News of the Week (August 16-20)

Progyny; Ayr Wellness; Duolingo; Upstart; Cresco Labs; Lemonade; My Activity

1. Progyny Leadership at a Bank of America Conference

“Overall the mood of the market for our selling season has normalized. Benefits managers and consultants are back to building programs at a more typical level.” — CEO David Schlanger

Progyny is enjoying more large enterprise selling opportunities this year vs. last year to coincide with this normalization. These large accounts sharply pulled back amid Covid-19 and are now expressing interest in Progyny’s benefits at a clip running above internal company expectations.

Two variables are contributing to this positive development:

Primarily, economic re-opening

Secondarily, the extremely tight labor market places added pressure on employers to stand out in attracting talent. Females making up a larger and larger % of the workforce merely amplifies this.

The proliferation of LGBTQ+ parenthood demand creates a compellingly sustainable long term growth tailwind for the company.

Progyny’s EBITDA margin on incremental revenue in this current quarter continued to greatly outpace the company’s business as a whole, pointing to continued expansion here.

Progyny’s net promoter score (NPS) for fertility and Rx is +81. NPS is a metric gauging the satisfaction of Progyny’s clients with the product.

Just to remind investors, Progyny is already the fertility benefits manager for behemoths such as Amazon, CVS Health, Microsoft, Google, Uber, PayPal, Unilever and so many more.

Cross-selling activity of Progyny’s fertility benefits and Rx benefits solutions has already reached the company’s full year target for 2021. Progyny believes eventually 100% of clients will be using both.

Schlanger reiterated that growth for 2022 will be similar to the company’s 2021 annual midpoint guide of 50.5%. Analysts were expecting growth to be closer to 45% for 2022 before this guidance was issued.

Progyny offered more color on the dip in utilization rate it saw at the beginning of July:

The dip was across all specialties (not just fertility) pointing to a more macro cause.

Progyny’s utilization rate bottomed in the beginning of July at around 88% of expected levels. It has since rebounded to 90%.

Clinics believe this is via pent-up travel demand and NOT the delta variant as folks make up for 18 months of not being able to vacation. The dip was not geography specific hinting at this issue not being related to regional outbreaks.

The forward guidance assumes Progyny’s utilization rate gets back to 92%-95% of normal levels.

“We do believe this [utilization rate dip] is a summer phenomenon that will correct itself relatively rapidly.” — Schlanger

2. Ayr Wellness earnings

“We will continue to think big in terms of footprint, products and branding and we will continue to deliver on those big plans.” — Founder and CEO Jonathan Sandelman

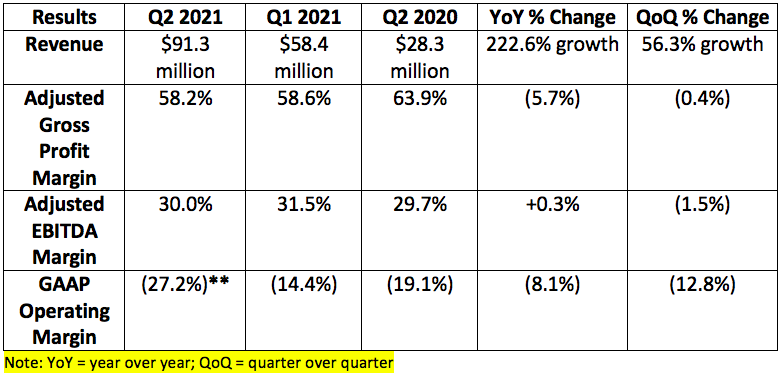

a. Results

**$52.3 million in one-time expenses and non-operating adjustments accounted for the $24.9 million GAAP operating loss. Without these non-recurring charges, GAAP operating margin would have been a lofty 28.9%.

Note that a large chunk of this Q2 2021 revenue was realized via inorganic growth and new store openings. The company will continue to be rationally aggressive with M&A going forward. Still, some of its markets generated same store sales growth of 50% in the quarter and organic wholesale growth also contributed.

“We’re able to buy great companies at EBITDA multiples of 5 or 6 growing over 100%. Premium beverage brands growing between 5% and 8% trade at EBITDA multiples of 25 to 30. We are investing.” — Sandelman

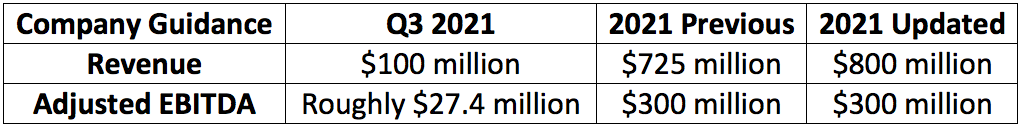

b. Guidance Updates

The lack of an EBITDA guidance raise in light of the revenue raise is due to “accelerating investments in branding, new markets and growth.” Margins are expected to trough and move higher in the coming quarters as new projects mature.

c. Operational Highlights

Ayr announced a deal to purchase 100% of Cultivauna LLC — the owner of Levia cannabis seltzers and water-soluble tinctures. The deal is for $10 million in cash and $10 million in shares up-front with an incremental $40 million available in shares based on internally set 2022 and 2023 revenue targets. I personally love seeing proceeds tied to the realization of operational goals. This keeps interests aligned.

