News of the Week (November 28 - December 2)

Shopify; Lululemon; PayPal; SoFi; CrowdStrike; Meta; Progyny; Revolve; Olo; Upstart; Duolingo; Market Earnings; Cannabis; Macro; My Activity

Today’s Piece is Powered by my Favorite Research Platform: Stratosphere.io:

Welcome to the 815 new readers who have joined us this week. We’re delighted to have you all as subscribers and permanently determined to provide as much value & objectivity as possible.

1. Shopify (SHOP), Lululemon (LULU) & PayPal (PYPL) – Holiday Performance Divergence

a) Shopify (SHOP) – Strong

Shopify’s volume growth this holiday season was expected to abruptly slow to 9% YoY as the company lapped its toughest, stimulus-related comps perhaps in its existence. Instead, over the Black Friday-Cyber Monday weekend, Shopify’s merchant volumes rose by 19% YoY (21% constant currency) while its 3-year compounded annual growth rate (CAGR) came in at a robust 37%. I guess commerce isn’t dead and Shopify isn’t either. Who knew?!

Even when accounting for inflation, the 11%-12% real growth was a positive surprise and one I take with significant optimism. For context, Adobe, Salesforce and Sensoramic reported data throughout the weekend hinting at 2%-6% nominal growth and so negative real growth for commerce overall. For e-commerce specifically, growth was around 9%-12% depending on which vendor we use. But regardless, Shopify is outperforming both online and in-store by a handsome margin.

b) Lululemon (LULU) – Anecdotal Hints

Lululemon, as expected, didn’t publish overarching data from the holiday weekend, but there were some encouraging anecdotes published elsewhere. According to BMO Markets, Lulu was able to restock its popular belt bags just in time for the holiday season which then very quickly sold out. This is a high margin product for the firm. There are other small hints circulating around the internet that lines for Lulu stores were comparatively long vs. the competition all weekend long. But again, this is all anecdotal and could either be a small positive or irrelevant.

c) PayPal (PYPL) – Weak Sauce

While Shopify’s holiday season performance was admirable, the data we have from PayPal was not. It lagged all available demand metrics from the vital 4-day period. Over the weekend (per Deutsche Bank and Salesforce), overall adoption for PayPal checkout fell 8% YoY across the globe and 4% in the United States. There were some other metrics pointing to underperformance especially in places like Ireland, but considering the company has de-prioritized its business and investments there, that’s not concerning. The global underperformance, however, certainly is concerning especially considering competition like Apple grew adoption by over 50%.

Some silver linings amid the negative headline:

Baird and Wedbush came out with notes saying holiday season results bode well for companies including PayPal and Q4 estimates. I guess they weren’t expecting much.

PayPal commerce skews far more discretionary than does Apple Pay. Discretionary spend is severely challenged by the macro climate at the moment -- so this may not be a PayPal-specific issue.

PayPal’s deepening relationship with Apple and new integrations mean the two could theoretically benefit from each other's success.

Regardless of these notes, I’m disappointed in this result, and so I’ve decided to pause adding to the name until I have a better sense of what this actually means for its long term compounding prospects. The data leaves more questions than answers, and I need those questions resolved before I resume buying shares. The two growth engines for PayPal will continue to be Braintree and Venmo, but legacy PayPal needs to maintain reasonable health to keep the cash flow churning, the margins expanding, and the investor community happy.

2. SoFi Technologies (SOFI) – CFO Interview & Product Updates

a) CFO Chris Lapointe Interviews with Credit Suisse

On Student Loans:

SoFi was expecting a ramp in student loan refinancing (refi) volume this month in anticipation of the moratorium ending. With the moratorium now having been extended to June 2023, that will not come. This will hurt SoFi’s Q4 and 2023 results. As an aside, I hope its first 2023 guide offered just assumes the moratorium lasts all year. Force any surprises here to be positive surprises… please & thank you.

