Welcome to the hundreds of new subscribers who have joined us this week. We’re delighted to have you and determined to provide as much value as possible.

1. CrowdStrike (CRWD) – CrowdStream & Google

a) CrowdStream

CrowdStrike debuted CrowdStream this week. The product expedites the location and querying of relevant 3rd party data to be infused into the Falcon platform. It unifies the data securing process from countless disparate silos to uplift threat remediation and prevention at its core. In essence, that is what the X in XDR (extended detection and response) means: Unlocking more partner data sources to combine with Falcon’s threat graph and customer data. Customers can do this free of charge for the first 10 GB of data. The product is offered in partnership with Cribl, an “open observability tool” and one of Falcon Fund’s (its VC arm) first investments.

Per the release, it “connects any data source into Falcon using Cribl’s observability tech. As the middleman, CrowdStrike vastly organizes and scalably eases this process. Alone, this is complex and expensive which has been a real hurdle for embracing XDR use cases. Problem solved.

b) Google

CrowdStrike and Google Cloud deepened their budding partnership this week. Now, Falcon is directly integrated into Google Cloud and its work environments. While CrowdStrike struggled in its early days to play nice with public cloud titans and missed out on significant partner revenue, that’s no longer the case. Whether it’s rapid revenue growth with AWS customers or Google developments like this, it’s becoming a better team player and its results will benefit. In terms of Microsoft, its direct competition with the company caps how closely these two can work together.

2. SoFi Technologies (SOFI) -- Student Loans & APY

a) Student Loans

Politico released a great article this week on a potential restart to student loan payments. According to the report, funding is running low as the Department of Education (DoE) has not collected revenue from this segment in 3 years and costs exploded higher to offer more borrower support. DoE fears that the Government does not have the funds to restart student loan payments and knows it does not have the funds to keep the moratorium in place. Tough spot.

In terms of the SoFi implications, they’re actually quite positive. This is forcing the hand of Capitol Hill to finally resume collections. That resumption would vastly accelerate SoFi’s refinancing demand and bolster what was its largest revenue segment pre-moratorium. Per the article, DoE officials are telling loan players like SoFi to prepare for a restart of payments in September. This hints at the current guidance of the moratorium ending by August 30th at the latest still being in place.

Still, there are planned “safety net” provisions which would allow borrowers to miss a certain number of payments with no penalties. That would slow, not halt, the re-ramping of demand. Policy makers want this grace period to last up to a year, but they don’t currently have the funding to do so.

SoFi’s guidance currently contemplates that student loan demand begins recovering in September. There was little certainty on this being the case as we were frankly worried about yet another extension hitting its full year estimates. Encouragingly, it does not look as though that will happen, although the grace period would dampen the ramp throughout 2023.

b) APY

SoFi raised its savings account APY from 4% to 4.2%. Perhaps not coincidentally, this is slightly ahead of Apple’s new rate and has no deposit maximums unlike the competition. While this will surely support top of funnel member growth, as we’ve said before, it is not a durable competitive edge. Alternatives like Robinhood and even Vanguard are rapidly raising their own rates as well. SoFi wins with its product suite breadth and tech stack integration offering more cross-selling opportunities and savings that it can pass on to customers. That is its consumer-facing edge… not a slightly higher APY.

Catch up on the markets daily for free in under 5 min in just One Read. Everyday we provide market highlights, important news and economic analysis in a easy to read simplified format. Don’t waste time filtering through all the stories in the financial world, sign up now and receive our update everyday after close!

3. Shopify (SHOP) -- Shopify Bill Pay

Shopify continues to expand its financial services offering. This week, through a partnership with a B2B payments vendor called Melio, it launched Shopify Bill Pay. The tool makes organizing and expediting bill pay obvious and doable all from the centralized Shopify Admin. There are no sign-up or subscription fees to use this.

As businesses scale, payment methods and vendors morph into a maze of names. Our business personally has about 10 advertisers in the database and nearly 10 different payment methods we use with them. It’s very annoying. According to the presser, the tool saves 16 hours per month on bill paying and is 2x faster than alternatives. In its mission to ensure businesses of all sizes have access to enterprise level infrastructure and resources, this is the latest development. The offering integrates perfectly into Shopify Balance to allow merchants to pay expenses from that account.

