News of the Week (February 14-18)

Upstart; CrowdStrike; The Trade Desk; Teladoc Health; JFrog; PayPal Holdings; Meta Platforms; The Boeing Company; Cannabis News; My Activity

1. Upstart (UPST) — 10K Wrap-Up + Encouraging Analyst Revisions

a) 10K Wrap-Up

Upstart reported earnings and a link to my review of the results can be found here. The company waits to publish some key information until it releases its SEC filing, which happened yesterday. Here were the highlights:

Upstart’s 2021 take rate expanded from 5.81% to 6.17% year over year (YoY). The take rate expansion is direct evidence that Upstart’s growing value proposition is justifying a larger and larger piece of the profit pie; its admirable performance throughout rapidly changing macroeconomic environments is a big reason for this.

Take Rate Definition: (referral fees + platform fees) / total volume

We’ve seen other players in different pieces of consumer credit lower their take rates to fend off competition in recent months. Upstart has not had to follow suit.

Note: In the future, more of Upstart’s overall revenue will be coming from its blossoming auto business which means lower up-front referral and platform fees and higher revenue from interest. This will lead to Upstart’s average fee take rate falling. That’s not a good or bad thing, but is simply an interesting difference in how each product generates revenue.

Hopefully, Upstart soon splits the auto and unsecured businesses into different disclosure segments so that we can evaluate the take rates for each individual product.

Between interest and fee revenue, Upstart expects its auto business to carry a similar margin profile to its unsecured product in the coming years. It will, however, take time to get there.

From a partner concentration risk perspective, Cross River Bank (CRB) (Upstart’s main capital market originating conduit) originated 55% of Upstart’s 2021 loans vs. 67% in 2020. Similarly, CRB accounted for 56% of total Upstart revenue in 2021 vs. 63% in 2020. Finwise Bank (FB) — its other major originating conduit partner — is picking up this reduction in CRB volume. It accounted for 36% of Upstart’s 2021 volume vs. 24% YoY and also represented 27% of Upstart’s 2021 revenue vs. 18% YoY.

While concentration risk is never preferred, it does not bother me in this case. Why? CRB and FB are not performing a particularly unique service. They’re merely originating loans for a small cut which takes very little work and requires very little balance sheet risk. If CRB or FB were to ever end this economically easy and efficient agreement, they should be easily replaced.

The more pressing concentration risk (in my view) comes from one of its traffic partners — Credit Karma. This entity funnels a lot of demand to Upstart.com and is now owned by deep-pocketed Intuit. In the past, Upstart had disclosed the percentage of traffic coming from Credit Karma, but it did not do so in the annual filing. CFO Sanjay Datta has told us that this concentration was boosted amid the pandemic via many loan players halting operations. Upstart and Credit Karma did not, which left Upstart with less traffic partners to lean on. This disclosure removal could be a sign of the risk diminishing as “direct to Upstart” channel growth has outpaced partner channel growth over the last several quarters. At this point, we just do not know.

From a 2021 funding source perspective, Upstart’s loans were funded by institutional investors 80% of the time with its lending partners retaining 16% of loans and Upstart assuming the remaining 4% for itself. This compares to 22% funded by partners, 76% funded by capital markets and 2% funded by Upstart in 2020. Investors should prefer to see partners retaining a larger portion of loans over time — so this is not ideal. Section 6 of my Upstart Deep Dive explains the somewhat complex reasoning behind this partner retaining preference in detail and can be found here.

Encouragingly, in the company’s most recent quarter, its proportion of total volume re-purchased to sell through capital markets actually fell to 69% vs. 76% over the first 9 months of the year. This marks an encouraging and sharp pivot. I will be looking for partners to retain a larger and larger portion of Upstart-sourced loans going forward. I’d also like to see the 4% of loans retained on Upstart’s balance sheet prove to be a peak for the company — I want that at 0% ideally.

b) Analyst Revisions Post Earnings

Following Upstart’s strong quarter, forward average analyst revisions per Koyfin continue to rise:

Analysts’ 2022 revenue estimates rose 14.8% to $1.39 billion, 2023 revenue estimates rose 17.3% to $1.83 billion and 2024 revenue estimates rose 11% to $2.61 billion.

Analysts’ 2022 EBITDA outlook for Upstart actually fell by 4% as the company leans into auto and other growth projects. Conversely, 2023 EBITDA estimates rose 3.6% to $344 million while 2024 EBITDA estimates rose 58% to $605 million.

Analysts’ 2022 earnings outlook rose 3.1% to $2.30. 2023 and 2024 earnings estimates also rose 12% to $3.10 and 57.6% to $4.65 — respectively.

