1. Upstart (UPST) — New KBRA Surveillance Report + Affirm

a) KBRA Surveillance Report

On ratings and credit enhancements:

Kroll Bond Rating Agency (KBRA) published a new surveillance report this month detailing the performance of Upstart loan pools being funded through capital markets. Overall, credit rating action decisions were uniformly positive with the agency upgrading the ratings on 14 classes of notes issued through these loan funding programs and 18 more classes of notes having ratings reaffirmed. For 2021 transactions specifically, one note class was upgraded with the rest reaffirmed.

From a credit enhancement perspective, all asset-backed transactions continue to have excess reserve account funds and all continue to be sufficiently or over-collateralized as of February 1st, 2022. Most of its pass-throughs are structured without reserve accounts and do not build credit enhancements unless the trigger rate is breached. Thankfully, no triggers have been breached for Upstart pass-throughs to date. This all points to the loan pools being able to effectively compensate all investors which ensures continued capital market demand and justifies Upstart’s 6.1% take rate.

- Credit Enhancement definition: Financial cushion allowing securitized loan pools to palate a certain level of default-related losses.

On individual transactions:

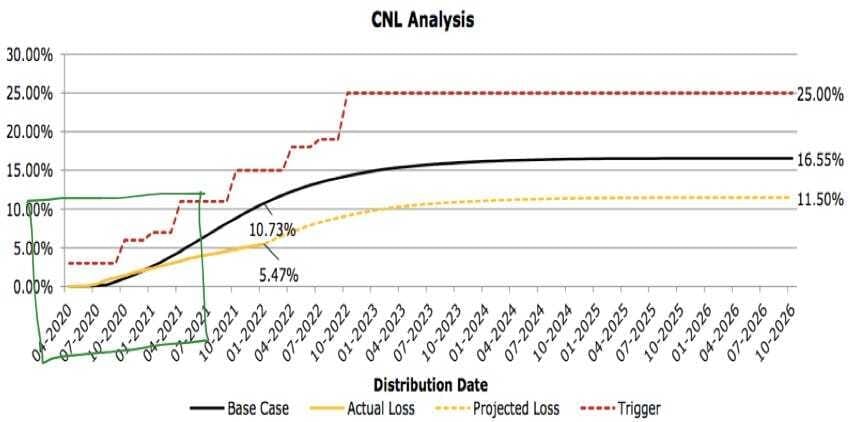

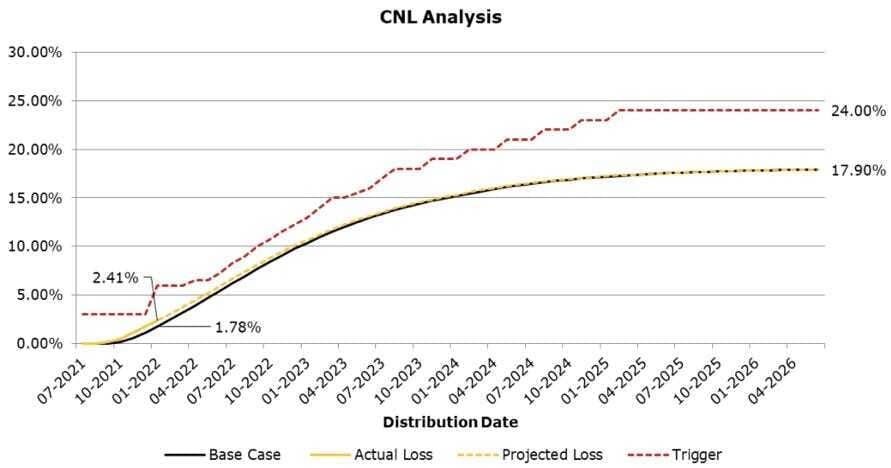

