News of the Week (August 7-11)

Duolingo; Upstart; Disney; Palantir; Datadog; Celsius; Axon; Twilio; Hims; PayPal; Uber; Amazon; Macro; Portfolio

Today’s Article is Powered by Savvy Trader:

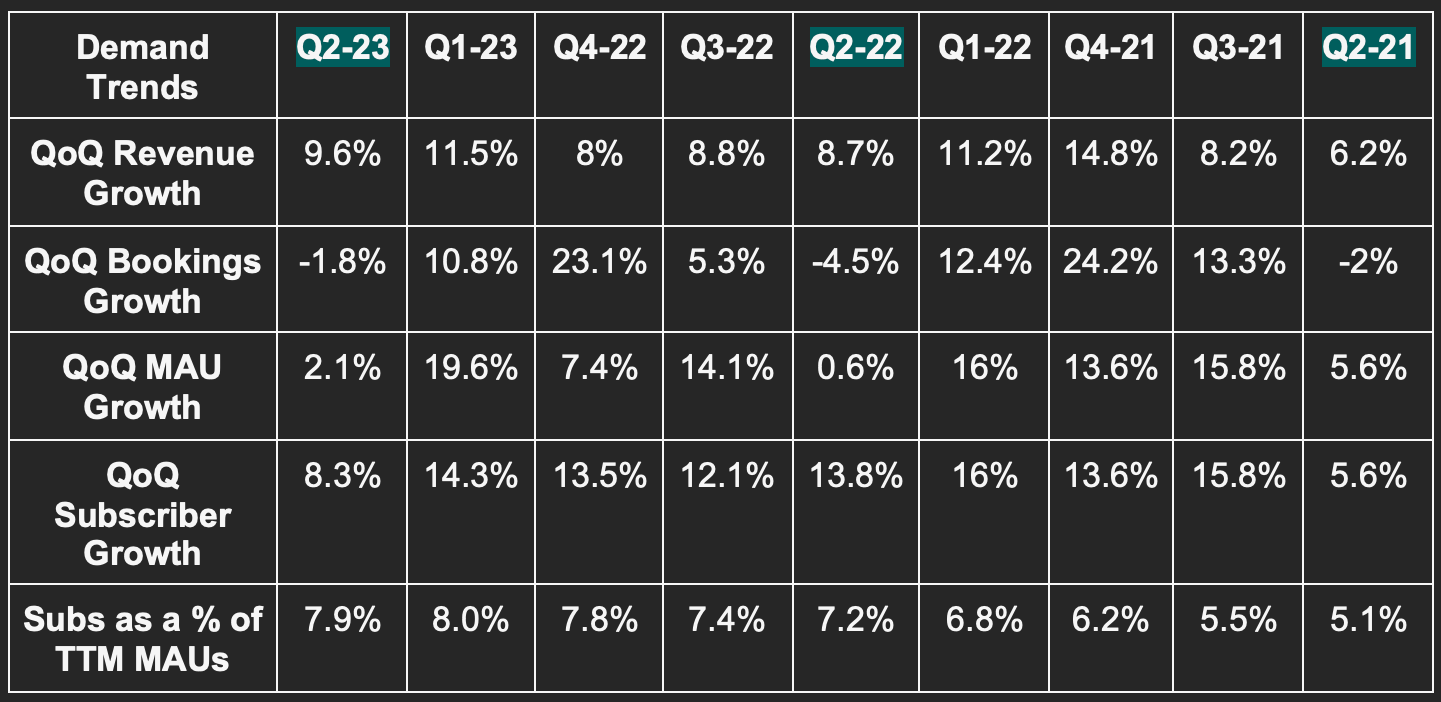

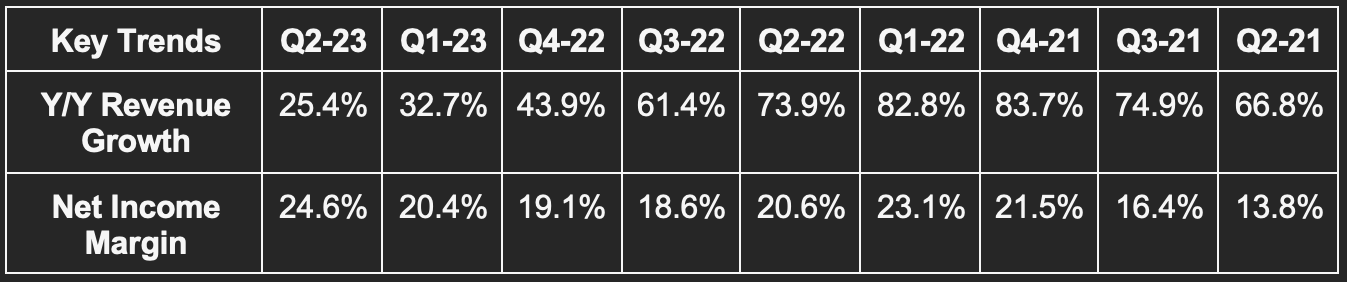

1. Duolingo (DUOL) -- Q2 2023 Earnings Review

a) Demand

Beat bookings guidance by 6.2%.

Beat revenue estimates by 2.5% & beat guidance by 2.6%.

Demand Context:

Advertising revenue rose 16.4% Y/Y to reach $13.1 million. Rapid growth is being driven by subscriptions and Duolingo English Test to a much lesser extent.

Other revenue (which is made of in-app purchases on virtual goods) more than doubled Y/Y to reach $8.8 million. Impressive, and soon will be quite material to overall results.

Subscriptions = 75% of revenue vs. 76% Y/Y.

46.9% 3-yr revenue CAGR vs. 60.3% Q/Q & 64.8% 2 quarters ago.

DAUs as a percent of MAUs set a new record of 29%.

Someone reached out to us claiming a Q/Q bookings decline from Q1 to Q2 was a reason to be bearish. They simply needed to revisit historical financials to know they were wrong. This happens every year and is related to marketing spend timing as well as consistent seasonality. Nothing to see here.

