News of the Week (December 5 - 9)

Lululemon; PayPal; CrowdStrike; SoFi; Meta Platforms; Progyny; Match Group; JFrog; Olo; Cannabis; Macro; My Activity

Today’s Piece is Powered by Stock Unlock:

Welcome to the 320 new readers who have joined us this week. We’re delighted to have you all as subscribers and permanently determined to provide as much value & objectivity as possible.

1. Lululemon Athletica (LULU) – Earnings Review

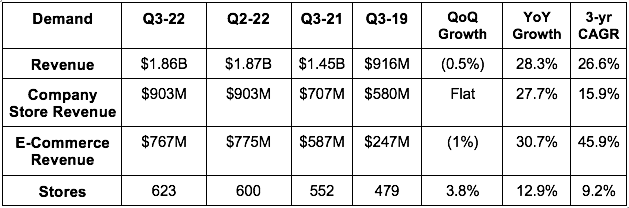

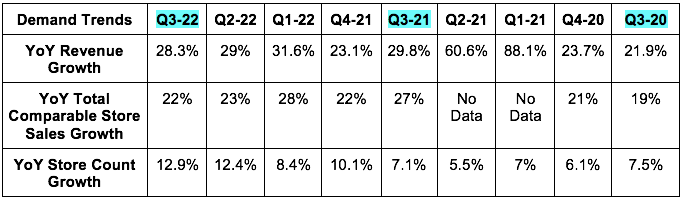

a) Demand

Lulu beat its revenue guidance by 3.9% and analyst estimates by 2.8%.

More Context on Demand:

Net revenue rose by 26% in North America and 41% internationally.

Total comparable sales growth was 25% YoY when excluding the foreign exchange (FX) hit.

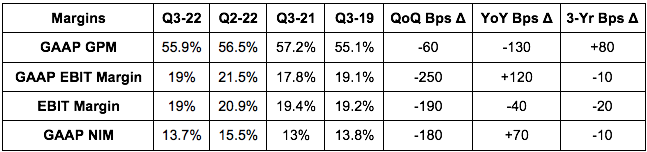

b) Profitability

GPM = gross profit margin; EBIT = earnings before interest and taxes; NIM = net income margin; BPS = basis point = 0.01%

More Margin Context:

Why gross margin fell:

60 basis point headwind from FX.

40 basis point headwind from higher markdowns and inventory provisions.

Some de-levering of fixed costs (temporarily) from distribution center investments to support future growth.

All of this was expected except for the FX hit which is why GPM fell by 60 basis points more than expected YoY.

c) Balance Sheet

Lulu has $350 million in cash & equivalents and another $395 million in untapped credit capacity.

The company slowed its buyback pace greatly during the quarter. It repurchased $17 million in stock vs. $125 million sequentially. It has $800 million left on its $1 billion buyback program.

Inventory grew by 13% QoQ & 85% YoY to $1.7 billion. Most of this YoY growth was from previous quarters, but I wanted to see sequential inventory growth below sequential revenue growth. That did not happen.

Still, the company believes that “inventory is well positioned to support growth.”

d) Guidance

Full year Guidance:

Now expects 120 bps of GPM contraction for 2022 vs. 2021 vs. previously 115 bps.

Now expects a flat operating margin for 2022 vs. 2021 vs. previously “flat to slightly up.”

Q4 2022 Guidance:

Q4 guidance missed estimates for both revenue and GAAP EPS by less than 1%.

Expect gross margin for the quarter to rise 10-20 bps YoY.

Markdown rates are not expected to rise.

The guide of around 23% YoY growth assumes a continued vast outperformance of its long term 15% growth expectations.

Now expects to open 79 stores this year vs. 75 previously.

CapEx guidance rose with the small boost to revenue guidance to support new distribution space.

EPS guidance does not include any share buybacks.

e) Call Notes

On Demand Trends to Date:

“Guest metrics have been consistently healthy across traffic, new guest acquisition and dollar spend.” -- CEO Calvin McDonald

On the Holiday Weekend:

CEO Calvin McDonald is “Pleased with the results.” He talked about the wildly volatile macro backdrop, but added that he’s encouraged with the results in the current quarter to date.

Lulu gained more share (150 basis points YoY) in its sector than any other brand per NPD Group Consumer tracking.

On Supply Chains:

More supply chain improvements with its suppliers now back to pre-pandemic production levels.

