News of the Week (February 22-25)

Upstart; SoFi Technologies; Lemonade; Olo; Revolve Group; Teladoc Health; Ozon; Cannabis News; My Activity

If you enjoy reading this, please feel free to share it wherever you’d like.

1. Upstart (UPST) — My Interview with KBRA Senior Managing Director and Head of Consumer ABS Eric Neglia

a. On why a few of Upstart’s most recent capital market transactions are not beating Kroll base case CNL expectations:

“KBRA started working with Upstart while they were in the early stages of developing their credit scoring models. Given the limited performance data available at that time, we built conservatism into our CNL assumptions. As more performance data became available over time and the company developed an operational track record, we lowered our loss expectations to be more in line with that data.”

(Note: lower loss expectations are a good thing)

When firms feature little data to prove efficacy, Kroll takes a cautious approach to base case assumptions (like it should). As a newer company proves itself, these layers of conservatism are removed to reflect a more data-driven expectation. This process played out with Upstart and is why its newest transactions aren’t outperforming KBRA CNL base case assumptions by such wide margins like before. This is a matter of KBRA estimates becoming more data-driven and accurate, not a matter of Upstart’s loan underwriting abilities deteriorating.

“We want our base case CNL assumptions to accurately estimate the lifetime net losses of a collateral pool. Since Upstart’s AI credit models weren’t in place long enough to show performance data through the life of a loan or through full economic cycles, KBRA supplemented that data with proxy performance data for comparable consumer loan and marketplace lending programs to help derive and validate our base case loss assumptions.”

These proxies are actively being phased out of KBRA’s modeling as Upstart scales.

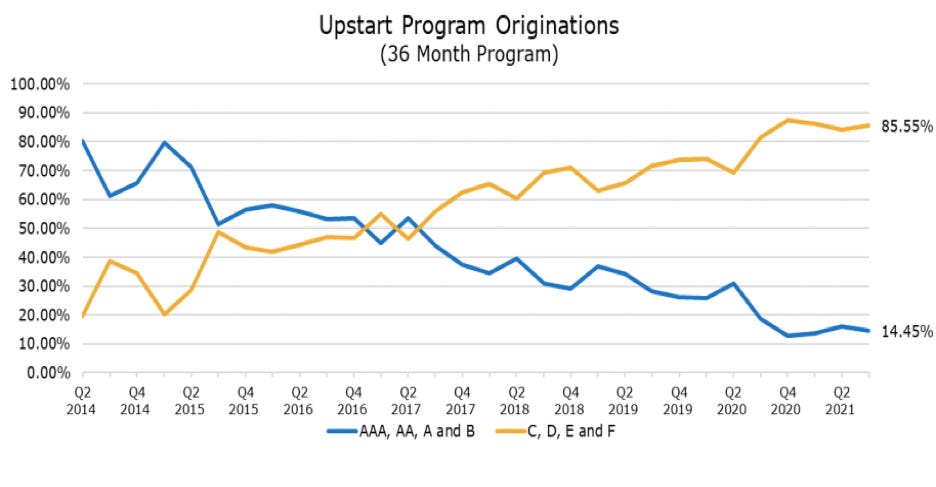

b. On Upstart’s Credit mix shift being the reason for rising delinquency:

“In Q2 2017, Upstart began shifting their program’s origination mix to include longer term loans and to borrowers with lower credit grades… Higher delinquencies and losses are expected as a result of these pool mix changes… Credit grade E & F loans represented approximately 25% of the 2020-ST3 securitization. A year later, the E & F loans represented 49% of the 2021-ST3 collateral pool balance. To account for this mix shift, KBRA’s expected closing CNL increased from 15.90% to 19.30%. Both of these transactions are performing better than KBRA’s expectations to date.”

Credit mix as the reason for rising delinquencies means lenders and loan investors are compensated via higher interest payments. He highlighted the same credit mix charts I’ve been talking about to prove his point:

“The actual performance trend against expectations is most important. If you just look at total delinquency charts all you can see is that delinquencies are rising. Delinquency rates have increased on recent securitizations, however, so have KBRA’s loss expectations due in part to pool mix changes. Nothing is outside of our expectations at this point.”

“As shown in our recent surveillance report, KBRA lowered its loss assumptions for all Upstart term securitizations during the most recent review, except for 2021-3 which is only five months seasoned, and all 2020 pass-through securitizations.”

c. On the weird macroeconomic back-drop:

“Strong loan performance seen in consumer since mid-2020 has been influenced by a number of factors including widespread borrower assistance programs and several rounds of government stimulus. As Upstart and other platforms develop their models, it’s important for them to account for the impact of that stimulus.”

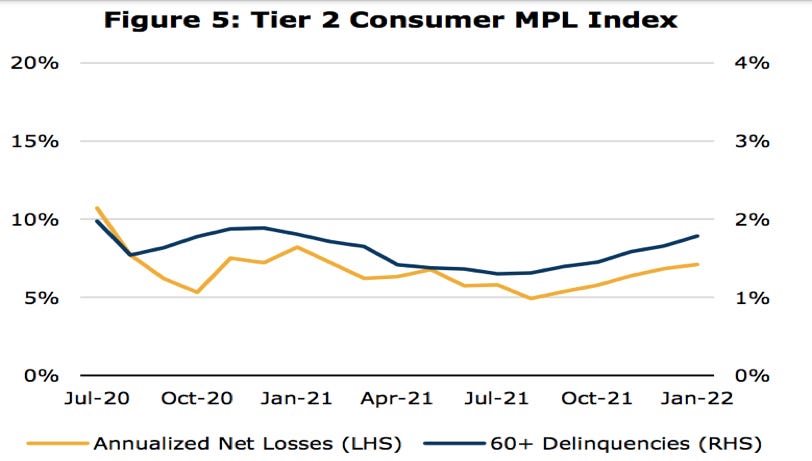

He highlighted KBRA’s consumer loan index report from January 2022 for tier 2 specifically (which is where Upstart resides) to support this point. As we can see from the image below, net losses have risen by roughly 50% from the stimulus-aided lows:

As a reminder, rising delinquency is priced into Upstart’s forward guidance (which vastly outperformed expectations).

d. On Upstart’s Performance:

“Upstart’s credit scoring model has demonstrated an ability to rank-order credit risk and predict the probability of default. To date, credit performance has generally been in line or better than KBRA’s initial expectations.”

The theme of this section of the interview was promises made, promises kept. Upstart’s bold claims are proving themselves in the results and data they’re delivering. It’s one thing to say you’re better… it’s another to show it.

Click here for my Upstart Deep Dive.

2. SoFi Technologies (SOFI) — M&A & Better Banking

a. Technisys Acquisition

SoFi is acquiring a banking technology platform called Technisys for 84 million shares of its stock representing a value of $1.1 billion based on volume weighted pricing ($890 million based on SoFi’s current price). This combined entity will create “the only end-to-end vertically integrated banking technology stack, from user interface capabilities to a customizable multi-product banking core.”

From a consumer perspective, Technisys will allow SoFi to upgrade its user experience (UX) to truly make it best in class. In recent interviews, CEO Anthony Noto has told us he thinks SoFi is close to this ambition, but not yet there. This acquisition should bring them a large step closer.

Galileo (SoFi’s business to business software provider) was already a Technisys partner as the two were actively developing a lending-as-a-service product for Galileo’s clients before the deal. That will continue. Interestingly, Technisys serves several legacy banks which marks SoFi’s accelerated entrance into that space and also serving “non-financial enterprises.”

Beyond a slicker UX, this will also allow SoFi to circumvent and pocket 3rd party servicing fees from its consumer business to enhance its unit economics further. That is due to SoFi’s plans to use Technisys’ platform to power its banking, credit and other new products (and the UX) while Galileo powers payment processing. All of SoFi’s products will be run on these two platforms by 2025. SoFi currently uses two legacy 3rd party providers for checking and savings plus an entirely separate software provider for credit. The vertical integration will save the company roughly $65 million annually (or 6.5% of its current revenue) in the years to come. In a largely commoditized banking world, cutting costs is vital as it means a company can profitably differentiate via passing savings on to the end consumer.

