News of the Week (December 12 - 16)

Airbnb; SoFi; Meta; Lemonade; Match/Duolingo; Shopify; The Trade Desk; PayPal; CrowdStrike; Macro; My Activity

This piece is powered by my friends at Savvy Trader:

Welcome to the 301 new readers who have joined us this week. We’re delighted to have you all as subscribers and permanently determined to provide as much value & objectivity as possible.

1. Airbnb (ABNB) -- New Position & News

a) Introduction

I started a 25% full position in Airbnb this week. I love the company, but still don’t love the multiple. So? I will selfishly hope for more multiple compression to build out my stake. But the research I’ve done on the name makes me interested enough in owning a small piece despite it seeming a bit too expensive today. I felt waiting entirely to dip my toe was getting too cute with the multiple now close enough to where I’d like it to be. Here, I’ll briefly explain my thinking. I will publish a deep dive on the company in 2023 that goes into far more detail.

I love investing in verbs. Venmo is my favorite part of the PayPal bull case and few other verbs carry as much meaning as “To Airbnb it” in today’s public markets. That’s why the company was still able to find healthy demand DESPITE turning off all marketing dollars during the pandemic.

The brand’s word of mouth virality is simply elite… and that matters to me a lot. It’s how a company finds seamless operating leverage while delivering robust demand and its how economies of scale can deliver the very best margin profiles over time. That’s what I expect here, and the signs of it getting to that point are already clear. Ex-stock comp free cash flow is already quite strong, and I see a lot more juice to squeeze out of its fixed cost base.

Furthermore, I view this company as the prime player in the longer term vacation/rental market. GenZ is far more nomadic and experience driven than previous generations have been, and Airbnb is the perfect service to allow these young spenders to find a special place anywhere… often for extended stays. And speaking of experiences, its expansion into enabling hosts to offer their talents in addition to their living quarters is a promising long term growth vector to explore.

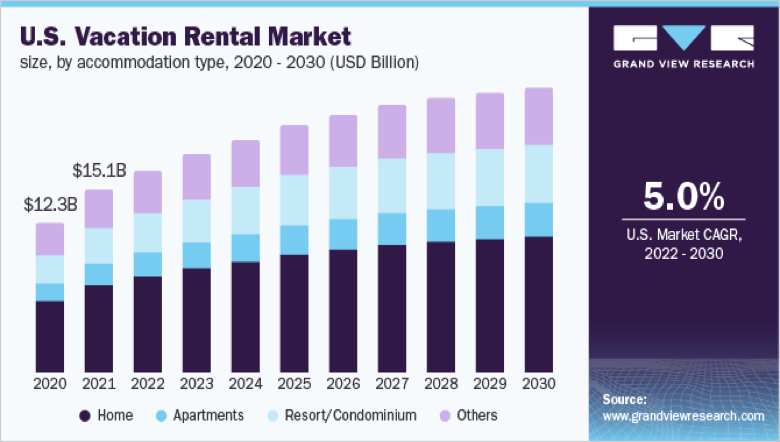

More broadly speaking, Airbnb’s market is expected to continue outpacing overall GDP growth and its share gains (as seen from the dark purple bars below) speak to its ability to take advantage of that opportunity better than others can.

So what are the main risks I see today? First and foremost is local regulation amid common housing shortages. One way to combat these shortages is by blocking short term rentals like Airbnb. Although this is possible, it would take a large group of local municipalities to make the move to have a significant impact on the business -- and it would upset tax paying hosts in those affected cities. Furthermore, skyrocketing interest rates has made a large dent in housing demand which should ease this concern for the time being. I think special local taxes being implemented are more likely than the economic disruption a ban would cause.

But still, today, key international cities like Barcelona and Paris have strict limitations on Airbnb rentals. This will surely make international expansion less fruitful and it’s always possible that more cities or nations will follow suit.

