News of the Week (Jan 30 - Feb 3)

Meta; Shopify; Match Group; Lululemon; PayPal; Upstart; SoFi; Apple; Google; Amazon; AMD; Starbucks; Macro; My Activity

Today’s piece is powered by Masterworks:

Welcome to the 573 new readers who have joined us this week. We’re delighted to have you all as subscribers and determined to provide as much value & objectivity as possible. This piece was too long to send via email in its entirety.

1. Meta Platforms -- Apple

A lot has been made over the past few weeks of Apple’s entrance into the virtual/augmented/mixed reality (AR/VR/MR) space to rival Meta Platforms. While this is understandable, considering the firm’s cult-like following and unmatched balance sheet, it’s a net positive in the mind of Meta leadership. Why? Legitimacy. Zuckerberg has said time after time that Meta’s goal is to both command a strong share of the budding market and ALSO to “accelerate its arrival.”

Why is this acceleration so important? Because Apple and Google today own the mobile computing platform. That gives these two companies control over the software ecosystems Meta relies on for distribution. It also allows Apple to hurt Meta via things like blocking cross-app data sharing to weaken ad targeting capabilities — a move that shaved several percent off of Meta’s 2022 revenue growth.

Apple shifting resources to build out its competing virtual reality platform is a hint that it acknowledges that a sea change away from phone screens is coming. This is Apple doing its part to accelerate the Metaverse’s arrival.

Meta has no chance at garnering mobile hardware share and has no interest in doing so. It has a far higher probability of success to be a real player in the next computing platform. It leads on things like hand and facial expression tracking and is already creating compelling enterprise use cases. And if the company can command a sizable hardware share of this future, multi-trillion dollar opportunity, that will not only mean more revenue, but more control over its destiny by not being reliant on mobile gatekeepers behaving.

In case you missed it, click here for my Meta Earnings review from this past week.

2. Shopify (SHOP) -- Bullish Note & Buy with Prime

a) Bullish Note

Roth Capital upgraded Shopify to overweight this week. As always, upgrades and price targets don’t matter to me. BUT… the reasoning behind these notes -- when compelling & legitimate -- does matter to me. Roth Capital sees Shopify approaching 20% revenue growth in 2023 despite extremely tough comps, discretionary spending weakness and foreign exchange pressures. Furthermore, it sees the recently announced price hikes pushing more merchants to longer term subscription plans which will enhance the longevity and visibility of Shopify’s book of business.

The 20% growth expected merely brings Roth Capital in line with consensus estimates for 2023, but it’s still nice to see another firm raising their demand base case.

Shopify will largely wrap up an aggressive investment cycle by the end of the year as it builds out its Shopify fulfillment network (SFN). From now to then, margins are set to trough with profit growth resuming after a year-long pause. When pairing that with upcoming easier comps, strengthening revenue estimates, lapping its subscription take rate reduction, large merchant packages gaining clear traction and macro pressures beginning to ease, the 2023 set-up is quite compelling.

Unfortunately, markets seem to have sniffed that out over the last few months with the stock roughly doubling from the lows. That puts it around 18X 2023 gross profit which represents a more than 100% premium vs. markets. I think it deserves a hefty premium, but that may be a bit stretched at these levels. So? I’ve paused building out the position until multiple expansion begins to revert and (as noted last week) trimmed a small piece of the holding. I’m ok with accepting the risk of my position turning out to be smaller than I’d like if multiple compression doesn’t come. This high quality company is very expensive again and valuation always matters.

b) Amazon

Amazon launched its “Buy with Prime” offering to all merchants in the U.S. This extends its industry leading logistics services to 3rd party merchant sites for all products also offered on Amazon’s Marketplace. Similarly to SFN, “Buy with Prime” early on has delivered a 25% conversion spike for merchants due to shortened delivery windows. While this is clearly a strong competitor, it’s one that I view Shopify as fully capable of co-existing with. Why?

SFN doesn’t force merchants to plug into Amazon’s marketplace and so doesn’t force merchants to concede control of their data and brand relationships. 60% of Shopify’s merchants don’t sell on Amazon with many avoiding it for these reasons. While “Buy with Prime” trail-blazes a more direct consumer relationship, that can only be enjoyed if you list on Amazon -- which many merchants are simply unwilling to do. Direct to consumer (DTC) has become an imperative growth channel for countless merchants and SFN allows that DTC approach to be more complete and consistent without marketplace interruption.

Furthermore, Shopify is NOT trying to compete on Amazon’s delivery timelines or its logistics footprint. Shopify is merely trying to promise 1-2 day delivery to juice conversion rates so that merchants can sell more and Shopify can collect more revenue from happier clients. And it’s using fulfillment partners like FedEx and DHL to do so while sparingly leasing warehouse capacity in the most populous U.S. cities. Shopify’s expertise here is really on the software side of things. It has a great ability to plug cross-channel fulfillment into inventory management, marketing campaigns and all other areas of business for an seamless, cohesive, actionable view of operations. It’s not trying to come remotely close to matching Amazon’s fulfillment capacity, but is instead actively working on an integration while Shopify’s Deliverr is already an Amazon fulfillment partner.

As Shopify founder Tobi Lutke has frequently told us -- “this is not nearly as zero sum as people seem to think.” Some firms like UBS see “Buy with Prime” as a potential 1000 basis point headwind to Shopify growth, but “recognizes the actual impact could be lower” which is what I expect (and what most other firms expect as well).

If you follow me on Twitter, you’d know the pace of the Fed’s rate hikes has been the fastest since the 1980s. And during these hikes, investors lost an eye-popping $350B.

But one investing app posted record gains in 2022 through all of the chaos.

It’s called Masterworks – the company that has finally democratized access to fine art.

They make real multimillion-dollar paintings investible through shares, similar to how a company is broken up into pieces through stock.

