News of the Week (August 29th - September 2nd)

Lululemon; Meta; SoFi; Shopify; The Trade Desk; Upstart; Revolve; Cresco Labs; Olo; Macro; My Activity

To view my current portfolio, click here.

1. Lululemon Athletica (LULU) -- Earnings Review

1a. Demand

Lululemon guided to $1.76 billion in sales while analysts expected $1.77 billion. The company posted $1.87 billion in sales, beating its expectations by 6.3% and analyst estimates by 5.6%.

More demand context:

Total comparable sales (same store sales + Direct to Consumer (DTC) revenue) rose 23% YoY vs. 24% YoY last quarter. Note that this excludes temporarily closed stores due to the pandemic.

On a 3-year basis, revenue is compounding at a 28% clip. This slightly accelerated QoQ.

Same store traffic continues to compound at a brisk clip of 8% on a 3-year basis while e-commerce traffic is compounding at a 40% 3-year clip.

DTC represents 42%% of sales vs. 41% last year. This is higher margin business.

International revenue grew 35% YoY while China continues to rebound as it moves away from yet another round of pandemic lockdowns.

Lulu now operates 40 stores in China after opening up 8 more this quarter. This is a big piece of the international growth push. As a reminder, it launched a new digital store on JD.com in that country during the quarter.

Men’s grew by 30% on a 3-year compounded basis vs. 25% for women.

1b. Profitability

Lululemon guided to earnings of $1.85 per share while analysts expected $1.86. It earned $2.20, beating its expectations and analyst estimates by roughly 19%. GAAP earnings came in at $2.26. Note that GAAP earnings is higher because it excludes a small loss on the disposal of assets.

More context on margins:

YoY GPM compression was due to freight and supply issues shaving 150 bps off of it as well as FX impacts erasing another 40 bps. Without these headwinds, GPM would have been 58.4% and expanded 30 bps YoY.

Inventory rose 85% YoY this quarter. That’s why cash flow margins were negative. Much more on this later.

Free Cash Flow margin was also hit by a near doubling of CapEx YoY mainly related to its new distribution center build-out.

1c. Balance Sheet

The company has $500 million in cash and equivalents vs. $650 million last quarter as it builds out its inventory and buys back shares.

This quarter, it bought back $125.3 million worth of stock as part of its billion dollar authorization.

It still has roughly $400 million untapped on its current credit facility.

1d. 2022 Guidance

Lululemon previously guided to sales of $7.66 billion while analysts had expected $7.69 billion. It updated its guidance to $7.90 billion, raising its expectations by 3.1% and beating analyst estimates by 2.7%.

Lululemon previously guided to adjusted EPS of $9.53 while analysts had expected $9.43. It updated its guidance to earnings of $9.82, raising its expectations by 3.0% and beating analyst estimates by 4.1%.

It also raised its GAAP earnings guide from $9.50 to $9.90 for the year.

Lululemon also now expects gross profit margin to fall by 115bps YoY vs. previous expectations for falling 125bps YoY (mainly freight related). It

Lululemon expects about 130bps of SG&A leverage mainly due to outperforming demand (and so getting more out of its fixed cost base).

The company expects e-commerce growth in the low to mid 20% range for the year and to open 75 new retail stores total.

3rd quarter 2022 guidance was similarly strong on the top and bottom lines.

“Based on our guidance, we expect a high level of performance to continue next quarter.” -- CEO Calvin McDonald

1e. Notes from CEO Calvin McDonald

On Macro & Inventory:

Lululemon and McDonald have been intensively monitoring guest data and spend to identify consumption shifts due to deteriorating macro. It has seen 0 negative impact to date. New guest acquisition “remains strong” with first timers rising 24% YoY and existing shopper frequency rising 17% YoY. Importantly, this traffic is NOT being created through pricing promotions as its business remains “predominately full price.” It has not changed its mark-down strategy and “has no plans to do so.” Mark-down rates are flat vs. pre-pandemic.

