News of the Week (August 9-13)

CuriosityStream, Duolingo, GoodRx and Tattooed Chef Earnings Reviews; Final Upstart Notes; Barstool Sportsbook Expansion; Teladoc + CVS

1. CuriosityStream

“We continue to expect a robust second half of 2021 and we are as excited as ever about the long term growth prospects of the business.” — CEO Clint Stinchcomb

a. Demand

CuriosityStream does not guide to quarterly revenue, only annual. Analysts expected the company to generate $14.95 million in sales for the quarter. It posted $15.3 million thus beating those expectations by 2.3%.

CuriosityStream grew its direct subscribers by 56% year over year vs. 27% growth for Disney+ and (1%) growth for Netflix. Note that 56% year over year growth is comparing results vs. peak pandemic pain.

b. Profitability

Analysts expected the company to lose $0.18 per share for the quarter. It lost $0.19 per share thus missing expectations by 5.5%.

The firm has $120.8 million in cash and equivalents and burned $8.3 million during the 2nd quarter. This gives CuriosityStream 3.5 years of cash on hand at the current burn rate, but it expects to turn profitable within the next 2 years.

Gross margin is expected to fall to the low 40% range for the next 2 quarters. This is due to a large ramp in pre-sale revenues that are recognized as sales but cannot be recognized as gross profit during the same period. It has nothing to do with the underlying unit economics of the business.

Zooming out further, direct to consumer gross margins are expected to remain elevated in the years to come thanks to lower cost of content production in the factual space vs. scripted. For context, factual production costs as little as 5% of scripted content on an apples to apples basis.

c. Operational Highlights

The company maintained its guidance of at least $71 million in 2021 sales.

CFO Jason Eustace told investors the company’s 2021 revenue guide is now more than 90% committed vs. 90% committed last quarter and 80% committed 2 quarters ago.

“It’s our first full year as a public company and we want to demonstrate that we can hit our annual targets.” — Stinchcomb

CuriosityStream has officially launched the Curiosity Channel in German-speaking Europe as part of its new partnership with SPIEGEL TV and Autentic. SPIEGEL comes with millions of built-in subscribers and CuriositySteam has added hundreds of hours of German-dubbed programming for the launch. Germany is already a top 3 non-English-speaking market for the company. The company now has direct subscribers in 176 countries.

“Europe represents a vast DTC opportunity with hundreds of millions of affluent broadband subscribers. Unlike many traditional media companies, our international expansion opportunity is less hampered by fractured rights issues and is greatly enhanced by how well our content travels.” — Stinchcomb

The company’s Mars episode of its Secrets of the Solar System series was nominated for an Emmy in the category of Outstanding Science and Technology Documentary — a strong indicator as to the quality of the programming.

d. Management Commentary

CEO Clint Stinchcomb:

“We have successfully navigated the users who signed up during the pandemic better than anyone else in the industry. There was some concern about an uptick in churn impacting our business when lockdowns were lifted but we retained a higher percentage of users who signed up in Q2 2020 than any other streaming service. This is based on data from ANTENNA for the 13 months ending May 2021. — Stinchcomb

72% of subscribers who signed on during the height of the pandemic have been retained. Netflix is at 71%, Disney is at 55%, Hulu is at 52%, HBO Max 41% and Apple TV+ 17%.

All of CuriosityStream’s renewals came at a higher rack rate vs. its Q2 2020 promotional pricing. This contributed to rising ARPU for the company (although no specific metric there).

“We believe our industry-low churn demonstrates the high value of our service as well as the success of our annual subscription strategy. We continue to think we have considerable pricing power. — Stinchcomb

The company’s rate of churn was flat year over year despite the uniquely positive demand shock CuriosityStream received and despite the heavy promotional activity it conducted in Q2 2020. This offers evidence for the meaningfully positive price elasticity Stinchcomb is talking about.

The company will release more new originals this year than at any point in its history.

Stinchcomb explicitly told investors that CuriosityStream has “strong interest and some strong commitments” from brand sponsors for the rest of the year. The company expects sponsorship deals to accelerate as the world opens up and in can conduct more in-person meetings.

2. CFO Jason Eustace

“As the world reopens and entertainment options increase, our subscriber growth continues unabated.” — Eustace

e. My Take

This was a strong report for the company. Facing extremely difficult year over year subscriber and revenue comparisons, CuriosityStream demonstrated little difficulty in driving more eyeballs to its platform.