Ocean delivery times continue to fall.

On Inventory:

“As we’ve discussed, inventory was too lean last year and we’ve made the decision to build inventories this year… we remain comfortable with both the quality and quantity of our inventory… Q3 will also represent the high point for inventory.” -- CEO Calvin McDonald

“We’re in a much better inventory position this year vs. last to meet guest demand… we remain pleased with inventory levels” -- CFO Meghan Frank

The inventory growth was in line with its internal expectations.

The company guided to 60% YoY inventory growth next quarter vs. previously seeing 55%-60% growth. The rise was to take advantage of continued supply chain improvements and robust demand.

Lulu was able to stock all 11 SKUs of its outerwear “Wunder Puff” line for women this season which all sold very well. It was supply constrained here last year.

Markdown levels were flat vs. 2019 and met expectations. It is in no way, shape or form feeling a need to liquidate inventory. Roughly half of it is season-less, and all of it is high quality.

On International:

Mainland China missed revenue estimates due to pandemic closures but still grew 70% YoY.

On track to 4X international revenue from 2021-2026 like it guided to at its last investor day. Growth has been above estimates consistently, but it’s not yet ready to raise its growth forecasts for the planning period.

f) My Take

Some were alarmed by the inventory growth, but that was entirely expected and also entirely ok when it coincides with such impressive demand outperformance. I thought this was a great quarter with more market share gains, new product momentum and solid execution overall. I selfishly hope the price keeps falling so I can build out the new position. Great quarter.

2. PayPal Holdings (PYPL) – CEO Dan Schulman Interviews with UBS

On Quarter to Date Results vs. Q4 Guidance:

The holiday period for PayPal is shaping up as expected. Schulman said PayPal “either maintained or slightly grew” its market share.

PayPal is ahead of its $900 million in cost savings guide for 2022. Schulman thinks earnings will come in slightly ahead of its guidance for the quarter.

Revenue for the quarter so far “right on track to grow by around 9%” which is in line with previous PayPal guidance.

On 2023 Guidance:

PayPal now expects more than $1.3 billion in 2023 cost savings as operating expenses will shrink next year vs. previous expectations of them being stable.

PayPal is “clearly on track” to expand its operating margins by at least 100 basis points and grow EPS by AT LEAST 15% like it previously indicated.

These estimates assume an arguably overly bleak outlook for e-commerce and macro for 2023. Per Dan, “if macro is better than expected, we’ll be in great shape. But it’s prudent to plan for a more difficult environment.”

“We are planning for dire times.” -- CEO Dan Schulman

Similarly to Match, this seems like a wonderful setup for some “under promise and over deliver” to come. Macro won’t suck forever.

On Checkout:

Checkout latency is down 40% year to date.

PayPal’s availability is pushing 99.999% vs. 99.99% previously. This matters when you’re serving tens of millions of merchants.

50% of the PayPal user base can now skip passwords entirely and prove identity with passkeys.

A new PayPal software development kit (SDK) now allows all PayPal white-label checkout (the “commerce platform” which caters to smaller merchants than unbranded Braintree) to be done within the merchant’s app or site. This was previously only available to Braintree’s massive customers. This fully in-app experience boosts checkout conversion rates by up to 9%.

The unbranded PayPal commerce platform will soon allow Apple Pay as an alternative payment method. This was previously only for Braintree’s massive customers.

A Review of What the New Apple Partnership Means:

PayPal merchants can now use their iPhone as a mobile point of sale to accept offline transactions through PayPal’s platform on an iPhone.

Venmo and PayPal cards can be added to Apple Wallets. This happened in Germany with Google’s Wallet where Google enjoyed a 20% boost to checkout volume from this integration ALONE.

On Buy Now, Pay Later (BNPL):

PayPal BNPL volume rose 110% YoY during Cyber 5.

Schulman thinks it’s now the #1 preferred vendor in the space 2.5 years post launch.

PayPal’s 90%+ acceptance rate vs. ~60% for most competitors coincides with some of the lowest loss rates in the space. So it accepts more and loses less. That’s the benefit of having a deep historical portrait of every customer’s financial lives to guide your underwriting.

Unlike others, PayPal has seen zero deterioration in its loss rates this year.

PayPal is close to 300,000 merchants with BNPL upstream presentment (showing the PayPal checkout option on the product page). This directly raises its checkout share.