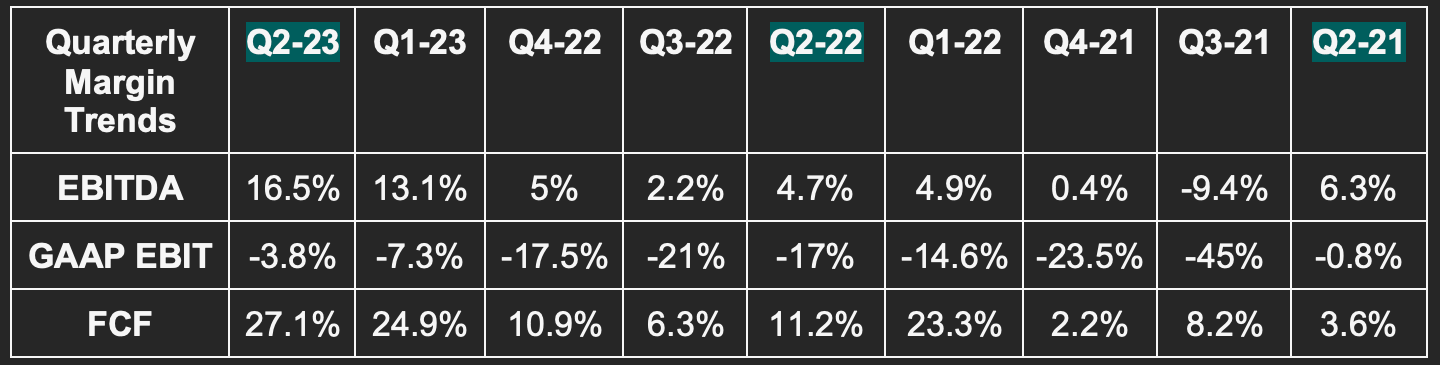

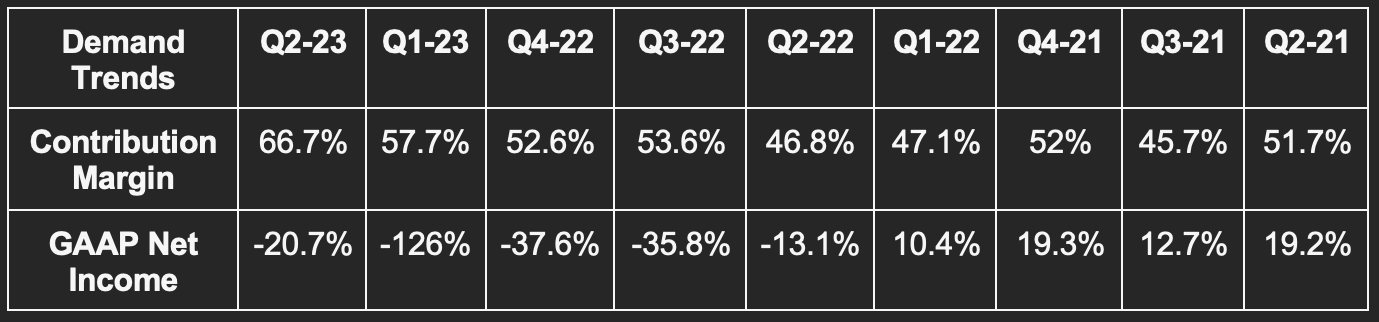

b) Profitability

Beat EBITDA estimates by 48.2% & beat guidance by 48.2%.

Beat GAAP EBIT estimates by 46.7%

Beat -$.20 GAAP EPS estimates by $0.28; Interest income helped this turn positive for the quarter. Regardless, margin expansion would have been rapid. And furthermore, the hefty interest income is a luxury that a cash-rich, debt-free firm like this one has earned.

c) Balance Sheet

$608M in cash & equivalents.

No debt.

Share count rose by 5% Y/Y as IPO-related awards continue to dilute shareholders. This is the ONLY negative to pick at amid a sea of positives. Share count growth has slowed and needs to slow further as it’s expected to. A buyback here would be tempting, but the reinvestment opportunities remain extremely compelling. It can likely do both. Between all outstanding options, there is a potential for 17% additional total dilution. This 17% will vest over the coming years. Vitally, it reiterated 2% share dilution for 2023 with that modest pace of growth expected to continue thereafter (not assuming any buyback program).

d) 2023 Guidance

Raised 2023 bookings guidance by 2.8%. The company now expects 33.5% Y/Y growth here.

Raised 2023 revenue guidance by 1.7%.

Raised 2023 EBITDA guidance by 28%. It raised EBITDA margin guidance by a full 300 bps.

The quarter and guidance led to a 2023 EPS estimate boost from $1.37 to $1.85, a 22% boost to EBITDA estimates and a 1.6% boost to revenue estimates. Strong.

e) Call & Letter Highlights

Mainly Organic Growth, But Also a Marketing King:

The vast majority of Duolingo’s user growth continues to come from organic word of mouth. This is fully expected to be the case going forward as its spend on paid user acquisition remains miniscule. It has obsessed over product first since inception to build the most engaging and impactful app possible. That’s how it thought it could best and most sustainably grow… and it was dead right.

When DUOL does lean into marketing, it does so in a creative and uniquely effective manner. It calls this approach “Social-First Marketing.” The idea is to infuse its brand into pop culture events like the Barbie Movie premier (which Duo attended). It was even referenced in the hit film as an “inbound request” (!) from the makers. It also utilizes social media heavily to generate virality at very low cost (just the social media team’s salary) user growth. It never tries to directly sell the app with campaigns, but rather builds buzz (or hoots). Fans and users routinely use this content for inspiration which merely amplifies the impact. All in all, social impressions for Duolingo are up 150% Y/Y and that’s a large source of its outperformance.

DUOL has gleaned key insights from this engaged marketing approach in important growth markets like China. For example, China loves Lily (one of its characters) while the rest of the world loves the Duo Owl mascot the most. So? It’s shifting marketing content to emphasize Lily in the PRC.

Engagement also remains strong with retention stable despite rapid growth as well as growing instances of long user streaks.

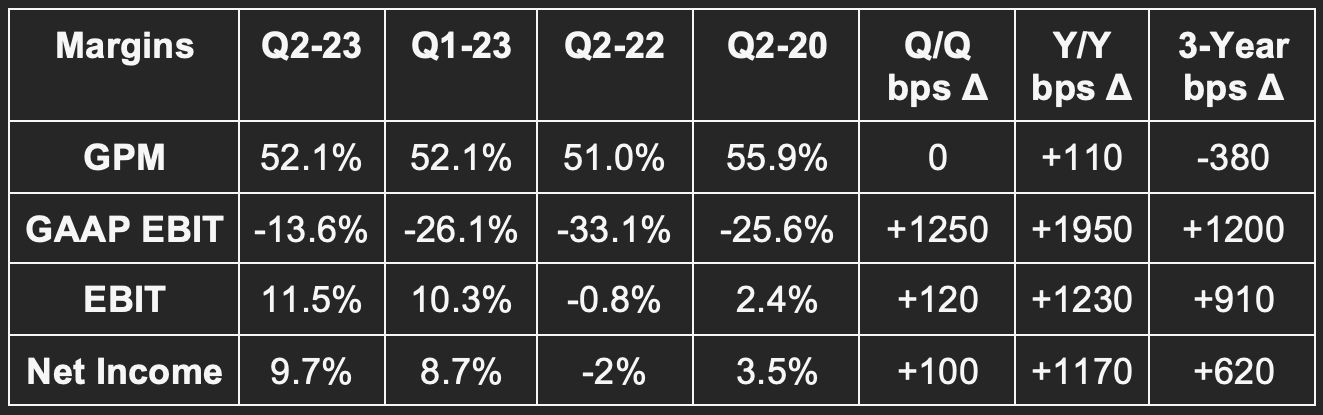

Margins:

Duolingo pushed some Q2 marketing spend to the second half of the year. Without this help, EBITDA margin would have been 15% and ~only~ expanded by 1020 bps Y/Y. This was Duolingo’s first quarter with incremental EBITDA margins above its target range of 30%-35%

Revenue per Subscriber:

Revenue per subscriber fell by 7% Y/Y. This is solely driven by foreign exchange (FX) headwinds and also pricing changes in some geographies Q3 of last year. Average revenue per user (ARPU) will turn flat sequentially in Q4 and resume positive growth thereafter.

Duolingo Max (More Expensive Subscription Tier) & Generative AI:

Duolingo continues to aggressively split test the planned Duolingo Max subscription tier. Current pricing is 2x that of the existing tier but is fluid at the moment and that could change. It’s working hard on “Roleplay” (conversational practice) to add more complex dialogue while adding new tools like “In-Lesson Coaches” with Generative AI to help learners. All in all, “the reception has been very good so far” per Luis.

Beyond the new subscription tier, Duolingo is actively building Generative AI into its content processes to expedite and enhance pace of lesson creation.

TAM:

A big concern for Duolingo is how large the language learning market truly is. Well? Really Big. It’s large and Duolingo has a vast digital market share lead. Specifically, the industry is $50 billion in size. But there are three interesting additions here:

80% of Duolingo users are brand new to language learning. It’s directly growing the market.

