News of the Week (April 10 - 14)

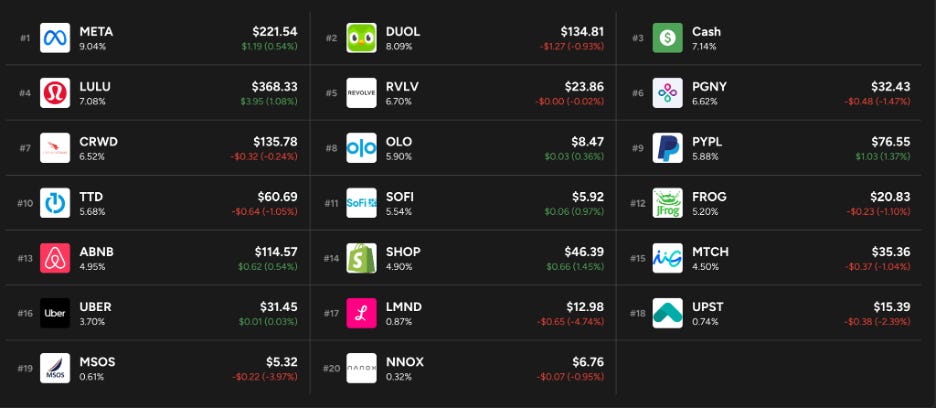

CrowdStrike; JP Morgan & Big Bank Earnings; The Trade Desk; Uber; Shopify; PayPal; Progyny; Airbnb; UnitedHealth; Alphabet; LVMH; Inmode; Apple; Amazon; Tesla; Upstart; Macro; My Activity

1. CrowdStrike (CRWD) -- Extended Detection & Response (XDR) Meet Internet of Things (IoT)

CrowdStrike debuted Falcon Insight for Internet of things (IoT) this week. The release extends CrowdStrike’s threat protection to operational technology (OT) environments to merge with IT-based threat coverage.

OT encompasses tools to monitor and facilitate standard operating procedures for endpoints like fulfillment center robots or some medical devices. IT refers to context-rich data that a business uses and organizes to generate insight and direction. The newfound unification inherently means more relevant data feeding the Falcon platform and so better efficacy for the client. It also allows software-based and physical environments to better communicate and share more precise and productive learnings.

According to the investor materials, “traditional IT-based solutions cannot interoperate with extended Internet of Things (XIoT) assets and lack context needed for effective protection while frequently disrupting OT-based processes.” This is the company’s solution to that headache by conjoining IT and OT-based threat protection with no prohibitive disruptions. The release vastly bolsters the addressable endpoints for Falcon by officially plugging in smart appliances, Programmable Logic Controllers (PLCs) etc. to its central platform. It also brings yet another area of software ecosystem protection under Falcon’s watch to combine with traditional endpoints, cloud workloads and data.

Programmable Logic Controller Definition: Purpose-Built computer used to remotely control and track operational workflows like assembly lines.

Customers of the new use case will be able to tap into the full breadth of CrowdStrike XDR alliance’s 3rd party data sets to offer a more precise, complete and contextualized view of vulnerabilities.

2. JPMorgan Chase (JPM) & Big Banks -- Earnings Summary

JPMorgan Chase offers investors a wonderful view into the health of the American consumer, business landscape and economy overall. This is a key bellwether and one that must be followed. Based on these results, the economy and consumer remain pleasantly resilient but with “storm clouds still on the horizon.”

“Our years of investment and innovation, vigilant risk and controls framework, and fortress balance sheet allow us to produce these returns, act as a pillar of strength in the banking system and stand by our clients during a period of heightened uncertainty.” -- CEO Jamie Dimon

a) Results vs. Expectations

Beat consensus revenue estimates by 7%

Beat $3.37 consensus EPS estimates by 21.7% or $0.73.

Beat return on assets (ROA) estimates of 1.15% by 23 bps.

Beat return on equity (ROE) estimates of 15.2% by 280 bps.

b) Outlook

The company raised its net interest income guide for 2023 (excluding markets) sharply from $74 billion to $81 billion. This was unsurprisingly called “market dependent” and will vary based on economic scenarios, monetary policy, loan growth and consumer spending health. The guide still assumes Fed rate cuts late in 2023. It still expects a normalized run rate net interest income in the mid-70-billion-dollar range.

It reiterated expense guidance of $81 billion and card net charge-off rate of 2.6% for 2023. This compares to 1.62% in Q4 2022 and 2.07% this quarter as it expects consumer health to continue eroding as economic headwinds persist.

c) Balance Sheet

Paid out $3 billion in dividends vs. $3 billion QoQ & $3 billion YoY.

Resumed share repurchases this quarter following improvement in its capital ratios. Specifically, its CET1 target is 13% (and 12.5% regulatory minimum) with its 13.8% result greenlighting it to buy back shares once more. It bought back $1.9 billion in stock vs. $0 QoQ & $1.7 billion YoY. It has north of $26 billion left on its current buyback program.

Book value per share rose from $86.16 to $94.34 YoY; tangible book value per share rose from $69.57 to $76.69 YoY.