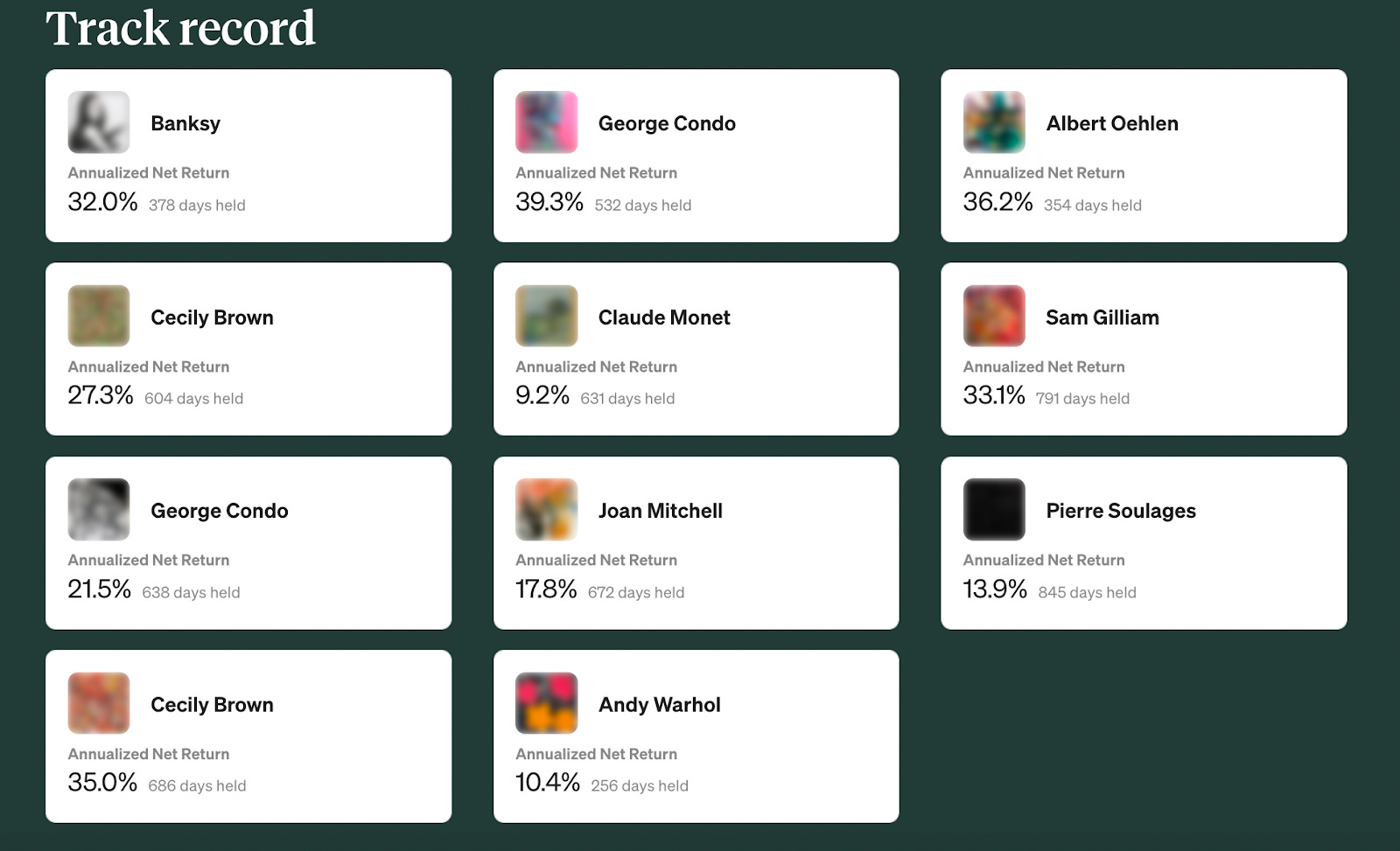

And, the returns speak for themselves — all 11 exits were profitable:

It’s no surprise why. Their experts from Sotheby's and BofA analyzed +5,000,000 proprietary data points to identify great opportunities for your capital.

The takeaway? While your friends stress about market timing, inflation, and rate hikes, many Masterworks investors have enjoyed +10% net returns like clockwork… across all pieces of economic cycles.

Thanks to our partnership, if you have a +$250,000 portfolio, you can skip the waitlist now.

*“Net Return" refers to the annualized internal rate of return net of all fees and costs, calculated from the offering closing date to the date the sale is consummated. IRR may not be indicative of Masterworks paintings not yet sold and past performance is not indicative of future results. See important Regulation A disclosures.

3. Match Group (MTCH) -- Q4 2022 Earnings Review

“2022 was worse than what we expect of ourselves. We made corrective changes & feel we’re going momentum into 2023.” -- New CEO Bernard Kim

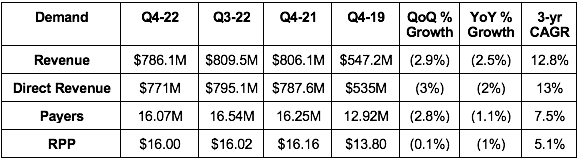

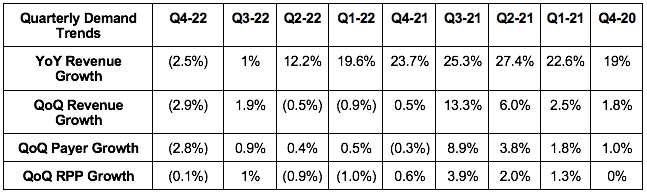

a. Demand

Match missed analyst revenue estimates by 1.1% & beat its guide by 0.1%. The guide assumed a 900 basis point foreign exchange (FX) growth headwind like it endured in the previous quarter. The actual FX headwind was 700 basis points. Match needed this assistance to simply meet its expectations. It told us that “weaker than expected business performance” across the globe but mainly in Europe was the cause of this relative weakness. Disappointing, but somewhat expected. Leadership needs time to turn Tinder around.