It sees user growth above its 25%-30% range pre-IPO for the foreseeable future and a long-term slowing towards that range. 25%+ user growth is still excellent and expansion will be faster than that for the next several quarters if not years.

Most of the TAM is for complex English learning. Duolingo does not have all of the content it needs to support these advanced learners. It will launch a large content update later this year that it thinks will close this gap and unlock a majority piece of the TAM.

Math App:

“We’re very happy with progress so far. The app’s growth looks a lot like early Duolingo.” – Co-Founder/CEO Luis von Ahn

f) Takeaway

Another flawless quarter from Duolingo. What else is new? While forward multiples are stretched, the estimates forming those multiples are woefully low in our view. So? We’re fine with capital appreciation as we don’t think actual forward multiples are remotely close to where the sell side thinks they are. This company is killing it. Rapid growth, rapid operating leverage, successful expansion into new products and an ideally organic source of growth. Such an easy company to own. Go owl go.

2. Upstart (UPST) -- Q2 2023 Earnings Review

a. Demand

Beat revenue estimates by 0.4% & beat guidance by 0.6%.

Beat fee revenue guidance by 11%.

Demand Context:

Conversion rate is being slammed by soaring interest rates and diminished funding supply appetite. Some borrowers are being priced out of credit while others are more frequently declining more expensive offers.

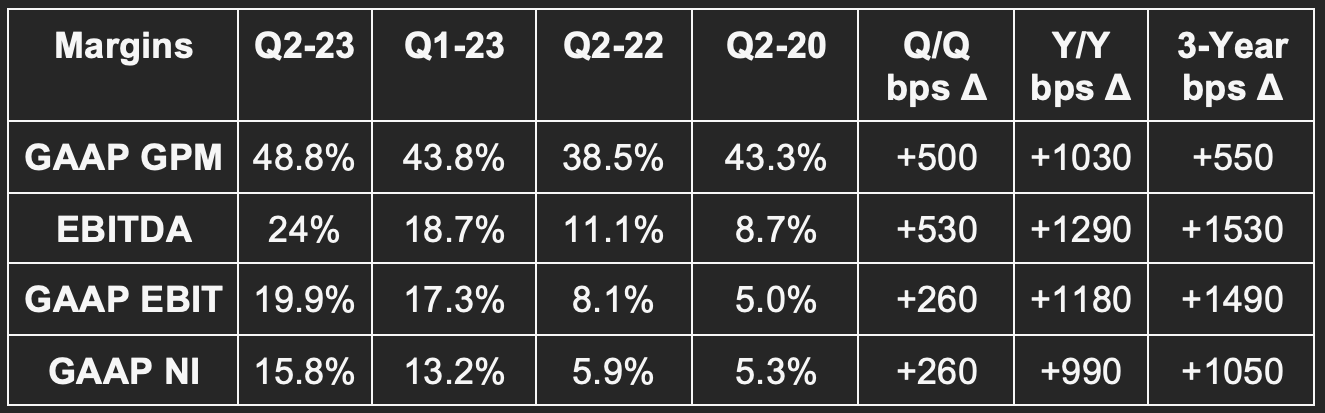

b. Margins

Beat contribution margin estimate by 670bps.

Beat $0.5M EBITDA estimate by $4.5M & beat guidance by $5M.

Beat GAAP EBIT, GAAP EPS & EPS estimates comfortably.

Margin Context:

Contribution margin is elevated mainly because nobody is willing to fund their loans and because it greatly reduced its marketing spend in light of this reality.

A new record for loans fully automated also helped contribution margin. This was a positive source of the strength. This factor is encouraging and points to Upstart’s ability to leverage more volume from its fixed cost base when the environment improves.

Operating expenses fell 35% Y/Y.

Upstart took another $7 million out of its fixed cost base during the quarter with $17 million in permanent savings identified year to date.

c. Guidance

Missed revenue estimate by 10%.

This includes -$10 million in net interest income via continued fair value markdowns of the loans on its balance sheet.

Sharply missed EBITDA estimates by over 60% or about $4 million.

Missed -$0.38 GAAP EPS estimates by $0.07.

A small adjusted net loss vs. expectations of modest adjusted net income.

A 65% contribution margin.

A large portion (over 50%) of Upstart’s balance sheet credit is from older loans issued for research & development purposes (mainly within Auto). Charge-offs on these loans are soaring while loss rates spike higher. That will likely lead to more fair value markdowns in the coming quarters. Note that while the balance sheet loan reduction is encouraging, the cause is not encouraging and contributed to the decline. In fairness to them, loan sales did help too.

“When we are finally clear of the environmental turmoil around us, we are convinced that our business will be as formidable as ever.” -- Co-Founder/CEO Dave Girouard

d. Balance Sheet

$443 million in cash vs. $790 million Y/Y (and it’s no longer profitable and won’t be next quarter either).

$930 million in debt.

$837 million in loans at fair value vs. $623 million Y/Y. The rise Y/Y is not ideal, but this position did fall from $1.01 billion Q/Q. The 17% sequential decline in loan balance was a 14% decline when excluding the impact of fair value markdowns. Ideally, this balance would be much smaller, but the team is making a “rational economic decision in the current environment” and using its own balance sheet to plug gaps on compelling credit. We vividly remember Upstart in its S1 flexing an ability to sell 98% of its origination volume. My how times have changed.

The company reiterated its funding supply of $500 million per quarter from committed partners. It told us that it signed on new committed capital partners but will not raise that $500 million rate.

e. Call & Release Highlights

Committed Capital:

Upstart added another committed capital partner after Q2 ended with more conversations ongoing. With this committed funding, it closed on a securitization deal in July at credit spreads better than the Y/Y period. To be candid, spreads couldn’t have gotten much worse than last year. Interestingly, the $200 million ABS deal came from its balance sheet in a move that will help to alleviate liquidity fragility next quarter. That’s a positive. It said it did this to “reset market understanding of how recent vintages should perform” and to try to build capital market confidence that it has righted its mistakes.

More balance sheet relief is needed but may not be coming as quickly as we’d hoped. Why? All in all, it used about $800 million in committed capital this quarter between securitizing old originations and funding new credit. As part of this secured capital, it had to risk share on $40 million of its own funding. It views this $40 million investment as worth about $52 million today. The entire point of the committed capital arrangements was to diminish balance sheet pressure and fragility. If it needs to allocate capital every time this funding is accepted, that will materially dilute the benefit. The originations from this committed capital are performing as expected.

Macro:

The company that thought it was uniquely immune to macro and credit cycles in 2021 continues to mightily struggle with the less favorable part of this current cycle. Macro headwinds and a much higher benchmark Fed Funds rate are resulting in Upstart pricing its 36% APR limit and so declining borrowers. Borrowers below the 36% limit are more commonly rejecting offers due to more expensive rates. When combining that with an extremely minuscule partner and capital market appetite for its credit, we’re left with this quarter’s (and this year’s) challenged results. Borrower demand remains sky high. It’s just not able to presently take advantage of this demand. This is unfortunate considering that competition like Pagaya had the funding sources in place to keep growing this quarter.

Upstart’s macro index continues to deteriorate. Regardless of a strong labor market, savings rates are not rising as all earnings are being spent.

