News of the Week (December 13-17)

Teladoc Health; SoFi Technologies; Olo; CuriosityStream; CrowdStrike; Lemonade; Duolingo; Meta Platforms; JFrog; Nanox; The Fed & Macro; Cannabis News; My Activity

1. Teladoc Health (TDOC) — National Labor Alliance + Cigna

Teladoc Health announced a deepening of its exclusive relationship with National Labor Alliance (NLA) — the largest alliance of labor unions and labor management coalitions in the United States. The new arrangement includes Teladoc’s full suite of products to bring whole-person care to this organization’s vast network. The deal also creates an “exclusive endorsement” to NLA’s coalition across 6 million members and all 50 states.

Cross-selling is a large part of Teladoc’s plans for long term growth. In its investor day presentation, the majority of the 25%-35% 3 year compounded annual growth rate (CAGR) that it laid out was mainly due to up-selling new services within its existing member base. Teladoc already has a 36% share of its current market according to McKinsey — but whole-person activations are poised to grow this market from $121 billion to $261 billion in the coming years. I believe it’s best-positioned to capture this opportunity.

To further highlight the impact of cross-selling, a case study from a company client with 10,000+ employees revealed that purchasing multiple products leads to Teladoc collecting $95 per member per month (PMPM). This is vs. $70 with one product — not to mention most of the revenue from a 2nd product sale flows to Teladoc’s bottom line. Breadth of services and data is how Teladoc differentiates itself in a sea of competition — this piece of news serves as another sign that this path is being met with real traction.

Cigna also dropped Livongo as a digital health tool of choice. According to a Teladoc Spokesperson, this was a matter of the company deciding “not to pay the premium for the privileged status next year” along with hundreds of other digital tools. This seems to be a matter of endorsement fees and not utility.

2. SoFi Technologies (SOFI) — Warrants Redeemed

SoFi finalized the redemption of all outstanding warrants dated October 8th, 2020 — adding gross proceeds of $95 million to its balance sheet.

Click here for my broad overview of SoFi.

3. Olo (OLO) — New Lyft Partnership

Olo announced a new partnership between its Dispatch module and Lyft to deepen the value proposition of Olo’s delivery optimization software.

The Dispatch module allows restaurant chains to field bids from all delivery service providers (DSPs) in real-time — as well as any internal options available — to automatically select the best bid based on pricing and timing. For many of Olo’s clients, Dispatch has cut reliance on 3rd party DSP’s — and so hefty take rates and consumer data fragmenting — by 50%.

Adding a massive, national driver fleet like Lyft’s merely bolsters the appeal of this product. More bids means more options and lower pricing for Olo’s clients leading to better margins and service scores. As a reminder, Olo does not actually fulfill any of these deliveries. It’s merely facilitating the process as economically as possible for its partners. This is why the company’s margins are so good.

Click here for my Olo deep dive.

4. CuriosityStream (CURI) — New Partners + Adding it to My Hot Seat

CuriosityStream announced 3 million additional subscribers via new partnerships announced with vendors in China, Europe and Latin America. This announcement brings its total subscriber count to roughly 23 million — the company will debut more languages to support the expansion.

To be candid, this was not all that encouraging to me. The 4th quarter is supposed to be the company’s best time of the year for demand. With the period’s end just weeks away, jumping from 20 million to 23 million sequentially is nothing to be proud of and it has little time to land more deals for 2021. This is not good enough. The pandemic did halt its travel and a lot of its bundled selling activity, but that should not have impacted subscription growth like it did.

Maintaining its original $71 million revenue guidance and lofty direct subscriber growth both make that less concerning. Still, a lot more of the total revenue pie is being generated via non-recurring program sales than I expected. That revenue is lower quality and diminishes the selection of CuriosityStream’s own content library.

As a result, I am placing CuriosityStream on my hot seat and pausing any adds going forward. The company needs to generate $71 million or more in 2021 sales and guide to over $120 million in 2022 sales with an improved gross margin for me to resume accumulating shares. I’d also like to see it turn EBITDA positive at some point next year as well. I have no plans to sell any shares, but will simply hold what I have until those benchmarks are cleared. If performance continues to deteriorate, I will sell.

As an investor in young, unproven, high growth disruptors — I will always have bad picks and will never bat 1.000. Thankfully, the fixed potential downside and unlimited potential upside that public equities feature make that reality perfectly fine. This is also why I never invest more than 4% of my total capital in any single position. It doesn’t take a portfolio full of future Google’s to generate life-changing wealth over decades — just a few.

It’s about how right I am when I am right about a company. For example, the return generated by holding Revolve has more than tripled the losses I’ve realized thus far with my worst 3 performing positions.

I am not ready to give up on CuriosityStream — but I am getting slightly closer to that point. As a reminder, Nanox and Tattooed Chef are also on my hot seat.

Click here for my broad overview of CuriosityStream.

5. CrowdStrike (CRWD) — Accolade

Frost & Sullivan named CrowdStrike the Asia-Pacific Endpoint Security Company of the Year for 2021.

This just serves as yet another sign of the utility and incremental efficiency that CrowdStrike generates.