Galileo will also get a large boost via benefiting from bundling all of Technisys’ added utility into its offering. Technisys will be able to tap into Galileo’s elite client roster and benefit from cross-selling as well.

“We’ll have one stack for every consumer product vs. disparate stacks for each offering which is cumbersome, inefficient and expensive. The vast majority of Galileo’s partners want to offer lending, credit cards, rewards and many other products but they can’t extend their current core. Building separate cores for each new product risks the same siloed issues we see in legacy banks.” — SoFi CEO Anthony Noto

This single, internal technology core will also empower SoFi to innovate and iterate with more speed and personalization. In the company’s quest to build the industry standard for consumer digital banking and the software that powers it, this purchase greatly helped in both areas. Despite the dilution, I am a fan.

Additional Technisys notes:

Technisys is expected to add $500-$800 million in “high margin” cumulative revenue through 2025.

The purchase also gives Galileo an immediate presence in 16 additional countries including Chile and Brazil.

Galileo and Technisys will practice a “joint go-to-market” approach where each’s utility is used to grow the value and reach of the other.

Technisys is part of the Banking Industry Architecture Institute’s “Coreless Bank Initiative” to create compliant software for modern banking infrastructure. JP Morgan, Citi, Technisys & more are part of this initiative.

Technisys is enjoying accelerating growth and will post around $70 million in 2021 sales.

SoFi expects to generate a “mid-teens” internal rate of return (IRR) on this purchase through 2025 without considering any of the synergies expected.

Importantly, Miguel Santos will continue as CEO of Technisys and the platform will be run under SoFi’s umbrella as an independent platform -- just like Galileo.

Technisys has 60+ partners including legacy banks, neo-banks and non-financial firms vs. Galileo having slightly over 100. Technisys features a market place to seamlessly plug into other technology vendors like Plaid, Okta, Salesforce, several credit bureaus and more.

“With Technisys, we are acquiring a rare strategic asset that we believe is the best next-generation technology. Every multi-product financial services company — old and new — will need to transition off of older banking cores to cores like Technisys to keep pace with the rate of innovation it can provide... or risk being left behind.” — SoFi CEO Anthony Noto

b. Better Banking

SoFi has officially launched its 1% annual percentage yield (APY) checking and savings accounts. This is more than triple the rate offered by other disruptors like Robinhood.

More product features include:

No overdraft fees.

Limitless transfers between accounts.

2 day early paychecks and no fee.

Access to Allpoint’s 55,000 ATMs.

SoFi Relay will be the singular dashboard for connecting all SoFi products and accounts into a single intuitive interface that frees these products to work “better together.”

Click here for my broad overview of SoFi (Deep Dive coming in 2022).

3. Lemonade (LMND) — Q4 2021 Earnings Review

In 18 months, Lemonade has evolved from a renter insurance company to one offering 5 different forms of insurance.

a. Demand

Lemonade guided to:

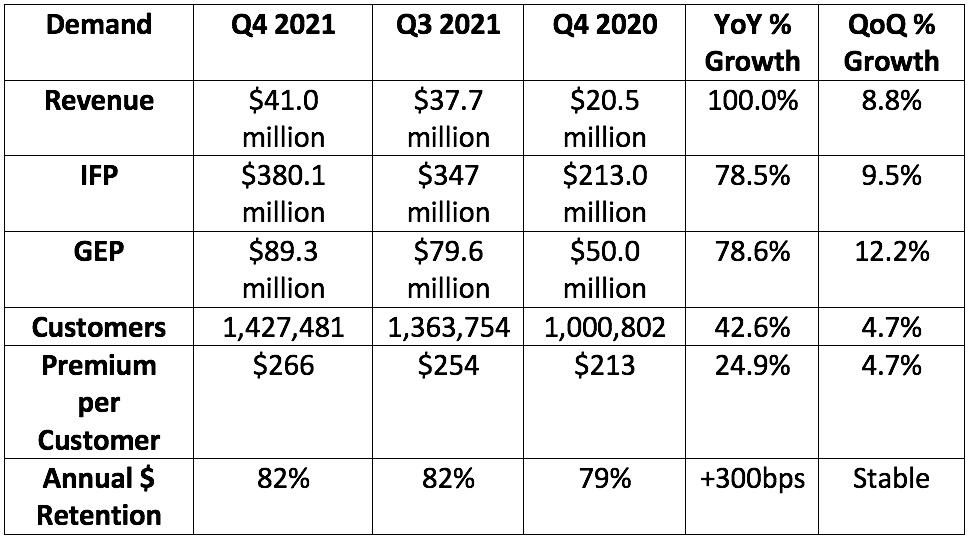

$39.5 million in revenue with analysts expecting the same. Lemonade posted $41.0 million, beating expectations by 3.8%.

$382 million in, In Force Premium (IFP). It posted $380.1 million, missing expectations by 0.5%.

$88.5 million in Gross Earned Premium (GEP). It posted $89.3 million, beating expectations by 0.9%.

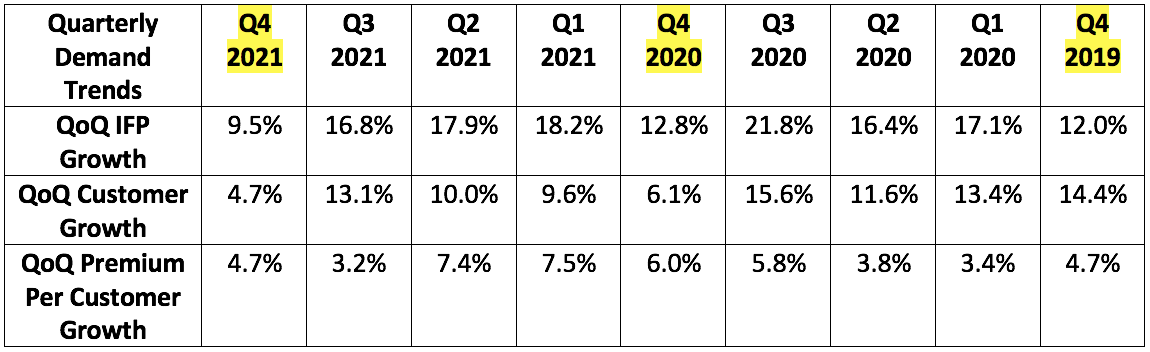

This was by far Lemonade’s most underwhelming quarter for sequential growth since it went public. Note that Q3 2020 is its strongest period of the year which did make sequential comps somewhat difficult. Still, customer and premium growth must re-accelerate for this investment case to work:

