News of the Week (August 2-6)

Progyny, REVOLVE, Penn National and JFrog earnings reviews; GoodRX; CuriosityStream; Upstart/SoFi; Cannabis Sales Record; Butterfly; Duolingo; The Week Ahead

1. Progyny 2nd Quarter Earnings Review

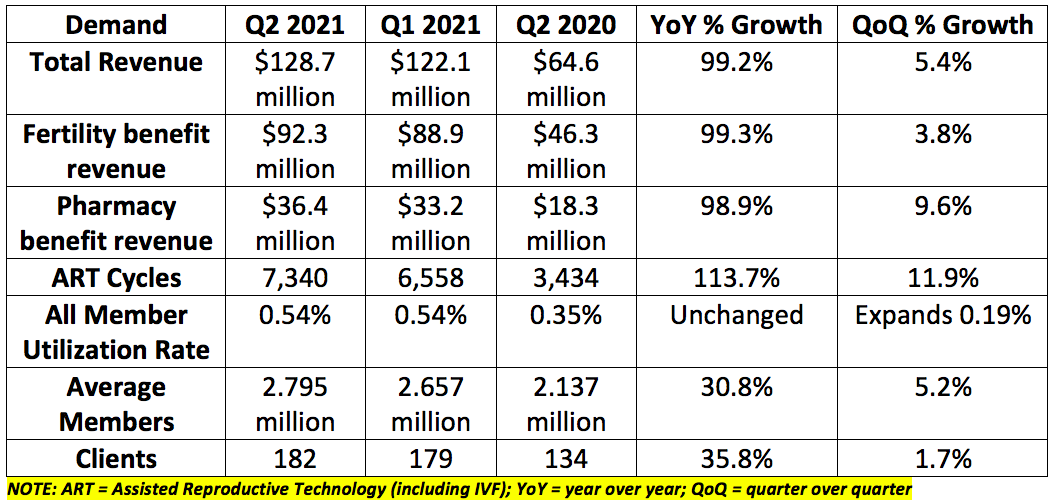

a. Demand

Progyny — a fertility benefits manager — guided to $126-$131 million in revenue for the quarter. It posted $128.7 million representing 99.2% growth and essentially in-line results.

CDC and Society for Assisted Reproductive Technology fertility report findings:

Since 2016 Progyny has boosted live birth rates by 14% while the national mean has stagnated. Stagnating national averages demonstrate how difficult it is to match Progyny’s value.

Progyny’s program yields a 16% higher pregnancy rate vs. the national mean.

Progyny’s program yields a 25% higher live birth rate vs. the national mean.

Progyny’s program yield a 26% lower miscarriage rate vs. the national mean.

Remember some treatments cost over $10,000 a piece. Less treatment is a massive economic advantage to complement the outcome advantage.

Additionally, (not included in the CDC-published report) Progyny’s program continued to generate improved employee productivity and workforce satisfaction.

b. Profitability

Progyny earned $0.19 per share beating expectations by 111%. The $0.19 metric includes a $0.07 tax benefit. Without the benefit, Progyny would have beaten expectations by 33.3%.

Progyny guided to $17.5-$19 million in adjusted EBITDA. The company posted $18.4 million in adjusted EBITDA, in line with guidance.

Cash flow from operations margin was uniquely hurt by the timing of payments received from pharmacy program partners. This is expected to normalize going forward and is what led to the near doubling in accounts receivable year over year.

Adjusted EBITDA margin on new, incremental revenue was 22.9% pointing to continued expansion here going forward.

c. Selling Season Notes

New client demand has returned to pre-pandemic levels.

“Commitments received is the most we’ve ever seen at this point in the selling season and beyond our expectations.” — CFO Peter Anevski

A large number of existing customers — including some of Progyny’s largest — have already committed to service expansions for 2022. The company proclaimed it has already reached its goal for annual up-selling revenue.