6. Lemonade (LMND) — Bitcoin

Lemonade now has $1 million worth of Bitcoin on its balance sheet — or roughly 0.1% of its cash and equivalents — as part of the Metromile purchase. This was an interesting headline but not relevant to my bull thesis for the company.

Click here for my broad overview of Lemonade.

7. Duolingo (DUOL) — New Board Member

Duolingo named John Lilly to its Board of Directors. Here are his credentials:

Partner at Greylock — early investor in Instagram and Dropbox

Former CEO of Mozilla — predecessor to Firefox and open source browsing

Co-Founded of Reactivity — an internet security company purchased by Cisco where he stayed on as CTO

Former “Senior Scientist” in Apple’s research labs

Click here for my Duolingo deep dive.

8. Meta Platforms (FB) — The 2 Billion Club

Instagram became the 4th social app in the word to boast 2 billion monthly active users (MAUs). Facebook owns 3 out of 4 of those apps. There are surely people with several Instagram accounts on their own, but this is still quite notable. Growth for the platform is remaining strong as our world opens back up.

9. JFrog (FROG) — Addressing the Log4J (Java-based logging service) Vulnerability + Canada

To support Apache’s new Log4j update, JFrog debuted a new, free software scanning product to support the program within both source code and binaries. The Log4j vulnerability is being actively exploited — it has already impacted roughly 50% of all global enterprises — to conduct security supply chain attacks that are difficult to uncover and fix. This integration will allow for better understanding, collaboration and remediation.

JFrog also announced regional hosting center support from AWS and Azure to run JFrog’s platform in Canada.

Finally, the company named Meerah Rajavel — Citrix’s current CIO — to its board of directors. Rajavel has previously served as a Senior Manager at McAfee and Cisco.

Click here for my broad overview of JFrog.

10. Nanox (NNOX) — USARAD Re-Certification

USARAD — Nanox’s recently purchased tele-radiology company — was re-certified by the Joint Commission’s Gold Seal of Approval. The Joint Commission is an American entity responsible for accrediting organizations in healthcare. The recognition is for companies demonstrating a “commitment to high quality and safe patient care based on ongoing compliance.”

Click here for my broad overview of Nanox.

11. How Macro and the Fed Impact my Investment Approach

The Federal Reserve (Fed) and Jerome Powell published forward-looking expectations for tapering, balance sheet reduction, and interest rate hikes. The Fed now expects to hike its target rate 3 times (so 75 basis points) next year with more hikes expected thereafter. Those 2021 hikes would take the Fed funds rate from it’s current target range of 0%-0.25% to 0.75%-1.0%. It also updated and accelerated the pace of its tapering with quantitative easing now expected to end in spring of 2022 vs. summer (previously expected).

As an aside, it also highlighted cybersecurity as a main threat to economic and monetary stability — something that should lead to continued public sector spending growth within this industry like we recently saw with CrowdStrike.

The vast majority of my focus is on company-specific performance or microeconomics. Still — with monetary conditions meaningfully changing — I thought it would be interesting and valuable to discuss the topic and my thoughts on it.

Powell and the Fed are now taking a more hawkish stance to fend off inflation that has proven to be more durable than previously expected. While some are fearing elevated inflation may even be a permanent fixture in this monetary cycle — I do not see it that way for several reasons.

First, this most recent year over year inflation reading is comparing our current demand recovery vs. a period in which the economy was effectively shut down with commerce severely limited. The two timeframes feature a macroeconomic picture that could not be more different. As we move forward and begin to have inflation readings comparing two more similar periods, I believe that will greatly work to ease this issue.

Furthermore, global supply chains do not have a playbook for exiting a pandemic. Industries have been aggressive with rebuilding inventory as a shield against outages — but this reorganization takes time. With demand recovering more quickly and supply chains still working to support that recovery — prices will inherently rise as scarcity and delays remain. It takes more time for global supply chains to normalize than it does for the consumer to decide they’re ready to go spend. This is also contributing to our elevated Consumer Price Index (CPI) and Producer Price Index (PPI) and the variable will surely diminish in the coming months. The economy will find an equilibrium eventually and is not yet there.

We also have to consider that the Fed is especially concerned with wage inflation outpacing economic productivity growth per worker. This phenomenon leads to profit margin compression for enterprises that cope by raising prices — which boosts inflation more. Wage inflation also seems to be uniquely explainable to me. Stimulus checks are only a few months in the past and stock market indexes are near all-time highs. Consumer savings rates surged via these factors as well as the previous economic shut down precluding spending habits.

Some people just haven’t needed to look for a job yet. Furthermore, spontaneous and temporary school closures due to variant outbreaks make it more difficult for parents to find a job. In this scenario, the child is not accounted for during the work day and childcare is expensive.

All of this likely explains why our labor force participation rate has not recovered with unemployment improving. As these workers slowly come back into the labor force in the coming months and years, that added supply and competition will work against wage inflation.

Other factors such as global demand for our bonds — where transactions are all dollar-denominated — and the somewhat sticky technology-adoption shock that the pandemic fostered both serve as inflation headwinds as well.