Secondly is the founder. I see him as a strength and a risk. He’s smart, capable, driven… and a bit too optimistic at times. That means I have to take what he says with a large grain of salt which is obviously not ideal. Still, his track record speaks for itself and hard decisions he has made like price transparency and the aforementioned marketing pause amid Covid-19 have been the right ones in my view. He just needs to chill out a little.

We also must consider macro as a key risk for Airbnb. Vacations are discretionary purchases that are always cut before food or other basic necessities. Yes, economic weakness does motivate more hosts to list their own homes for a new income stream. Still, nightly rates, demand and lower investment property affordability all make poor macro an overall headwind for this business. Selfishly that is what has opened the door for me to start a position.

Airbnb is also still somewhat expensive. The company trades for about 30x forward earnings with about 15% revenue growth expected and margin expansion pausing until 2024. That’s about triple Expedia’s multiple and 50% higher than Booking.com. While Airbnb’s growth deserves a heftier valuation, this premium is quite generous and we’re still in a hawkish macro backdrop where pricey growth is automatically hated. Again, this is why I’m starting the position so small.

Airbnb is a safe 15% revenue compounder with obvious operating leverage ahead of it. The company has rapidly built an iconic brand despite several entrenched competitors fighting it at every turn. It has carved a deep niche with younger generations, and it has done so in a quite profitable manner. I find all of that admirable and compelling as an investment case.

b) Miscellaneous

Airbnb eliminated 4,000 hosts from its database for breaking discrimination policies.

Airbnb officially debuted a guest search option to view total price (including cleaning fees) on the site. This is an attempt to solve for guests upset with sticker shock post fees being added to the bill.

2. SoFi Technologies (SOFI) -- Insider Buying, BNPL, Galileo & APY

a) Insider Buying

Since August 2021, SoFi CEO Anthony Noto has purchased about $3.8 million in SoFi stock via 22 separate open market transactions. This week, Noto purchased another $5 million in company stock in one fell swoop. While executive buying is not a crystal ball for future returns, it IS a strong indication that insiders are optimistic. It’s curious to me that some can confidently argue otherwise, but I suppose they’re entitled to their opinion that contradicts endless historical research. But I digress.

Especially considering that Noto is ~only~ worth about $100 million, investing roughly 9% of his total net worth into SoFi stock over the past 18 months is surely notable. And it deserves even more context. Out of the $100 million in total net worth, a large chunk of that is tied to SoFi stock options that ONLY VEST IF SOFI SUCCEEDS. He is already overly exposed to the company’s execution. I guess he still wants more.

b) Buy Now, Pay Later (BNPL)

SoFi launched its own “Pay in 4” product using Galileo’s software as the backbone. The option can be selected at any merchant that accepts Mastercard for both online or in-store purchases. To start, this will be for transactions of $50-$500 dollars and will feature interest free payments. SoFi is Mastercard’s first Installments Program partner to go live.

As part of this program, the BNPL offering will feature Mastercard’s fraud and liability protection programs.

To use this feature, SoFi members will get a Mastercard branded virtual card upon acceptance that can be used for the transaction.

c) Galileo

Galileo launched “Direct Deposit Switch” in partnership with software provider Atomic. With this launch, Galileo’s clients can more seamlessly and expeditiously pay their constituents. Furthermore, it features automated tools for allocating a set amount of paychecks to investment accounts or for specific use cases like vacation funds. Atomic will help Galileo instantly approve and verify employee account funding requests like these.

With virtually all Americans receiving wages via direct deposit, enabling these dollars to be allocated to more places with more speed and automation matters a lot. Doing so in real-time with preferences easily and intuitively conveyable is simply icing on the cake. The added layer of convenience is expected to raise direct deposit adoption even further for Galileo clients which is especially appealing for credit-based customers relying on these dollars to fund loans.

As an aside, this also marks the debut of Technisys technology in the United States as it was a key piece of bringing the Galileo-powered offering to light.

