News of the Week (August 21 - 25)

Earnings Roundup; Disney; Shopify; CrowdStrike; Progyny; Meta; Amazon; PayPal; SoFi; Macro; Portfolio

1. Earnings Roundup

a) Workday (WDAY)

Results vs. Expectations:

Beat revenue estimate by 1.1% & beat guide by 1.1%.

Beat EBIT estimate by 6.8% & beat guide by 8.1%.

Beat $0 GAAP EBIT guide by $36.3M.

Beat $.01 GAAP EPS estimate by $.29.

Beat $1.26 EPS estimate by $.19.

Full year Guidance:

Raised full year subscription revenue guide by 0.3%.

Raised full year revenue guide by 0.2%.

Raised EBIT guide by 2.2% while raising EBIT margin guidance as well.

Raised GAAP EBIT margin guide by about 50% while raising GAAP EBIT margin guidance as well.

Reiterated $1.65 billion free cash flow (FCF) guide.

Next quarter guidance was slightly ahead across the board.

Balance Sheet:

$6.6B in cash & equivalents.

$3B in debt.

Diluted shares up 4% Y/Y while basic shares rose 2.7% Y/Y.

Results Context:

Gross revenue retention remains over 95%.

Workday is a vendor for over half of the Fortune 500.

Its 19.1% 3-year revenue CAGR compares to 18.3% Q/Q and 19% Y/Y.

Timing of cash collections and expenses propped up margins a bit this quarter.

Macro:

Budget scrutiny continues to hold back growth, but leadership praised its sales team’s ability to overcome that challenge by staying “close to customers.” Its domestic pipeline is healthy and points to a strong second half of the year while recent product events abroad are showing signs of building a robust international pipeline. Early renewals were ahead of estimates while contract duration lengthened to offer evidence of macro headwinds easing. This, according to leadership, is thanks to the mission critical nature of its platform, its vendor consolidation capabilities and the aforementioned strong sales team execution.

AI:

Workday spoke on its human centric approach to AI and how its massive data set is an ideal asset to participate in the wave. Still, it will not directly monetize the products it’s working on here. It will take more of an Amazon approach by indirectly enjoying expected boosts to win and renewal rates thanks to the incremental value. AI/ML inferences rising 60% Y/Y illustrates how this strategy is working. It’s also pleased with the developments in the EU on its planned AI act. The proposed legislation “includes many Workday suggestions” in it.

Customer Wins and Expansions this Quarter Included:

Airbus, Dell, Nike, Rite Aid and 7-11 expansions.

New wins with customers like the University of Florida.

Retail and Hospitality is the company’s second customer group to reach $1 billion in annual recurring revenue (ARR) (joining financial services).

b) Intuit (INTU)

Results vs. Expectations:

Beat revenue estimate by 2.7% & beat guide by 2.7%.

Beat -$0.28 GAAP earnings per share (EPS) estimate by $0.60 & beat guide by $0.64. GAAP EPS rose from -$0.20 to $0.32 Y/Y.

Beat $1.44 EPS estimate by $0.21 & beat guide by $0.20. EPS rose from $1.10 to $1.65 Y/Y.

Beat EBIT estimate by 8.6%.

Initial Fiscal Year 2024 Guidance:

Met full year revenue estimate for about 11% Y/Y growth.

Beat EBIT estimate by 1.3%.

Beat $8.87 GAAP EPS estimate by $0.65.

Beat $15.96 EPS estimate by $0.36.

The guide was called prudent in response to uncertain macro.

Next quarter guidance was slightly weak across the board, but the upbeat full year guide makes that less concerning.

Balance Sheet:

$3.6B in cash & equivalents.

$6.1B in debt. $4.2 billion is due within 15 months and the company is exploring refinance opportunities to ladder out these maturities.

Roughly stable share count Y/Y.

Dividend payments rose 15% Y/Y.