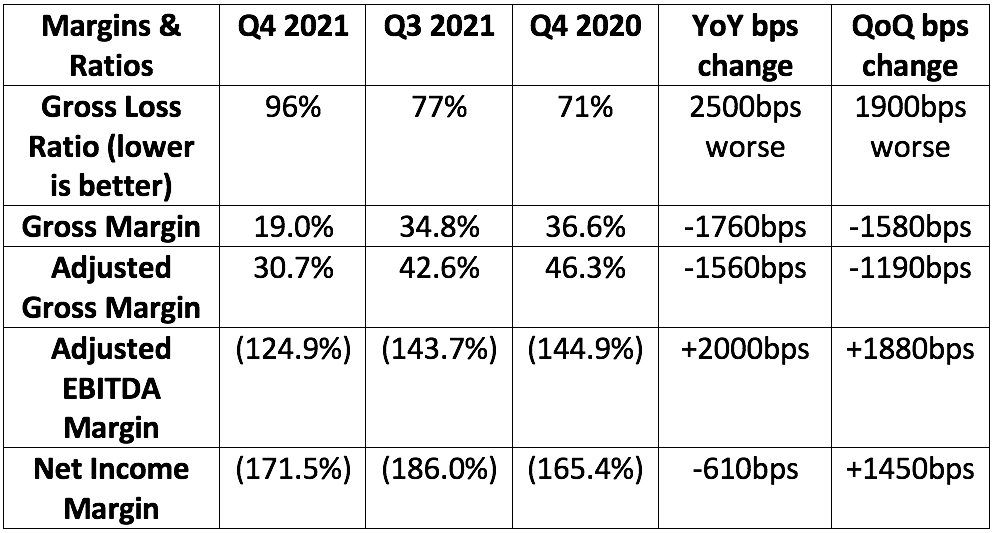

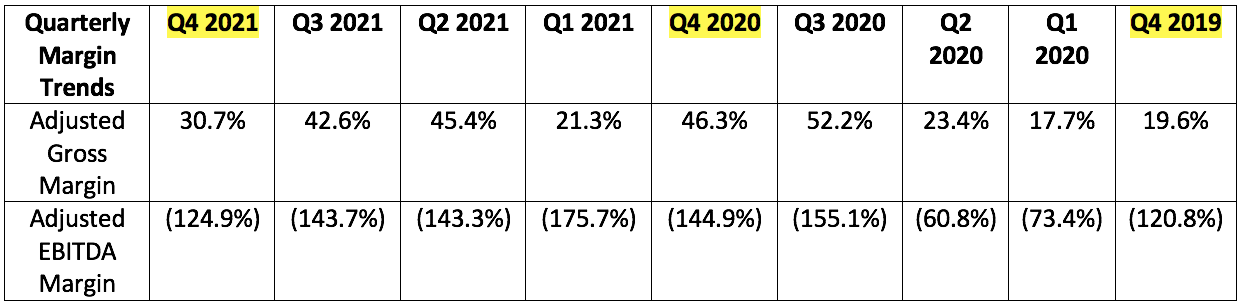

b. Profitability

Analysts were looking for Lemonade to:

Lose $50.3 million in EBITDA. It lost $51.2 million, missing expectations by 1.7%.

Lose $1.12 per share. It lost $1.14, missing expectations by 1.7% or $0.02.

Note that in Q3 of 2020, Lemonade conducted an accounting policy change that prevented it from recognizing premiums ceded to re-insurers as revenue which had been inflating the top line. This positively impacted adjusted gross margin as the company began dividing gross profit by an abruptly smaller number. Conversely, EBITDA margin was hit as the negative EBITDA metric was divided by an abruptly smaller number. IFP and GEP were not impacted — while revenue growth temporarily halted — which is why I used those 2 metrics for quarterly demand trends. The falling adjusted gross margin this quarter is a product of rising loss rates explained below.

c. Guide & Liquidity

Q2 2022:

Analysts were looking for $44 million in sales. Lemonade guided to $42 million, missing expectations by 4.5%.

Analysts were looking for -$44.6 million in EBITDA. Lemonade guided to -$67.5 million, missing expectations by 51.3%.

Lemonade also guided to IFP of $407.5 million and GEP of $93 million. This would represent further sequential deceleration in both metrics.

2022:

Analysts were looking for $219.3 million in sales. Lemonade guided to $203.5 million, missing expectations by 7.3%. This would represent 58.4% YoY growth.

This guide does not include any contribution from Lemonade’s Metromile acquisition expected to close by July. KoyFin expects $74 million in 2022 Metromile revenue and Lemonade will realize roughly 50% of that this year due to the timing of the closing. Considering this, revenue estimates with Metromile included would have likely been around $240.5 million for 87.3% YoY growth.

IFP and GEP growth including Metromile is expected to be around 70% YoY.

Analysts were looking for an EBITDA loss of $216.2 million. Lemonade guided to an EBITDA loss of $282.5 million, missing expectations by 23.5%.

d. Notes from Co-Founder CEO Daniel Schreiber

On the stock price:

“We see our job as value creation not share price appreciation. We do not pay attention to our share price on a month to month basis. Success will reflect itself in our share price in the fullness of time but short term price fluctuations are noise that we will not credit as a signal… We have no plans for a share buyback as we have excellent investment opportunities for our cash.”

On a pivot and future profitability:

“Our largest investments are mostly behind us, or soon will be.”

Schreiber spoke on investments in recent years being predominately to debut new products required to establish the full suite of products and bundling capabilities Lemonade needed to succeed. It now feels like it has achieved a “critical mass of infrastructure” which will free it to pivot resources to harnessing this asset base.

“Investment will shift to lowering our expense ratio via automation and lowering loss ratios through AI/ML while growing LTV/CAC. In prior years, those investments took a backseat to new product launches and tech build-out and that balance will now shift… Loss and expense ratios will improve through 2022 and in the years to come.

Despite this color, it thinks it’s 2-3 quarters away from “peak losses” with 2022 being the year of max EBITDA losses. While it remains far from profitable, it sees a “clear path to profitability.” We shall see. The company reminded us that of the $1.5 billion in funds it has raised in its life, it still has 73% of that on its balance sheet. Liquidity will only be a concern if its peak loss schedule isn’t realized — it has 4 years of cash burn at its current burn rate. Several months ago, analysts expected peak EBITDA losses to come in 2021, but that has now unfortunately been pushed out.

To me, this seemed like Schreiber attempting to appease shareholders and convince us that Lemonade’s full focus on growth over profit is both the right one and also temporary. In our currently hawkish monetary climate, the growth-at-all-costs path has quickly gone out of favor.

On Lemonade vs. the competition:

Vs. other disruptors — Lemonade is the only multi-product unified platform with all of a user’s insurance needs. This allows it to bolster LTV to justify more market share spend and allows it to avoid offloading business to competition.

Vs. incumbents — While the platforms are often complete, incumbents lack the talents to lace automation throughout the process and to shift from proxy to precision based risk pricing.

“Winning with technology and growing with our customers have been two pillars guiding us since our inception and our experience to date has only served to strengthen the conviction that in choosing these pillars, we chose well. We enter 2022 in an enviable position having launched 4 products in 18 months. 5 years post launch, it’s clear our investments have yielded structural differences vs. the industry and sets us up very well for the next 5 years.”

On Lemonade Car being allowed to use precision pricing in larger states:

“Metromile’s largest state is California which is fine with precision pricing. New York has also become much more open to telematics in recent months and the trend line is in that direction as it increases fairness.”

e. Notes from Co-Founder/CTO Shai Wininger

Click here for my overview of Lemonade’s Metromile acquisition.

On Lemonade Car:

“This is an area where we expect to shine and outperform incumbents due to our ability to practice precision pricing.”

75% of Lemonade car customers in Illinois are bundling it with at least 1 other product and the debut period in the state has contributed 3X more revenue than Illinois’ pet debut last year.

“We have outstanding net promoter score (NPS) across our customer and claims experience groups so far.”

Lemonade considers Metromile to essentially be Lemonade Car 2.0, meaning it’s not making the investments in people and auto technology it would otherwise be making as it’s anticipating the assets from Metromile to become available. The growth coil is winding up.

Lemonade closing its Metromile acquisition will give it licensing in 48 other states as well as an ability to launch “pay-per-mile” insurance. It expects that within the year, Lemonade Car will be available to the majority of its customers. Ramping growth throughout 2022 is the product of this Metromile acquisition not closing until Q2.

On Lemonade’s Technological edge:

“Internally, we track the impact of every product we release and have a high degree of confidence that our technology delivers a transformative impact. Falling loss ratios by product is evidence of that along with 67% of our customers having fully automated experiences. The AI bot Jim handles 96% of all first claim notices with 33% of our customers having fully automated claims experiences. All of this allows us to deliver a superior experience and an NPS that is unequaled throughout the sector.”