“Clients leveraging payroll connectivity solutions, such as direct deposit switching, have seen as high as a 3-4X lift on direct deposit acquisition when benchmarked to other solutions.” -- Atomic Head of Markets Lindsay Davis

d) Savings Annual Percent Yield (APY)

SoFi raised its savings APY to 3.5% for direct deposit consumers. As a reminder, this 3.5% cost of deposits is lower than what SoFi had been paying on warehouse facilities. Rather than pocketing this savings via better loan book margins, SoFi is more focused on driving market share and demand growth. So expect the rate to continue rising to reel in more lucrative direct deposit customers.

Robinhood offers 4% (if you pay $60 for its gold subscription) and there are a few other less-established brands with higher yields but also strict deposit maximums (with yields falling thereafter). SoFi does not have these maximums.

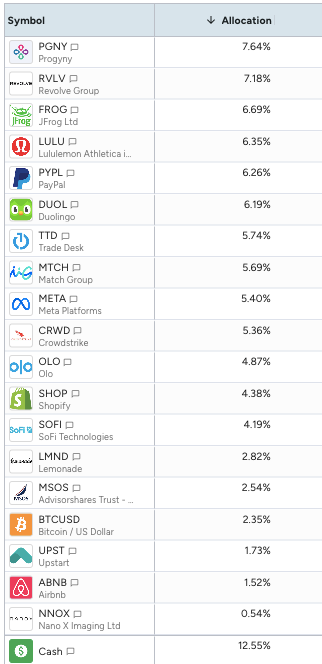

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. Meta Platforms (META) -- Borrowing Ideas & TikTok

a) Borrowing Ideas

Meta Platforms is adding a candid stories tool to Instagram to compete with “BeReal:” A new social media app gaining significant traction. I know this seems icky to some, but it’s just good business. Meta has the built in network to make compelling social tools more successful than anywhere else can. So? When it sees companies like Snap thriving with stories, TikTok taking share with short-form video or BeReal storming onto the scene, it has every incentive to mimic what’s working for its own success. That’s what is again happening here.

b) TikTok

The Senate passed a law banning TikTok from government devices.

There was a bipartisan bill introduced in the Senate to ban TikTok more broadly.

4. Lemonade (LMND) -- Car

The young insurance disruptor launched Lemonade Car in Texas this past week as it briskly expands that product across the U.S. Today, just 3.7% of Lemonade customers are multi-policy in nature. With car and home being the most popular bundle in the industry, Lemonade was (as it describes) “operating with a hand tied behind its back” by not being able to bundle car and home at a discounted rate like its competition routinely can. That’s changing with the Metromile deal which equipped Lemonade with the licensing it needs for this product to launch nationally. Now it’s just a matter of how quickly it can be rolled out.

The impact of this Texas launch should be material based on previous Lemonade Car debuts. For example, in Illinois where this first launched, Lemonade’s multi-policy customer rate rose to roughly 6% vs. the 3.7% for its whole business mentioned above. This not only means more revenue, but also better margins because its acquisition cost doesn’t materially rise as new policies are bought by existing users.

While Lemonade started as a renters insurance company, its success will be based on how effectively it can expand into other insurance verticals. Renters premiums are tiny compared to all other insurance offerings, and churn is inevitable unless you can offer existing customers the products they want as lifestyles evolve. Renters is a wonderful top of the funnel, but it’s merely 1 small tool in a tool kit of building a successful business in this space. Lemonade finally has the needed tools.

There are thousands of Lemonade customers in Texas on the waiting list eager to purchase a car policy. There are about 300,000 other Lemonade customers in other states also on waiting lists as demand out of the gate has been encouragingly robust.

The stock continues to be hated just like all other cash burning, hyper-growing, share diluting firms. But the company is doing exactly what it needs to do to find operating leverage, continue compounding and eventually find favor with investors whenever the macro backdrop is not so wildly hawkish. It’s executing… don’t let the stock price fool you.

5. Match Group (MTCH) & Duolingo (DUOL) -- Apple App Store

Apple is (supposedly) finally opening up key parts of its app store to more 3rd parties in Europe. According to Bloomberg, the consumer tech giant is actively working on new integrations for independent developers and app stores to FINALLY be able to directly plug into Apple’s store. This means companies reliant on app store subscription revenue will be able to choose other payment vendors and save a material chunk of the 30% commission Apple currently fetches. No other 3rd party has the clout to demand anything remotely close to 30% -- especially amid more open competition for business like this would bring.