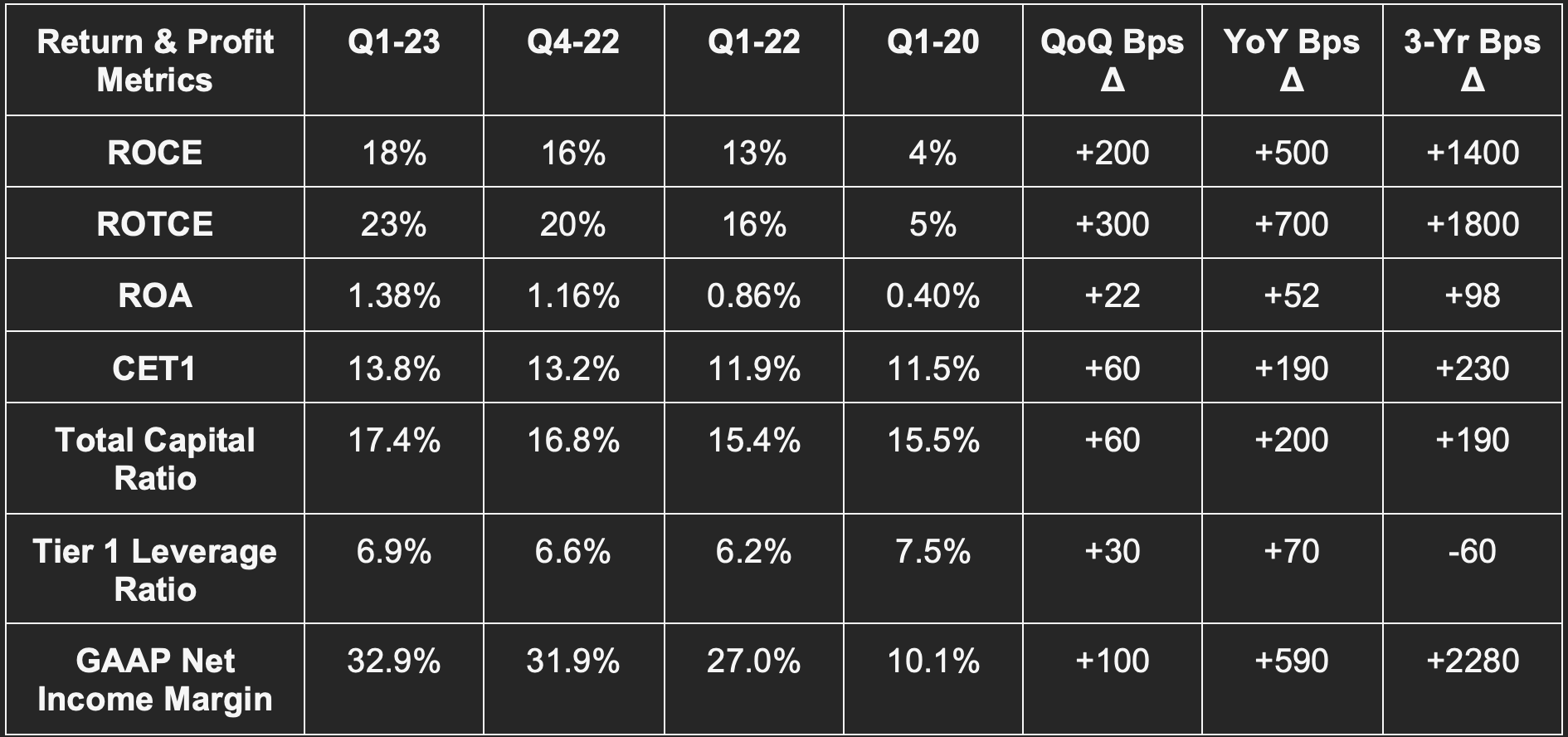

Its tier 1 leverage ratio was 6.9% vs. 6.6% QoQ & 6.2% YoY.

It has $412.8 billion in held to maturity (HTM) securities.

$1.128 trillion in loans outstanding; $3.7 trillion in total assets.

d) Notes from the Call & release

Macro Outlook:

The company sees a “rising probability of a moderate recession.”

Consolidated Demand Context:

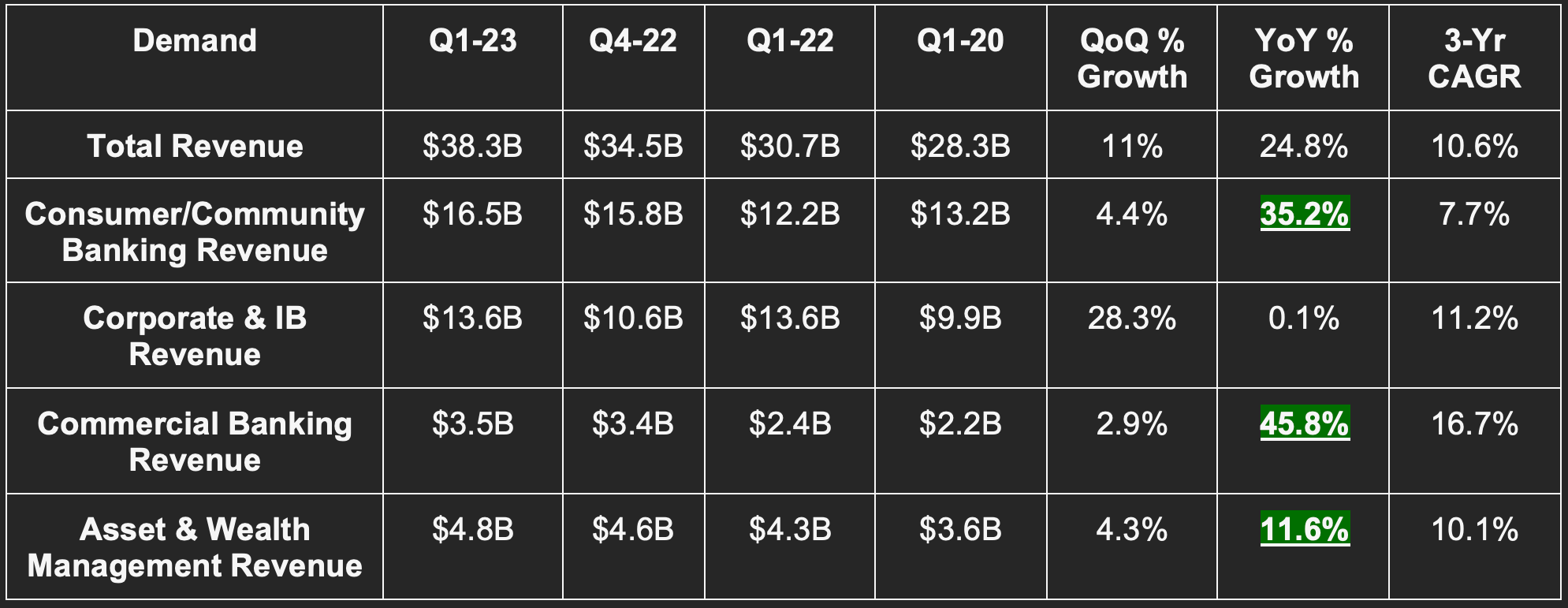

Average deposits fell by 8% YoY. Strength in overall results was driven by higher rates feeding its net interest income. We did not (yet) see much of a drastic impact from regional banking deposits shifting to bigger banks like JP Morgan & Chase.

Average loans rose 6% YoY.

Return & Margin Context:

Net interest income of $20.8 billion rose 49% YoY and 78% YoY excluding the volatile markets segment. Rate hikes helped mightily here while lower deposits hurt somewhat.

$2.3 billion in credit loss provisions via $1.1 billion in charge-offs and $1.1 billion in reserve building due to “deterioration in weighted average economic outlook.” This was related to its consumer community banking segment where charge-offs more than doubled YoY.

$2.3 billion in credit loss provisions is flat QoQ and rose from $1.5 billion YoY as part of continued delinquency and credit loss normalization post-stimulus.

Consumer Community Banking Segment:

Net income here rose 80% YoY to grow from 35% of JP Morgan’s total profits to 41% YoY.

Explosive growth was driven by higher deposit margins thanks to rate hikes.

Card and auto net revenue rose 14% YoY due to more net interest income and higher revolving credit balances but was partially offset by lower auto operating lease income. Still, auto assets on its balance sheet rose from a modest $8.4 billion to $9.2 billion YoY as it continues to operate here.

Home lending fell 38% YoY via tighter loan spreads and lower volumes due to rising mortgage rates.

Corporate and Investment Banking (IB) Segment:

Wallet share of IB fees rose to 8.7% vs. 8% QoQ and 8% YoY as it took significant share.

Net income rose 1% YoY here with flat revenue. This segment was comping YoY vs. a large equity investment gain which weighed materially on growth.

There’s not much IPO activity feeding this segment right now and debt underwriting fees were also challenged due to rising cost of capital. IB fees overall fell 19% YoY.

Asset and Wealth Management Segment:

Assets under management (AUM) for its wealth and asset management arm rose 2% YoY to $3 trillion.

Higher deposit margins were a main source of this segment’s robust, outperformance. A $339 million gain on investment for its joint venture in China helped too.

Dimon’s Take on the Consumer & Economy:

Consumer spending “remained healthy” with debit + credit volume rising 10% YoY. Still, consumers are utilizing more leverage to deliver this robust growth with card loans rising 21% YoY.

“The U.S. economy continues to be on generally healthy footings. Consumers are still spending and have strong balance sheets; businesses are in good shape. However, the storm clouds that we have been monitoring for the past year remain on the horizon, and the banking industry turmoil adds to these risks. The banking situation is distinct from 2008 as it has involved far fewer financial players and fewer issues that need to be resolved… Still, we do not know if this will slow consumer spending. We also continue to monitor for potentially higher inflation for longer (and thus higher interest rates), the inflationary impact of continued fiscal stimulus, the unprecedented quantitative tightening, and geopolitical tensions. While we hope these clouds will dissipate, the Firm is prepared for a broad range of outcomes.” -- CEO Jamie Dimon

Dimon’s Take on Silicon Valley bank and Hold to Maturity Securities Regulation:

“We're hoping everyone takes a deep breath and looks at what happened, and the regulations already in place. Obviously, when something happens like this, you should adjust. So I think down the road, there may be some limitations on HTM, maybe more total loss absorbing capacity (TLAC) for certain type size banks and more scrutiny. But it doesn't have to be a revamp of the whole system. It's just recalibrating things. I think it should be done knowing what you want the outcome to be. The outcome you should want is very strong community and regional banks. And certain actions we are taking, which are drastic, could actually make them weaker.” -- CEO Jamie Dimon

e) More Big Bank Earnings

Citigroup (C):

Citi Bank beat revenue expectations by a whopping 6.7%. It destroyed GAAP EPS estimates of $1.69 by $0.50 or nearly 30%. Its ROE came in at 9.5% which was a full 210 basis points ahead of consensus. Book value per share was also 1.3% ahead of consensus. The lone soft spot was a 6% miss on EBIT.

As a notable point of relative strength (even if books of business vary by focus), Citi saw flat YoY deposits while peers endured small contractions.

Similarly to JP Morgan, it built up credit reserves by $241 million vs. releasing $138 million YoY. This was a GAAP net income headwind that it overcame. Still, total costs associated with credit (losses + reserves + other provisions) more than doubled YoY as the economy normalizes.

Its return and liquidity ratios also all improved. ROE rose from 9% to 9.5% YoY. ROTCE was 10.9% vs. 10.5% YoY. CET1 Capital ratio of 13.4% vs. 11.4% YoY jumped back over its required regulatory minimum. This green lights the company to “increase excess capital returned to shareholders over time” per CEO Jane Fraser.