More Demand Context:

Tinder Direct revenue of $444 million was flat YoY & up 8% YoY FX neutral.

Macro was blamed partially for briskly slowing growth. Tinder execution was blamed as the main cause of the weakness.

Tinder Payers rose 3% YoY to 10.8 million while payers within the rest of its app fell 8% YoY.

Revenue Per Payer (RPP) was hit by an 800 bps FX headwind with that most pronounced in APAC. RPP actually rose 7% YoY FX neutral.

Hinge grew revenue by 30% YoY in Q4 and 44% YoY for 2022 as a whole. It generated $284 million in 2022 revenue vs. $300 million estimates due to the delayed release of its new, more expensive subscription package.

For 2022 as a whole, total Match Group revenue grew 7% YoY & 14% YoY FX neutral.

b. Profitability

Match beat adjusted operating income estimates by 4.3% and its guide by 5.0%.

Match missed GAAP EPS estimates of $0.46 by $0.15.

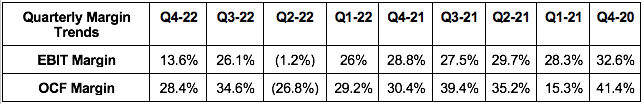

Margin Context:

2022 free cash flow was hit by $441 million in legal settlements. That’s why it generated $476 million in 2022 FCF vs. $832 million YoY. Ex-settlement, FCF would have grown 10% YoY to $917M.

EBIT margin was hit by a $102 million impairment charge due to lower Meetic (one of its acquired dating apps) projections and rising discount rates for its Hyperconnect purchase valuation. Its financial targets for Hyperconnect did not change.

Selling & marketing fell for the 3rd straight quarter by 9% YoY and represented 16% of revenue vs. 17% YoY.

Match continues to hire new talent for Tinder and Hinge.

c. Balance Sheet

$581 million in cash, equivalents & short term investments vs. $398 million last quarter.

$3.9 billion in long term debt with 90% of it fixed rate.

Fully undrawn $750 million credit revolver.

Trailing 12 month net leverage ratio of 2.9X vs. 3.1X sequentially and vs. nearly 5X in 2020.

Match paused its share buybacks in Q4 vs. buying back $267 million in stock in Q3. This was to “allow the cash balance to build” and amid “concerning stock volatility.”

Will likely now restart buybacks with the bolstered cash pile.

Basic share count grew 2.7% YoY in 2022 (related to new CEO hire) while diluted count fell by 3.3%.

Stock comp was 6.7% of sales vs. 4.3% YoY due to to leadership changes.

d. Guidance

Q1 2023:

Match’s revenue guide missed estimates by 3.2%.

Match’s adjusted EBITDA guide missed estimates by 8%.

This implies a 32% margin for the quarter.

2023 guide:

REITERATED roughly $3.42 billion in 2023 revenue, meeting estimates.

Leadership added that it’s “increasingly confident” in this guide.

REITERATED “flat or better” adjusted EBITDA margins safely implying a 35% margin or $1.20 billion in 2023 adjusted EBITDA. This met estimates as well.

This includes $14 million in unique severance & Google Escrow account headwinds and does not include any help from potential Google regulation or easing macro headwinds like FX.

Growth & margins will improve throughout the year as better execution translates into better results at Tinder and as comps and macro get easier while cost savings initiatives take hold.

$240 million in 2023 stock comp or 7% of revenue.

Nearly $400 million in Hinge revenue for ~40% YoY growth.

$840 million in free cash flow with a 70% EBITDA to FCF conversion rate. This gives it a 2023 FCF multiple of 15X. Still, this was 8% worse than expected.

So far in 2023, macro pressures have been “in line with expectations” and it continues to see itself exiting 2023 with double digit growth. It’s conducting a companywide cost review to reduce low return marketing, headcount and overhead. These savings will be infused into higher growth brands like Hinge, Tinder, Pairs and BLK as well as “new bets.”

“To the extent there are FX tailwinds, that would be a factor to push us to the higher level of our guidance or potentially above it. It’s too early to adjust the guide considering how volatile FX is.” -- CFO Gary Swidler

e. Shareholder Letter and Call Notes

Macro:

Match will reduce the global workforce by 8% in 2023. This is partially due to reorganizing its leadership structure which involved combining emerging and evergreen brand departments. That combination created redundant roles that it’s now eliminating.

Japan operations have not yet begun to recover while pandemic restrictions begin to ease. Match expects this recovery, but avoided including it in its 2023 guide. Japan’s comeback will present upside to guidance whenever it happens.

Tinder:

The team is preparing to launch a “bold global marketing campaign.” Leadership continued to talk about how Tinder’s historic virality & word of mouth growth fostered a bit of complacency on handling the brand narrative. It aims to reclaim this narrative and reshape it away from the “hookup app” label Tinder boasts today. This plan will raise Tinder marketing dollars as a percent of direct revenue by 200 bps in 2023 vs. 2022.