The pivot is voluntary like a troubled executive “resigning” is voluntary. In an ideal world, Apple would keep its ecosystem closed, take advantage of its unmatched network effect and keep reeling in the hefty 30% fee. But that ideal world seems to be less realistic with legislation like the Digital Markets Act in the EU forcing large caps to level the playing field via basic 3rd party integrations to payment processing vendors.

Once fully in effect, this change could mean a gross margin tailwind of about 200 basis points for Match and likely something similar for Duolingo -- countless other firms would benefit as well. The companies could choose to invest more aggressively into new opportunities or to become instantly more profitable overnight. Good options.

Importantly for Match specifically, its 2023 guide assumes zero help from lower app store fees. It saw the Digital Markets Act taking up to a year to be implemented and the benefit to its business being realized in 2024. That boost could be coming even sooner… not to mention similar processes playing out in countries like Korea which would merely add to the tailwind.

The scale that Apple (and Google) built clearly deserves a larger take rate than the 2-3% that a standalone payment processor gets. But there are miles of middle ground between that 2-3% and 30% and I hope that regulators continue to force Apple to close that gap..

6. Shopify (SHOP) -- New HQ

Shopify no longer plans to be the anchor tenant of a new real estate development in Toronto. The company has been among the most aggressive and consistent in its dedication to permanently remote work. This is the latest sign of its loyalty to that goal along with (I think) a hint of its belt tightening to focus finite investment dollars on higher priorities like fulfillment. The company doesn’t need to be moving into a lavish, massive new building with its shares so challenged and its workforce shrinking via layoffs -- I’m glad it made this move.

7. The Trade Desk (TTD) -- Netflix

Reports circulated this week that Netflix is missing its total viewership targets for advertisers and offering these clients the option to claw future placement dollars back. While this sounds somewhat concerning, considering The Trade Desk will be a key part of Netflix’s advertising ecosystem, more context is (as always) needed. First and foremost, Netflix has barely begun marketing for this new subscription tier and plans to ramp these efforts into the New Year. Furthermore, in an email retained by Bloomberg, Netflix leadership called the launch a pleasing success.

It’s too early to be worried about this launch as a TTD shareholder, but I will be keeping a close eye on progress here.

8. PayPal (PYPL) -- Crypto

PayPal announced a new partnership with Consensys Software and its MetaMask crypto wallet. As part of the arrangement, PayPal users will now be able to use account funds to buy Ethereum from MetaMask with real time transferability as well. PayPal continues to push further into the space following this news and its decision to open its ecosystem up to external crypto exchange transfers. With crypto winter in full swing and large players dropping like flies, this is the time for PayPal to pounce and take a larger share of this future opportunity. It has the brand, the regulatory relationships, the cash flow and the balance sheet that its crypto competition simply cannot match. Go seize the opportunity.

9. CrowdStrike (CRWD) -- External Attack Surface Management (EASM)

Following CrowdStrike’s purchase of EASM vendor Reposify, it has integrated the capabilities into the Falcon Platform and has released a new standalone module. Companies struggle to gain full visibility of potential vulnerabilities across external network, endpoint and cloud environments. CrowdStrike’s always-on scanner of potential threats should boost the just 9% of organizations with a full view of their external attack surface environments.

“CrowdStrike is uniquely positioned to win in the EASM market for three reasons. First, we know more about adversaries than anyone else in the industry. Second, getting visibility into internet exposures requires both an outside-in and inside-out perspective. We will integrate our IT hygiene, vulnerability management and EASM modules, so we can deliver insights of enterprise risk across assets. Third, we deliver EASM from a unified security platform with a single, lightweight agent. This approach enables us to drive the best outcomes for customers.” – CTO Michael Sentonas

10. Macro

a) Fed Highlights

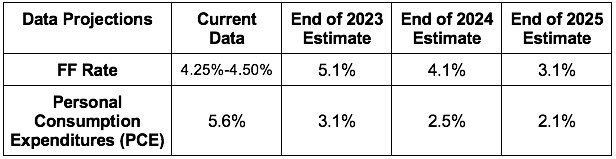

Fed Funds (FF) rate hiked 50 bps to 4.25%-4.50%. The decision was unanimous and more hikes will be appropriate.