And speaking of mark-down cadence, the only concern coming out of this report was inventory rising around 85% YoY. There are a few notes I’d like to offer on why this doesn’t concern me. First, is its ability to sell most gear at full price and its continued robust forward demand outlook. But most importantly, we are still comping vs. a time when Lululemon was having significant trouble sourcing inventory from the supply chain chaos. Those supply chains have since eased a bit and Lulu is taking advantage. According to the team, “it was leaving demand on the table” last year via frequent out-of-stocks and this is its normalization of inventory levels. It sees today’s inventory position as far healthier than Q2 2021.

“We remain comfortable with both our quality and quantity of inventory. We are well positioned for the fall season.” -- CEO Calvin McDonald

“We are pleased to see some promising signs of supply chain improvement yet recognize further normalization will take time.” -- CEO Calvin McDonald

The bulk of its supply chain headaches have come from frequent opening and re-closing of the Chinese ports and economy due to the pandemic. A significant portion of its operations are connected to that economy. Now -- per McDonald -- vendors in China who had to close last quarter due to renewed pandemic outbreaks “are catching back up” with global supply chain needs. Overall vendor readiness specifically, which spiked from 45 days to 90 days last year, is back down to 70 days.

On the Lulu Play Category (Golf, Tennis, Hiking):

“We’re thrilled by the early reaction to our hike collection which launched in Q2… we will continue to expand the new category to include heavier styles to protect against the elements during cold gatherings.” -- CEO Calvin McDonald

On Footwear:

Its first women’s shoe -- Blissfeel -- “continues to perform well.” Lulu was having issues sourcing inventory for the popular running shoe after its debut, but those issues are now behind it.

This quarter, it launched RestFeel (a multi-gender slide) and Chargefeel (a women’s trainer). It will launch Strongfeel (a shoe “designed to keep the foot anchored and secured during workouts”) this year.

On the New Membership Program -- Launching soon:

This will have a free tier functioning like a loyalty program for Lulu apparel benefits. The paid tier will involve a MIRROR (to be re-branded Lululemon studio) membership.

On International:

As previously covered, Lululemon is entering Spain which is its first new launch in Europe since 2019. The e-commerce store is open there now and its Barcelona store opened this past week. Its Madrid store will open soon.

“International is one of the key pillars to our Power of Three x2 growth plan which calls for a 4Xing of our international revenue by 2026. We are off to a great start.” -- CEO Calvin McDonald

On Products:

Launched SenseKnit -- a new fabric offering “zone compression for runners.”

It’s now expanding into heat retention fabrics for runners to enter more cold-weather use cases. Furthermore, it’s creating “reflective detailing” to enable safer running in the dark.

Its new Scuba line continues to thrive out of the gate.

The company will re-launch its unicorn tears print style for some SKUs. This hasn’t been available in a decade.

“We’ve definitely seen market share gains. According to NPD, we were the largest share gainer in the quarter at 1.4%.” -- CEO Calvin McDonald

1f. Notes from CFO Meghan Frank

More on Inventory:

Starting in Q4 2022, expect inventory growth rates to significantly fall.

In 2023, expect inventory growth to mirror its revenue growth.

Use of more expensive air freight contributed to the 85% YoY growth. From an inventory unit perspective (so not dollar based) the metric rose 64% YoY.

On Price Hikes and Core:

Lululemon was able to pass on several price hikes within its core apparel with no resistance from consumers. It continues to show its pricing power. Core apparel line sales continue to drive the company’s success. New products are working, but Lulu’s legacy apparel is still kicking butt and taking names.

On Macro:

“I’m excited with our teams executing at a high level. However, we continue to plan the business for multiple scenarios. We have multiple levers to pull when it comes to discretionary expenses and CapEx.” -- CFO Meghan Frank

1g. My Take

This quarter was flawless. The only small concern I had was around the inventory number, but the robust forward demand expectation and commentary from management eased that fear entirely. This company is outperforming its peers by a mile with brisk market share gains, rapid successful product expansion and an increasingly iconic brand. Two thumbs up from me. If I had more thumbs, they’d be pointed up too. Great job, Lululemon. I added to my stake despite the modest multiple expansion following the report.

Click here for my Lulu overview.