“In particular, until we see a definitive inflection and reversal in the trajectory of the macro index, we will continue to err on the side of being very conservative in our assessment and pricing of borrowers.” -- CFO Sanjay Datta

Parallel Timing Curve Calibration:

Upstart announced a patent pending risk algorithm process called “Parallel Timing Curve Calibration.” One of the bottlenecks of rapid credit risk model development is that you need to actually observe how the loans from that model perform overtime. Otherwise, it’s all theoretical with model quality lacking real-world, supporting evidence.

Upstart believes that this new model calibration technique will vastly boost the cadence of model introductions and enhancements. How? Now, new models will be able to pull from all existing credit to “predict how all outstanding platform loans will perform in the coming months.” This means a larger seasoning sample size and faster improvements.

Underwriting & more on Capital Markets:

Upstart continues to think that its risk models are “properly calibrated” and have been since late last year. It also sees new loan cohorts will deliver “at or above target returns.” As you can see from the image below, its realized returns on loans continue to re-approach target returns after about a year of underperformance. It will be interesting to see if this year of underperformance will be forgiven by fickle capital markets as macro improves. We’re uncertain. Hedge funds don’t easily forgive.

Furthermore, its credit bands remain better at predicting defaults than FICO-only models. It’s worth noting, however, that no other lender is only using FICO scores in their underwriting models today. There are more variables being used everywhere. I repeat: Everywhere. That is a very important caveat as it makes this comparison perhaps unfairly easy for the company:

“The ongoing supply of loans on offer in the secondary markets by sellers anxious for liquidity contributes to a challenging market dynamic. Loan books are being sold at bargain prices and creating no shortage of buying opportunities for investors. Our view is that it will take some time for the market to work its way through this surplus of cheap available yield.” -- CFO Sanjay Datta

Auto Loans:

Added its second & third auto retail lending partners.

Added 12 more states to its auto lending footprint to now cover 65% of the U.S. population today.

It now has 61 dealerships offering Upstart Auto Loans vs. 39% Q/Q.

Small Dollar Loans:

Upstart added expected cash flow data to its small dollar underwriting and other credit products. This was frustrating to hear. Why? Because other lenders like SoFi have been using this variable for years and not claiming it to be a unique edge. It isn’t a unique edge.

Small dollar borrowers thus far have been purely incremental to its volumes. This is not cannibalizing core personal loan revenue. Good news.

Take Rate:

Upstart’s take rate is being boosted by a mix shift towards institutional funding via the committed capital and its bank partners being extremely timid with originations.

f. Takeaway

I’m quickly losing faith in this team. The company that used to claim relative macro immunity can make macro excuses all they want. It doesn’t play with investors that remember what was said a few quarters ago. While some of those excuses quite warranted, some of this fundamental weakness was self-inflicted. See Pagaya and its far more durable performance for evidence. Upstart was caught with its pants down in 2022 thinking it could rely on fast money hedge funds to supply capital for subprime credit through an inevitable credit cycle. Maybe it needed some financial service experience in the C-suite rather than a team full of ex-Googlers. Just maybe.

The company then proceeded to flip-flop on usage of its balance sheet to fund capital and has turned that balance from a strength to a weakness in less than a year. It has just been one disappointment after another. The guide shows zero signs of green shoots while we see those green shoots pop up for competitors. Perhaps capital markets have not forgotten the several months of underperforming vintages from Upstart in 2022. Add to that 1 sequential partner add (with these partners unwilling to fund credit) and my patience is wearing very thin.

So? All of this is to say that this business is now as low quality and speculative as anything else I own. I trimmed 50% of the holding (after selling 25% of it a few weeks ago and trimming all the way up in 2021) to make it 0.5% of the portfolio. It had been about 1.1% heading into the report. As of today, I have officially taken out my entire original investment between 2021-2022 trims and these two sales.

The upside associated with them figuring things out and delivering drama-free execution is immense. The probability of that coming to fruition is shrinking. Disappointing… again. Great companies overcome macro headwinds. While this model is as cyclical as things come, it still should have fared as well as other direct competition in its credit bucket. Weakness is understandable, this level of weakness is not. One more quarter of disappointment and I’m out.

I used the proceeds as a source of cash to start the Disney position. And speaking of Disney…

