News of the Week (August 14 - 18)

PayPal; Sea Limited; Bill.com; Cresco Labs; Nanox; Earnings Round-up; The Trade Desk; Disney; SoFi; Amazon; Meta Platforms; 13F Season; Macro; Portfolio

Today’s Piece is Powered by our Friends at Long Term Mindset:

1. PayPal (PYPL) -- Alex Chriss & Adyen

a. Alex Chriss

Section 1a is very similar to the thread I posted on Twitter this past week. If you read that, this may seem redundant and I’d skip to section 1b.

Context:

Dan Schulman will retire as PayPal CEO next month. This is a bit earlier than expected and finally wraps up a challenged tenure. The company has fallen slightly behind players like Shopify within branded checkout flow. It has made its fair share of poor M&A decisions. It was perhaps one of the biggest examples of over-hiring & fixed cost bloat via getting too excited during the pandemic. It struggled with messaging when it came to a needed shift from prioritizing account quantity to quality. It has been frustratingly slow with monetizing Venmo. It has also been frustratingly slow with expanding into higher margin Braintree & PayPal Commerce Platform products. Execution has been underwhelming… but the asset base remains compelling.

The assets:

The company still leads branded checkout share & adoption by a large margin. That adoption lead actually grew vs. Apple Y/Y in 2022. Apple is by far the closest 2nd for adoption.

Speaking of Apple (& Google)… PayPal is now deepening its partnership with that giant just like it did a decade ago with card networks to fend off the previous competitive threat. Card networks were supposed to make PayPal a "dinosaur" & instead made them a key partner. The same is playing out with tech giants. When you represent 400 million accounts and nearly 100 million monthly active users who fiercely trust your brand, you are inherently an attractive partner. Even for Apple.

PayPal still features large merchant checkout boosts for conversion, authorization, basket size & chargeback rates. The conversion edge vs. the sector recently grew from 6% to 8%. That edge is massive when considering what an extra 8 sales per 100 shoppers means to a merchant.

Venmo is a verb & a product that my generation lives on. FedNow is clunky & lacks comparable consumer protection programs. But even if it takes P2P share, P2P contributes 0 to PayPal's profits. Its just a top of funnel source of new users that it will have to maintain or replace. Venmo checkout is just now ramping with Amazon, Starbucks, CVS, LiveNation etc.

Braintree continues to kill it. It’s now as large as Stripe & Adyen in terms of comparable volume. From a margin perspective, it’s well behind those two. Why? Because its entire book of business is gigantic brands like Uber & Airbnb. The more volume a client contributes, the better deal they can command. Braintree's book is made up of these kinds of sweetheart deals.

To round out the product suite highlights, Hyperwallet gives merchants unmatched breadth for payment methods. Zettle & cards are getting PayPal's foot in the door to brick & mortar growth. Honey (now PayPal Gold) continues to see rapid growth in adoption of its loyalty program.

When putting this all together, branded checkout share is stable while Braintree’s continues to sharply rise. Some don’t believe PayPal when they say that, but its branded growth is in line to slightly ahead of all of the closest sector benchmarks with unbranded well ahead of its own benchmarks.

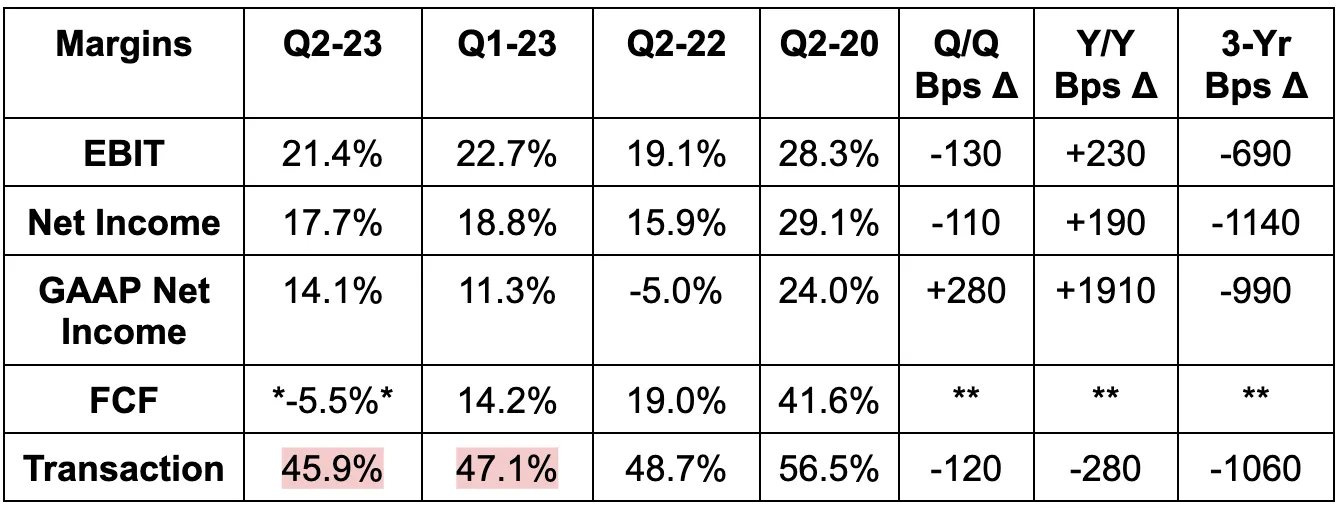

Braintree’s rapid growth is heavily weighing on the firm’s transaction margin. That margin pressure easing is top priority for Chriss. Second priority is effectively extracting value out of its quality assets. The two priorities are tightly connected.