4. Alphabet (GOOGL) -- Earnings Review

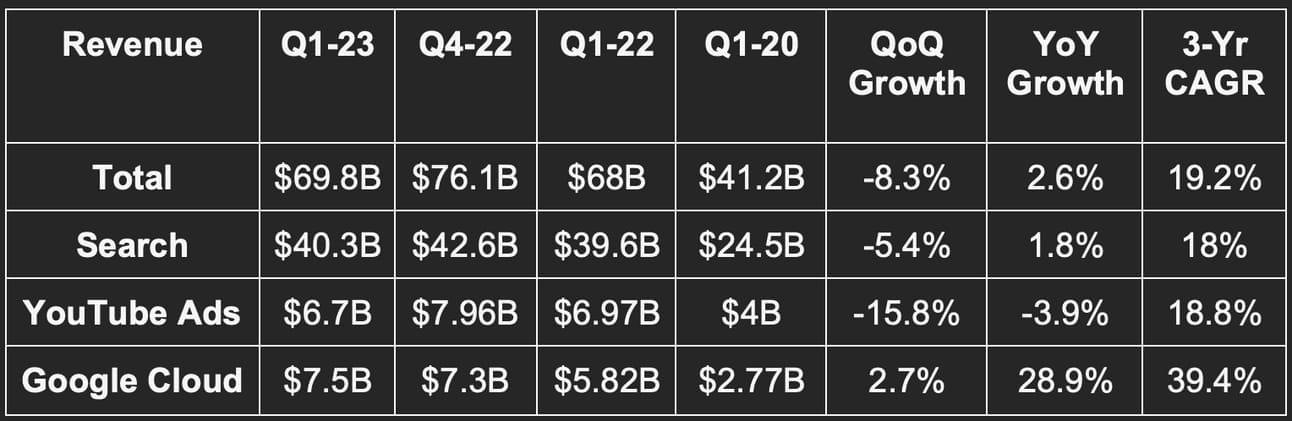

a) Results vs. Expectations

- Beat revenue estimates by 1.4%.

- Beat EBIT estimates by 7.1%.

- Beat $1.07 EPS estimates by $0.10.

- Beat free cash flow (FCF) estimates by 14.7%.

b) Forward Guidance

Alphabet does not offer formal forward guidance. It did tell us that 2023 Capital Expenditures (CapEx) would be slightly higher than in 2022. This represents a small raise to that cost expectation as it builds out data center and server infrastructure to support its AI ambitions. It also sees FX headwinds moderating for Q2 vs. Q1.

c) Balance Sheet

- Announced a new $70 billion buyback; Repurchased $13.3 billion in stock vs. $15.4 billion last quarter.

- $114 billion in cash and equivalents.

- $14.7 billion in long term debt.

- It paid out $5.3 billion in quarterly compensation for 7.6% of its revenue and 30.8% of its free cash flow. It’s more than offsetting the dilution with buybacks, but that’s still elevated for a company at this stage of maturity -- especially considering it shifted more stock comp out of Q1 and into Q2.