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

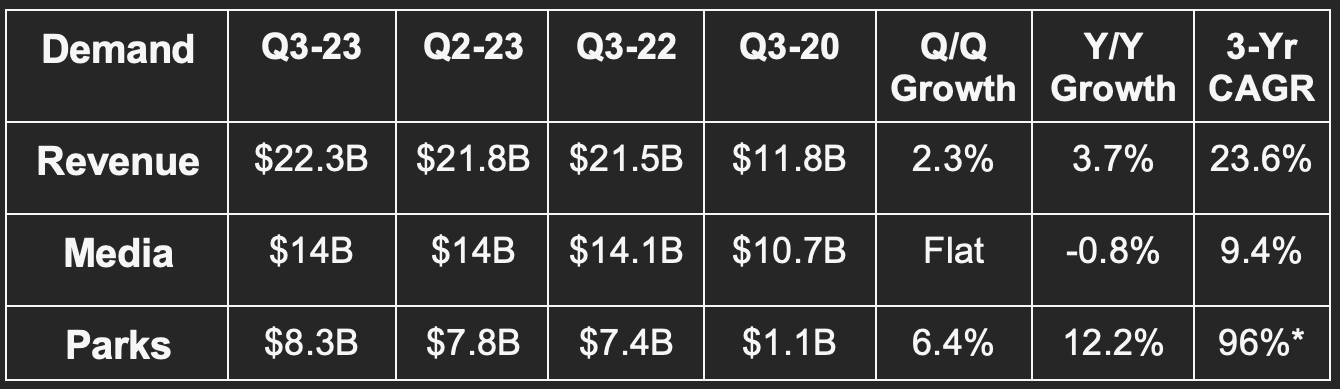

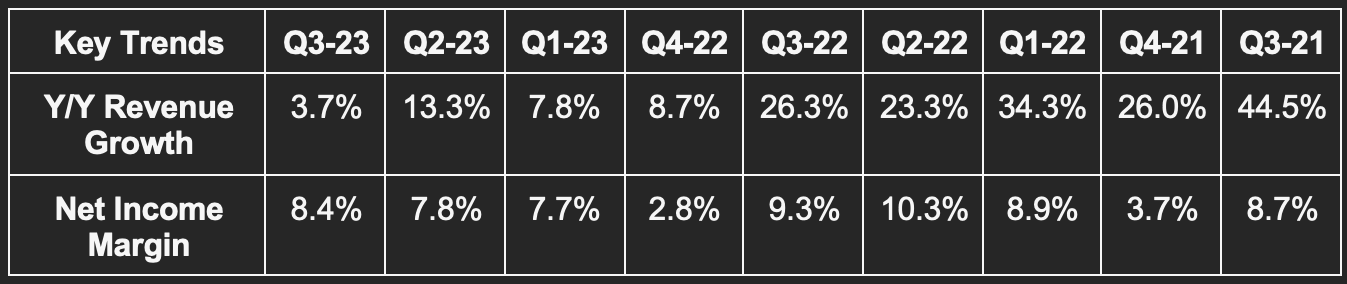

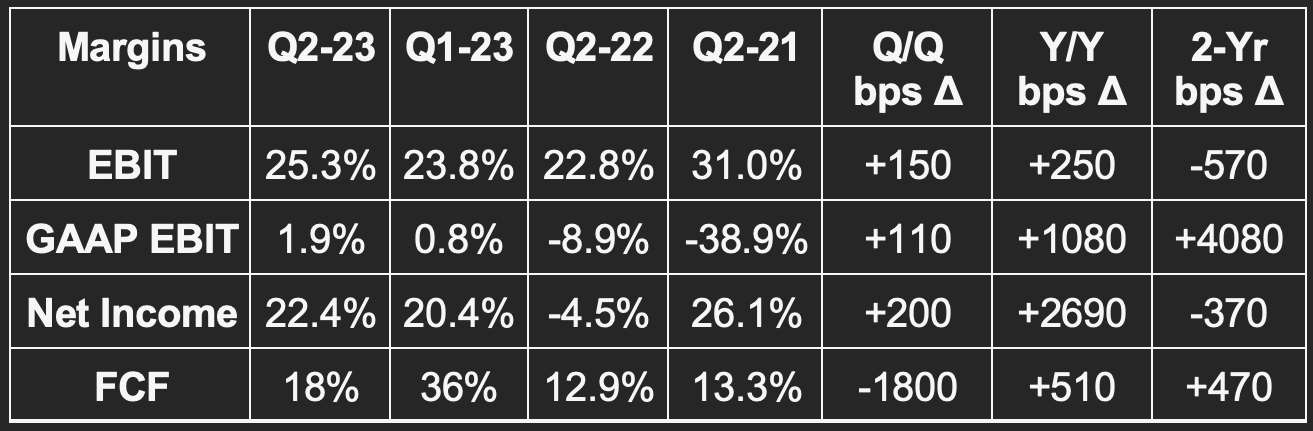

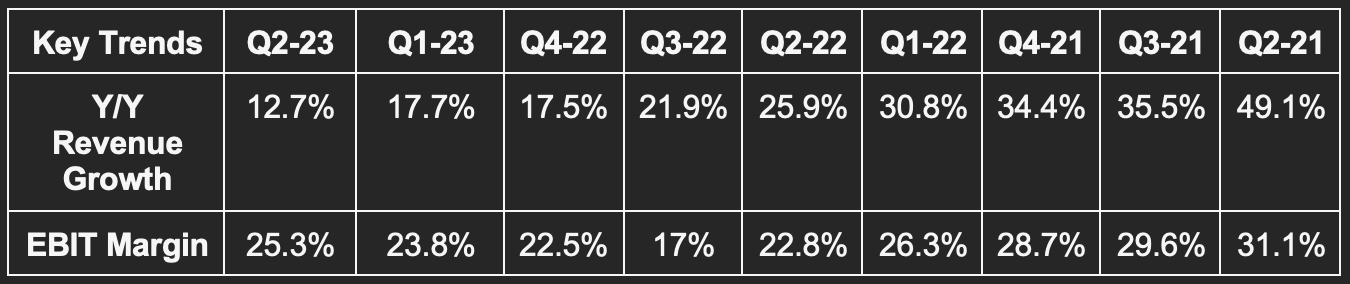

3. Walt Disney (DIS) -- Earnings & a New Position

“There’s a lot more to do. I’m overwhelmingly bullish on Disney’s future and that we’re on the right long-term trajectory.” -- Charismatic CEO Bob Iger

a) The Report

Results vs. Expectations:

Missed revenue estimates by 0.9%.

Missed $0.05 GAAP EPS estimates by $0.30.

Beat $0.97 EPS estimates by $0.07.

Guidance:

The most important part of this report was Disney reiterating 7%-9% revenue and EBIT growth for the full year. It also expects more subscriber additions in Q4. It will also recommend the reinstating of its dividend to the board while it cuts content and CapEx spend due to writer strikes. This is temporarily helping free cash flow.

Balance Sheet:

$11.5B in cash & equivalents.

$44.5B in debt.

Flat share count Y/Y.

Media Demand:

105.7M Core Disney+ subscribers grew 0.8% Y/Y. It changed the disclosure this quarter to strip out ad-supported subscribers. Q/Q additions were in line with guidance BUT the old disclosure structure lagged external estimates.

Disney+ Hotstar subs fell from 52.9 million to 40.4 million Q/Q via things like not renewing Indian Premier League (IPL) Cricket rights.

ESPN+ subs and Hulu subs were both roughly flat Q/Q.

Linear revenue fell 7% Y/Y via broadcasting & cable weakness as cord cutting continued to accelerate. This weighed on ad revenue. ESPN ad demand was a notable bright spot as live sports content continues to dominate the hearts & minds of global consumers. This content moving to streaming is the last domino to fall within linear TV.

Domestic linear revenue fell 4% Y/Y while international fell 20% Y/Y. IPL Cricket ad rates hurt international performance materially. Disney did not renew these content rights for next season.

Direct to consumer revenue rose 9% Y/Y.

Parks Demand:

3-year park comps were very easy while 3-year streaming comps were difficult.

Disney’s Shanghai resort was open all quarter vs. just 3 days Y/Y due to the pandemic. This helped international park revenue rise 94% Y/Y vs. 4% Y/Y domestic growth for this segment.

The recovery for Disney parks and experiences across all of Asia was called “stronger than expected.”

Walt Disney World struggled a bit this quarter which held back the segment. The weakness was largely Y/Y comp-related due to lapping its 50th anniversary celebration and the unleashing of pent-up travel demand in Florida last year. It pointed to tax data to offer evidence of this unleashed demand now slowing state-wide.

Despite this weakness, the resort’s revenue and EBIT is 21% and 29% higher than pre-pandemic levels respectively.

Q4 booked occupancy for its cruises is at 98% of capacity as it gears up to keep growing the fleet in coming years.

“Following a number of recent changes, we continue to see positive guest experience ratings in our parks and positive indicators for guests booking future visits.” -- CEO Bob Iger

Margins:

GAAP margins were hard hit by a $2.44 billion impairment charge. This was driven by removing some direct-to-consumer content and exiting some 3rd party licensing agreements. Severance added $210 million to this charge.

For this reason, we more commonly use non-GAAP metrics than we normally would for a firm at this stage of maturity in this section.

EPS fell 6% Y/Y. GAAP EPS turned negative Y/Y via restructuring.

15.9% EBIT margin vs. 16.6% Y/Y.

Disney Media & Entertainment EBIT margin of 5.1% vs. 9.8% Y/Y. Linear EBIT margin fell from 34.3% to 28.2% Y/Y while DTC EBIT margin improved from -21% to -9.3% Y/Y.

Hulu remains profitable while Disney+ and ESPN+ both saw margin improvement.

Parks & Experiences EBIT margin of 29.1% vs. 29.6% Y/Y.

Lower volumes via aforementioned Walt Disney World headwinds as well as cost inflation led to Y/Y margin contraction.

Free cash flow and capital expenditure results are being aided by less content spending via writer strikes.

8 Months into Iger’s Return:

Disney will exceed its $5.5 billion in projected cost savings.

Signed a new licensing partnership with Penn Entertainment to push ESPN’s brand into sports betting. This should lead to a vast boost to engagement like it has delivered for other sports betting vendors. The difference here is that Disney directly benefits from those added eyeballs as it also owns the content rights.

Disney is leaning more aggressively into omni-channel film distribution to rationally optimize value creation from its content spend. It was ignoring so much low hanging fruit but now no longer will. It will reduce the number of titles it releases, cut the cost per title and focus more on its highest quality brands and IP.

A Media Pivot:

Iger spoke on the shifting philosophy for Disney’s streaming properties. While the initial performance indicator was solely subscriber growth (partially because of how strong that growth was), that’s no longer the case. Again, it’s focused on cost rationalization while delivering positive EBIT by September 2024.