Why I think Chriss is a good hire:

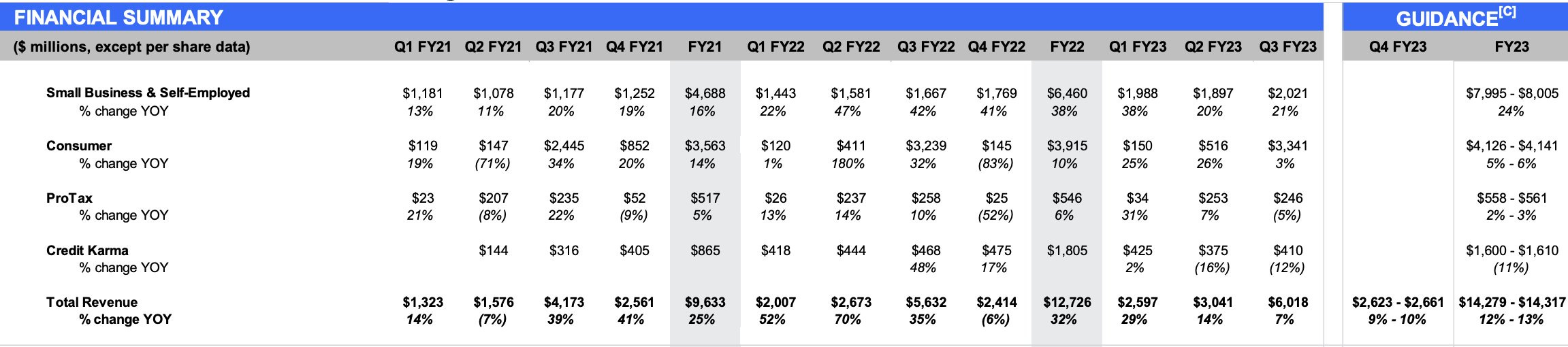

Chriss’s background is in running the small business & self-employed segment at Intuit. He spent 19 years there in roles like Chief Product Officer and also worked for Microsoft in the past. While he wasn’t the CEO of Intuit, he did lead a segment representing a third of the $140 billion enterprise’s revenue. It was over half of revenues until the Credit Karma purchase. As you see below, this is also Intuit’s most promising organic growth bucket.

Schulman met with nearly 2 dozen key investors including Elliott (which recently exited its PayPal stake) before making this decision. PayPal interviewed several FinTech & consumer bellwether CEOs, but thought his resume was the most compelling. And if you think about it, that makes sense. Why? Because Braintree has 3 margin levers to pull & Chriss is the man to pull them.

First is expansion into small and medium businesses (SMBs). Selling value-add software to small businesses is Chriss’s bread & butter. It is what he did with Intuit for products like QuickBooks and more. PayPal's marketing & loyalty programs are another key up-sell channel with Chriss having experience there as well in Mailchimp (more later). His software-centric, SMB-focused experience is ideal to say the least. The second margin lever is international expansion. Well? Chriss led a segment full of financial service products offered in 170 countries. He inherently has a deep understanding of the sensitive, fragile & complex relationships that global financial services firms must maintain with regulators. He has been threading that needle for years & years.

The third margin lever is up-selling value add software like Hyperwallet. Again… that is exactly what Chriss did with Intuit. He should have a keen sense of go-to-market strategies for these attractive products. Taking the PayPal job indicates that he sees these products as truly attractive.

Mailchimp:

The one black eye on Chriss’s resume is Intuit overpaying for Mailchimp. It has since written down the $14 billion acquisition by $3.4 billion. Like PayPal tried (and thankfully failed) to buy Pinterest, Intuit and many others sought ill-advised acquisitions while money was free, valuations were egregious, and growth at any cost was rewarded. While he wasn’t the CEO or CFO picking the price tag or offering the final stamp of approval to send the proposal to the board... he led the transaction. As counterintuitive as this may sound, I view this black eye as a positive.

Chriss should have a deep understanding of how difficult transformative M&A is to seamlessly integrate & execute. He should directly understand how C-suites are vulnerable to becoming too excited with presumed synergies. He should have a VERY high bar to clear for future M&A.

I don’t see PayPal as needing to plug an asset gap with another purchase. I see them as needing to execute within their existing asset base a lot better. Chriss has already learned a difficult lesson in Mailchimp. That should make him less prone to try and buy a Pinterest… for example.

Where we go from here:

This is not an “all clear.” Chriss can’t come in and wave a magic wand to make this a fintech darling overnight once more. It will take time for his strategy to be implemented and it will take time for that to show up in results within the massive book of business.

This is a step in the right direction… but a transaction margin trough is the step I want to see to resume adding to my stake. Chriss’s resume should have PayPal investors feeling cautiously optimistic that he can deliver. We’ll see how he does, but I’ll be giving him a full year to show real signs of turning the tide.

b. Adyen

Adyen, Stripe and Braintree round out the 3 highest profile white label processors around the globe. Adyen reported challenged first half results this past week that significantly missed on the top and bottom line while sending the shares falling nearly 40% in a single session. It missed revenue estimates by 4.4%, EBITDA by 12%, EBIT by 14.4% and $9.45 EPS estimates by $0.38. While this wasn’t a good quarter on the surface, this absolutely is a wonderful company with years upon years of lofty revenue compounding at gaudy margins. So then what happened?

A few things. First was aggressive hiring. Adyen leadership in 2021 did not participate in Fintech’s and Software’s hiring binge. It held back on adding headcount due to fierce competition for talent and so elevated comp demands. That fierce competition has since subsided and so Adyen, with its pristine balance sheet, has accelerated its pace of hiring. That’s why profit margins were below consensus across the board as the team told us “it could have optimized” for profitability but chose to invest in the long term.

The demand disappointment stemmed from its sales team not yet being large or trained enough due to this same pandemic-related talent competition issue. Interestingly however, the disappointment was also via increased pricing competition in North America. There are no rumors and no news anywhere about Stripe cutting rates… so this is referring to PayPal’s Braintree. This is yet another sign of how strong the momentum is for this now large part of PayPal’s total operations.

As I’ve discussed at length, the main PayPal risk today is where the transaction margin bottom is. When and where will we see an inflection? The margin compression is almost entirely related to Braintree’s rapid growth. While “pricing competition” doesn’t inspire confidence in Braintree’s margin potential, a successful expansion into smaller clients, more geographies and more software up-sells like Chargehound will. It’s inning one of these three endeavors.

Furthermore, Braintree can likely afford this added pricing competition. Why? Because when PayPal lands a large Braintree client, it generally is able to win better branded placements for both Venmo and branded PayPal checkout. Branded is high margin. Finally, in what was an abnormally weak quarter for Adyen, it still posted a robust 43% EBITDA margin. If Braintree even approached HALF of that margin as these new revenue streams kick in, that would work wonders for revenue and in reversing the erroneous narrative that white label processing can’t be high margin business. Adyen clearly proves that it can be. Based on using price as a competitive lever, Braintree likely won’t ever see the level of EBITDA margin Adyen saw in this report… and it doesn’t need to for the unit to morph into a profit driver at PayPal. That won’t happen this quarter… it likely won’t happen in Q4… it should absolutely start to play out in 2024.