Just like the last two years, Lapointe expects SoFi to continue to gracefully overcome this obstacle:

“Again, given the diversification of our model and ability to allocate capital effectively, we feel like we’ll have another strong year of growth and profit improvement the same way we’ve done the last 2.5 years.” – CFO Chris Lapointe

This is a frustrating headwind… but not one that relates to SoFi’s execution, value proposition, operating leverage and vast opportunities ahead. So? It’s a headwind that I’d likely add into if Mr. Market continues to punish the stock enough. It’s already a large position, so I’m being overly patient and picky here on any future accumulation regardless of the high conviction.

On Path to Profitability & Stock-Based Compensation:

Lapointe reiterated what leadership has been telling us all along. By the end of 2023, all 3 SoFi segments will be net operating income positive and in 2024 the company will produce GAAP profitability for the year.

He also confirmed financial services would have a positive contribution margin as we enter 2023. That would mean significant sequential improvement is coming.

Of the $75 million in quarterly stock comp, $25 million is from share units awarded via the IPO. THESE WILL CONTINUE IN 2023, and then end at the start of 2024 when SoFi expects stock comp as a % of revenue to fall below 10%.

At that time, if it’s still rapidly compounding and expanding margins (which is fully expected), that would actually be comparatively reasonable vs. other hyper-growers.

On Customer Engagement & Lifetime Value:

Lapointe was pressed on user engagement as SoFi only discloses cumulative members and products, but not things like monthly active users (MAUs). He told us that engagement is high and continues to rise with monetization per member growth being the direct evidence.

Lapointe also told us that metrics like MAUs are less relevant for SoFi than the cumulative stats as the company’s mission is to:

be that one-stop-shop in banking

build a decades-long relationship with customers

maximize lifetime value.

These life-long users will ebb and flow in terms of engagement as their needs evolve. The longer term engagement trend will be up and to the right as things like cross-selling take hold, but that trend will not be linear. To be honest, I found this explanation to be a bit lame and I’d still like to see them disclose MAUs or something along those lines. More relevant info is always better.

On Customer Acquisition Cost:

“We’ve had a tremendous amount of progress in terms of marketing efficiency over the last few years driven by growth in brand awareness, cross buy rates and financial services.” -- CFO Chris Lapointe

On Personal Lending:

SoFi’s large market share boost of 4.5% last year to 6% this year HAS NOT MEANT any deterioration in loss or delinquency rates. Its current credit trends remain “really strong.”

Broken record alert: It’s good to cater to affluent individuals in 2022.

Lapointe thinks these updates are helping with the gains:

Moving from 8 days to 2 days to fund loans for customers.

Upgrading its 2-tiered pricing model from 2018 to “pricing across dozens of cohorts and able to dynamically move pricing day-to-day” to the outperformance.

SoFi’s unwavering dedication to responsible, FCF-based underwriting and its seamless pricing power (allowing it to raise weighted coupons with rising benchmark rates) have helped it preserve margins. BUT, the biggest help has been SoFi’s wildly effective hedging program which has allowed gain on sale and life of loan margin preservation amid all of the macro volatility.

As soon as SoFi originates loans with rate sensitivity, it locks in terms with a hedge to guarantee acceptable cash flow per loan. It does not seek out upside through hedging -- it just wants to eliminate downside risk. The program has been a savior for the lending segment’s results this year.

On Home Loans:

Lapointe again hinted at wanting to buy a backend purchase mortgage vendor to take control of that process and accelerate SoFi’s time to fund improvements.

On SoFi’s decision this year to repurchase $1 billion in loans:

“Generating deposits means we need to earn a return to cover costs. We do that via originations or purchasing loans. In this case, we bought $1 billion of loans we originally underwrote and were servicing, which we viewed as a great asset. These are SoFi members. We know them and understand their loss profiles. These were seasoned loans so overall losses were less than for new originations. It came down to generating the highest return on our cash. We will continue to do this given the opportunity.” -- CFO Chris Lapointe

IMPORTANT: Any time SoFi makes a move like this, the conversion of cash to loans on the balance sheet shows up as operating “cash burn.” So, in 2022, this led to a billion of negative free cash flow which is why people think it’s so irresponsible with cash. In reality, it isn’t. Also in reality, this move isn’t one that burns cash, but simply changes the firm’s asset structure and bolsters net interest income. It’s a weird GAAP accounting artifact. And furthermore, if SoFi were pressed for cash (which it isn’t) it could easily liquidate these pools to bolster liquidity.