Results Context:

Q3 is seasonally strong for Intuit’s business model as it coincides with the U.S. tax filing season. The Q/Q growth for this reason is irrelevant. Over a 3-yr period, Intuit’s revenue compounding of 14.2% compares to 26% last quarter and 21.5% 2 quarters ago. Small/Medium Business (SMB) and self-employed revenue growth led for Intuit at 21% Y/Y while Credit Karma revenue fell 11% Y/Y as macro headwinds hurt its lending and insurance businesses. It’s seeing stability across Credit Karma’s products and still is confident in 20%-25% annual growth for the segment.

AI:

Intuit’s AI approach is similar to many other large tech companies that are not directly operating in the model or app building segment. It plans to use its treasure trove of customer data to transform its tax, accounting and other tools from requiring significant manual work to requiring none. To this company, AI means automation.

With 100 million customers, thousands of relevant financial data points per account and integrations with industry leading large language models (LLMs) (as well as its own), it’s easy to see how Intuit will infuse more value into its suite over time. This won’t simply come via more automation, but by gleaning unique cross-selling data to offer better access to its offerings. For example, if I know your cash flow data, I can probably approve a loan for you more frequently and at lower rates.

Mailchimp:

While Mailchimp is largely considered a poor acquisition, the company is still LEADING with this offering as its main go-to-market tool as it expands into new geographies. Paid customer growth continues to accelerate while quarterly retention set a 2 year high this quarter. Maybe Alex Chriss (PayPal’s new CEO) wasn’t so silly to want to buy this after all. They did overpay, but the product seems to be plugging in very nicely to the rest of the business. Revenue here rose by a mid-teens percentage Y/Y.

Intuit is now adding generative AI tools to Mailchimp to fully automate campaign creation and real-time promotions. As an aside, Mailchimp’s full year of revenue contribution vs. 3 quarters in fiscal 2022 added 3 percentage points to its 24% full year, company-wide growth rate.

License-Based Desktop Transition:

Intuit is moving its license-based desktop customers to recurring subscriptions while it raises desktop pricing to accelerate this change. It’s 2/3 of the way through the transition which will serve as a tailwind to its online ecosystem growth next year as it wraps up the shift.

Final notes:

Tax season timing volatility has led to some odd seasonality in its results since 2019.

TurboTax will expand into business taxes.

Will spend $700 million in deferred debt payments next year which will be a margin headwind.

c) Autodesk (ADSK)

Results vs. Expectations:

Beat revenue estimate by 2.2% & beat guide by 2.2%.

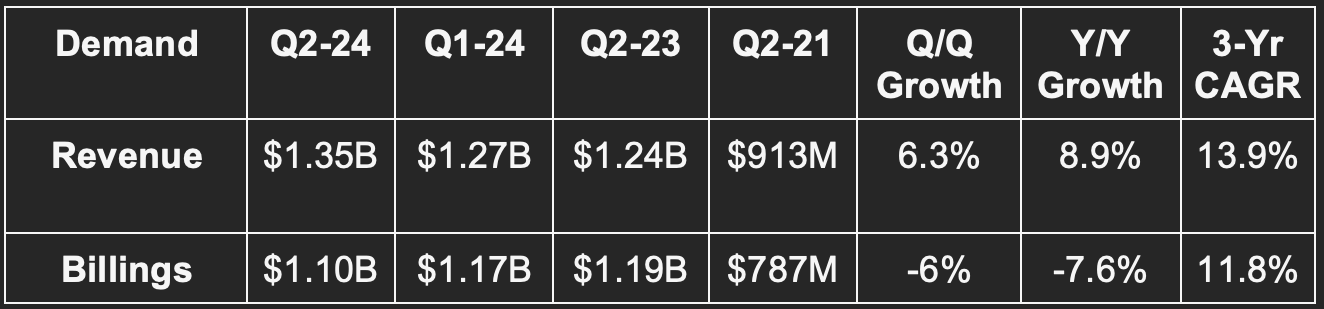

Its 13.9% 3-yr revenue CAGR compares to 12.7% Q/Q & 13.6% 2 Qs ago.

Beat EBIT estimate by 6.9% & crushed FCF estimate.

Beat GAAP EPS estimate by $0.17 & beat guide by $0.20.

Beat EPS estimate by $0.18 & beat guide by $0.19.

Full Year Guidance:

Raised billings & revenue guide by 0.4% each.