On the loss ratio spiking, again:

Gross loss ratio worsening from 73% to 96% YoY is a product of two things:

Older losses that were under-reserved. “We have a strong track record of cautious reserving, but it’s an imprecise science. Notably, there was no spike in our accident quarter loss ratio during the period suggesting no book deterioration.” — CFO Tim Bixby

Business mix evolution to newer products which experience peaking loss ratios right at the beginning of their lives with falling loss ratios thereafter.

Lemonade’s loss ratios continue to fall for every individual product, but the hyper growth of the new segments (with higher loss ratios vs. its renter product) is causing upward loss ratio pressure for its book overall. More on this mix shift in the next section.

“We’ve seen a couple of quarters with rising loss ratios which is intentional and mainly a result of our shifting business mix mainly to home and pet.” — Co-Founder/CTO Shai Wininger

f. Notes from CFO Tim Bixby

Lemonade Pet premiums as a percentage of total IFP is “heading to 20%” vs. 15% sequentially. Renters is “just under 50%” vs. 53% sequentially and 56% six months ago. As a reminder, Lemonade will acquire $118 million in 2021 auto premiums when its Metromile purchase closes which would have made auto represent roughly 23% of Lemonade premiums in 2021 vs. basically 0% now.

“In terms of our outlook on long term, sustainable growth, we’ve never been more bullish. We’re merely scratching the surface on markets beyond renters that are several times larger.”

Rising operating expenses accelerated by:

The Metromile acquisition.

Car and other recent product launches (rapid headcount growth of 97% YoY).

An LTV/CAC remaining comfortably over 2X — thus justifying more spend.

“We saw a doubling of our marketing efficiency throughout the last 3 years. With many other companies, a reliance on online acquisition made their acquisition price actually increase… that’s not happening for us. Our forward guidance expects the same efficiency going forward. We have modeled no improvement despite expecting it.”

g. My Take and Plan

This was not a terrible quarter for Lemonade but was still underwhelming. Sequential growth was generally light, customer additions were disappointing and guidance is weak (although the Metromile acquisition will help). Still, new products are working and spiking loss ratios are mix-driven rather than underwriting quality-driven. It was nice to hear a schedule behind when peak losses will be and I will now be looking for margins to meaningfully improve later in 2022 — they need to.

I’ve decided I’m not ready to sell my stake, but this quarter used up most of my slack and I will be pausing any future accumulation until performance improves. If it doesn’t, I will sell.

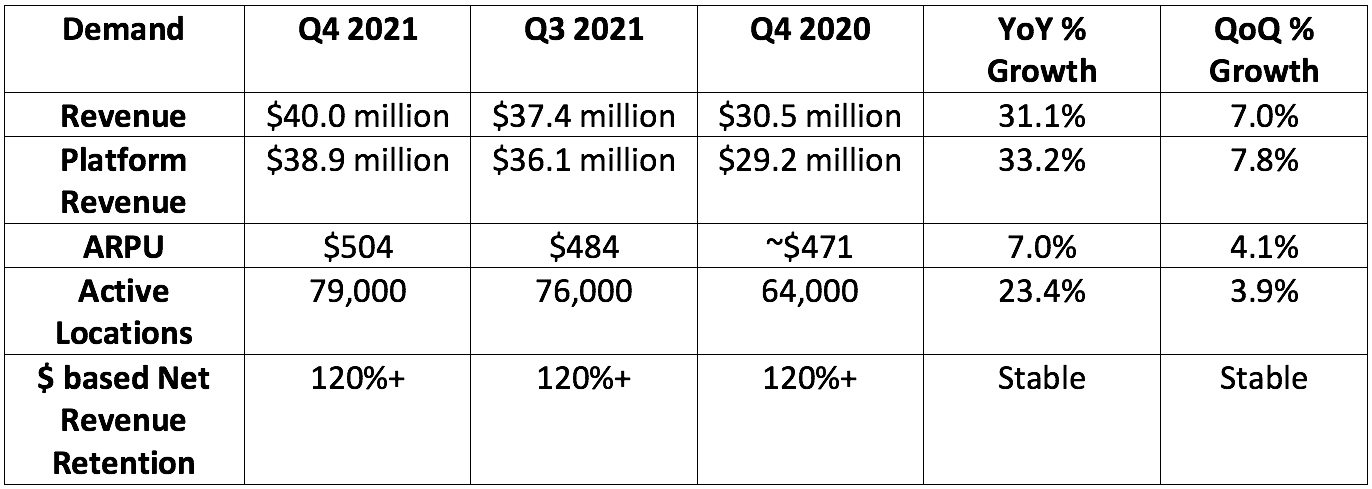

4. Olo (OLO) — Q4 2021 Earnings Review

“As we enter 2022, we’ve never been more confident in our position and more excited about our opportunity ahead. We believe that we have a 100X growth opportunity in U.S. enterprise restaurants.” — Founder/CEO Noah Glass

a. Demand

Olo guided to $39.05 million in Q4 2021 revenue. Analysts were expecting $39.1 million in revenue. Olo generated $40 million in revenue, beating its expectations by 2.4% and analyst expectations by 2.3%.

Note that Olo greatly benefitted from the pandemic accelerating off-premise dining. Its revenue is largely volume-based so the demand spike that COVID-19 fostered directly boosted its business. As a result, growth comps over the last handful of quarters have been quite difficult.

Olo revenue generated via DoorDash’s usage of its Rails (channel management) module made up 16.7% of Olo’s 2021 revenue overall vs. 19.3% in 2020. In the past, Olo and DoorDash have had some relationship issues which have since been resolved. Still, it’s always nice to see concentration risk fade.

b. Profitability

Olo guided to $3 million in non-GAAP operating income. It posted $4.3 million, beating expectations by $1.3 million or 43.3%.

Olo’s forward EBITDA and earnings outlook from analysts fell after this report as it looks to lean into more growth in the coming years (its revenue estimates rose). Its acquisition of Omnivore (discussed below) is also part of the reasoning behind this profit outlook worsening as it will add a few million in incremental operating and integration costs during 2022. With the company already demonstrating an ability to be deeply profitable and its strong balance sheet, this spend is easy for me to support.

c. Guide and balance sheet

2022:

Analysts were looking for $189.9 million in 2022 sales. Olo guided to $195 million, beating expectations by 2.7%. This would represent 30.5% YoY growth.

Olo expects 10% YoY ARPU growth.

Olo Pay will not be a material 2022 growth driver.

Olo guided to $8.2 million in operating income which implies a 4.3% margin vs. 14.2% YoY.

Q1 2022:

Analysts were looking for $43.5 million in Q1 2022 sales. Olo guided to $41.75 million, missing expectations by 4.0%. This is not demand driven but timing driven based on the 2022 demand guide outperforming.

Olo guided to $800,000 in operating income which implies a 1.8% margin.

“We remain prudent in our approach to forecasting given evolving industry dynamics, specifically impacts from COVID-19 and industry labor challenges.” — CFO Peter Benevides

Olo has $514.4 million in cash on hand after paying $75.2 million in connection with its previous purchase of Wisely.

d. Notes from Founder/CEO Noah Glass

On module adoption highlights:

Papa Murphy’s — the largest take-and-bake pizza company — added Olo Dispatch (its delivery module) during the quarter. This is their second Olo module in addition to Olo Ordering. Papa Murphy’s is looking to take a larger piece of the traditional pizza delivery pie (sorry couldn’t resist). Established restaurant brands like Applebee’s adopted its virtual brand (ghost kitchen) module. It also has Mr. Beast Burger and several more prominent digital brands as virtual-only clients and recently signed a deal with TikTok’s planned ghost kitchen concept.