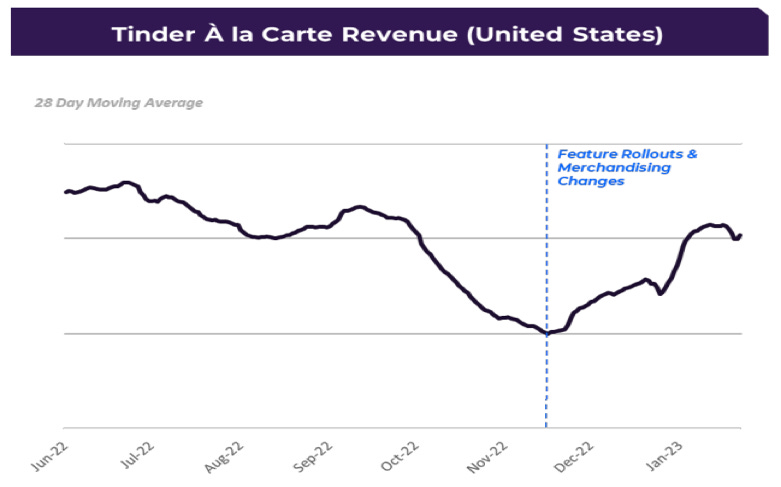

As evidence of new product initiatives working and the new team executing, Tinder -- through new perks like dynamic subscription offer surfacing, granular profile descriptions and Primetime Boosts -- reversed a negative trend in à la carte revenue. Match has seen encouraging stabilization to à la carte over the last several months:

The loss of 300,000 Payers QoQ for Tinder was due to eliminating discounted packages in what was called a “revenue neutral” decision.

Tinder continues to test new ad formats and subscription packages (including the plan tailored to female monetization).

Product shipping cadence rapidly accelerated in the 2nd half of the year vs. the first half.

Leadership sees significant “low hanging fruit” around pricing optimization.

CEO Bernard Kim told us the previously rumored ultra-premium Tinder subscription plan was in very early testing.

Tinder (and all other apps) are now seeing stability in peak season demand trends.

Hinge New Subscription:

Launched its new, ultra-premium subscription tier called “Hinge X.” This costs $60 per month vs. $35 for the lower tier plan.

Hinge X offers “better recommendations to raise awareness,” an “always on boost” to bring your profile to the top of everyone’s piles and likes pinned to the top of prospective match feeds.

New plan is “delivering on expectations in its initial testing with significant take rates.” The conversion rate is actually higher than expected and this has not cannibalized à la carte revenue to date.

The subscription will roll out to all Hinge markets by the end of February.

Hinge Going Global:

5 months into its Germany launch, it’s now the #3 dating app (vs. #4 last quarter).

It’s #3 across the Nordics DESPITE only having launched in Sweden.

With 0 marketing spend to date, Hinge is close to cracking the top 10 in France, Italy and Spain. It will wrap up product localization/translation there in the coming months and then launch marketing campaigns.

Hinge is set to be fully translated across Europe this year before turning its attention to Asia and Latin America in 2024.

International will NOT be a key 2023 revenue driver as it takes time to build enough scale in new markets to motivate premium subscription sales.

Hinge is now a Top 3 dating app in: The U.K., Australia, Ireland, The U.S., Canada, Germany, Austria, Switzerland, Sweden, Norway, Finland and Denmark.

F. My Take

The report was largely as expected, the Q1 guide was disappointing and the full year 2023 guide was in line with expectations. I hoped that a weakening dollar would have provided some upside to its previous 2023 forecast -- but that guide was merely reiterated as leadership thinks it’s too early to get excited there. I wholeheartedly believe Bernard Kim is the perfect CEO to right this ship, but it will take time for the company’s operational improvements to gradually improve the financial trends we’re seeing.

Macro & micro are both hitting them at the same time. Macro headwinds will ease throughout the year as it attempts to get its micro-level mojo back through product roadmaps that are working well thus far. I’m not interested in trimming or adding after this report. I will hold.

4. Lululemon Athletica (LULU) -- Nike

Nike is suing Lululemon over footwear patent infringement on 4 shoe models. This is far from the first batch of legal drama we’ve seen from the two companies, and it will likely turn out to be a large nothing burger -- but I will keep an eye on this just in case.

5. PayPal (PYPL) -- Layoffs

PayPal announced that it will lay off 7% of its staff in another move to control costs. This has turned into an unfortunate cliché for even the strongest technology and fintech companies over the last year. It’s a necessary evil for PayPal in its drive to deliver the 15%+ earnings growth it has committed to for 2023 -- which is an imperative piece of this investment case.

The company (as leadership often admits) spread itself too thin across products and geographies in 2021 as it extrapolated the pandemic pull-forward as more permanent than it turned out to be. This is a painful part of removing that excess and becoming leaner and more focused on its higher-probability growth vectors like Venmo, Braintree, Europe and China.

6. Upstart (UPST)

a) Layoffs

It’s no secret: Macro headwinds paired with leadership blunders have hurt Upstart mightily over the last year. Knowing this, and in response to “significantly reduced or paused loan originations” across the sector, Upstart is “streamlining operations to return to profitability.” To do so, it’s firing 20% of its workforce and will incur about $15 million in Q1 2023 severance charges as a result. Once finished, this move will save Upstart about $57 million in operating expenses and will cut stock comp by $42 million as well. Furthermore, it is suspending the rollout of its small business loan product to release once macro is not so negative for the firm.

While we’ve seen strong macro green shoots for other lending players like SoFi, the same has not yet been true for Upstart within its lower credit quality category. Still, financial conditions continue to loosen with the 2 year yield now 51 basis points off of 52 week highs and that benefit will eventually make its way to Upstart’s demographic and funding supply.

As with PayPal, this is both a tough piece of news for the 365 people impacted and a necessary maneuver to ensure Upstart has the liquidity to comfortably survive the remainder of this downturn. In terms of my plans with the position, it remains on my Do Not Add list until funding supply (both from partners and investors) shows signs of bottoming. I haven’t seen those signs yet as delinquencies across its niche continue to rise and so capital appetite continues to be challenged.

b) New Partner

Upstart landed NBKC Bank as its newest referral network partner (Upstart’s largest source of revenue by far). The two companies had worked together since June on a pilot program and this marks the deepening of that relationship. This Kansas-based institution is the 742nd largest bank in the U.S. with about $1.13 billion in total assets.