Gross profit margin remains elevated, and new content continues to set new viewership records for the company. The factual streaming niche is working. Great quarter.

2. Duolingo

“Our goal is to become the industry standard when describing someone’s level of language proficiency. So instead of saying you’re an intermediate level speaker, you’ll say you’re a Duolingo 65 in Spanish.” — Co-Founder/CEO Luis Von Ahn

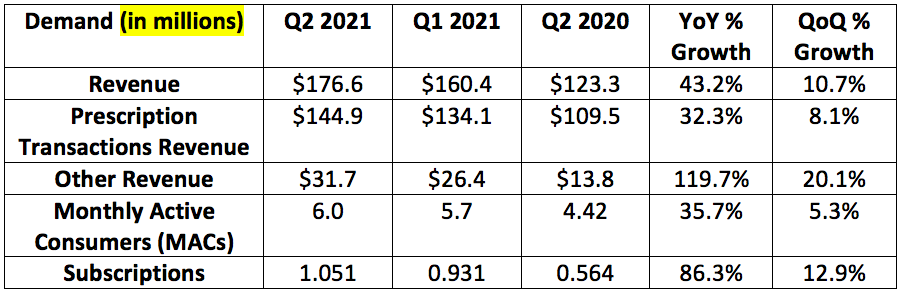

a. Demand

The company’s 2nd quarter bookings are generally similar to 1st quarter bookings. Last year, the company saw 35% sequential growth from Q1 2020 to Q2 2020 as a result of the pandemic. This made the Q2 2021 year over year comparison quite difficult. When adjusting for this impact growth rates accelerated in the quarter across the board.

Encouragingly, daily active users (DAUs) as a % of (monthly active users) MAUs for the quarter rose from 22.9% to 24% year over year. This is an explicit example of strong engagement even as lockdowns fade. Over 50% of these DAUs currently have a usage streak of longer than 7 days.

Visualizing the pandemic’s impact on Duolingo’s business:

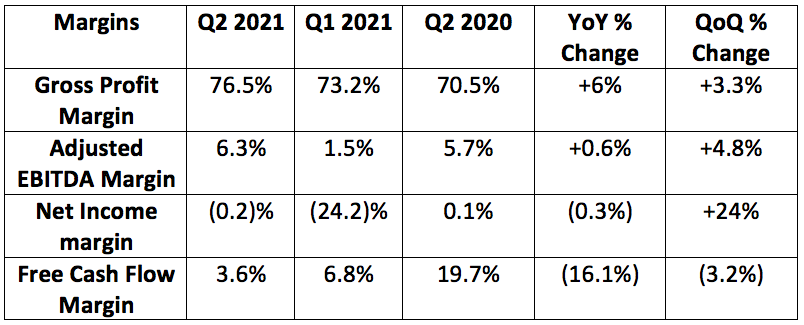

b. Profitability

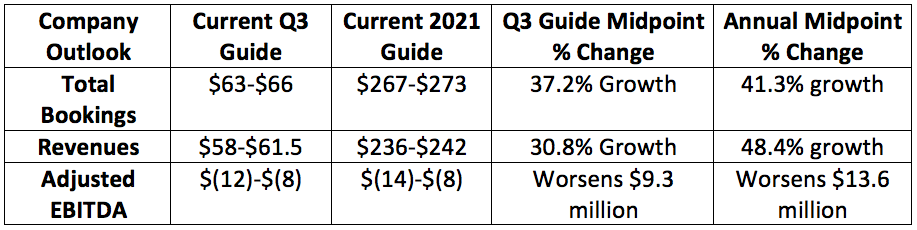

c. Third Quarter and Annual Guidance

d. Conference Call Commentary from CEO/Founder Luis Von Ahn

Ahn reiterated that language learning will be the first subject Duolingo covers, not the only. He also told investors Duolingo will be revealing more details on its family plan at “Duocon” on the 20th.

Most of the company’s growth came from organic word-of-mouth during the quarter rather than external marketing campaigns just like in previous quarters. This is why half a billion downloads, close to 40 million MAUs and top of mind brand awareness is so vital.

“At Duolingo, instead of focusing on marketing, we are obsessed with our product.” — Ahn

Ahn discussed the that boost Covid-19 gave to its user engagement and confirmed the company expects to return to its user growth trajectory in the coming quarters.