“Competitors are having to pull back because they can’t continue to lose money. So we have a big advantage… we are winning global accounts coming up for rebid there… there’s a flight to quality that we’re picking up on.” -- CEO Dan Schulman

Venmo:

“What PayPal was to eBay will be what Venmo is to Amazon. We’re excited.” -- CEO Dan Schulman

As a reminder, Checkout with Venmo just launched on Amazon and is expected to be a domino motivating other large merchants to follow suit. Clearly, things are off to a good start here.

“I feel good about the progress that Venmo has made, but I feel we can make better progress going forward.” -- CEO Dan Schulman

Stock Unlock’s mission is to help you grow your wealth through long term, fundamental investing. Our Insights analyze and grade the fundamentals of over 170,000 stocks on 65 global exchanges so you can save time and find the best investments.

We use the investment techniques and teachings of legendary investors such as Warren Buffett, Charlie Munger, and Peter Lynch to power our analysis so you can find the best stocks while avoiding all the hype.

Stock Unlock is a platform that truly makes you a better investor. Oh, and it’s only $6.99/month, but with this link you can get your first month totally free. We believe in offering you the best product at the most affordable price -- just like a no brainer investment.

Click here to check it out.

3. CrowdStrike (CRWD) – Leadership Interview & SentinelOne

a) CEO George Kurtz and CFO Burt Podbere Interview with Barclays

Much of what was said on the earnings call was repeated in this interview. To avoid redundancy, I’ve linked to my review of that report rather than repeating the updates.

On Microsoft Competition:

“We have to respect Microsoft. They are big, so I’ve got to say that. In terms of tech, Microsoft Defender is a legacy signature-based antivirus product. If that worked for Symantec and McAfee, they wouldn’t be called Broadcom and Trellis right now… when you look at efficacy and the cost advantage of using CrowdStrike, it’s not even close.” -- Founder/CEO George Kurtz

On Forward Guidance and Why Net New ARR will Fall Next Q (usually rises from Q3 to Q4):

“Going into next year, we wanted to be prudent and just assume headwinds carry forward.” -- CFO Burt Podbere

Again, I love to see management teams assuming exogenous headwinds will continue until they don’t. Leave all surprises for the upside.

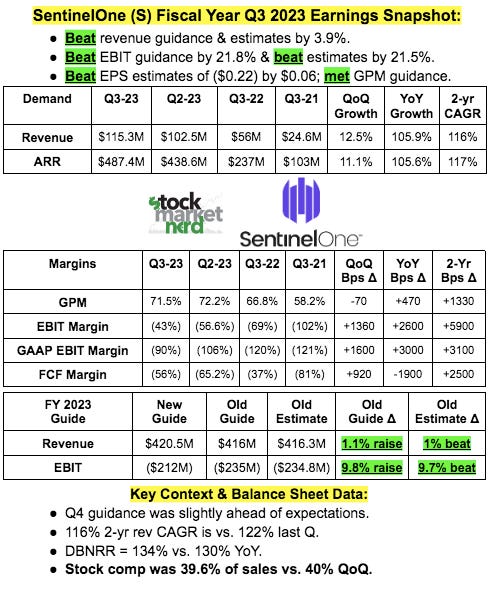

b) SentinelOne (CrowdStrike Competitor)

SentinelOne’s earnings call sounded similar to CrowdStrike’s report. Sales cycle elongation was referenced and the company beat its guidance by a smaller margin than investors have grown accustomed to. It talked up win rates, retention levels and Microsoft displacements and echoed CrowdStrike’s language of its demand pipeline being at record highs.

SentinelOne guided to 8% net new ARR growth for 2023 while CrowdStrike guided to flat to slightly higher net new ARR growth. SentinelOne also guided to at least 50% total ARR growth which bested the CrowdStrike guide of 30-35%. BUT, keep in mind that CrowdStrike is about 5X the size of SentinelOne and didn’t slow to 50% growth as quickly as SentinelOne is expected to (during a hectic 2023).

Their ARR guidance actually fared a bit better than CrowdStrike as SentinelOne isn’t dealing with the same level of multi-phase deployments and the associated ARR delays. Keep in mind, this has been frequent for large enterprises -- which is CrowdStrike’s main niche while SentinelOne’s niche is smaller companies.