d) Call & Release Highlights

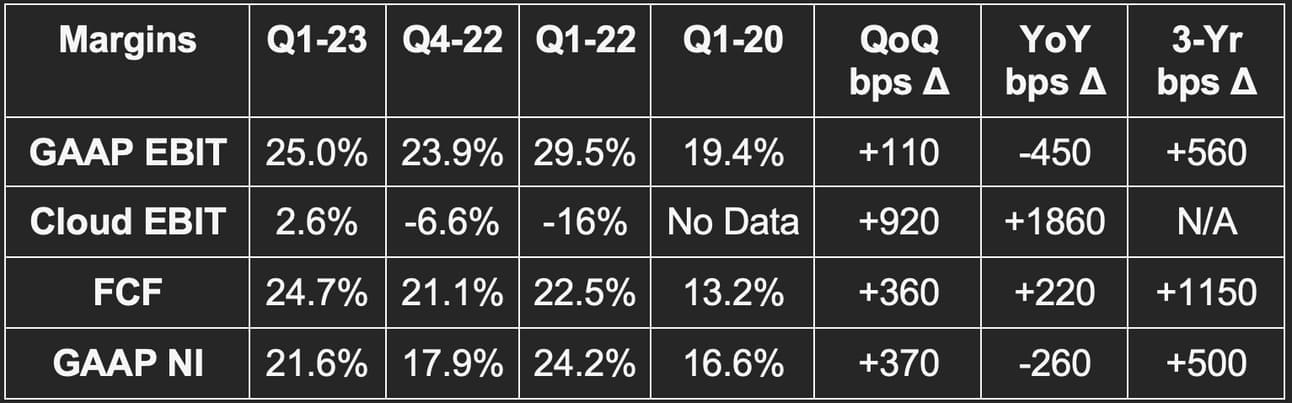

More Margin Context:

Google took $2.6 billion in charges related to layoffs and real estate footprint shrinkage. This hit GAAP margins and is why operating expenses rose by 19% YoY. Without these one-time charges, OpEx rose by about 5% YoY. GAAP EBIT margin for the quarter would have been 28.6% without this hit and GAAP NI margin would have been 25.2%.

More Accounting Changes & Cost Reductions Announced:

- Google saved $988 million in depreciation charges from extending the useful life of its data center infrastructure. Microsoft and Meta have done the exact same thing this year.

- The benefit from less depreciation will be ongoing; the hit from restructuring will be just for this year.

- Google will continue to very selectively hire at a snail’s pace. Q1 headcount includes employees fired in January.

- Will allocate more unallocated corporate costs to specific segments for “more decision making transparency.”

- Timing of stock comp to shift from Q1 to the rest of the year. This helped Q1 margins along with the depreciation perk while the restructuring charges hurt. Very weird quarter for margins.

“In our view, there’s more to do with cost optimization.” -- CFO Ruth Porat

More Demand Context:

- Revenue growth was 6% YoY on an FX neutral (FXN) basis.

- 3-yr revenue CAGR of 19.2% compared to 18.2% last quarter and 19.5% 2 quarters ago.

Google Cloud & Accounting:

Google Cloud delivered its first quarter of positive EBIT. This was aided by stripping some operating expenses out of the segment to reallocate to its largest Google Services segment. With this help, the segment reported $191 million in EBIT for a 2.6% margin vs. -16% YoY and beat dollar estimates by well over 100%. Without this help, assuming a roughly $250 million quarterly boost from the change, it posted a -0.8% margin vs. -16% YoY for a nearly 100% beat. Great performance either way.

- Annual cloud deal volume has risen 500% since 2020.

- Large deals over $250 million have grown by 350% since 2020.

- 60% of the largest 1,000 companies in the world are Google Cloud Platform (GCP) customers.

- 13 dedicated System Integrator (SI) programs are now in place to help sell GCP vs. 0 in 2020.

- Growth continued to be impacted by ongoing usage optimization to minimize cost amid chaotic macro for its clients.

AI Model Updates:

- Released Google Bard, an experimental conversational model in March while updating it several times since with newer tools like code generation aid.

- Debuted the Palm API to allow developers to tap into Google’s large language learning models to more easily and quickly build AI apps.

- Will combine the Google Brain and DeepMind teams into 1 group. This is expected to accelerate development by consolidating all of its talent with full access to Google’s vast resources.

- Performance Max (PMax) conversion tool is now delivering 18% higher conversions at similar advertiser cost. This compares to a 13% boost a little over a year ago as AI investments continue to bear fruit. For Corissia Hotels Group, PMax had boosted their revenue by 323% just 30 days after implementation.

- Rolled out in-store sales reporting that integrates perfectly into Google’s online conversion reporting tools. This allows advertisers to measure conversion and returns in both online AND offline settings. Magasin used this new perk to raise omni-channel return on ad spend (ROAS) by 128%.