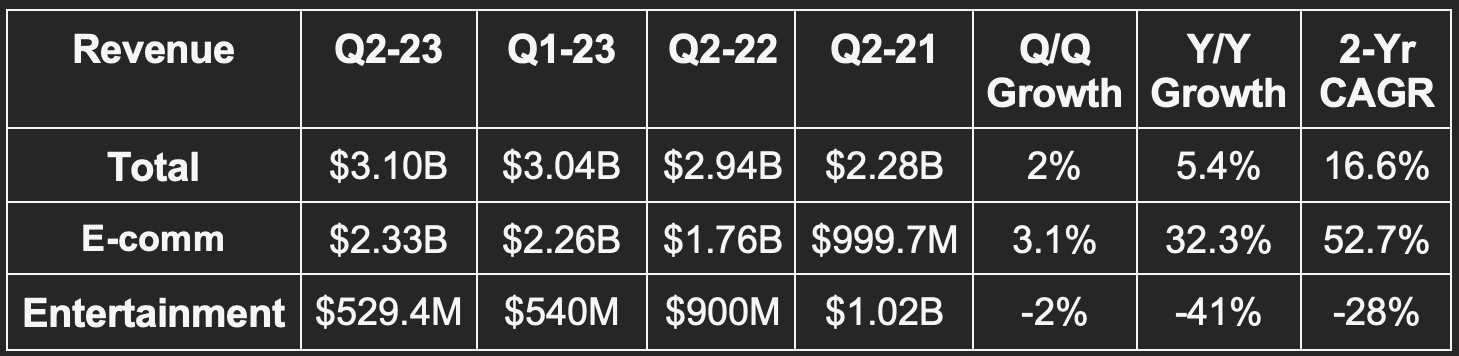

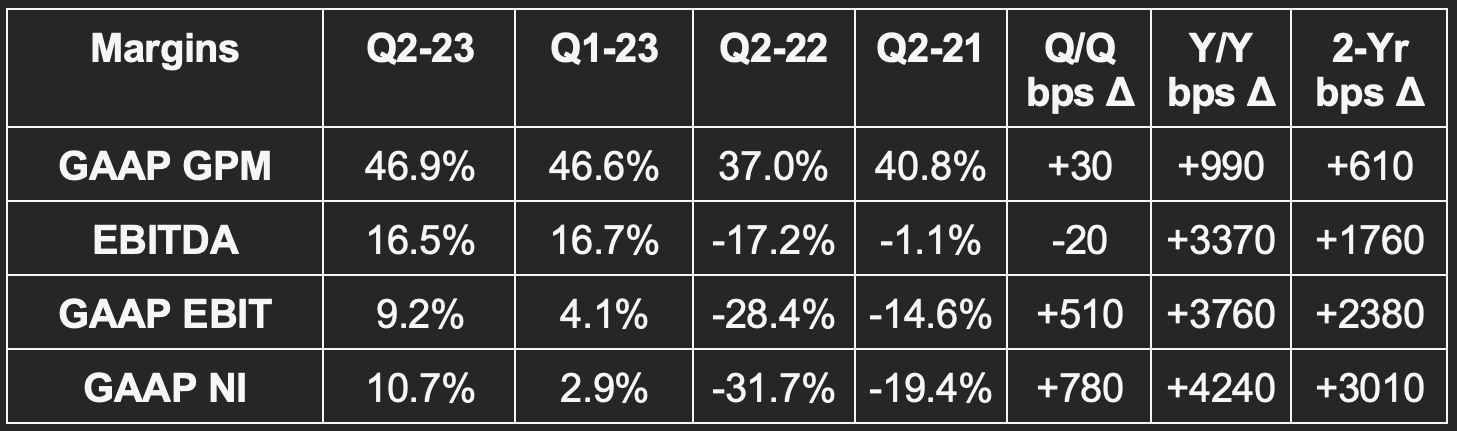

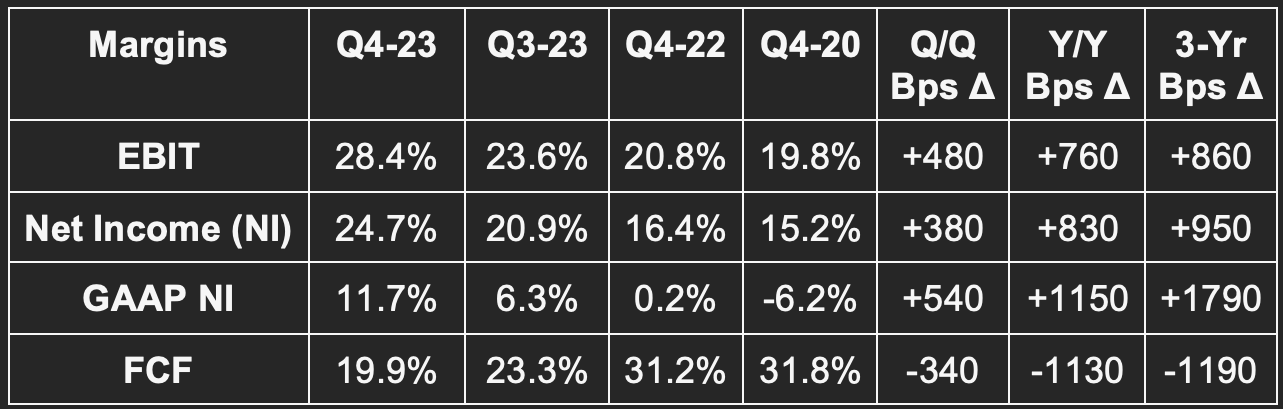

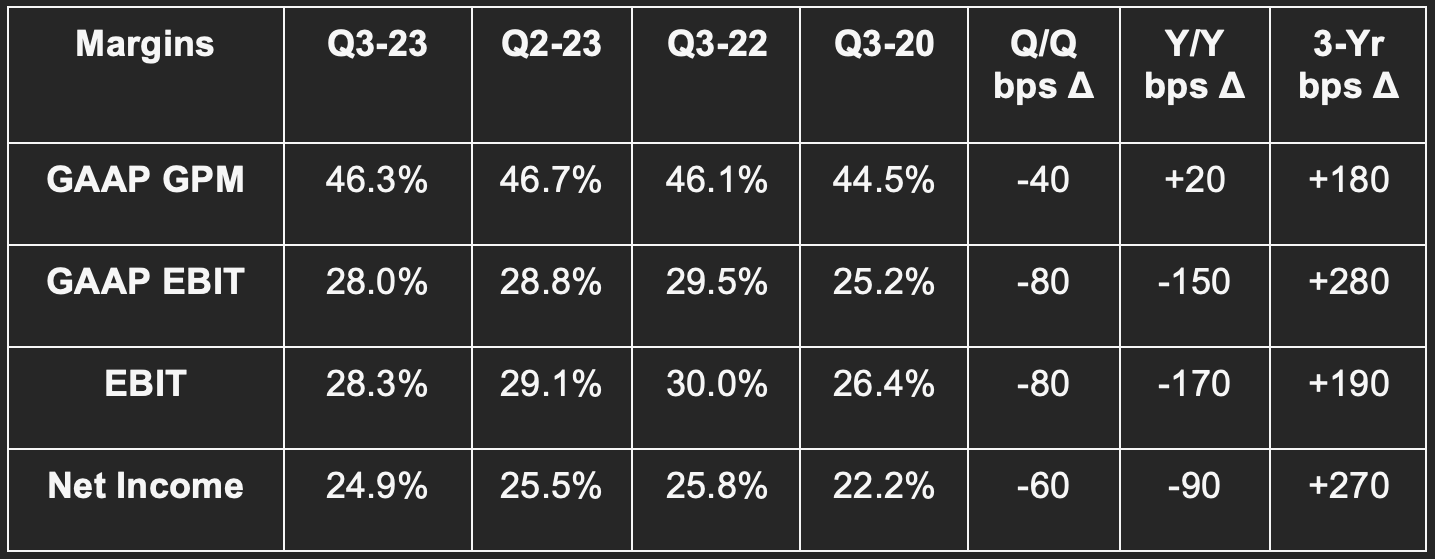

2. Sea Limited (SE) -- Q2 2023 Earnings Review

a) Results vs. Expectations

Missed revenue estimates by 4.6%.

Beat EBITDA estimates by 3.2%; beat GAAP EBIT estimates by 8.8%.

Beat $0.46 GAAP EPS estimates by $0.08.

b) Balance Sheet

$5.7B in cash & equivalents. We exclude long term investments from this metric which SE includes.

$3.3B in convertible notes.

c) Call & Release Highlights

Macro:

Sea Limited sees its Asia Pacific markets as showing strong resilience and weathering the current global economic uncertainty.

Continued Pivot:

Starting a few quarters ago, Sea Limited pivoted from an aggressive growth approach to one that prioritized profitability more strongly. The global money printer turned off and it adjusted accordingly. It thinks it has now demonstrated “self-sufficiency” and proven the profitability of the model. Now, it’s ready to re-accelerate investments in growth and warned investors that this intentional move may weigh on margins in some quarters.

Sales & marketing fell 49% Y/Y.

General & administrative fell 19% Y/Y.

Provision for credit losses rose 37% Y/Y.

Research and development fell 24% Y/Y.

E-Commerce:

Core marketplace revenue rose by a robust 37.6% while orders jumped by over 10% sequentially. Its EBITDA margin here also sharply inflected positively from -38% to 4.8% Y/Y as it became the only large and profitable e-commerce marketplace in that region. New buyer tools like order scheduling and tracking led to a 10% Y/Y rise in net promoter score while it continues to cut costs by adding pick-up points throughout its markets.

Interestingly, its live streaming service is creating some great cross-platform growth for Shopee. Its July streaming campaign drove 12x transaction volume vs. a normal day while its August campaign was met with similar success. It’s the number 1 live streaming platform in Indonesia per Populix.

Digital Entertainment:

Free Fire (one of its popular games) saw sequential bookings growth for the first time in nearly 2 years.