Just one year ago, analysts expected Upstart to generate $0.57 in 2023 earnings. The company generated $0.89 in its Q4 2021 ALONE with 2023 estimates now at $3.10 (443% higher than twelve months ago). The degree of these beats and upward revisions is not normal for most public companies but has become common for this unique compounder.

2. CrowdStrike (CRWD) — 2022 Global Threat Report

CrowdStrike released its 2022 Global Threat Report — here were the highlights:

62% of hacks use no malware which supports CrowdStrike’s broadened mission of stopping breaches and not just malware.

CrowdStrike’s OverWatch (the managed detection team) observed a 45% rise in intrusion campaigns in 2021 vs. 2020.

2021 saw an 82% rise in ransomware-related data leaks with large spikes seen across every single industry.

21 new state-sponsored and independent adversaries were named.

E-crime continues to dominate intrusion activity at 49% of all intrusions overall vs. 52% YoY. Targeted intrusions (not searching for vulnerabilities broadly but attacking a specific entity) rose to 18% of activity vs. 13% YoY.

The takeaway is both encouraging and unsurprising for CrowdStrike — cybercrime continues to proliferate. It will continue to be a tide that lifts all boats in the sector and CrowdStrike is among the best-positioned to benefit in the cloud workload and endpoint pieces of the booming industry.

3. The Trade Desk (TTD) — The Super Bowl & More

Nielsen announced that 11.2 million viewers streamed the Super Bowl vs. 5.7 million YoY. It’s not clear if these metrics are 100% apples to apples, but it’s impressive growth regardless. iSpot — another company NBC uses for measuring viewership — reported even higher numbers and also revealed that 70% of viewers were cord-cutters.

In the series of dominos to fall throughout the evolution away from linear and towards connected TV (CTV), live sports shifting to our streaming services was perhaps the final blow to legacy viewing methods. Nearly 90% of the most watched shows in the United States are live sporting events — and so these events moving to services like Peacock, ESPN+ and Paramount+ should accelerate cord cutting further.

Considering CTV is The Trade Desk’s largest and fastest growing segment, this should be yet another tailwind fostering more growth. Furthermore, Google’s and Apple’s privacy changes have no impact on The Trade Desk in this CTV environment — the bigger the segment gets the more insulated The Trade Desk becomes from its competition. Yes, the company’s vast base of partner and training data makes it a fierce competitor regardless, but this still surely helps. I like tailwinds.

The company also reported earnings this week. Click here for my summary of the report.

In other TTD news, the company released its annual filing on Wednesday which revealed that it ended 2021 with 980 total clients vs. 875 YoY. Additionally, in 2021 it had three clients (which are agencies serving hundreds of advertisers) that represented 41% of its total receivables vs. four clients representing 51% of its total receivables in 2020.

Click here for my Deep Dive into The Trade Desk’s Business.

4. Teladoc Health (TDOC) — Chronic Care Launch & a Primary360 Update

a) Chronic Care Launch

Teladoc debuted a new product called “Chronic Care Complete” tailored to chronic care management for patients with more than one condition (representing 1 out of 3 adults on Planet Earth). The product leverages Livongo’s monitoring capabilities with enrolled members receiving connected gluccometers, blood pressure cuffs and a dedicated Chronic Care Professional coach to set and meet goals. The new product will also lean on Teladoc’s broad healthcare professional relationships to create the company’s most comprehensive chronic care product yet. This network will ensure the firm provides actionable solutions to go along with all the data members will be equipped with. It’s one thing to empower consumers with information and it’s another to connect that information to the very best next step.

“Take, for example, a member newly diagnosed with diabetes. They are not only relying on monitoring and coaching as they learn to live with their new diagnosis but will receive physician support for determining appropriate medications and adjustments, as well as mental health support for dealing with a potentially life-changing diagnosis.” — Teladoc Chief Product Officer Donna Boyer

These chronic conditions equate to an astonishing 90% of all healthcare spending, marking an opportunity for Teladoc to deliver desperately needed efficiency and value while enjoying a powerful growth lever to pull. Per GoodRx’s (GDRX) S1, an estimated 3 in 10 emergency room visits can be avoided with better access to primary and preventative care. This product could work wonders in enhancing access to care before the issues turn in to costly, deadly ailments.