Reiterated margin guidance & GAAP EPS guide while slightly raising EPS & FCF guide. Estimates & guidance were nearly identical.

Balance Sheet:

$2 billion in cash & equivalents.

Share count fell slightly Y/Y.

No debt.

Billings:

Autodesk is actively transitioning from up-front multi-year contracts to annual billings. This is why billings growth is negative while all other demand metrics show strong expansion. The impact will be largest in FY 2024 and smaller next year and will hit both billings and FCF generation throughout that period.

Macro:

Autodesk is still seeing the impact of a chaotic macro backdrop, but its own strong execution allowed it to overcome this challenge. Furthermore, “early customer expansions and strong renewal rates” as well as recovering engagement and “cautious channel partner optimism “ led it to raising the low end of its guidance. Its seamless ability to connect disparate workflows and consolidate vendors is a popular selling point in 2023 just like for the rest of the software ecosystem.

The firm’s revenue retention rate remains between 100% and 110%. I’d love to see them offer some more precision here.

An inspiring aside:

Autodesk’s CEO talked through a case study on its technology being used by Coral Maker to restore coral reefs. With current processes, about 1 hectare (about 2.5 acres) can be restored per year. Using Autodesk’s AI and automation capabilities, it’s 100Xing that metric. Coral reefs are at the heart of our world’s biodiversity and natural tropical storm protection. This matters a lot and is a real, tangible example of how incredible of an uplifter great software can be.

2. Walt Disney (DIS) -- Parks & Drama

I will have a complete introduction on the Disney investment case sent in next week’s article.

I also discussed ESPN developments in the Amazon section.

a) Parks

Disney World will reintroduce its parking lot trams to Epcot and Disney’s Hollywood Studios in September. These trams were removed during the pandemic era while attendance restrictions remained in full force. Disney had told fans to expect this return by the end of 2022, but only met that timeline for Magic and Animal Kingdoms. Now it’s doing so for the remaining Walt Disney World parks. It’s a decent walk from parking lots to parks and Florida gets very hot during the summer. I can personally vouch for that with 2023 being an abnormally warm summer in the state. These trams are important for making attendance as convenient and comfortable as it can be. That matters especially in 2023 as Disney’s park attendance underwhelms.

Specifically, wait times have shrunk Y/Y from 31 minutes to 27 minutes according to the Touring Plans Data service and it’s also reporting disappointing summer traffic overall. The wait times could actually be a positive sign that its investments in service enhancements are bearing fruit. The foot traffic, however, is clearly negative to a point that Disney plans to offer deeper discounts on Christmas passes this year.

Why is traffic down? There are a few complex variables causing the subtle weakness. If you ask Florida’s governor, this is self-inflicted and a matter of the company’s “woke agenda.” Perhaps that’s contributing, but I don’t think that that's the main factor. If you look across all parks in Florida, attendance is down everywhere. This points to it not being a Disney issue, but a sector issue.

And when digging deeper, it becomes utterly clear why the sector is struggling this year. First is tough comps. 2022 and early 2023 featured an aggressive unleashing of pent-up travel demand. Well? Rapid growth one year means tougher growth comps the next year. Furthermore, Iger pointed to Florida tax revenue data on the last call showing state-wide tourism weakness this year as we lap the unleashing of that pent-up demand.

Amplifying this softness is the aforementioned abnormally warm Florida summer as well as the return of cross-border travel to Europe and Asia with domestic travel no longer being the only option in town. That’s why travel players like Airbnb are still performing well while domestic park businesses like this one aren’t. Poor macro and evaporating savings cushions merely add to the headwinds and, when taken altogether, these all offer a clear sense of how this softness is occurring.

b) Double Drama

Political and contractual drama continues to feed the negative sentiment associated with this name. That drama will not disappear overnight, but should eventually. While that’s a bit frustrating, it has opened the door for me to start a position and should lead to more stock turbulence to build it out over time. Neither of these issues should be permanent and I’m selfishly leaning in.