BJ’s, Jack Stack Barbecue and several others added Olo Network during the quarter. This module helps chains plug in to non-marketplace demand channels. With it, a restaurant can do things like display menu items directly on a Google search page (thanks to an Olo/Google partnership). The company found that although a restaurant had the clout to get a direct search, Google displayed several delivery service providers (DSPs) before the actual restaurant. This meant despite getting the direct search, chains lost lucrative consumer data and offloaded a large chunk of margin to these DSPs. With Olo Network these issues are solved.

“Restaurant Brands recognize the importance of owning commission-free direct ordering channels. The consumer relationship is imperative to avoid being disintermediated.”

On Wisely:

“In the few months since acquiring Wisely, we successfully integrated on a go-to-market basis its suite of solutions including the host module, which streamlines reservations and table management, as well as its marketing, sentiment and customer data platform (CDP) modules to enhance consumer engagement.”

On Olo Pay:

Olo announced the commercial availability of Olo Pay to serve as a unifying layer (much like its other products) on top of payment processors for ensuring one, single payment interface.

“Olo has served as the gateway into payment processors but these processors have led to suboptimal experiences for the consumer and elevated fraud and chargeback levels for brands. Olo Pay’s integrated vertical payment solution goes beyond core credit card processing and will benefit the operator and consumer by offering fraud protection and improved authorization rates for valid transactions.”

With this unifying layer, a consumer will only need to enter their card information into a brand’s database one time. After that, consumers enjoy an expedited checkout (via cards, Apple Pay, Google Pay etc.) to raise conversion. This will juice growth for restaurants’ most profitable channel: direct digital orders. Without Olo Pay, a consumer will need to re-enter card information every time they’re buying from a different franchise location without an identical payment stack — which is the norm. Glass cited Shop Pay’s ability to raise basket conversion by 72% and expects this product will have a similar directional impact.

“With a network of 79,000 restaurants and 85 million consumers, Olo has achieved critical mass to unlock Shop Pay-like capabilities in the form of our borderless Olo Pay offering. We have conviction that this two-sided payment network offers a consumer and restaurant win. Our success in bringing to market platform-level innovations like Dispatch and Rails by creating these two-sided networks gives us confidence that we can do the same with the launch of borderless Olo Pay… Restaurant brands are telling us they want to operate as one digital business and they are pulling user into payments and on-premise opportunities.”

The “borderless payment” function will free consumers to pay for baskets with one single click. They won’t even have to create an account let alone enter in card information once they’ve made a purchase at any restaurant location one single time. With their permission, that data will be ready with the click on a button for the consumer to pay for an order.

“Olo Pay is a significant unlock for our direct digital program on many fronts. We are particularly excited about borderless payments to drive frictionless checkout.” — EVP of Technology at Noodles & Company.

On its acquisition of Omnivore:

“To accelerate the restaurant industry’s ability to operate as one business, we must unlock on-premise solutions. That is why Olo has signed an agreement to acquire Omnivore… We don’t want to have an off-premise and on-premise system to manage. We want it to be one system, one platform.”

Omnivore paired with Olo will enable:

Brands to create & use “back-of-house data” via deep integrations, expediting connections to Olo’s 200+ technology partners.

Simplified and contextualized review of data through a “developer friendly” point of sale (POS) API to extend Olo’s unification capabilities to the physical point of sale.

A birds-eye-view of on-premise ordering to accelerate throughput and boost consumer experience within the 4 walls.

Gains access to more technology partners not yet part of Olo’s vast ecosystem as well as some developer tools.

Omnivore powers restaurants to connect to apps and technologies to streamline operations, improve consumer experiences and increase profitability by allowing restaurant technology partners to inject and extract data from multiple points of sale through one integration. This unlocks the potential of restaurants’ POS systems. Ultimately, Olo Plus Omnivore will allow our brands to gain immediate access to new on-premise capabilities plus an expanded partner network outside of core ordering. Olo’s existing POS integrations will be updated and backed by a large, combined team of top industry specialists.”

This deal will raise Olo’s partner roster from 200+ to 300+. Its these integrations that are imperative for Olo creating as unified of an experience as possible. It needs to integrate with all of these fragmented point solutions to achieve this objective. Especially when technology stacks vary so widely even within a single chain (like they do for restaurants), this is a large selling point for Olo.

“One of the things that appeals to use about Omnivore is its two-way integrations. This allows for what’s called an open check which is like putting your card on file at the bar and having the ability to keep that tab open. We think this type of interaction with the POS is compelling for on-premise occasions when you are placing multiple orders on the same check. It’ll be key for the on-premise ordering experience.”

The revenue contribution from Omnivore will be “immaterial” in 2022. This was not the reason for the revenue guidance raise.

With this purchase, Olo now has 12 different modules across order management, delivery, customer engagement, front-of-house management and payments.

On future growth:

Glass expects Olo’s opportunity to grow by 100X via the following 3 growth channels:

Nearly 4X opportunity to capture all 300,000 enterprise restaurant locations.

Moving the currently 15% of total restaurant orders being digital to 100% (digital entirety) provides a 6.25X opportunity to generate more platform transactions.

Olo pay quadruples the revenue per order opportunity vs. Olo’s current payment role.

4*6.25*4 = 100X which represents a TAM of $16 billion today. This does not consider international expansion planned for the distant future.

e. Notes from CFO Peter Benevides

On new logo wins:

Olo added Ruby Tuesday, Sbarro, Wetzel’s Pretzels, Insomnia Cookies (why I gained 20 pounds in college) and Sizzler as new brands during the quarter. Olo expects to add a similar amount of new locations in 2022 vs. last year’s 14,000 organic adds.

On module adoption:

Benevides disclosed a new metric, modules per location, which currently sits at 2.7.

“We see a lot of momentum ahead in ARPU as customers continue to expand their adoption of multiple modules.”

On margin compression:

“As expected, the year-over-year decrease in gross margin was driven by an increase in headcount and associated compensation costs to support the continued growth of active locations added to the platform.”

“Fulfilling our emboldened vision of digital entirety requires some near-term investments in the platform to capitalize on the opportunities our customers are pulling us into. As we’ve seen first with Dispatch and then with Rails, customer-led opportunities have been great growth drivers for the company. Much of this investment is expected to occur in the first half of the year, and as we progress throughout 2022, we expect to return to more normalized levels of profitability.”

Benevides split this large spend into 3 buckets:

Omnivore investments to accelerate Olo’s on-premise presence will lower profitability “by a couple of million dollars this year.”

Olo is raising its Olo Pay investment to “more quickly bring borderless capabilities to market and set the stage for processing card-present transactions.”

It’s also raising investment in front-of-house to “tie it all together.”

Cost lines trends (source of the margin compression):

Sales and marketing expenses as a % of sales rose from 8% to 11% YoY.

General and administrative expenses as a % of sales rose from 20% to 27% YoY.

“We’re creating a suite of digital ordering solutions to address all ordering, underpinned by a best-in-class customer engagement suite and a seamless payment experience.”

On lapping pandemic-era comps:

“We believe pandemic-related challenges will be lapped beginning in the second quarter and that revenue growth rate and net revenue retention will begin to re-accelerate.”

f. My Take

This was yet another solid quarter for Olo. It was not incredible but it was certainly good enough and allows me to continue building out my position into the recently-extreme stock volatility we’ve seen.

With the volatility, I’ve been able to lower my average cost basis by over 50% and have much more room to average in. This is why I start so small and add so slowly when I’ve decided I want to own a company but the stock is also very/too expensive. That was Olo, but is not anymore. Now, the company and the stock both look attractive to me.

Click here for my Olo Deep Dive.