Wells Fargo (WFC):

Wells Fargo’s results were fine as well. It beat revenue estimates by 3.3%. It beat $1.12 GAAP EPS estimates by $0.11. Average deposits fell by 5% YoY and strength was due to rising rates and expanding net interest margin (NIM). Within consumer lending segments, home revenue shrank 42% YoY with rising cost of capital, credit card rose 3% YoY, personal unsecured rose 9% YoY and auto fell by 12% YoY.

Wells Fargo’s CET1 ratio still looks a bit light at 10.8% vs. 10.5% YoY compared to some other consumer banking titans, but it is moving in the right direction. This improvement also helped it to buy back $4 billion in stock during the quarter -- nearly 3% of its total market cap in just 3 months. Aggressive. ROE rose sharply from 8.7% to 11.7% YoY with ROTCE spiking from 10.4% to a respectable 14% YoY.

Its provisions for credit losses hit profits by $1.21 billion vs. aiding profits by $787 million YoY. Still net income rose by over 30% YoY thanks to soaring interest rates and so more lucrative deposits.

3. The Trade Desk (TTD) -- Proxy Statement

As expected, Co-Founder/CEO Jeff Green’s compensation normalized in 2022. This followed an $830 million 2021 salary via a founder package that started vesting in connection with hitting all of his performance targets. His total compensation was $5 million for the year which actually shrank from $16 million in 2020 (the most recent normal period comparison). Grayson (CFO) and Pickles (CTO) got a large raise from roughly $5 million to $7.5 million when including all forms of compensation.

Baillie Gifford & Co. owns 5.2% of the overall voting power vs. 6% YoY. It has 10.6% ownership of all class A shares.

Vanguard’s voting power is stable YoY at 4.5% with its class A share ownership rising slightly from 9% to 9.1% YoY.

Morgan Stanley owns 3.5% of the firm’s voting power vs. 3.2% YoY as it now holds 7% of all class A shares.

BlackRock is no longer a 5%+ owner of class A shares.

Co-Founder CEO Jeff Green owns 48.2% of the total voting power vs. 49.3% YoY. This is due to his 94.5% ownership stake in class B shares.

CTO Dave Pickles saw his stake grow to 5.5% of class B shares and 2.8% of total ownership.

All 11 executive officers and directors together own 1.7% of class A shares vs. 1.5% YoY and 51.2% of the voting power vs. 51.5% YoY.

4. Uber Technologies (UBER) -- Liquidity Event

Uber sold just over a 50% stake in a segment of its Middle East entity called Careem. The buyer was Emirates Telecommunications Group and the price tag was roughly $400 million in gross proceeds. Uber bought the company for $3+ billion 3 years ago and will use this cash infusion to expand to more markets and product categories with its new partner. Importantly, all 3 Careem co-founders will stay with the newly organized company. Under the new format, Careem will split into two different entities: Careem Rides and Careem Technologies. Uber will continue to entirely own and operate the rides business while it will jointly operate the other segment as a Super App next to its new investor and the founding team. Careem Technologies is the segment involved in the sale. Careem’s CEO, Mudassir Sheikha, will run Careem Technologies.

Uber still has $4 billion in equity investments sitting on its balance sheet as well as another $4.2 billion in cash and equivalents. It has $9.2 billion in total debt and is currently inflecting to consistently positive free cash flow. The balance sheet still cannot be called a strength, but it’s looking healthier than it has in the past.

5. Shopify (SHOP) -- Upgrade & an Initiation

JMP Securities upgraded Shopify this past week. As always, I don’t care about the price target, but I do care about the reasoning behind the upgrade. The rationale was two-fold. First, JMP channel checks show that Shopify is gaining traction with larger enterprises. The source of this momentum is (I think) likely its brand-new Commerce Components by Shopify (CCS) package and its System Integrator (SI) program which provides consulting firms like EY incentive and resources to sell Shopify’s bundles. Massive enterprises don’t embark on technology system overhauls on their own. They do so with SIs like EY and Accenture. Shopify is finally partnering with and incentivizing all of these major players and it provides a significantly higher probability of winning major, large-enterprise business.

The second source of JMP optimism comes on the cost and margin side. It sees Shopify Fulfillment Network (SFN) expenses being “lower than it feared” following CFO Jeff Hoffmeister’s comments at recent investor events. It also sees several other areas for easy cost cuts and synergies to bolster profit. With the new CFO now in place and his more balanced growth-profit philosophy, I expect aggressive margin expansion going forward to complement near-20% revenue compounding. With Shopify’s current high valuation metrics, that needs to happen for this investment to work.

Conversely, Needham initiated the company at hold due to mounting macro pressures and competitive risks within products like SFN. I think they’re about 12 months late on that call.

Our deep dive will be published April 23rd. We can’t wait to share it with you. New readers can subscribe below to have it sent right to your inbox for free.

6. PayPal (PYPL) -- Visa, Competition & Proxy Data

a) Visa and Competition

Visa will partner with PayPal and Venmo on its new peer-to-peer (P2P) product. The new offering, called Visa+, will permit customers to send and receive funds within digital wallets like Venmo and PayPal. Visa+ will use software-based identifiers (not physical cards) to allow people to connect to digital wallets to openly transfer funds. PayPal and its Venmo product will surely not be the only options available under this new release, but it’s still nice to see Visa select them as the first two.

10 years ago, PayPal was going to turn into a dinosaur because card rails like Visa were going to compete away all of its market share. They were going to debut directly competitive products that rendered PayPal’s offering antiquated. That didn’t happen. Yes, they compete somewhat directly on checkout and other card-based offerings, but the relationship is more collaborative than it is competitive at this point. 10 years later, PayPal is doing over a trillion in annual volume.

