipe for attracting buyers. 3rd party sellers will always follow that demand to feed selection and traffic further.

Counterintuitively, the razor thin margin profile of this segment is one of the things we find most appealing. The gaudier the margins, the more competition a firm will invariably attract. That added competition requires a stronger competitive moat to maintain traction. Well? Amazon has made a super low margin business profitable thanks to incredible scale. That scale has created one of the most compelling and concrete competitive moats on the planet. Emulating it requires tens of billions of dollars that nobody is willing to spend for the small EBIT prize it currently represents.

With this formula of two-sided loyalty firmly established, the company has earned the ability to create more margin. Just a bit of expansion with its massive revenue base would be quite needle moving. The question is where and how this can occur. A few areas look promising.

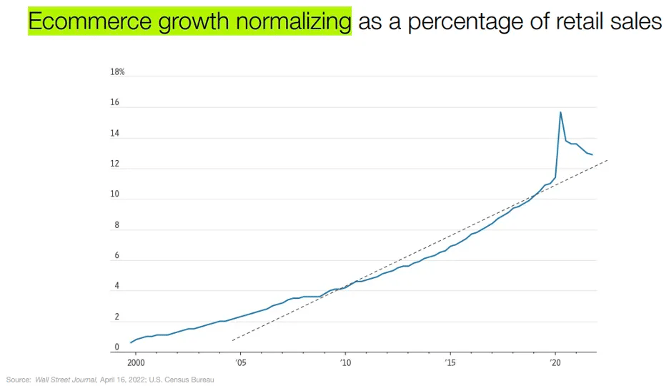

First, like all e-commerce players, Amazon got too excited in extrapolating pandemic trends as permanent. It built out huge excess capacity and hired tens of thousands of employees to meet its fulfillment growth expectations. It assumed the e-commerce pull forward would normalize at a lower rate of growth without giving back any gains. That didn’t happen as you can see below:

Brick and mortar shopping instead came back with more momentum than virtually anyone expected. That led to a lot of Amazon’s added capacity rapidly morphing into deadweight loss. And just like Meta’s year of efficiency, Amazon has taken the last few quarters to cut that capacity, pull back on expansion, right size its headcount and rationalize its cost base. This work is still ongoing with the firm’s North American marketplace EBIT margin at 1.2% last quarter vs. over 4% pre-pandemic. It sees a clear path to getting back to 4% which is also the main source of our bullishness. That 280 basis points of expansion alone would represent over $2 billion in incremental quarterly profits flowing through the income statement. The boost requires no investments and little risk; it merely requires operating more rationally.

That 4% margin, however, may have more upside. As part of Amazon’s ongoing fulfillment overhaul, it will take a more local, regional courier approach. The firm is reorganizing its national network into 8 regional networks all equipped with abundant SKU availability. This is set to cut miles to fulfill and costs while further shrinking delivery times. Win, win. As the team told us last call, it built out a last mile delivery infrastructure the size of UPS’s in just 24 months. Now, it’s time to extract as much value out of those assets as possible while e-commerce growth resumes and accelerates over time. In another move to extract more value from its courier footprint, it’s also allowing merchants to utilize the service in a white-labeled manner via its newer “Buy with Prime” product. That means more usage of its current fulfillment capacity which should help margins a bit too.

Beyond these initiatives, more 3rd party selling on the marketplace is yet another margin tailwind to look forward to. This one is key. These 3rd party sellers generate higher margin business for Amazon than its 1st party business (more asset light service with incremental fees and no wholesaler take rates) and represented 59% of total unit sales last quarter vs. 55% Y/Y. That durable trend should continue and will inherently make the marketplace more profitable as 3rd party sales slowly grow as a % of total. Most recently, this 3rd party segment outpaced overall marketplace growth of 3% Y/Y by a full 1700 basis points.