For now, new partners will not move the financial performance needle if they’re not willing to fund a material chunk of Upstart’s loan marketplace demand. Still, it does diversify Upstart’s access to funds for when (or if) this willingness to fund returns. Furthermore, partner funding is inherently more durable than capital market funding which means this is a (small) piece of good news for making Upstart’s future operations more durable in the face of macro challenges.

7. SoFi Technologies (SOFI) -- Earnings Review

In case you missed it here is my SoFi Earnings Review.

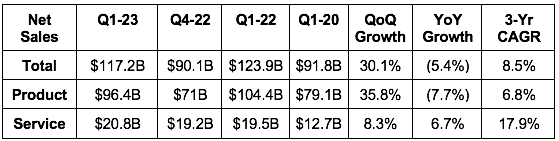

8. Apple (APPL) -- Earnings Snapshot

a) Results vs. Expectations:

Missed revenue estimates by 3.8%.

Missed EBIT estimates by 3.2%.

Missed $1.95 EPS estimates by $0.06.

Met its GPM guide & estimates.

b) Balance Sheet:

$165B in cash, equivalents & securities. Wild.

$111B in debt including its commercial paper ($9.7B current).

Bought back $19.5B in stock; paid out $3.8B in dividends.

c) Outlook:

Apple hasn’t provided concrete guidance in several quarters. It did offer some abstract outlines of how to think about next quarter. It told us to expect YoY revenue growth next quarter to be roughly similar to the -5.5% growth we saw this quarter. Analysts wanted -2.6% growth. It further guided to a gross margin of 44% which met expectations and $13.8 billion in total operating expenses. This implies EBIT estimates that roughly met expectations.

d) Call & Earnings Release Highlights:

Results context:

8.5% 3-yr CAGR vs. 12.1% last Q & 15.5% 2 Qs ago.

Product GPM was 37% vs. 34.6% QoQ & 38.4% YoY.

Services GPM was 70.8% vs. 70.5% QoQ & 72.4% YoY.

Apple generated $111.4 billion in 2022 free cash vs. $92.9 billion YoY as this margin line actually improved from 25.4% to 28.3% YoY.

6% YoY services growth was 13% YoY constant currency.

Product Traction:

Revenue fell YoY in every single geography & for all products but iPad. This was due to an 800 bps FX headwind. Revenue grew 3% YoY constant currency.

Apple added 150 million paid subscribers in 2022 to reach 935 million. This number has compounded at a lofty 31% clip over the last 5 years.

MacBook revenue YoY comps were vs. its successful M1 MacBook Pro launch making the comparison uniquely difficult.

Apple crossed 2 billion active devices in its install base. This has compounded at 10.4% over the last 7 years. Elite growth considering the scale.

Controlling Costs and Macro:

Leadership acknowledged 3 exogenous headwinds weighing on the business into 2023: foreign exchange headwinds, supply chain challenges with iPhone and general macro headwinds weighing on consumer discretionary spend. The supply chain issues from pandemic lockdowns and flare-ups in China hurt iPhone supply through most of the quarter. This lengthened ship times and hit supply. Production and supply chains have both now normalized. Demand for the new iPhone cycle was called strong with the supply shortage dampening results materially.

To counteract macro softness, total operating expenses for Apple during that quarter were $14.3 billion vs. its guidance of $14.8 billion as it “takes actions to respond to the current macro environment.” It’s tightening its belt, although less aggressively and explicitly than other mega caps like Meta, Amazon and Google.

Tim Cook also acknowledged how challenged the PC market continues to be.

9. Google (GOOGL) -- Earnings Snapshot

a) Results vs. Expectations:

Missed revenue estimates by 0.6%.

Missed EBIT estimates by 1.3%.

Missed $1.20 EPS estimates by $0.15.

Missed FCF estimates by 14.5%.

b) Balance Sheet Data:

Bought back $15.4B in stock vs. $15.4B QoQ & $13.5B YoY.

Bought back $59 billion in 2022 total.

~$114 billion in cash & marketable securities.

$14.8B in long term debt.

c) Call & Earnings Release Highlights:

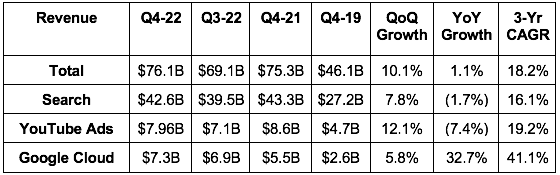

Results Context:

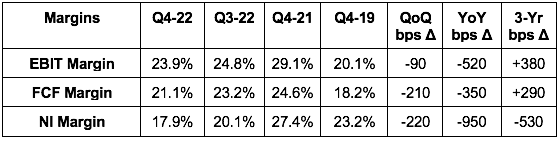

Cloud EBIT margin was -6.6% vs. -10.2% QoQ & -16.1% YoY. Leadership continues to be laser-focused on operating leverage here as it has already “invested ahead of demand.”

The 18.2% 3-yr revenue CAGR compares to 19.5% last quarter & 21.5% 2 quarters ago.

FX was a 600bps growth headwind vs. 500bps expected. FX-neutral growth was 7% YoY.

Like Meta, Google extended the useful life of some of its servers to lower operating expenses in 2023 by $3.4 billion via lower depreciation charges.

Macro:

Margins were hit by $1.2 billion in inventory charges to “reflect pricing pressures and changes to future expected needs.”

Leadership unsurprisingly talked about an end to digital spending acceleration from the pandemic as macro “becomes more challenging.” This is weighing on advertiser budgets which is a key to Google’s growth. CEO Sundar Pichai sees “now as an important time to reengineer the company’s cost base in a durable way.” It committed to slowing OpEx growth through 2023 with leverage ramping in 2024 as billions in severance charges will delay margin expansion. This sounded eerily similar to Meta’s “year of efficiency” theme from its call earlier in the week.