“We are well on our way to returning to the sequential growth trend in client and covered lives that we had been on before the pandemic.” — CEO David Schlanger

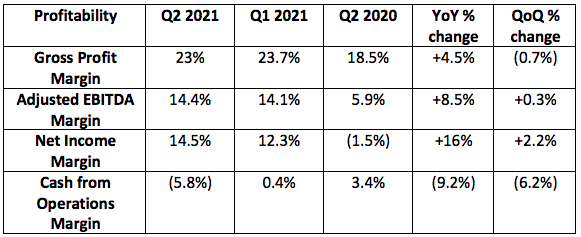

d. Guidance Updates & Rationale

Progyny is ahead of schedule in terms of signing new companies. Still, utilization and appointment trends have recently been impacted (along with the sector). 90% of its members are going about normal treatment schedules but the remaining 10% have grown more hesitant due to a combination of the delta variant and pent-up summer vacation demand.

It expects to get back to 95% of normalized utilization by Q3 although allowed for utilization to stay at 90% in its guidance. Progyny believes this is a “short-term anomaly” and is already “seeing indications of member activity returning to levels that are closer to expectations in the last week.” This is why it adjusted its revenue guide down, despite the enterprise contract momentum.

d. Management Commentary

“The factors critical to our ongoing growth -- including industry-leading outcomes, high member satisfaction rates and high client retention rates — are all going extremely well.” — CEO David Schlanger

Its net promotor score (NPS) stands at its highest level ever which implies an NPS over +81.

The company expects to maintain a similar 48%-54% growth rate that it guided to for 2021 into 2022 as retention, up-selling and new client win trends all remain strong. This does not assume any “baby boom” for 2022.

e. My Take

The numbers were good, but the guide was underwhelming. Utilization rate is hurting them at the moment, but it’s encouraging for them to see trends already normalizing and referring to the dip as an “anomaly.”

This was not a perfect quarter. It was acceptable, however, especially considering Schlanger told us to expect a similar 48%-54% growth rate for 2022. That coupled with precipitously expanding gross profit and EBITDA margins makes me confident going forward despite the guidance miss. A below-average quarter, but my thesis is fully intact. I added to my position on Friday and will be looking to slowly add more to Progyny if it dips further.

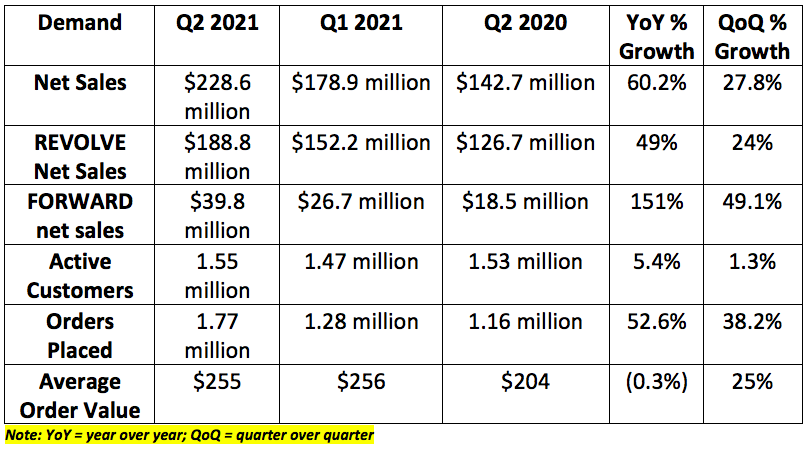

2. REVOLVE 2nd Quarter Earnings Review

“2021 annual growth will likely end up far above our long term 20% target.” — Co-CEO Mike Karanikolas

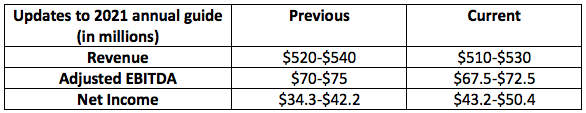

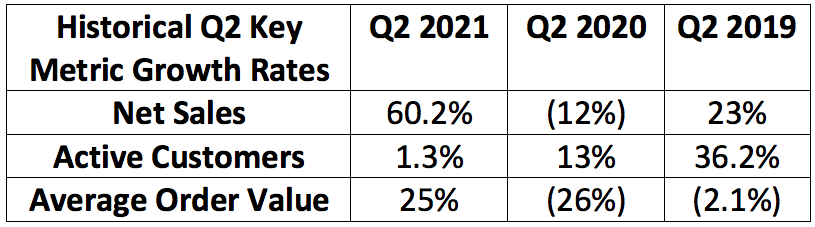

a. Revenue

REVOLVE — an online retailer specializing in women’s clothing — was expected to generate $198.8 million in Q2 net sales. It posted $228.6 million in net sales beating expectations by 14.9%. Domestic sales grew 59% year over year (YoY) while international sales grew by 63% YoY.

