News of the Week (August 30-September 3)

Upstart; CrowdStrike; Lemonade; Olo; REVOLVE; Apple's Change; Ayr Wellness; Green Thumb; CuriosityStream

1. Upstart (UPST) — New Product Launch

Upstart launched a Spanish language version of its AI-powered, digitally-native lending product. According to the company, this is the “first online personal loan lending platform with full support for Spanish speakers across the USA. This product launch should be an important one for the company.

Nearly 1-in-5 Americans are of Hispanic descent and this minority is discriminated against within the traditional loan setting at a clip far higher than Caucasians and Asian-Americans. Upstart’s inclusive loan operations were already boosting Hispanic approval rates by 27.2% while lowering APR by 10.5%. Filling out applications in native-tongue should boost these advantages further by allowing Spanish-speaking Americans to enter information in a more comfortable manner. Better information feeds Upstart’s algorithm and its competitive edge.

Click here for my broad overview of Upstart.

2. CrowdStrike (CRWD) — Final Notes From the 10-Q

At the beginning of the year, CrowdStrike had one customer representing 17% of its total accounts receivable. It now has no customers representing over 10% of accounts receivable depicting meaningful concentration risk reduction as its client list rapidly grows.

CrowdStrike’s headcount is now 4,224 employees representing 49% year over year growth. Clearly the company sees more growth ahead.

3. Lemonade (LMND) — Student Housing Data

The rise of the Delta variant is not expected to shutter college campuses like it did in 2020, but it will have another interesting impact.

COVID-19 is boosting demand for off-campus housing as students seek out more space and cleanliness than is often provided in college dorms. These off-campus rentals will need insurance plans and that should bode very well for Lemonade.