It’s “working on improving cost structure and margins” within its Pixel smartphone line.

AI -- the theme of the call:

Perhaps in response to ChatGPT’s rapid traction gains, Google will make language models available to the general public to be used within search in the coming weeks.

Google AI and DeepMind’s protein database is now used by 1 million biologists globally.

An upgrade to ad targeting models during the quarter raised advertiser conversions by 35% with an update to its smart shopping campaign product yielding another 12% conversion boost.

Product Notes:

YouTube Shorts revenue sharing started this past week. Shorts are now averaging 50 billion daily views vs. 30 billion 9 months ago.

YouTube Music and Premium Subscribers crossed 80 million subscribers with NFL Sunday Ticket rights expected to help accelerate growth here.

The 2022 Pixel Phone line was the “best selling ever and gained share in every market.”

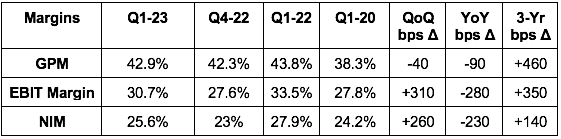

10. Amazon (AMZN) -- Earnings Snapshot

a) Results vs. Expectations:

Beat sales estimates by 2.3%; beat its guide by 3.6%.

AWS revenue missed estimates by 1.8%.

Beat EBIT estimates by 12%; beat its guide by 35%.

*Missed $.17 EPS estimates by $.14.*

Missed operating cash flow estimates by 9%.

b) Forward Guidance:

Missed revenue estimates by 2%.

Missed EBIT estimates by 46%.

c) Balance Sheet Data:

$96B in cash & equivalents.

$48.7B in long term debt.

Amazon did not repurchase any shares during the quarter.

Stock based awards outstanding as a % of common stock is 3.8% vs. 3.9% QoQ and 2.8% YoY.

Share count including stock comp rose 1.6% YoY.

Inventories rose 5.5% YoY. Good job leadership.

d) Call and Earnings Release Highlights:

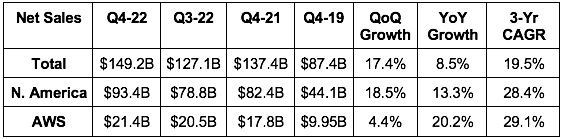

Results Context:

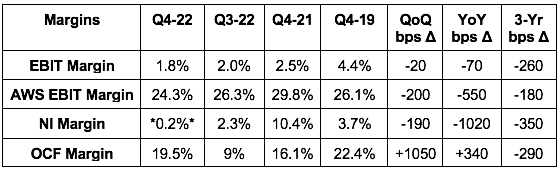

*Net income margin was sharply propped up by Rivian equity gains in Q4 2021 which led to a tough comp. To make things even more difficult for the net income comparisons, Rivian mark to market equity fair value sharply dropped this quarter which counts towards GAAP net losses. Ex-Rivian, net income margin was 1.7% vs. 1.8% YoY.

During the quarter, operating income was also hit by employee severance, operating lease charges and property and equipment impairments. Without these charges, Amazon’s $2.7 billion in EBIT would have been $5.4 billion for a 3.6% margin vs. 2.7% YoY.

The 19.5% 3-yr revenue CAGR vs. 22% last Q & 23.4% 2 Qs ago.

FX headwinds were 100 bps lighter than expected. This led to the revenue beat.

Macro:

Leadership is “encouraged by its cost reduction progress” via cutting staff and fulfillment capacity.

It’s seeing customers remain “cautious” with more noticeable pressure on discretionary spend and a shift to lower prices and value brands. It asked Whole Foods suppliers to lower their costs as inflation falls.

Amazon’s ad market commentary was actually a bit more upbeat than Google’s and Meta’s. Its ad revenue rose 23% YoY constant currency.

AWS -- so far in the quarter, AWS YoY growth is in the “mid-teens.” This was disappointing.

AWS customer wins during the quarter include: Nasdaq; Yahoo; Brookfield Asset Management; Duke Energy.

New AWS Accenture partnership to remove migration friction.

Data usage optimizations in response to poor macro continued into this quarter. This will continue to hurt AWS growth in the first half of the year. Leadership added that the “new customer pipeline remains healthy” and there are many deployments in the plans.

Product News:

“Buy with Prime” is now available for all U.S. merchants to add Prime logistics directly onto their websites for all products also listed on Amazon. This raises conversion by 25%, similar to Shopify Fulfillment Network.

Its robotic hardware to augment inventory handling (“Sparrow”) was added to its first fulfillment center.

Launched Amazon Clinic to deliver virtual care for 20 conditions.

Launched RxPass as a new Prime benefit for “unlimited eligible prescription meds for $5 per month and free shipping.”

Partnering with Snap on AR shopping.

Amazon continues to be “encouraged by return on content spend” for Amazon Prime which rose from $5 billion in 2021 to $7 billion in 2022.

11. AMD (AMD) -- Earnings Snapshot

“2022 was a strong year for AMD as we delivered best-in-class growth despite the weak PC environment… Although the demand environment is mixed, we are confident in our ability to gain market share in 2023 and deliver long-term growth based on our differentiated product portfolio.” -- AMD Chairwoman/CEO Dr. Lisa Su

a) Expectations vs. Results:

Beat revenue estimates by 1.4% & beat its guide by 1.8%.

Beat GPM estimates by 30bps & beat its guide by 10 bps.

Met EBIT estimates.

Beat $.67 EPS estimates by $.02.

Missed $.21 GAAP EPS estimates by $.20.

b) Forward Q1 2023 Guidance:

Missed revenue estimates by 3.8%.

Missed GPM estimates by 150 bps.