Estimated 2023 FF rate raised from 4.6% to 5.1%.

Estimated 2023 unemployment rate raised from 4.4% to 4.6%

Roughly $95B per month in QT will continue.

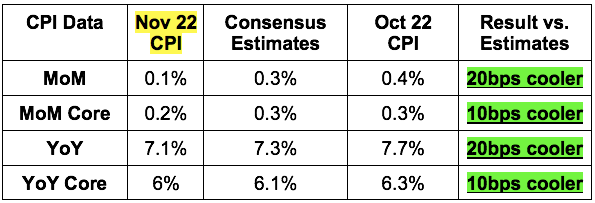

According to Chairman Powell, inflation data for October & November showed a “welcome reduction in the pace of price increases, but we need more evidence to think inflation is in a sustained downward path.”

The labor market remains supply constrained and “extremely tight.”

Labor Force Participation is too low. Needs to fix this to control wage inflation.

Expect real GDP growth of 0.5% in 2023.

“The speed of rate hikes was important earlier in the year. Now that we’re into restrictive territory, how fast we move is not as important. How long we are restrictive and where we end up is important. The speed of hikes is no longer the focus.” -- Jerome Powell

b) More Data from the Week

Consumer data:

Month over month (MoM) November core retail sales of -0.2% missed expectations of 0.2%.

November retail sales of -0.6% missed expectations of -0.1%.

Employment data

Initial jobless claims of 211,000 was better than the 230,000 estimate.

Manufacturing data:

New York’s and Philadelphia’s Manufacturing Indexes for December both sharply missed expectations and contracted.

MoM Industrial Production of -0.2% missed 0.1% estimates.

The Manufacturing Purchasing Managers Index (PMI) for December of 46.2 missed 47.7 estimates.

The S&P Global Composite PMI for December of 44.6 missed 47.0 estimates.

The Services PMI for December of 44.4 missed 46.8 estimates.

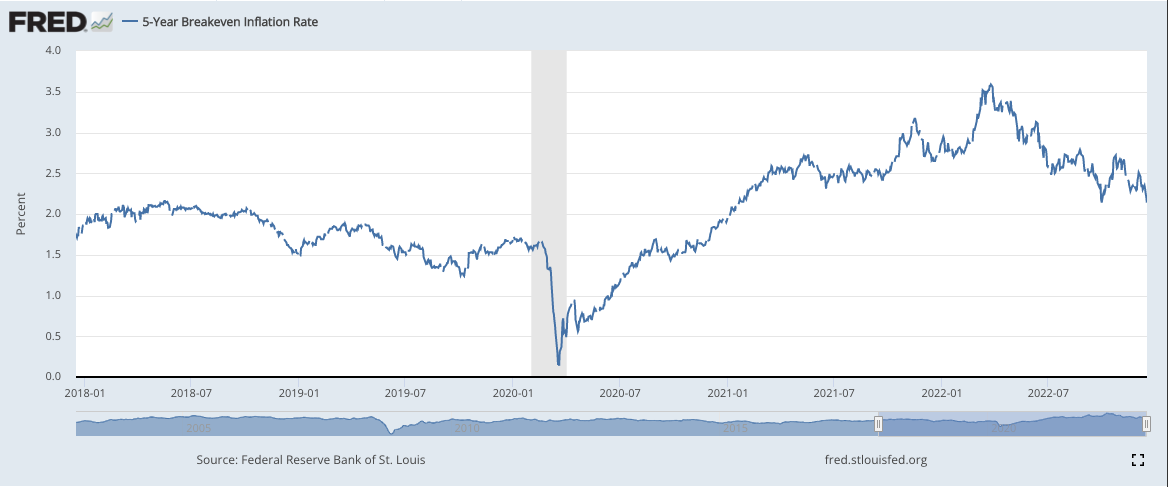

5-year breakeven inflation continues to be in a well-defined downtrend:

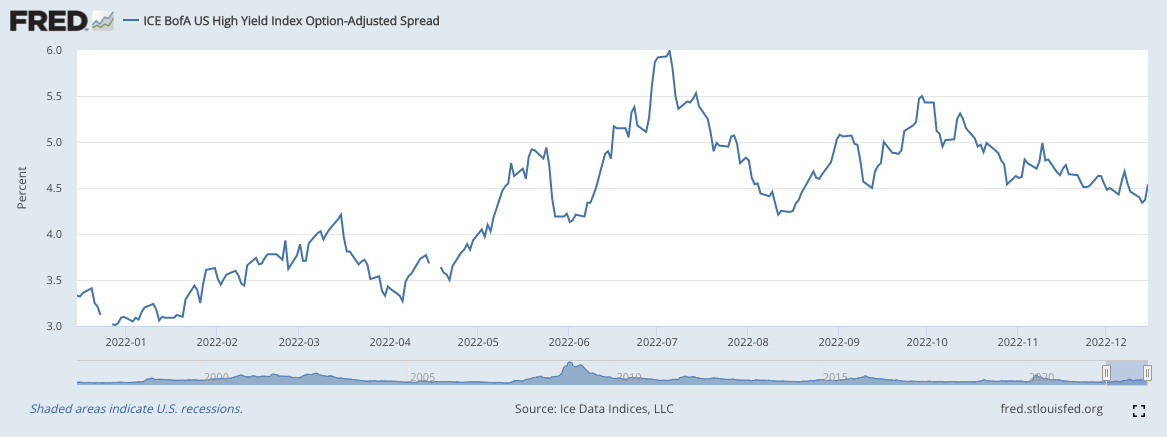

High yield option adjusted corporate credit spreads unfortunately shot higher this week following the relatively hawkish Fed presser:

c) Level-Setting all of the Data

While it was a very busy week in macro-land, not much changed about my views going forward. The Federal Reserve cannot say anything besides “rates will keep moving higher” with inflation still this elevated. BUT, we now have more than 2 months before the next rate decision. During that time, it’s almost obvious that economic weakness will continue to intensify and forward looking inflation indicators will continue to crater. That weakness hasn’t yet shown up in jobless claims (only a matter of time as Goldman Sachs is the latest to announce a large layoff), but it has shown up essentially everywhere else.

If inflation data continues to look better, and production data continues to look worse from now to then, I think the most likely scenario is one additional 25 basis point hike and then a pause. Futures markets are expecting something similar. This pause will likely coincide with at least a mild recession as it will be a response to employment and economic growth becoming more challenged than inflationary pressures.

This will make the rare, structurally profitable compounders all the more coveted as growth becomes scarce and discount rates stop rising. I see that happening by the middle of 2023 when I plan to be fully invested. That could always change if the incoming data doesn’t support this approach. I do not fear a recession as a growth investor. I fear runaway inflation pushing discount rates endlessly higher. The CrowdStrikes of the world do not need 3% GDP growth to profitably compound at 30% on the top line.

11. My Activity

I added to Lululemon, Lemonade, Meta Platforms, Progyny, Olo and CrowdStrike during the week. I also started a new position in Airbnb. My cash position now sits at 12.6% of holdings.

Loved your persective on ABNB. I recently did a deep dive podcast episode on the company along with detailed financials. Feel free to use it for your research and share with your readers.

Cheers!

https://open.substack.com/pub/beachman/p/is-abnb-going-to-be-a-multi-bagger?r=12ociv&utm_campaign=post&utm_medium=web

Do you think ABNB could do a monthly/yearly subscription or some type of paid rewards membership for Nomad types or people who engage in longer stays due to the ability to work from anywhere?