I say this because in 2023, Apple and Apple Pay have replaced card rails as the entities that will make PayPal extinct. I expect this narrative to shake out very similarly to how it did with VISA. Apple will debut competing products, those products will likely find success, and that success won’t prevent PayPal from its own execution. A new PayPal and Apple partnership helps too. As fear of extinction fades and PayPal continues its new trend of under-promise, over-deliver, the stock should finally find some footing. We’ll see.

b) New Proxy Statement Highlights

Vanguard now owns 8.4% of the company vs. 8% YoY.

BlackRock owns 6.7% of the company vs. 6.5% YoY.

Executives and Insiders own 1.5 million shares which is flat YoY.

Outgoing CEO Dan Schulman owns 500,000 shares vs. 370,000 YoY largely via open market purchases.

7. Progyny (PGNY) -- No Issues

Likely in response to Hedgeye’s new short report, Progyny released an 8K. In it, the firm once again reiterated that utilization and demand trends are strong across all services and its client base. It also continues to see “strong levels of interest” as it moves through the 2023 selling season. This strength, if it lasts like I expect it to, will eventually be reflected in 2024 results. Its new partnership with the Children’s Hospital Association (CHA) is further bolstering the strong performance. This is a new selling channel for Progyny and the opportunities there are significant. There will likely be more CHA-type opportunities coming that will juice demand and margins.

I wanted to thank the leadership team for publishing this filing. They did not need to, but I’m glad they did. After I’ve defended this company following 3 different short reports, it’s nice to hear that business is continuing to boom -- exactly as I said it would be. I’m not always right. I’m right here. I’ll continue to read all short reports with an open mind. I’ll continue to advocate for my holdings only when warranted.

8. Airbnb (ABNB) -- Experiences

One of the intuitive growth levers I see for Airbnb is enabling hosts to share talents and experiences with guests. A professional chef offering cooking lessons (like MasterClass) seemed like an obvious expansion of the core product suite. This past week however, news broke that Airbnb has paused accepting new experience applications. It’s unclear why this is happening. Ideally, it’s just to do some retooling of the service to make it more compelling and intuitive for hosts and guests. It could, however, mean that Airbnb is focusing more singularly on its current core business. That would mean more short-term margin upside and less long-term growth potential. That’s not a trade-off I would support. Short-term rentals are not an endless growth opportunity, and it will need other contributors at some point to continue briskly compounding on the top line.