“We are now back to growing at our normal rate.” — Ahn

e. My Take

Duolingo was among the largest beneficiaries of the Covid-19 outbreak and this quarter represented its toughest year over year comp ever. The company specifically called this out in its S1, so to see revenue growth remain at a lofty 47% rate is encouraging. The next few quarters will also come with difficult comps before we lap the pandemic lockdowns.

Monthly active users did fall slightly and daily active users only grew by 2% year over year, but it was nice to continue seeing lofty subscription growth despite this. I was also disappointed that it didn’t mention the impact of China banning its app on the business.

Tough quarters ahead paired with Duolingo trading for 24 times diluted price to 2021 sales could mean it may be a while for the stock to start to deliver meaningful returns. Still, strong forward looking guidance does hint at headwinds not hurting the company too much.

From an organization standpoint, I continue to believe Duolingo has a compellingly long growth runway to pursue thanks to its increasingly ubiquitous brand, efficacy and optionality. It’s massive word-of-mouth marketing channel enables this growth to come with elevated profit margins. It only began to monetize its products 4 years ago and is already poised to eclipse a quarter billion in annual sales.

My position is currently very small, and I would be a buyer on any significant weakness; I have no plans to do anything but accumulate shares.

3. GoodRx

a. Demand

GoodRx internally guided to $172-$176 million in quarterly revenue. Analysts had expected $174.7 million. It posted $176.6 million beating the high point of its internal guide by 0.3% and analyst expectations by 0.7%.

This 43% year over year growth compares to 31% trailing 12-month growth.

Note that each subscription plan covers 1.5 Americans on average so the subscription footprint is roughly 1.57 million people in total.

GoodRx broke out subscription revenue from its other revenue segment for the first time this quarter. I added these 2 revenue lines together to make the comparison apples to apples.

Subscription revenue on its own grew 125% year over year to reach $14.3 million driven by an 86% rise in GoodRx Gold plans within its Kroger partnership. Other revenue now only includes its manufacturer benefits solutions revenue and telahealth. This segment rose 136% year over year to reach $17.4 million.

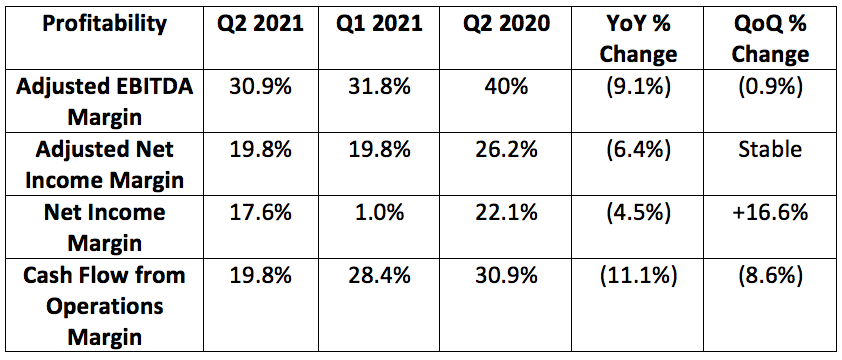

b. Profitability

GoodRx internally guided to a 30%-32% adjusted EBITDA margin. It posted a 30.9% margin essentially in line.

Analysts expected GoodRx to earn $0.08 per share. It did exactly that.

Falling net income, cash flow from operations and EBITDA margins are due to a few things:

Marketing spend rose sharply year over year as our world began to normalize. GoodRx’s spend this quarter was also compared to a period in which it was heavily pulling back on promotional activity.

Public company costs and stock-based compensation in connection with the IPO.

Telehealth continuing to make up a larger portion of the business — as expected.

The timing of tax payments in connection with the IPO

Prepayment of marketing costs

This 30.9% EBITDA margin compares to 46.4% just two years ago. The company had been anticipating this as its lower margin telahealth segment continued to grow. This quarter is expected to be the EBITDA margin trough with CFO Karsten Voermann explicitly telling us “margins will expand moving forward.”

c. Guidance

GoodRx REMOVED its annual 2021 guidance due to volatility centered around the delta variant.

In the q&a CFO Karsten Voermann explicitly stated that the company “hasn’t pulled our full year guidance or changed the range.” It did, however, remove this guidance from its investor presentation which hints at slightly more uncertainty for the remainder of the year. He can say it didn’t remove projections, but his company’s published results say otherwise.