2. Meta Platforms (META) -- India, VR & Snapchat

a) India

In 2020, Meta invested $5.7 billion in Jio Platforms for 9.99% ownership in the company. Jio is a technology conglomerate with several operating verticals -- including grocery through JioMart. This week, Meta announced that JioMart users can now shop for groceries and place orders by sending a text all within WhatsApp. After a cart has been filled, a shopper -- in one click -- can send the order to the store, confirm the delivery address and the payment method as well.

The lack of WhatsApp monetization to date has left some Meta investors quite frustrated. To me, this merely means that all of the low hanging monetization fruit is ahead of this app and company. Whether it is with programs like this, pay use cases in Brazil, or an Uber partnership allowing users to call for a ride in-app, the wheels are finally in motion. Let’s see where WhatsApp can go.

“I’m excited about the opportunities this opens up for businesses to build experiences on WhatsApp!” -- Head of WhatsApp Will Cathcart

b) VR

The new Oculus Quest headset will launch this month. This headset is geared towards enterprise-level use cases and comes with a vast interface upgrade vs. the older model.

Meta and Qualcomm will collaborate on a new custom VR chip as part of a multi-year relationship announced this week. This isn’t an exclusive deal for Meta, but one where Qualcomm will be closely working on next-gen chips to support Meta’s vision.

Meta is acquiring Lofelt — a VR start-up based in Germany. This company specializes in “haptic technology” or emulating the feel of physical touch within a VR environment.

c) Snapchat

Snapchat announced a 20% workforce layoff during the week. The one silver-lining from that sad piece of news was that its revenue growth quarter to date is at 8%. That may not sound like much, but considering that it told us in its last earnings call that quarter to date growth had been roughly 0%, it was good news. That’s likely why Meta and ad-tech responded so positively to what at first appeared to be bad news.

d) Gaming

Meta is shutting down its independent gaming operations. Meta likes to make frequent bets on future growth opportunities and some of these bets will invariably miss the mark. We saw the same thing with its entrance into the online dating space. To me, I like to see these chances being taken vs. observing a company resting on its laurels.

3. SoFi Technologies -- Marcus

Goldman Sachs is contemplating greatly pulling back on its consumer app: Marcus. Spend, unit economics and traction there have all underwhelmed to a point where CEO David Solomon is being pressured to pivot from what he considered a core growth vector for the company going forward.

This goes to show how unique SoFi’s rapid success within consumer finance has been. Just a few years ago, it merely offered student loans. Now, it has several thriving verticals while it rapidly approaches profitability. That’s the benefit of owning your own, cutting-edge tech stack. It facilitates more expedient and relevant software upgrades and vertical integration to power unique cost savings. I think investors take for granted the brisk member, product and revenue growth this firm has been able to consistently deliver (with a moratorium-challenged student loan business) alongside operating leverage. This lucrative combination is not automatic -- and far from it even for iconic financial institutions like Goldman Sachs.

4. Shopify -- Amazon

Shopify has formally warned its merchants that usage of Amazon’s Buy with Prime eliminates Shopify’s fraud protection aptitude and ability to protect consumer data. External Amazon codes include 3rd party, unprotected blocks which are outside of Shopify’s protection domain. Merchants can still accept these orders, but now must first explicitly accept this risk each time.

Considering Buy with Prime is attempting to emulate a small piece Shopify’s white-labeled niche, this battle makes sense. I’d imagine these are real issues -- but even if they’re not and Shopify is merely talking them up to benefit itself -- I don’t care. I care about market share, growth and cash flow. Whatever Shopify needs to do to win is fine with me.

I started a new position in Shopify this week. Click here for my overview of the company. My deep dive will be published this year.

5. The Trade Desk (TTD) -- “What Matters” Campaign

In Q4 2021, The Trade Desk leveraged its own platform to educate enterprises on the power and need of open internet advertising. In conjunction with Lucid, The Trade Desk conducted extensive marketing and surveying to quantify the brand awareness lift it could facilitate. This was across multiple channels, but predominately Connected TV (CTV). The study revealed unsurprising yet promising results: Brand awareness enjoyed a 4.6% lift with CTV marketing and brand favorability ratings also rose 7.1%. That second metric shows that consumers are not being annoyed with frequent ad-repetition somewhat common in this channel.