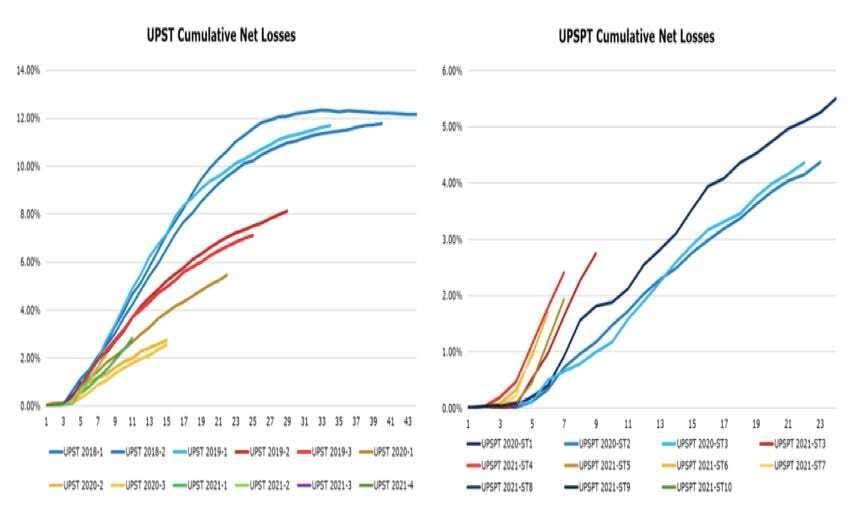

Beyond upgrades and downgrades, KBRA shared new data on the performance of each individual pass-through and asset-backed securitization trust transaction. For 2018, 2019 and 2020, Upstart’s cumulative net less (CNL) leads continue to grow over Kroll’s base case current CNL projections.

2021 has been more of a mixed bag thus far. For all 2021 asset-backed transactions, CNL rates continue to outperform KBRA’s base case rates for all three of Upstart’s transactions. For pass-throughs, 1 of the transactions is outperforming, 1 is performing in line and 3 are actually slightly underperforming.

A few things to consider here. First, base case estimates from KBRA are arrived at using all past loss data from each individual company’s loan history. With stimulus massively aiding CNL rates amid the pandemic, this naturally dragged down base case CNL assumptions for newer 2021 transactions not benefiting as much from stimulus checks.

Furthermore, some of Upstart’s best performing transactions in the past had underperformed KBRA base case CNL estimates for the first few months of the transaction’s life before finding success.

Encouragingly, Kroll has not raised any of the base case ranges for the 3 underperforming pass-throughs. Additionally, no CNL rate is anywhere near the trigger rate which would lead to accelerated amortization of the loan pools and would spell trouble for Upstart on that particular tranche.