First is more political drama. In February 2023, Florida Governor Ron DeSantis replaced the Reddy Creek Improvement District with the Central Florida Tourism Oversight District. This change entailed board seats transitioning from Disney loyalists to DeSantis loyalists. This new district board just filed yet another complaint against its predecessor for offering impermissible free passes and discounts to district employees such as Firefighters. The accusation involves just $2.5 million in total so the financial hit would be immaterial. What is material is the continued signs of an adversarial relationship between the company and the Florida state government.

I’m apolitical and view meshing business and politics as a mistake. I want Iger and Disney to drop the current lawsuits and to play nice with DeSantis. It has nothing to do with left or right wing. It has everything to do with shareholder value creation. Don’t create powerful enemies. I’m optimistic that Iger will work to mend this broken relationship over time.

The second piece of drama centers on the ongoing Writer’s Guild of America (WGA) strike. The Alliance of Motion Picture and Television Producers (AMPTP) (which represents Disney, Netflix, Paramount and others) submitted its latest offer to the WGA as talks resumed this week. The offer included a 13% pay raise, generative AI protections and minimum employment lengths. Shortly after the meeting, AMPTP publicized the details which WGA called a move to get them to “cave.” The response hints at this offer not resolving key issues and this strike continuing on for now. The longer it goes, the tougher 2024 content slates will become to deliver. Disney is somewhat insulated thanks to its sports rights and ample evergreen content, but this is still a risk to watch closely.

3. Shopify (SHOP) -- Flexibility = Conversion

Shopify Payments and Shop Pay added Solana pay as a new payment checkout option for its merchants. Regardless of what you think of crypto and Web3 (I’m not a believer personally), more payment options is always a positive. Giving more method flexibility directly bolsters shopper conversion and makes Shopify a more valuable partner for its clients.

4. CrowdStrike (CRWD) -- Special

When SentinelOne debuted on public markets, it was the shiny new thing in endpoint that everyone wanted to own. Fast forward to today, and the company is putting itself up for sale after a disappointing quarter.

If you read the research of ten different vendor research firms, 5 will say CrowdStrike is the best and 5 will say SentinelOne is the best in terms of technology. SentinelOne seemingly has strong tech… So why has one thrived while the other preps to throw in the towel? Great tech is not the only thing that matters. A solid go-to-market approach matters as well. SentinelOne has one of the ingredients while CrowdStrike has both. This is why CrowdStrike has built a book of business vastly larger than SentinelOne despite the two being founded roughly at the same time. It’s why CrowdStrike has had more success expanding into SentinelOne’s smaller client niche with Falcon Go than SentinelOne has had trying to win big customers. Finally, it’s why CrowdStrike is rapidly compounding at healthy margins while SentinelOne enjoys rapid growth but remains deeply entrenched in cash burn mode. CrowdStrike is special.

This is not a knock on SentinelOne… It's simply my admiration of CrowdStrike as one of two companies in the world boasting its combination of scale, growth and profitability (Snowflake being the other). Many more endpoint disruptors will come and go. CrowdStrike looks to be here to stay.

5. Progyny (PGNY) -- Timely Press Release

Progyny released a presser this week celebrating 30,000 Amazon employees under its coverage network. The timing of this release was not a coincidence. It comes after Amazon announced the expansion of its fertility benefits offering with Maven Clinic throughout the globe. Why is this not concerning? Because the partnership excludes the only 2 markets that Progyny competes in: The U.S. and Canada. Amazon will continue to heavily utilize Progyny in these two countries… nothing to see here.

6. Meta Platforms (META) -- Product Announcements

Meta made a few new product announcements this week. First, its Threads App will soon release a web version. Next, it continues to roll out new apps and tools with its generative AI models. Llama 2 has been packaged into a new automated code writing tool called Code Llama while Meta also debuted automated speech and text translation models.

Just as with all of Meta’s generative AI tools, it will not directly monetize like Microsoft is doing with Copilot. Instead, it will work to infuse this technology across its discovery and content engines to raise engagement and indirectly monetize with the traffic boost. Furthermore, this open-sourced, free-to-use approach should cause developers to flock to build on Meta which will result in more compelling products in its ecosystem. These products, like new Quest games for example, can also be easily sold on its app stores with Meta commanding a hefty cut. It’s the same playbook that Meta masterfully ran with its Family of Apps: Build product market fit, create scale and THEN monetize. Not profiting directly… but still creating lucrative potential financial benefits down the road.