Click here for my TTD Deep Dive.

6. Upstart (UPST) -- National Community Reinvestment Coalition

Upstart partnered with the National Community Reinvestment Coalition (NCRC) this past week on its Innovation Council for Financial Inclusion. This partnership will entail conjoining efforts between FinTech disruptors and “grassroots communities” to enhance access to credit for underserved borrowers.

A combination of artificial intelligence and credit origination within Upstart’s business model invites ample regulatory attention and scrutiny. These two buckets are among the most heavily regulated and Upstart is intimately involved in both. Any partnerships like this showing its cooperation with community outreach organizations and regulatory bodies serve as small pieces of good news.

Click here for my Upstart Deep Dive.

7. Revolve (RVLV) -- NYC Fashion Week

Revolve will again host its REVOLVE Gallery as part of the New York City Fashion Week. This event last year was a hit success for the company and materially bolstered its reputation, brand and financial results. Let’s see if it can repeat the magic in a year when macro is serving as a large headwind vs. tailwind in 2021.

8. Cresco Labs (CRLBF) -- Florida

Cresco opened 3 new Sunnyside dispensaries in the state of Florida -- one of the highest margin states in the cannabis industry. The stores are in the highly populated Tampa area, as well as Cape Coral and Panama City Beach. As a reminder, Sunnyside is the most productive retail brand among tier 1 cannabis growers and store openings are expected to accelerate over the next several quarters. This news brings its store count in the state to 19.

9. Olo (OLO) -- Case Study

Family Express -- a Midwestern convenience store chain with 80+ locations -- switched to Olo for digital ordering. With its legacy solution, things like menu modifications took weeks at a time (vs. real time with Olo) and the interface more broadly was quite clunky. Family Express tested 6 solutions and went with Olo for its partner ecosystem, cross-channel ordering software and thorough, open data reporting with complete 1st party consumer profiles to leverage. Specifically, Olo delivered:

A 164% increase in digital revenue.

A 103% increase in orders.

A 45.3% increase in basket size.

“Olo created a frictionless guest experience at Family Express… from an operational standpoint, it streamlined online ordering and made it easier for employees to manage orders.” -- Family Express Digital Marketing Manager Thierry Lyles

That’ll work!

Click here for my Olo Deep Dive.

10. Macro Update

a) Key Data from the Week

Conference Board (CB) Consumer Confidence came in at a robust 103.2 vs. forecasts for 97.9 and a 95.3 reading last month.

The Institute for Supply Management’s (ISM’s) Manufacturing Purchasing Manager’s Index (PMI) came in ahead of expectations at 52.8 vs. 52.0 expected. This is a leading indicator and a hint at continued robust activity here.

The Atlanta Fed once again expects GDP readings for the quarter well over 2%.

Job Openings came in well ahead of expectations at 11.24 million vs. 10.48 million expected. Initial jobless claims came in below expectations as well at 232,000 vs. 248,000 expected. Those two labor metrics point to much more slack in the labor force. HOWEVER:

ADP Non-farm Employment Change sharply missed expectations with 132,000 added vs. 300,000 adds expected.

Unemployment came in ahead of expectations at 3.7% vs. 3.5% expected.