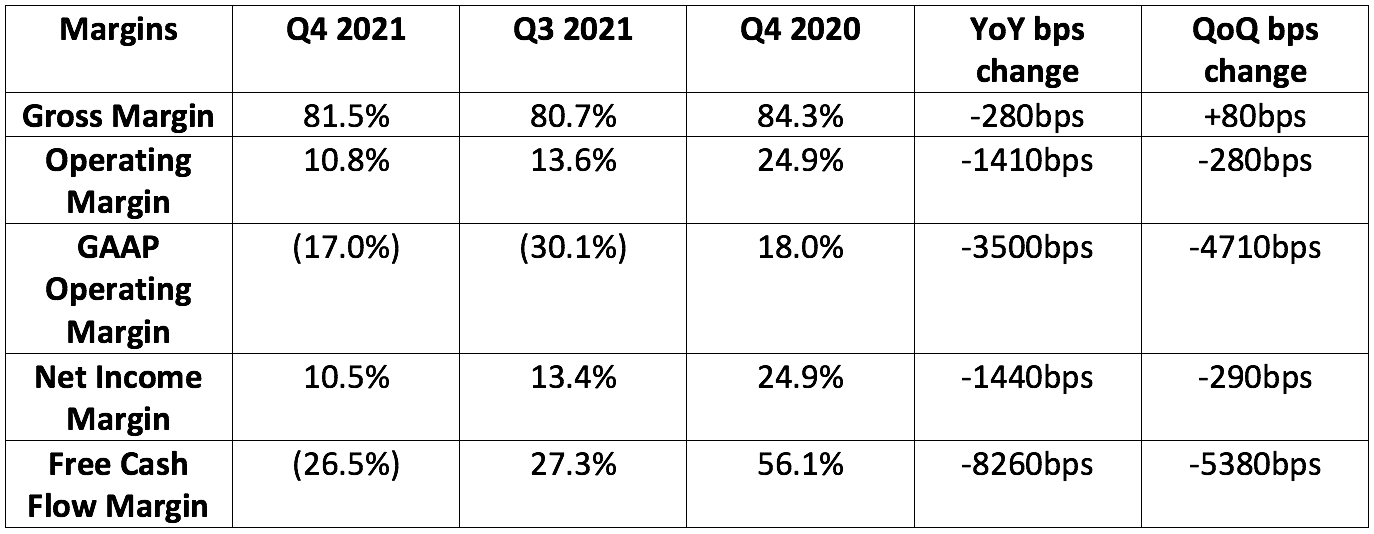

5. Revolve Group (RVLV) — Q4 2021 Earnings Review

“2021 was a year in which we outperformed in the face of macro challenges and supply chain headwinds, demonstrating the strength of our brands and execution by our team.” — Co-Founder/Co-CEO Mike Karanikolas

a. Demand

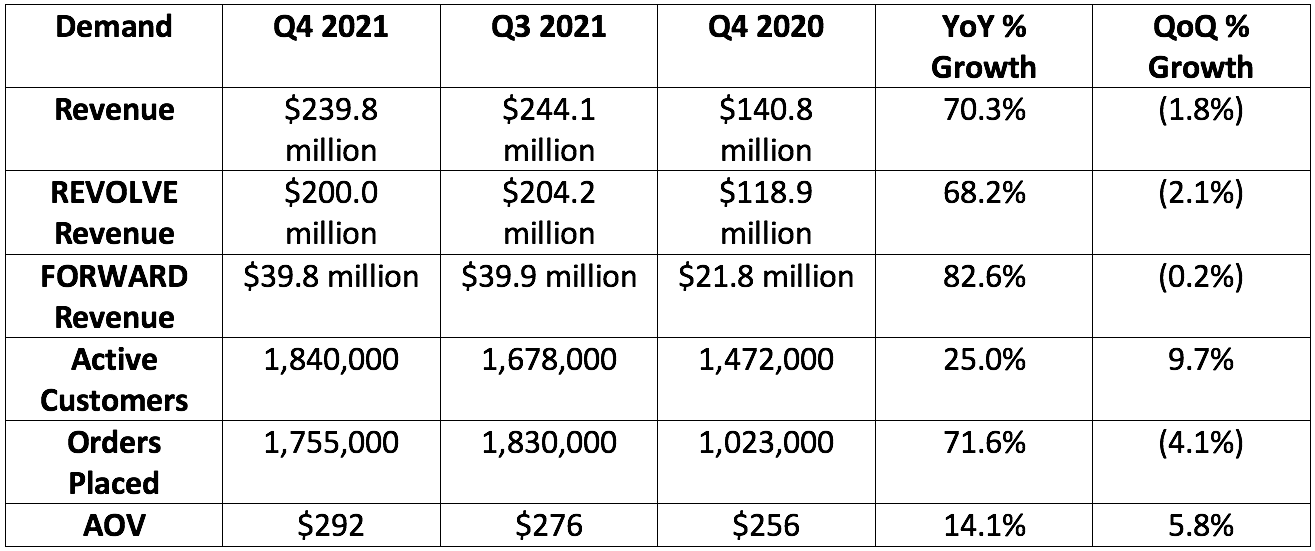

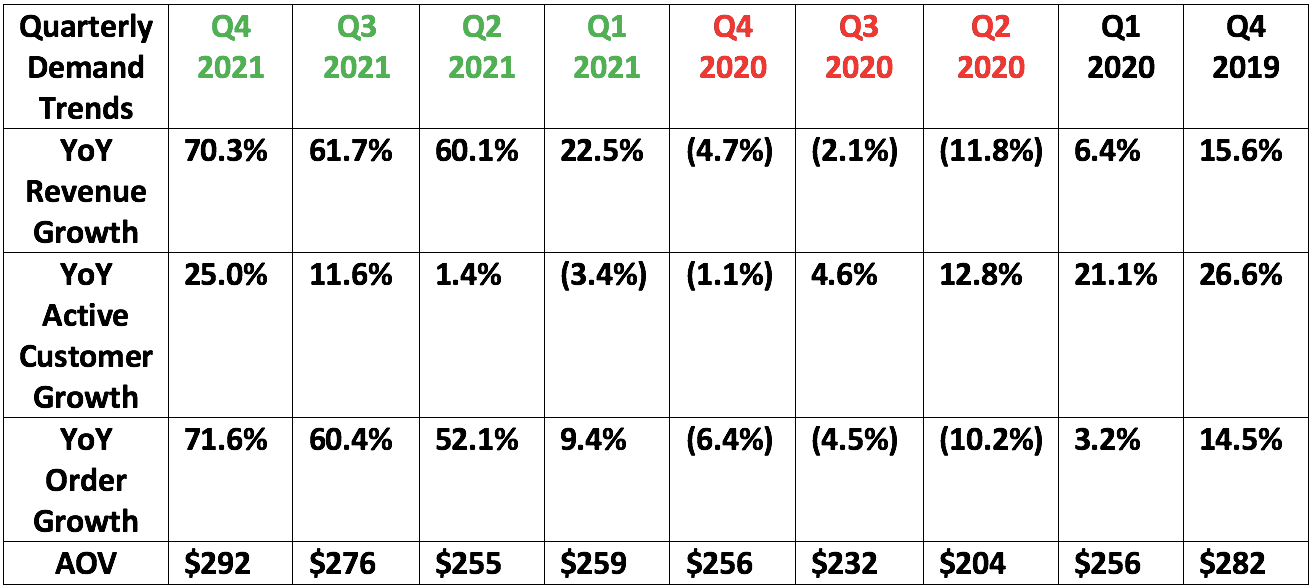

Analysts were looking for $221.1 million in sales for the quarter. Revolve posted $239.8 million, beating expectations by 8.5%. Revolve’s 2-year revenue growth rate accelerated from 58% last quarter to 63% this quarter. The “REVOLVE” segment (one of its two brands alongside “FWRD”) enjoyed accelerating YoY growth in every quarter during 2021.

The pandemic was a severe headwind for this e-commerce company as it predominately sells clothing people wear when going out/to work and also allocates most of its marketing dollars to live events that were halted. The quarters that were most adversely impacted are highlighted in red. Recently, these headwinds have become tailwinds and pent-up demand has unwound to accelerate Revolve’s growth — people are going out and going to the office once more. The most boosted quarters are highlighted in green. It’s interesting to think about an e-commerce company as a beneficiary of the pandemic ending, but it is.