7. Amazon (AMZN) -- Margin Levers & ESPN

a) Margin Levers

When you represent such a massive portion of developed market commerce… when you boast a subscription that delivers unparalleled value… and when you can ship goods more expediently than others… you naturally enjoy pricing power. That pricing power comes from unique utility and Amazon provides unique utility in droves.

Pricing power for such a massive yet low margin book of business can do wonders in driving profit growth. Just 10 basis points (1/10th of 1%) of global marketplace EBIT margin expansion has a material impact on this firm’s results. The obvious margin levers in advertising and 3rd party selling have been bolstering the profitability for the firm’s commerce segment, but it has more tailwinds to enjoy.

This week, Amazon announced that UK Prime members will now have to pay for fulfillment of same day goods. Secondly, it’s now leaning further into Amazon Shipping. This product features external fulfillment (still only for Amazon merchants) to directly compete with the FedEx’s of the world in North America and some EU nations. The ability to utilize excess capacity will trim deadweight loss within Amazon’s gigantic footprint and should be another small margin tailwind. Some of this deadweight loss will always be inevitable (need to be able to flex with demand) but minimizing it will always be imperative. Amazon’s Buy with Prime program allows all Amazon merchants to offer its fulfillment to Prime members on their own websites. Amazon shipping opens up Amazon’s world-class fulfillment to non-prime members.

b) ESPN

ESPN and Amazon held preliminary talks on an ESPN partnership and a potential ownership stake as well. Aside from Apple, it’s hard to envision a better distribution partner for Disney than Amazon and its massive base of subscribers. For Amazon, it’s hard to envision a more compelling injection of content to bolster the value of its subscription. Sharing the cost burden could also easily allow the duo to control a larger portion of highly relevant live sports content to drive more unique and unmatched streaming value. It would make bidding wars on this expensive, scarce content less competitive as well. ESPN + Amazon seems like a great idea and a strong win-win for both companies. I’d love to see it happen.