Quarterly paying users rose 14.6% sequentially to continue an encouraging reversal of Q/Q declines.

EBITDA margin was 45.2% vs. 42.6% Y/Y.

Financial Services:

Revenue here continues to rapidly grow at a 53% Y/Y clip. The segment also turned convincingly profitable Y/Y with a 32% EBITDA margin vs -40% Y/Y.

The most important thing for this segment is credit quality… and credit quality is stable. 90+ day non-performing loan rate is flat at 2% of gross profit. It spent the last quarter sharpening its underwriting and deepening its access to 3rd party funding sources. It made good progress in both areas per the team.

Long-Term Mindset is a FREE weekly newsletter emailed each Wednesday. Each issue contains five pieces of timeless content to encourage you to think long-term. All issues can be read in less than 1 minute. There’s a reason why we are consistent readers and think you should be too. Subscribe here.

3. Bill.com (BILL) -- Earnings Review

Bill.com sells back-office financial service software mainly to small and medium businesses (SMBs). With the majority of SMBs still using manual payment & financial reconciliation tools, digitization within this niche is a key structural Bill.com tailwind.

a) Results vs. Expectations

Beat revenue estimates by 4.7% & beat guidance by 6.3%.

Beat $0.41 EPS estimates by $0.18 & beat guidance by $0.19.

Beat EBIT estimates by 60%.

b) Initial Fiscal Year 2024 Guidance

Barely missed FY 2024 revenue estimates by 0.2%.

Beat FY 2024 $1.83 EPS estimates by $0.07.

Bill has a strong track record of prudent guidance and consistent under-promise, over-deliver. While the revenue number did technically miss by a small margin, it’s very likely that Bill.com ends up revising that metric higher throughout its year. This is not alarming from our innocent bystander point of view. In the call, leadership spoke about next year featuring a “constricted macro environment” indicating the conservatism in the baked-in assumptions.

c) Balance Sheet

$2.6B in cash & equivalents.

$1.7B in senior convertible notes.

Share count up 1.9% Y/Y.

d) Call & Release Highlights

Results Context:

Core revenue rose 33% Y/Y for the quarter.

Bill has 5.8 million network members vs. 4.7 million Y/Y for 23% Y/Y growth.