On the Tech Platform:

Overall customer concentration has fallen considerably (no specific % given) from 2021 when it last disclosed that 5 clients equated to 65% of its sales. More client wins will continue to lower this risk.

“We couldn’t be more pleased with Galileo’s technology, scalability, robustness and ability to innovate. We believe we’re second to none… the technology is superior and lower cost… We continue to steal share which we expect to continue… And with it Technisys, we’re in discussions with large financial institutions (FIs) we never were in before. We feel like we’re well positioned to win larger FIs operating with legacy, siloed providers as a matter of when, not if.” -- CFO Chris Lapointe

Noto said something very similar last week.

b) Two Product Updates

SoFi raised its savings account annual percent yield (APY) to 3.25% for direct deposit customers. This is still below what it can offer with its banking charter in hand while still being better off than it was using warehouse facilities pre-charter. Specifically, Lapointe hinted at another 250 basis points in leeway here for the company to raise the APY. 3.25% is already well over 100X the national average.

Not only are these direct deposits lower cost for issuing new loans, but they also juice high margin revenue segments such as debit interchange fees which direct deposit customers use more frequently.

In other news, SoFi has finally begun its launch of options trading. The product features 0 fee contracts and a slick user interface (similar to Robinhood’s). For now, the product only offers the ability to buy contracts, but selling calls and puts will be added soon.

This has been a missing link in SoFi’s investing offering that has kept many people from switching over to the vendor for other things like the aforementioned 3.25% direct deposit APY. I expect this debut (especially once selling contracts is enabled) to be a material tailwind for SoFi’s financial services business immediately.

Fundamental stock research just got way easier. Thanks to Stratosphere.io, no longer must we dig through endless SEC filings for relevant information.

Stratosphere has all of the financial statement data, estimates and insider insight I could ever want. And it pulls from high quality, RELIABLE sources to ensure everything I’m absorbing is entirely accurate. It’s the only non-primary source that I actually trust.

But it gets better. Not only does this platform feature all needed traditional data, but it even has key performance indicators depicted with beautiful visuals. With this powerful tool, I pulled up Airbnb’s take rate and nights booked stats from the last several years vs. spending time seeking out the needed metrics myself. This is truly a force efficiency multiplier for research, and I know you’ll all agree.

All of this leaves me asking myself: “Stratosphere, where have you been all my life?” Luckily, it has officially arrived and you can check it out here.

3. CrowdStrike (CRWD) – Stock Comp

Questions and concerns about CrowdStrike’s stock comp policy were the talk of Twitter after its earnings report. I’m sure that’s because the stock price fell (when I think it was instead because of the ARR recognition delay), but I wanted to address that valid concern with a few points:

CrowdStrike accelerated its hiring pace in 2022 to take advantage of new talent becoming available via competitor layoffs. It hired essentially all of the talent it needs for 2023 already. So? Headcount growth will greatly slow next year which means stock comp growth will as well.

It has $2.5 billion in cash & equivalents ($1.8 billion in net cash) that it could use to initiate a buyback to offset some of the dilution. Lowering net compensation as a percent of sales from 24% to 12% this past quarter would have taken just 2% of its cash pile. The cash pile is also consistently growing faster than the amount of quarterly buybacks I’m imputing (about $70 million).

While I think the company should institute a buyback now, I understand why it may not feel like it’s time yet. But still, this option is easily on the table for CrowdStrike, meaning it could easily solve the issue if it felt the need. For now, its capital allocation preferences are focused on products, selling & talent. While I see these as priorities over a buyback, I think its balance sheet and unit economics allow it to spend on long term growth and also buy back shares.

When a company is scaling this rapidly and expanding into multiple new verticals simultaneously, it’s hard to expect stock comp to be low. Talent likes equity.

Last, and least importantly, while stock comp at 24% of revenue is too high, it’s actually far lower than most of its closest comps like Zscaler, Snowflake, Cloudflare etc.

I fully expect stock compensation as a percent of revenue to fall well under 20% next year and continue to briskly fall thereafter. And it needs to! If that does not happen, I’ll have to re-evaluate my position.