Google Services:

- Advertising Search and other revenue rose 2% YoY largely thanks to the travel and retail segments with finance and media verticals notable weak spots.

- Saw “signs of stabilization and performance” for YouTube ads. The in-network ad demand environment was materially weaker with continued spend pullbacks.

- Channels uploading YouTube Shorts rose 80% YoY. Monetization continues to improve. Closing the monetization gap between short form and long form video is a key priority for this segment -- much like Reels and Meta.

- YouTube delivers 40% higher ROAS vs. linear and 34% higher than other online video per a Nielsen study running from 2020-2022.

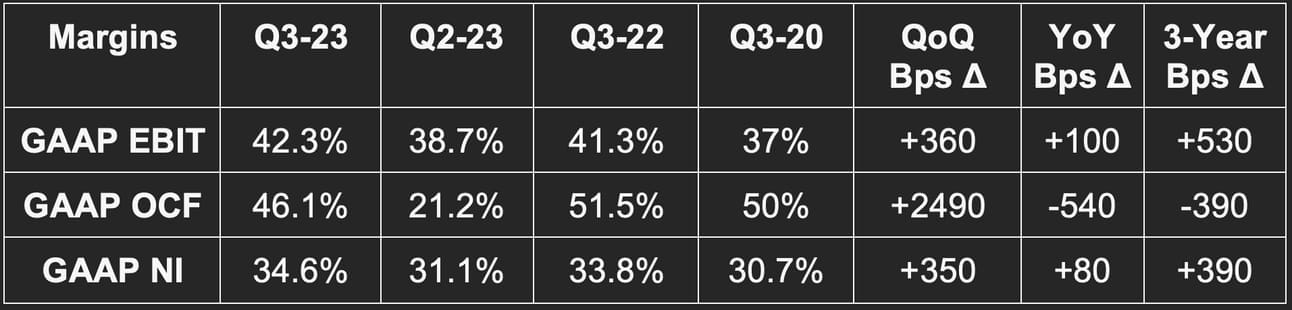

5. Microsoft (MSFT) -- Earnings Review

a) Results vs. Expectations

- Beat revenue estimates by 3.6% & beat its guidance by 3.7%.

- All 3 revenue segments beat with personal computing delivering the largest beat.

- Beat EBIT estimates by 9.3% & beat its guidance by 9.3%.

- Beat $2.23 EPS estimates by $0.22; Met OCF estimates.

- Azure roughly met FXN estimates with 31% YoY growth.

- 11% commercial bookings growth sharply beat Microsoft guidance of flat YoY growth.

b) Forward Guidance

- $55.35 billion revenue guidance beat estimates by 0.8%.

- $23.3 billion EBIT guidance beat estimates by 3.1%.

- 26.5% constant currency Azure growth (so about 25% YoY growth) missed by about 100-200 basis points depending on the source.

c) Balance Sheet

- $104 billion in cash & equivalents.

- $42 billion in long term debt.

- Bought back $5.5 billion in stock vs. $8.8 billion YoY.

d) Call & Release Highlights

Demand Context:

- 7.1% revenue growth overall was 10% FXN.

- Cloud revenue rose 22% YoY and 25% FXN.

- 10.8% Productivity and Business growth was 15% FXN. Microsoft 365 Consumer Subscribers now total 65.4 million.

- Xbox content and search + news advertising were the only personal computing segments that grew YoY. The rest shrank amid poor macro, supply gluts and PC cyclicality. Still, the shrinkage was much better than feared.

- Commercial Remaining Performance Obligations (RPO) sits at $196 billion vs. $189 billion QoQ and $155 billion YoY.

“I feel like we are well positioned to continue to take share in so many key places.” -- CFO Amy Hood

Margin Context:

- Gross margins were aided by extending the useful life of its data centers last quarter just like with Alphabet.

- $2.45 in EPS represents 10% YoY growth (14% FXN).

- Temporary R&D provision charges hit cash flows materially this quarter.

What’s Microsoft Copilot?