Fiscal Year 2023 in Review:

This past year, Bill.com set out to unify its product buckets across a singular platform. It also consolidated sales teams to conjoin go-to-market approaches and to increase customer traction and cross-selling. Like Shopify allows all pieces of commerce (and now financial services) to be routed through its singular dashboard, Bill.com allows all financial services to be organized through its own admin. This unification approach is working as its penetration of client volumes processed through Bill rose from 10% to 13% Y/Y. Additionally, its free cash flow in fiscal year 2023 sharply turned positive from -$33 million to $156 million Y/Y while it saw material EBIT and net income margin leverage as well. From a demand point of view, revenue growth was lofty at 65% Y/Y as it voraciously took more market share.

Partners:

Bill’s bank and accounting firm integrations are integral in creating interoperability and broader functionality within its platform. It allows for more pay-out and pay-in method flexibility, paves the way for easier data sharing and financial reconciliation and just makes things work more smoothly for all stakeholders. As of now, there are over 7,000 accounting firms integrated into the platform vs. about 6,000 Y/Y.

Furthermore, the two highest quality banks in the nation continue to work closely with this company (among many others). JP Morgan Chase just extended its Cashflow360 program (which Bill runs) for another 5 years. It’s also “in the process of expanding a Bank of America relationship” to offer its tools to its vast base of business accounts.

Conversely, Bill’s partnership with Intuit to “co-market embedded Bill pay” services expired 2 months ago without renewal. While this business represented almost 1% of Bill’s revenue, the company believes that it is actually better positioned without Intuit. This is from Bill’s point of view, but Intuit was the reason for the non-renewal.

4. Cresco Labs (CRLBF) & Nanox (NNOX) -- Earnings Results

These two holdings represent 0.9% of my total holdings. Both are wildly speculative for very different reasons. For Nanox, the product that could create potential shareholder value has not yet been commercially deployed and is not generating revenue. It has secured FDA clearance, but there’s no guarantee that this revenue actually starts flowing in and there’s ample uncertainty about what kind of margins the revenue will carry. So? I won’t add to this tiny stake until that becomes more clear

Cresco Labs is a high-quality organization with a great team in a compelling sector. It has the largest wholesale cannabis business in the USA and the most efficient retail business as well. So why is this so high risk? Because its operational success will not translate into financial success until legislation allows for it. They still can’t open a bank account, can’t secure business insurance, can’t deduct ordinary business expenses from their bills and cannot list on U.S. exchanges. Cresco and the sector are operating with handcuffs tightly clamped onto their wrists. That won’t change until politicians pass legislation that 70% of the country wants. When will that be? No clue. And I will not add to this name until that becomes clearer.

Commercial deployment for Nanox and legislation for Cresco are prerequisites for these HIGHLY risky and speculative investments to work. This is why both holdings are tiny and why I’m not building out either at the moment.

a) Cresco Labs

Results:

Cresco Labs beat revenue estimates by 1.6% but sales shrank by nearly 10% Y/Y as pricing pressures continue to hit its business quite hard. Its adjusted gross margin fell from 53% to 46.8% Y/Y (improved Q/Q) due to these same pressures paired with input cost inflation. It beat EBITDA estimates by about 25%... but again… EBITDA fell by 25% Y/Y (up 38% Q/Q). This was a bad quarter on the surface, but as good of a quarter as it could have been for Cresco given the daunting circumstances plaguing this sector as of today.

Other highlights:

Market share leader in Illinois, Pennsylvania and Massachusetts.

It has $265 million in cash & equivalents with $75 million being restricted.

As previously announced, it terminated its agreement to buy Columbia Care.

It needs to find a way to buy its way into more key east coast states.

It expects more sequential operating leverage in Q3 and Q4. It sees CapEx also significantly falling which should mean better free cash flow.

It expects revenue declines Y/Y to continue all year long.

Continues to boast the top selling branded flower portfolio in the U.S. and is top 5 across other form factors.

Retail transactions rose 11% Y/Y while unit volume sales rose 19% Y/Y pointing to the severe pricing pressure facing the space today.

Now has 68 dispensaries.

Margins in core markets are improving, but $22 million in impairment charges from its exit of struggling markets hit GAAP margins. In addition to Arizona and California, it has now added Maryland to its list of states in which it will pull back.

Takeaway:

I continue to admire this team and see Cresco as the best-in-class name in cannabis. I just don’t know when politicians will finally do what everyone wants them to do with banking and more federal reform. Financials will look ugly until that happens and Cresco will keep becoming even smaller than the 0.5% of holdings it makes up if regulation is delayed further. The potential is there, the path is currently blocked. Frustrating… but that’s the reality and why this has to be so small. Do you think you can predict political agendas? I surely cannot.

b) Nano-X Imaging (NNOX)

This was a boring quarter for Nanox. I was hoping to hear more news about potential North America deployments or at least the test model being live in Ft. Lauderdale with its multi-source clearance in place. That didn’t come, but there were also no alarm bells or red flags to be worried by.

It talked about progress within securing more supply access for its chips, x-ray tubes and machines. It entered into an “original equipment manufacturing collaboration” with a U.S. government agency to explore security use cases.

Financials today outside of the balance sheet are irrelevant. Its revenue is coming from ancillary services that I view as niche opportunities. Its gross margins reflect those somewhat irrelevant business segments. Share count rose by less than 1% Y/Y and it has $73 million in cash & equivalents vs. $77 million at the start of the year.

Takeaway:

This is a lottery ticket and, again, one that I wouldn't even think about adding to until real revenue is generated. It’s just 0.4% of total holdings for this reason. Nanox could still be a home run… it could also still be a zero.

5. Earnings Round-Up -- Applied Materials, Walmart & Nu Bank

a. Palo Alto Networks (PANW) -- Earnings Review

Palo Alto plays in both endpoint and network security. It calls CrowdStrike and SentinelOne key endpoint competitors while Zscaler and Cloudflare directly compete with it in the network niche.

Results:

Missed Billings guide by 0.7%.

Missed revenue estimate by 0.2% but beat revenue guide by 0.1%.

Beat $1.29 EPS estimate by $0.15 & beat guide by $0.16.

Beat FCF estimate by 8%.