The company expects the following results for the third quarter:

$193-$197 million in revenue for 39% year over year growth

A roughly 30% adjusted EBITDA margin

d. Operational Highlights

The company eclipsed $30 billion in total consumer savings to date.

2 million prescribers now have a patient using GoodRx and 80% of those prescribers recommend GoodRx to their patients.

GoodRx brand awareness among healthcare professionals is a gaudy 88%.

Net promoter score (NPS) for GoodRx from healthcare providers specifically is +86. Provider word-of-mouth fuels GoodRx’s business. If providers are happy, that is great news for this company’s future and +86 is a phenomenal score. Consumer NPS was also impressively lofty at +90.

The average prescription discount for GoodRx during the quarter was 79%. GoodRx beat the prices of over 50% of insurance quotes during the quarter by an average discount of over 50%.

GoodRx and GoHealth signed an exclusive agreement to bring the GoHealth Medicare and engagement solutions directly to GoodRx users. This is the company’s first step into the insurance market — the first of many.

Leadership elaborated on its new Surescripts partnership. Surescripts is a “leading health information network” in the United States. It delivered 2 billion prescriptions electronically during 2020. Now, some of these subscriptions will be able to directly tap into GoodRx’s pharmaceutical benefits manager (PBM) discounting ecosystem. This will make it even easier for physicians to recommend GoodRx by integrating its offering directly into electronic health records (EHRs).

GoodRx Gold subscription plan highlights:

Added Rite Aid’s 2000 locations to the network

Signed a partnership with USAA (13 million members) and DoorDash (roughly 1 million drivers) to provide GoodRx Gold discounting access

40% of telahealth visitors have converted to Gold subscribers since the company began offering Gold to telahealth users at check-out

60% of GoodRx Care visits are now driving cross-selling activity vs. just 30% year over year

The company continues to see the pandemic as a strong business headwind as it is causing deferred visits and undiagnosed conditions. The care backlog continued to grow to 1.2 billion visits from 1.1 billion sequentially according to IQVIA depicting that GoodRx’s demand recovery is entirely ahead of it.

e. Notes on GoodRx’s branded manufacturer solutions business

This segment now attracts 20 million “high intent” monthly users to GoodRx’s platform with 1 in 5 GoodRx searches being for branded drugs.

Some highlights on this segment:

Triple digit year to date revenue growth

150% net revenue retention

95% presence in top 20 Pharma Manufacturers (just 10% of the top 550 as GoodRx first focused on the largest)

GoodRx generates 10X more traffic to its drug savings page vs. a manufacturer’s internal brand savings page

Delivered an 8X return on investment (ROI) across 5 brands for a top 20 manufacturer with that customer spending 70% more with GoodRx year over year

Manufacturers increased digital ad spend (including with GoodRx) by 43% year over year

The company broadened its branded drug manufacturer network with the addition of Sanofi and Boehringer Ingelheim allowing for heavy discounts on some of their products.

Branded mediation pricing has risen 78% in 7 years merely adding to the need for this solution.

This GoodRx segment collects 85% of its revenue from set flat fees making it extremely predictable from quarter to quarter.

GoodRx’s scaled platform of highly relevant consumers allows manufacturers to more effectively market their product and forgo a large chunk of the $30 billion spent annually on external marketing. This relationship actively boosts a consumer’s lifetime value (LTV) for manufacturers despite the discounting. This segment covers just 4% of the top 1000 branded medications pointing to a long growth runway here.

f. Conference Call Commentary

CFO Karsten Voermann

GoodRx expects subscribers as a % of monthly active consumers (MACs) to continue to rise as it deepens the value proposition of this offering.

The company added new PBMs (plural) to its network during the quarter but did not name these entities specifically.

Co-CEO and Co-Founder Trevor Bezdek:

On Amazon:

“No competitor has ever had a material impact on our growth. Amazon has been trying to grow a pharmacy delivery business that we believe has not been successful. Even after COVID-19, mail makes up just 5% of fill count in the U.S. and is starting to decrease. Since November, we have observed almost 0 usage of the Prime RX discounts at retail. We have also now seen 3rd party data showing they only have a few hundred users per month.” — Bezdek

Search and Facebook make up a very small part of GoodRx’s acquisition. A change in 3rd party cookies and Apple’s IDFA should not impact the company all that negatively.

g. My Take

This was a strong quarter for the company. Growth began to rebound as expected and the additional color we were given on its manufacturer solutions segment was impressive as well as greatly appreciated. The reiterated confidence on the company’s ability to compete against Amazon was also a notable positive.