These sales represent 41% growth vs. the comparable pre-pandemic period in 2019. Last quarter, REVOLVE grew sales by 30% vs. the comparable pre-pandemic period in 2019 meaning growth is meaningfully accelerating sequentially.

REVOLVE leans heavily on live music festivals to market its products. It also predominately sells clothes people wear for going out. As a result, the pandemic impacted the company in a uniquely negative way while it boosted most other e-commerce names. Normalization will greatly help REVOLVE as the growth in net sales this quarter indicates. Encouragingly, performance remained strong into July with YoY growth of over 40% and strong traffic/conversion trends continuing.

b. Profitability

Revolve was expected to earn $0.21 per share. It earned $0.42 beating expectations by 100%. This was boosted by an effective tax rate of just 3.5% vs. 23% in the comparable period. Revolve expects this rate to be 25% in the future. Had it been 25% this quarter it would have earned $0.30 per share beating expectations by 43%.

Free cash flow margin decreased due to aggressively ramping inventory investments to support recovering demand. We are also lapping a period in which it greatly pulled back on spending. Inventory rose 18% sequentially to give an idea of how aggressively it’s pursuing growth.

Gross margin expansion was powered by a record high percentage of net sales at full-price. Operational efficiencies & more automation also contributed to margin expansion here.

c. Call Notes

“FORWARD” segment customers coming from REVOLVE “accelerated overnight” after the company launched its new FORWARD loyalty program fully integrated with its core REVOLVE segment. The results are “exceeding all of [management’s] expectations.” Still, just 5% of REVOLVE segment consumers shop on the FORWARD web site. There’s a long way to go here, but encouragingly cross-selling already contributes 10% of total FORWARD sales. The company will debut more FORWARD loyalty programs outside of the U.S. in the coming quarters.

REVOVLVE added a record number of new customers sequentially during the quarter to re-surpass its pre-pandemic levels. Revolve’s business remains just 3% penetrated in its core GenZ/Millennial female demographic.

Localization of marketing efforts contributed to rising returns on invested capital in Revolve’s international markets. It pursues influencers/celebrities with especially strong clout in a given geography to sell its products.

“We will be investing more than ever on some exciting marketing initiatives. This is the time to invest. Expect marketing spend to continue to sharply rise throughout the year.” — Mike Karanikolas

There continues to be 0 debt on the balance sheet with $220 million in cash to deploy. It’s time to be aggressive.

d. My Take

REVOLVE’s data driven inventory system enabled them to precipitously expand margins despite demand for its products collapsing during Covid-19. Now with demand returning, it’s time for the company to press the gas pedal on growth. The great results indicate that has already begun. REVOLVE is my 3rd largest holding and I am not looking to add to or trim my position at this time.

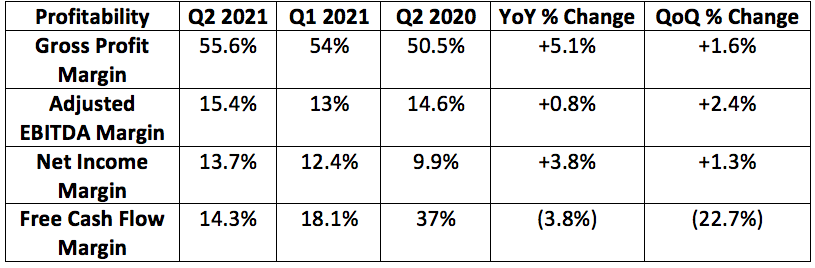

3. Penn National Gaming 2nd Quarter Earnings Review

a. Results

Penn National Gaming — a regional gaming company — posted Q2 revenues of $1.55 billion beating expectations by 6.8%. The company posted sales 17% above its comparable pre-pandemic period in 2019. Every company region besides the West has comfortably passed 2019 revenues with ease.