For 2023, AMD expects client and gaming revenue to decline YoY while data center and embedded revenue rises.

c) Balance Sheet Data:

Inventory rose 12% QoQ & 93% YoY.

$5.8 billion in cash, equivalents & investments.

$2.5 billion in debt.

It bought back $250 million in stock vs. $617 million QoQ & $756 million YoY.

Returned $3.7B total to shareholders in 2022

d) Call and Earnings Release Highlights:

Results Context:

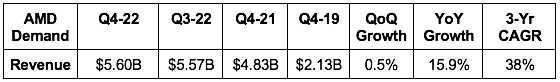

The 38% 3-year revenue CAGR compares to 45.7% last quarter and 62% 2 quarters ago.

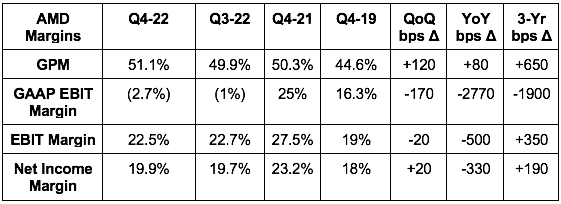

GAAP EBIT loss was via amortization of acquired intangibles from the Xilinx acquisition. GPM for 2022 was 45% vs. 48% in 2021 due to amortization of intangible assets via Xilinx. Non-GAAP GPM was 52% vs. 48% YoY which accounts for this.

AMD generated $3.1 billion in 2022 free cash flow vs. $3.2 billion YoY.

Product News:

Within embedded, AMD is collaborating with Energy Sciences Network in U.S. Department of Energy’s newest science network.

EVP and CFO Devinder Kumar retired after 39 years with AMD. Jean Hu is the new EVP and CFO.

Macro & Forward-Looking Commentary:

AMD’s pipeline of enterprise clients “continues to expand” with “a number of new Fortune 500 wins” in Q4.

2023 demand is expected to remain mixed but AMD is expecting the same second half ramp that ASML talked about last week.

12. Starbucks (SBUX) -- Earnings Snapshot

a) Results vs. Expectations:

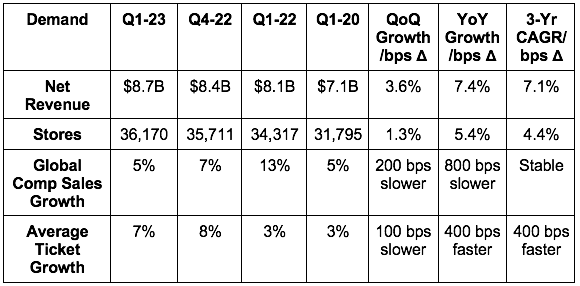

Missed revenue estimates by 0.8%.

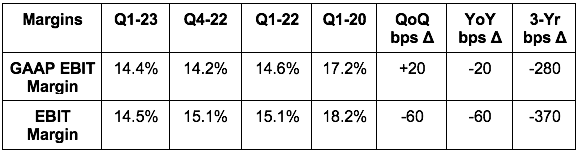

Missed EBIT estimates by 2.9%.

Missed EPS estimates of $0.77 by $0.02.

b) Balance Sheet Data:

Resumed buyback this Q and repurchased $191.4M in stock. 96% of its buyback capacity on the new program remains.

$3.3B in cash, equivalents & investments with another $600M in long term investments.

$13.2B in long term debt.

c) Forward Guidance:

For 2023:

Reiterated 11% revenue growth (14% FX neutral) vs. expectations of 11.4% growth.

Reiterated EBIT margin expansion roughly in line with expectations.

Reiterated 17.5% earnings growth vs. expectations of 15.1%.

Leadership expects a demand ramp in China throughout 2023 as stores are now all back to open without restrictions. For evidence, January China comp store sales fell 15% vs. declining 42% in December. Slow progress is being made here.

Long term:

Reiterated 45,000 stores by end of FY 2025.

Reiterated $20 billion returned to shareholders by the end of FY 2025.

d) Call and Earnings Release Highlights:

Results Context:

Rewards loyalty active members in the U.S. reached 30.4M – up 15% YoY.

FX erased about 400bps from revenue growth.

China mobility restrictions and a spike following the zero policy hit comp sales 4X harder than expected. Reduced EPS by $0.06 which was the source of the small miss.

51% of stores are company owned and 49% licensed.

EBIT fell due to “investments in labor including enhanced store partner wages & benefits, inflationary pressures & sales de-leveraging in China".”

Macro:

“We posted today's strong results despite challenging global consumer and inflationary environments, a soft quarter for retail overall and the unprecedented and COVID-related headwinds that unfolded in China in Q1.” -- CEO Howard Schultz

13. Macro

a) Fed Rate Announcement

Fed hiked its benchmark rate 25 basis points as expected to 4.50%-4.75%.

Balance sheet reductions continue as planned.

The Fed hinted at continued rate hikes with markets now pricing in one more 25 basis point hike at the next meeting and then a pause.