If SentinelOne wasn’t so deep in cash burn and dilution mode I may start a small position here. It seems like the 2nd best in the gigantic endpoint space and that position will come with massive growth ahead. But with where it is, I’d need a far easier macro backdrop to start a position like this. There will not even be any EBIT for 2 more years.

Here’s a brief snapshot of SentinelOne’s results:

4. SoFi Technologies (SOFI) – Galileo BNPL Launch

Galileo launched its BNPL product for banks and fintechs this week. The product includes “single-use virtual cards” and loans fully serviced by Galileo and its partners. By offering this product as a white-labeled service through financial entities, Galileo is able to merge the strengths of its own, slick tech stack plus the rich consumer data that legacy banks bring to the table. This will mean a wonderful guest experience without the elevated loss rates that standalone BNPL operators feature vs. other established credit offerings.

It looks like consumers will have to seek out these offers through the actual bank partner apps. Upon approval, a consumer then gets this aforementioned single use card to be used across “most” retailers. Candidly, that is less convenient for the consumer than using something like PayPal BNPL which can be selected directly in the merchant’s checkout flow. Still, PayPal and other BNPL vendors are not banks, and many consumers do prefer to seek out credit like this through their trusted, existing bank vendor. For those consumers, this could be an ideal option regardless of the added layer of friction.

5. Meta Platforms (META) -- November Data & Regulation

a) November Data

Sean Emory on Twitter shared some encouraging data for Meta’s Family of Apps. For the month of November, Instagram was the top global app download -- ahead of TikTok. Not only that, but the download lead for Instagram vs. TikTok was the largest in 4 years. Instagram’s monthly downloads are also at 2X the rate of 2019 levels -- BEFORE the positive pandemic shock. TikTok monthly downloads fell to their lowest level in 2 years while Instagram monthly downloads came in at the second highest number ever… following the record that it set in October. But Meta is dead, right?

This news matters more to me than any anecdotal headline coming from Metaverse developments. This is the cash cow for Meta. It’s how the company generates the funds needed to bet on speculative projects, and it’s how it will win back over the minds of Wall Street analysts.

Thanks for sharing, Sean! Great news.

b) Regulation

Europe seems to be progressing towards legislation that would make Meta ad targeting opt in vs. opt out. This would hurt its ability to target certain users. We’ll see how this shapes up.

6. Progyny (PGNY) – Short Report

I was able to chat with a VP from Progyny about the report. He confirmed a lot of what I sent out earlier in the week and had some more valuable context to add:

On the change in using expected gross margin to historical gross margin to calculate accrued payables:

This did not have any material change on the way the company recognizes accrued payables. The jump in gross margin at that time was from renegotiated contracts with clinics as Progyny gained larger scale and so negotiating leverage. Progyny felt that calculating the metric based on expected gross margin allowed them to calculate clinic expenses owed in more of a real-time manner vs. relying on past data as its gross margin evolved.

Progyny’s independent auditor -- Ernst Young -- specifically reviewed this accrual policy change -- as it does for all newer healthcare service firms -- and found zero issues with it. And think about it: If Progyny were inflating its take rate with sly accounting tricks and under-booking costs owed to clinics to fetch a larger piece of the pie, clinics would immediately be wondering where their portion of revenue was. Considering none of them have left the network, there’s a long line of new clinics trying to join the network, and that this change in language happened a year ago, this argument is weak.

Estimates of accruals are REQUIRED in GAAP accounting. After costs owed have actually been booked, companies will then create a new accounting line item to reconcile estimated accrued payables with actual payables from the period. Progyny’s reconciliation of this item has never led to a material change in payables owed. Its estimates have always been accurate and candid.

On bad debt expense being higher than some other technology companies:

The comparisons to Progyny that the short report used were borrowed from Progyny’s proxy statement were apples and oranges. Progyny uses those comparisons because they compete with firms like Teladoc for talent, not because there is any relation whatsoever in business models. The best comps are the actual fertility clinics collecting revenue for the services Progyny facilitates. According to independent 3rd party research, average bad debt expense for these firms is 5% with anything under that considered good. Progyny’s is under 2% and has fallen YoY. As an aside, this is one of the advantages it brings to its loyal member clinics: A higher portion of revenue collected due to more patient education of costs and treatments via Progyny’s Patient Care Advocates (PCAs)

On the weird PayPal Note:

The author of the report thought it was concerning that PayPal is forcing its employees to switch carriers to continue using Progyny benefits. This is a clear misunderstanding of the Progyny business model. Progyny attaches to carriers and integrates intimately with them to offer benefits on a pre-tax basis. Progyny can only provide services to clients through their overarching carrier. PAYPAL SWITCHED CARRIERS THIS YEAR… so of course its employees had to switch too.