From a tapering perspective, Powell seems to be taking a cautious approach. He explicitly acknowledged how sensitive markets can be to changes in the Fed’s balance sheet and so assured investors they would be slow and methodical with this piece of the equation. I took this to mean a lower probability of a taper tantrum 2.0 next year.

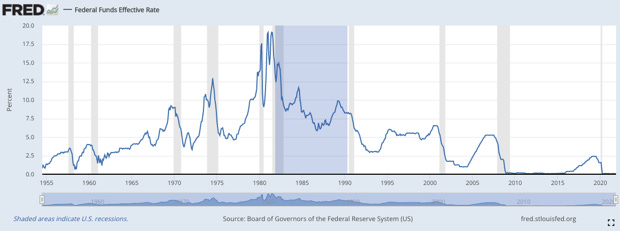

For a quick note on rate hikes — I’d just like to say I’m entirely in support of them. The economy is beginning to hum once more and these interest rate boosts are vital pieces of re-loading the Fed’s toolkit to ease the impact of our next recession whenever that may come. We can’t stay at 0% forever. Additionally, a Fed funds effective rate even approaching 2.5% would still represent an accommodative environment for speculative assets historically speaking:

If inflation does truly prove to be a permanent fixture and my opinion is wrong, that would not change much for me. I seek out companies with concrete value propositions vs. industry alternatives. This differentiation inherently translates into pricing power that can be used to offset some of the impact associated with inflation.

Furthermore — and by far most importantly — macroeconomic conditions will not be the primary determinant of my returns. My success in future decades will depend predominately on identifying companies that can sustainably and profitably compound at a lofty rate in the years to come. Yes, higher rates will most likely lead to heavier cash flow discounting and multiple compression. But still, whether or not CrowdStrike is doing $30 billion in cash flow or $3 billion in cash flow at maturity will have a far larger impact on my results than where the federal funds rate is and what multiple the cash flow receives at the time. Profitable compounding will always matter the most eventually. So what do I do in periods of macroeconomic turbulence like this? I stick to my stock picking plan.

I continue to separate company performance from stock performance and hone in on the former as strictly as I can. Just like in any other environment, I sell struggling companies — not struggling stocks. We’ve all heard the statistic of Apple, Google and every other iconic company having their stocks severely hit on numerous occasions. It’s part of public markets and must be stomached to enable ourselves to reap the returns that a successful disruptor can deliver.

For thriving companies with struggling stocks, my goal is to hold through many tightening and easing cycles as long as the firm’s performance remains strong. So, when tightening leads to extreme fear — and extreme multiple compression — I actually take that as an opportunity to accumulate more shares of healthy companies I perceive to be carrying an enhanced risk/reward.

When mania/greed takes hold in markets, I use excessive multiple expansion to slowly make small trims. This prepares me for accumulation once more when things again get difficult. These trims are generally just 5-10% of my position which allows me to stay mainly invested at all times while also opening myself up to take advantage of future opportunities.

My cash position fluctuates between 5% and 20% as these processes play out.

I may not pick the same kind of stocks that Warren Buffett selects — but I use the same ultra-long time horizon and “greedy when others are fearful” mentality that has made him so successful.

The anxiety associated with this week’s Fed meeting led to some recently indiscriminate selling of stocks which swept up great companies in the process. This, coupled with tax loss harvesting is creating opportunities that should last through the end of the year. It’s easy to be a long term investor when our stocks are going up in a straight line. It’s far more difficult and far more imperative to stick with that philosophy when turmoil reigns in markets.

I am sticking to the plan and will continue to slowly accumulate as/if more volatility comes.

12. Cannabis News

a. Company News

Green Thumb opened its 68th dispensary in Chelsea, Massachusetts.

Cresco Labs opened its 45th dispensary in Sarasota, Florida.

b. Industry News

Toi Hutchinson is the new head of the Marijuana Policy Project after most recently advising Governor Pritzker of Illinois on cannabis policy. This is the (self-proclaimed) number 1 organization in the USA dedicated to legalizing cannabis. It has directly supported regulatory efforts in the majority of the states with legal cannabis today.

A federally funded survey revealed there’s actually a negative correlation between legalization of cannabis and teen consumption. Great news for state holdouts.

Ohio is quickly working towards passing a bill that broadens the conditions that a physician can cite to recommend medical cannabis. A doctor can now prescribe the medicine for any condition they honestly think could be helped by the plant. This will surely juice medical enrollment like it has in other states that broadened acceptable use cases.

Click here for my broad overview of American Cannabis regulation.

13. My Activity

This was another busy week for me just like most of late November and December has been. I’ll continue to be in active accumulation mode as multiple compression further intensifies. With this week’s accumulation I brought my cash position down from roughly 14.35% to 13.60%. It was over 17% just a few weeks ago. I made small adds to the following names:

Ayr Wellness (click here for my broad overview of Ayr)

Lemonade

Olo

Upstart

Teladoc Health

JFrog

GoodRx (click here for my GoodRx deep dive)

SoFi Technologies

Progyny (click here for my Progyny deep dive)

Revolve Group

Thank you🙏