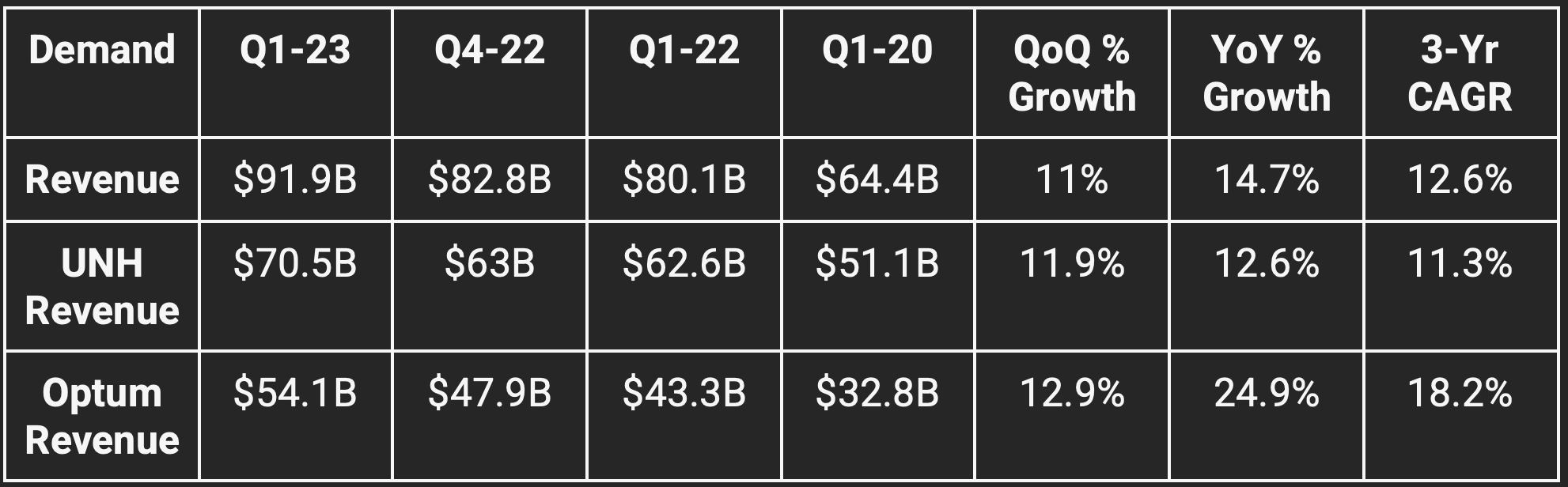

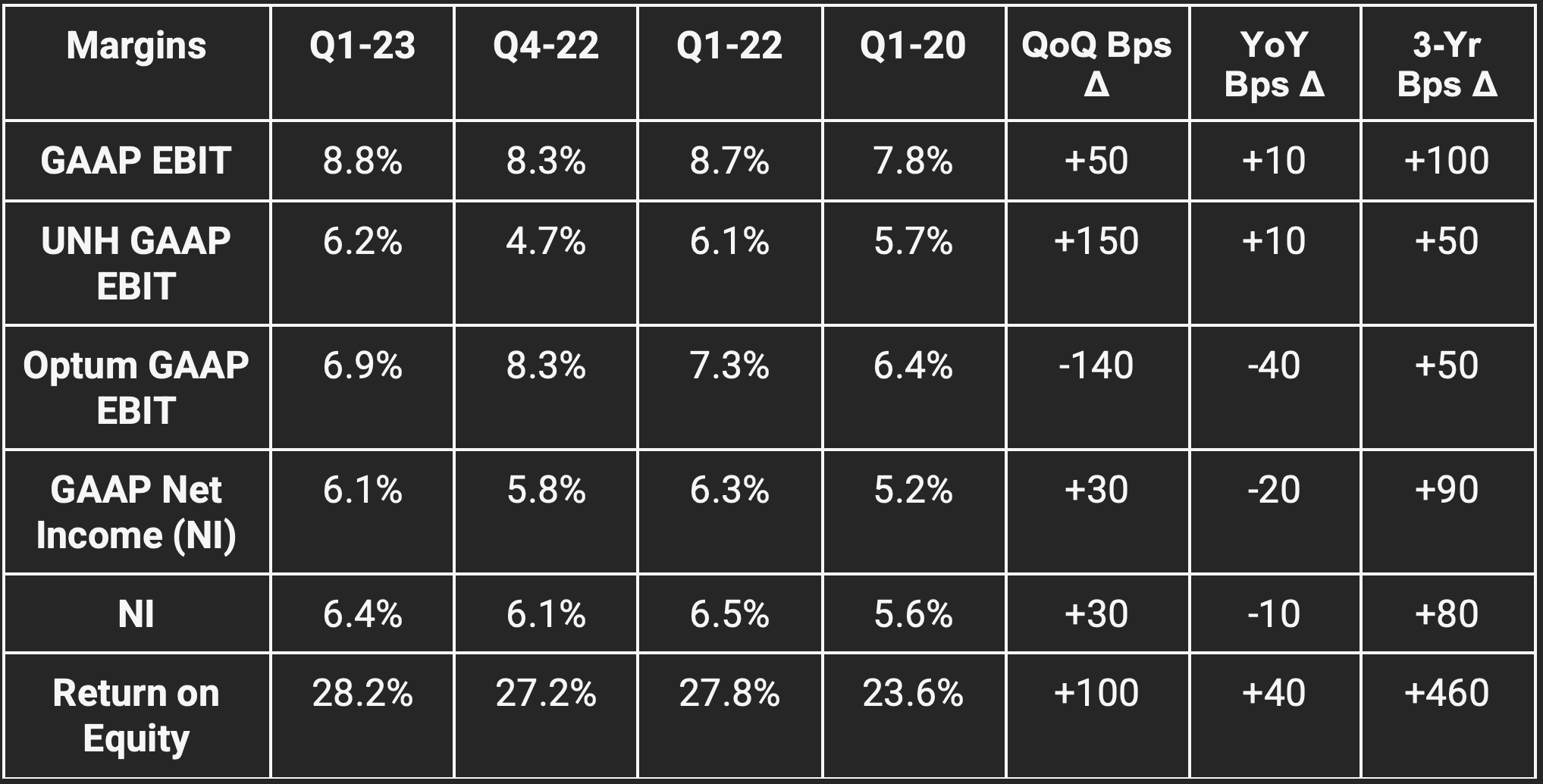

9. UnitedHealth (UNH) -- Earnings Review

“UNH is pacing strongly to its outlook for another year of market-leading growth in serving more people through Medicare Advantage offerings.” -- UNH CEO Andrew Witty

a) Results vs. Expectations

Beat revenue estimates by 2.4%.

Beat EBIT estimates by 2.4%.

Beat $5.83 GAAP EPS estimates by $0.12; Beat $6.08 EPS estimates by $0.18.

b) Forward Guidance:

The company reiterated its full year revenue outlook of $358.5 billion which was 0.3% below expectations at the midpoint. On the call, leadership acknowledged that revenue performance was “a little ahead of our view on guidance” and was “certainly positive.” It thought it was premature to update the overall revenue guidance number but it sounds like that’s just a matter of time.

Raised its GAAP EPS guide from $23.40 to $23.50 which is $0.17 below estimates. Raised its EPS guide from $24.65 to $24.75 which is $0.18 below estimates. Analysts know this company is a beat and raise machine.

OCF guidance was not updated but the quarterly results were “consistent with the company’s outlook.”

c) Balance Sheet

Bought back $2 billion in stock vs. $2.5 billion YoY.

Paid out $1.54 billion in dividends which rose 13.2% YoY.

$46.5 billion in cash and short-term investments and another $46.8 billion in long term investments.

$60.6 billion in long term debt; $9.9 billion in current debt (due in next 12 months).

d) Call & Release Highlights

On Cash Flow:

UNH reported $16.3 billion in operating cash flow (OCF). This was vastly aided by Center for Medicare and Medicaid (CMS) cash collections for UNH services within those programs. Adjusted OCF, which excludes this help, was $5.1 billion.

On Results:

Please note that growth is being supported by an inorganic contribution from its $13 billion Change Healthcare purchase late last year. This helps Optum Insight revenue and allowed its backlog to rapidly grow YoY by 35%.

Medicaid contracts won in Indiana and Texas will “expand products and geographies served” going forward.

Optum Health was specifically called out as a profit out-performer contributing to the guidance raise.

Medical Care Ratio (MCR) is a loss ratio which refers to percent of premiums paid out in services. MCR rose from 82% to 82.2% YoY due to service mix shift.

Optum revenue per customer rose 34% YoY due to continued service expansion.

Optum script volume rose 7.4% YoY to 378 million.

10. Alphabet (GOOGL) -- Streaming & More

a) Streaming Secret Weapon

Google recently signed a contract to secure NFL Sunday ticket rights for YouTube TV at a price tag of $2 billion annually. The service will charge $349 for its newly acquired NFL Sunday Ticket rights with a discount for current YouTube TV subscribers. NFL redzone costs another $40. There is a $100 promotion running into June.