My take:

The report is a giant nothing burger. I won’t be selling any shares.

7. Match Group (MTCH) – CFO Gary Swidler Interviews with Morgan Stanley & Barclays:

On Macro Trends & Guidance:

There has been no notable worsening or improvement to macro trends vs. what Match assumed in its previous guidance offered on the last call.

For the 2023 outlook, Match is assuming zero macro improvement and a “tough first half of the year” to arrive at its 5-10% revenue growth guide. All it would take is a continued weakening of the U.S. dollar to offer a meaningful tailwind to that forecast. Furthermore:

Match is assuming quite conservative uptake for the new Hinge subscription tier and Swidler sees “more 2023 upside there than downside” with a clear path to surpassing its expectations.

Match is also assuming modest international success for Hinge while traction in the markets where it has launched is surpassing expectations to date.

The guide assumes no recovery in Japan.

The guide assumes modest success from the new Tinder team which -- per Swidler -- is “firing on all cylinders.”

Finally, the guide assumes the frothy ad market remains throughout 2023 and so Match cannot spend as much as it wants to on acceptably profitable growth. They’re already seeing signs of rates coming down and every indication is that the trend will continue for now. There will likely be more productive marketing dollars to spend but it’s assumed that doesn’t happen for the time being.

2023 expectations are to maintain or expand operating margins and this does not rely on any App Store regulation relief.

Translation? I expect guidance to be materially raised for 2023 at some point as long as the world is anything but a worst case scenario for Match. I really like that setup.

“We wanted to make sure the 5-10% growth is easily attainable with upside if the bigger, more complex shots on goal are executed on.” -- CFO Gary Swidler

On Tinder:

Match will borrow marketing dollars from other more mature brands to try to reshape the Tinder narrative from the “hookup app” label it currently has in 2023.

A key focus will also be on improving the female experience by giving them more flexibility and personalization.

On Hinge:

Following successful launches in Germany, Switzerland and a few other European countries, Hinge will launch in Spain, Italy and France next year.

Asia expansion is planned for 2024.

Hinge is seemingly overcoming all macro headwinds with its superb momentum. That’s partially due to the relatively affluent demographic it caters to as well as the product’s resonation with the world.

“We’ve seen great organic traction as we enter markets which is successfully driving user growth. The product is resonating in all of the markets we are expanding into.” -- CFO Jacob Shulman

On Buybacks:

“We’re comfortable with our leverage ratios. We think the stock is attractive at these levels, so we’ve been betting on ourselves.” -- CFO Jacob Shulman

Match is exploring other, small M&A opportunities as private market valuations shrink. It’s especially interested in making purchases within its core dating app niche in Southeast Asia.

8. JFrog (FROG) -- CFO Jacob Shulman Interviews with Credit Suisse

On Macro:

JFrog’s enterprise niche (85% of the Fortune 100 are its customers), as well as its reliance on revenue expansion vs. new client growth insulates it from macro pressures currently faced by countless other firms. Still, it isn’t immune, and it is dealing with some lengthened sales cycle and cloud usage optimization impact. That’s why it didn’t raise guidance *even more* last quarter.

On Competition:

The source code players like GitLab and GitHub are building binary repositories that will directly compete with JFrog. JFrog is confident that it’s “by far the leading vendor in the space.”

In terms of relationships with public cloud providers, there’s “no change in the competitive dynamic. This confused me a bit considering Microsoft owns both Azure and GitHub.

On Future M&A to fortify its security capabilities:

“As we try to build end-to-end security capabilities we’ll use our cash for M&A. We still see a large gap between public and private company valuations so for now we continue to work on our wish list. When the time comes, we’ll use that firepower.” -- CFO Jacob Shulman

The advanced security launch from earlier in the year is merely step one in rounding out its end-to-end security capabilities (thanks to the Vdoo M&A). This pushed it from solely a software composition analysis tool to other use cases like authorization controls and more.