In Iger’s words, all of the rapid subscriber growth happened while it was still split testing pricing, content, marketing and more. With significantly more knowledge and experience today, it is expeditiously rolling out price hikes. These price hikes have been met with less churn than expected, meaning the added revenue is sticky and will materially juice unit economics. This week, it announced a raise to Disney+ Premium from $10.99 to $13.99 while raising Hulu’s ad-free tier by $3 and holding the price of the Disney/Hulu bundle stable. ESPN+ pricing was raised from $9.99 to $10.99. In the coming quarters, it plans to “unify” these disparate streaming assets into more intuitive bundles which, in the past, has proven to raise engagement, advertiser value and retention.

In other newer media developments:

The ad-supported Disney+ option crossed 3 million subscribers in 9 months while 40% of new Disney+ subscribers are going with this plan.

● The company is working on limiting account sharing like we saw with Netflix.

● ESPN ad rates keep rising despite continued cord cutting while it continues to consider strategic ESPN partnerships.

Up-Front (AKA in-advance ad impression selling) Results:

● Volumes stable Y/Y.

● 40% of total upfront inventory is addressable meaning that it is infused with data for more granular targeting and ad revenue optimization.

● The company continues to work closely with The Trade Desk on the demand side to optimize the value of its impressions on the sell side.

b) Takeaway & a New Position

Was this quarter perfect? Far from it. Rather, it was the beginning of the beginning. It confirmed to me that I want to own this name today. I started a new position in the company on Friday afternoon. Today, it’s 3% of holdings and I consider the position 50% full. Why did I buy? Bob Iger is why.

For too long Disney has been too proud to extract maximum value from its iconic IP. Why it hadn’t been in sports betting until now is baffling. Why it hadn’t been fully embracing omni-channel film releases is equally baffling. Why it hadn’t already debuted more streaming bundles within its 3 products is… you guessed it… baffling.

But that’s now all changing and there are some easy, easy demand and margin levers to enjoy. Disney is finally leaning into gambling and exploring strategic ESPN partners, finally rationalizing costs and seeing streaming race to positive EBIT and finally embracing placing its content on as many surfaces and in front of as many eyeballs as possible. It’s finally operating like a business rather than focusing on poking its nose into cultural and societal issues. Finally.

Similarly to Airbnb in 2021 or Uber in 2022 or Shopify in 2023, I think sell side analysts have been slow to build all of the cost-cutting into their models. Disney now expects to exceed its previous $5.5 billion savings guide comfortably while it pulls back on speculative spend, leans into its core, enjoys an improving ad demand backdrop, hikes streaming prices with little churn and prioritizes monetization further. When pairing those cost cuts with iconic IP, deep sports rights and its parks/experiences compounding machine, I see a lot to like qualitatively. The team does too, which is why it reiterated roughly 8% revenue and EBIT growth for 2023.

And speaking of numbers, it’s looking for multi-year profit compounding in excess of 20% while being 3 months away (at today’s price) from trading at 17x forward earnings. This business, in my (now a shareholder) view, is too high quality to have a Price/Earnings Growth (PEG) ratio anywhere close to 1x. Disney’s is below 1x. I will have much more to say about this with more detail on prospects and risks later this month. For now, I am swamped with earnings season. Full introduction coming in August. I still see some magic left in this beleaguered magic kingdom. Welcome to the portfolio.

4. Palantir (PLTR) -- Earnings

a. Results vs. Expectations:

Barely missed revenue estimates by 0.1% & beat guidance by 0.6%.

Beat EBIT estimates by 10.2% & beat guidance by 12.5%.

Met GAAP & non-GAAP EPS estimates.

b. Guide

Raised 2023 revenue guidance by less than 0.1%. I think that’s the smallest raise I’ve ever seen. But still a raise.

Raised 2023 EBIT guidance by 8.4% & beat estimates by 8.7%.

Reiterated positive GAAP net income for the rest of 2023.

Next quarter was barely light on revenue & well ahead on EBIT.

Following the call, sell side consensus revenue estimates were stable and profit estimates rose by about 9%.

c. Balance Sheet

$3.1B in cash & equivalents.

New $1 billion buyback program.

Basic shares +4% year to date.

Diluted shares +10.9% year to date. Not a typo & not ok.

d. Call & Release Highlights

Demand:

U.S. commercial revenue & customers rose by 20% and 35% Y/Y respectively.

U.S. Government revenue rose 10% Y/Y.

Average trailing 12 month revenue per client rose 15% Y/Y to $53 million.

Billings rose by 52% Y/Y to reach $603 million. As a forward-looking demand indicator, this bodes well for a future growth acceleration. That acceleration needs to happen for this investment to work. Rapid billings growth shows that it could.

66 million+ dollar deals signed vs 64 Q/Q. 30 of them were worth $5 million or more vs. 22 Q/Q. 18 were worth more than $10 million vs. 8 Q/Q. Good progress.

Margins:

2nd consecutive GAAP EBIT quarter. This shows that GAAP net income improvement is being driven by operating leverage (and also interest income).

$0.01 in GAAP EPS compares to -$0.09 Y/Y.

The AI platform (AIP) will require accelerating investments to support the launch and updates. Still, Palantir materially raised its 2023 profit guidance.

New Contracts & Clients & Case Studies:

Signed a $463 million deal with the U.S. Special Operations Command to help build an “AI-enabled” command platform.

New $110 million Air & Space Force contract.

Novartis is now using AIP which its CEO was quoted saying gives the company a “fundamental edge” over peers. It has greatly accelerated R&D cadence within the firm.

A healthcare client is using Foundry to cut scheduling time per month from 15 hours to 1.

Tampa General is using Foundry to cut patient hold times by 28% and time spent to manage patient placements by 83%.

Cleveland Clinic boosted patient transfers from other hospitals by 8.5% with Palantir in just 4 months.

Artificial Intelligence Platform (AIP):

Amid a storm of generative AI interest & investment, Palantir sees itself as in pole position to capitalize. Just 10 weeks into the launch, AIP has signed 100 customers with 300 more in the pipeline. This demand is expected to be incremental and not cannibalistic. Leadership describes this early traction as unprecedented. J.D. Power is using it to expedite insight glaring, and Jacobs Engineering is using it to sharpen & improve workflows.

AIP is not another series of large language models (LLMs). Instead, it’s a complement to them. In leadership’s words, AIP allows companies to “wheel LLMs securely into their enterprise.” It thinks (and it’s right) that optimal LLM utility is only possible when paired with actionable software tools. Otherwise the models don’t really know how to query the right data for an appropriate response. AIP serves as the tool plug-in for those LLMs to rapidly manifest maximum value.

“AIP is not only the best tool. It is a tool factory that enables enterprises to quickly forge new use cases in hours.” -- Shyam Sankar

e. Takeaway

What a polarizing name. Bulls will tell you the company is miles ahead of any competition’s technology. Bears will point to that lead not really translating into rapid growth while it aggressively dilutes shareholders. Where do I stand? This is firmly in the too hard pile. I wouldn’t touch this (long or short) with a ten foot pole. The bookings growth is the notable highlight that should have bulls excited. The rest of the results were quite average.

5. Earnings Roundup

a. Datadog (DDOG) Earnings

Results vs. Expectations:

Beat revenue estimate by 1.7% & beat guide by 1.9%.

Beat EBIT estimate by 26.8% & beat guide by 26.8%.

Beat $.28 EPS estimate & guide by $.08.

Beat FCF estimate by 94%.

2023 Guidance Updates:

Lowered 2023 revenue guide by 1.7% & missed estimate by 1.9%.

Raised 2023 EBIT guide by 12.8% & beat estimate by 12.4%.