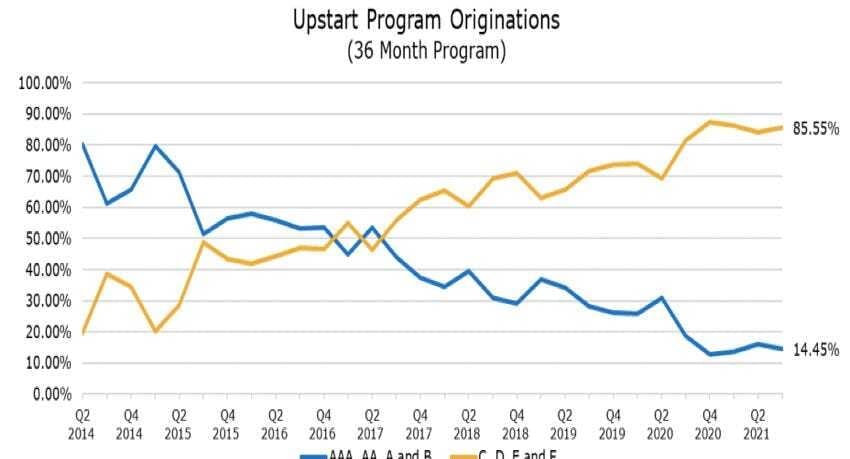

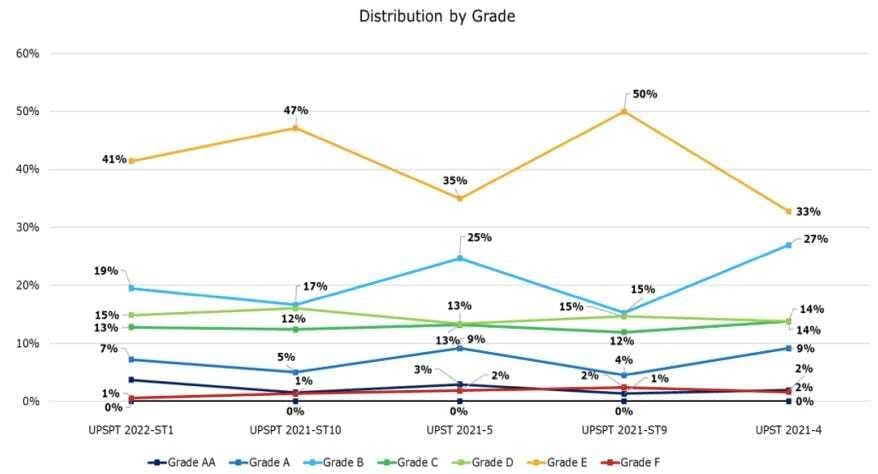

Also consider: as capital markets and partners become more and more comfortable with Upstart, they typically lower credit parameters and accept riskier and riskier loans. The result of this process is depicted below and naturally results in rising loss rates. Investors are compensated for this incremental risk in the form of heftier residual interest payments.

This risk-on trend appears to have leveled off in Upstart’s most recent transactions:

Overall transaction trends:

CNL rates for Upstart capital market transactions overall have shown upward pressure in some of its newer transactions. For asset-backed (left), the CNL trend is actual downward and so positive. For pass-throughs (right), the trend is more negative.

In a perfect world, every new transaction would feature lower and lower loss rates — but our world is far from perfect. The most important piece of all this is that reserve levels are comfortably sufficient to cover any default turbulence in residual cash flow coverage.

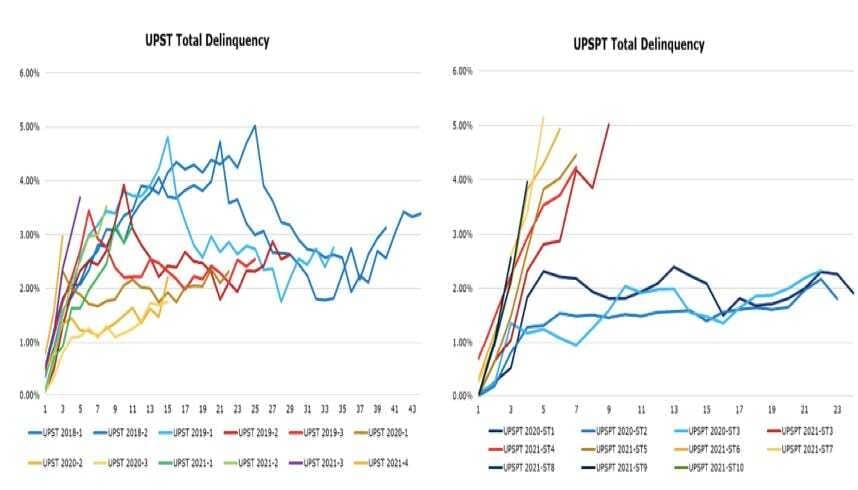

Delinquency rates for some of (not all of) the company’s transactions have risen back to pre-pandemic levels with some pass-through delinquency rates slightly overshooting historical means. This trend is less aggressive for asset-backed transactions (left) and more aggressive for pass-throughs (right):

While lower delinquency and CNL is always preferred, these sub-optimal trends have already been assumed and priced in to the company’s forward guidance:

“In terms of macro outlook, we are seeing the early signs of a return to the pre-COVID consumer profile with personal savings rates in the economy having fallen to pre-Covid levels and credit balances edging up to within 90% of pre-COVID levels. We expect the continuation of this trend to lead to an increase in consumer default rates consistent with pre-COVID levels and we believe that any issuer who has not priced this in is likely to experience a deterioration in their returns.” — CFO Sanjay Datta.