For now, I’m looking at the $100 per share level where it broke out and found support a few years ago to add to my stake. It’s already a large position, so I’m comfortable with not getting the chance to add and am being overly picky on when to buy more. It’s still not cheap at likely 50X forward earnings, but I no longer see the multiple as egregious.

In case you missed it, I published a CrowdStrike earnings review during the week that can be found here.

4. Meta Platforms (META) -- 2 Advertising Green shoots

Meta took a large step in November towards addressing its ad conversion and attribution challenges created by Apple’s 2021 privacy changes.

a) Conversion Breakdowns

When Apple introduced its new privacy policies last year, Meta was prevented from automating the identification and targeting of granular customer cohorts. This made it a less effective advertiser overall. After several months of work to re-introduce this needed signal, Meta has now added the capability back to its ad-stack. This paves the way for more audience selection customization, better targeting and better performance.

b) 28-Day Click Attribution

I missed this important news from earlier in the month. Meta is re-introducing 28-Day click attribution following its removal of the feature after Apple’s signal-damaging privacy changes. Obviously, some advertisements convert eventual buyers beyond a 7 day period, so losing this ability meant Meta was reporting worse conversion metrics than it was actually delivering. Now, it can begin to take full credit and so demand more favorable pricing going forward. I think and hope this will be a large price per impression tailwind, although the Reels monetization ramp may dampen that impact near term.

This is really important and a sign that its aggressive investments in rebuilding its advertising stack are bearing fruit. The feature is available for a select group of advertisers today and will roll out more broadly in the coming months.

5. Progyny (PGNY) – A Raise & An Unfortunate Structural Tailwind

a) Guidance Raise

As I covered in the earnings review, Progyny’s forward guide assumed Menopur (popular fertility drug) supply chain issues would persist through the quarter and hurt demand and margins. It also said this situation was quickly resolving itself, which hinted at any progress resulting in upside to its forecasts. Well? The issue is resolved and Q4 guidance has been raised:

Raised its revenue outlook by 2.1%.

Raised its EPS outlook from $0.015 to $0.025.

Raised its EBITDA outlook by 7.7%.

b) An Unfortunate Structural Tailwind

Oxford University published some bleak data on sperm count trends across the globe. Since 1973, mean sperm concentration declined by 51.6% with total sperm count falling over 60%. Furthermore, declines have merely accelerated since the 22nd century began. If these trends continue, it will be rare for a couple to be able to bear children without fertility treatment in the coming decades.

While this is certainly dire for the human race, it’s actually ideal for Progyny. 10% of births in developed nations (just 2% in the USA) are via assisted reproductive treatment today, meaning this could greatly expand the serviceable market for Progyny. It’s already expanding into more male fertility services as we speak.

This company has been a 40%+ compounding, margin expanding, share taking, clinical outcome leading machine since it debuted its fertility program less than a decade ago. I expect that to continue, with its unmatched value proposition and compelling secular tailwinds.

Click here for my Progyny Deep Dive.

6. Revolve Group (RVLV) – CFO Conference

On What to Expect in a Normalized World following the re-opening demand tailwind that Revolve enjoyed:

Expect percent of sales at full price to fall from the 87% post-pandemic peak but to stay above 80% which is better than pre-pandemic.

Expect net revenue retention to fall from the 120% post-pandemic peak back to its long term trend of 90%.

120% is ridiculously good for a retailer and non-sustainable. 90% is still good.

Expect continued record customer satisfaction metrics as it localizes in more countries and speeds up fulfillment with its new east coast distribution center.

The slight inventory glut will be addressed by the second half of next year. As a reminder, it’s “willing to hold inventory longer than most as it doesn’t have expensive floor space to clear” like its physical competition. Its carrying costs are comparatively low.

Continued profitability no matter how bad macro gets. This company will continue to be disciplined like it has been for 20 years. Understandable considering the founders still own 45% of the firm -- it’s their money.

On Logistics:

Revolve expects the 30 basis points of fulfillment leverage to continue via:

The east coast facility lowering fulfillment rates.

An international facility eventually lowering fulfillment rates further.

Considering Revolve markets itself as an e-commerce player freeing shoppers to “turn their homes into a dressing room” via seamless and free returns, fulfillment leverage matters… a lot.