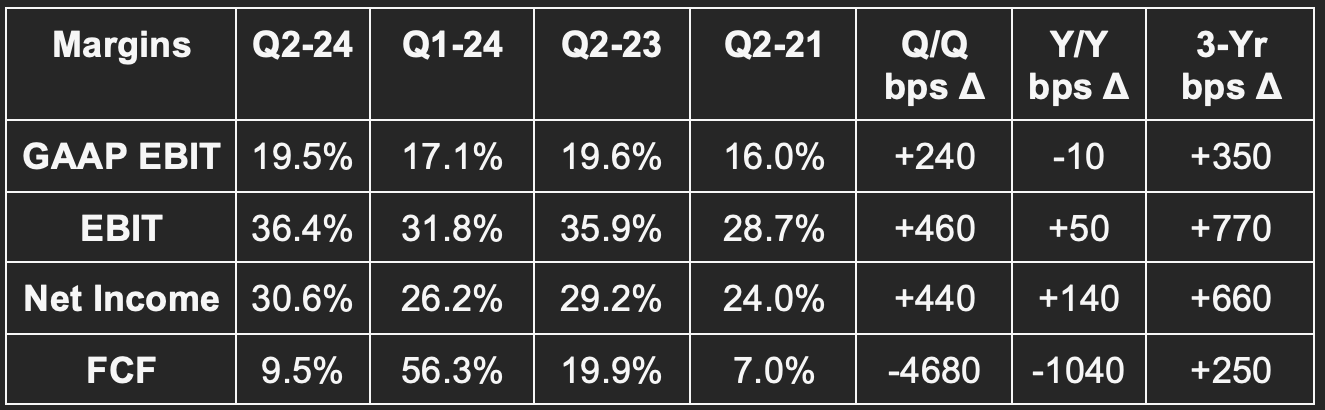

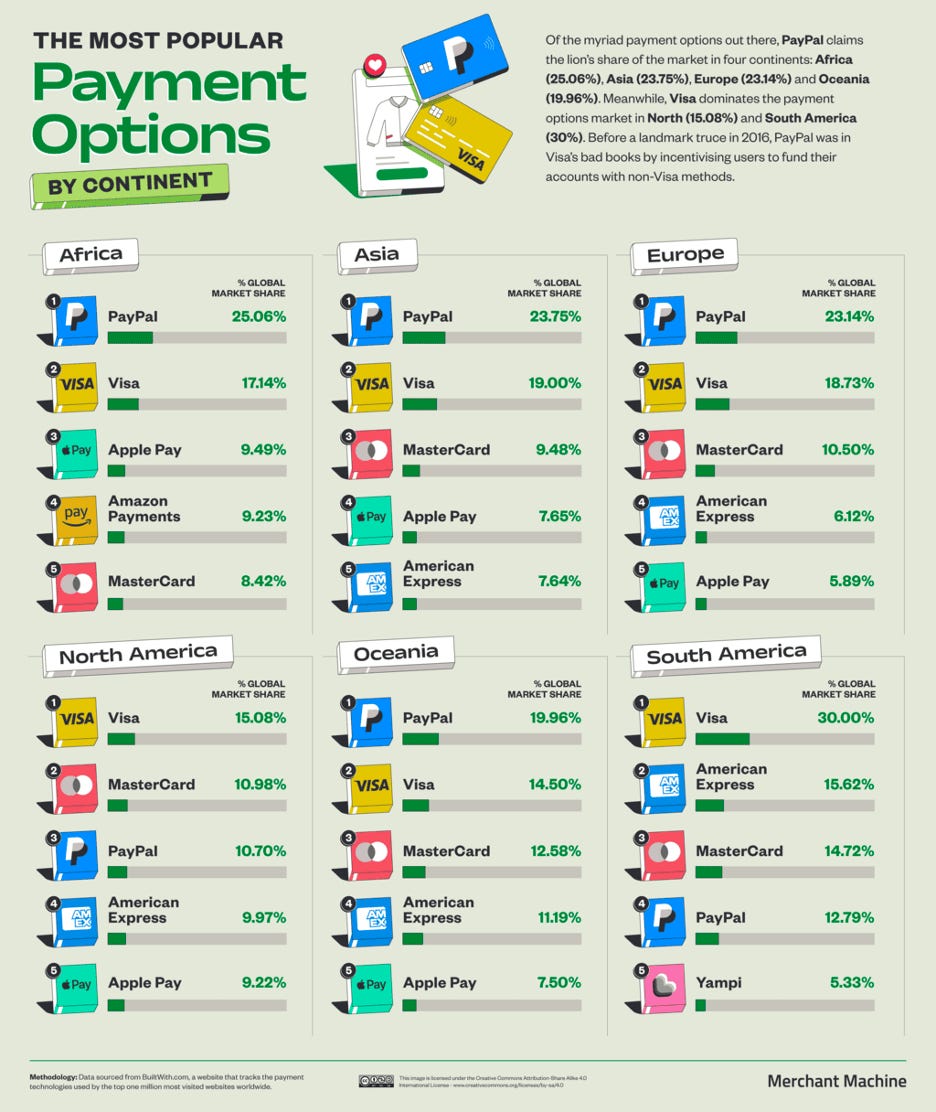

8. PayPal (PYPL) -- Ideally Agnostic

The account @Kross_Roads on twitter shared some great research from Builtwith.com on global payment market share across the web. While the chart doesn’t include mobile payment data where Apple Pay is more popular, it’s still encouraging. Here’s market share data by geography:

For the world as a whole, PayPal commands the top market share position at 20.5% with Visa in second place at 15.7% (Venmo is 10th). If a merchant wants access to branded PayPal and Venmo options along with deep alternative payment method integrations and tangible checkout stat leads that continue to grow… They go with PayPal. If a consumer wants broad-based payment interoperability, unmatched merchant availability and world-class buyer protection programs… They go with PayPal. It’s the unifying layer of moving money from one place to another. This layer isn’t Apple Pay, Google Pay or the Card Networks, but PayPal thanks to its ubiquity, brand strength and omnipresent ecosystem partnerships.