Live sports is the last domino to fall in the move from cable to streaming. Nearly 90% of the most popular shows in the United States are sporting events with the vast majority of those titles being NFL games. This was a big get for Google -- which is why it was willing to shell out $2 billion a year for the rights to claw it away from DIRECTV. With 5 million+ YouTube TV subscribers as of summer 2022, the product would need to convert somewhere around 65-70% of existing paid subscribers to breakeven. That’s not realistic. What is realistic is this serving as a powerful top of funnel for driving new subscriber growth to get that fee in addition to $876 annually for the users also opting in to YouTube TV. There is no better motivator for driving traffic in the U.S. than having NFL games.

In other streaming news, Google TV is adding a package of 800 free channels to bolster the product’s appeal and advertising revenue.

b) Regulation:

Google wants U.S. courts to dismiss the antitrust case currently levied against them. Good luck. Whether it’s app store practices or double dipping in ad-tech, regulatory pressures are mounting, and I don’t expect that to stop any time soon. Still, there are very few companies better equipped than Google to combat this headwind.

11. LVMH and Inmode (LVMHY; INMD) -- Preliminary Q1 Results

a) LVMH

LVMH released its revenue results for the first quarter of the year. Performance was robust as its overall revenue beat analyst estimates by 5.1%. It grew organically by 17% YoY to reach roughly $23.2 billion in quarterly sales. Europe and Japan continued rocking and rolling for the global luxury conglomerate while North America stayed strong and Asia enjoyed a “significant rebound.” Selective Retailing grew by a whopping 28% YoY. Fashion and Leather Goods grew by 18% YoY as Pharrell Williams was named as that group’s new male creative director. Wines and Spirits, partially due to some supply gluts, was the slowest growth segment at 3% YoY.

All of this led to the report calling the start of the year “excellent” and the press release reading like a victory lap. The high-end consumer, which is the most recession resistant demographic, is healthy.

b) Inmode

Inmode released preliminary results for the first quarter which were strong across the board. It guided to $105.8 million in revenue which beat a range of consensus estimates by roughly 5%. EPS guidance of $0.505 beat estimates by 9.7%; gross margin guidance of 84% at the midpoint beat consensus estimates by about 100 basis points. It will release its full quarterly results on May 2nd.

12. Apple (AAPL) -- Supply Chain Shake-Ups

Several pieces of news this week dropped regarding Apple’s quest to reimagine its global supply chains. The tech titan is supposedly shifting a portion of MacBook production out of China to Thailand. The firm is also opening new retail stores in India while Bloomberg reported that 7% of its total iPhone production now occurs in India vs. just 1% in 2021. It’s clearly looking to ease reliance on China further. Finally, Apple is seeking to have 100% of its cobalt usage come from recycled sources by 2025. With Russia the #2 supplier of this material and Republic of the Congo (where China continues to invest billions of dollars) being #1, this to me is yet another way of Apple taking more geopolitical control of its supply chains.

13. Amazon (AMZN) -- Quick Shareholder Letter Highlight

Amazon reiterated its cost cutting plan and the profit tailwind it should facilitate. The near-term outlook for the business “including AWS” remains challenging but the company is quickly putting its cost base in a far healthier position to combat the temporary headwinds.

While Amazon is cutting costs in several areas, generative AI is not one of them. It continues to aggressively allocate funds there to augment its advertising business and to create new growth vectors to explore. It also debuted a new AI model called Bedrock (built on Amazon Titan) for AWS in a sign that these investments will truly help everywhere. This model will serve as a configurable foundation for building more industry-specific AI models for clients.

14. Tesla (TSLA) -- Price Cuts

Tesla’s delivery and production numbers last week were above consensus estimates. Still, it did produce about 18,000 more cars than it delivered which could (key word “could”) mean some level of inventory gluts. The important context here is that Q1 often sees production levels ahead of deliveries in typical seasonality. If this trend reverts in Q2, it will put the small concern to bed.

Still, the concern is heightened by more recent news of price cuts. In January, it slashed pricing for some models in China, but raised pricing for other models according to Elon. Inventory liquidation doesn’t typically coincide with select price hikes. This month however, it cut pricing across a few models by 2%-6% in the U.S. and extended pricing cuts to Israel, Singapore and Europe to join Australia, South Korea and other geographies. Tesla says this is the result of more operational efficiencies and savings that are being passed on to consumers. In the U.S. market, it could also relate to shrinking EV credits making its cars more expensive on a relative basis.

I can speculate on what this means, but I don’t think that would be productive. Luckily, it reports in a few days. We really need to see how the next few quarters of results come in to know why this is happening. And with Tesla’s uniquely robust margins, there is room for cuts while still leaving its unit economics best in class.

There’s a reason why this company is firmly in my “too hard” pile. An incredible story, and an incredibly difficult enterprise to track and value.

15. Upstart (UPST) -- Proxy & a Small Win

a) Proxy Statement

Co-Founder/CEO Dave Girouard owns 14.83% of Upstart’s common stock vs. 14.46% YoY. He made $9.6 million in total compensation vs. $15 million YoY.

CEO Sanjay Datta owns 1.41% of Upstart’s common stock vs. 1.25% YoY. He made $11.5 million in total compensation vs. $7.9 million YoY.

CTO Paul Gu owns 2.23% of Upstart’s common stock vs. 1.98% YoY. He made $51.85 million in compensation (via a non-recurring stock award) vs. $7.9 million YoY.

Vanguard owns 7.81% of Upstart’s common stock vs. 5.89% YoY.

Vulcan Value Partners is no longer a 5%+ holder.