7. Olo (OLO) – New Brand

R&R BBQ and its 12 locations became the newest Olo brand client. Similarly to Bakehouse 46 last week, this is another emerging brand and another sign that Olo’s newer ambition within this emerging segment is gaining traction. Also just like Bakehouse 46, the brand is launching with 4 Olo modules including Olo Pay. The trends of Pay adoption and stronger module up-take are both quite strong.

8. Upstart (UPST) -- New Partner

Upstart signed Carver Federal Savings Bank -- a Minority Depository Institution -- as its newest partner and referral network participant. This is a small bank with $735 million in total assets, but another sign that Upstart is effectively removing discriminatory biases inherent within the legacy lending process. I don’t expect this to be a meaningful near term contributor to results.

Upstart remains on my do-not-add list. I view this company in a similar light to Lemonade or Nanox. It’s a boom or bust with vast potential upside and a great chance that upside is never realized. I will resume adding once more progress is made with securing partner and committed capital market funding and once volume appetites from these constituents return. That means I won’t catch the bottom… and I do not care.

9. Duolingo (DUOL) – Forbes

Duolingo’s social media accounts go viral on a seemingly daily basis. Forbes noticed this too as it named Duolingo’s social media manager (Zaria Parvez) to its 30 under 30 list. As social media is the most powerful free marketing channel to drive organic growth, it certainly matters that Duolingo does it better at it than the rest. This is why Duolingo has been able to enjoy so much operating leverage within sales and marketing while delivering over-achieving growth. 90% of its demand growth is via word of mouth!