Penn National Gaming reported earnings per share (EPS) of $1.17 for the quarter beating expectations by 30% and up 165% from the comparable pre-pandemic period in 2019.

Penn National Gaming reported adjusted EBITDAR of $586.6 million beating the midpoint of its recently pre-announced guidance by 4.6%.

Note that I am comping vs. the pre-pandemic 2019 period rather than the comparable 2020 period. As Penn’s properties were largely shuttered in the 2020 period, measuring vs. 2019 gives a better idea of normalized growth rates. The company 5Xed revenue from 2020-2021.

These numbers beat the company’s pre-announced results from just 1 month ago pointing to strong demand momentum. Positive trends continued into July with adjusted EBITDAR projected to exceed the same 2019 period by 40%.

b. Score Media and Gaming Acquisition

Penn paid $2 billion in total to purchase Score Media and Gaming (ticker: SCR). This includes $17 dollars per SCR share in cash, and .2398 shares of Penn National stock per each Score Media and Gaming share.

Penn is funding $1 billion of the transaction with cash from its balance sheet. Post transaction, Penn National shareholders will own 93% of the combined entity with Score Media and Gaming shareholders owning 7%.

“We are now uniquely positioned to seamlessly serve our customers with the most powerful ecosystem of sports, gaming and media in North America… ultimately creating a community that doesn’t currently exist and we believe driving best in class engagement and retention.” — CEO Jay Snowden

The purchase creates a one-stop destination for gambling and gives Penn full ownership of its tech stack — meaning controlling both its front-end (user interface) as well as its back-end (application programming interfaces & other tools to actually build the interface).

Now customers will be able to engage with their favorite personalities, research bets, interact with content and gamble all in one place. This vertical integration will lead to significant 3rd party cost savings and thus will generate $200 million in annualized, incremental adjusted EBITDA by next year — $2 billion was a great deal price. Penn believes Score Media and Gaming’s platform and “state of the art” business-to-business tech stack is the perfect complement to Barstool’s massive following — I agree.

The purchase will allow Barstool to directly incorporate more stats, user data, scores and videos. Score Media and Gaming will also help boost Penn interactive segment margins by at least 5% over time. Penn also plans to enter the esports media vertical with theScore.

The Levy Family (previous owners of theScore) will importantly continue to oversee Score Media and Gaming’s business with the entity continuing to be operated as a stand-alone operation. theScore app will not be re-branded to Barstool.

A few brief stats on theScore:

It’s the number 1 sports app in Canada.

It’s the number 3 sports app in North America.

theScore boasts 4.7 billion trailing 12-month (TTM) user sessions.

Engagement for theScore in terms of minutes per month is up 359% YoY to 113 minutes. This compares to 84 minutes for ESPN and 142 for Barstool.

theScore has 9X the MAUs of ESPN in Canada.

c. Barstool Sportsbook/Penn Interactive

By year-end 2021, Penn will double its state footprint with launches in Colorado, New Jersey, Tennessee, Virginia & Arizona. Maryland is also now in play with the closing of its Hollywood Casino Perryville acquisition in July.

The company continues to see 13% gross gaming revenue (GGR) market share as a sustainable target with revenue market share trending above that thanks to superior profitability and lower customer acquisition cost. Barstool’s app rating sits at 4.7 stars and it is now up to 130 million social media followers across all platforms.

“Barstool Sports — the media company — continued to show tremendous growth this year financially and in audience metrics and it has continued to evolve into a highly diversified media/entertainment/lifestyle brand.” —CEO Jay Snowden

Same-game parlay and sharable bet-slip features will both be added to the digital sportsbook this quarter.

“We will increase our marketing efforts to further widen the funnel into our omni-channel ecosystem as we gain scale across the country while remaining focused on a profit-driven approach. We have spent virtually nothing on external marketing to date.” — Snowden

Snowden expects this segment to begin “meaningfully contributing” to company EBITDA by 2023. The segment is already roughly EBITDA breakeven today.

d. Brick & Mortar

More plans for Barstool by year’s end:

Penn National will open its first 2 Barstool-branded sports bars in Philly and Chicago & will rebrand 5 more retail sportsbooks to Barstool.