It has $434 million in cash and equivalents and no debt.

9. Olo (OLO) – Case Study and New Brands

a) Case Study

Portillo’s and its 70 locations added its 4th Olo module, Olo Serve, to replace its custom front-end software with Olo’s for better on-premise dining experiences. The results are encouraging:

Doubling cart conversion.

Larger average ticket size.

Faster checkout.

b) Two New Brands

Olo also added two small brands this week equating to about 23 new locations. Each brand landed with 8 modules (more than 3X an average client) including Olo Pay.

10. Cannabis News:

Once again, excitement surrounding cannabis banking reform has fizzled out. I’ve said it before and I will keep saying it: Reform is inevitable, but riding the regulatory waves of emotion is not productive. Let’s get excited once something is actually signed.

New York is beginning bicycle deliveries of cannabis.

Connecticut will begin recreational cannabis sales next month.

11. Macro:

a) Economic News from the Week

Purchasing Managers Index (PMI) & other Inflation Data:

S&P Global Composite PMI was 46.4 vs. 46.3 expected.

The services PMI was 46.2. vs. 46.1 expected.

Institution of Supply Management’s (ISM) non-manufacturing PMI was 56.5 vs. 53.3 expected.

Employment & Consumer:

ISM’s non-manufacturing employment was 51.5 vs. 49.1 last month.

Initial jobless claims met expectations.

Michigan’s Consumer Expectations and Sentiment levels remain very depressed but slightly higher than expected.

Producer Price Index (PPI) & other Inflation Data:

The month over month (MoM) PPI rose 0.3% vs. 0.2% expected.

MoM Core PPI (strips out food & energy) rose 0.4% vs. 0.2% expected.

Michigan’s 1 year inflation expectations were 4.6% vs. 4.9% expected.

The U.S. Dollar continued to cool from recent highs.

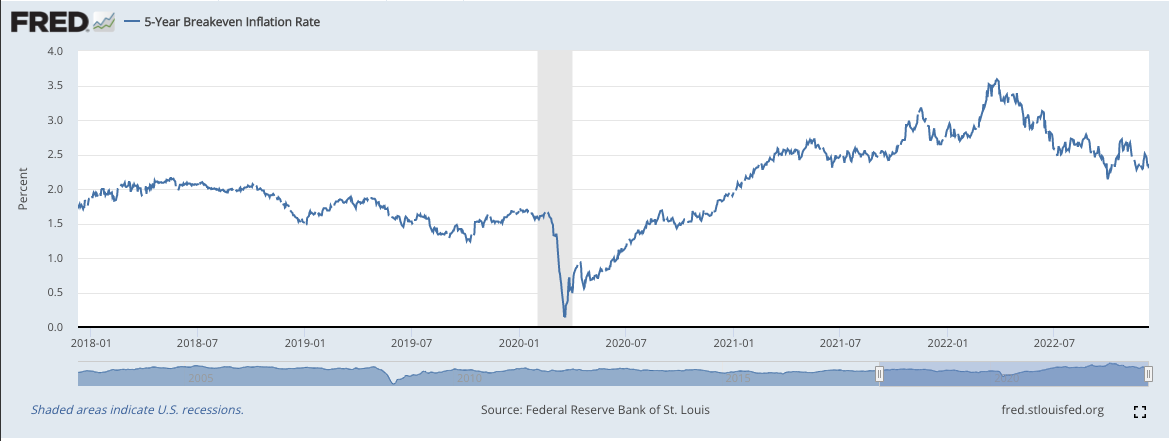

5-year breakeven inflation rate:

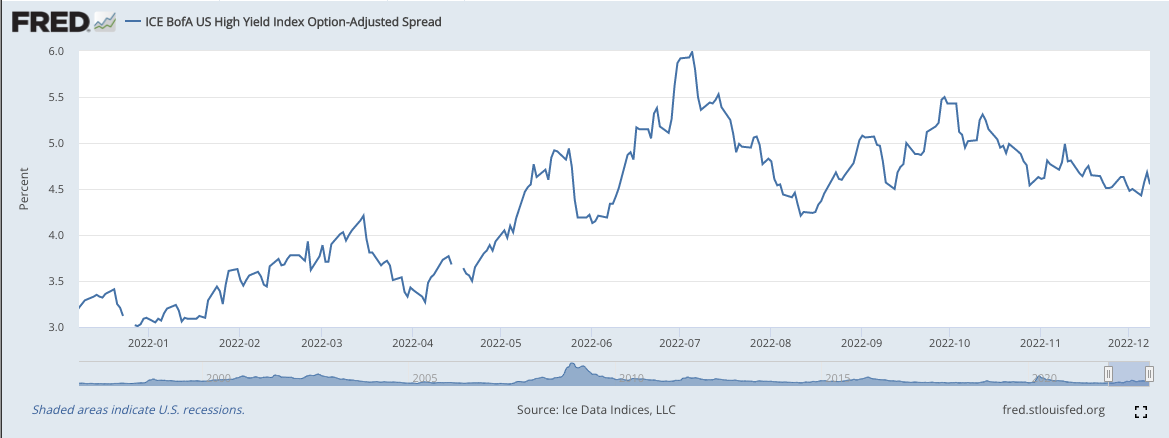

High yield option adjusted corporate credit spreads (lower is better):

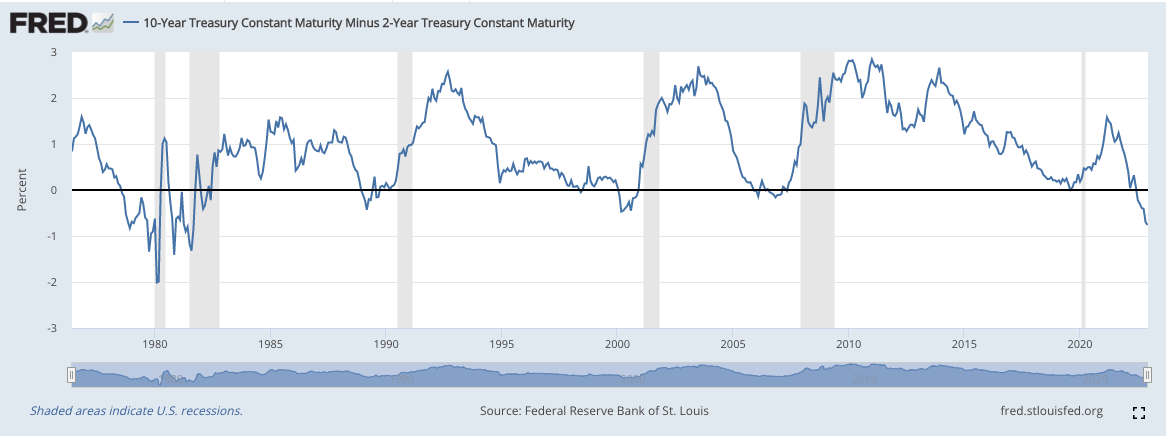

The 10-year, 2-Year Yield Curve is more inverted than it has been in about 40 years:

b) Market News from the Week

Amazon launched a TikTok style video feed.

Texas banned TikTok for state agencies.

The Federal Trade Commission is suing to block the Microsoft purchase of Activision Blizzard.

Disney launched its new ad supported streaming tier.

c) Level-Setting the Data

This week was a win for the macro hawks. Inflation data was slightly negative while economic activity data was slightly positive. Still, all forward looking indicators for inflation are cooling quickly and most of the economic data we have points to continued weakening.

One PPI data point does not make a trend, but if we get a string of inflation prints that cool less rapidly than expected, it could delay my expected timeline for the hawkish pause. The inflation peak is almost definitely in, but now the pace of the fall needs to be brisk enough to force the Fed to pay more attention to economic cracks forming than inflation. I still see that happening in the first half of 2023, but more negative data points could always change that.

12. My Activity:

I liquidated Penn Entertainment this week for a small gain. I haven’t loved some of the decisions that management has made amid this economy recently (property expansion and buyback aggression is a bit misplaced in my view). Furthermore, Barstool Sportsbook market share across states hasn’t found the type of consistent upward momentum that I was expecting. So? The investment became more about a brick and mortar regional casino company and less about its digital media assets than I wanted. BUT: There’s nothing glaringly wrong with the investment. The main reason for the move was to allocate to higher conviction names and to top off the cash pile.

My cash position is now 16.6% of holdings. Positive CPI data later this month would still prompt me to deploy a large chunk of my remaining cash… we’ll see how that shakes out.

This week I added to:

Shopify

Revolve

Lululemon

Match Group