Initial Fiscal Year 2024 Guidance:

Beat full year billings estimates by 1.7%.

Missed full year revenue estimates by 2.5%.

Beat full year $4.95 EPS estimates by $0.38.

Balance Sheet:

$2.3B in cash & equivalents.

$3B in long term investments.

$2B in convertible senior notes.

Diluted shares up 5.4% Y/Y; basic shares up 2.8% Y/Y.

Results Context:

Product revenue rose 24.3% Y/Y and carried a 79.4% gross margin vs. 65.0% Y/Y.

Subscription and support revenue rose 26.6% Y/Y and carried a 72.2% gross margin vs. 69.4% Y/Y.

Next generation security (NGS) annual recurring revenue (ARR) rose 56% Y/Y to reach $2.95 billion while it added $381 million in net new NGS ARR during the quarter.

37% Y/Y growth in $10+ million deals and 43% Y/Y growth in $20+ million deals.

Prisma (cloud security) saw 45% Y/Y growth in consumption while 5+ module customers rose 179% Y/Y.

Secure Access Service Edge (SASE or network security) saw 60% Y/Y ARR growth.

Palo Alto continues to work with clients on their payment schedules while macro remains somewhat chaotic. This led to a year high in % of bookings under deferred payments. This was why billings growth underwhelmed while remaining performance obligation growth was quite strong.

b. Applied Materials (AMAT)

Results:

Beat revenue estimate by 4.4% & beat guide by 4.6%.

Met 46.3% GPM estimate & same guide.

Beat $1.75 EPS estimate by $0.15 & beat $1.74 guide by $0.17.

Its 13.5% 3-yr revenue CAGR compares to 18.8% Q/Q & 17.4% 2 quarters ago.

Next Quarter Guidance:

Beat revenue estimate by 10.9%.

Beat $1.60 EPS estimate by $0.40.

Balance Sheet:

$6.5B in cash & equivalents.

$5.5B in long term debt.

Inventory fell Q/Q and year to date.

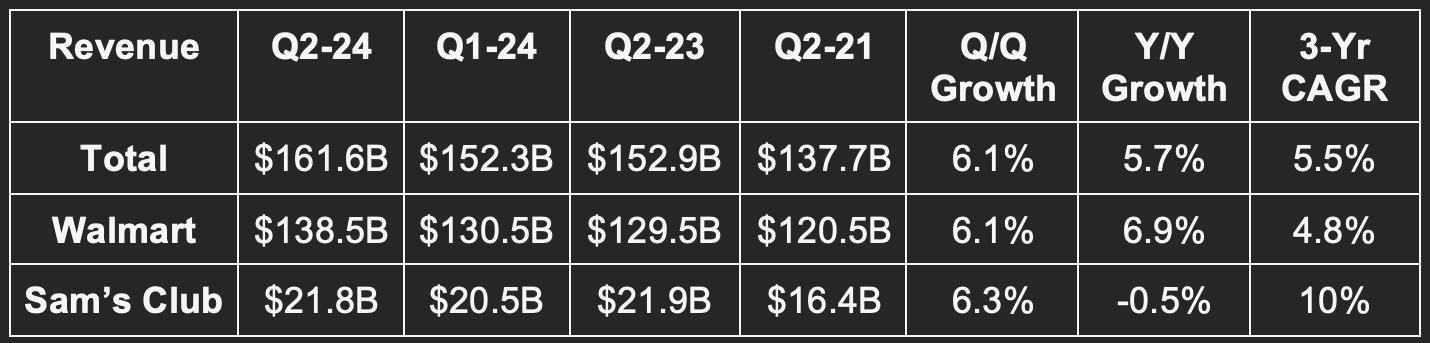

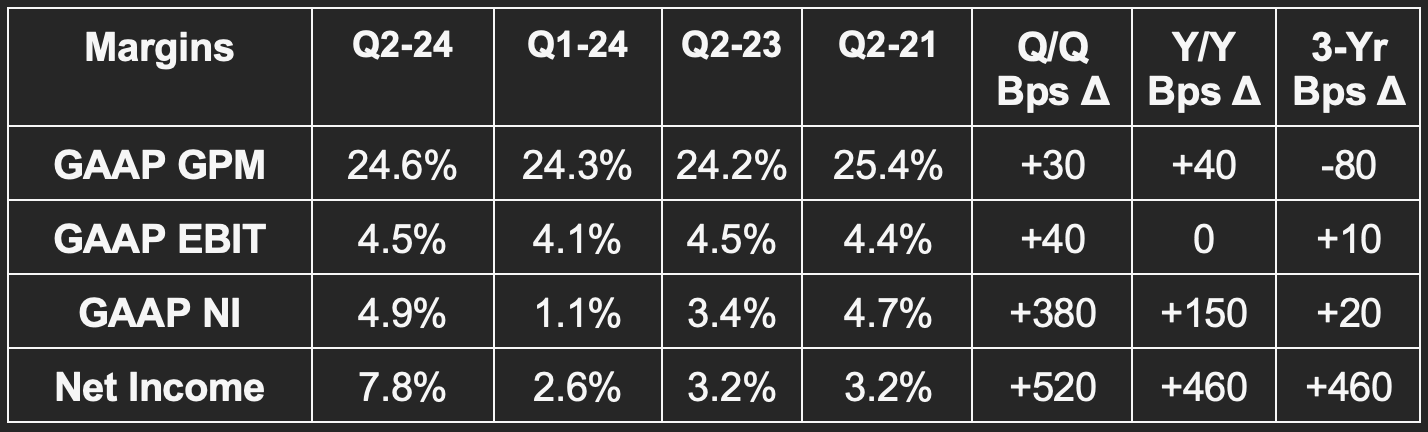

c. Walmart (WMT)

It’s tempting to see the strong results that Walmart posted and see it as a green flag for consumer health. We must consider, however, how Walmart caters to those seeking optimal savings and often trading down to manufacture that savings. Its business is somewhat countercyclical. Earlier reports from all 3 major card networks, bellwether banks and commerce giants were the consumer health green flags.

Results:

Beat revenue estimate by 1.4%; beat FXN revenue growth guide.

Beat GAAP EBIT estimate by 4.8%.

Beat $1.71 EPS estimate by $0.13 & beat guide by $0.18.

Beat 23.8% GAAP GPM estimate by 80 bps.