Barstool will launch its first in-house (& Barstool-branded) online table/slot games on its iCasino product.

Reminder that Barstool became the exclusive sponsor/broadcaster/merchandise provider for the Barstool Sports Arizona Bowl. CBS previously held the broadcasting rights. Since the deal was announced, Barstool has been approached by organizations among the major 4 American sports to partner on more naming and broadcasting rights according to founder Dave Portnoy.

e. My take:

Margins continue to set new records and sales have comfortably surpassed pre-pandemic levels. It’s still early day for Barstool’s — and now theScore’s — expansion and the potential with both assets at Penn’s side is all but endless. I have added to my stake in PENN a few times recently and plan to continue doing so over time. Good purchase; good results.

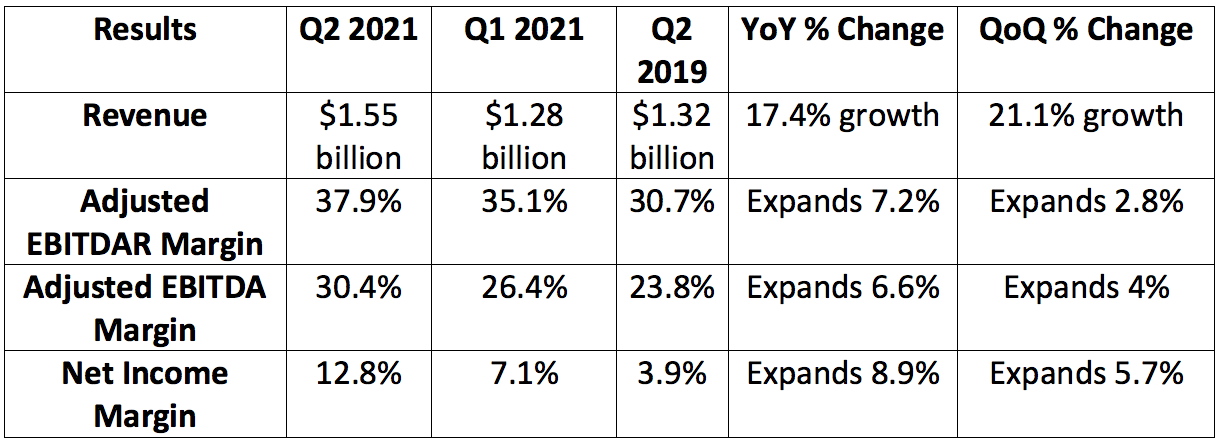

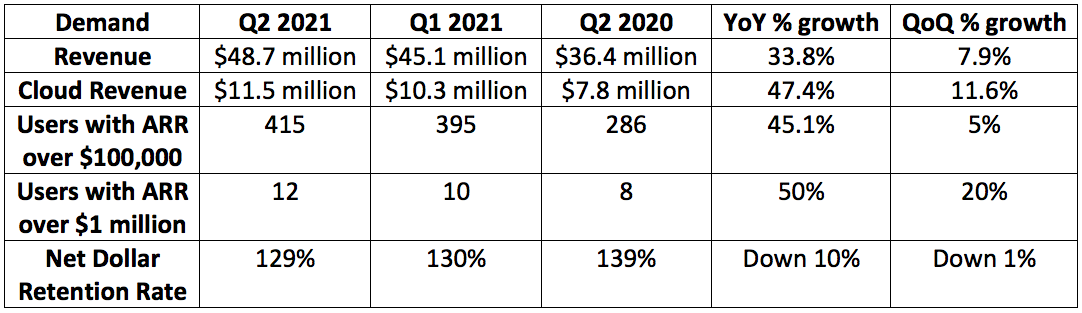

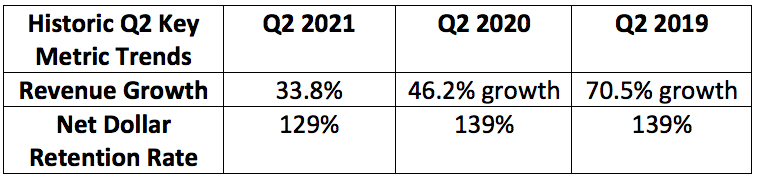

4. JFrog 2nd Quarter Earnings Review

“In the second quarter we continued to see JFrog displace legacy competitors with our unified, scalable dev-ops platform. We anticipate acceleration in the business in the second half of 2021.” — Founder/CEO Shlomi Ben Haim

a. Demand

JFrog — an end-to-end dev-ops company — was expected to generate $47.6 million to $48.6 million in revenue for the quarter. It posted $48.7 million slightly beating the high point of the guide.