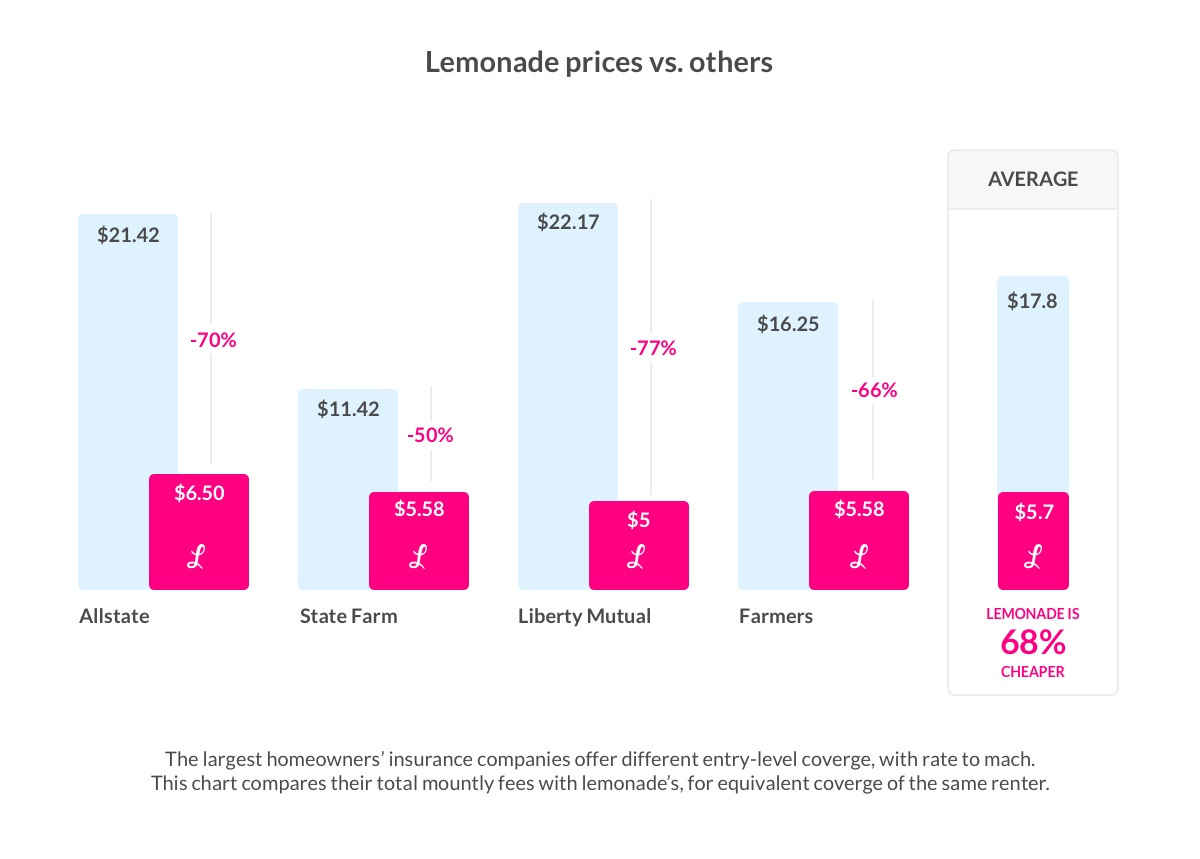

While renter plans yield far less premium than any other product Lemonade offers, the category also feeds customer growth for the company more than any other channel. Lemonade undercuts renter competition (often times by more than 50%) to win over customers new to the insurance world — such as college students. It then charges market rates on all other products it sells to a user.

Cheaper rental policies and excellent customer service both build loyalty for Lemonade to cross-sell its pet and life products or to up-sell a renter to a homeowner plan. This is where the premiums really start to pile up for the company.

Click here for my broad overview of Lemonade.

4. Olo (OLO) — New Restaurant Data

The National Restaurant Association published its mid-year “state of the restaurant industry” update which is quite relevant to Olo.

Here were the key findings:

a. Delta Variant Impact

52% of adults want to see restaurants incorporate more technology to make ordering and payment easier.

19% of adults have completely stopped going to restaurants due to the Delta variant.

27% of adults switched from dining in to delivery/takeout because of the Delta variant.

Olo’s core niche is incorporating more technology into a restaurant’s ordering system. The majority of consumers now calling for this change is fantastic news for the company. Furthermore, Olo’s core off-premise business will directly benefit from the 27% of adults switching from on-premise to off-premise dining.

Olo does not need pandemic tailwinds to find long term success. Still, this shorter-term boost is a reality and should be considered.

b. Industry Metrics

Restaurant/foodservice sales are projected to reach $789 billion for 2021 — up 19.7% from 2020 following a steep drop due to the pandemic from 2019-2020.

According to data from the Freedonia group this is poised to reach $1.1 trillion by 2024 to surpass grocery spend

Restaurants continue to have the highest level of unfilled job openings of any industry

This forces chains to do more with less which is where Olo thrives

Click here for my broad overview of Olo (deep dive coming this week).

5. REVOLVE (RVLV) — New Creative Director

REVOLVE named Kendall Jenner as the new creative director for its FORWARD brand. REVOLVE leans on live events and influencers to market its product offerings. To put things plainly, there are few bigger fish to land in the influencer category than Jenner and her 186 million Instagram followers.

I don’t think the significance of this news can be understated. Much like Penn National Gaming transformed the prospects of its business with the purchase of Barstool Sports, Jenner is a complete game-changer for raising REVOLVE’s ceiling.

In her new role, Jenner will control the “look and feel of the site” as well as selecting brands to be sold. She’ll also be deeply involved in brand partnerships and her role will begin at New York’s Fashion Week this month.

Great move REVOLVE!

6. APPLE (APPL) — Big News Pending

Last week, rumors surfaced about Apple allowing certain developers to link to more external payment methods outside of its walled-garden ecosystem. This week, those rumors evolved into a real change.