This next quarter for Upstart on February 15th is its most important since going public — by far. The primary risk to the company is whether its relative loan outperformance relies on a certain macroeconomic climate rather than the efficacy of its own machine learning models. With stimulus checks fading further away, the 2022 guide offered will be very telling of how much of Upstart’s success will be sustainable in the years to come. I’m excited to see the results. We’ll see how the company does.

I’m working on an interview with the head of asset-backed securities with KBRA. I want to learn — in his view — which are the most important trends in these reports to follow most closely. Hopefully I’ll get some specific feedback on Upstart as well. It should be completed in the next few weeks and will be included in a future News of the Week post.

b) Affirm

Affirm — a player in the buy now pay later (BNPL) space — posted what seemed to be fine results and then subsequently tanked perhaps due to language surrounding lowering credit quality to juice growth. While these two companies are often lumped together, I don’t think that is warranted. Here’s why:

Upstart relies on partners and institutions to fund its loans and set risk parameters. It cannot unilaterally lower restrictions to find more top line growth whenever it wants to — that’s up to the funders. Furthermore, while the growth rates of the 2 firms are similar, Upstart trades for roughly 30X EBITDA and 45X earnings for 2022 (assuming no beats) while Affirm remains fully entrenched in cash burn mode. Amid this tightening macroeconomic backdrop, cash burn like Affirm’s is out of favor and cash generation like Upstart’s is coveted. Finally, Upstart is not a buy now pay later company. Most of its loans are sourced to re-finance expensive debt — not to buy another depreciating asset like a Peloton. This is not me saying the quarter will be great, bad or anything in-between. This is merely me saying Affirm’s reaction should not be extrapolated to assume the same for Upstart.

Click here for my Upstart Deep Dive.

2. GoodRx (GDRX) — Prescription Costs Rise Again + a Clear Competitive Edge

a) Prescription Costs Rise Again

Drug manufacturers continued to precipitously raise prices into 2022. The average price hike for the year was 5.1% vs. 4.6% between 2020 and 2021: this problem is not abating but rather accelerating. Within this data set, the more expensive healthcare provider-administered drugs saw the most aggressive increases.

GoodRx’s branded manufacturers product directly combats this issue by bringing discount programs to its millions of consumers. As prices rise, the motivation to seek out these solutions rises and so does demand for GoodRx’s product. Considering just 3% of patients know about the discounting programs that branded manufacturers run, there’s immense (and growing) utility for this healthcare disruptor to create.

A small subset of generics saw their prices rise by an average of 12.6% which bolsters the value of GoodRx’s price comparison tool used predominately for these generics. Since 2014, GoodRx’s list price index has seen prices rise by 33% with broad-ranging price hikes seen every January and usually every July as well.