Cloud revenue now makes up 24% of JFrog’s total revenue vs. 21% YoY. Cloud growth was hit by the current contract negotiations JFrog is conducting with some of its largest clients. JFrog does not expect any issues with arriving at new agreements and expects cloud revenue growth to accelerate in the coming quarters.

JFrog expects net dollar retention rate to rise back above 130% for the remainder of the year.

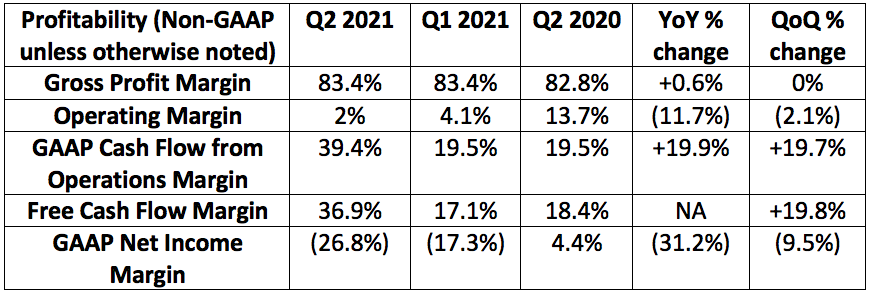

b. Profitability

Falling operating and net income margins are directly related to JFrog accelerating growth spend (especially in the APAC region). Both cash flow margins represent new company records. The company expects gross profit margin to continue improving over time.

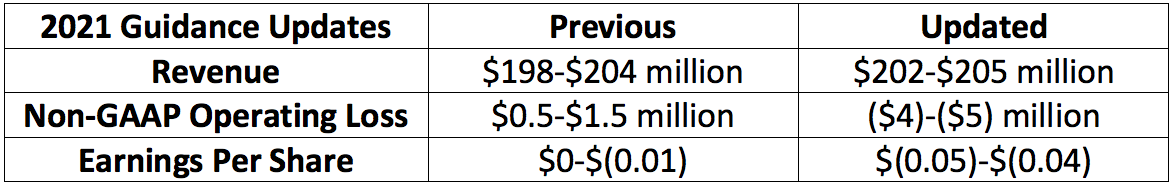

c. Guidance Updates

Vdoo — JFrog’s recent software security acquisition — contributed “a few hundred thousand dollars” to the guidance raise as it has only begun its go-to-market strategy and does not generate material revenue. Most of this raise was via organic growth.

Note the company expects $5 million in incremental operating expenditures for 2021 in connection with the Vdoo purchase hence the reduction in operating income guidance.

d. Management Commentary

1. CEO/Founder Shlomi Ben Haim

JFrog entered into strategic co-selling & co-marketing arrangements with AWS, Azure & Google Cloud. These partnerships have already resulted in winning contracts with the largest retailer point of sale software provider and the largest cloud data services company. JFrog expects growth here to accelerate in the second half of the year.

Free-tier user conversion continues to improve 3 quarters into the program.

The Vdoo executive team will be part of the newly formed leadership team and will oversee JFrog’s security dev-ops business.

JFrog’s Cold Artifact Storage product is now in beta testing. This allows entities archive artifacts that aren’t needed anymore but are required for regulatory compliance.

2. CFO Jacob Shulman

The company entered Q2 with a smaller than typical pipeline due to the “accelerating conversion of users” leading up to JFrog’s subscription price increase. Shulman told us the team has now rebuilt the pipeline and is entering the 3rd quarter with a “very healthy pipeline. JFrog has $415 million in cash on hand & 0 debt post-Vdoo acquisition.

e. My take

Momentum continues to build for JFrog as it exits a period of heavy organic and inorganic investment and enters a period where accelerating growth is expected. Cash flow margins stood out along with the small organic raise to 2021 revenue guidance.