Copilot is an OpenAI-powered tool pulling from Microsoft’s language learning models to unlock conversational workflows and extensive work automation. As the name would indicate, it’s a copilot for expediting productivity much like ChatGPT has proven to be. It was integrated into GitHub for source code creation where it’s being monetized today. Microsoft fully plans to extend this software building and work companion to the rest of its suite.

Azure:

- Azure grew 27% YoY and 31% FXN and “took more market share.”

- The integrated Azure and OpenAI service now has 2,500 customers vs. 250 QoQ.

- Epic Games started integrating OpenAI algorithms into its software. Shopify and Snap are using it as well. Unilever went “all in on Azure in one of the largest ever cloud migrations in consumer goods.”

- Azure Arc (its integration tool to build on Azure) has 15,000 customers up 150% YoY.

- Workload usage optimization is ongoing amid poor macro. This is holding back Azure growth but should ease throughout 2023 as customers are unable to just continue endlessly optimizing existing capacity.

GitHub and Developers:

- 76% of the Fortune 500 now uses GitHub to create software.

- 10,000 organizations have developers using Copilot just 3 months post launch. These include Coke and GM.

- Its low code building Power Platform added Copilot recently and has 33 million monthly active users (MAUs) -- up 50% YoY.

Teams & LinkedIn:

- Teams crossed 300 million MAUs vs. about 280 million YoY. Teams “took share across every category.”

- Microsoft recently launched a new Teams version with 2x better performance and 50% less memory usage.

- Teams phone is delivering clients a 3-year return on investment (ROI) of 140%.

- LinkedIn revenue rose 8% YoY and 10% FXN. It has 930 million members with member growth accelerating for 7 straight quarters.

Security:

- Took share in all of its major security markets.

- 600,000 customers have 4+ modules up 35% YoY.

Search:

“Bing now has 100 million+ daily active users. We are winning new customers with Bing Mobile installs up 4x since launch. We took market share in the USA.” -- CEO Satya Nadella

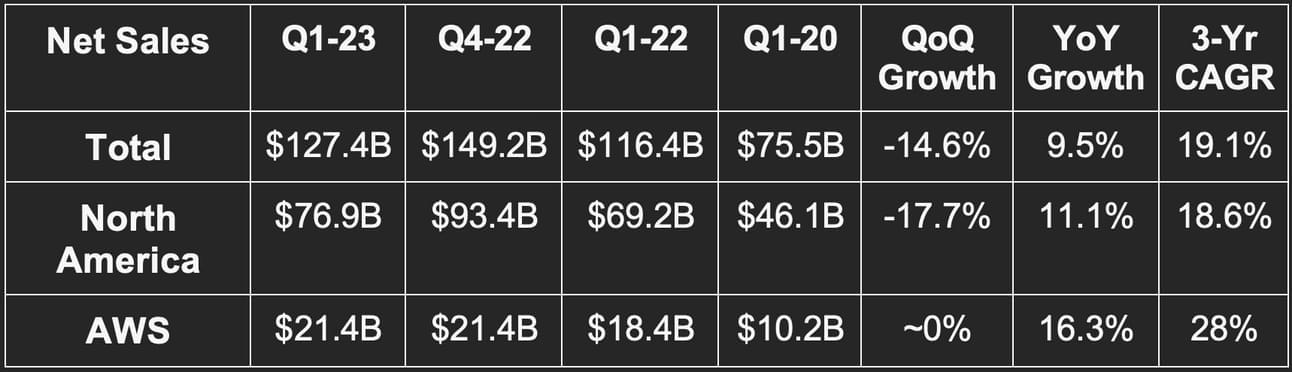

6. Amazon (AMZN) -- Q1 2023 Earnings Review

a) Results vs. Expectations

- Beat sales estimates by 1.4% & beat its guidance by 3.2%.

- AWS revenue beat estimates by 1.1%.

- Beat EBIT estimates by 53% & more than doubled its EBIT guidance.

- Beat $0.21 EPS estimates by $0.10.

b) Next Quarter Guidance

- Met revenue estimates.

- Missed EBIT estimates by 14.8%.