In Teladoc’s journey to differentiate itself amid a swarm of commoditized competition — whole person care is the path that it’s taking. This requires creating a wide breadth of actionable primary, chronic and mental care solutions in a virtual setting. (Livongo made this possible and is why the company spent so much to acquire it)

As a reminder, Piper Sandler recently came out with a note revealing slightly underwhelming chronic care enrollment in Q4 2021 for Teladoc. Hopefully, this product launch will help going forward.

b) Primary360 Update

Teladoc shared some interesting information with Business Insider on its next-generation virtual primary care product — Primary360. This product aims to deepen the utility and breadth of service that can be enjoyed in a more efficient and affordable virtual primary care setting. This is nothing short of vital for combatting our world’s pressing doctor shortage.

Within Primary360, each patient is assigned a primary care doctor, nurse and medical assistant to guarantee timely, personal consultation. These professionals can also refer patients to other pieces of Teladoc’s offering like chronic and metal health. This deeper presence unlocks broader value creation and more lucrative employer contracts plus more cross-selling abilities for the company.

Here were the highlights from the report:

Member satisfaction sits at an elite 98%.

Primary360 enrollment has doubled internal Teladoc expectations to date.

25% of Primary360 members with diabetes and hypertension were new diagnoses. Earlier detection is a core driver of both consumer health and care unit economics.

This is a key enabler of Teladoc’s value proposition — unlocking earlier detection through broader access.

Half of Primary360 members use 2+ services.

Teladoc has signed 50 health plans and employers to Primary360 which includes 11 Fortune 500 companies like Dollar General.

New patients are seeing their assigned physician in less than 7 days vs. 56 days in several key markets according to Merritt Hawkins.

Patients receive an average of 50 minutes of hands-on consultation in these new visits.

The Teladoc employee who was interviewed by Business Insider reiterated the company’s plans to shift to value-based care pricing.

This variable costing system will allow Teladoc to turn its deeper value creation into commanding a larger chunk of the overall profit pie.

CVS has seen “hundreds of thousands of members” sign up for Primary360 this year.

“Another insurer” (probably Centene) is seeing enrollment “exceed expectations” with 3/4 of its new sign-ups being brand new to Teladoc despite being eligible for previous products.

Primary360 is planning to add the following “last-mile” features to merge virtual and physical care settings:

At home vaccinations via clinics

Preventative screenings

Home script delivery

Broader measurement of vitals

5. JFrog (FROG) — Investor Day

a. CFO Jacob Shulman

JFrog’s customer acquisition cost payback period for 2021 was 17 months vs. 16 months in 2020 — a slight worsening but still very (very) strong.

On JFrog’s client list and revenue contributions:

85% of the Fortune 100 uses JFrog which represents 15% of its business.

45% of Fortune 500 uses JFrog which represents 20% of its business.

30%+ of the Global 2000 uses JFrog.

“We continue to believe we can meaningfully expand within our existing customer base and that we haven’t penetrated more than 20% of the opportunity with our biggest customers.”

Roughly 36% of JFrog revenue is coming from its enterprise+ solution (full product suite) yet less than 5% of customers have adopted this solution. It believes more than half of its customers will adopt this newer solution overtime — this will be a core revenue driver.

On long term targets:

An 80% gross margin (vs. 84% today).

A 23% operating margin (vs. 2% today).

A 30% free cash flow margin (vs. 21% today).

Roughly 130% net dollar retention rates (stable).

Over 30% growth “for the foreseeable future.”

If these forecasts are met through the end of 2025, then we could see JFrog generating $175 million in free cash at that point in time. If we were to plug in a cash flow multiple of 30X, we would be left with a $5.3 billion company ($63 per share) for a compounded annual return of 27% annually in the 4-year period. Things could ALWAYS go wrong, but that’s where the company can realistically be if it executes.

Analysts seemed to like this forecast based on 2024 average revenue estimates rising 8.7% to $462 million vs. before the event.

In 2020, 60% of JFrog’s new customers were self-managed vs. using its software as a service (SaaS) offering. In 2021, it flipped to 58% SaaS and 42% self-managed as JFrog’s free-tier product drove cloud adoption which is higher margin and features a much longer growth runway for the company.

DevOps is set for a brisk 9% compounded annual growth rate (CAGR) to reach a $40 billion market over the next 6 years. When adding security into the mix, the total addressable market (TAM) will be more like $57 billion. This does not contemplate JFrog’s future internet of things (IOT) focused products.

b. Co-Founder/Chief Technology Officer Yoav Landman

On what binaries are:

“Developers write source code which is merely a text file that cannot be used in runtime. Through a process called compilation this source code is converted to another file format which is a binary that can be run. Applications are not made up of just one binary, but thousands. You create an application using all of these binaries and that is what you deploy to be run on an iPhone or some other device… So when we talk about the software update flow it’s really powered by a flow of binaries.”