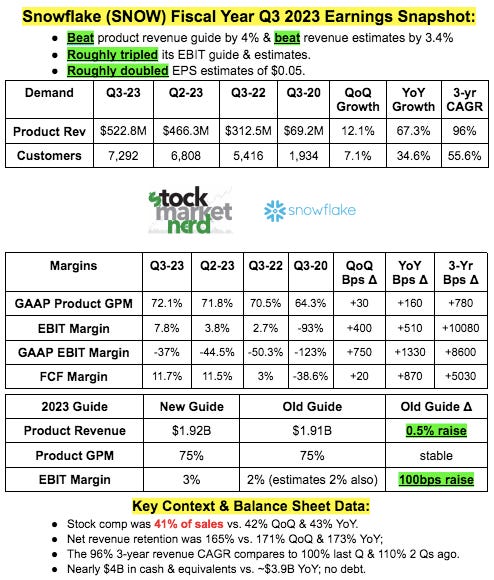

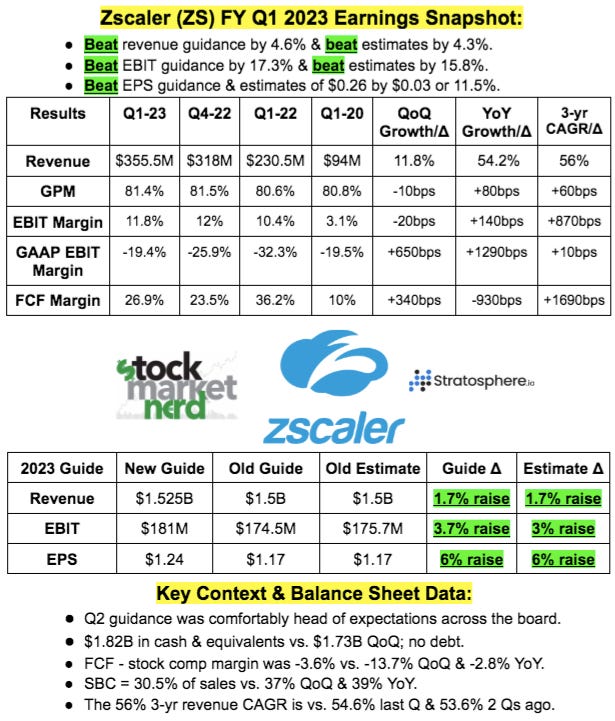

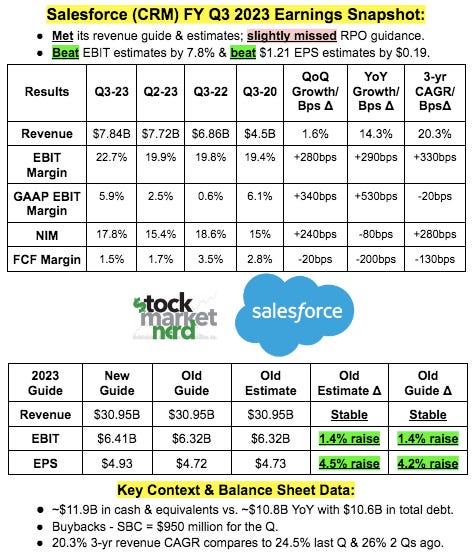

10. Earnings (of non-holdings) 1-Pagers from the Week:

a) Snowflake

b) Zscaler

c) Salesforce

11. Cannabis News

The President signed a medical cannabis research bill into law this week and congress is supposedly hard at work on cannabis banking reform. I’ll keep saying it: This is all political theater until we get actual capital market, taxation and listing reform. There’s no reason to get excited until our unproductive politicians actually do something meaningful.

12. Macro

a) Key Macro Data from the Week

Jerome Powell Press Conference – no surprises:

The size of rate hikes should slow as soon as this month’s meeting.

There’s a lot more work to do on taming inflation (I think he’s wrong and the impact of previous rate hikes will continue to ease inflation more than he thinks it will).

Personal Consumption Expenditures (PCE) & Inflation Data:

PCE was 6% YoY vs. 6% expected and 6.3% last month.

PCE was 0.3% month over month (MoM) vs. 0.5% expected and 0.3% last month. Good news.

Core PCE (strips out food & energy) was 5% YoY vs. 5% expected and 5.2% last month.

Core PCE was 0.3% MoM vs. 0.5% expected & 0.3% last month. More good news.

The GDP Price index fell from 9% last quarter to 4.3% this quarter.

Average hourly earnings rose 0.6% MoM vs. expectations of 0.3% growth. Still too little labor supply.

Employment Data:

ADP non-farm employment change for November was 127,000 vs. 200,000 expected. Yikes.

Conversely, non-farm payroll rose by 263,000 vs. 200,000 expected.

Payroll cannot continue to outperform if employment change continues to underwhelm.

JOLTs Job Openings were slightly larger than expected.

Initial jobless claims were 225,000 vs. 235,000 expected.

Labor participation is still too low and now falling. It was 62.1% vs. 62.2% last month.

Economic Data:

The Chicago Purchasing Managers Index (PMI) sharply missed 47.0 estimates with a reading of 37.2. Yikes again.

The Manufacturing PMI was 47.7 vs. 47.6 expected.

GDP was 2.9% vs. 2.7% expected and 2.6% last quarter.

The Institute of Supply Management’s (ISM’s) PMI was 49 in November vs. 49.8 expected as it dipped into contraction territory.

Unemployment is at 3.7% -- in line with estimates.

Blackstone is limiting REIT redemptions after requests have exceeded its limits. Triple yikes.

Consumer Data:

Conference Board (CB) consumer confidence was in line with estimates.

5-Year Breakeven Inflation Ticked up (a bad thing) this week:

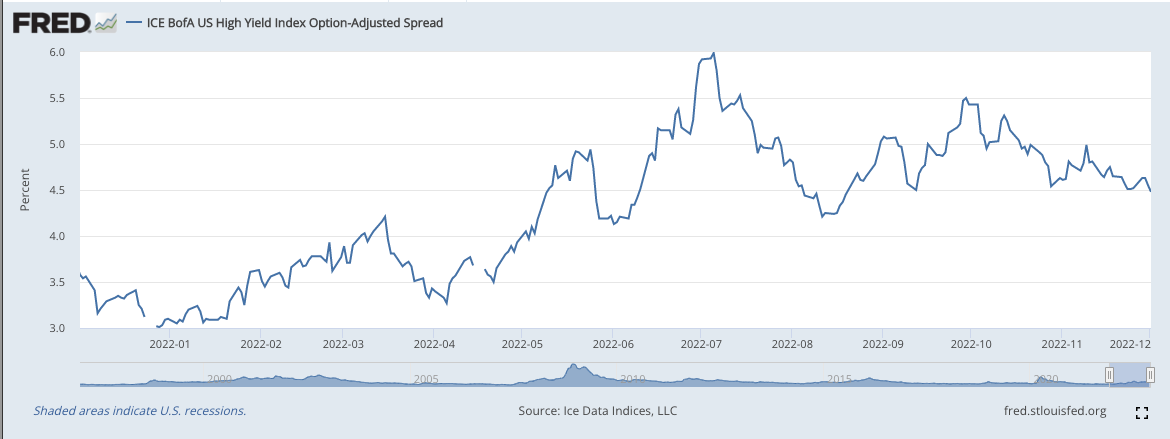

High Yield Option Adjusted Corporate Credit Spreads tightened (a good thing) this week:

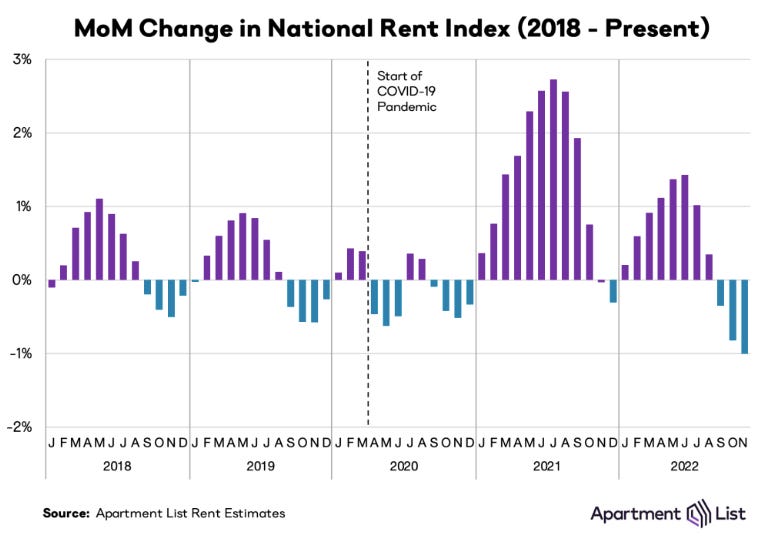

Apartment List’s forward looking indicator for rent inflation looks promising. It’s usually negative for Q3, but that seasonal pattern has been more pronounced this year. Good news:

b) Level-Setting the Data -- Nothing Changed from Previous Weeks

The trends continue to become more and more convincing to me. Inflation is cooling and needs to cool more. Employment cracks are deepening and unfortunately will likely deepen more in the coming months. We still have too much wage inflation, and more economic weakness will be the only way to tighten labor supply, push labor force participation higher and solve that issue. Constant layoff news (this week was DoorDash and Wells Fargo) and record job cuts of 76,000+ that DOUBLED MoM are clear signs that were getting to needed labor supply normalization at a brisk pace. I know this sounds insensitive, but it is our reality.

I fully expect the Fed’s rate hike cadence to slow down to 50 basis points at the next meeting and for the pause I’ve been talking about for a year to happen in the first half of 2023. It’s NOT coming today. Employment data is still too robust with inflation too high for hawkish policy to halt. But we’re getting closer and closer. As markets are forward looking, and as I’ve said before, positive December inflation data would prompt me to deploy another large chunk of my remaining cash pile.

13. My Activity

I liquidated my SOXX position and used a small chunk of the cash to add to Lemonade, Meta Platforms and Shopify. In the coming months, I will be creating a second, more concentrated ETF portfolio that I’ll allocate around 10% of my funds to. SOXX will be a core holding of that portfolio and would have made it redundant in this current portfolio.

I also liked the idea of giving myself 1 more arrow in the quiver in terms of another 4-5% in cash to deploy in the near future as macro green shoots form.

Please note: I am waiting on a private market liquidation event to be the source of cash for the new portfolio so I can remain flexible and nimble in the main portfolio. Amid this personal macro backdrop, I’m fine with not having any cyclical semiconductor exposure for a few months. My cash position sits at 14% of holdings after the changes.

Very comprehensive, kudos. Plus great visuals!