Apple will now allow what it calls “reader apps” to utilize external payment links which will allow these apps to forgo the 30% commission they’ve had to pay to Apple up until this point. The change will take effect next year. Importantly, this reader app category also includes video and audio with titans such as Netflix explicitly mentioned as a beneficiary of this news. That implies that CuriosityStream’s competing business model will also benefit — although the company has not yet responded to my request for information.

Any fee reduction will serve as a powerful margin tailwind for any organization lumped into this reader app category.

Importantly, the change does not apply to games that generate revenue from in-app purchases such as Duolingo. This is interesting considering the initial complaint propelling this development was levied by Epic Games — the creator of FortNite.

I also do not believe this change applies to the following positions in my portfolio: REVOLE, Planet Fitness, Duolingo, Lemonade, GoodRx, SoFi.

Apple collects nearly 75% of its app store revenue from the gaming channel. Based on this, it appears that the organization is attempting to cater to regulators without actually having to change the core benefits of the app store to its operations.

I do not believe this is the end of battles between developers and regulators and Apple and I’ll be laser-focused on any fee movement going forward. Nearly half of my positions (and every paid app on the market) stand to gain from more Apple concessions.

7. Ayr Wellness (AYRWF) — Warrants and M&A

Ayr Wellness announced an acceleration of the expiration of its outstanding warrants which now must be exercised by September 30th, 2021. The company is also offering a C$0.75 cash exercise incentive on these outstanding warrants. This piece of news meshes quite well with last week’s 5% share repurchase program announcement.

The company wants all remaining warrants exercised now, does not want these warrants to be converted to shares, and is repurchasing 5% of its float. My takeaway? It is crystal clear that Ayr thinks its shares are wildly undervalued — and I agree.

The company also agreed to purchase PA Natural Medicine, LLC — the owner of 3 dispensaries in the state of Pennsylvania including one on Penn State University’s campus. All 3 retail shops will be rebranded to AYR Wellness following the closure of the deal and this adds to the 6 retail licenses Ayr already owns in the state.

The deal is in response to “great momentum in the Pennsylvania market” and is for $80 million in total. This includes $20 million in stock, $25 million in notes and $35 million in cash as well as an additional $40 million incentive if 2021 EBITDA targets are met.

Finally, the company launched its Origyn Extracts brand in Pennsylvania as part of its plan to roll this label out to its entire footprint.

Click here for my broad overview of Ayr Wellness.

8. Green Thumb (GTBIF) — M&A

Green Thumb purchased GreenStar Herbals. GreenStar owns 2 recreational dispensaries in Massachusetts with a license to open up a third in the state. It also has 3 medial-use dispensaries and provides the “largest variety of premium organic cannabis in the state”. This brings Green Thumb’s retail footprint here to its maximum size allowed by regulation.

Massachusetts is already at a revenue run rate of over $1.2 billion after starting adult-use sales just 3 years ago.

Click here for my detailed exploration of American cannabis politics.

9. CuriosityStream (CURI) — An Investment In Nebula

CuriosityStream purchased a “significant minority” stake in Nebula — “the world’s largest creator-owned streaming and technology platform” — at a valuation of $50 million. The two companies have partnered on marketing efforts and subscription bundling since Nebula was created in 2019 — clearly the partnership was going well. Nebula’s CEO Dave Wiskus will continue on in his current role and — interestingly — CuriosityStream will also now have Nebula board representation.

Some statistics on Nebula:

140 active creators with 120 million YouTube subscribers combined

350,000 paying subscribers just 2 years after launch

Subscriptions cost $5/month or $50/year

Nebula is a small fraction of the size of YouTube, but its niche is compelling with the total addressable market (TAM) for the creator economy at a hefty $100 billion. The investment from CuriosityStream will be used by Nebula to accelerate its product roadmap and marketing efforts.

Click here for my broad overview of CuriosityStream.

Thank you for reading! My Olo deep dive will be published this week.

Another great article👏👏👏