This was a fine quarter by my sights are set on the second half of the year. I’m not looking to trim or add to my position at this time. I will be waiting to see if the company delivers on its promises of improving margins and accelerating growth going forward; if it does I would look to start accumulating shares again.

5. GoodRX Survey & Surescripts Deal

GoodRX surveyed 4000 of its users and here are the results:

81% of users can afford all medications with GoodRX vs. 23% without it.

80% of users bought more goods at the pharmacy, spending $40 more on average.

1/4 GoodRX users made additional trips to their pharmacy because of GoodRX.

GoodRX users are satisfied with the service at a 95% rate.

Not only is the company helping consumers, but it seems to be aiding the top lines of pharmacies as well. This was a pleasant surprise to me.

GoodRX also announced a new partnership with SureScripts to integrate its drug pricing information onto the SureScripts electric health record (EHR) database. Now, uninsured, unregistered or under-insured will be able to directly access GoodRX’s prices within the Surescripts prescriptions benefits.

98% of the U.S. population is in the Surescripts master patient index & it connects with 2 million healthcare professionals & organizations annually.

6. Sneak Peak into CuriosityStream’s Sub Growth & a Distribution Win

Antenna Data published a report on subscriber growth from June 2020 to 2021. CuriosityStream enjoyed 55% YoY subscription growth in the period. This compares favorably to 27% growth for Disney+ and (1%) growth for Netflix.

With the world opening back up, CuriosityStream is not having trouble attracting more eye balls — and the comps will only get easier. Brand new services like Paramount+ did outgrow CuriosityStream. This is likely a result of the newness and the deeper pockets ViacomCBS possesses to spend on live sports and user acquisition.

Furthermore, CuriosityStream is now available on Samsclub.com with special pricing for all members. This continues a trend of positive distribution deals with Tata Sky, SPIEGEL TV, Sony and now Sam’s Club.

7. Consumer Debt & Upstart/SoFi

U.S. household debt ballooned to nearly 14.96 trillion in a report out this week from the Federal Reserve. The rate of increase was the fastest we’ve seen in nearly 15 years.

Pairing this with the phenomenal results that loan issuer Lending Club posted, and it’s crystal clear that macro-loan demand is strong. This should bode well for both Upstart an SoFi in their respective quarters.

Interestingly, Lending Club specifically called out its bank charter as a driver of growth — SoFi has already received conditional approval for this.

8. Illinois Cannabis Sales Record

For the month of July, Illinois reported $127 million in monthly cannabis sales. This is up 112% year over year and 9.5% sequentially. Another record.

9. A Butterfly IQ For All Students

Temple’s Medical School gave its first year students a Butterfly IQ. Penetration within institutions should be a powerful revenue driver for the company & this is a good sign.

10. Duolingo’s China Problem

China’s government removed Duolingo’s app — along with all for-profit education apps — from stores across the country. Duolingo does have an office in Beijing, but it’s unclear what percent of its revenues come from China at this time. Hopefully, we will learn more at the upcoming “Duocon” event August 20th.

To be candid, I will be using any stock weakness associated with this news to add to my position.

11. The Week Ahead

Monday, August 9th

The Trade Desk earnings before the market

Butterfly earnings before the market

Planet Fitness earnings after hours

Tuesday, August 10th

Nano-X Imaging earnings before the market

Progyny presents at a Bank of America conference

CuriosityStream earnings after hours

Olo earnings after hours

Upstart earnings after hours

Wednesday August 11th

Teladoc presents at a Canccord Genuity Conference

Green Thumb earnings after hours

Thursday August 12th

GoodRX earnings before the market

SoFi earnings after hours

Tattooed Chef earnings after hours

Friday, August 13th

Cresco Labs earnings before the market

Thank you for reading!

@Brad Freeman, thanks for this week "News of the Week" :) Do you own all the companies highlighted in you "News of the Week" articles ? Do you have a Concentrated or Diversified Portfolio ? How do you select the stocks in your portfolio and when do you Buy or Sell a company ?