“Binaries are used in the production and deployment environment, not source code.” — Vdoo Co-Founder and JFrog Head of Security Nati Davidi

On Artifactory:

“The goal of Artifactory is to be able to know exactly what ends up in a software package and any updates. People refer to this as the software bill of materials (SBOM). This is just an itemized list of everything that exists in the final package. It’s all about creating a secure bill of materials across a package’s journey. This is what Artifactory provides and enables.”

Explaining JFrog’s product suite in action:

This presentation was nearly 4 hours long. If you’re going to watch 5 minutes of it, I’d highly recommend going to minute 51:50 through minute 56:00 for a condensed overview of the product suite. Click here for the link.

c. Co-Founder/CEO Shlomi Ben Haim Key Note

“JFrog is the only end-to-end manager of binaries to achieve trusted, liquid, automated software updates.”

On the Binaries Niche & Competition:

“No matter where you operate within the modern software supply chain industry, everything you do will go through the binary repository. Binaries are the center of gravity for the modern software supply chain. JFrog is too integrated to fail as every player in the landscape must access the binaries and meta data which means integrating with us.”

Note that Binaries are also called software packages, artifacts and sometimes containers as well. The Log4j software pandemic (and every other major breach in 2021) came from a vulnerable set of binaries. Reliable binary deliverance and protection is imperative.

The cloud vendors — which are great partners — actively co-market with us. They still provide developer solutions but when you need a multi-cloud, hybrid, end-to-end solution these offerings are not enough.”

“We must ask ourselves if you can really implement end-to-end software supply chain management with source code. And the answer is clearly no — you don’t have to ask me just ask developers. Source Code is important for developers and their security. Everything that happens post compilation (of source code to binaries) and all the way to production and deployment requires binaries for effective enough scale. Developers are using source code and it’s very important — but it’s complementary to a binary-based platform.”

On JFrog’s Platform:

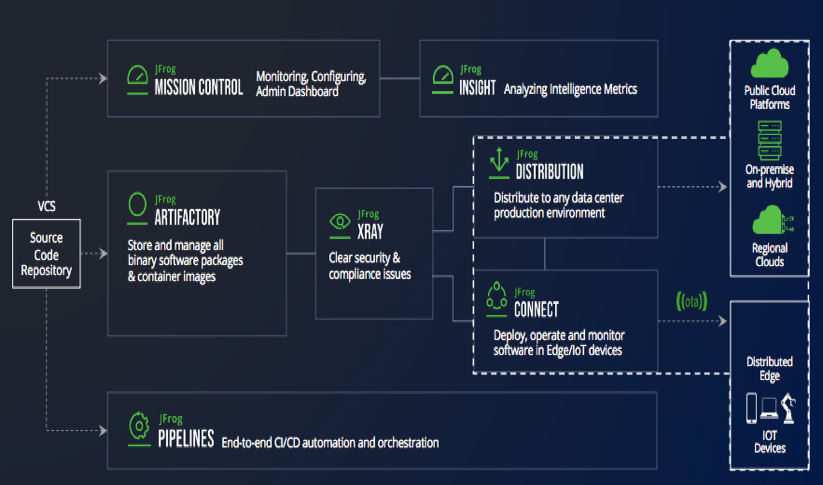

JFrog offered an awesome graphic outlining its various modules and how they feed into each other to power continuous software management, security and release. It all begins with source code and is transformed into binaries (1s and 0s) to be seamlessly stored with immense scale. Once that transformation occurs, JFrog handles the rest. Here’s the visual:

“The Artifactory database is where companies store everything that will eventually be run. X-Ray scans for security and compliance issues. Distribution takes the packages pre-deployment to prepare them for runtime (the time a program is actually running on a server or device) deployment. JFrog Connect (previously called Upswift) takes the binaries straight to the devices.” — CTO Yoav Landman

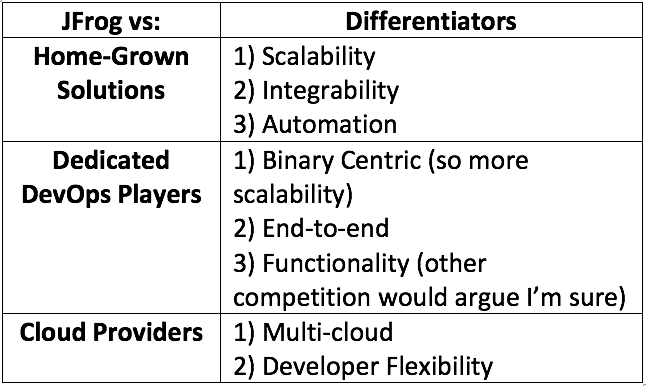

On why customers choose JFrog:

“Most of our new business comes from replacing home-grown solutions.”

d) Notes from Founder of Vdoo (now called JFrog Connect) and Head of JFrog Security Nati Davidi

On attacks and binaries:

“Binaries are what the attacker is reverse engineering to identify vulnerabilities and gain access, not source code. The 4 largest attacks of 2022 were all distributed as a binary, not as source code. This means binaries MUST be analyzed, monitored and protected to protect organizations using software. A binaries approach to software security is the common ground to protect the developer’s compiled source code as well as the enterprise and security teams using and controlling the software.”

On JFrog Connect:

“We are pioneering malicious code detection. We are the first to create an ability to locate malicious packages introduced into your firm’s software ecosystem. We are doing this in a fully automated manner… we were able to find another 2 packages in addition to the Log4j that were in the same level of ubiquity. We found it and otherwise it would have been exploited. We prevented another Log4j from happening and we will keep doing just that.”

“Zero day vulnerabilities — unknown vulnerabilities — are the holy grail for attackers as they can be exploited for long periods of time without detection. All major 2021 attacks were 0 days.”

On selling to JFrog:

“We are extending our security capabilities across the entire software supply chain. From the developer to the device. Only by doing continuous examination of binaries can we achieve true software security. That’s why we were excited to join JFrog. Selling a successful start-up and going the combined route was a tough decision. From the moment we began talking, we realized this comprehensiveness is what will replace the many other point solutions in the market.”

6. PayPal Holdings (PYPL) — Crypto Fees

PayPal and Venmo are altering their fee structures. For smaller transactions, PayPal’s new tiered fixed-fee arrangement will greatly boost its take rate from crypto transactions while keeping these rates effectively the same for larger transactions over $200.

Per Washington post, Venmo’s cryptocurrency wallet is the 3rd largest in the world with 18% market share and PayPal’s digital wallet is number 1 in the category. Any pricing power here could work wonders in juicing PayPal’s overall take rate and allowing its total payment volume (TPV) to flow more directly to revenue and down the income statement. In the company’s most recent quarter, it reversed a multi-year trend of take rate compression — this was largely attributed to Venmo’s product suite maturation.

7. Meta Platforms (META) — Horizon’s Early Results

Meta Platforms (formerly Facebook) has seen its Horizon Worlds VR platform 10X its user base to 300,000 since December. This is still a microscopic piece of Meta’s business, but the segment needs to walk before it can run and that’s certainly happening thus far.

8. The Boeing Company (BA) — Insider Buying & the 787

A Boeing Director purchased $1 million in new company stock to triple his overall stake. Steve Mollenkopf — another Boeing director and former Qualcomm CEO — also purchased a small piece of stock this month to raise his stake by 42%.

This week, the FAA publicly stated that it won’t allow Boeing to certify its own new 787 units and that the company needs a “systemic fix” to resolve the 787’s issues. Two things remain true: the odds of Boeing succeeding within a supply-constrained global duopoly are high and also it needs to execute better and more consistently.

“They’ve got to produce the quality on their production line that we’re looking for and that they’ve committed to.” — Outgoing FAA Admin Steve Dickson per Reuters

9. Cannabis News

a) Industry news — Mainly per Marijuana Moment

New York’s Senate passed legislation to allow hemp producers to grow THC-containing cannabis. This is on a temporary basis and is in preparation for its recreational program debut.

Delaware, Missouri, South Dakota, Kentucky, Hawaii, New Hampshire, Wyoming and now Alabama continue to work towards cannabis legalization bills.

Virginia is working towards recreational legalization as well.

The Mayor of Washington D.C. signed into law a bill to allow the elderly to access medical cannabis with no physician permission.

Most voters in the deeply conservative state of Arkansas support cannabis legalization.

b) Company-Specific News

Ayr Wellness Closed its Levia Acquisition. This is the largest THC-infused beverage brand in the nation.

In recent weeks, Ayr Wellness has consistently set new THC sales records in Florida. Its competition is seeing flatter THC sales growth in the state over the same period.

10. My Activity

I added to my stakes in GoodRx, Teladoc Health, PayPal and SoFi Technologies during the week. My cash position is now 10.0% of total holdings.

So great Brad. Thank you very much for your insightful and generous commentary.

Thanks to yours weekend articles, I don't have to follow companies that we both own that much :)