It’s encouraging to think this 43% growth rate came despite our nation’s health care backlog continuing to grow. This means the benefit GoodRx will receive from the inevitable unwind of the backlog is 100% in front of the company. It could be fun times ahead.

Good results. I have been slowly adding to my position and I have no interest in trimming at this time.

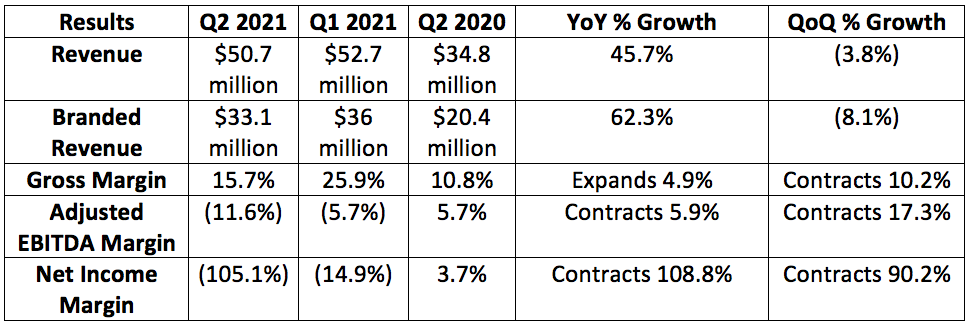

4. Tattooed Chef

Analysts were looking for $54.05 million in quarterly sales. Tattooed Chef posted $50.7 million missing expectations by 6.2%.

The sequential decline in revenue was from timing of promotional events within its club segment. Grocery and mass grew precipitously quarter over quarter.

“In the third quarter you’ll start to see more consistent growth as grocery and mass become a bigger part of the business.” — Sam Galletti

This $50.7 million in revenue included a $4.3 million benefit from its Foods of New Mexico purchase.

Private label sales are flat year over year as Tattooed Chef focuses entirely on branded growth.

According to SPINS — a data collection service for retailers — for the 12 weeks ending July 11th, 2021 Tattooed Chef branded sales were up 60% year over year depicting strong forward-looking momentum into the third quarter.

$46 million of Tattooed Chef’s $53.2 million in net loss was due to a one-time charge via a “valuation allowance on a deferred tax asset due to continued investment.” Without this charge, net income margin would have been (14.4%).

Gross Profit Margin was hit by elevated freight and container costs which topped 13% of total sales during the quarter. Tattooed Chef anticipates this quarterly 15.7% gross profit margin will move higher for the third and fourth quarters.

The decrease in adjusted EBITDA margin was partially driven by $2.6 million in public accounting costs not present in the comparable year over year period. Furthermore, $6.1 million was spent on external marketing during the period vs. virtually nothing in the year over year period. For context, operating expenses rose nearly 7-fold for the company year over year as it spent on growth, quadrupled production capacity and became a public company.

The adjusted EBITDA margin would have been 5.5% without these charges, but marketing spend will likely continue to be elevated in the coming quarters so this expense should not be adjusted for.

The company has cash and equivalents of $140.2 million on hand.

b. Updates to 2021 guidance

The company provided the following update to 2021 guidance:

$235-$242 million in revenue — unchanged

16%-22% gross profit margin vs. 20%-25% previously

($17)-($14) million in adjusted EBITDA vs. $2-$4 million previously

The decline in margin guidance is due to an increasingly aggressive plan to pursue growth. It’s now gearing up to spend more than it had previously planned on head count, infrastructure and marketing. Increases in logistics costs, storage fees, and general inflationary pressures are also contributing to this rise.

Without its Foods of New Mexico purchase — a Mexican food manufacturer it recently bought — the company would have guided to its original $222 million in 2021 revenue from its investor presentation.

The company also reiterated its 2022 revenue guidance of “at least $300 million.” This would translate into at least 24% year over year growth.

c. Conference Call Commentary

CEO Sam Galletti

Branded sales now make up 65% of the total business. The company is “well ahead of schedule” for achieving its goal of being 75%-80% branded in the next few years.

Per SPINS — Tattooed Chef has 2 of the top 10 SKUs by sales velocity in the veggie entrée category.

In the 24 weeks ended July 11th, Tattooed Chef had 80% of the top 5 innovation SKUs within the frozen entrée category.