Highlights:

Revolve’s AOV (for both REVOLVE and FWRD) had been falling from 2017 to 2020 but that trend reverting (as we were told it would) in 2021.

Revolve’s 162,000 active customer adds was the most in its history for any quarter — following last quarter’s record of 124,000 active customer adds.

Revolve told us that its 70% YoY growth rate had been maintained into the first seven weeks of Q1 2022 where the pandemic-related tailwind is far less strong vs. previous quarters.

The company said the same thing in its last quarterly report before delivering these exceptional results.

Comps will get much tougher starting next month which should result in us beginning to return to Revolve’s long term growth target of 20-25%.

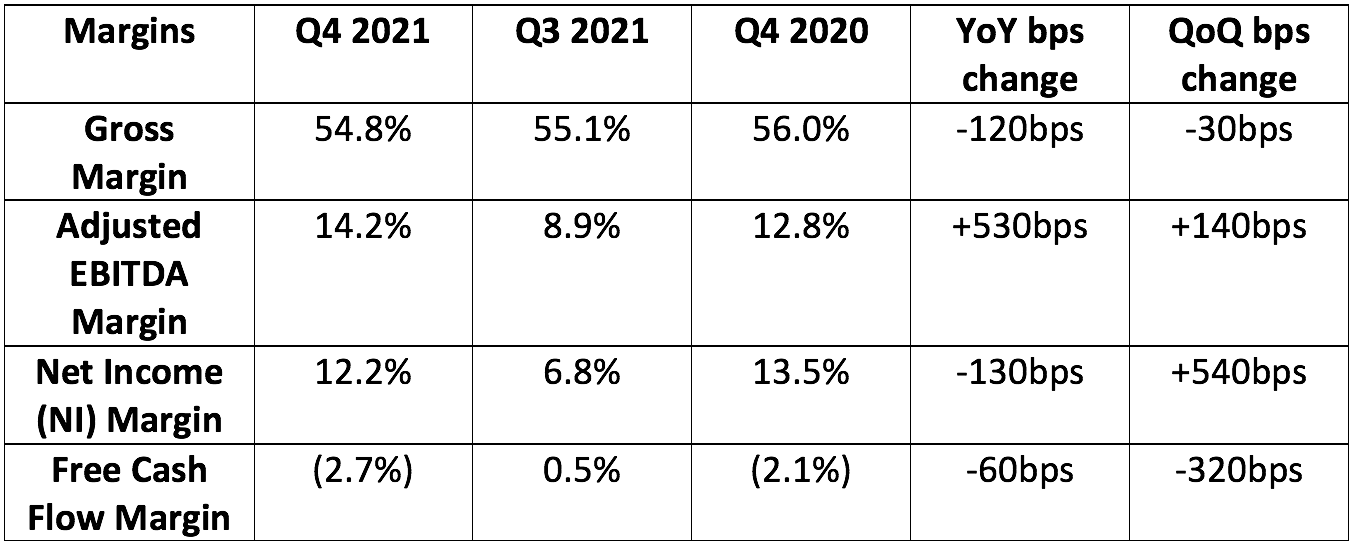

b. Profitability

Analysts were looking for $20.2 million in adjusted EBITDA for the quarter. It delivered $34.2 million, beating expectations by 69.3%

Analysts were looking for $0.18 in earnings per share. Revolve generated $0.39 per share beating expectations by $0.21 or 116.7%. This included a tax benefit worth $0.05 per share. Without it, Revolve would have beaten expectations by $0.16 or 88.9%. There was also a much larger tax benefit enjoyed in Q4 2020 which is why net income margin contracted YoY. Without the exogenous tax benefit in either period (so apples to apples), net income margin would have expanded from 8.5% to 10.6% YoY.

Revolve guided to a 2021 gross margin of 54.5%. Considering it was above that over the first 9 months of the year, the guide implied a Q4 2021 gross margin well below 54.5%. Instead, Revolve posted a 54.8% gross margin.

FWRD maintained the 500 bps gross margin expansion (from 41% to 46%) it enjoyed from 2019-2020 when it pulled back on spend during the pandemic. The REVOLVE segment remained at a lofty 57% gross margin.

For 2021 vs. 2020 as a whole, gross margin expanded to 55.0% from 52.6%. Adjusted EBITDA margin for the full year 2021 was 12.9% vs. 11.9% in 2020.

Note that lower free cash flow margins in 2021 vs. 2020 are solely a result of Revolve re-building inventories over the past year to take advantage of accelerating demand as we exit the pandemic. The company had pulled back (in a perfectly-timed manner) amid the pandemic as its demand was temporarily hit. As a result, it actually managed to expand margins throughout 2021 while interest in what it sold was halted by COVID-19. It has maintained these efficiency gains to coincide with recovering demand growth which — to me — is a sign of excellent leadership.

c. Guide and liquidity

Revolve doesn’t offer forward guidance (but did give that color on the first 7 weeks of 2022).

Revolve has $218.5 million in cash and equivalents on hand vs. $222 million sequentially and $146 million YoY as the result of strong cash flow generation. Inventory levels sharply rose by 80% YoY for the reason previously mentioned.

d. Notes from Co-Founder/CEO-CEO Mike Karanikolas:

On the success amid headwinds:

“We believe our outstanding results during a challenging environment underscore our sustainable advantages. Omicron created new headwinds and logistical challenges. Air freight costs increased to the highest levels we’ve ever seen and other macro pressures required us to be agile. Against this backdrop, I am proud to share that our operations didn’t skip a beat and that we achieved record NPS during Q4 and the full year. We proved how effectively our organization can scale while maintaining our quality standards.”

“Our 20 year history has taught Michael and I that these challenging operating environments create opportunities for the best-positioned companies to capitalize on their strengths. Just as we navigated the Great Financial Crisis, our team and differentiators have guided our outperformance throughout the pandemic… Revolve has historically thrived amid periods of disruption because when times get tough, it gets easier for us to put distance between ourselves and the competition.”

Revolve customer retention levels for previous 12-month customer cohorts reached a new record high for the company, offering strong evidence of rising engagement and customer lifetime value (LTV) which justifies more marketing spend to take more market share. The company is attributing this to its REVOLVE and FWRD loyalty programs which are each less than 18 months old.

Early results of the loyalty programs:

Loyalty members place triple the orders of non-members.

In each month since the FWRD loyalty program launched last year, Revolve has enjoyed rising shopper overlap between the 2 sites.

REVOLVE’s loyalty program will roll out in certain international markets this year.

On 2022 investment priorities:

Build more brand awareness.

The new brand ambassador program has performed “extremely well” so far and will be an area of focus.

Owned-brand net sales as a percentage of total Revolve segment sales rose YoY for the first time since 2020. Revolve had to pull back on owned brands amid the pandemic as 3rd party usage allowed them to be far more flexible with inventory in a volatile environment. That now seems to be behind us which should be a strong margin tailwind for the firm. Revolve expects this trend to continue into 2022. In 2021, 20% of Revolve’s sales were via owned-brands vs. roughly 36% at the company’s peak a few years ago.

Enhance international service levels.

Following interface, checkout, fulfillment, tax and returns assistance upgrades in Canada, sales doubled in 2021. Revolve will mimic these changes in other key markets across the globe in 2022.

The company will break ground on its 2nd U.S. warehouse which it thinks “will even further raise the bar on our very high standards for customer service and fulfillment operations.” Meeting these standards will take some capex.

Invest further in data analytics to continue raising shopper conversion rates via experience personalization.

e. Notes from Co-Founder/Co-CEO Michael Mente

On 2021:

87% of Revolve’s overall sales were at full price vs. 77% in 2020. This is the first time Revolve has exceeded 80% for a year in its history.