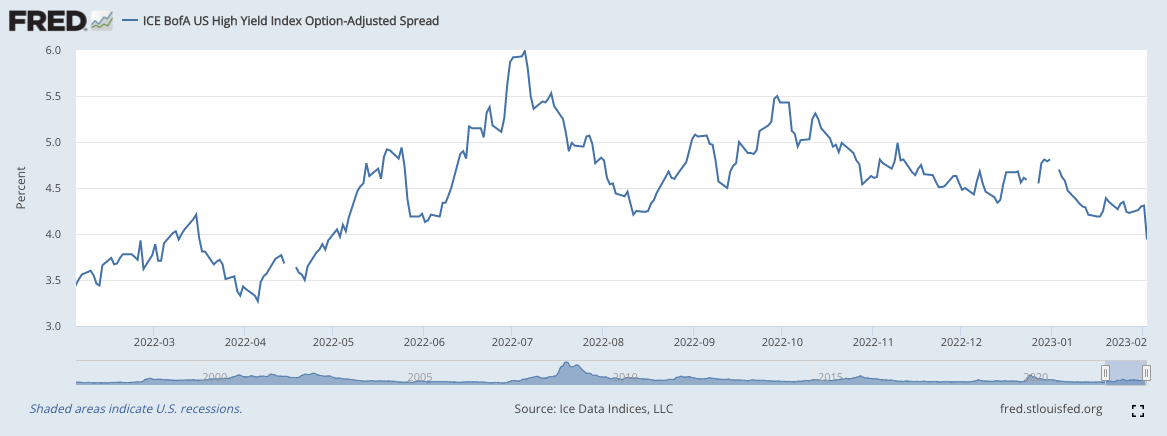

Jerome Powell did not express any concern over the loosening financial conditions in credit and equity markets we’ve seen over the last couple months. He said those expectations are based on inflation falling more quickly than he expects and in that scenario he would welcome a sooner pause and eventual pivot. The outlook for 2023 today assumes no cuts while markets expect 2 cuts later in the year. What actually happens will depend on the pace of disinflation. Financial conditions loosened further after this statement as can be seen by high yield option adjusted corporate credit spreads (lower means better liquidity):

Business fixed investment is weakening with more hawkish policy.

Labor market is still too tight with labor force participation still too low.

Powell repeated that low inflation requires likely below trend growth and labor market softening.

The mean terminal rate forecast of 5%-5.25% was not changed.

“Inflationary data shows a welcome reduction in the pace of price increases. More evidence is needed to be confident we’re on the right path. Long term inflation expectations remain well anchored.” -- Chair Powell

“The slower pace of hikes allow us to better assess progress as we approach sufficiently restrictive policy… we’re not very far from appropriately restrictive with real rates now positive.” -- Chair Powell

“Goods and housing inflation have a credible story of disinflation with that process having now started. Services inflation ex-housing hasn’t seen that same progress.” -- Chair Powell

"I believe there is a path to 2% inflation without significant economic decline or labor market softening... my base case is returning to 2% without a significant downturn or increase to unemployment" -- Chair Powell

b) More Data from the week

Consumer & Employment:

Conference Board Consumer Confidence was 107.1 vs. 109 expected and 109 last month

Non-farm Payroll for January rose 517K vs. 185K expected. The outsized increase was largely taken as an anomaly by the market as the reporting methodology changed significantly.

Labor force participation rate slightly ticked up from 62.3% to 62.4%

ADP non-farm employment change for January was 106K vs. 178K expected and 253K last month.

JOLTs Job Openings for December were 11 million vs. 10.25 million expected. There are 1.9 job openings per seeker as of now.

Initial Jobless Claims were 183,000 vs. 200,000 expected and 186,000 last month.

Unemployment fell from 3.5% to 3.4% in January.

Economic Output:

Manufacturing Purchasing Managers Index (PMI) for January was 46.9 vs. 46.8 expected & 46.8 last month.

Institute of Supply Management (ISM) Manufacturing PMI was 47.4 vs. 48 expected and 48.4 last month.

S&P Global Composite PMI for January was 46.8 vs. 46.6 expected and 44.7 last month.

ISM Non-Manufacturing PMI for January was 55.2 vs. expectations of 50.4 and 49.2 last month.

Inflation:

Average Hourly Earnings for January rose .3% month over month as expected.

5 year breakeven inflation expectations remain well-anchored around 2%:

c) Level-Setting the Data

The trends we’ve seen play out since late 2022 continued into this week. For consistent readers, this section will sound familiar. Inflation progress has been brisker than the pace of economic or employment weakening. That bodes well for the soft landing thesis many of my colleagues have and for my base case of a mild 2023 recession. It allows the Fed to pause before hiking us beyond slowing growth or a mild recession into something more dire. I continue to expect a 1H Fed pause (NOT a pivot) with that pause lasting for most of 2023 before eventual cuts towards the end of the year or early 2024.

I thought the hike this month would be 25-50 basis points with the Fed pausing now. Instead, it hiked 25 bps and guided markets to expect one more 25 bps hike. Close enough. My cash position is largely deployed at this point and I do not expect that to change. While volatility and chop could remain chaotic, I truly believe we are much closer to a cycle bottom than top. My skin is in the game.

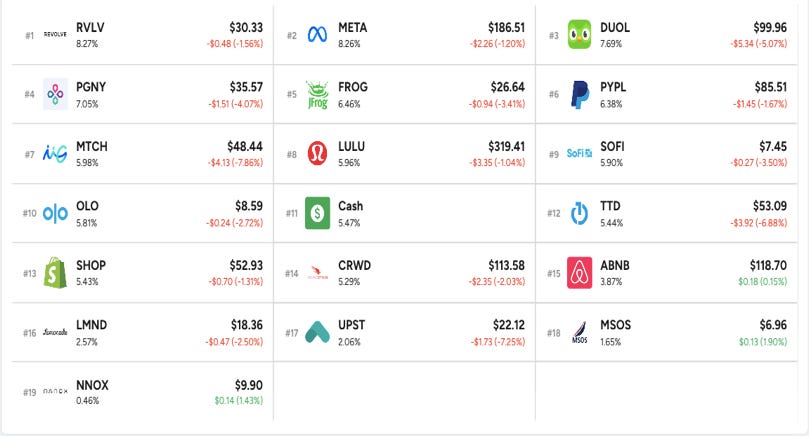

14. My Activity

I did not transact at all this week. Here’s the updated portfolio:

Just subscribed and really enjoy your straightforward reviews

Your articles are always a delight to go through, it really tells how much time you put into them.