The investment has been a tough one so far, but I continue to reject the notion that this company is dying. With over a trillion in volume last year, it’s alive and well while being a transaction margin bottom and easier FinTech sentiment away from morphing back into a darling. PayPal isn’t dead, it’s hibernating.

9. SoFi (SOFI) -- Home Lending

SoFi launched a Federal Housing Administration (FHA) mortgage product this week. The launch is part of its planned product rollout following the purchase of Wyndham Capital. The timing of this rollout is perfect as mortgage rates are set to peak in the coming quarters. Falling rates will directly juice home and student loan demand to offset the personal lending headwind from those same rate declines.

As part of FHA loans, the FHA protects the lender from delinquencies and defaults so that players like SoFi can feel more comfortable underwriting within somewhat wider credit bands. FHA loans require lower down payment proportions to enhance access for less affluent borrowers.

10. Macro Data

Output Data:

Building permits met expectations.

The Manufacturing Purchasing Managers Index for August came in at 47 vs. 49.3 expected and 49 last month.

The S&P Global Composite PMI for August came in at 50.4 vs. 52 expected and 52 mast month.

The Services PMI for August came in at 51 vs. 52.3 expected and 52.3 last month.

Core Durable Goods Orders M/M for July came in at 0.5% vs. 0.2% expected and 0.2% last month.

Durable Goods Orders M/M for July can in at -5.2% vs. -4% expected and 4.4% last month.

Employment and Consumption Data:

Existing home sales for July came in at 4.07 million vs. 4.15 million expected. New home sales for July slightly beat expectations.

Initial Jobless Claims were 230,000 vs. 240,000 expected and 240,000 last month.

Michigan Consumer Expectations for August came in at 65.5 vs. 67.3 expected and 68.3 last month.

Michigan Consumer Sentiment for August came in at 69.5 vs. 71.2 expected and 71.6 last month.

Inflation Data:

Michigan 5-year inflation expectations for August were 3% vs. 2.9% expected and 3% last month.

Michigan Inflation Expectations were 3.5% for August vs. 3.3% expected and 3.4% last month.

Jackson Hole:

For as much focus as there was paid to Jackson Hole, it was a boring Friday. Powell said what he has been saying for months. Inflation progress has begun, more progress is needed and the Fed may or may not raise rates again. Alert the presses.