Raised $1.17 2023 EPS guide by $0.15 & beat estimate by $0.14.

The team made it seem like it built even more pessimism and uncertainty into its forward guide than it ever has. It’s not seeing the macro backdrop get worse… But not seeing it improve either. Others like ServiceNow and JFrog talked up improving backdrops. Different sections of software, but still worth noting. It seems like Datadog guided to the kitchen sink and a worst case scenario. So? If that worst case doesn’t come to fruition, there could be significant upside. Especially considering how strong of a beat and raise track record this c-suite has. There is no change to its longer-term expectations despite this near term weakness.

It is seeing early signs that cloud optimization is easing but told us it’s too early to build that into forward expectations. Bookings growth was strong with upbeat new logo additions and cross-selling to offer evidence of this optimization stabilizing.

Balance Sheet:

$1.2B in $ & equivalents.

Shares +2.3% Y/Y.

$740M in convertible senior notes.

Demand Context:

21% of customers with 6+ products vs. 19% Q/Q.

Customers with annual recurring revenue of $100,000 or more rose 24% Y/Y to reach 2,990.

120%+ dollar based net revenue retention (DBNRR) rate vs. 130%+ for the last 2+ years.

53.8% 3-yr revenue CAGR vs. 54.2% Q/Q & 60.4% 2 Qs ago.

Margin Context:

Like for many others, while the environment remains somewhat hectic, DataDog remains in cost control mode. That was credited as the source of the meaningful margin expansion.

AI:

Datadog launched a new large language model (LLM) observability tool. This will allow developers to craft and perfect models while flagging and resolving issues in a more expedient manner. This should lead to better model hygiene and more proper permissions. It also launched Bits AI to scrape all client observability data to resolve issues at the application level as well.

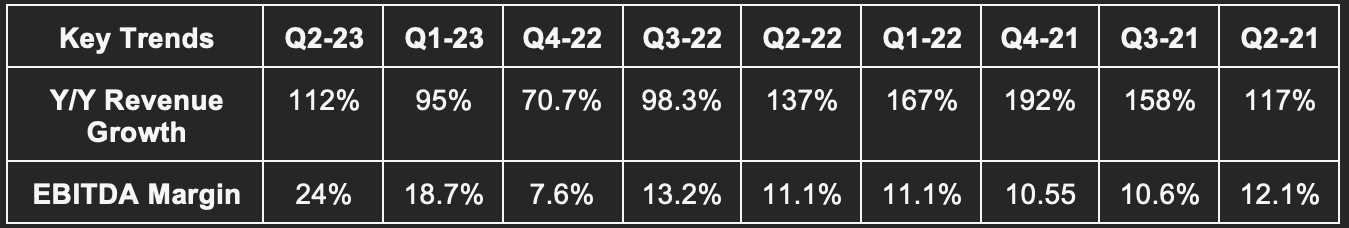

b. Celsius (CELH) Earnings

What a quarter this was. Longs, enjoy your well-deserved victory lap. Congrats to you. The market share gains remain robust, the Pepsi partnership is working like a charm, and there is nothing negative to pick at within these dynamite results. So impressive.

Results vs. Expectations:

Crushed revenue estimate by 17.6%.

Crushed EBITDA estimate by 99%.

Crushed 43.7% GPM estimate by 510 bps.

Crushed $0.29 GAAP EPS estimate by $0.23.

Balance Sheet:

$681M in cash & equivalents.

Inventory down year to date.

Share count stable Y/Y

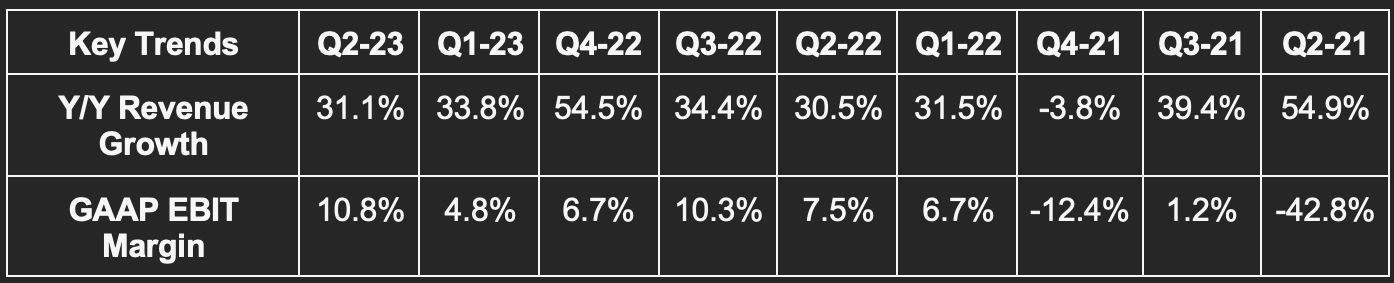

c. Axon (AXON) Earnings

Results vs. Expectations:

Beat revenue estimate by 7%.

Beat EBITDA estimate by 29%; Doubled GAAP EBIT estimate.

Beat 59.5% GAAP GPM estimate by 250 bps.

Missed $0.28 GAAP EPS estimate by $0.11. It paid $25 million in taxes vs. $3.3 million Y/Y which led to GAAP net income margin contraction

2023 Guidance:

Raised revenue guide by 4.8% & beat estimate by 4.1%.

Raised EBITDA guide by 4.8% & beat estimate by 3.8%.

Balance Sheet:

Just over $1.1 billion in cash & equivalents with another $233 million in strategic investments.

$675 million in convertible notes.

Share count rose by a little over 2% Y/Y.

Results Context:

38.5% 3-yr revenue CAGR vs. 32.6% Q/Q & 25.0% 2 Qs ago.

122% net revenue retention vs. 121% Q/Q & 119% Y/Y.

$25M in taxes vs. $3.3M Y/Y = source of GAAP NIM contraction.

d. Twilio (TWLO) Earnings

Results vs. Expectations:

Beat revenue estimate by 5.3% & beat guide by 5.6%.

Beat EBIT estimate by 69% & beat guide by 70%.

Beat $.29 EPS estimate & beat same guide by $.25

Beat 51.4% GPM estimate by 70 bps.

Guidance:

Twilio raised its 2023 EBIT guide by 20%. For next quarter, its revenue and EBIT estimates missed by 3.4% and 11.6% respectively.

Balance Sheet:

$3.7B in cash & equivalents.

$988M in long term debt.

Share count up 0.6% Y/Y.

e. Hims & Hers (HIMS) Earnings

Just like for Celsius, this was a flawless quarter for Hims. Direct to consumer healthcare is a wildly difficult space in which to disrupt and compete. I guess this company didn’t get the memo.

Results vs. Expectations:

Beat revenue estimate by 1.4% & beat guide by 2.7%.

Beat EBITDA estimate by 68% & beat guide by 93%.

Beat -$0.04 GAAP EPS estimate by a penny.

Guidance:

Raised 2023 revenue guide by 2.4% & beat estimate by 1.1%.

Raised 2023 EBITDA guide by 28.4% & beat estimate by 36%.

Next Q guide was ahead across the board.

Balance Sheet:

Share growth up 2.2% Y/Y.

$190M in cash & equivalents.

Inventory flat Y/Y.

6. PayPal (PYPL) -- Stablecoin

PayPal will issue a U.S. Dollar pegged Stablecoin called PayPal USD. PayPal’s core goal is to maximize transaction volume at compelling margins. This feeds directly into that core goal. Why? Because more complex transactions like this will innately fetch a higher transaction margin than credit or debit while the added payment method flexibility should be a positive for conversion. The major caveat here is that PayPal does over $1 trillion in annual volume. This would need to get very big to become a real financial driver. At the very least, that will take significant time while there’s no guarantee it will succeed. We’ll see.