Fiscal year 2024 Guidance:

Raised FXN revenue growth guide from 3.5% Y/Y to 4.25% Y/Y.

Raised FXN EBIT growth guide from 4.25% Y/Y to 7.25% Y/Y.

Raised EPS guide by $0.26 to $6.41 & beat $6.27 estimate by $.14.

Balance Sheet:

$13.9B in cash & equivalents.

$50B in low-rate debt.

$500 million in buybacks vs. $700 Q/Q and $3.3 billion Y/Y.

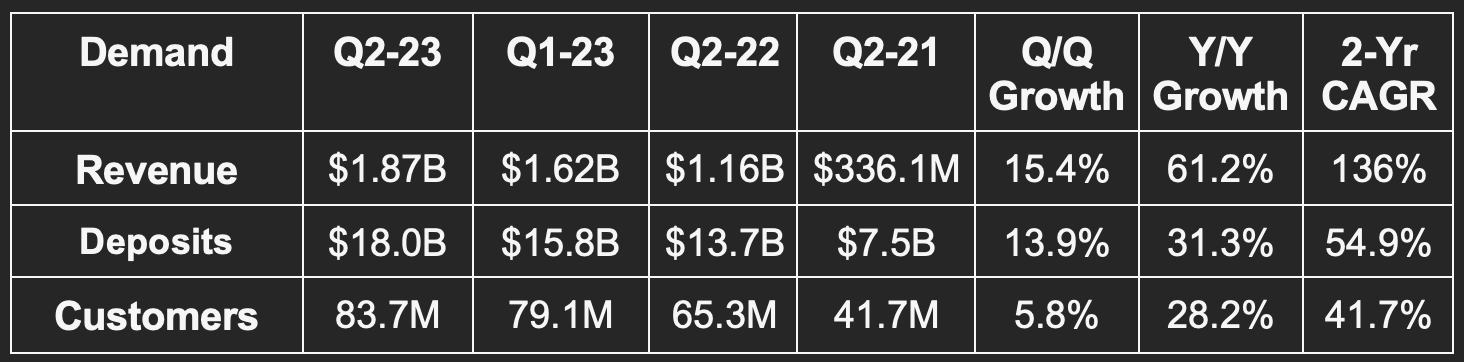

d. Nubank (NU)

Nubank is a large fintech player in Latin America.

Results:

Beat revenue estimates by 5.4%.

Beat GAAP EBIT estimates by 56%.

Beat GAAP net income estimates by 75%.

Balance Sheet:

$6.2B in cash & equivalents.

$10.4B in credit card receivables.

90 days or more non-performing loan rate was 5.9% vs. 5.5% Q/Q.

Net Interest Margin was 18.3% vs. 15.7% Q/Q.

6. The Trade Desk (TTD) -- Bullish Note & My Updated Plan

Piper Sandler published a note this week on the state of digital advertising. The research consisted of a faster than expected recovery with demand improving at a rapid pace. This research led to it raising its TTD revenue growth estimate for next quarter from 17.7% to 21.9% Y/Y. That bodes well for the firm but is still below The Trade Desk’s 22.8% or better growth guidance. The company is a consistent “Beat and Raise” machine and I fully expect next quarter to be no different. It is in an ideal position to dominate as streaming penetration sets new highs and Fortune 500 retailers line up to work with this firm.

Over the last few months, avid readers have heard me voice concern about the valuations of two companies: The Trade Desk and Shopify. This concern led to multiple trims with both names and a desire to see valuation multiple contraction before I lean back in. That multiple contraction has since come for both and I’ve since started adding to Shopify once more, but not yet TTD. I want to see a price to EBIT/ growth ratio approach 2.0x for this firm. Based on where I see EBIT coming in this year, that would mean it falls another 8% from here. 2.0x is still expensive, but less than it has been… and I think this share leading compounder deserves a premium like it has always fetched. I selfishly want to add more shares here and I’m almost ready to do so.

7. SoFi Technologies (SOFI) -- Accounting Irony

Well, well, well… what do we have here. SoFi bears have long criticized SoFi’s fair value accounting mechanism for loans. Despite this method marking loan values based on all of the same variables as CECL, despite SoFi baking intentionally pessimistic assumptions into these markings, despite its recent capital market sales at gain on sale ABOVE markings and despite its continued vast underwriting outperformance vs. benchmarks… this criticism has endured.

Well? This week the Office of the Comptroller of the Currency (OCC) revealed an extremely ironic proposal. This proposal entails making banks with $100 billion or more in assets mark the value of their asset bases more frequently… just like SoFi does under fair value accounting every 3 months for its loan book. Translation? “Hey banks… be more like SoFi.” I’m sure the drama and polarization will continue based on this being a rare approach to loan and asset accounting. But the approach in my mind is superior in terms of limiting unrealized loss risk and amplifying transparency. Maybe the OCC agrees.

8. Walt Disney (DIS) -- Penn Entertainment (PENN) & Open for Business

In somewhat surprising news last week, Disney’s ESPN and Penn announced a 10 year deal to transform Barstool Sportsbook into ESPN Bet. Penn will gain access to ESPN’s iconic brand to elevate the appeal of its brick-and-mortar assets while Penn will gain “access to top ESPN talent” as well.

Disney will receive $1.5 billion in cash proceeds over the 10 year period to fund marketing. ESPN also gets $500 million in up front stock warrants with the ability to earn more based on how strongly ESPN Bet’s market share trends and also Penn’s share price. Iger called the offer “better than any others by far” with Penn “stepping up in a very aggressive way” on the call. Disney entering gambling was an important green flag for me starting a position… this commentary only makes that news more encouraging. Penn knows the power of ESPN’s brand and knows it needs a piece of it. So? It seemingly paid up.

The one risk I see within this partnership is the actual quality and interface of the newly branded app. The Barstool product was awful compared to all others on the market. Considering how low consumer switching costs are here, ESPN and Penn have a lot of work to do to bring it up to par with the DraftKings of the space.

Disney isn’t just embracing Penn as a new ESPN partner, it’s looking at others like Verizon to partner with on distribution, content funding and monetization. Yet another sign that Iger is approaching operations from a rational, business-minded perspective.