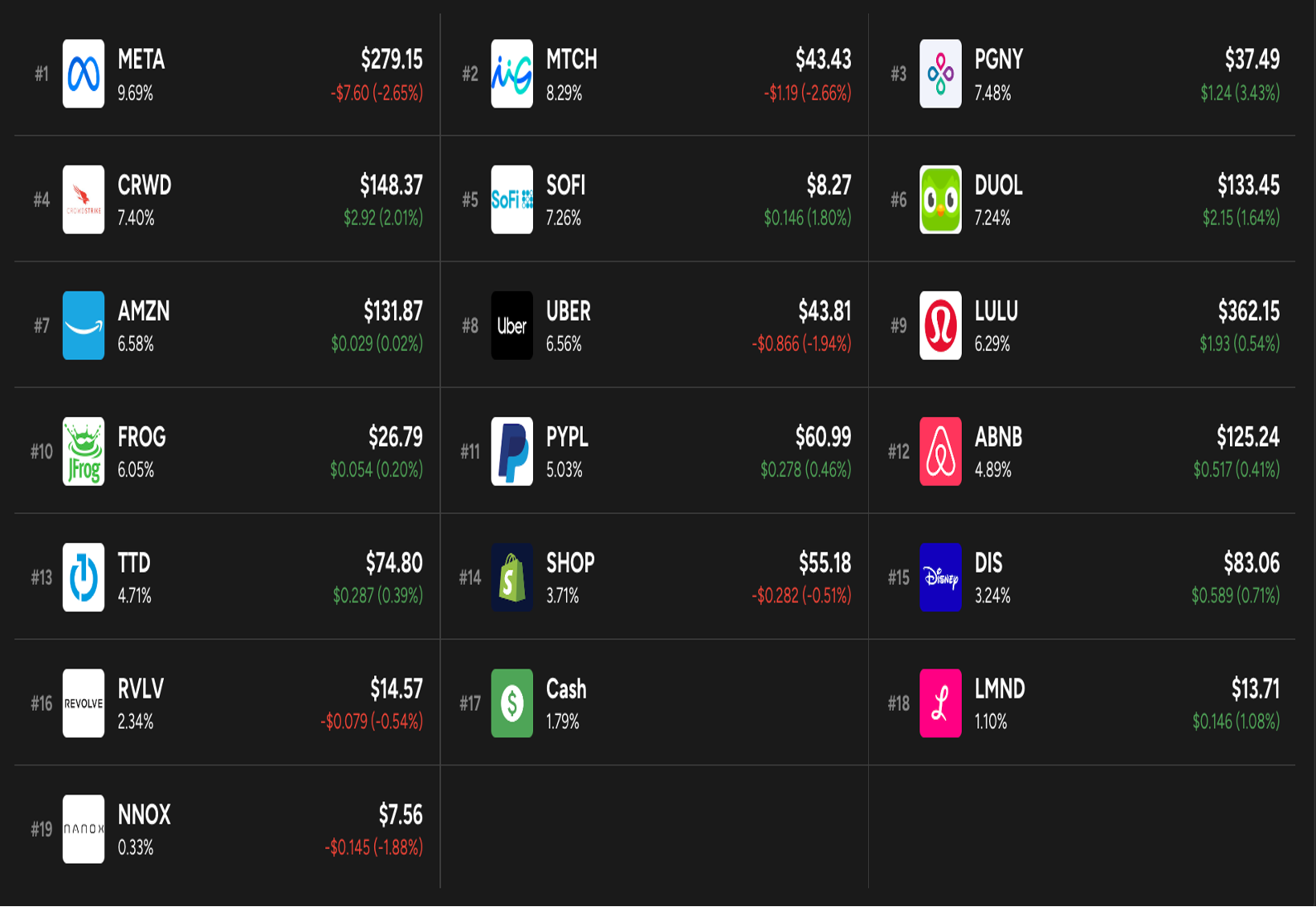

11. My Portfolio

I exited my tiny stakes in Upstart and Cresco Labs this week. I’ve caught myself making too many excuses for Upstart and I’ve struggled to confidently justify owning it following several self-inflicted blunders from the team. Some of the issues are macro related, some are their fault. See Pagaya’s 2023 results for evidence of how Upstart needed to secure committed funding long before it did. That’s not macro… that’s leadership.

I have little confidence in capital market demand ever recovering to 2021 levels following Upstart’s underperforming credit vintages throughout 2022. I have lost faith in the team and no longer believe in what they’re saying. I’d rather not own it today, see if it can foster a turnaround (and prove me wrong) and then buy shares again at higher levels vs. continuing to hold through immense uncertainty and risk. Calmly holding shares was becoming too difficult and I want to focus on higher conviction names. I wish those sticking with this holding all the best and hope the company thrives from here.

While I had already taken out more than my original investment at a blended price above my cost base, I think this still should be considered a failed investment. I should have been selling even more aggressively in 2021 as it raced towards $400. Hindsight 20/20.

The Cresco Labs sale was for somewhat similar execution reasons, but I have no criticism of its leadership team. Poor execution is truly not their fault. The company has done the best it could in today’s heavily restricted regulatory environment. It can’t open a bank account. It can’t purchase business insurance. It can’t deduct business expenses from its tax bill. It can’t be listed on major exchanges. When combining all of that with immense pricing pressure and the growing list of states that it has exited to preserve cash and margins, it NEEDS reform and who knows when that reform will come. It has been nearly 5 years of countless false starts and no change from politicians. It could be another 5 years for all I know. Just like with Upstart, this will be allocated to higher conviction names.

I’m always searching for lessons on what went wrong to avoid repeating inevitable mistakes in the future. Along those lines, this investment has led to the creation of a new rule for me. I will not rely on political reform as a large chunk of a bull case as that’s relying on irrational people behaving rationally. I wish those sticking with this company the best of luck.

I added to Lemonade and Walt Disney during the week using the proceeds from these two sales.

Great stuff Brad! I always appreciate your insights.