b) About Mark Cuban’s Project

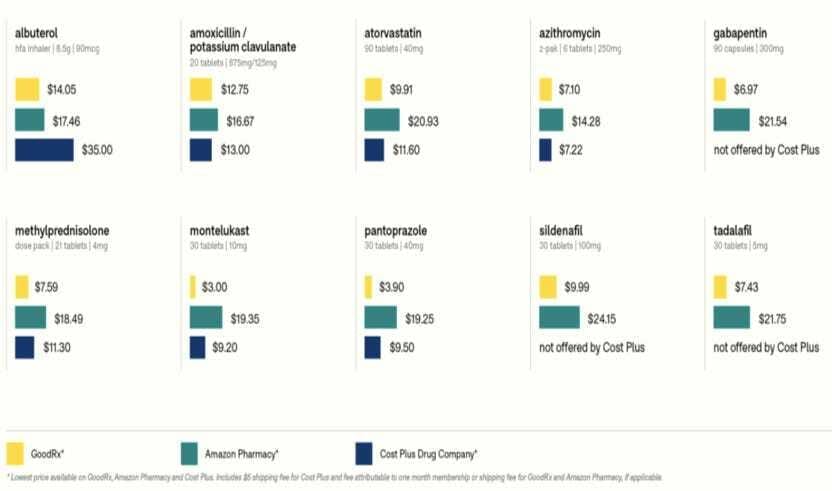

A lot has been made lately about Cost Plus’s (Mark Cuban’s) entrance into the discounted prescription space. Knowing this, Co-CEO Doug Hirsch published a blog post depicting just how much better GoodRx is vs. its more intimidating competition (including Amazon). Richard Chu (@richard_chu97) brought this article to my attention and for that I wanted to thank him. Here were the key findings:

- Per Cowen, more than half of Americans prefer in person interaction with prescriptions. Beyond using pharmacy stops to buy other goods, keep in mind that patients must be at the door to sign for most scripts if they’re delivered, which is obviously not ideal or all that convenient.

- Cost Plus and Amazon are both trying to build out a mail delivery system while most of GoodRx’s business is via brick and mortar (it does have a delivery offering too).

- Specifically, mail order delivery as a % of total script volume topped at just 5% amid peak pandemic pain and even has begun to recede before we completely exit Covid-19.

- GoodRx beats Amazon pricing via mail or retail 90% of the time.

- Just 27/50 of the most popular drugs are available on Cost Plus. Cost Plus is solely mail and shipping rates are $5. Including this fee, GoodRx is cheaper 98% of the time (86% of the time without).

- This isn’t unique to Amazon and Cost Plus… GoodRx is better than everyone else. That’s why its take rate continues to rise while competition like SingleCare is seeing its fall.

“We hope we can work with Cost Plus to introduce their service to our millions of monthly visitors. The bottom line: it’s really hard to do mail-order, even if your last name is Cuban or Bezos... The reality is that it’s not easy to lower the price of drugs.” — Co-CEO Doug Hirsch

Click here for my GoodRx deep dive.

3. SoFi Technologies (SOFI) — New Galileo Partner + a Marketing Campaign

a) New Galileo Partner

SoFi’s Galileo and Global Rewards announced a new partnership to tap into Galileo’s payment processing software. Global Rewards specializes in “payment and technology services” to automate all corporate payment flows. The firm is only 3 years old and is among Galileo’s smallest enterprise client wins to date — this is certainly no Chime or Robinhood. Still, Global Rewards is rapidly growing and could contribute more meaningfully to revenue in the distant future. For now, the announcement serves as yet another sign that SoFi’s transformation of Galileo’s product suite from on-premise to the cloud is gaining more traction. As of last quarter, Galileo had 35 total enterprise clients.

b) Marketing Campaign

SoFi has also launched its “Break Up With Bad Banking” marketing campaign following the issuance of its Banking Charter and the closure of its Golden Pacific acquisition. Per Wall Street Journal, banks feature a 33% approval rating yet the average American has used the same checking account for an average of 14 years — there’s a long runway for conversion if a company like SoFi can do things better like it thinks it can. With perks like a 1% annual percentage yield (APY) on savings accounts, I think they’re right.

SoFi’s digital-nativity and ability to cross-sell more products than its competition means its customer acquisition cost is relatively lower vs. alternatives while the value these customers provide to it is also higher. That reality paves the way for aggressive marketing tactics to claim more market share and that’s exactly what we are seeing here. The campaign has embarked on promotions across TikTok (where its last campaign got billions of impressions) and other social media platforms with linear TV and Connected-TV (CTV) placements as well. SoFi plans to give millions away in rewards to bolster campaign success.

Click here for my broad overview of SoFi.

Click here for a summary of banking charter perks for SoFi.