“With Levia and CannaPunch, we have 2 of the top-selling beverage brands in the United States.” — Sandelman

Since Levia launched in Massachusetts 6 months ago it has become the top selling THC drink in the market eclipsing 80% total market share.

“The easiest move for CPG to enter the cannabis world will be in the beverage and the can business. Who knows it better than big beer? With their massive distribution and bottling it would be an obvious move.” — Sandelman

Ayr is supply constrained in the states where it operates. It quickly sells out everything it makes.

Ayr made 2 additional M&A moves during the quarter and the details can be found here.

Ayr’s entrance into Illinois pushes its population footprint to 85.7 million Americans thanks to the Herbal Remedies purchase and its affiliate (Land of Lincoln) winning a key license.

The company expects to quickly return to cash flow positive as all of its M&A and capital expenditures come online.

Ayr sold its brands in 280 stores during the quarter up 3x year over year.

In Florida, yield per square foot has risen 50% since it purchased Liberty Health Sciences this February to expand into that state. Thanks to Ayr’s introduction of some of Ayr’s owned-brands and FAR more supply, transactions are up 40% since the purchase, basket size is up 38% and Ayr has enjoyed a 27% rise in new patients. Ayr has opened 8 new dispensaries in the state bringing its footprint to 39. The firm hopes to push this number to 50 by the end of the year. It’s now the 4th largest the producer in the state vs. 7th when it purchased Liberty.

Ayr’s Western region highlights:

Arizona same store retail revenue is up 50% year over year.

Completed 30,000 square feet in total production capacity across Arizona and Nevada. 80,000 more square feet of cultivation space is now under construction in Phoenix.

Revenue is pushing $1 million per month at its newest dispensary in Nevada. Nevada is now generating $20 million per year per store.

Ayr’s Northeast highlights:

Wholesale flower brand launches of Revel & Seven Hills in Pennsylvania sold out in a week.

Received 3 adult-use licenses in the Greater Boston area.

175,000 square feet of new cultivation space is underway in Massachusetts to bring Ayr to its maximum footprint in the state.

d. Conference Call Commentary

“I told you recently that we expect the value of our Florida operations soon to be larger than our entire market cap and I feel even more confident in that statement given our recent success.” — Sandelman

The company now has 57 owned stores and sells into 280 retail locations. At this time last year, it owned 7 stores and sold into 100 retail locations.

Ayr’s most mature markets (Massachusetts and Nevada) grew at an annualized rate of 36% with that growth being entirely organic.

Ayr’s operational focus will be on its “Kynd Flower”, “Origyn Extracts” and now “Levia” brands. These brands will all be rolled out to Ayr’s entire 8 state footprint over time.

All of the company’s retail stores that are not currently branded as “Ayr” will be by the end of the year.

e. My Take

All eyes remain on 2022 for Ayr Wellness. $800 million in revenue with $300 million in EBITDA would be a truly remarkable step forward for this organization — so far, it’s proving it can deliver on these ambitious goals.

The company’s rational M&A path is already yielding meaningful returns and its operational excellence is getting the most out of all of its new retail assets. I’m a big fan of the Levia purchase as market share data in Massachusetts hints at its immense popularity. Great quarter. Great company. I will be doing nothing but adding to my position over time.

3. Duolingo’s “Duocon” 2021

a. The State of Duolingo from Co-Founder/CEO Luis Von Ahn

The company is working on adding a uniform proficiency score to its app to transform language proficiency descriptions from “intermediate or advanced” to “Duolingo 65 or Duolingo 85.”

NEW STUDY: A speaking study for brand new learners not using any other materials showed that after finishing unit 5, over 50% of its speakers eclipsed expected speaking proficiency. Duolingo is now adding speaking lessons to its platform.

Duolingo Hoots is being introduced to improve writing skills. It’s a daily writing prompt that Duolingo grades for us in real-time. Corrections are given if there are any issues.

Duolingo is adding 5 new languages to its platform for English speakers including Tagalog, Zulu and Haitian Creole.

The company is re-vamping the user interface and on-boarding process for Duolingo for Schools which is already used in 40% of language learning classrooms.

Duolingo is set to debut its new, gamified Mathematics app for elementary students next year.