Tattooed Chef SKUs per retailer has risen from 4.4 to 7.7 quarter over quarter.

Previous guidance had the company reaching 10,000 stores and 65,000 distribution points by the end of 2021. It now expects to be in over 12,000 retail stores and have 79,4000 distribution points by the end of the third quarter. Distribution points are up 135% since this merger closed last October. Despite this outperformance, as noted above, the company did not raise its full year 2021 revenue outlook. It stated this was because it anticipated these business wins but I personally would have expected a raise if their presence in retail is trending above expectations.

Its Foods of New Mexico purchase in May gives them the capacity to reach $500 million in revenue and it believes this acquisition will eventually contribute $200 million to total company sales annually. It believes it has the production capacity to reach $500 million in sales.

1 mass retailer’s (likely Walmart or Target) case study according to SPINS data for the 4 weeks ending July 11th:

Tattooed Chef has the top 2 selling SKUs in the frozen vegetable entrée meal category by sales volume.

Tattooed Chef has the highest sales per point of distribution of all brands sold in the frozen vegetable entrée category.

Within the mass retailer segment, the company is now in over 50% of Walmart stores and nearly every Target store. It has grown sales within mass retail from $651,000 to $7.9 million in the last year.

Grocery chain wins during the quarter:

Whole Foods

Harris Teeter

Jewel

The third quarter is when distribution in Sprouts Farmers Market, Kroger and Albertsons will start contributing to company sales. Tattooed Chef will also become available in Publix in the 4th quarter.

Chief Creative Officer and Tattooed Chef, Sarah Galletti

According to Millward Brown, Tattooed Chef has raised its U.S. brand awareness from 6% to 15% thanks to its first external marketing campaign.

“After just a few months of advertising, purchase consideration for Tattooed Chef is approaching the levels of competitors who have been around for years.” — Sarah

The company plans to further boost marketing spend into 2022.

E-commerce still is a small part of the Tattooed Chef business. The company is launching a subscription service in 2021 for loyal customers to build out this new channel.

According to data from SPINS, Tattooed Chef’s plant-based burrito bowl is the #1 best-selling new SKU in the frozen vegetable entrée category for the last 6 months. This is measured by both volume and sales velocity.

Tattooed Chef continues to gear up to launch within food service. It has created an 11 SKU portfolio for restaurants that can be used to integrate more plant-based presence into menus.

The company still expects to expand beyond frozen goods to refrigerated and snack foods early on in 2022.

d. My Take

This was a somewhat disappointing quarter for the company. It talked a lot about distribution momentum and exceeding store projections, yet merely maintained its 2021 revenue outlook. It also meaningfully lowered profit projections for the near-term as transitory issues persist and it spends on more growth. It did say it was being conservative and cautious with the change but it’s still a concern.

I was hoping to resume adding to my position after this quarter, but it was not strong enough for me to do so. I will continue to be patient here. I have no plans to trim my position, but I will wait to restart accumulating until the company can prove it’s capable of sustainable execution. This needed to be better, but my long term thesis still looks compelling to me.

5. Final Notes from Upstart’s Second Quarter Report

On concentration risk:

Loan originations derived from Credit Karma traffic accounted for 49% of total Upstart fees for the first six months of the year. This is stable year over year. CFO Sanjay Datta explicitly told us concentration risk fell during the quarter. While the 10-Q did not provide the quarterly metric, this likely means it was lower than 49% for the 3-month period.

Cross River Bank originated 60% of Upstart’s transaction volume for the first six months of the year. This is vs. 79% in the year over year period.

A bonus press-release from Upstart showed consumers receive the following benefits from paying off their credit card debt with an Upstart loan:

A 10% rate reduction

A 43 point credit score boost

No prepayment penalties

6. Barstool Sportsbook Expansion

Penn and Barstool Sports launched Barstool Sportsbook in Colorado on August 9th and in Virginia on August 10th.

7. CVS Health and Teladoc

CVS officially launched a first-of-its-kind nationwide virtual primary care product called Aetna Virtual Primary Care.

This solution will offer things like timely access to a broad network of physicians and is powered by Teladoc’s software.

8. The week ahead

Monday, August 16th

Nanox presentation

Tuesday, August 17th

Ozon earnings before the market

Ayr Wellness earnings before the market

Friday, August 20th

2021 Duolingo “Duocon” event