All 10 directors and executives own 18.45% of Upstart’s common stock vs. 18.87% YoY.

b) CorePlus Federal Credit Union

CorePlus was added to Upstart’s partner roster. CorePlus is a very small credit union with $175 million in total outstanding loans as of its most recent annual filing. This likely will not be material to Upstart’s results.

16. Final Market Headlines:

Microsoft expanded its PC Game Pass availability to 40 new countries. ChatGPT was also allowed to restart operations in Italy following a brief ban for privacy concerns.

Elon Musk is creating a company to rival OpenAI. Maybe this is why he wants the U.S. government to pause AI development for 6 months.

Olo debuted “Olo Connect” to serve as a network of ecosystem partners with Olo functioning as the unifying integration layer conjoining all of the disparate tools.

Mastercard debuted “Cross-Border Services Express” as a solution for clients managing global transactions.

Softbank is liquidating most of its Alibaba stake.

17. Macro:

a) Inflation Data from the Week

Consumer Price Index (CPI)

MoM (month over month) Core (strips out food & energy) CPI for March was 0.4% vs. 0.4% expected and 0.5% last month.

MoM CPI for March was 0.1% vs. 0.2% expected and 0.4% last month.

YoY Core CPI for March was 5.6% vs. 5.6% expected and 5.5% last month.

YoY CPI for March was 5% vs. 5.2% expected and 6% last month.

Producer Price Index (PPI) (which is a leading CPI indicator):

MoM Core PPI was -0.1% vs. 0.3% expected and 0.2% last month.

MoM PPI was -0.5% vs. 0.1% expected and 0% last month.

Auctions & Inventories:

The 3-year note auction closed at 3.81% vs. 4.635% in the previous auction as the fixed income demand environment improved.

The 10-year note auction closed at 3.455% vs. 3.985% in the previous auction.

Crude Oil Inventory barrels rose 600,000 vs. expectations of shrinking by about 600,000.

Business Inventories MoM for February rose 0.2% vs. 0.3% expected and 0.2% in January.

b) More Data from the Week

Consumer Data:

Core Retail Sales MoM in March shrank 0.8% vs. expectations of shrinking 0.3% and 0% growth last month.

Retail Sales shrank 1% MoM in March vs. expectations of shrinking 0.4% and 0.2% shrinkage last month.

Michigan Consumer Expectations for April came in at 60.3 vs. 60 expected and 59.2 last month.

Michigan Consumer Sentiment for April came in at 63.5 vs. 62 expected and 62 last month.

Production Data:

Industrial Production MoM for March rose 0.4% vs. 0.2% expected and 0.2% last month.

5-Year Breakeven Inflation Expectations:

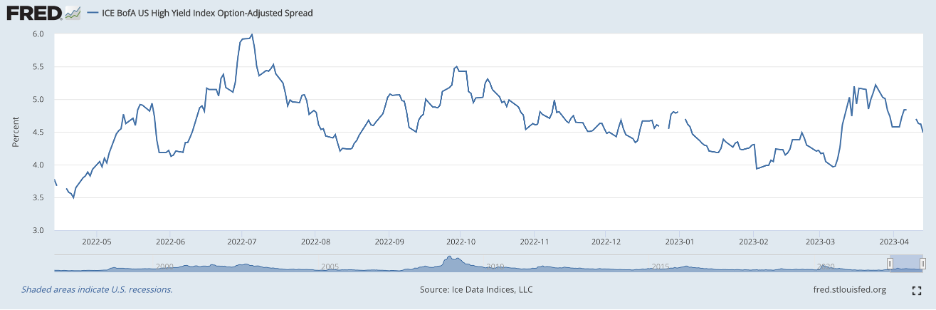

High Yield Option Adjusted Corporate Credit Spreads Improved a Bit:

c) Level-Setting the Data

Runaway inflation as a risk is a distant memory. I could not have scripted a better PPI print this week and the CPI print was on the cool side of things as well. To make things even more encouraging, backward looking rent inflation is the main source of continued elevated inflationary readings with more real-time indicators like Truflation, Owner-Equivalent Rent (OER) and the Apartment List Index pointing to that area of price increases now collapsing.

That paired with falling consumption and output data over the last couple months makes my base case of a mild recession all the more likely. The Fed also came out this past week and called this its base case in the Fed Minutes. It doesn’t expect rate cuts this year. JP Morgan does expect cuts this year. Whether we get the first cut at the end of 2023, or the start of 2024 is somewhat unimportant to me. We avoided the worst-case scenario of inflation forcing the Fed to hike our economy into a depression.

As a long-term investor in long duration risk assets, I fear runaway inflation, spiking cost of capital and soaring discount rates far more than I do a mild recession (or a couple quarters of negative GDP growth). Structural growers will still find slower growth in this environment, and future cash flows will finally start to be discounted less aggressively – making them inherently more valuable. With as far as some valuations have shrunk over the last 18 months, I view this as a positive setup for my holdings and speculative growth stocks. As always, I welcome all readers to disagree. My bias that has skewed slightly more towards trim vs. accumulate is now gone. I’m ready to take advantage of some deals -- slowly and carefully as always.

18. My Activity:

I did not transact this week.

I love having this information presented in a TEXT format. There are too many videos these days. Sure, they’re easy to make, but the information density usually doesn’t hold up. Thanks Brad!

Love your column. However, I'd put Tesla in the "too easy" pile. Leader in the paradigm shift toward electric light transport, massive growth in energy storage (which should show signs of becoming material this quarter) Leader in autonomous driving, which will revolutionize transport, building new factories to produce an EV at half the cost, irons in the fire with AI, robotics, and a clear disruptive force in manufacturing. Buy some, and put it away for a decade or two. Thanks again for your great write ups.