“We have not won until we are teaching everything there is to teach.” — Von Ahn

b. New Duolingo Features

(Note that Duolingo+ is the company’s paid subscription plan.)

Because learners requested more focus on weak areas and because Duolingo obsesses over personalization, Duolingo+ introduced its “Mistakes Inbox” which:

Aggregates a subscriber’s mistakes in one place to learn from them in a more expedient way.

Saves all mistakes automatically.

Crafts these mistakes into a targeted lesson for review at a subscriber’s own pace.

Clears mistakes from the inbox as questions are answered correctly.

Duolingo+ also introduced a family plan — 6 Duolingo+ accounts on 1 affordable plan. It includes:

Seamless member on-boarding and inviting through the Duolingo+ dashboard.

Seamless tracking of member progress within the family plan.

New Duolingo non-Latin writing systems with:

A new dedicated tab to teach non-Latin lettering systems with a new “learn the characters” button.

A brand new puzzle game to help learners master non-Latin lettering thus feeding into Duolingo’s “learning is better when it’s fun” philosophy.

Filled gaps in Duolingo’s ability to teach Asian and Middle-Eastern languages.

c. Duolingo A.I.

Duolingo’s A.I. engine is the key to crafting the most granular and effective of lessons for users. It uses 5 billion exercises performed on Duolingo per week to foster a laser-focused approach to lesson plans.

Its birdbrain algorithm keeps learners in the “zone of proximal development” to ensure lessons are challenging BUT not too challenging. This keeps users more engaged and motivated. Birdbrain knows the probability of us answering every question correctly and adjusts the questions — in real-time — accordingly.

Since Birdbrain was built last year, the quality of its prediction has risen from 76% to nearly 80% for all courses.

Birdbrain’s presence has also boosted lesson difficulty by 3%-5% while also raising time spent learning by more than 6%. Harder is better.

Birdbrain fosters a statistically significant boost in engagement and efficacy.

Click here for my Duolingo deep dive.

4. Upstart’s Debt Offering

Following another remarkable quarter for Upstart, the company announced a 0.25% convertible debt offering to raise $561 million in net proceeds for the company.

The debt matures in 2026 and comes with some very interested covenants including:

Upstart cannot redeem the notes until August 20, 2024 when it will be able to convert the outstanding notes into cash ONLY IF Upstart’s stock price is 130% of the conversion price of $285.26 per share for a 20 day period.

Upstart has no obligation to redeem the notes over time.

Holders of these notes were granted an option to require Upstart to buy back all of their notes “upon the occurrence of a fundamental change” at a price of 100% of the principal amount outstanding + accrued interest. This is why the interest rate is so low. Note holders are essentially entirely insured for their full investment.

Note conversion rate: $1,000 of notes in principal = 3.5056 Upstart shares (or $285.26 per share).

Upstart entered into a capped call transaction as a hedge with some of the note buyers. This limits the number of notes that can be converted to Upstart shares. It also limits the cash payments Upstart is required to make in amounts beyond the principal amount. Upstart calls this anti-dilutive but in reality, it’s dilution-limiting. This capped call transaction strike price is $400.36 per share.

$50.9 million of the total proceeds will be used to fund the capped call transactions. The rest of the funds will be used for “general corporate purposes.”

My Take:

Upstart’s balance sheet was already pristine and its business model is already quite profitable. It did not need this cash — at all.

Perhaps the company is gearing up for another purchase to enter an adjacent market (like when it purchased Prodigy for auto loans) or maybe the company is planning an ambitious internal product expansion. Regardless, management has given me all of the confidence in the world that it will handle this cash infusion appropriately. We shall see how it uses the funds.

Click here for my broad Upstart overview.

5. Cresco Labs M&A

Cresco Labs had a busy week:

Cresco is purchasing 100% of Blair Wellness — a medical dispensary in the Baltimore area. The press release did not include a deal price, but Cresco is paying 1.8x 2021 revenue via a mixture of cash and promissory notes. Blair operates “one of the top performing dispensaries in Maryland” and will be added to Cresco’s Sunnyside dispensary brand — the most productive retail brand among national multi-state operators (MSOs).

Cresco Labs also opened a new dispensary in Fort Lauderdale, Florida. This is the company’s ninth retail location in the state and will be its first under the Sunnyside brand.

6. Lemonade’s CEO Daniel Schreiber Gives an Interview

“I do think car insurance will be a game changer because what we’ve found is selling home insurance without car insurance is like operating with one hand tied behind our back.” — Schreiber

7. My Activity This Week

Added to:

SoFi Technologies

Lemonade

Ozon

CuriosityStream

When I add to positions it is generally in very small pieces — these purchases were no exception. I plan to send out an update on my holdings at the end of each earnings season along with my plans for each position. That will be sent out in the days following CrowdStrike’s earnings report on August 31st.

Thank you for reading!