Revolve’s average cost per order fulfillment fell 12% YoY despite all of the inflation and historical supply chain/air freight pressures faced!!

“Accelerating growth throughout 2021 benefitted significantly from having access to the right type of inventory during a time when supply chains were an industry-wide challenge. Out data-driven inventory system and automation of so many pieces of the decision making-process have been huge amid this disruption. We can leverage data much faster than others to identify trends and make merchandise decisions in an accurate, efficient way.”

On the Brand Ambassador program launched 4 months ago:

This program received 10,000 signups on day 1. Most of the signups were micro influencers that Michael thinks “comprise an exciting area of opportunity.” Revolve offers top performers access to their exclusive, highly coveted events to drive wildly cost-effective growth.

“The program is a community-driven extension of our pioneering influencer marketing strategy. It’s built directly into our tech stack so we capture all of the added data and insights and is already generating meaningful incremental traffic and revenue.”

On marketing initiatives:

Revolve is poised to re-launch its Revolve Social Club which is a pop-up retail concept that will be open in LA starting next week through April. Revolve Festival will be back after a two-year pandemic-related pause. This is its most powerful marketing event and the company’s recent growth is in spite of not having access to its impact.

The company has seen no drastic impact from Apple or Google tracking changes thanks to its brand strength (so first party data treasure chest).

f. Notes from CFO Jesse Timmermans

On 2022:

“We are confident in our ability to meet or exceed our long term target growth rate of 20% in 2022 — even coming off a year when we delivered growth of 54%... We feel really good about our long term plan of 20-25% growth but we hope to do better than that because we do have a lot of tailwinds.”

Growth rates will slow throughout 2022 back to long term targets as comps become more difficult.

Revolve expects gross margin of 53.75% in the first quarter of 2022 which would represent the lowest sequential gross margin decrease compared to the preceding fourth quarter in 7 years.

It expects gross margin to be relatively stable around 55% in 2022 via a higher owned-brand mix tailwind, a FWRD mix shift headwind (its sales are lower margin than REVOLVE) and in-bound freight costs continuing to be elevated — they’re currently 3X vs. 2019 for the company. There’s no relief here assumed in Revolve’s 2022 performance.

g. My Take

This was another fantastic quarter for the company. There are no negatives to pick at, just mammoth outperformance of analyst expectations to enjoy.

6. Teladoc Health (TDOC) — CEO Jason Gorevic and CFO Mala Murthy Interview with Citi Bank

Gorevic and Murthy on earnings results and the 2022 guide (why full year was in line and Q1 was light):

“The 4th quarter was the strongest bookings quarter we’ve seen in the history of the company. Many of those launches are set for the second half of the year. This wasn’t a structural difference in our guide vs. expectations but a timing difference relative to closing and launching signed deals.” — Gorevic

“Chronic care membership growth will meaningfully accelerate in the 2nd half of the year starting around July 1st. These are all already booked deals that set us up extremely well for strong growth through 2023… it will take a few months to on-board initial enrollees before we hit a more gradual increase over time. By the end of Q3, we will be at a significant run-rate.” — Gorevic

As a reminder, Teladoc doesn’t profit from Chronic Care on a per member per month (PMPM) basis but rather a per participant per month (PPPM) manner. That’s why the large contracts being put in place throughout 2022 will fuel growth in the years to come — activity per client will be directly correlated with Teladoc’s growth. This is its “value-based care” philosophy (charging per value add) in action and is why it’s so important for Teladoc to offer the deepest breadth of service in the space. Not only does that aim differentiate the firm, but also frees it to collect a larger piece of the healthcare revenue pie. Revenue per member will be Teladoc’s core growth driver, NOT member growth. It sees its PMPM ceiling at $68 which is a more than 27X sales increase from today with no membership growth.

“There’s nobody else in the market with this range of services. I think this is where the misconception comes from that our main growth driver should be membership growth. Membership is a 60-65% growth opportunity vs. a 27X opportunity with revenue per member.” — Gorevic

Teladoc has double the number of its Chronic care patients using 2+ products YoY.

Gorevic noted the large, new chronic care client whose program will now launch in the second half of the year vs. previous expectations for it to have launched by now. This was a factor of “internal client data issues with identifying recruitable Chronic Care members.” This was on the client, it was not Teladoc’s blunder. Aside from this client, all other launches were originally planned for the 2nd half.

“We have very strong visibility into the 2022 revenue ramp. Our 25-35% chronic care growth range still stands and we expect to be in that range by the second half of the year.” — Murthy

Leadership also hit on the weak Q1 2022 EBITDA guide paired with the in-line full year 2022 EBITDA guide. This is also a function of the revenue ramp as top line growth will flow down the income statement to bolster EBITDA. This was also partially due to advertising spend being Q1 weighted to “take advantage of a currently favorable pricing environment.”

On competition and health plans developing their own virtual care products:

“Things like Cigna buying MDLive are very good for us. We’ve seen a lot of takeaway opportunities as other health plans don’t want to use competition like Cigna to outsource their Telehealth service. In the second half of last quarter we also signed on 2 more payers for our Primary360 product. The plan for insurers to do this themselves will be the exception, not the rule.” — Gorevic

Gorevic reiterated the strong and growing relationship the firm has with our nation’s largest owner of physician practices — United Health Group.

“For the last 20 years, big tech has been getting into healthcare. Just after we went public, it was Google that was trying to get into virtual care. That never materialized. It’s not to say that they can’t gain traction, but the healthcare system just does not lend itself to monopolies. We don’t regularly see these players in our competitive environment.” — Gorevic

On Mental Health’s (should be 50% of sales by 2024) durability & margins:

“Mental health margins are strong and accretive to the overall business. We are seeing our operating metrics become healthier across the board which are the ingredients fueling the strong margins.” — Murthy

Murthy and Gorevic both attributed BetterHelp’s (its direct to consumer mental health product) separation from the pack (via better churn, LTV and growth) to impactful endorsements, diverse and creative marketing tactics and a massive therapist base that is 10X the next largest.

7. Ozon (OZON) — My Plan

Ozon is fundamentally thriving in every sense of the imagination. Growth and retention are both fantastic, it posted positive free cash flow last quarter and every single new product is working wonders. Still, it’s a Russian company amid a Russian-induced geopolitical crisis. Fundamentals will not matter until Russia’s government stops bombing apartment buildings in The Ukraine and instigating war. For this reason, I am pausing any future accumulation of more shares until the situation becomes clearer. I will not sell a single share. The forward multiples (under 2X gross profit with 70% growth) are wildly compelling to me, but as long as this lasts, cheap could and likely will get cheaper.

I don’t sell companies because their government is malicious like Russia’s is. After all, there are thousands of brave Russians lining streets in protest and these are the customers Ozon is selling to. Not Vladimir Putin. I am taking an extremely cautious approach to this position for the time being .

8. Cannabis News — Mainly per Marijuana Moment

The NCAA is working to lower punishments for student athletes testing positive for THC. This comes months after Sha’Carri Richardson was suspended from the Olympics for testing positive for cannabis — prompting global outcry from the athletic community.

The USDA released its first ever hemp survey depicting a market value of $824 million. Since the report, the USDA has requested funding for another, larger survey to collect more information.

Recreational cannabis sales will launch in New Jersey medical dispensaries in the next several weeks according to Governor Phil Murphy.

According to Leafly, the American cannabis labor force grew 42.7% YoY to reach roughly 428,000.

9. My Activity

I aggressively added to several positions throughout the week to lower my cash position from 10.0% of holdings to 8.5% of holdings. Here’s what I added to:

SoFi Technologies

PayPal Holdings

Upstart

Olo (twice)

Teladoc Health

GoodRx

Progyny

Match Group

Penn National Gaming

Thanks for your continued UPST analysis and deep research!