As my colleague on Twitter (@SupBagholder) pointed out, this proliferation also directly supports its high margin advertising business. These 3rd party sellers exist within a sea of merchants on Amazon’s site. They are all driven to stand out via sponsored product placements and preferred treatment in ways that Amazon 1st party business does not incentivize. This is one of the many levers contributing to Amazon’s 23% Y/Y advertising revenue growth to buck trends of broader industry slowing. The combination of unparalleled traffic and embracing 3rd party sellers is a powerful one to say the least.

c) Marketplace Peanut Butter to Prime Subscription Jelly

Amazon transformed and extended its fulfillment business and marketplace into a Prime subscription with nearly 200 million members by infusing more customer utility to fortify its edge.

Just like with Uber and Uber One for example, Amazon can afford to offer unique perks to subscribers. This results from Prime Subscription’s meaningful retention benefit and how much scale it features. Retention means small boosts to revenue. Scale allows the frequent retention-based gains to aggregate in a more meaningful fashion. That recipe coincides with slower fixed cost growth to power more appealing unit economics and generate positive returns. Cross-selling/bundling is always cheaper than winning a new customer. This all justifies Amazon’s heavy investment in Prime Video content, Gaming etc. which further motivates member loyalty. The more services it provides vs. the competition, the more bundling potential it has, and the more revenue it will generate thanks to less churn. Amazon is in pole position to offer the most valuable subscription in its space.

Over time, this subscription should consistently get more valuable as it adds new perks like discounted prescriptions and telehealth, grocery delivery and so much more. That’s how it raised the Prime subscription price from $119 to $139 annually this year with virtually no user push-back.

Like 3rd party seller growth supports the ad business, more engaged customers lead to more traffic to further juice ad demand. Amazon Prime’s leading scale means it has more traffic and eyeballs shopping on its platform than anyone else… by a mile. Those eyeballs are ripe for ad-based monetization, and Amazon is taking advantage. The company continues to enhance ad load across its ecosystem. Between sponsored seller products and grocery delivery placements, there’s a long way to go to realize the earned benefits of being the biggest. Ad revenue is very high margin revenue as it requires minimal fixed cost to deploy. The impression real-estate is there… it’s just a matter of monetizing it.

d) Cloud Titan

AWS is the other vital growth driver. As a public cloud vendor, it offers Fortune 500 clients the compute and data capacity/storage needed to operate in today’s software and app-powered world. Customers pay for secured usage of this to take the headache out of maintaining complex infrastructure.

AWS is the largest in the space with Microsoft’s Azure quickly closing in. Both are dealing with macro-related challenges. While Amazon is clearly trying to do more with less this year, so are all of its AWS clients. All C-suites are laser-focused on becoming as lean as possible. This has meant added layers of deal approvals, elongated sales cycles and workload optimization -- leading to slowing usage growth. AWS is openly supporting customers in this optimization journey to align with their cloud evolution trajectories and focus on the long-term. Still for now, this led to its cloud growth slowing to 11% Y/Y for the month of April vs. about 16% for Q1.

That slowing was more noticeable than for Microsoft’s Azure… but there are two caveats. First, ChatCPT and OpenAI proliferation singularly feeds Azure cloud usage. The historical pace of that application's proliferation has slightly buffered the macro-obstacles for Azure. AWS doesn’t have this buffer. While one could argue that Google doesn’t either and GCP grew by over 30% Y/Y last quarter, the scale in which GCP operates is still peanuts vs. AWS. That makes differing growth rates somewhat inevitable. Secondly, and much more impactfully, Azure skews more to large enterprise clients vs. AWS’s small and medium business (SMB) leaning niche. AWS dominates with startups and smaller firms with less internal resources that are more fragile across macro cycles. Intuitively this makes sense as virtually all Fortune 500 enterprises are already using Microsoft’s productivity apps which paves the way for seamlessly cohesive Azure cross-selling.

This diverging AWS and Azure performance has led some to believe Amazon will not be able to compete as effectively in cloud as AI use cases become a larger piece of the industry’s growth. To that we say not so fast. While Microsoft has garnered all of the headline-based hype, Amazon is more than capable of being a prominent piece of this computing wave. In terms of AI capabilities, Amazon has been investing heavily into its training chip set (called Trainium) for years. It sees these investments as giving it the ability to train large language models (LLMs) more cheaply and with more scale than any other competitor on the market. I’m sure Azure, Nvidia and others would disagree, but the point is that AWS is very much so in this conversation and very much so trying to hold its own.