The coins will be issued via partnership with Paxos which PayPal works with on other crypto offerings as well. With PayPal USD, customers will be able to transfer between “compatible external wallets,” send peer-to-peer payments, fund checkout transactions and convert the coins to cash.

PayPal doesn’t the crypto price hype & speculation that deeply. It merely sees it as a bridge to central bank digital currencies (CBDCs). It further views these offerings as necessary proof of concept to establish a track record of drama-less execution for regulators to observe.

The presser didn’t cover this, but we’d hope and think that this crypto product will function similarly to others for PayPal’s merchants. By this we mean that merchants will ideally accept transactions in fiat while PayPal handles conversion. That will mean virtually no onboarding work for its merchants (like with its other crypto products), and again should lead to heftier transaction margin for these specific sales.

Regulators unsurprisingly voiced concern in response to this news while Coinbase sees it as a game-changer. While that may be true for the sector, this will not be a game-changer for PayPal’s near-term financials. The needed transaction margin bottom will come from recovering cross-border trade, e-commerce acceleration and Braintree successfully expanding into higher margin geographies, smaller clients and value-add up-sells.

7. Uber (UBER) -- Lyft

Lyft is more aggressively competing on price. I hesitate to say this, but to me that’s advantage Uber. Why? Because it has the scale, it has the subscriber base/loyalty, it has the product breadth, and it has the superior margins to easily win this battle. Uber has been and will continue to be the lower cost provider which, paired with its much stronger balance sheet, should mean it wins any pricing wars with ease. Go ahead and cut your prices Lyft… I double dare ya.

8. Amazon (AMZN) -- Miscellaneous

Will meet with the Federal Trade Commission next week on antitrust concerns. This will likely be all bark and zero bite.

Amazon will host a Prime Member-only shopping event in October. This is simply another (of many) lever it can pull to drive more subscriber growth.

Amazon is expanding its Family Building benefits program to 50 countries with Maven. Progyny shareholders have no fear, Amazon is a client in the U.S. It just doesn’t operate in the geographies that Amazon will expand into.

Amazon is rumored to be a potential anchor investor for the ARM IPO. As a reminder, it has its own AI-inspired chip sets for training (Trainium) and Inference (inferentia).

Amazon is building a large new warehouse in Australia to further expand into the country.

Amazon Drivers continue to strike in select markets. Something to keep a close eye on following the concessions that UPS had to recently make.

9. Macro

Inflation Data:

The Consumer Price Index (CPI) was a bit cool or in line across the board.

Y/Y CPI for July was 3.2% vs. 3.3% expected and 3% last month.

M/M CPI for July was 0.2% vs. 0.2% expected and 0.2% last month.

Core (strips out food & energy) M/M CPI for July was 0.2% vs. 0.2% expected and 0.2% last month.

The Producer Price Index (PPI) was slightly hot across the board.

M/M PPI for July was 0.3% vs. 0.2% expected and 0% last month.

M/M Core PPI for July was 0.3% vs. 0.2% expected and -0.1% last month.

Michigan inflation expectations for August of 3.3% vs. 3.8% expected.

Michigan 5-year inflation expectations of 2.9% vs. 3% expected.

Employment & Consumer Data:

Initial jobless claims of 248,000 vs. 230,000 expected.

Michigan consumer expectations of 67.3 vs. 68.1 expected and 68.3 last month.

Michigan consumer sentiment of 71.2 vs. 71 expected and 71.6 last month.

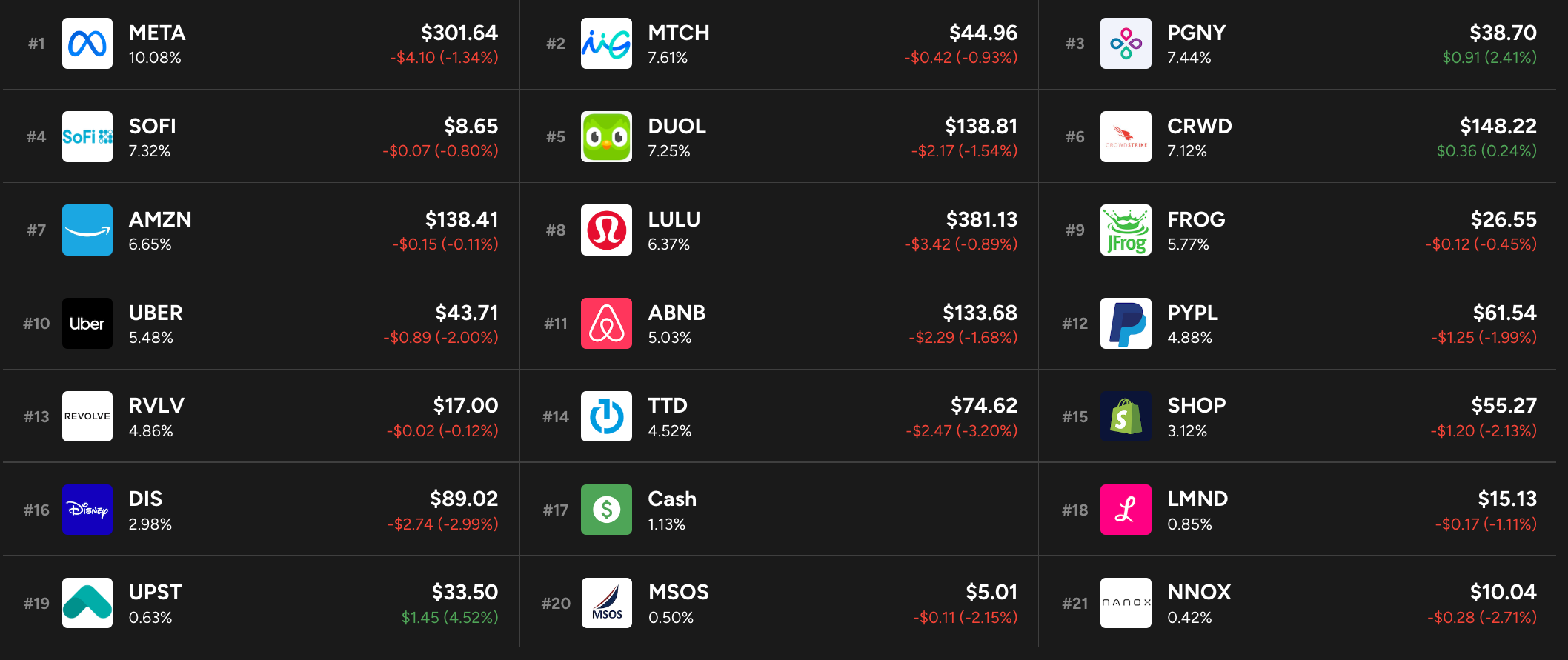

10. Stock Market Nerd Portfolio

I made several transactions in what was a busy week for the portfolio. These included adds to CrowdStrike, Match Group, Progyny and Uber. I also started a new Disney position and sold off 50% more of my Upstart stake.

Duolingo had yet another amazing quarter. Just listened to the call today. Great updates there and as always, Luis and Matt were excellent.

One thing that I notices throughout the last few quarters is that DET doesn’t get attention anymore in the reports and calls. What’s your opinion on that? It’s growing quite nicely although it could be faster considering the small basis. Do you think that’s a sign that DET‘s TAM is smaller than expected or how do you think about that?