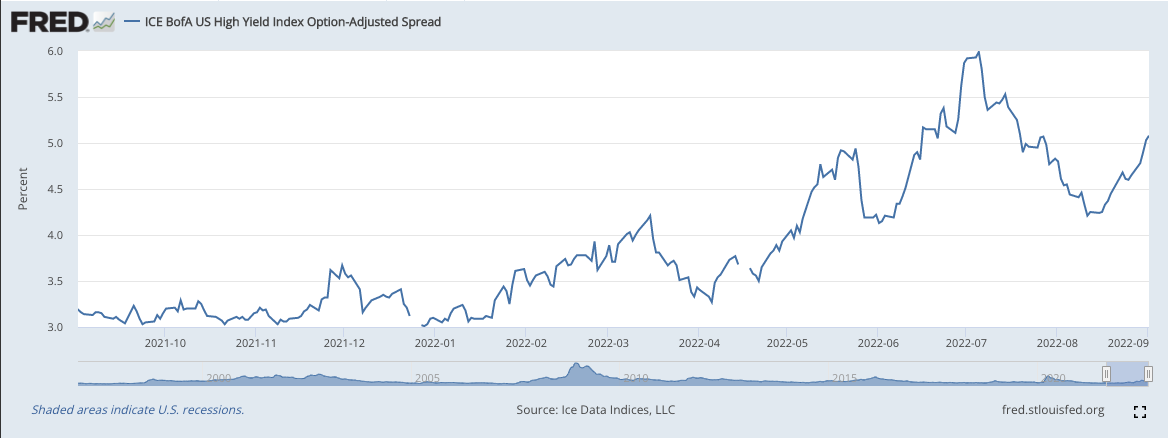

High Yield Corporate Credit Spreads unfortunately continue to tick back up:

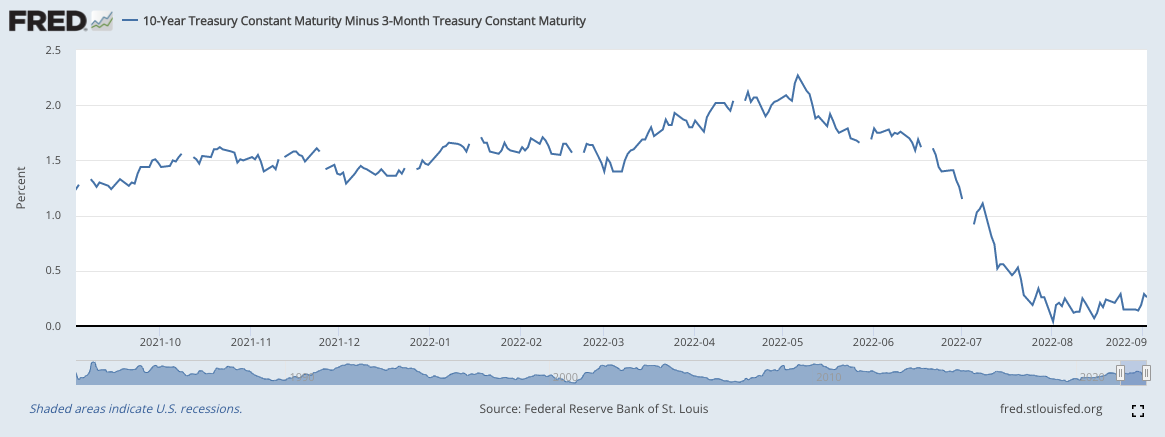

The Ten Year, Three Month Yield Curve Chart continues to float around inversion but not invert:

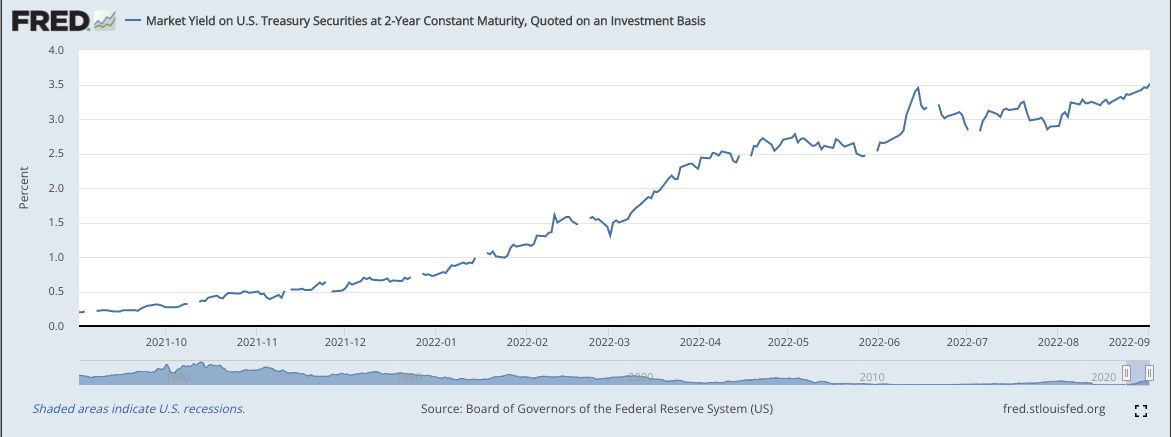

The Two Year Treasury Yield unfortunately continues to briskly rise:

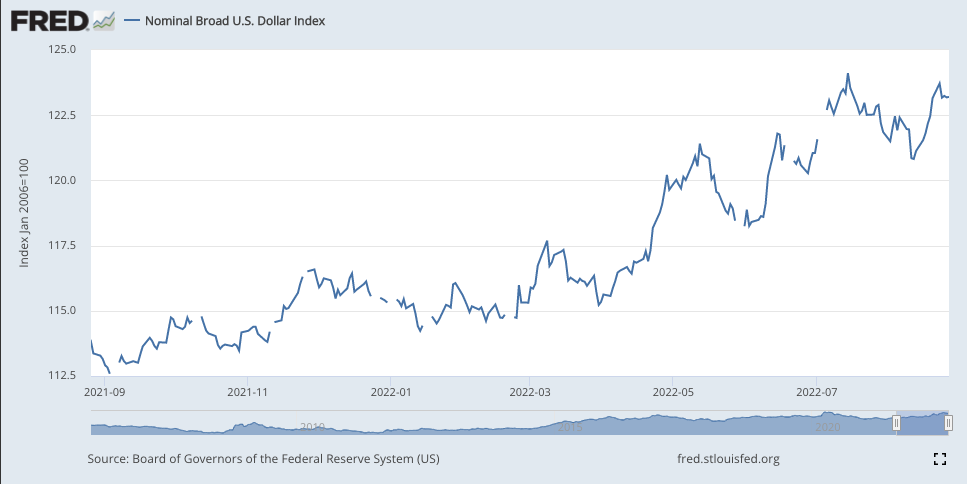

The Dollar is hovering near 52 week highs:

b) Level-Setting the Data

This recipe of employment data leaves ample room for subjective takeaways and interpretation. The data points are somewhat conflicting and so different conclusions will inevitably be drawn. While unemployment is terrible for those affected, rising unemployment reduces consumer demand and inflationary pressure and allows the Fed (all else equal) to be a bit less aggressive with rate hikes. That is one of its two mandates after all, and with inflationary data BEGINNING to look a lot more encouraging, if employment starts to look less healthy, that will surely be taken into consideration. So? I still think the macro data is more positive than negative in terms of getting to an easier Federal Reserve… and I continue to think the Federal Reserve will remain hawkish for now, but gradually less so in the coming several months. I’ll continue to deploy cash until that data turns more sour. As a relevant aside, spiking corporate credit spreads should also be another small Fed consideration for taking a slower approach to hawkish policy as it points to fragile systematic liquidity. But inflation is the main driver of that hawkish cadence today.

One other thing that I’d like to call out that could realistically make this inflationary and macro data look worse is Russian Gas. Russia has indefinitely suspended gas exports to Europe through the Nordic Stream 1 Pipeline. That will put even more pressure on global energy prices and could be something that complicates our need for precipitously falling inflation through this year and next. I will be keeping a close eye on this. Energy is one of the most volatile pieces of inflationary readings. It can fade away rapidly… but also return with vengeance.

11. My activity

I initiated a new position in Shopify during the week and also added to my stake in Lululemon following what I saw as a stellar earnings report. I also published a CrowdStrike earnings review during the week which can be found here.

If you’d like access to my real time portfolio and to sign up for text notifications when I transact, my friends at Savvy Trader now make that possible. It’s 100% free and can be accessed via the button below. Please note that the MSOS position is a placeholder for my positions in Green Thumb and Cresco Labs while OTC stocks are added to the platform. You can also re-create your very own portfolio through Savvy Trader.

Who would have thunk that the Lulu fanny pack would be the hit item this year for a company that is on track to perhaps become the next Nike? Color me intrigued by Lulu, Sofi and Shop as H2 2022 opportunities.