9. Amazon (AMZN) -- Blue Shield of California

Blue Shield of California will greatly limit usage of CVS’s pharmacy benefit manager (PBM) offering in favor of a combination of Amazon and Cost Plus (Mark Cuban’s firm) among a few other partners. This is expected to drive $500 million in annual savings for the company. CVS’s inflexibility with matching the better pricing that Blue Shield of California found on some specialty drugs led to the split.

Healthcare, along with other endeavors like Project Kuiper) is among Amazon’s speculative bets that it plans to keep aggressively pursuing. This is both a sign that the pursuit is gaining traction and how Amazon’s value proposition can stick out in this field. Its unparalleled ability to bundle together value for its consumers to drive cross selling and retention allows it to offer PBM deals like this in a rational way. It continues to add tools like automated coupons to bolster the value.

Other Amazon News:

Launched AI-generated summaries of product reviews.

Chief Device Officer Dave Limp is retiring.

Amazon Music is hiking its pricing.

It will add fees to sellers wanting to self-ship goods.

Amazon is expanding its sponsored listing ad-types to external partners like Pinterest and BuzzFeed.

10. Meta Platforms (META) -- Copilot and CodeWhisperer Competition

Meta is launching a gen-AI powered model to free developers to automate the creation of source code. This will compete with Microsoft Copilot and Amazon CodeWhisperer.

11. 13F Season

13F season is always interesting. While it’s fun to see what icons like Buffett, Loeb and Ackman own, it’s more noise than signal for us long term investors. Why? Because we want to ideally own companies for years and let compounding (or the 8th wonder of the world) work its magic. A large chunk of the funds (minus the Berkshire’s of the world) are trying to outcompete benchmarks on a quarterly basis. They’re doing whatever they can to be able to tell investors that they beat a key index by a basis point or 2.

Given this context, mirroring their every move is a great way to over-transact, over-manage and over-think our portfolio construction. Dan Loeb loading up on Amazon doesn’t mean he thinks it’s a great long-term play. Elliott selling PayPal doesn’t mean they think it’s a poor long-term play. Is this interesting data to observe? Sure. Is it anything more than that? No it isn’t.

12. Macro

Employment & Consumption Data:

Core Retail Sales rose 1% M/M in July vs. -0.3% expected and 0.2% growth last month.

Retail sales M/M for July rose 0.7% vs. 0.4% expected and 0.3% last month.

Initial Jobless claims of 239,000 fell slightly vs. last report’s 250,000 reading and were in line with estimates

Output Data:

NY Empire State Manufacturing Index for August was -19 vs. -1 expected and 1.1 last month.

Building Permits for July slightly missed expectations.

Industrial Production M/M in July rose 1% vs. 0.3% expected and -0.8% last month.

Philly Fed Manufacturing Index for August came in at 12 vs. -10 expected and -13.5 last month.

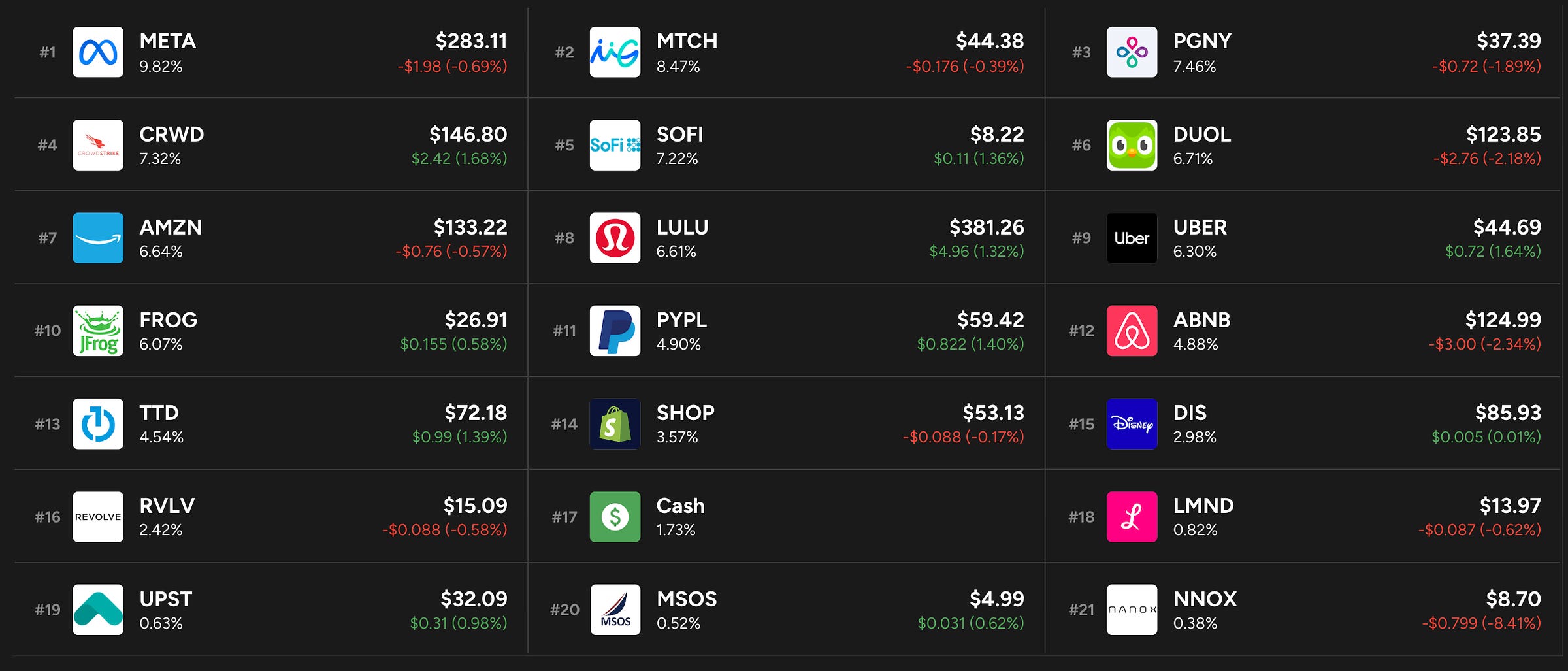

13. Portfolio

I resumed adding to Shopify during the week following a 25% trim in July.

Can you share your thoughts on why you see SHOP valuation attractive now to start adding? Thanks 🙏

Great post!